Nestlé Buys Meal-Delivery Company Freshly as Pandemic Boosts Eating at Home

October 30 2020 - 5:08PM

Dow Jones News

By Saabira Chaudhuri

Nestlé SA took full ownership of Freshly in a deal that it said

values the online prepared-meal startup at $950 million,

positioning the world's biggest packaged-food company to capitalize

on a pandemic-driven shift toward at-home dining.

Nestlé said it would pay an additional $550 million if the

business hits certain growth targets. The Swiss food giant bought a

16% stake in Freshly in 2017. Nestlé said Friday that the agreement

to buy the rest of the company will help it navigate the "new

realities" in the U.S. food market.

Consumer goods companies have been betting that a shift toward

shopping online and eating at home -- forced on many during

Covid-19 lockdowns -- will remain long after the pandemic

abates.

"Consumers are embracing e-commerce and eating at home like

never before, " said Nestlé U.S. head Steve Presley. "It's an

evolution brought on by the pandemic but taking hold for the long

term."

Freshly sells prepared meals but competes with meal kit

companies like Blue Apron Holdings Inc. and HelloFresh SE, which

deliver portioned ingredients for meals that can then be prepared

at home.

The pandemic has given a limited boost to the nascent industry.

Investors had cooled on Blue Apron, a pioneer in the business, over

the high costs of procuring and delivering kits. But the

coronavirus crisis has lifted sales, and Blue Apron in July

reported its first quarterly profit since going public three years

ago.

Uber Technologies Inc. this summer said it would buy its Uber

Eats rival Postmates Inc. for $2.65 billion, a move the

ride-hailing operator sees as helping it better compete in

restaurant delivery and the market for shuttling groceries and

other staples. The month before, Grubhub Inc. agreed to combine

with Europe's Just Eat Takeaway.com.

Freshly currently ships more than a million meals each week to

customers in 48 U.S. states and has estimated sales for this year

at $430 million. It and Nestlé said Friday that their deal would

help Freshly expand quickly.

The company has tried to distinguish itself in the increasingly

crowded market for prepared and partially prepared food by selling

meals that it says are gluten-free, with less sugar, fewer

processed ingredients and more nutrients than those of rival

companies.

The agreement marks Nestlé's latest push to diversify from its

traditional portfolio of big packaged-food brands. The maker of

Nescafé coffee and DiGiorno frozen pizza in August agreed to buy

the rest of a biopharmaceutical company that earlier this year won

approval for the first treatment for peanut allergies. That deal

valued the company, Aimmune Therapeutics Inc., at $2.6 billion

including debt. Like the Freshly purchase, Nestlé had previously

held a stake in Aimmune.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

October 30, 2020 16:53 ET (20:53 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

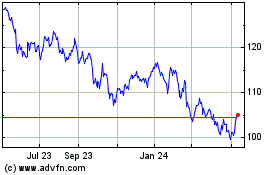

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024