Current Report Filing (8-k)

March 15 2019 - 4:49PM

Edgar (US Regulatory)

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

________________

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report

(Date of Earliest Event Reported): March 11, 2019

________________

NEON

BLOOM, INC.

(Exact Name of Registrant as Specified in

Its Charter)

|

Nevada

|

|

000-56029

|

|

20-8018146

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

99 Wall Street, Suite 542

|

|

|

|

|

|

New York, NY

|

|

|

|

10005

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

(631) 991-5461

(Registrant’s

telephone number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

[_] Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[_] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [_]

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [_]

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On March

15, 2019, the Company closed a Share Exchange Agreement (the “Share Exchange Agreement”) dated February 1, 2019 with

Neon Bloom, Inc. Pursuant to the terms of this agreement in exchange for 100% of the Neon Shares (50,053,124 shares) the Company

will issue in the name of the Neon Stockholder a stock certificate for 50,053,124 shares of its common stock. The agreement will

be a 1 for 1 share swap between the two companies. This Share Exchange Agreement will take effect post reverse split of the current

outstanding shares of Phoenix International Ventures, Inc. The merger will be accounted for as a “reverse acquisition”

and recapitalization.

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws.

|

On

March 11, 2019, Neon Bloom, Inc. (the “Company”) filed a correction to the Amended Certificate of Incorporation (the

“Amendment”) with the Secretary of State of the State of Nevada, to (i) change its name from “Phoenix International

Ventures, Inc.” to “Neon Bloom, Inc.” (“Name Change”) and to (ii) effect a 1-for-50 reverse stock

split (“Reverse Split”). The Name Change and Reverse Split became effective with the State of Nevada on March 11, 2019

and with the Financial Industry Regulatory Authority, Inc. (“FINRA”) effective as of March 18, 2019 (“Effective

Time”).

At

the Effective Time, each 50 shares of the Company’s common stock, par value $.001 per share (“Common Stock”),

issued and outstanding were converted and reclassified into one share of the Company’s Common Stock. Currently, the company

has 14,085,285 common shares outstanding, post-split the common shares outstanding will be reduced to approximately 281,706 common

shares. No fractional shares of the Company’s Common Stock were issued in connection with the Reverse Split. Shareholders

who would otherwise be entitled to a fractional share will instead receive a new certificate rounding up their fractional share

to the next nearest full share.

On

March 18, 2019, the Company’s Common Stock will begin quotation on OTC Market under the new name and a trading symbol of

“PIVND”. The “D” will be removed in 20 business days and the symbol will change to “NBCO”.

In addition, the common

stock of NBCO will trade under a new CUSIP number 640503 108, with the par value per share remaining at $.001.

The

foregoing description of the Amendment is qualified in its entirety by reference to the full text thereof which is filed as Exhibit

3.1 to this Current Report on Form 8-K and incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits

|

Exhibit Index

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Date: March 15, 2019

|

|

|

|

Neon Bloom, Inc.

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Douglas DiSanti

|

|

|

|

|

|

Douglas DiSanti

|

|

|

|

|

|

Chairman & CEO

|

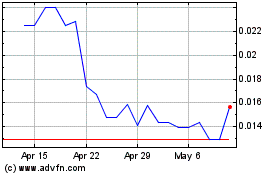

Neon Bloom (PK) (USOTC:NBCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

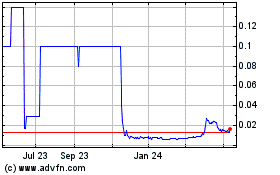

Neon Bloom (PK) (USOTC:NBCO)

Historical Stock Chart

From Apr 2023 to Apr 2024