As filed with the Securities and Exchange Commission on September

25, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NATUR INTERNATIONAL

CORP.

(Exact name of registrant

as specified in its charter)

|

Wyoming

|

|

2037

|

|

45-5547692

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(Primary

Standard Industrial

Classification Code Number)

|

|

(I.R.S.

Employer

Identification No.)

|

Jachthavenweg

124

1081 KJ Amsterdam

The Netherlands

011- 31-20-578-7700

(Address, including

zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ruud Huisman

Chief Financial

Officer

Natur International

Corp.

Jachthavenweg

124

1081 KJ Amsterdam

The Netherlands

011 31-20-578-7700

(Name, address, including

zip code, and telephone number, including area code, of agent for service)

Copies to:

Andrew D. Hudders,

Esq.

Golenbock Eiseman Assor

Bell & Peskoe LLP

711 Third Avenue, 17th Floor

New York, NY 10017

(212) 907-7300

Approximate date of commencement of proposed sale to the

public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are

to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box:

☒

If this Form is filed to register additional securities for

an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

|

Non-accelerated filer ☐

|

Smaller reporting company ☒

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title

of each class of securities to be registered

|

|

Amount to be

registered

|

|

|

Proposed

maximum offering

price per security

|

|

|

Proposed

maximum aggregate

offering

price

|

|

|

Amount of

registration

fee

|

|

|

Common Stock, par value $0.001, per share (1)

|

|

|

200,000,000

|

(2)

|

|

$

|

0.10

|

(3)

|

|

$

|

20,000,000.00

|

|

|

$

|

2,424.00

|

|

|

Common Stock, par value $0.001, per share, underlying

Series A Preferred Stock (1)

|

|

|

79,105,403

|

(2)

|

|

|

0.10

|

(3)

|

|

|

7,910,540.30

|

|

|

|

958.75

|

|

|

Common Stock, par value $0.001, per share, underlying Warrants (1)

|

|

|

33,000,000

|

(2)

|

|

|

0.10

|

(4)

|

|

|

3,300,000.00

|

|

|

|

399.96

|

|

|

Common Stock, par value $0.001, per share, underlying Warrants (1)

|

|

|

6,000,000

|

(2)

|

|

|

0.15

|

(4)

|

|

|

900,000.00

|

|

|

|

109.08

|

|

|

Common Stock, par value $0.001, per share, underlying

Series G Preferred Stock (1)

|

|

|

58,736,843

|

(2)

|

|

|

0.10

|

(3)

|

|

|

5,873,684.30

|

|

|

|

711.89

|

|

|

Common Stock, par value $0.001, per share, underlying

Warrants (1)

|

|

|

58,736,843

|

(2)

|

|

|

0.10

|

(4)

|

|

|

5,873,684.30

|

|

|

|

711.89

|

|

|

Total:

|

|

|

435,579,089

|

|

|

|

n/a

|

|

|

$

|

43,857,908.90

|

|

|

$

|

5,315.58

|

|

|

(1)

|

There are (a) 200,000,000 shares of common

stock being registered hereunder to be sold by the registrant, (b) 118,105,403 shares

of common stock being registered hereunder to be sold by a selling shareholder, consisting

of 79,105,403 shares of common stock that may be acquired upon conversion of shares of

Series A Preferred Stock and 39,000,000 shares of common stock that may be acquired upon

exercise of two separate warrants, and (c) 117,473,686 shares of common stock being registered

hereunder to be sold by several selling stockholders, consisting of 58,736,843 shares

of common stock that may be acquired upon conversion of shares of the Series G Preferred

Stock and 58,736,843 shares of common stock that may be acquired upon exercise of warrants.

|

|

(2)

|

Pursuant

to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”),

the shares being registered hereunder include such indeterminate number of shares of

common stock as may be issuable with respect to the shares being registered hereunder

as a result of stock splits, stock dividends or similar transactions.

|

|

(3)

|

Estimated solely for the purpose of calculation of the registration

fee pursuant to Rule 457(o) under the Securities Act based on the average of the high and

low per share prices of the registrant’s common stock as reported on the OTCQB on September

18, 2019.

|

|

(4)

|

Estimated

solely for the purpose of calculation of the registration fee pursuant to Rule 457(g)

under the Securities Act based on the higher of (i) the price at which the warrants may

be exercised and (ii) the average of the high and low per share prices of the registrant’s

common stock as report on the OTCQB on September 18, 2019.

|

The Registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange

Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains two forms of prospectus,

as set forth below.

|

|

●

|

Public

Offering Prospectus. A prospectus to be used for the offering by the registrant of 200,000,000 shares of common stock, through

the efforts of its Chief Financial Officer (the “Public Offering Prospectus”).

|

|

|

●

|

Security

Holder Prospectus. A prospectus to be used in connection with the potential distribution by, (a) Alpha Capital Anstalt, a

security holder, of up to an aggregate of 118,105,403 shares of the registrant’s common stock issuable in connection with

the Series A Preferred Stock and two warrants, and (b) Mr. Ranny Davidoff, Arcade Dynamic Event Fund Ltd., and Atlantic

Global Fund B.V. of an aggregate of 117,473,686 shares of the registrant’s common stock shares issuable in connection with

the Series G Preferred Stock and three warrants, for a total of 235,579,089 shares of common stock to be sold by all the four

selling security holders (the “Security Holder Prospectus”).

|

The Public Offering Prospectus and the Security Holder Prospectus

will be identical in all respects except for the following principal points:

|

|

●

|

they

contain different front covers;

|

|

|

●

|

they

contain different tables of contents;

|

|

|

●

|

they

contain different Offering sections;

|

|

|

●

|

they

contain different Use of Proceeds sections;

|

|

|

●

|

a

Selling Stockholder section is included in the Security Holder Prospectus and not in the Public Offering Prospectus; and

|

|

|

●

|

they

contain different sections for the Plan of Distribution.

|

The registrant has included in this registration statement

a set of alternate pages to reflect the foregoing differences between the Security Holder Prospectus and the Public Offering Prospectus.

The information

contained in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the

registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell

nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS

Subject to

Completion, Dated September 25, 2019

natuR

INTERNATIONAL CORP.

200,000,000

Shares

of

Common Stock

Up to 200,000,000 shares of our common

stock are being sold by an officer of Natur International Corp. on a self-underwritten, best efforts basis, with no minimum. The

offering by us will commence on the date of this prospectus and will continue for nine months thereafter or until all the shares

offered are sold, if earlier. Sales will be made at market prices or negotiated prices, for cash, retirement of debt and other

company obligations and/or other property. We will not escrow any cash funds or property received in the sale of our common stock.

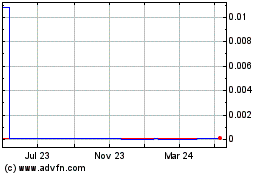

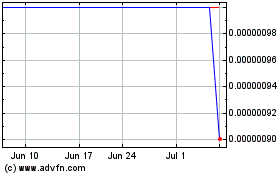

Our common stock is listed on the OTCQB

under the symbol “NTRU.” On September [__], 2019, the closing price of the common stock on the OTCQB was $[●].

Investing in our common stock involves

a high degree of risk. See “Risk Factors” beginning on page 5 for a discussion of information that should be considered

in connection with an investment in our securities.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2019

TABLE OF CONTENTS

Unless the context requires otherwise,

in this prospectus Natur International Corp. (“Parent”), and its subsidiaries, the principal one of which is Natur

BPS, BV (“Natur” or “Subsidiary”), shall collectively be referred to as “NIC”, “the

Company”, “we”, “us”, and “our” unless otherwise noted.

Some of our trademarks, including our product

logo, are used in this prospectus, which are intellectual property owned by the Company. This prospectus also includes trademarks,

trade names, and service marks that are the property of other organizations. Solely for convenience, our trademarks and trade

names referred to in this prospectus appear without the TM symbol, but those references are not intended to indicate,

in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor

to these trademarks and trade names.

We have not authorized anyone to provide

you with information different from that contained or incorporated by reference in this prospectus or in any supplement to this

prospectus, and we do not take any responsibility for any other information that others may give you. This prospectus is not an

offer to sell, nor is it a solicitation of an offer to buy, the securities in any jurisdiction where the offer or sale is not

permitted. You should not assume that the information contained in this prospectus or any prospectus supplement is accurate as

of any date other than the date on the front cover of those documents, or that the information contained in any document incorporated

by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time

of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects

may have changed since those dates.

PROSPECTUS SUMMARY

The following summary highlights selected

information contained elsewhere in this prospectus. This summary does not contain all the information you should consider before

investing in our common stock. You should carefully read this prospectus in its entirety before investing in our common stock,

including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this

prospectus.

Overview

The Company commenced its business in 2015

with the objective of becoming a leader in the “hi-tech health” food and beverage marketplace; achieved by responding

to changing market needs and staying continuously ahead of emerging trends. The Company also intends to address the demand of

the consumer for knowledge about what he/she consumes with a greater level of supply chain transparency.

It is the commitment of the Company to

integrate new manufacturing technologies with standard practices for superior products and yet remain Naturalicious (natural &

delicious) to build out its value chain for the burgeoning market of nutritious beverages and healthy snacks with and without

hemp-derived supplements or other nutrient dense fusions. Our products have been delivered in the Netherlands and the United Kingdom,

with plans on expanding to additional locations in Europe and ultimately the United States. Our understanding and application

of the technological aspects of manufacturing assures a pathogen-free food and beverage experience that preserves the nutrients

and enzymes to the maximum level possible, while retaining the raw fresh nature of the products. The result is what we believe

to be the best tasting product with the maximum “goodness” and highest nutrient density -- something the consumer

seeks more and more in our target markets.

The clear differentiator of the Company

is the “natur” brand which is supported by its disruptive marketing. Yes, we are branding nature. The Company finds

that consumers are interested in “what we produce and how we voice this to the market” more than how it is made. From

an investment perspective, this is a fundamental component of our business model as we do not have to commit very significant

capex to building our own modern production and bottling facilities to deliver into the increasing demand for our product.

In the future we anticipate delivering

documented nutrigenomic (precision nutrition) properties that we believe will be an aid to personal weight management, increase

energy, lower cholesterol, counter sleep disorders and boost immunity response. We believe that these product aspects will position

the Natur products at the top of the European market at a mid-market price point. This profile will be accessible internationally,

as we have already undertaken preliminary discussions with distributors in major international markets outside Europe.

Our market profile will be further enhanced

with the new Natur personalized snacking/juicing experience that will accelerate the trend towards “snackification”

already present in more mature markets in the United States and Europe.

Through third party contract manufacturers,

we apply patented technology to proprietary nutrient dense blends of fruit and vegetables, adding hemp-derived supplements. These

are bottled or packed with technically advanced food and product safety measures and in some cases cold high-pressure processing

to bring fresh tasting fruit, vegetable and hemp-derived supplement blends to market through more than fifteen product types.

These newly innovated products are brought to market, in Europe, through Natur’s distribution channels of direct-to-business,

direct-to-consumer and through select distributors.

The Company focus, however, is evolving.

At the onset of 2019, our product line up centered on a range of cold pressed juices and healthy snacks. Beginning in the fourth

quarter of 2018, and throughout the first half of 2019, the Company began to shift its dependence on the legacy fruit and vegetable

juices and snacks toward innovating a new line of hemp-derived natural food and beverage products and functional health &wellness

products, validated supply chains and direct to consumer business models. The Company product value proposition will be to provide

affordable, culturally relevant, authentic, fresh fruit, vegetable and hemp-derived supplement consumer products to democratize

clean, healthy, eating and drinking occasions, with plans to address the growing needs for products that address other personal

needs in health, wellness and beauty care.

The Company is also pursuing opportunities

to acquire other businesses that it believes are complementary to its legacy and new line of products and facilitate and expand

its distribution. On July 25, 2019, the Company acquired a controlling position in Temple Turmeric, Inc., a Delaware corporation

(“Temple”). Founded in 2009, Brooklyn, New York based Temple’s mission is to bring the highest quality turmeric

to the world by pioneering the first Turmeric-based ready to drink beverage line. Temple has driven consumer understanding and

demand for Turmeric as it has become more and more widely consumed through this decade. Temple now adds adaptogenic herbs and

ancient super food formulations to beverages with a turmeric foundation. The Company has also entered into two letters of intent

to explore the acquisition of businesses that would expand its distribution capabilities and add products that include based on

hemp-derived CBD or cannabidiol. Both of these potential transactions are in the due diligence and pre-documentary stages, and

may not be concluded or if concluded may not be on the terms as currently contemplated by the letters of intent. There is no assurance

that the Company will conclude any potential transactions.

Corporate Information

Natur operated as a private enterprise

in the Netherlands from its founding in 2015 through November 13, 2018, when it was acquired as a wholly owned subsidiary in a

share exchange transaction by Future Healthcare of America.

Future Healthcare of America was formed

on June 22, 2012, and its operations were in the field of providing home healthcare and health care staffing services in Wyoming

and Montana commenced in 2014 after several corporation reorganization actions. During 2018, Future Healthcare of America began

to discontinue its home healthcare services due to demographic changes in its market areas while it was negotiating and preparing

to acquire Natur. This discontinuation of its healthcare operations and final liquidation of the legacy business of Future Healthcare

of America is expected to be complete in the third quarter of 2019.

On December 28, 2018, Future Healthcare

of America changed its corporate name to Natur International Corp. The trading symbol on The OTC Market, as of January 7, 2019,

is “NTRU.”

In May 2019, the Amsterdam District Court

confirmed the closure of the Company’s Netherlands subsidiary companies Natur Holding BV, Hi-Tech Juices BV, NL Juices Retail

BV and NL Juices Online BV, as part of the Company’s corporate restructuring plan. Natur BPS BV, a recently formed Netherlands

subsidiary of the Company, assumed the Natur Holding BV legacy business to complement its product portfolio of functional products.

This court process allows the historical business of the Company’s beverage business to be continued and eliminates a substantial

amount of the liabilities of the Company. As a result of the Petition the control of Natur International Corp. over Natur Holding

B.V., the former subsidiary, terminated for financial reporting purposes and Natur International Corp.’s investment in it

was deconsolidated as of May 1, 2019.

Our executive offices are located at Jachthavenweg

124, 1081 KJ Amsterdam, The Netherlands. Our telephone number is 011-31-20-578-7730.

THE OFFERING

The following is a brief summary of certain

terms of this offering by the Company.

|

Shares

offered by us:

|

|

200,000,000

shares

|

|

|

|

|

|

Offering Price:

|

|

Determined at

the time of sale

|

|

|

|

|

|

Offering:

|

|

The offering

and sale of the shares offered hereby will be made from time to time, by an officer of the Company. There is no minimum number

of shares that must be sold by the Company for it to be able to sell any of the shares. There is no assurance that any of

the offered shares will be sold.

|

|

|

|

|

|

No Escrow of

Proceeds:

|

|

Proceeds from

the sale of any of the offered shares, if concluded, will not be placed in escrow; rather they will be deposited into the

general accounts of the Company and available for use upon deposit.

|

|

|

|

|

|

Use of Proceeds:

|

|

Any cash proceeds

that we may receive from the sale of the shares will be used for working capital and other general corporate purposes. Any

shares of Common Stock issued for other property or for cancellation of outstanding debt obligations will not result in any

proceeds to the Company.

|

|

|

|

|

|

Common Stock

Outstanding Prior to the Offering:

|

|

322,230,038 shares,

which excludes the (i) 79,105,403 shares issuable on conversion of the Class A Preferred Stock, (ii) 180,291,808 shares issuable

on conversion of Class D through Class G Preferred Stock and (iii) 223,502,535 shares issuable on exercise of outstanding

warrants.

|

|

|

|

|

|

Risk Factors:

|

|

Investing in

our securities involves a high degree of risk. See the section entitled “Risk Factors” of this prospectus.

|

|

|

|

|

|

Trading Symbol:

|

|

NTRU

|

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus of the Company contains

“forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking

statements relate to future events or future performance and include, without limitation, statements concerning the Company’s

business strategy, future revenues, market growth, capital requirements, product introductions and expansion plans and the adequacy

of the Company’s funding. Other statements contained in this prospectus that are not historical facts are also forward-looking

statements. The Company has tried, wherever possible, to identify forward-looking statements by terminology such as “may,”

“will,” “could,” “should,” “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates” and other comparable terminology.

The Company cautions investors that any

forward-looking statements presented in this prospectus, or that the Company may make orally or in writing from time to time,

are based on the beliefs of, assumptions made by, and information currently available to, the Company. Such statements are based

on assumptions, and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are

beyond the Company’s control or ability to predict. Although the Company believes that its assumptions are reasonable, they

are not a guarantee of future performance, and some will inevitably prove to be incorrect. As a result, the Company’s actual

future results can be expected to differ from its expectations, and those differences may be material. Accordingly, investors

should use caution in relying on forward-looking statements, which are based only on known results and trends at the time they

are made, to anticipate future results or trends. Certain risks are discussed in this prospectus and also from time to time in

the Company’s other filings with the Securities and Exchange Commission (the “SEC”).

This prospectus and all subsequent written

and oral forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in

their entirety by the cautionary statements contained or referred to in this section. The Company does not undertake any obligation

to release publicly any revisions to its forward-looking statements to reflect events or circumstances after the date of this

prospectus.

RISK FACTORS

Investing in our common stock involves

a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other

information in this prospectus, including our consolidated financial statements and related notes, before investing in our common

stock. If any of the following risks materialize, our business, financial condition, operating results and prospects could be

materially and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all

of your investment.

Risks Related to Our Business

Because our business and product

marketing plans may be unsuccessful, we may not be able to continue operations as a going concern. Our ability to continue

as a going concern and expand our business is dependent upon our generating cash flow that is sufficient to fund operations or

finding adequate investment or borrowed capital to support our operations. Our business and product marketing plans may not be

successful in achieving a sustainable business and generating revenues. We have no arrangements in place for sufficient financing

to be able to fully implement our business plan. If we are unable to continue as planned currently, we may have to curtail some

or all of our business plan and operations. In such case, investors will lose all or a portion of their investment.

The audit report for our financial

statements have a “going concern” disclosure. At the time of the audit report of our financial statements

in March 2019, the Company concluded that its negative working capital and decreased cash flows from operations are conditions

that raised substantial doubt about the Company’s ability to continue as a going concern. Since that date, the Company has

sold a significant amount of equity securities and its financial position allows the management to currently conclude that there

is no going concern based on its operations and financial results set forth in the most recent quarterly report. Notwithstanding

the current financial position, the Company will need to raise additional funds for its operations and expansion into various

lines of business. There is no assurance that the Company will not continue to have a going concern note or disclosure.

The Company is undertaking a corporate

reorganization and debt restructuring to reduce its debt burden, which if unsuccessful will have a continuing material effect

on its ability to raise capital and fund operations. The Company has taken steps to restructure its debt, including the

reorganization of a former subsidiary through a court sanctioned petition in The Netherlands, and continuing negotiations to restructure

retained and new debt into equity. The restructuring has included and will include raising new capital. No assurance can be given

that the Company will reorganize its debt sufficiently to improve its overall debt position and be able to continue its business

plan as currently structured and as it is hoped for the future.

Integrating the acquisition of companies

and their products into our product line will require substantial effort and expense. We have completed an acquisition

and are contemplating growth through future acquisitions. The potential acquisitions that are being contemplated are subject to

due diligence review, negotiation of definitive agreements and conclusion of various financial terms. There is no assurance that

the Company will concluded any contemplated acquisition. Any acquisition that may be concluded will put additional time and financial

demands on the personnel and resources of the Company. There is no assurance that the Company overall will be able to meet these

demands on a timely basis or at all, so as to achieve an integrated, consolidated operation. If not, the Company will experience

disruption and expense on which it may not achieve its expected return. As a result, the financial results of the Company may

be impaired.

Acquisitions of existing businesses

have many risks, many of which cannot be anticipated. Acquisitions of other businesses, assets or products typically involve

a number of special risks, including the diversion of management’s resources, issues related to the assimilation of the

operations and personnel of the acquired businesses, potential adverse effects on operating results and amortization of acquired

intangible assets. In addition, gross margins may be negatively impacted to the extent that gross margins on acquired product

lines are lower than our own product’s average gross margins. If we seek and find attractive acquisition candidates, we

may not be able to complete the transaction on acceptable terms, to successfully integrate the acquisition into our operations,

or to assure that the acquisition won’t have an adverse impact on our operations. Any plans to invest in new markets or

to consider additional acquisitions may cause us to seek additional financing that may be dilutive to current investors or result

in a higher debt-to-equity ratio than would otherwise be the case. Any financing we obtain may not be on terms favorable to us,

even if it is available.

Our products are new to the marketplace,

and may not achieve acceptance. All of our products are recent in their development and conception. Therefore, we will

need to spend substantial effort and resources on introducing them to the marketplace. Consumers may not find our products acceptable

and our sales objectives may not be achieved. The acceptance of any new consumer product is speculative. If our products do not

achieve market acceptance, we will suffer a significant loss and our financial position will be adversely impacted.

Our products have a limited shelf

life. The Natur products generally are made with fresh ingredients; therefore those particular products have a limited

shelf life and must be transported and stored in cooled locations and consumer shelving. In order to maintain our “day-of-production”

flavor, we further restrict the shelf life of products through early expiration dates. The restricted shelf life means that we

don’t have any significant finished goods inventory and our operating results are highly dependent on our ability to accurately

forecast near term sales in order to adjust fresh fruit and vegetable sourcing and production. We do not have a long history of

forecasting product demands, and we may not be able to accurately forecast product demand in the future. When we don’t accurately

forecast product demand, we anticipate being either unable to meet higher than anticipated demand or producing excess inventory

that cannot be profitably sold.

Our trade partners may have the right

to return unsold products. Natur may enter into agreements with our trade partners that provide a right to return unsold

products. Due to the limited shelf life Natur might need to destroy the products because they can’t be sold anymore. This

right will reduce the income due to Natur for the destroyed products, which will have a negative impact on its earnings.

Cost sensitivity. Our profitability

is highly sensitive to increases in raw materials, labor, shipping and other operating costs. Unfavorable trends or developments

related to inflation, raw material supply, labor and employee benefit costs, including increases in hourly wage and minimum unemployment

tax rates, rent increases resulting from the rent escalation provisions in our leases, and the availability of employees may also

adversely affect our results.

Typical of smaller companies at the

early stage of development, we expect our quarterly results to fluctuate. Due to our limited scale and the need for expansion

we expect that our results of operations will fluctuate on a quarterly basis and due to the total size of the Company, which may

have a large effect on our total financial results.

Claims related to product liability.

Because our products are not irradiated or chemically treated, they are perishable and contain certain naturally occurring

microorganisms. We may receive complaints from consumers regarding ill effects allegedly caused by our products. These claims

may result in monetary damages payable to persons that have had adverse reactions to our products. Also, these claims may result

in adverse publicity. Either of these outcomes could seriously harm our business, our business reputation, sales and results of

operations. Although we maintain product liability insurance, our coverage may not be sufficient to cover the cost of defense

or related damages in the event of a significant product liability claim.

Claims related to our product assertions.

Our products are sold as natural, cold pressed fruit and vegetable products containing substantial amounts of various

ingredients. We also make various other assertions about our products, such as no additives, no sugar and no preservatives. Consumers

and other consumer groups often challenge these types of claims. The law in the area of what is natural and other aspects of our

marketing our products is not settled and, in most cases, not statutory. In the U.S., there is a mixture of federal and state

law that is not consistent. Therefore, we may be subject to various claims about our advertising and our products from time to

time, which may cause us to pay monetary damages, change our advertising or change our products. Any of these actions may result

in adverse consequences to our operations, our product placement and results of operations.

Sources of raw materials.

We depend upon the fruit and vegetable produced in various locations, with a current dependence on raw materials from Spain and

a few other countries. The farming locations and the agricultural production may be damaged or limited as a result of windstorms,

pests or plant disease. As our products are meant to be healthy options, our suppliers of raw materials are not able to use many

agricultural chemicals, and therefore, they may not be able to maintain production in the quantities that we will need from time

to time. Any decrease in the supply of fresh fruit and vegetables could have a material adverse effect on our business and results

of operations.

We depend on one supplier for a significant

amount of our raw materials and product development. We rely on one supplier for a majority of our raw materials. We also

are largely dependent on this supplier for important aspects of our product development. This supplier is a significant shareholder

of the Company. In the believed unlikely event that this supplier is unable to provide us with the current level of raw materials

and any increase in the raw materials due to an increase in our product requirements, our business may be adversely impacted.

Additionally, if we are not able to obtain the product development services that are currently provided, our business development

and the innovation of our products will suffer, which may have an adverse impact on or business. We do not have any alternative

suppliers or product developers from which we can obtain the quality or quantity of raw materials and services.

Concentration of production capacity.

Virtually all of our juice production capacity is located at Murcia, Spain, which includes our cold pressing, blending

and bottling capability. Because currently we maintain minimal finished goods inventory at our production location as part of

our “day-of-production” production system, we could be challenged to continue to produce an adequate supply of products

in the event that production at or transportation from our production facility were interrupted by fire, flood or other natural

disasters, work stoppages, regulatory actions or other causes. Any significant interruption would seriously harm our business

and results of operations.

Currently, our products are distributed

in a limited geographic area. Our wholesale accounts and retail trade partners are located in a few countries within the

European Union. Most of our sales are in the metropolitan areas within that region. Due to this concentration, natural disasters,

economic downturns and other conditions affecting the region may adversely affect our product distribution and our business generally,

and our results of operations.

Brexit may have an adverse impact

on the Company. The consequences to the Company, if any, of Brexit cannot be determined at this time. If there is an impact,

it will depend on the quantity of products that are being sold by the Company to distributors and consumers located in the United

Kingdom, and what those sales represent of the overall sales and revenues of the Company. Some of the consequences of Brexit may

include (i) delays in the shipping and delivery of our products due to border conditions, which delay may have an impact on the

limited shelf life of our products, thereby limiting their marketability, (ii) increased costs due to duties and other imposts

imposed on the importation of goods into the United Kingdom, and (iii) other non-tariff barriers that the United Kingdom may impose,

such as changing regulations concerning our products that are different than those of the European Union.

We have a limited range of products

and therefore have a limited diversification. Natur’s business is vertically integrated and centered around a limited

number of products, being all-natural super-premium beverages and healthy snacks, sold primarily through our direct-store-delivery

system and a limited number of distributors. Any significant disruption in our product supply to the consumer and any decrease

in the consumption of our products generally or specifically would have an adverse effect on our business and results of operations.

Risks related to outsourced product

development. The Company obtains its finished products from third-party suppliers. Following any anticipated or unanticipated

change, shortages could result in an increase of the costs of goods, or adversely affect the Company’s ability bring a product

to market. Price increases due to inflationary pressures or supply side shortages from a contract packer would directly affect

the Company’s profitability if increases were not successfully passed on to customers.

Risks related to expansion of our

product lines and distribution. Our continued growth depends in part upon our ability to expand into new geographic areas,

either through internal growth or by acquisition. We are also beginning to expand into hemp-based products. Overall, our growth

in the range of products depends on having the necessary capital, being able to increase production, finding raw materials that

satisfy our criteria, expanding distribution channels, and securing consumers through our marketing efforts and those of others.

Due to the extent of our operating losses in recent years, we currently anticipate limited expansion in during the next fiscal

year and thereafter. There can be no assurance that we will expand into new product lines or geographic areas or be able to invest

in new markets. There can be no assurance that if expansion or investment is undertaken that it will be successful or that expansion

can be accomplished on a profitable basis. Demands on management and working capital costs resulting from the perishable nature

of our products may limit the ability, or increase the cost of, expansion into new regions. Furthermore, consumer tastes vary

by region, and there can be no assurance that consumers located in other regions will be receptive to our products.

Some of our products will have hemp

derived elements. As our product lines evolve, some of them will contain hemp derived elements. These products are currently

only being designed for distribution in Europe. The regulatory regime for products with these elements is evolving. There is no

comprehensive body of regulations at this time. It is currently possible to distribute these types of products but there may be

regulatory limitations in the future that restrict or eliminate the possibility of their distribution. Regulation may be either

EU wide or member state or locally legislated, and the regulation may be limited to only some kinds of products and not others,

such as limited to ingested products. If future regulation is enacted that affects any of our products, we may have to discontinue

their manufacture and distribution, in which case we would lose revenue and otherwise suffer financial losses.

Competition. We currently

compete with the following products distributed in our current markets: Innocent, Naked Juice, Savsé, Coolbest and a retailer’s

own label. In the near future, we expect to expand into the German, Moldavian, French, Swiss, and United States markets and we

will encounter further competition from competitors that are active in those markets. New products are introduced all the time,

many of which will be directly competitive to our products or may be competitive on a tangential basis, but in all cases likely

diluting our place in the market as a provider of cold-pressed juice and other fruit and vegetable products. There are efforts

by large established companies, regional companies and local producers to address the healthy living and aging consumer goods

products, such as Odwalla and Naked Juice. We also face competition from local outlets selling smoothie products and other fresh

squeezed products and white label products offered by chain outlets. While we believe that we compete favorably with our competitors

on factors including quality, nutritional integrity, food safety, merchandising, service, sales and distribution, multiple flavors,

brand name recognition and loyalty, our products are typically sold at prices higher than most other competing beverage and bar

products. Significant competitive pressure from these or other companies could negatively impact our sales and results of operations.

Shifting Consumer Tastes.

Consumer acceptance and desire for existing and emerging healthy foods, snacks and beverages are continually changing and are

extremely difficult to predict. The Company is striving to be on the right side of this macro shift at all times. Increased consumer

concerns about nutrition, healthy diets (some known as Paleo, KETO, Whole30, and GAPS regimens) and food allergies are ever changing.

This brings to our business the risk that sales of our products may decline due to perceived health concerns, changes in consumer

tastes or other reasons beyond the control of the Company. The consumer acceptance and resulting success of new products will

be one of the keys to the success of the Company’s business plan. There can be no assurance that the Company will succeed

in the development of any new products or that any new products developed by the Company will achieve market acceptance or generate

meaningful revenue for the Company.

Brand Image. The Company’s

success is tied to its ability to maintain the brand image and product quality for the Company’s existing products, new

products and brand extensions. The Company can give no assurance that the Company’s advertising, marketing and promotional

programs will have the desired impact on its products’ brand image and on consumer preferences. Real or imagined product

quality issues or contaminations, even if blatantly false, could adversely affect to the Company’s profitability and brand

image. There is no assurance that the Company will not be party to product liability litigation. If the Company experiences product

liability claims, the Company’s financial condition and business operations could be materially adversely affected.

Marketing Costs. Adequate

retail authorization, distribution and shelf space for product availability, particularly in hypermarkets, are required for success

in marketing health food, snack and beverage products. These authorizations can require additional marketing support spending

to obtain additional shelf space. In general, this is a competitive condition the Company will meet, or choose otherwise. The

Company may incur significant shelf space or other promotional costs as a necessary condition of entering into competition or

maintaining market share in particular markets or stores, and, if incurred, such costs may materially affect the Company’s

financial performance.

Our products may be contaminated,

tainted or damaged by third parties acting beyond our control. Third parties, acting on behalf of the Company, manufacture

and physically distribute the Company’s products. Therefore, our products could become contaminated, tainted or damaged

by these other parties whose actions are beyond the control of the Company. The third parties that we engage for manufacturing

and distributing our product and the retail outlets for our products must take adequate precautions not to contaminate, taint

or damage the Company’s products. Although we have established handling protocols and we believe our manufacturer, distributors

and retailers will follow these protocols and use good commercial sense in handling a perishable product, the Company cannot be

certain that the its products will not be damaged in the ordinary course of business. In the event the Company’s products

are damaged, contaminated or tainted, the Company may experience an adverse financial effect due to lost sales, the cost of a

product recall, and product liability damages and an adverse business effect due to reputational damage and reluctance of consumers

to trust our products. The Company, at this time, cannot estimate any cost or liability amounts that the Company might incur in

connection damaged, contaminated or tainted products.

We are dependent on the continued

services and on the performance of our senior management and other key personnel. The loss of the services of any of our

executive officers, such as Paul Bartley, our Chief Executive Officer, or Ruud Huisman, our Chief Financial Officer, or other

key employees could have a material adverse effect on our business, operating results and financial condition. We also depend

on our ability to identify, attract, hire, train, retain and motivate other highly skilled technical, managerial, sales, operational,

business development and customer service personnel. Competition for such personnel is intense, and there can be no assurance

that we will be able to successfully attract, assimilate or retain sufficiently qualified personnel. The failure to attract and

retain necessary skilled personnel could have a material adverse effect on our business, operating results and financial condition.

If the protection of trademark, brands

and other proprietary rights is inadequate, we could lose our proprietary rights and experience a loss of revenues. We

rely on a combination of copyright, trademark, trade dress and trade secret laws, employee and third-party non-disclosure and

invention assignment agreements and other methods to protect our proprietary technology. Despite these precautions, it may be

possible for unauthorized third parties to obtain and use information that we regard as proprietary. In addition, the laws of

some foreign countries do not protect proprietary rights to the same extent as do the laws of the United States. There can be

no assurance that the steps taken by us to protect our proprietary rights will be adequate or that third parties will not infringe

or misappropriate our trademarks, copyrights and similar proprietary rights. If we resort to legal proceedings to enforce our

IP rights, those proceedings could be expensive and time-consuming and could distract our management from our business operations.

Intellectual property claims against

us can be costly and could impair our business. We cannot predict whether third parties will assert claims of infringement

against us, or whether any future assertions or prosecutions will harm our business. Although we take significant steps to make

sure that our products do not infringe on the rights of others, there is always the possibility that another person or company

may assert that we infringed on their proprietary rights. If we are forced to defend against any such claims, whether they are

with or without merit or are determined in our favor, we may face costly litigation, diversion of management, or product launch

delays, any of which could adversely impact our business. As a result of such a dispute, we may have to enter into royalty or

licensing agreements. Such royalty or licensing agreements, if required, may be unavailable on terms acceptable to us, if at all.

If there is a successful claim of intellectual property infringement against us and we are unable to license the infringed or

similar IP on a timely basis, our business could be impaired.

Government regulations may increase

our costs of doing business. The adoption or modification of laws or regulations relating to our business could harm our

operating results and financial condition by increasing our costs and administrative burdens. Laws and regulations directly applicable

to our business are becoming more diverse and prevalent in all the markets where we are likely to distribute our products. We

must comply with regulations in Europe, the United States, as well as any other regulations adopted by other countries where we

do business. Compliance with any newly adopted laws or regulations may prove difficult for us and may harm our business, operating

results and financial condition.

We will require additional capital

in the future, which may not be available on terms acceptable to us, or at all. Our future liquidity and capital requirements

will depend upon numerous factors, including the success of our products and market developments. We will to need to raise funds

through public or private financings, strategic relationships or other arrangements. There can be no assurance that such funding,

will be available on terms acceptable to us, or at all. If funds are raised through the issuance of equity securities, the percentage

ownership of our stockholders will be reduced, stockholders may experience additional dilution in net book value per share, and

such equity securities may have rights, preferences or privileges senior to those of the holders of our existing capital stock.

Furthermore, any debt financing, if available, may involve restrictive covenants that may limit our operating flexibility with

respect to certain business matters. If adequate funds are not available on acceptable terms, we may not be able to continue to

develop or enhance our products, take advantage of future opportunities or respond to competitive pressures, any of which could

have a material adverse effect on our business, operating results and financial condition.

Risks Related to Ownership of Our Common Stock

There is not an active market for

our common stock. There has been no sustained activity in the market for our common stock and we cannot provide any assurances

that an active market for our common stock will ever develop. Investors should understand that there may be no alternative exit

strategy for them to recover or liquidate their investments in our common stock. Accordingly, investors must be prepared to bear

the entire economic risk of an investment in the Company for an indefinite period of time. If an active market ever develops for

our common stock, we anticipate that our then financial condition and product offerings will greatly impact the market value of

our common stock. The market value at any point in time may not reflect the value of our business or our business prospects.

We are subject to the reporting requirements

of the United States securities laws, which will require expenditure of capital and other resources. We are a public reporting

company subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and other federal securities laws, including, without limitation, compliance with the Sarbanes-Oxley Act (“Sarbanes”).

The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC and furnishing

audited reports to stockholders will cause our expenses to be substantially higher than they would otherwise be if we were privately-held.

It will be difficult, costly, and time-consuming for us to develop and implement internal controls and reporting procedures required

by Sarbanes, and we will require additional staff and third-party assistance to develop and implement appropriate internal controls

and procedures.

Because we are subject to the “penny

stock” rules as our shares are quoted on an over-the-counter market, the level of trading activity in our stock may be reduced.

If an active trading market does develop for our stock, it is likely that our stock will be subject to the regulations

applicable to penny stocks. The regulations of the SEC promulgated under the Exchange Act that require additional disclosure relating

to the market for penny stocks in connection with trades in any stock defined as a penny stock. The SEC regulations define penny

stocks to be any non-exchange equity security that has a market price of less than $5.00 per share, subject to certain exceptions.

Unless an exception is available, those regulations require the broker-dealer to deliver, prior to any transaction involving a

penny stock, a standardized risk disclosure schedule prepared by the SEC, to provide the customer with current bid and offer quotations

for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements

showing the market value of each penny stock held in the purchaser’s account, to make a special written determination that

the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction.

These disclosure requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for

a stock that becomes subject to the penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers

to trade our securities. We believe that the penny stock rules discourage market investor interest in and limit the marketability

of our Common Stock.

In addition to the “penny stock”

rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority, Inc. (“FINRA”)

has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds

for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their

non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial

status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there

is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA requirements

make it more difficult for broker-dealers to recommend that their customers buy our Common Stock, which may limit an investor’s

ability to buy and sell our stock.

We may not be able to attract the

attention of major brokerage firms or securities analysts in our efforts to raise capital. In due course, we plan to seek

to have our common stock quoted on a national securities exchange in the United States. There can be no assurance that we will

be able to garner a quote for our common stock on an exchange. Even if we are successful in doing so, security analysts and major

brokerage houses may not provide coverage of us. We may also not be able to attract any brokerage houses to conduct secondary

offerings with respect to our securities.

Because future sales by our stockholders

could cause the stock price to decline, our investors may lose money on their investment in our common stock. No predictions

can be made of the effect, if any, that market sales of shares of our common stock or the availability of such shares for sale

will have on the market price prevailing from time to time. Nevertheless, sales of significant amounts of our common stock could

adversely affect the prevailing market price of our common stock, as well as impair our ability to raise capital through the issuance

of additional equity securities.

Risks Relating to this Offering

Without a successful offering, we

may not be able to fully implement our business plan. We need to sell the shares being sold in this offering in order

to fully implement our business plan of restructuring. If we do not sell a sufficient number of shares, we may have to curtail

aspects of our business plan or abandon them altogether. Revising the business plan may result in our not being able to continue

in business as planned.

This offering is being made without

an underwriter; therefore, it is possible that we will not sell all the shares offered. The offering is self-underwritten.

This means we will not engage the services of an underwriter to sell the shares. We intend to sell the shares through the efforts

of one of our officers, and we will not pay him any commissions. Without the services of a professional finance firm, it is possible

that we will not sell all the shares offered. If we do not sell the full number of shares being offered, we may have to modify

ours business plan, which may adversely affect our financial condition.

This offering is being made without

any escrow of investor funds or provisions to return funds. When investors purchase our common stock, the purchase price

will not be placed in any escrow account and will become a general asset of the Company. There is no minimum offering amount.

Sales will be made on a rolling basis. There are no investor protections for the return of invested monies.

Because there is no minimum offering

requirement, early investors in this offering bear a disproportionate risk of the Company being able to implement its business

plan on the basis of shares actually sold. This offering is made on a rolling basis with no minimum amount having to be

raised. Therefore, early investors will participate in the offering with no assurance that a sufficient amount of shares will

be sold for the Company to fully implement its business plan. If an insufficient number of shares are sold in this offering, we

may have to limit the extent to which we will be able to implement our business plan, but investors will not be able to get their

investment funds back.

Our officers will have broad discretion

in the use of proceeds from this offering. Although we intend to use the net cash proceeds from this offering for working

capital and other general corporate purposes, the use of any cash funds received can be changed by management at any time. The

amount allocated to a use also may be changed depending on management's determination about the best use of the funds at a particular

time. Therefore, investors must rely entirely on the business judgment of management in the use of the offering proceeds and to

determine how and what portions of the business plan will be implemented.

USE OF PROCEEDS

The offering is on a best-efforts, no minimum

basis. We intend to use the cash net proceeds from this offering for working capital and other general corporate purposes.

PLAN OF DISTRIBUTION

The 200,000,000 shares being offered by

us will be sold by the efforts of Rudolf Huisman, our Chief Financial Officer and a director of the Company. He will not receive

any commission from the sale of any shares. He will also not register as a broker-dealer pursuant to Section 15 of the Securities

and Exchange Act of 1934 in reliance upon Rule 3a4-1, which sets forth those conditions under which a person associated with an

issuer may participate in the offering of the issuer's securities and not be deemed to be a broker-dealer. These conditions included

the following:

|

|

●

|

None

of the selling persons are subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of

the Exchange Act, at the time of participation;

|

|

|

●

|

None of such persons are compensated in connection

with his or her participation by the payment of commissions or other remuneration based either directly or indirectly on transactions

in securities;

|

|

|

●

|

None of the selling persons are, at the time

of participation, an associated person of a broker-dealer; and

|

|

|

●

|

All of the selling persons meet the

conditions of paragraph (a)(4)(ii) of Rule 3a4-1 of the Exchange Act, in that they (A) primarily

perform or are intending primarily to perform at the end of the offering, substantial duties for or on behalf of the issuer

otherwise than in connection with transactions in securities, and (B) are not a broker or dealer, or an associated person

of a broker or dealer, within the preceding twelve months, and (C) do not participate in selling and offering of

securities for any issuer more than once every twelve months other than in reliance on this rule.

|

Since the offering is self-underwritten,

we intend to advertise and hold investment meetings in various states and other locations where the offering will be registered

and will distribute this prospectus to potential investors at the meetings and to persons with whom management is acquainted who

are interested in the Company and a possible investment in the offering.

We are offering the shares subject to prior

sale and subject to approval of certain matters by our legal counsel.

This offering will commence on the date

of this prospectus and continue for a period of nine months, unless we sell all the shares prior to that final date. We may terminate

this offering at any time, for any reason; thus not selling any or all of the shares offered. There is no minimum number of shares

that we are required to sell.

We will not escrow any funds received in

payment for any of the shares that are sold pursuant to this offering. Any funds received will be immediately deposited into the

Company accounts and available for use by the Company for working capital purposes.

BUSINESS

Company mission and overview

Natur’s vision is for technology

to be the force of our innovation as we build culturally relevant consumer products that nurture the human body. The mission of

Natur is to deliver 100% natural products that are good for everyone and for nature, with an aim to sell products that meet or

exceed consumer expectations for health, wellness and good taste. Natur specially selects plant-based ingredients, including Hemp

Cannabidiol (CBD), fruits and vegetables, committing not to use concentrates, preservatives, stabilizers or additives in our products.

Natur further invests in sustainability projects to reduce the environmental impact of our own activities.

Business Overview

The Company commenced its business in 2015

with the objective of becoming a leader in the “hi-tech health” food and beverage marketplace; achieved by responding

to changing market needs and staying continuously ahead of emerging trends. The Company also intends to address the demand of

the consumer for knowledge about what he/she consumes with a greater level of supply chain transparency.

It is the commitment of the Company to

integrate new manufacturing technologies with standard practices for superior products and yet remain Naturalicious (natural &

delicious) to build out its value chain for the burgeoning market of nutritious beverages and healthy snacks with and without

CBD or other nutrient dense fusions. Our products have been delivered in the Netherlands and the United Kingdom, with plans on

expanding to additional locations in Europe and ultimately the United States. Our understanding and application of the technological

aspects of manufacturing assures a pathogen-free food and beverage experience that preserves the nutrients and enzymes to the

maximum level possible, while retaining the raw fresh nature of the products. The result is what we believe to be the best tasting

product with the maximum “goodness” and highest nutrient density -- something the consumer seeks more and more in

our target markets.

The clear differentiator of the Company

is the “natur” brand which is supported by its disruptive marketing. Yes, we are branding nature. The Company finds

that consumers are interested in “what we produce and how we voice this to the market” more than how it is made. From

an investment perspective, this is a fundamental component of our business model as we are not having to commit very significant

capex to building our own modern production and bottling facilities to deliver into the increasing demand for our product.

In the future we anticipate delivering

documented nutrigenomic (precision nutrition) properties that we believe will be an aid to personal weight management, increase

energy, lower cholesterol, counter sleep disorders and boost immunity response. We believe that these product aspects will position

the Natur products at the top of the European market at a mid-market price point. This profile will be accessible internationally,

as we have already undertaken preliminary discussions with distributors in major international markets outside Europe.

Through third party contract manufacturers,

we apply patented technology to proprietary nutrient dense blends of fruit and vegetables, adding hemp-derived supplements. These

are bottled or packed with technically advanced food and product safety measures and in some cases cold high-pressure processing

to bring fresh tasting fruit, vegetable and hemp-derived supplement blends to market through more than fifteen product types.

These newly innovated products are brought to market, in Europe, through Natur’s distribution channels of direct-to-business,

direct-to-consumer and through select distributors.

The Company focus, however, is evolving.

At the onset of 2019, our product line up centered on a range of cold pressed juices and healthy snacks. Beginning in the fourth

quarter of 2018, and throughout the first half of 2019, the Company began to shift its dependence on the legacy fruit and vegetable

juices and snacks toward innovating a new line of hemp-derived natural food and beverage products. The Company product value proposition

will be to provide affordable, culturally relevant, authentic, fresh fruit, vegetable and hemp-derived supplement consumer products

to democratize clean, healthy, eating and drinking occasions, with plans to address the growing needs for products that address

other personal needs in health, wellness and beauty care and pet care.

Cannabidiol (CBD) is the non-psychoactive

cannabinoid of the cannabis plant, often known as hemp. CBD is not the THC cannabinoid of the plant that is an intoxicating substance

which is illegal in many jurisdictions. CBD however, extracted and separated from specific varieties of the industrial hemp plant,

is legal worldwide. Although CBD can be found in other plants, it is the hemp plant that is used because of its abundance in the

plant, typically representing up to 40% of its extracts. When separated into its pure form, it cannot provide the intoxication

effects of THC. CBD is typically used for health reasons. Although there is much research to be done in the field, it is believed

that there are a wide range of health benefits. CBD products may be used for wellness purposes such as to aid sleep, or for pain

or anxiety management: they do not require a prescription.

On July 25, 2019, the Company acquired

a controlling position in Temple Turmeric, Inc., a Delaware corporation (“Temple”). Founded in 2009, Brooklyn, New

York based Temple’s mission is to bring the highest quality turmeric to the world by pioneering the first Turmeric-based

ready to drink beverage line. Temple has driven consumer understanding and demand for Turmeric as it has become more and more

widely consumed through this decade. Temple now adds adaptogenic herbs and ancient super food formulations to beverages with a

turmeric foundation.

On June 30, 2019, the Company expressed

its interest in pursuing a transaction with SIH. The contemplated transaction would be an acquisition of assets and companies

that together will operate a consumer distribution and logistics supply business. The identification of assets and companies has

yet to be done. The terms of a potential acquisition have yet to be negotiated and finalized. The overall transaction will in

all events be subject to many conditions precedent. There may be conditions to the transaction that cannot be satisfied. Therefore

there is no certainty that any transaction with SIH will be finalize or that if finalized will be consummated.

The Company” has entered into a letter

of intent to acquire a majority position of Infinite Product Company LLP (“IPC”), a Colorado based limited liability

partnership, manufacturing and selling products using the research related to the characteristics of CBD or cannabidiol and the

endocannabinoid system. IPC formulates a wide range of products including topicals, ingestibles, oils, beauty and pet products.

The IPC products have not been evaluated by the United States Food and Drug Administration and are not intended to treat, cure

or prevent any disease or illness. The purchase price for the majority position will be paid in installments over several months

at and from the closing of the transaction in an amount equal to $6,120,000, and then a further maximum amount of $5,000,000,

based on IPC meeting specified EBITDA targets in fiscal year 2010. The parties have agreed that the Company will have the right

to purchase the balance of the partnership under terms and conditions to be agreed, and determined at a later time. The letter

of intent is only an expression of the parties’ intent to pursue a transaction. The parties must still conduct due diligence

on the other, draft acquisition documentation, verify the terms of the letter of intent and purchase price determinations and

otherwise commence the transaction beyond the stage of the letter of intent. There is no assurance, therefore, that a transaction

will be concluded, or if concluded on the terms set forth in the letter of intent.

Corporate Management

The Company and Natur have gathered a top

team of experienced management and consultants in the field of food and beverage, who have an in-depth knowledge of the market

arena for our products and yet have the right fit of discipline and entrepreneurial vision and drive.

The Natur non-executive board has top industry

relevant experience and has a hands-on drive to make the company successful and to gain a leadership position in the healthy product

food and beverage market place through the offering of a palette of products that not only are natural and delicious but with

functional beneficial properties and can also be supplied as organic. Their expertise and insights in the digital world will also

help drive the Natur to embrace these new delivery frontiers.

From Farm to Functional

Natur markets “farm-to-functional”

organic and/or all-natural plant-based consumer products. The product portfolio has recently been expanded to include full-spectrum

cannabinoids (CBD)-based consumer products including cosmetic, beauty, pet care, nutraceuticals and other products in the health

and wellness sector. Natur applies technologically advanced solutions to both product development and consumer enjoyment as a

true and certified “breed to brand” experience, available anytime, anyplace, anywhere. Natur is building a leading-edge,

safe and transparent supply chain for all customers, making it well positioned and able to establish its market share and partner

with the major international distribution leaders.

Products

The

Company divides its products in seven categories: (1) beverages, snacks and other products infused with CBD, (2) not from concentrate,

fruit and vegetable juice blends, 250ml sized, mildly pasteurized, with a 180 day shelf life, 3) not from concentrate fruit smoothies,

250ml sized, mildly pasteurized, with a 180 day shelf life, 4) fruit and vegetable blend juices, 250ml sized, cold pressed, high

pressure processed, with a shelf life between 50 and 120 days, 5) fruit and vegetable blend shots, 100 ml sized, cold pressed,

high pressure processed with a shelf life between 50 and 120 days, 6) innovative snacking options low in calories and high in

daily requirements for fruits and vegetables and 7) the Temple products. Below is a product description within the categories.

Beverages,

snacks and other products infused with Cannabidiol (CBD)

Our

product line consists of the following categories:

|

|

o

|

NFC

Juices shelf life 180 days

|

|

|

o

|

HPP

Juice shots shelf life 90-120 days

|

|

|

o

|

Bio

Chocolate Bars, vegan

|

|