Current Report Filing (8-k)

September 17 2018 - 12:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

August 28, 2018

NanoFlex Power Corporation

(Exact name of registrant as specified in

its charter)

|

Florida

|

|

333-187308

|

|

46-1904002

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

17207 N. Perimeter Dr., Suite 210

Scottsdale, AZ 85255

(Address of Principal Executive Offices)

480-585-4200

(Registrant’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

|

Item

1.01

|

Entry into a Material Definitive Agreement.

|

On August 28, 2018, NanoFlex Power Corporation, a Florida corporation

(the “Company”) entered into a Securities Purchase Agreement (the “SPA”) with One44 Capital LLC (“One44”)

pursuant to which One44 agreed to purchase a convertible redeemable note (the “Note”) in the aggregate principal amount

of $50,000. On August 28, 2018, the Company issued the Note. The Note has an interest rate of 12% per annum and matures on August

28, 2019.

Pursuant to the Note, One44 may convert all or a portion of

the outstanding principal amount into shares of Common Stock of the Company at a fixed conversion price of $0.25 per share. Starting

on the six month anniversary of the date the Note is issued, the conversion price per share shall be equal to 60% of the lowest

trading price of the Common Stock during the 20 prior trading days (including the day upon which a notice of conversion is received).

One44 may not convert the Note to the extent that such conversion would result in beneficial ownership by One44 and its affiliates

of more than 4.99% of the Company’s issued and outstanding Common Stock.

If the Company prepays the Note within 60 days of its issuance,

the Company must pay the principal at a cash redemption premium of 120%, in addition to accrued interest; if such prepayment is

made from the 61st day to the 120th day after issuance, then such redemption premium is 130%, in addition to accrued interest;

and if such prepayment is made from the 121st day to the 180th day after issuance, then such redemption premium is 140%, in addition

to accrued interest. After the 180th day following the issuance of the Note, there shall be no further right of prepayment.

In connection with the Note, the Company agreed to cause its

transfer agent to reserve 1,851,000 shares of Common Stock, in the event that the Note is converted.

The foregoing summaries of the terms of the Note and the SPA

are subject to, and qualified in their entirety by, the agreements and instruments attached hereto as Exhibits 4.1 and 10.1, respectively,

which are incorporated by reference herein.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth under Item 1.01 above with respect

to the Note, the SPA and the related agreements is incorporated herein by reference.

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

The information set forth under Item 1.01 above with respect

to the issuance of the Note is incorporated herein by reference. The issuance of the Note was made in reliance upon the exemption

from the registration requirements of the Securities Act of 1933, as amended (the “Act”), pursuant to Section 4(a)(2)

of the Act.

As reported in the Company’s current

report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on December 22, 2017 and on June

11, 2018, the Company borrowed $100,000 from Morningview Financial, LLC (“MV”) and issued to MV a convertible promissory

note (the “MV Note”) in the amount of $100,000 with a maturity date of December 12, 2018. On June 6, 2018 the Company

entered into an amendment (“Amendment No. 1”) to the MV Note, pursuant to which the deadline to pay the total balance

of the MV Note was extended to July 15, 2018. The Company and MV subsequently mutually agreed to further extend this deadline

to September 15, 2018. The Company paid off the MV Note in full on September 5, 2018, with total payments of $192,570.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 17, 2018

|

|

NanoFlex Power Corporation

|

|

|

|

|

|

|

By:

|

/s/ Dean L. Ledger

|

|

|

Name:

|

Dean L. Ledger

|

|

|

Title:

|

Chief Executive Officer

|

EXHIBIT INDEX

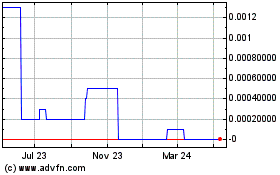

NanoFlex Power (CE) (USOTC:OPVS)

Historical Stock Chart

From Nov 2024 to Dec 2024

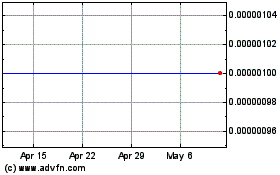

NanoFlex Power (CE) (USOTC:OPVS)

Historical Stock Chart

From Dec 2023 to Dec 2024