UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

|

☒

|

Preliminary

Proxy Statement

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive

Proxy Statement

|

|

☐

|

Definitive

Additional Materials

|

|

☐

|

Soliciting

Material under §240.14a-12

|

mPhase

Technologies, Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

☒

|

No

fee required

|

|

|

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

|

|

|

|

|

|

mPHASE

TECHNOLOGIES, INC.

|

|

|

9841 Washingtonian Boulevard,

#200

|

|

|

Gaithersburg, MD 20878

|

|

|

Tel:

(301) 329-2700

|

NOTICE

OF 2022 SPECIAL MEETING OF STOCKHOLDERS

To

Be Held on March , 2022

Dear

Stockholder:

We

are pleased to invite you to attend the 2022 Special Meeting of stockholders (the “Special Meeting”) of mPhase Technologies,

Inc. (“mPhase” or the “Company”), which will be held on March , 2022 at 10:00 a.m. Eastern Time located at

1101 Wootton Pkwy, #1020, Rockville MD 20852 for the following purposes:

|

|

1.

|

To

approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”)

to effect a reverse stock split at a ratio not less than 1-for-10 and not greater than 1-for-45, with the exact ratio

to be set within that range at the discretion of our board of directors without further approval or authorization of our stockholders;

and

|

|

|

2.

|

To

approve and adopt the 2022 Equity and Incentive Plan.

|

Our

Board of Directors has fixed February 14, 2022 as the record date (the “Record Date”) for the determination

of stockholders entitled to notice of, and to vote at, the Special Meeting and at any adjournment or postponement of the meeting.

All

stockholders are cordially invited to attend the Special Meeting. Whether or not you expect to attend the Special Meeting, please complete,

sign and date the enclosed proxy and return it promptly. If you plan to attend the Special Meeting and wish to vote your shares personally,

you may do so at any time before the proxy is voted.

IF

YOU PLAN TO ATTEND:

Please

note that space limitations make it necessary to limit attendance to stockholders of record only. Registration and seating will begin

at 9:30am Eastern Time. Shares of common stock can be voted at the Special Meeting only if the holder is present in person or by valid

proxy.

For

admission to the Special Meeting, each stockholder may be asked to present valid picture identification, such as driver’s license

or passport, and proof of stock ownership as of the Record Date, such as the enclosed proxy card or a brokerage statement reflecting

stock ownership. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting to be held on March , 2022 at 10:00 a.m. Eastern Time.

|

|

BY

ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

|

|

|

|

Dated:

February 8, 2022

|

Anshu

Bhatnagar

|

|

|

Chairman

and Chief Executive Officer

|

Whether

or not you expect to attend the Special Meeting in person, we urge you to vote your shares at your earliest convenience. This will ensure

the presence of a quorum at the Special Meeting. Promptly voting your shares will save mPhase the expenses and extra work of additional

solicitation. An addressed envelope for which no postage is required if mailed in the United Stated is enclosed if you wish to vote by

mail. Submitting your proxy now will not prevent you from voting your shares at the Special Meeting if you desire to do so, as your proxy

is revocable at your option. Your vote is important, so please act today!

|

|

mPHASE

TECHNOLOGIES, INC.

|

|

|

9841

Washingtonian Boulevard, #200

|

|

|

Gaithersburg,

MD 20878

|

|

|

Tel:

(301) 329-2700

|

PROXY

STATEMENT FOR THE

2022

SPECIAL MEETING OF STOCKHOLDERS

To

be held on March , 2022

The

Board of Directors (the “Board” or “Board of Directors”) of mPhase Technologies, Inc. (“mPhase” or

the “Company”) is soliciting your proxy to vote at the 2022 Special Meeting of Stockholders (the “Special Meeting”)

to be held at 1101 Wootton Pkwy, #1020, Rockville, MD 20852 on March , 2022, at 10:00 a.m. Eastern Time, including at

any adjournments or postponements of the Special Meeting.

Our

of Board of Directors is asking you to vote your shares by completing, signing and returning the accompanying proxy card via mail or

fax or vote over the Internet. If you attend the Special Meeting in person, you may vote at the Special Meeting even if you have previously

returned a proxy card. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to

vote at the Special Meeting, you must obtain a proxy issued in your name from that record holder as described in more detail below.

We

intend to begin mailing this proxy statement, the attached notice of the Special Meeting, the enclosed proxy card, and copies of our

Annual Report on Form 10-K and 10-Q for the second quarter ended December 31, 2021 on or about February , 2022 to all stockholders

of record entitled to vote at the Special Meeting. Only stockholders who owned our common stock on February 14, 2022 are entitled

to vote at the Special Meeting.

mPHASE

TECHNOLOGIES, INC.

TABLE

OF CONTENTS

QUESTIONS

AND ANSWERS ABOUT THIS PROXY STATEMENT AND VOTING

What

is a proxy?

A

proxy is the legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone

as your proxy in a written document, that document is also called a proxy or a proxy card. By completing a proxy card, as more fully

described herein, you are designating Anshu Bhatnagar, our Chief Executive Officer as your proxy for the Special Meeting and you are

authorizing Mr. Bhatnagar to vote your shares at the Special Meeting as you have instructed on the proxy card. This way, your shares

will be voted whether or not you attend the Special Meeting. Even if you plan to attend the Special Meeting, we urge you to vote in one

of the ways described below so that your vote will be counted even if you are unable or decide not to attend the Special Meeting.

What

is a proxy statement?

A

proxy statement is a document that we are required by regulations of the U.S. Securities and Exchange Commission, or “SEC,”

to give you when we ask you to sign a proxy card designating Mr. Bhatnagar as proxy to vote on your behalf.

Why

did you send me this proxy statement?

We

sent you this proxy statement and the enclosed proxy card because our Board is soliciting your proxy to vote at the 2022 Special Meeting

of stockholders. This proxy statement summarizes information related to your vote at the Special Meeting. All stockholders who find it

convenient to do so are cordially invited to attend the Special Meeting in person. However, you do not need to attend the meeting to

vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card or vote over the Internet.

We

intend to begin mailing this proxy statement, the attached notice of Special Meeting, the enclosed proxy card, and copies of our Annual

Report on Form 10-K and 10-Q for the second quarter ended December 31, 2021 to all stockholders of record entitled to vote at the Special

Meeting. Only stockholders who owned our common stock on February 14, 2022 are entitled to vote at the Special Meeting.

What

Does it Mean if I Receive More than one set of proxy materials?

If

you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please

complete, sign, and return each proxy card to ensure that all of your shares are voted.

How

do I attend the Special Meeting?

The

Special Meeting will be held on March , 2022, at 10:00 a.m. Eastern Time located at 1101 Wootton Pkwy, #1020, Rockville,

MD 20852.Information on how to vote in person at the Special Meeting is discussed below.

Who

is Entitled to Vote?

The

Board has fixed the close of business on February 14, 2022 as the record date (the “Record Date”) for the

determination of stockholders entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof.

On the Record Date, there were shares of [ ] common stock outstanding. Each share of common stock represents one vote

that may be voted on each proposal that may come before the Special Meeting.

What

is the Difference Between Holding Shares as a Record Holder and as a Beneficial Owner (Holding Shares in Street Name)?

If

your shares are registered in your name with our transfer agent, Worldwide Stock Transfer LLC, you are the “record holder”

of those shares. If you are a record holder, these proxy materials have been provided directly to you by the Company.

If

your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner”

of those shares held in “street name.” If your shares are held in street name, these proxy materials have been forwarded

to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting

at the Special Meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares.

Who

May Attend the Special Meeting?

Only

record holders and beneficial owners of our common stock, or their duly authorized proxies, may attend the Special Meeting. If your shares

of common stock are held in street name, you will need to bring a copy of a brokerage statement or other documentation reflecting your

stock ownership as of the Record Date.

What

am I Voting on?

There

are two matters scheduled for a vote:

|

|

1.

|

To

approve an amendment to the Company’s Certificate of Incorporation to effect a reverse stock split at a ratio not less than

1-for-10 and not greater than 1-for-45, with the exact ratio to be set within that range at the discretion of our board

of directors without further approval or authorization of our stockholders; and

|

|

|

2.

|

To

approve and adopt the 2022 Equity and Incentive Plan.

|

What

if another matter is properly brought before the Special Meeting?

The

Board knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought

before the Special Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance

with their best judgment.

How

Do I Vote?

Stockholders

of Record

For

your convenience, record holders of our common stock have three methods of voting:

|

1.

|

Vote

by Internet. The website address for Internet voting is on your vote instruction form;

|

|

|

|

|

2.

|

Vote

by mail. Mark, date, sign and promptly mail the proxy card; or

|

|

|

|

|

3.

|

Vote

at the Meeting. Attend and vote at the Special Meeting held in person at 1101 Wootton Pkwy, #1020, Rockville, MD,

20852.

|

Beneficial

Owners of Shares Held in Street Name

For

your convenience, beneficial owners of our common stock have three methods of voting:

|

1.

|

Vote

by Internet. The website address for Internet voting is on your vote instruction form;

|

|

|

|

|

2.

|

Vote

by mail. Mark, date, sign and promptly mail your vote instruction form; or

|

|

|

|

|

3.

|

Vote

at the Meeting. Obtain a valid legal proxy from the organization that holds your shares and attend and vote at the Special Meeting

held in person at 1101 Wootton Pkwy, #1020, Rockville, MD, 20852.

|

IMPORTANT:

If you vote by Internet, please DO NOT mail your proxy card.

All

shares entitled to vote and represented by a properly completed and executed proxy received before the Special Meeting and not revoked

will be voted at the Special Meeting as instructed in a proxy delivered before the Special Meeting. We provide Internet proxy voting

to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions.

However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access

providers and telephone companies.

If

you do not indicate how your shares should be voted on a matter, the shares represented by your properly completed and executed proxy

will be voted as the Board of Directors recommends on the enumerated proposal, with regard to any other matters that may be properly

presented at the Special Meeting and on all matters incident to the conduct of the Special Meeting. This authorization would exist, for

example, if a stockholder of record merely signs, dates and returns the proxy card but does not indicate how its shares are to be voted

on one or more proposals. If other matters properly come before the Special Meeting and you do not provide specific voting instructions,

your shares will be voted at the discretion of Mr. Bhatnagar, the Board of Directors’ designated proxy.

If

you are a registered stockholder and attend the Special Meeting, you may deliver your completed proxy card in person. If your shares

are held in “street name” (i.e. shares are held by a broker for you as a beneficial owner) and you wish to vote at the Special

Meeting, you will need to obtain a proxy form from the institution that holds your shares. All votes will be tabulated by the inspector

of elections appointed for the Special Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

We

provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness

of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as

usage charges from Internet access providers and telephone companies.

How

Many Votes do I Have?

On

each matter to be voted upon, you have one vote for each share of common stock you own as of the close of business on the Record Date.

Is

My Vote Confidential?

Yes,

your vote is confidential. Only the inspector of elections, individuals who help with processing and counting your votes and persons

who need access for legal reasons will have access to your vote. This information will not be disclosed, except as required by law.

What

Constitutes a Quorum?

To

carry on business at the Special Meeting, we must have a quorum. A quorum is present when a majority of the shares entitled to vote,

as of the Record Date, are represented in person or by proxy. Thus, shares must be represented in person or by proxy to have a quorum

at the Special Meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your

behalf by your broker, bank or other nominee) or if you vote in person at the Special Meeting. Abstentions and broker non-votes will

be counted towards the quorum requirement. Shares owned by us are not considered outstanding or considered to be present at the Special

Meeting. If there is not a quorum at the Special Meeting, either the chairperson of the Special Meeting or our stockholders entitled

to vote at the Special Meeting may adjourn the Special Meeting.

How

Will my Shares be Voted if I Give No Specific Instruction?

We

must vote your shares as you have instructed. If there is a matter on which a stockholder of record has given no specific instruction

but has authorized us generally to vote the shares, they will be voted as follows:

|

|

1.

|

“For”

the approval of amendment of the Company’s Certificate of Incorporation to effect a reverse stock split with the exact ratio

to be determined at the discretion of the Board of Directors;

|

|

|

|

|

|

|

2.

|

“For”

approval of the Company’s adoption of the 2022 Equity and Incentive Plan.

|

This

authorization would exist, for example, if a stockholder of record merely signs, dates and returns the proxy card but does not indicate

how his, her or its shares are to be voted on one or more proposals. If other matters properly come before the Special Meeting and you

do not provide specific voting instructions, your shares will be voted at the discretion of the proxies.

If

your shares are held in street name, see “What is a Broker Non-Vote?” below regarding the ability of banks, brokers and other

such holders of record to vote the uninstructed shares of their customers or other beneficial owners in their discretion.

How

are Votes Counted?

Votes

will be counted by the inspector of election appointed for the Special Meeting, who will separately count, for the election of directors,

“For,” “Withhold” and broker non-votes; and, with respect to the other proposals, votes “For” and

“Against,” abstentions and broker non-votes. Broker non-votes will not be included in the tabulation of the voting results

of any of the proposals and, therefore, will have no effect on such proposals.

What

is a Broker Non-Vote?

A

“broker non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with

respect to a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially owns the shares

and (2) the broker lacks the authority to vote the shares at their discretion.

How

many votes are required to approve each proposal?

The

table below summarizes the proposals that will be voted on, the vote required to approve each item and how votes are counted:

|

Proposal

|

|

Votes

Required

|

|

Voting

Options

|

|

|

|

|

|

|

|

Proposal

No. 1:

|

|

To

approve an amendment to the Company’s Amended and Restated Certificate of Incorporation

to effect a reverse stock split

|

|

“FOR”

“AGAINST”

“ABSTAIN”

|

|

|

|

|

|

|

|

Proposal

No. 2:

|

|

To

approve and adopt the 2022 Equity and Incentive Plan

|

|

“FOR”

“AGAINST”

“ABSTAIN”

|

What

is an Abstention?

An

abstention is a stockholder’s affirmative choice to decline to vote on a proposal. Any stockholder who is present at the Special

Meeting, either in person or by proxy, who abstains from voting, will still be counted for purposes of determining whether a quorum exists

for the meeting. If you hold your shares in “street name” and you do not instruct your bank, broker or other nominee how

to vote, your shares will be included in the determination of the number of shares present at the Special Meeting for determining a quorum

at the meeting but may constitute broker non-votes, resulting in no votes being cast on your behalf with respect to certain proposals.

See “What is a broker non-vote?”

What

Are the Voting Procedures?

In

voting by proxy with regard to the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees,

or withhold your votes as to specific nominees. With regard to other proposals, you may vote in favor of or against the proposal, or

you may abstain from voting on the proposal. You should specify your respective choices on the accompanying proxy card or your vote instruction

form.

Is

My Proxy Revocable?

If

you are a registered stockholder, you may revoke or change your vote at any time before the proxy is voted by filing with our Corporate

Secretary, at 1101 Wootton Pkwy, #1020, Rockville, MD, 20852, either a written notice of revocation or a duly executed

proxy bearing a later date. If you attend the Special Meeting you may revoke your proxy or change your proxy vote by voting at the meeting.

Your attendance at the Special Meeting will not by itself revoke a previously granted proxy.

If

your shares are held in street name or you hold shares through a retirement or savings plan or other similar plan, please check your

voting instruction card or contact your broker, nominee, trustee or administrator to determine whether you will be able to revoke or

change your vote.

Who

is Paying for the Expenses Involved in Preparing this Proxy Statement?

All

of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid

by us. In addition to the solicitation by mail, proxies may be solicited by our officers and other employees by telephone or in person.

Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage

houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of

record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in forwarding solicitation

materials.

Do

I Have Dissenters’ Rights of Appraisal?

Neither

the adoption by the board of directors nor the approval by the majority of the amendment to our Certificate of Incorporation provides

shareholders any right to dissent and obtain appraisal of or payment for such shareholder’s shares under the New Jersey corporate

law, the articles of incorporation or the bylaws.

How

can I Find out the Results of the Voting at the Special Meeting?

Preliminary

voting results will be announced at the Special Meeting. In addition, final voting results will be disclosed in a Current Report on Form

8-K that we expect to file with the SEC within four business days after the Special Meeting. If final voting results are not available

to us in time to file a Current Report on Form 8-K with the SEC within four business days after the Special Meeting, we intend to file

a Current Report on Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file

an additional Current Report on Form 8-K to publish the final results.

Do

the Company’s Executive Officers and Directors have an Interest in Any of the Matters to Be Acted Upon at the Special Meeting?

Members

of the Board and executive officers of mPhase do not have any substantial interest, direct or indirect, in Proposal No. 1 or 2.

PROPOSAL

1:

AMENDMENT

TO OUR ARTICLES OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

Our

Board has determined it may be advisable and in the best interest of the Company and its shareholders and is submitting to the shareholders

for their approval a proposed amendment to our Articles of Incorporation that would allow the Board, if the Board determined that such

action would be in the best interests of the Company in light of the factors discussed below, to effect a reverse stock split of our

issued and outstanding common stock and treasury stock (the “Reverse Split”) at a ratio ranging from 1-for-10 or to

1-for-45, with the final ratio to be determined by the Board in its discretion following the approval by the shareholders,

without the proportional reduction in the number of shares of common stock the Company is authorized to issue.

If

the Board, following the approval by the shareholders, decides in its discretion to effect the Reverse Split, it would set the Reverse

Split ratio from the range described in this Proposal 1 and the Articles of Incorporation would be amended accordingly. Approval of this

Reverse Split proposal will authorize the Board in its discretion to effect the Reverse Split at any of the ratios within the range described

above, or not to effect the Reverse Split. A form of the Articles of Amendment to the Company’s Amended and Restated Articles of

Incorporation that would be filed with the Secretary of State of New Jersey to effect the Reverse Split is set forth in Appendix A (the

“Amendment”). However, such form is subject to amendment to include such changes as may be required by the office of the

Secretary of State of New Jersey or as the Board deems necessary and advisable to effect the Reverse Split. If at any time prior to the

effectiveness of the filing of the Amendment with the New Jersey Secretary of State, the Board determines that it would not be in the

best interests of the Company and its shareholders to effect the Reverse Split, in accordance with New Jersey law and notwithstanding

the approval by the shareholders, the Board may abandon the Reverse Split without further action by the shareholders.

We

believe that giving the Board the discretion to set the ratio within the stated range will provide us with the flexibility to implement

the Reverse Split in a manner designed to maximize the anticipated benefits for our shareholders. By voting in favor of the Reverse Split,

you are expressly authorizing the Board to select one ratio from among the ratios set forth in this Proposal 1. If the shareholders approve

this Proposal 1, the Board would effect the Reverse Split only upon the Board’s determination that the Reverse Split would be in

the best interest of the Company and its shareholders at that time. In determining whether to implement the Reverse Split and selecting

the Reverse Split ratio, our Board will consider several factors, including:

|

|

●

|

the

initial listing requirements of The Nasdaq Stock Market (“Nasdaq”), including the minimum bid price requirement;

|

|

|

●

|

the

historical trading price and trading volume of our common stock;

|

|

|

●

|

the

then prevailing trading price and trading volume for our common stock;

|

|

|

●

|

the

anticipated impact of the Reverse Split on the trading price of and market for our common stock; and

|

|

|

●

|

the

prevailing general market and economic conditions.

|

If

approved by the shareholders, the authorization to effect the Reverse Split will remain effective until our common stock is listed on

a national securities exchange or one year from the date of the Special Meeting, whichever is earlier.

Appendix A as provided with

this Proxy Statement does not purport to be a complete description of the entirety of the Company’s Articles of Incorporation,

and merely only provides the material amendment that is relevant to this Section. Such descriptions are qualified in their entirely by

reference to the full text of the Company’s Articles of Incorporation effective on the date of this Proxy Statement.

Reasons

for the Reverse Split

The

purpose of the Reverse Split is to increase the market price of our common stock in connection with the potential up-listing of the Common

Stock to the Nasdaq. The Board intends to implement the Reverse Split only if it believes that a decrease in the number of shares outstanding

is likely to improve the trading price for our common stock on a split adjusted basis.

The

Board believes that effecting the Reverse Stock Split may be desirable for a number of reasons, including:

|

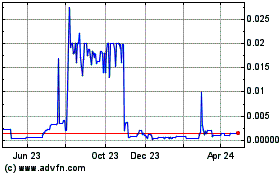

|

●

|

List

our Common Stock on The Nasdaq. Our common stock is currently quoted on the OTCMKTS market under the symbol “XDSL”.

The high and low sales prices of our common stock over the past thirty days were $.230 and $.186 per share. We intend

to apply to have our common stock listed on Nasdaq. We expect that the Reverse Split will increase the market price of our common

stock so that we will be able to meet the minimum bid price requirements of the listing rules of Nasdaq.

|

|

|

|

|

|

|

●

|

Broaden

our Investor Base. We believe the Reverse Split may increase the price of our common stock and thus may allow a broader range

of institutional investors with the ability to invest in our common stock. For example, many funds and institutions have investment

guidelines and policies that prohibit them from investing in stocks trading below a certain threshold. We believe that increased

institutional investor interest in the Company and our common stock will potentially increase the overall market for our common stock.

|

|

|

|

|

|

|

●

|

Increase

Analyst and Broker Interest. We believe the Reverse Split would help increase analyst and broker-dealer interest in our common

stock as many brokerage and investment advisory firms’ policies can discourage analysts, advisors, and broker-dealers from

following or recommending companies with low stock prices. Because of the trading volatility and lack of liquidity often associated

with lower-priced stocks, many broker-dealers have adopted investment guidelines, policies and practices that either prohibit or

discourage them from investing in or trading such stocks or recommending them to their customers. Some of those guidelines, policies

and practices may also function to make the processing of trades in lower-priced stocks economically unattractive to broker-dealers.

While we recognize that we will remain a “penny stock” under the SEC rules, if our common stock is not listed on the

Nasdaq, we expect the increase in the stock price resulting from the Reverse Split will position us better if our business continues

to grow as we anticipate. Additionally, because brokers’ commissions and dealer mark-ups/mark-downs on transactions in lower-priced

stocks generally represent a higher percentage of the stock price than commissions and mark-ups/mark-downs on higher-priced stocks,

the current average price per share of our common stock can result in shareholders or potential shareholders paying transaction costs

representing a higher percentage of the total share value than would otherwise be the case if the share price were substantially

higher.

|

Certain

Risks Associated with the Reverse Split

If

the Reverse Split does not result in a proportionate increase in the price of our common stock, we may not be able to list our common

stock on the Nasdaq.

We

expect that the Reverse Split of will increase the market price of our common stock so that we will be able to meet the minimum bid price

requirement of the listing rules of the Nasdaq. However, the effect of Reverse Split upon the market price of our common stock cannot

be predicted with certainty, and the results of reverse stock splits by companies in similar circumstances have been varied. It is possible

that the market price of our common stock following the Reverse Split will not increase sufficiently for us to be in compliance with

the minimum bid price requirement. If we are unable meet the minimum bid price requirement, we may be unable to list our shares on the

Nasdaq markets.

Even

if the Reverse Split achieves the requisite increase in the market price of our common stock, we cannot assure you that we will be able

to continue to comply with the minimum bid price requirement of either the Nasdaq.

Even

if the reverse stock split achieves the requisite increase in the market price of our common stock to be in compliance with the minimum

bid price of either the Nasdaq, there can be no assurance that the market price of our common stock following the Reverse Split will

remain at the level required for continuing compliance with that requirement. It is not uncommon for the market price of a company’s

common stock to decline in the period following a reverse stock split. If the market price of our common stock declines following the

effectuation of the Reverse Split, the percentage decline may be greater than would occur in the absence of a reverse stock split. In

any event, other factors unrelated to the number of shares of our common stock outstanding, such as negative financial or operational

results, could adversely affect the market price of our common stock and jeopardize our ability to meet or maintain either the Nasdaq

market’s minimum bid price requirement.

Even

if the Reverse Split increases the market price of our common stock, our stock price could fall, and we could be delisted from the Nasdaq

market.

The

Nasdaq market require that the trading price of its listed stocks remain above one dollar in order for the stock to remain listed. If

a listed stock trades below one dollar for more than 30 consecutive trading days, then it is subject to delisting. In addition, to maintain

a listing on the Nasdaq, we must satisfy minimum financial and other continued listing requirements and standards, including those regarding

director independence and independent committee requirements, minimum shareholders’ equity, and certain corporate governance requirements.

If we are unable to satisfy these requirements or standards, we could be subject to delisting. Such a delisting would likely have a negative

effect on the price of our common stock and would impair your ability to sell or purchase our common stock when you wish to do so. In

the event of a delisting, we would expect to take actions to restore our compliance with the listing requirements, but we can provide

no assurance that any such action taken by us would allow our common stock to become listed again, stabilize the market price or improve

the liquidity of our common stock, prevent our common stock from dropping below the minimum bid price requirement, or prevent future

non-compliance with the listing requirements.

The

Reverse Split may decrease the liquidity of our common stock.

The

liquidity of the shares of our common stock may be affected adversely by the reverse stock split given the reduced number of shares that

will be outstanding following the Reverse Split, especially if the market price of our common stock does not increase as a result of

the Reverse Split. In addition, the Reverse Split may increase the number of shareholders who own odd lots (less than 100 shares) of

our common stock, creating the potential for such shareholders to experience an increase in the cost of selling their shares and greater

difficulty effecting such sales.

Following

the Reverse Split, the resulting market price of our common stock may not attract new investors, including institutional investors, and

may not satisfy the investing requirements of those investors. Consequently, the trading liquidity of our common stock may not improve.

Although

we believe that a higher market price of our common stock may help generate greater or broader investor interest, there can be no assurance

that the Reverse Split will result in a share price that will attract new investors, including institutional investors. In addition,

there can be no assurance that the market price of our common stock will satisfy the investing requirements of those investors. As a

result, the trading liquidity of our common stock may not necessarily improve.

Principal

Effects of the Reverse Split

If

approved and implemented, the principal effects of the Reverse Split would include the following:

|

|

●

|

the

number of outstanding shares of the Company’s common stock and treasury stock will decrease based on the Reverse Split ratio

selected by the Board;

|

|

|

●

|

the

number of shares of the Company’s common stock held by individual shareholders will decrease based on the Reverse Split ratio

selected by the Board, and the number of shareholders who own “odd lots” of less than 100 shares of our common stock

will increase;

|

|

|

●

|

the

number of shares common stock reserved for issuance under our stock incentive plans will be reduced proportionally based on the Reverse

Split ratio selected by the Board (along with any other appropriate adjustments or modifications); and

|

|

|

●

|

the

exercise price of our outstanding stock options and warrants and the conversion price of our outstanding convertible securities,

including debt securities, and the number of shares reserved for issuance upon exercise or conversion thereof will be adjusted in

accordance with their terms based on the Reverse Split ratio selected by the Board.

|

The

Reverse Split will not change the number of authorized shares of our common stock or preferred stock, or the par value of the common

stock or preferred stock.

Fractional

Shares

No

fractional shares will be issued in connection with the Reverse Split. We will round up any fractional shares resulting from the Reverse

Split to the nearest whole share.

No

Going Private Transaction

Notwithstanding

the decrease in the number of outstanding shares of common stock following the proposed Reverse Stock Split, the Board does not intend

for this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 under the Exchange

Act.

Procedure

for Implementing the Reverse Split

The

Reverse Split, if approved by our shareholders, would become effective following the filing of the Amendment with the Secretary of State

of the State of New Jersey as of the time of filing or such other time set forth in the Amendment (the “Effective Time”).

The Effective Time of the Reverse Split will be determined by our Board based on its evaluation as to when such action will be the most

advantageous to us and our shareholders. Beginning at the Effective Time, each certificate representing shares of our common stock will

be deemed for all corporate purposes to evidence ownership of the number of whole shares into which the shares previously represented

by the certificate were combined pursuant to the Reverse Split. The form of the Amendment to implement the Reverse Split is attached

to this Proxy Statement as Appendix B. The Reverse Split alone will have no effect on our authorized capital stock, and the total

number of authorized shares will remain the same as before the Reverse Split. After the Effective Time, our common stock will have a

new Committee on Uniform Securities Identification Procedures (“CUSIP”) number, which is a number used to identify our equity

securities.

Effect

on Beneficial Owners of Common Stock

Upon

implementing the Reverse Split, we intend to treat shares held by shareholders through a bank, broker, custodian or other nominee in

the same manner as the shareholders whose shares are registered in their names. Banks, brokers, custodians or other nominees will be

instructed to effect the Reverse Split for their beneficial holders holding our common stock in street name. However, these banks, brokers,

custodians or other nominees may have different procedures than registered shareholders for processing the Reverse Split. Shareholders

who hold shares of our common stock with a bank, broker, custodian or other nominee and who have any questions in this regard are encouraged

to contact their banks, brokers, custodians or other nominees.

Effect

on Registered “Book-Entry” Holders of Common Stock

Certain

registered holders of our common stock may hold some or all of their shares electronically in book-entry form with Worldwide Stock Transfer,

LLC, our transfer agent (the “Transfer Agent”). These shareholders do not have stock certificates evidencing their ownership

of the common stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts.

Shareholders

who hold shares electronically in book-entry form with the Transfer Agent will not need to act in connection with the Reverse Split.

The Reverse Split will automatically be reflected in the Transfer Agent’s records and on their next statement.

Exchange

of Stock Certificates

Until

surrendered as contemplated herein, any physical stock certificates possessed by the shareholders shall be deemed at and after the effective

time of the Reverse Split to represent the number of whole shares of our common stock resulting from the Reverse Split. If the Reverse

Split is effected, shareholders holding certificated shares (i.e., shares represented by one or more physical stock certificates) may

be able to exchange their old stock certificate(s) for shares held electronically in book-entry form representing the appropriate number

of whole shares of our common stock resulting from the Reverse Split. This means that, instead of receiving a new stock certificate,

shareholders holding certificated shares prior to the effective time of the Reverse Split will receive a statement of holding indicating

the number of shares held by them electronically in book-entry form after giving effect to the Reverse Split. Shareholders of record

upon the effective time of the Reverse Split will be furnished the necessary materials and instructions for the surrender and exchange

of their old certificate(s) at the appropriate time by our Transfer Agent. Any shareholder whose old certificate(s) have been lost, destroyed

or stolen will be entitled to new shares in book-entry form only after complying with the requirements that we and our Transfer Agent

customarily apply in connection with lost, stolen or destroyed certificates.

Accounting

Matters

The

Reverse Split and the related proposed amendment to our Articles of Incorporation will not affect the par value of our common stock,

which will remain having no par value per share. Our shareholders’ equity, in the aggregate, will remain unchanged. However, after

the Reverse Split, net income or loss per share, and other per share amounts, will be increased because there will be fewer shares of

common stock outstanding. In future financial statements, net income or loss per share and other per share amounts for periods ending

before the Reverse Split would be recast to give retroactive effect to the Reverse Split.

Certain

Federal Income Tax Consequences

Each

shareholder is advised to consult their own tax advisor as the following discussion may be limited, modified or not apply based on your

particular situation.

The

following discussion of the material U.S. federal income tax consequences of the Reverse Split is based on the current provisions of

the Internal Revenue Code of 1986, as amended (the “Code”), Treasury regulations promulgated under the Code, Internal Revenue

Service (“IRS”) rulings and pronouncements and judicial decisions now in effect. Those legal authorities are subject to change

at any time by legislative, judicial or administrative action, possibly with retroactive effect to the Reverse Split. No ruling from

the IRS with respect to the matters discussed below has been requested, and there is no assurance that the IRS or a court would agree

with the conclusions set forth in this discussion. The following discussion assumes that the pre-split shares of common stock were, and

post-split shares will be, held as “capital assets” as defined in the Code. This discussion may not address certain U.S.

federal income tax consequences that may be relevant to particular shareholders in light of their specific circumstances or to certain

types of shareholders (like dealers in securities, insurance companies, foreign individuals and entities, financial institutions and

tax-exempt entities) that may be subject to special treatment under the U.S. federal income tax laws. This discussion also does not address

any tax consequences under state, local or foreign laws.

PLEASE

CONSULT YOUR OWN TAX ADVISOR REGARDING THE U.S. FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES OF THE REVERSE SPLIT

IN YOUR PARTICULAR CIRCUMSTANCES UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION.

We

will not recognize any gain or loss for U.S. federal income tax purposes as a result of the Reverse Split.

A

shareholder will not recognize gain or loss for U.S. federal income tax purposes on the exchange of pre-Reverse Split shares of our common

stock for post-Reverse Split shares of our common stock in the Reverse Split. A shareholder’s aggregate tax basis in the post-Reverse

Split shares of our common stock the shareholder receives in the Reverse Split will be the same as the shareholder’s aggregate

tax basis in the pre-Reverse Split shares of our common stock the shareholder surrenders in exchange therefor. A shareholder’s

holding period for the post-Reverse Split shares of our common stock the shareholder receives in the Reverse Split will include the shareholder’s

holding period for the pre-Reverse Split shares of our common stock the shareholder surrenders in exchange therefor. Shareholders who

have different bases or holding periods for pre-Reverse Split shares of our common stock should consult their tax advisors regarding

their bases or holding periods in their post-Reverse Split common stock.

Effect

of Not Obtaining the Required Vote of Approval

The

failure of shareholders to approve the Reverse Stock Proposal could prevent us from meeting the Nasdaq minimum bid price requirement

(the “Minimum Bid Price Requirement”), among other things, unless the market price of our common stock increases above the

Minimum Bid Price Requirement without a reverse split. If we are unable to uplist our common stock to Nasdaq, interest in our common

stock may decline and certain institutions may not have the ability to trade in our common stock, all of which could have a material

adverse effect on the liquidity or trading volume of our common stock. If our common stock becomes significantly less liquid due to our

inability to qualify for listing on Nasdaq, our shareholders may not have the ability to liquidate their investments in our common stock

when desired and we believe our access to capital would become significantly diminished as a result.

Interests

of Directors and Executive Officers in this Proposal

All

of our directors and executive officers have a direct interest in increasing the value of our shares. Therefore, they have an interest

in the approval of this proposal as it is expected it will lead to an increase in the value of our shares. However, the Board does not

believe this interest is different from that of any other shareholder.

Anti-Takeover

Effects of the Reverse Split

The

effective increase in our authorized and unissued shares as a result of the Reverse Split could potentially be used by our Board to thwart

a takeover attempt. The overall effects of this might be to discourage, or make it more difficult to engage in, a merger, tender offer

or proxy contest, or the acquisition or assumption of control by a holder of a large block of our securities and the removal of incumbent

management. The Reverse Split could make the accomplishment of a merger or similar transaction more difficult, even if it is beneficial

to the shareholders. Our Board might use the additional shares to resist or frustrate a third-party transaction, favored by a majority

of the independent shareholders that would provide an above-market premium, by issuing additional shares to frustrate the takeover effort.

As

discussed above, the principal goals of the Company in effecting the Reverse Split are to list our securities on Nasdaq and increase

the ability of institutions to purchase our common stock and stimulate the interest in our common stock by analysts and brokers. This

Reverse Split is not the result of management’s knowledge of an effort to accumulate the Company’s securities or to obtain

control of the Company by means of a merger, tender offer, solicitation or otherwise.

Neither

our Articles of Incorporation nor our Bylaws presently contain any provisions having anti-takeover effects and the Reverse Split proposal

is not a plan by our Board to adopt a series of amendments to our Articles of Incorporation or Bylaws to institute an anti-takeover provision.

We do not have any plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover

consequences.

Vote

Required

Approval

of the reverse stock split requires the affirmative vote of a majority of the shares outstanding at the Special Meeting. If approved

by the shareholders at the Company’s Special Meeting, the Amendment to implement the Reverse Split will be filed with the New Jersey

Secretary of State and will become effective.

Board

Recommendation

The

Board of Directors recommends that you vote “FOR” Proposal 1. Proxies solicited by the Board of Directors will be voted “FOR”

the Proposal 1 unless shareholders specify a contrary vote.

PROPOSAL

2:

APPROVAL

OF THE COMPANY’S 2022 EQUITY AND INCENTIVE PLAN AND THE RESERVATION OF UP TO 15,000,000 SHARES OF COMMON STOCK FOR ISSUANCE THEREUNDER

The

Company’s 2022 Equity Incentive Plan (the “2022 Plan”) was adopted by the Board on February 4, 2022, and we

are requesting approval of this new equity compensation plan because we need to be able to issue equity awards to service providers in

order to motivate and retain such persons and to further align their interests with those of our Stockholders. The 2022 Plan will only

become effective if approved by the Stockholders. If approved, the 2022 Plan will be effective immediately, subject to any restrictions

on the issuance of awards under the 2022 Plan because of a lack of available or reserved shares of Common Stock to underlie such awards.

Having

an adequate number of shares available for future equity compensation grants is necessary to promote our long-term success and the creation

of Stockholder value by:

|

|

●

|

Enabling

us to continue to attract and retain the services of key service providers who would be eligible to receive grants;

|

|

|

|

|

|

|

●

|

Aligning

participants’ interests with Stockholders’ interests through incentives that are based upon the performance of our Common

Stock; and

|

|

|

|

|

|

|

●

|

Motivating

participants, through equity incentive awards, to achieve long-term growth in the Company’s business, in addition to short-term

financial performance.

|

The

2022 Plan has identified the number of shares of Common Stock reserved for issuance as 15,000,000. The 2022 Plan will provide for the

grant of incentive stock options (“ISOs”), non-qualified stock options (“NQSOs”), stock appreciation rights (“SARs”),

other equity awards and/or cash awards to employees, directors and consultants. The 2022 Plan will remain in effect until the earlier

of (i) the time the Board decides to amend the Plan and (ii) the date upon which the 2022 Plan is terminated pursuant to its terms,

and in any event subject to the maximum share limit.

On

February 4, 2022, our Board adopted the 2022 Plan and authorized the reservation of up to 15,000,000 shares of Common Stock

for issuance thereunder, subject to availability. To the extent that there are no authorized and unreserved shares of Common Stock

available, the awards underlying the 2022 Plan will not be issuable until such time, and from time to time, as shares of Common

Stock are available to be reserved and in such amounts as are available. Assuming all 15,000,000 shares become available and the

Company may issue the full amount of awards under the 2022 Plan, the number of shares available for issuance under the 2022 Plan

shall constitute approximately [ ]% of our issued and outstanding shares of Common Stock as of the Record Date. The 2022

Plan is intended to provide us with a sufficient number of shares to satisfy our equity grant requirements until our 2022 Special

Meeting of Stockholders, based on the current scope and structure of our equity incentive programs and the rate at which we expect

to grant stock options, restricted stock, and/or other forms of equity compensation.

When

approving the reservation of up to 15,000,000 shares of Common Stock issuable pursuant to the 2022 Plan, the Board considered a number

of factors, including those set forth below:

|

|

●

|

Alignment

with our Stockholders. Achieving superior, long-term results for our Stockholders remains one of our primary objectives. We believe

that stock ownership enhances the alignment of the long-term economic interests of our employees and our Stockholders.

|

|

|

|

|

|

|

●

|

Attract,

Motivate and Retain Key Employees. We compete for employees in a variety of geographic and talent markets and strive to maintain

compensation programs that are competitive in order to attract, motivate and retain key employees. If we are unable to grant equity

as part of our total compensation strategy, our ability to attract and retain all levels of talent we need to operate our business

successfully would be significantly harmed.

|

|

|

|

|

|

|

●

|

Balanced

Approach to Compensation. We believe that a balanced approach to compensation - using a mix of salaries, performance-based bonus

incentives and long-term equity incentives (including performance based equity) encourages management to make decisions that favor

long-term stability and profitability, rather than short-term results.

|

Set

forth below is a summary of the 2022 Plan, which is qualified in its entirety by reference to the full text of the 2022 Plan, a copy

of which is included as Appendix B to this Proxy Statement. If there is any inconsistency between the following summary

of the 2022 Plan and Appendix B, the full text of the 2022 Plan included as Appendix B shall govern.

Key

Features of the 2022 Plan

Certain

key features of the 2022 Plan are summarized as follows:

|

|

●

|

If

not terminated earlier by the Board, the 2022 Plan will terminate on at a time the Board amends or removes the Plan.

|

|

|

|

|

|

|

●

|

Up

to a maximum aggregate of 15,000,000 shares of Common Stock may be issued under the 2022 Plan, subject to availability. The maximum

number of shares that may be issued pursuant to the exercise of ISOs is also 15,000,000, subject to availability.

|

|

|

|

|

|

|

●

|

The

2022 Plan will generally be administered by the Board or the Compensation Committee (the “2022 Plan Committee”). The

Board may also designate a separate committee to make awards to employees who are not officers subject to the reporting requirements

of Section 16 of the Exchange Act.

|

|

|

|

|

|

|

●

|

Employees,

consultants and Board members are eligible to receive awards, provided that the 2022 Plan Committee has the discretion to determine

(i) who shall receive any awards, and (ii) the terms and conditions of such awards.

|

|

|

|

|

|

|

●

|

Awards

may consist of ISOs, NQSOs, restricted stock, SARs, other equity awards and/or cash awards.

|

|

|

|

|

|

|

●

|

Stock

options and SARs may not be granted at a per share exercise price below the fair market value of a share of our Common Stock on the

date of grant.

|

|

|

|

|

|

|

●

|

Stock

options and SARs may not be repriced or exchanged without Stockholder approval.

|

|

|

|

|

|

|

●

|

The

maximum exercisable term of stock options and SARs may not exceed [ten] years.

|

|

|

|

|

|

|

●

|

Awards

are subject to recoupment of compensation policies adopted by the Company.

|

|

|

|

|

|

|

●

|

The aggregate amount of all cash compensation (including

annual retainers and other fees, whether or not granted under the 2002 Plan) plus the aggregate grant date fair market value of all

awards issued under the 2022 Plan (or under any other incentive plan) provided to any non-employee director during any single calendar

year may not exceed $300,000.

|

Background

and Purpose of the 2022 Plan. The purpose of the 2022 Plan is to promote our long-term success and the creation of Stockholder

value by:

|

|

●

|

Attracting

and retaining the services of key employees who would be eligible to receive grants as selected participants;

|

|

|

|

|

|

|

●

|

Motivating

selected participants through equity-based compensation that is based upon the performance of our Common Stock; and

|

|

|

|

|

|

|

●

|

Further

aligning selected participants’ interests with the interests of our Stockholders, through the award of equity compensation

grants which increases their interest in the Company, to achieve long-term growth over short-term performance.

|

The

2022 Plan permits the grant of the following types of equity-based incentive awards: (1) stock options (which can be either ISOs or NQSOs),

(2) SARs, (3) restricted stock, (4) other equity awards and (5) cash awards. The vesting of awards can be based on either continuous

service and/or performance goals. Awards are evidenced by a written agreement between the selected participant and the Company.

Eligibility

to Receive Awards. Employees, consultants and Board members of the Company and certain of our affiliated companies are eligible

to receive awards under the 2022 Plan. The 2022 Plan Committee will determine, in its discretion, the selected participants who will

be granted awards under the 2022 Plan.

Non-Employee

Director Limitations. With respect to our non-employee directors, the 2022 Plan provides that any non-employee director serving

in the following positions cannot receive awards in any fiscal year which in the aggregate exceeds the following: $300,000 in any calendar year. Provided

that the Board affirmatively acts to implement such a process, the 2022 Plan also provides that non-employee directors may elect to receive

stock grants or stock units (which would be issued under the 2022 Plan) in lieu of fees that would otherwise be paid in cash.

Shares

Subject to the 2022 Plan. The maximum number of shares of Common Stock that can be issued under the 2022 Plan is 15,000,000 shares.

The shares underlying forfeited or terminated awards (without payment of consideration), or unexercised awards become available again

for issuance under the 2022 Plan. The 2022 Plan also imposes certain share grant limits such as the limit on grants to non-employee directors

described above and other limits that are intended to comply with the legal requirements of Section 422 of the Internal Revenue Code

of 1986, as amended (the “Code”) and which are discussed elsewhere in this proposal. No fractional shares may be issued under

the 2022 Plan. No shares will be issued with respect to a participant’s award unless applicable tax withholding obligations have

been satisfied by the participant. To the extent that there are no authorized and unreserved shares of Common Stock available for the

2022 Plan, the awards underlying the 2022 Plan will not be issuable until such time, and from time to time, as shares of Common Stock

are available and in such amounts as are available.

Administration

of the 2022 Plan. The 2022 Plan will be administered by the 2022 Plan Committee. Subject to the terms of the 2022 Plan, the 2022

Plan Committee has the sole discretion, with among other things, to:

|

|

●

|

Select

the individuals who will receive awards;

|

|

|

|

|

|

|

●

|

Determine

the terms and conditions of awards (for example, performance conditions, if any, and vesting schedule);

|

|

|

|

|

|

|

●

|

Correct

any defect, supply any omission, or reconcile any inconsistency in the 2022 Plan or any award agreement;

|

|

|

|

|

|

|

●

|

Accelerate

the vesting, extend the post-termination exercise term or waive restrictions of any awards at any time and under such terms and conditions

as it deems appropriate, subject to the limitations set forth in the 2022 Plan;

|

|

|

|

|

|

|

●

|

Permit

a participant to defer compensation to be provided by an award; and

|

|

|

|

|

|

|

●

|

Interpret

the provisions of the 2022 Plan and outstanding awards.

|

The

2022 Plan Committee may suspend vesting, settlement, or exercise of awards pending a determination of whether a selected participant’s

service should be terminated for cause (in which case outstanding awards would be forfeited). Awards may be subject to any policy that

the Board may implement on the recoupment of compensation (referred to as a “clawback” policy). The members of the Board,

the 2022 Plan Committee and their delegates shall be indemnified by the Company to the maximum extent permitted by applicable law for

actions taken or not taken regarding the 2022 Plan. In addition, the 2022 Plan Committee may use the 2022 Plan to issue shares under

other plans or sub-plans as may be deemed necessary or appropriate, such as to provide for participation by non-U.S. employees and those

of any of our subsidiaries and affiliates.

Types

of Awards.

Stock

Options. A stock option is the right to acquire shares at a fixed exercise price over a fixed period of time. The 2022 Plan Committee

will determine, among other terms and conditions, the number of shares covered by each stock option and the exercise price of the shares

subject to each stock option, but such per share exercise price cannot be less than the fair market value of a share of our Common Stock

on the date of grant of the stock option. The fair market value of a share of our Common Stock for the purposes of pricing our awards

shall be equal to the closing price for our Common Stock as reported by the OTC Markets or such other principal trading market on which

our securities are traded on the date of determination. Stock options may not be repriced or exchanged without Stockholder approval,

and no re-load options may be granted under the 2022 Plan.

Stock

options granted under the 2022 Plan may be either ISOs or NQSOs. As required by the Code and applicable regulations, ISOs are subject

to various limitations not imposed on NQSOs. For example, the exercise price for any ISO granted to any employee owning more than 10%

of our Common Stock may not be less than 110% of the fair market value of the Common Stock on the date of grant, and such ISO must expire

no later than five years after the grant date. ISOs may not be transferred other than upon death, or to a revocable trust where the participant

is considered the sole beneficiary of the stock option while it is held in trust. In order to comply with Treasury Regulation Section

1.422-2(b), the 2022 Plan provides that all 15,000,000 shares may be issued pursuant to the exercise of ISOs, subject to the availability

of underlying shares of Common Stock.

A

stock option granted under the 2022 Plan generally cannot be exercised until it becomes vested. The 2022 Plan Committee establishes the

vesting schedule of each stock option at the time of grant. The maximum term for stock options granted under the 2022 Plan may not exceed

ten years from the date of grant although the 2022 Plan Committee may establish a shorter period at its discretion. The exercise price

of each stock option granted under the 2022 Plan must be paid in full at the time of exercise, either with cash, or through a broker-assisted

“cashless” exercise and sale program, or net exercise, or through another method approved by the 2022 Plan Committee. The

optionee must also make arrangements to pay any taxes that are required to be withheld at the time of exercise.

SARs.

A SAR is the right to receive, upon exercise, an amount equal to the difference between the fair market value of the shares on the date

of the SAR’s exercise and the aggregate exercise price of the shares covered by the exercised portion of the SAR. The 2022 Plan

Committee determines the terms of SARs, including the exercise price (provided that such per share exercise price cannot be less than

the fair market value of a share of our Common Stock on the date of grant), the vesting and the term of the SAR. The maximum term for

SARs granted under the 2022 Plan may not exceed ten years from the date of grant, subject to the discretion of the 2022 Plan Committee

to establish a shorter period. Settlement of a SAR may be in shares of Common Stock or in cash, or any combination thereof, as the 2022

Plan Committee may determine. SARs may not be repriced or exchanged without Stockholder approval.

Restricted

Stock. A restricted stock award is the grant of shares of our Common Stock to a selected participant and such shares may be subject

to a substantial risk of forfeiture until specific conditions or goals are met. The restricted shares may be issued with or without cash

consideration being paid by the selected participant as determined by the 2022 Plan Committee. The 2022 Plan Committee also will determine

any other terms and conditions of an award of restricted stock. In determining whether an award of restricted stock should be made, and/or

the vesting schedule for any such award, the 2022 Plan Committee may impose whatever conditions to vesting it determines to be appropriate.

During the period of vesting, the participant will not be permitted to transfer the restricted shares but will generally have voting

and dividend rights (subject to vesting) with respect to such shares.

Other

Awards. The 2022 Plan also provides that other equity awards, which derive their value from the value of our shares or from increases

in the value of our shares, may be granted. In addition, cash awards may also be issued. Substitute awards may be issued under the 2022

Plan in assumption of or substitution for or exchange for awards previously granted by an entity which we (or an affiliate) acquire.

Limited

Transferability of Awards. Awards granted under the 2022 Plan generally are not transferrable other than by will or by the laws of

descent and distribution. However, the 2022 Plan Committee may in its discretion permit the transfer of awards other than ISOs. Generally,

where transfers are permitted, they will be permitted only by gift to a member of the selected participant’s immediate family or

to a trust or other entity for the benefit of the selected participant and/or member(s) of his or her immediate family.

Termination

of Employment, Death or Disability. The 2022 Plan generally determines the effect of the termination of employment on awards, which

determination may be different depending on the nature of the termination, such as terminations due to cause, resignation, death, or

disability and the status of the award as vested or unvested, unless the award agreement or a selected participant’s employment

agreement or other agreement provides otherwise.

Dividends

and Dividend Equivalents. Any dividend equivalents distributed in the form of shares under the 2022 Plan will count against the 2022

Plan’s maximum share limit. The 2022 Plan also provides that dividend equivalents will not be paid or accrue on unexercised stock

options or unexercised SARs. Dividends and dividend equivalents that may be paid or accrue with respect to unvested Awards shall be subject

to the same vesting conditions as the underlying award and shall only be distributed to the extent that such vesting conditions are satisfied.

Adjustments

upon Changes in Capitalization.

In

the event of the following actions:

|

|

●

|

stock

split of our outstanding shares of Common Stock;

|

|

|

|

|

|

|

●

|

stock

dividend;

|

|

|

|

|

|

|

●

|

dividend

payable in a form other than shares in an amount that has a material effect on the price of the shares;

|

|

|

|

|

|

|

●

|

consolidation;

|

|

|

|

|

|

|

●

|

combination

or reclassification of the shares;

|

|

|

|

|

|

|

●

|

recapitalization;

|

|

|

|

|

|

|

●

|

spin-off;

or

|

|

|

|

|

|

|

●

|

other

similar occurrences,

|

then

the following shall each be equitably and proportionately adjusted by the 2022 Plan Committee:

|

|

●

|

maximum

number of shares that can be issued under the 2022 Plan (including the ISO share grant limit);

|

|

|

|

|

|

|

●

|

number

and class of shares issued under the 2022 Plan and subject to each award;

|

|

|

|

|

|

|

●

|

exercise

prices of outstanding awards; and

|

|

|

|

|

|

|

●

|

number

and class of shares available for issuance under the 2022 Plan.

|

Change

in Control. In the event that we are a party to a merger or other reorganization or similar transaction, outstanding 2022 Plan awards

will be subject to the agreement pertaining to such merger or reorganization. Such agreement may provide for (i) the continuation of

the outstanding awards by us if we are a surviving corporation, (ii) the assumption or substitution of the outstanding awards by the

surviving entity or its parent, (iii) full exercisability and/or full vesting of outstanding awards, or (iv) cancellation of outstanding

awards either with or without consideration, in all cases with or without consent of the selected participant. The Board or the 2022

Plan Committee need not adopt the same rules for each award or selected participant.

The

2022 Plan Committee will decide the effect of a change in control of the Company on outstanding awards. The 2022 Plan Committee may,

among other things, provide that awards will fully vest and/or be canceled upon a change in control, or fully vest upon an involuntary

termination of employment following a change in control. The 2022 Plan Committee may also include in an award agreement provisions designed

to minimize potential negative income tax consequences for the participant or the Company that could be imposed under the golden parachute

tax rules of Section 280G of the Code.

Term

of the 2022 Plan. If not terminated earlier by the Board, the 2022 Plan will terminate on at a time the Board amends or removes

the Plan. Outstanding awards shall continue to be governed by their terms after the termination of the 2022 Plan.

Governing

Law. The 2022 Plan shall be governed by the laws of the State of New Jersey (which is the state of our incorporation) except for

conflict of law provisions.

Amendment

and Termination of the 2022 Plan. The Board generally may amend or terminate the 2022 Plan at any time and for any reason, except

that it must obtain Stockholder approval of material amendments to the extent required by applicable laws, regulations or rules.

Certain

Federal Income Tax Information

The

following is a general summary, as of the date this Proxy Statement is filed, of the federal income tax consequences to us and