Current Report Filing (8-k)

December 23 2020 - 2:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 17, 2020

Medicine Man Technologies, Inc.

(Exact Name of Registrant

as Specified in Its Charter)

|

Nevada

|

001-36868

|

46-5289499

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

4880 Havana Street, Suite 201

Denver, Colorado

|

|

80239

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

|

|

(303) 371-0387

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

|

|

Not Applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange On Which Registered

|

|

Not applicable

|

|

Not applicable

|

|

Not applicable

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

As previously disclosed

in the Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on September 3, 2019,

Medicine Man Technologies, Inc., a Nevada corporation (the “Company”) entered into a binding term sheet with the Starbuds

Group (as defined below), whereby the Company agreed to purchase the membership interests of each member (each, a “Member”

and, collectively, the “Members”) of each Starbuds Company (the “Proposed Transaction”).

As previously disclosed

in the Current Report on Form 8-K filed with the SEC on June 8, 2020 by Medicine Man Technologies, Inc., a Nevada corporation (the

“Company”), the Company and SBUD, LLC, a Colorado limited liability company and wholly-owned subsidiary of the Company

(the “Purchaser”), entered into thirteen separate purchase agreements (each, an “Agreement” and, collectively,

the “Agreements”) with the sellers signatory thereto (each, a “Starbuds Company” and, collectively the

“Starbuds Group”), whereby the Purchaser agreed to purchase substantially all of the assets of the Starbuds Group from

each individual Starbuds Company pursuant to the Agreements (the “Purchase”). The Agreements were entered into in lieu

of the Proposed Transaction.

As previously disclosed

in the Current Report on Form 8-K filed with the SEC on September 21, 2020 by the Company, the Company and the Purchaser entered

into an Omnibus Amendment No. 1 to Asset Purchase Agreements (“Omnibus Amendment No. 1”) with each Starbuds Company.

Omnibus Amendment No. 1 revised certain material terms originally set forth in the Agreements.

Item 1.01. Entry into a Material Definitive

Agreement.

On December 17, 2020,

the Company and the Purchaser entered into an Omnibus Amendment No. 2 to Asset Purchase Agreements (“Omnibus Amendment No.

2”) with each Starbuds Company. Omnibus Amendment No. 2 revises certain material terms originally set forth in the Agreements,

as amended by Omnibus Amendment No. 1 (as amended to date, each, an “APA” and, collectively, the “APAs”),

and, among other things:

|

|

·

|

extends the Termination Date (as defined in Omnibus Amendment No. 2) to March 31, 2021;

|

|

|

·

|

extends the period of time for payment of the Deferred Cash Payment (as defined in Omnibus Amendment No. 2) to 60 months, increases

the portion of the Closing Cash Consideration (as defined in Omnibus Amendment No. 2) that constitutes the Deferred Cash Payment

from 33.33% to 50.0% and increases the interest rate associated with such Deferred Cash Payment to instead bear simple interest

at a rate of 12.0% per annum;

|

|

|

·

|

decreases the portion of the Closing Cash Consideration that constitutes the Closing Cash Payment (as defined in Omnibus Amendment

No. 2) from 66.67% to 50.0%;

|

|

|

·

|

provides for the issuance to the each Member in accordance with its respective Pro Rata Percentage (as defined in Omnibus Amendment

No. 2), of a warrant to purchase shares of the Company’s common stock at an exercise price of $1.20 per share of the Company’s

common stock on or prior to the five-year anniversary of the Closing Date (as defined in Omnibus Amendment No. 2) in an amount

equal to, in the aggregate (i) 15.0% of the Deferred Cash Amount (as defined in Omnibus Amendment No. 2) divided by (ii) $1.20;

|

|

|

·

|

provides for the payment by the Purchaser of each Starbuds Company’s legal expenses incurred in connection with the Purchase;

|

|

|

·

|

subject to certain exceptions and limitations, (i) for so long as the Starbuds Group and the Members thereunder hold, in the

aggregate, at least 25% of the Company’s preferred stock (or Company common stock equivalents thereof to the extent some

or all of the Company’s preferred stock is converted) issued pursuant to the Group 1 APAs (as defined in Omnibus Amendment

No. 1, which threshold was met on December 18, 2020), the Company will recommend to its board of directors (the “Board”)

and stockholders that Brian Ruden and Naser Joudeh be permitted to appoint two directors (in the aggregate) to the Board so long

as the total number of directors on the Board is five or more, and (ii) upon the closing of all the APAs and for so long as the

Starbuds Group and the Members thereunder hold, in the aggregate, at least 25% of the Company’s preferred stock (or Company

common stock equivalents thereof to the extent some or all of the Company’s preferred stock is converted) issued pursuant

to all the APAs, the Company will recommend to its Board that Brian Ruden and Naser Joudeh be permitted to appoint three directors

(in the aggregate and without duplication for the appointee rights set forth above) so long as the number of directors on the Board

is seven or more;

|

|

|

·

|

subject to certain exceptions and limitations, upon the closing of any of the transactions contemplated in the Group 1 APAs

(which requirement was met on December 17, 2020) and for so long as the Starbuds Group and the Member thereunder hold, in the aggregate,

at least 25% of the Company’s preferred stock (or Company common stock equivalents thereof to the extent some or all of the

Company’s preferred stock is converted) issued pursuant to the Group 1 APAs, the Company will recommend to its Board that

(i) the Board establish and maintain a budget and finance committee for oversight and input with respect to the financing, borrowing

and expenditures (the “Budget Committee”), and (ii) such Budget Committee consist of between three and five members

and include two director members appointed by Brian Ruden and Naser Joudeh; and

|

|

|

·

|

amends the non-compete restrictions associated with the APAs.

|

The aggregate purchase

price for the assets of the Starbuds Group is approximately $118 million, subject to adjustment upon the closing of the Purchase

based on, among other things, the target inventory as opposed to actual inventory and target working capital as opposed to net

working capital of each member of the Starbuds Group, and will be payable to the Starbuds Group and the Members as a combination

of cash, shares of the Company’s common stock and warrants. The Purchaser will not assume any liabilities of the Starbuds

Group other than accounts payable by the Starbuds Group, liabilities in respect of any contractual arrangements assigned to the

Purchaser by the Starbuds Group, and liabilities in connection with administrative fees associated with obtaining necessary governmental

approvals or waivers of such approvals.

On December 17, 2020,

pursuant to the applicable APA, the Company and the Purchaser closed on the acquisition of (i) Starbuds Pueblo LLC; and (ii) Starbuds

Alameda LLC. On December 18, 2020, pursuant to the applicable APA, the Company and the Purchaser closed on the acquisition of (i)

Starbuds Commerce City LLC; (ii) Lucky Ticket LLC; (iii) Starbuds Niwot LLC; and (iv) LM MJC LLC. The aggregate purchase price

for the assets of the Starbuds Group acquired on December 17, 2020 and December 20, 2020 was approximately $37.1 million and was

paid to each applicable Starbuds Company and the Members as a combination of cash, an aggregate of 7,877 shares of the Company’s

Series A Preferred Stock (“Preferred Stock”) together with an aggregate of 1,389 shares of Preferred Stock to be held

in escrow pursuant to the terms and subject to the conditions set forth in Omnibus Amendment No. 2 (the “Transaction Shares”)

and warrants to purchase an aggregate of 1,737,719 shares of the Company’s common stock at exercise price equal to $1.20

per share (the “Transaction Warrants”). The Company funded the aggregate cash portion of the purchase price for each

Starbuds Company who was acquired on December 17, 2020 and December 18, 2020 from proceeds received as disclosed in its December

22, 2020 8-k filing. Mr. Brian Ruden, a member of the Board, has an ownership interest in each Starbuds Company who was acquired

on December 17, 2020 and December 18, 2020.

The foregoing summary

of Omnibus Amendment No. 2 and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified

in its entirety by, the full text of Omnibus Amendment No. 2 filed as Exhibit 2.1 to this Current Report on Form 8-K, which is

incorporated herein by reference.

Omnibus Amendment No.

2 has been attached to provide investors with information regarding its terms. It is not intended to provide any other factual

information about the Company or any Starbuds Company, their respective businesses, or the actual conduct of their respective businesses

during the period prior to the consummation of the Purchase. Omnibus Amendment No. 2 contains representations and warranties that

are the product of negotiations among the parties thereto, and that the parties made to, and solely for the benefit of, each other

as of specified dates. The assertions embodied in those representations and warranties are subject to qualifications and limitations

agreed to by the respective parties and are also qualified in important part by other confidential materials delivered in connection

with Omnibus Amendment No. 2. The representations and warranties may have been made for the purpose of allocating contractual risk

between the parties to the agreements instead of establishing these matters as facts, and may be subject to standards of materiality

applicable to the contracting parties that differ from those applicable to investors. Accordingly, the representations and warranties

in Omnibus Amendment No. 2 may not constitute the actual state of facts about the Company or any Starbuds Company.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The information contained

in “Introductory Note” and Item 1.01 above is incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity

Securities.

The information contained

in Item 1.01 above is incorporated herein by reference.

The warrants have not

been registered under the Securities Act of 1933, as amended (the “Act”), or state securities laws. The issuance of

the warrants was exempt from the registration requirements of the Act pursuant to Section 4(a)(2) of the Act and Rule 506 of Regulation

D promulgated thereunder (“Regulation D”), made only to and with an “accredited investor” as defined in

Regulation D. This Current Report on Form 8-K shall not constitute an offer to sell, nor the solicitation of an offer to buy, the

securities described herein, nor shall there be any offer, solicitation or sale of the securities in any state in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state.

Item 9.01 Financial Statements and Exhibits

(a) Financial Statements

of Businesses Acquired

The audited financial

statements of each Starbuds Company required by this item will be filed by amendment to this Current Report on Form 8-K no later

than 71 calendar days after the date on which this Current Report on Form 8-K was required to be filed.

(b) Pro Forma Financial

Information

The pro forma financial

information reflecting the Purchase, to the extent required by this item, will be furnished by amendment to this Current Report

on Form 8-K no later than 71 calendar days after the date on which this Current Report on Form 8-K was required to be filed.

(d) Exhibits.

|

Exhibit No.

|

Description

|

|

2.1

|

Omnibus Amendment No. 2 to Asset Purchase Agreement, dated as of December 17, 2020, by and among SBUD LLC, a Colorado limited liability, Medicine Man Technologies, Inc. (dba Schwazze), a Nevada corporation, and each signatory thereto designated as a seller.

|

Certain schedules have been omitted

pursuant to Item 601(b)(2) of Regulation S-K under the Securities Exchange Act of 1934, as amended. The Company hereby undertakes

to supplementally furnish copies of any omitted schedules to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MEDICINE MAN TECHNOLOGIES, INC.

|

|

|

|

|

|

By:

|

/s/ Dan Pabon

|

|

Date: December 23, 2020

|

|

Dan Pabon

General Counsel

|

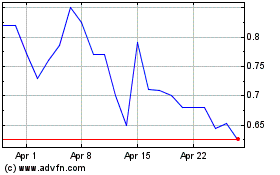

Medicine Man Technologies (QX) (USOTC:SHWZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Medicine Man Technologies (QX) (USOTC:SHWZ)

Historical Stock Chart

From Apr 2023 to Apr 2024