Current Report Filing (8-k)

October 05 2020 - 6:10AM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 1, 2020

MARIJUANA

COMPANY OF AMERICA, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Utah

|

|

Commission

File Number

|

|

98-1246221

|

(State or other jurisdiction of

incorporation or organization)

|

|

000-27039

|

|

(I.R.S. Employer

Identification Number)

|

1340

West Valley Parkway, Suite #205

Escondido,

California 92029

(Address

of Principal Executive Offices and Zip Code)

(888)

777-4362

(Issuer’s

telephone number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Securities

registered pursuant to Section 12(g) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common Stock

|

|

MCOA

|

|

None

|

Section

1 - Registrant’s Business and Operations

Item

1.01 Entry into a Material Definitive Agreement.

On

October 1, 2020, Marijuana Company of America, Inc. (the “Company”) entered into two Joint Venture Agreements

with Marco Guerrero, a director of the Company (“Guerrero”) dated September 30, 2020, to form joint venture

operations in Brazil and in Uruguay (the “Joint Venture Agreements”) to produce, manufacture, market and sell

the Company’s hempSMART™ products in Latin America, and will also work to develop and sell hempSMART™ products

globally. The Joint Venture Agreements contain equal terms for the formation of joint venture entities in Uruguay and Brazil.

The Brazilian joint venture will be headquartered in São Paulo, Brazil, and will be named HempSmart Produtos Naturais Ltda.

(“HempSmart Brazil”). The Uruguayan joint venture will be headquartered in Montevideo, Uruguay and will be

named Hempsmart Uruguay S.A.S. (“HempSmart Uruguay”).

Under

the Joint Venture Agreements, the Company will acquire a 70% equity interest in both HempSmart Brazil and HempSmart Uruguay. A

minority 30% equity interest in both HempSmart Brazil and HempSmart Uruguay will be held by newly formed entities controlled by

Guerrero, a director of the Company, who is a successful Brazilian entrepreneur. The Company will provide capital in the amount

of $50,000 to both HempSmart Brazil and HempSmart Uruguay under the Joint Venture Agreements, for a total capital outlay obligation

of $100,000. It is expected that the proceeds of the initial capital contribution will be used for contracting with third-party

manufacturing facilities in Brazil and Uruguay, and related infrastructure and employment of key personnel.

The

boards of directors of HempSmart Brazil and HempSmart Uruguay will consist of three directors, elected by the joint venture partners.

As part of the Joint Venture Agreements, the Company will license, on a royalty-free basis, certain of its intellectual property

regarding the Company’s existing products to HempSmart Brazil and HempSmart Uruguay to enable the joint ventures to manufacture

and sell the Company’s products in Brazil, Uruguay, and for export to other Latin American countries, the United States,

and globally in accordance with the terms of the Joint Venture Agreements.

The

Joint Venture Agreements provide the partners with a right of first offer (“ROFO”). Under this right, each partner

may trigger an “interest sale” ROFO process at any time pursuant to which the other partners may either acquire the

triggering partner’s interest in the joint ventures or permit the triggering partner to sell its interest to a third party.

In addition, the Company, as majority partner, may trigger a compulsory buy-sell procedure in the event a joint venture is frustrated

in its intent or purpose, pursuant to which the Company could pursue a sale of all or substantially all of the joint venture.

Subject to certain exceptions, the joint venture partners may not transfer their interests in HempSmart Brazil and HempSmart Uruguay.

The Joint Venture Agreements contain customary terms, conditions, representations, warranties and covenants of the parties for

like transactions.

The

foregoing description of the Joint Venture Agreements does not purport to be complete and is qualified in its entirety by reference

to the Joint Venture Agreements, copies of which are filed as Exhibit 10.1 and Exhibit 10.2 hereto and incorporated herein by

reference.

Item

8.01 Other Events.

Press

Release

On October 1, 2020, the Company issued a press release announcing

the launching of the joint ventures in Brazil and Uruguay. A copy of this press release is attached hereto as Exhibit 99.1.

Related

Party Transactions

Mr.

Marco Guerrero, a director of the Company, is a party to both Joint Venture Agreements and will, through his controlling interests

in the joint venture partners in Brazil and Uruguay, own 30% of HempSmart Brazil and HempSmart Uruguay. In its action approving

and authorizing the Share Exchange Agreements, the board of directors of the Company considered full disclosure of Mr. Guerrero’s

conflicting interest and his related party status and Utah state law governing transactions where a conflicting interest exists

that could reasonably be expected to exert an influence on the director’s judgment and requiring specific disclosures pursuant

to Section 16-10a-852 of the Utah Revised Business Corporation Act. In consideration of such disclosure, a unanimity of the Company’s

qualified, uninterested directors approved the transaction.

Item 9.01 Financial Statements and Exhibits.

|

Exhibit

|

|

Description

|

|

10.1

|

|

Joint Venture Agreement,

dated September 30, 2020, by and between the Company, Marco Guerrero, and MR Hemp Ltda. *

|

|

10.2

|

|

Joint Venture Agreement,

dated September 30, 2020, by and between the Company, Marco Guerrero, and MR Hemp Uruguay S.A.S. *

|

|

99.1

|

|

Press

Release dated October 1, 2020*

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated

October 2, 2020

MARIJUANA

COMPANY OF AMERICA, INC.

|

By:

|

/s/

Jesus Quintero

|

|

|

|

Jesus

Quintero

|

|

|

|

(Principal

Executive Officer)

|

|

2

Marijuana Company of Ame... (PK) (USOTC:MCOA)

Historical Stock Chart

From Mar 2024 to Apr 2024

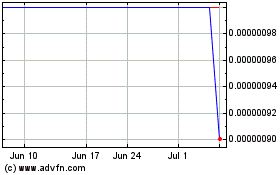

Marijuana Company of Ame... (PK) (USOTC:MCOA)

Historical Stock Chart

From Apr 2023 to Apr 2024