A Base Metal

No More….

+

The

fears about

Cobalt's viability in Lithium Ion Batteries were long only

price-oriented but now the most crucial fear is on strategic access

grounds

+

Increased

Manganese weighting in new LiB formulations is driving a refocusing

on the potential of this metal

+

Manganese in

not problematical due to its image of being "cheap" and "not

difficult" on the supply-side. These are in fact

its two main virtues

+

The wild

gyrations in Vanadium's price has made Manganese look like a

tempting option to replace, in part, Vanadium in Redox Flow Batteries for

mass storage

+

Lack of

Manganese production or resources in North America, makes the few

deposits that exist, interesting as crucial assets in the hunt for

non-Chinese supply chains for LiBs

-

Cobalt is down, but not out

for the count, as a Lithium Ion Battery component

-

There is a

perception that Manganese (somewhat like Nickel) is prolific and

thus "nothing to worry about"

Manganese

– The Road Less Travelled in Battery Metals

The pace of

change in the battery space has shifted

up a few gears

since a

small group of developers moved

into the

Manganese space in 2016/7. Lithium plays first

proliferated (and then came tumbling back to earth) and then Cobalt

became the word on everyone's lips as the Cobalt crisis moved into

centre stage and focusing minds on supply issues in the battery

space. Manganese was regarded as the

worry-free component of the Lithium Ion Battery formulations,

however this ignored the fact that there is almost no production of

the metal in North America.

Now, however,

the metal is receiving increasing

attention for its potential to reduce the Cobalt component in

various battery types using that metal via the rebalancing of the

relative weightings of elements in the battery cathode

formulations, particularly Nickel/Cobalt/Manganese in NMC

batteries.

A

Blizzard of Technologies

Battery

technologies have been proliferating in recent years like mushrooms

after the rain. Most of the buzz in the mainstream media is about

battery options that extend the life of cellphones or laptops and

other PDAs or with regard to hybrid- or all-electric vehicles.

However, the really great economic

leap forward has to do with mass storage devices which mesh with

energy grids to provide off-peak storage of electricity. Industrial

or natural gas has been stored since its inception in the

industrial revolution in massive tanks, caverns or gasometers,

while a solution to massive electricity storage has been much more

elusive. With conventional dry-cell battery using two electrodes

separated by an electrolyte, it would require thousands of

individual cells, the size of soft drink cans, to be strung

together in a massive installation to create a mass storage battery

of any usefulness to be attached the grid.

The relevance

of this has been heightened with the burgeoning of alternative

energy sources (wind and solar) that are irregular in their

generating periods and do not always coincide with peak

demand. While Elon Musk muses on

giving his auto-batteries a life-after-death as Powerwalls, the

real mass storage device

catching attention is Redox Flow Batteries (RFBs), with Vanadium (hitherto)

being the main beneficiary

of investor

enthusiasm. However, this has overlooked the different ways in

which Manganese can be mobilized for battery and mass storage

technologies.

A Case

Study: Manganese X Energy

Like many

other companies, Manganese X (TSX-V:MN,

OTC: MNXXF) was launched upon the tide

of the second Battery Wave in the middle years of the last decade.

Many of the other names, particularly in Cobalt and Lithium ended

up grounded, on the rocks or sunk.

Though

financing was almost non-existent across the swathe of battery

metal juniors, the management at Manganese X Energy battened down the hatches and

stayed the course. Now that a certain confidence has returned to

the broader mining markets it has had a firming effect on even the

battery metals. However, the emphasis has shifted.

Lithium still remains central to the LiB story

but

cobalt has

fallen into deep disdain.

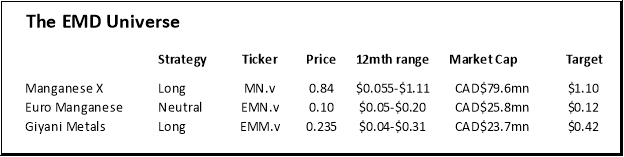

The market cap

is

up, and financing more

available, enhanced

potential to

finally kick up the resource calculation, potential mine

development and moreover implementation of a demonstration

plant prompt us to

maintain

a LONG

stance on

Manganese X Energy with a 12-month target price of

$1.10.

Conclusion

The

issue at the root of all

this though is the availability

of metal supplies. Lithium seemingly has a supply situation with

little in the way of constraints for a long way out.

Cobalt though

is relatively scarce, moreover with the Chinese having cornered the

supply, as least as it pertains to the largest producer, the

DRC. With no current supplies of

Manganese in the US or Canada,

and battery-grade

Manganese

processing capacity

under

Chinese

control, the US ambitions in the EV

space are essentially at the mercy of China.

The US is

reduced to the status of a Manganese scavenger unless it has access

to not only non-Chinese sources of ore, but also, and more

importantly regional Manganese

Sulphate

(MnSO4)

sources.

With the

strategic stockpile starting to have EMM added

again, for the first time since

2004, there is clearly rising concern in Washington.

It needs a

complete North American supply chain.

Combined the

rise of EVs and the possibility of Manganese muscling in on

Vanadium's turf in the VRB space and the developers in the EMM

(mining) space are few and far between. Increasingly the hunt for

enhanced economics in EV production will mean that cheaper, more

secure and more efficient battery formulations will be required and

Manganese might well be the secret sauce to make EV economics more

palatable to the mass market.

Sector Review

Christopher

Ecclestone

See complete

research report at:

http://hallgartenco.com/pdf/Battery/Manganese_Batteries_Sept2020.pdf

© 2020 Hallgarten & Company,

Ltd. All rights

reserved.