0001415332false--12-31Q220240.00130000000000000.0400014153322024-01-012024-06-3000014153322021-07-010001415332ltum:NorthBigSmokeyPropertyMember2023-01-012023-12-310001415332ltum:SummaLLCMember2023-01-012023-12-310001415332ltum:AlturaMemberltum:FishLakePropertyMember2021-10-012021-10-210001415332ltum:AlturaMemberltum:SanEmidioMember2024-01-012024-06-300001415332ltum:AlturaMemberltum:SanEmidioMember2021-09-160001415332ltum:AlturaMemberltum:SanEmidioMember2023-01-012023-12-310001415332ltum:AlturaMemberltum:FishLakePropertyMember2024-01-012024-06-300001415332ltum:AlturaMemberltum:FishLakePropertyMember2021-10-210001415332ltum:AlturaMemberltum:BigNorthSmokeyMember2024-01-012024-06-300001415332ltum:AlturaMemberltum:BigNorthSmokeyMember2022-05-240001415332ltum:SanEmidioMember2021-09-160001415332ltum:AlturaMemberltum:FishLakePropertyMember2021-04-290001415332ltum:AlturaMemberltum:BigNorthSmokeyMember2022-05-012022-05-240001415332ltum:SanEmidioMember2021-09-012021-09-160001415332ltum:AlturaMemberltum:FishLakePropertyMember2021-04-012021-04-290001415332ltum:FifteenConsultantsMember2022-05-012022-05-2600014153322023-01-012023-01-2400014153322023-01-2400014153322024-01-1100014153322022-05-2600014153322022-05-012022-05-260001415332ltum:StockOptiononeMember2024-06-300001415332us-gaap:StockOptionMember2024-06-300001415332ltum:StockOptiononeMember2024-01-012024-06-3000014153322023-01-012023-12-310001415332ltum:NorthBigSmokyPropertyMember2023-01-012023-12-310001415332ltum:FishLakePropertyMember2023-01-012023-12-310001415332us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001415332us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001415332us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001415332us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001415332us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001415332us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001415332us-gaap:StockOptionMember2024-01-012024-06-300001415332us-gaap:RetainedEarningsMember2024-06-300001415332ltum:AdditionalPaidInCapitalOptionsMember2024-06-300001415332ltum:AdditionalPaidInCapitalWarrantsMember2024-06-300001415332us-gaap:AdditionalPaidInCapitalMember2024-06-300001415332us-gaap:CommonStockMember2024-06-300001415332us-gaap:RetainedEarningsMember2024-04-012024-06-300001415332ltum:AdditionalPaidInCapitalOptionsMember2024-04-012024-06-300001415332ltum:AdditionalPaidInCapitalWarrantsMember2024-04-012024-06-300001415332us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001415332us-gaap:CommonStockMember2024-04-012024-06-3000014153322024-03-310001415332us-gaap:RetainedEarningsMember2024-03-310001415332ltum:AdditionalPaidInCapitalOptionsMember2024-03-310001415332ltum:AdditionalPaidInCapitalWarrantsMember2024-03-310001415332us-gaap:AdditionalPaidInCapitalMember2024-03-310001415332us-gaap:CommonStockMember2024-03-3100014153322024-01-012024-03-310001415332us-gaap:RetainedEarningsMember2024-01-012024-03-310001415332ltum:AdditionalPaidInCapitalOptionsMember2024-01-012024-03-310001415332ltum:AdditionalPaidInCapitalWarrantsMember2024-01-012024-03-310001415332us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001415332us-gaap:CommonStockMember2024-01-012024-03-310001415332us-gaap:RetainedEarningsMember2023-12-310001415332ltum:AdditionalPaidInCapitalOptionsMember2023-12-310001415332ltum:AdditionalPaidInCapitalWarrantsMember2023-12-310001415332us-gaap:AdditionalPaidInCapitalMember2023-12-310001415332us-gaap:CommonStockMember2023-12-3100014153322023-06-300001415332us-gaap:RetainedEarningsMember2023-06-300001415332ltum:AdditionalPaidInCapitalOptionsMember2023-06-300001415332ltum:AdditionalPaidInCapitalWarrantsMember2023-06-300001415332us-gaap:AdditionalPaidInCapitalMember2023-06-300001415332us-gaap:CommonStockMember2023-06-300001415332us-gaap:RetainedEarningsMember2023-04-012023-06-300001415332ltum:AdditionalPaidInCapitalOptionsMember2023-04-012023-06-300001415332ltum:AdditionalPaidInCapitalWarrantsMember2023-04-012023-06-300001415332us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001415332us-gaap:CommonStockMember2023-04-012023-06-3000014153322023-03-310001415332us-gaap:RetainedEarningsMember2023-03-310001415332ltum:AdditionalPaidInCapitalOptionsMember2023-03-310001415332ltum:AdditionalPaidInCapitalWarrantsMember2023-03-310001415332us-gaap:AdditionalPaidInCapitalMember2023-03-310001415332us-gaap:CommonStockMember2023-03-3100014153322023-01-012023-03-310001415332us-gaap:RetainedEarningsMember2023-01-012023-03-310001415332ltum:AdditionalPaidInCapitalOptionsMember2023-01-012023-03-310001415332ltum:AdditionalPaidInCapitalWarrantsMember2023-01-012023-03-310001415332us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001415332us-gaap:CommonStockMember2023-01-012023-03-3100014153322022-12-310001415332us-gaap:RetainedEarningsMember2022-12-310001415332ltum:AdditionalPaidInCapitalOptionsMember2022-12-310001415332ltum:AdditionalPaidInCapitalWarrantsMember2022-12-310001415332us-gaap:AdditionalPaidInCapitalMember2022-12-310001415332us-gaap:CommonStockMember2022-12-3100014153322023-01-012023-06-3000014153322023-04-012023-06-3000014153322024-04-012024-06-3000014153322023-12-3100014153322024-06-3000014153322024-08-19iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

Or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________to ________________

Commission File Number 000-54332

LITHIUM CORPORATION |

(Exact name of registrant as specified in its charter) |

Nevada | | 98-0530295 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| | |

1031 Railroad St. Ste. 102B, Elko, Nevada | | 89801 |

(Address of principal executive offices) | | (Zip Code) |

(775) 410-5287

(Registrant’s telephone number, including area code)

___________________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| | | | |

Common Stock | | LTUM | | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | | Accelerated filer ☐ |

Non-Accelerated filer ☒ | Smaller reporting company ☒ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. 117,892,441 common shares issued and outstanding as of August 19, 2024

LITHIUM CORPORATION

FORM 10-Q

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

Our unaudited interim financial statements for the six month period ended June 30, 2024 form part of this quarterly report. They are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

LITHIUM Corporation |

Balance Sheets |

|

ASSETS |

| | June 30, 2024 (unaudited) | | | December 31, 2023 | |

CURRENT ASSETS | | | | | | |

Cash | | $ | 3,390,604 | | | $ | 3,667,617 | |

Marketable securities | | | 175,061 | | | | 332,082 | |

Deposits | | | 700 | | | | 700 | |

Prepaid expenses | | | 8,350 | | | | 22,850 | |

Total Current Assets | | | 3,574,715 | | | | 4,023,249 | |

| | | | | | | | |

OTHER ASSETS | | | | | | | | |

Equipment, net of accumulated depreciation | | | 17,320 | | | | 20,986 | |

| | | | | | | | |

TOTAL ASSETS | | $ | 3,592,035 | | | $ | 4,044,235 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY |

| | | | | | | | |

LIABILITIES | | | | | | | | |

CURRENT LIABILITIES | | | | | | | | |

Accounts payable and accrued liabilities | | $ | 28,190 | | | $ | 8,386 | |

Accounts payable and accrued liabilities - related party | | | 33,868 | | | | 26,489 | |

Allowance for optioned properties | | | 2,191,102 | | | | 2,191,102 | |

| | | | | | | | |

TOTAL CURRENT LIABILITIES | | | 2,253,160 | | | | 2,225,977 | |

| | | | | | | | |

TOTAL LIABILITIES | | | 2,253,160 | | | | 2,225,977 | |

| | | | | | | | |

Commitments and contingencies | | | | | | | | |

| | | | | | | | |

STOCKHOLDERS' EQUITY | | | | | | | | |

Common stock, 3,000,000,000 shares authorized, par value $0.001; 117,892,441 and 117,892,441 common shares outstanding, respectively | | | 117,893 | | | | 117,893 | |

Additional paid in capital | | | 8,948,385 | | | | 8,948,385 | |

Additional paid in capital - options | | | 1,011,639 | | | | 957,247 | |

Additional paid in capital - warrants | | | 369,115 | | | | 369,115 | |

Accumulated deficit | | | (9,108,157 | ) | | | (8,574,382 | ) |

| | | | | | | | |

TOTAL STOCKHOLDERS' EQUITY | | | 1,338,875 | | | | 1,818,258 | |

| | | | | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 3,592,035 | | | $ | 4,044,235 | |

The accompanying notes are an integral part of these financial statements.

LITHIUM Corporation |

Statements of Operations |

(unaudited) |

| | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 | | | Three Months Ended June 30, 2023 | | | Six Months Ended June 30, 2024 | | | Six Months Ended June 30, 2023 | |

| | | | | | | | | | | | |

REVENUE | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | |

OPERATING EXPENSES | | | | | | | | | | | | | | | | |

Professional fees | | | 12,138 | | | | 24,023 | | | | 35,976 | | | | 35,526 | |

Depreciation | | | 1,833 | | | | 1,833 | | | | 3,666 | | | | 3,666 | |

Exploration expenses | | | 55,475 | | | | 4,798 | | | | 105,032 | | | | 8,577 | |

Consulting fees - related party | | | 72,000 | | | | 68,000 | | | | 144,000 | | | | 169,984 | |

Consulting fees | | | 15,000 | | | | 12,800 | | | | 84,392 | | | | 65,953 | |

Transfer agent and filing fees | | | 6,138 | | | | 4,812 | | | | 11,163 | | | | 13,198 | |

Travel | | | 3,333 | | | | 1,511 | | | | 13,206 | | | | 2,596 | |

General and administrative expenses | | | 11,749 | | | | 7,868 | | | | 17,719 | | | | 21,034 | |

TOTAL OPERATING EXPENSES | | | 177,666 | | | | 125,645 | | | | 415,154 | | | | 320,534 | |

| | | | | | | | | | | | | | | | |

LOSS FROM OPERATIONS | | | (177,666 | ) | | | (125,645 | ) | | | (415,154 | ) | | | (320,534 | ) |

| | | | | | | | | | | | | | | | |

OTHER INCOME (EXPENSES) | | | | | | | | | | | | | | | | |

Change in fair value of marketable securities | | | (52,695 | ) | | | (49,773 | ) | | | (157,021 | ) | | | (151,448 | ) |

Other income | | | 19,270 | | | | 18,688 | | | | 38,400 | | | | 37,076 | |

Gain (Loss) on sale of marketable securities | | | - | | | | 5,805 | | | | - | | | | 5,805 | |

Other income - related party | | | - | | | | - | | | | - | | | | 10,000 | |

TOTAL OTHER INCOME (EXPENSE) | | | (33,425 | ) | | | (25,280 | ) | | | (118,621 | ) | | | (98,567 | ) |

| | | | | | | | | | | | | | | | |

LOSS BEFORE INCOME TAXES | | | (211,091 | ) | | | (150,925 | ) | | | (533,775 | ) | | | (419,101 | ) |

| | | | | | | | | | | | | | | | |

PROVISION FOR INCOME TAXES | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | |

NET INCOME (LOSS) | | $ | (211,091 | ) | | $ | (150,925 | ) | | $ | (533,775 | ) | | $ | (419,101 | ) |

| | | | | | | | | | | | | | | | |

Gain on change in fair value of marketable securities | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | |

OTHER COMPREHENSIVE INCOME (LOSS) | | $ | (211,091 | ) | | $ | (150,925 | ) | | $ | (533,775 | ) | | $ | (419,101 | ) |

| | | | | | | | | | | | | | | | |

NET LOSS PER SHARE: BASIC AND DILUTED | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.00 | ) |

| | | | | | | | | | | | | | | | |

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING: BASIC AND DILUTED | | | 117,892,441 | | | | 115,907,826 | | | | 117,892,441 | | | | 115,176,419 | |

The accompanying notes are an integral part of these financial statements.

LITHIUM Corparation |

Statements of Stockholders' Equity |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Additional | | | Additional | | | | | | | |

| | | | | | | | Additional | | | Paid-in | | | Paid-in | | | | | | Total | |

| | Common Stock | | | Paid-in | | | Capital - | | | Capital - | | | Accumulated | | | Stockholders' | |

| | Shares | | | Amount | | | Capital | | | Warrants | | | Options | | | Deficit | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | |

Balance, December 31, 2022 | | | 113,692,441 | | | $ | 113,693 | | | $ | 8,571,524 | | | $ | 369,115 | | | $ | 887,910 | | | $ | (7,956,189 | ) | | $ | 1,986,053 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares issued for cash | | | 2,200,000 | | | | 2,200 | | | | 233,200 | | | | - | | | | - | | | | - | | | | 235,400 | |

Stock based compensation | | | - | | | | - | | | | - | | | | - | | | | 69,337 | | | | - | | | | 69,337 | |

Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | (268,176 | ) | | | (268,176 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, March 31, 2023 | | | 115,892,441 | | | | 115,893 | | | | 8,804,724 | | | | 369,115 | | | | 957,247 | | | | (8,224,365 | ) | | | 2,022,614 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares issued for cash | | | 200,000 | | | | 200 | | | | 19,000 | | | | - | | | | - | | | | - | | | | 19,200 | |

Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | (150,925 | ) | | | (150,925 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, June 30, 2023 | | | 116,092,441 | | | $ | 116,093 | | | $ | 8,823,724 | | | $ | 369,115 | | | $ | 957,247 | | | $ | (8,375,290 | ) | | $ | 1,890,889 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, December 31, 2023 | | | 117,892,441 | | | $ | 117,893 | | | $ | 8,948,385 | | | $ | 369,115 | | | $ | 957,247 | | | $ | (8,574,382 | ) | | $ | 1,818,258 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Stock based compensation | | | - | | | | - | | | | - | | | | - | | | | 54,392 | | | | - | | | | 54,392 | |

Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | (322,684 | ) | | | (322,684 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, March 31, 2024 | | | 117,892,441 | | | | 117,893 | | | | 8,948,385 | | | | 369,115 | | | | 1,011,639 | | | | (8,897,066 | ) | | | 1,549,966 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | (211,091 | ) | | | (211,091 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, June 30, 2024 | | | 117,892,441 | | | $ | 117,893 | | | $ | 8,948,385 | | | $ | 369,115 | | | $ | 1,011,639 | | | $ | (9,108,157 | ) | | $ | 1,338,875 | |

The accompanying notes are an integral part of these financial statements.

LITHIUM Corporation |

Statements of Cash Flows |

(unaudited) |

| | | | | | |

| | Six Months Ended June 30, 2024 | | | Six Months Ended June 30, 2023 | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | |

Net income (loss) for the period | | $ | (533,775 | ) | | $ | (419,101 | ) |

Adjustment to reconcile net income (loss) to net cash used in operating activities | | | | | | | | |

Change in fair value of marketable securities | | | 157,021 | | | | 151,448 | |

Depreciation | | | 3,666 | | | | 3,666 | |

Stock based compensation | | | 54,392 | | | | 69,337 | |

Gain on sale of marketable securities | | | - | | | | (5,805 | ) |

Changes in assets and liabilities: | | | | | | | | |

(Increase) Decrease in prepaid expenses | | | 14,500 | | | | 19,076 | |

Increase (decrease) in accounts payable and accrued liabilities | | | 27,183 | | | | (5,818 | ) |

Net Cash (Used in) Operating Activities | | | (277,013 | ) | | | (187,197 | ) |

| | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITY: | | | | | | | | |

Cash from sale of marketable securities | | | - | | | | 15,082 | |

Net Cash Provided by Investing Activities | | | - | | | | 15,082 | |

| | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITY: | | | | | | | | |

Shares issued for cash | | | - | | | | 254,600 | |

Net Cash Provided by Financing Activity | | | - | | | | 254,600 | |

| | | | | | | | |

Increase (Decrease) in cash | | | (277,013 | ) | | | 82,485 | |

Cash, beginning of period | | | 3,667,617 | | | | 3,576,911 | |

Cash, end of period | | $ | 3,390,604 | | | $ | 3,659,396 | |

| | | | | | | | |

SUPPLEMENTAL CASH FLOW INFORMATION: | | | | | | | | |

Cash paid for interest | | $ | - | | | $ | - | |

Cash paid for income taxes | | $ | - | | | $ | - | |

The accompanying notes are an integral part of these financial statements.

Lithium Corporation

Notes to the Financial Statements

June 30, 2024

Note 1 - Summary of Significant Accounting Policies

Lithium Corporation (formerly Utalk Communications Inc.) (the “Company”) was incorporated on January 30, 2007 under the laws of Nevada. On September 30, 2009, Utalk Communications Inc. changed its name to Lithium Corporation.

Nevada Lithium Corporation was incorporated on March 16, 2009 under the laws of Nevada under the name Lithium Corporation. On September 10, 2009, the Company amended its articles of incorporation to change its name to Nevada Lithium Corporation. By agreement dated October 9, 2009 Nevada Lithium Corporation and Lithium Corporation amalgamated as Lithium Corporation. Lithium Corporation is engaged in the acquisition and development of certain lithium interests in the state of Nevada, and battery or Tech metals prospects in British Columbia and is currently in the exploration stage.

Accounting Basis

The Company uses the accrual basis of accounting and accounting principles generally accepted in the United States of America ("GAAP" accounting). The Company has adopted a December 31 fiscal year end.

Cash and Cash Equivalents

Cash includes cash on account, demand deposits, and short-term instruments with maturities of three months or less.

Concentrations of Credit Risk

The Company maintains its cash in bank deposit accounts, the balances of which at times may exceed federally insured limits. The Company continually monitors its banking relationships and consequently has not experienced any losses in such accounts. The Company believes it is not exposed to any significant credit risk on cash and cash equivalents.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Such estimates include the useful life of equipment and inputs related to the calculation of the fair value of stock options. Actual results could differ from those estimates.

Revenue Recognition

Effective January 1, 2018, the Company adopted ASC 606 — Revenue from Contracts with Customers. Under ASC 606, the Company recognizes revenue from the commercial sales of products, licensing agreements and contracts to perform pilot studies by applying the following steps: (1) identify the contract with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to each performance obligation in the contract; and (5) recognize revenue when each performance obligation is satisfied. For the comparative periods, revenue has not been adjusted and continues to be reported under ASC 605 — Revenue Recognition. Under ASC 605, revenue is recognized when the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) the performance of service has been rendered to a customer or delivery has occurred; (3) the amount of fee to be paid by a customer is fixed and determinable; and (4) the collectability of the fee is reasonably assured.

Research and Development

Research and development costs are expensed as incurred. During the six months ended June 30, 2024 and 2023, the Company did not have any research and development costs.

Advertising Costs

Advertising costs are expensed as incurred. During the six months ended June 30, 2024 and 2023, the Company did not have any advertising costs.

Income per Share

Basic income per share is computed by dividing loss available to common shareholders by the weighted average number of common shares outstanding during the period. The computation of diluted earnings per share assumes the conversion, exercise or contingent issuance of securities only when such conversion, exercise or issuance would have a dilutive effect on earnings per share. The dilutive effect of convertible securities, represented by 4,200,000 stock options outstanding, is excluded in diluted earnings per share by application of the "if converted" method. In the periods in which a loss is incurred, the effect of potential issuances of shares under options and warrants would be anti-dilutive, and therefore basic and diluted losses per share are the same. The Company did not have any dilutive securities for the period ended June 30, 2024.

Income Taxes

The asset and liability approach is used to account for income taxes by recognizing deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amounts and the tax basis of assets and liabilities.

Financial Instruments

The Company's financial instruments consist of cash, deposits, prepaid expenses, and accounts payable and accrued liabilities. Unless otherwise noted, it is management's opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments. Because of the short maturity and capacity of prompt liquidation of such assets and liabilities, the fair value of these financial instruments approximate their carrying values, unless otherwise noted.

Investments in Marketable Securities

The Company’s Marketable Securities are considered Held-For-Trading (“HFT”) or Trading Assets. HTF- Trading securities are valued at their fair value when purchased/sold, and any unrealized gains or losses are recorded periodically on financial reporting dates as other income or loss.

Mineral Properties

Costs of exploration, carrying and retaining unproven mineral lease properties are expensed as incurred. Mineral property acquisition costs are capitalized including licenses and lease payments. Although the Company has taken steps to verify title to mineral properties in which it has an interest, these procedures do not guarantee the Company's title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects. Impairment losses are recorded on mineral properties used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets' carrying amount.

Optioned Properties

Properties under the Company’s ownership which have been optioned to a third party are deemed the Company’s property until all obligations under an option agreement are met, at which point the ownership of the property transfers to the third party. All non-refundable payments received prior to all obligations under an option agreement being met are considered liabilities until such time all obligations have been met, at which time ownership of the property transfers to the third party and the Company includes option payments into its statement of operations.

Recent Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new pronouncements that have been issued that might have a material impact on its financial position or results of operations.

The Company does not expect that recent accounting pronouncements or changes in accounting pronouncements during the six months ended June 30, 2024, are of significance or potential significance to the Company.

Note 2 – Going Concern

As reflected in the accompanying financial statements, the Company has used $277,013 (2023: $187,197) of cash in operations for the six months ended June 30, 2024. This raises substantial doubt about its ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company’s ability to raise additional capital and implement its business plan. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

Management believes that actions presently being taken to obtain additional funding and implement its strategic plans provide the opportunity for the Company to continue as a going concern.

Note 3 – Fair Value of Financial Instruments

Under FASB ASC 820-10-5, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). The standard outlines a valuation framework and creates a fair value hierarchy in order to increase the consistency and comparability of fair value measurements and the related disclosures. Under GAAP, certain assets and liabilities must be measured at fair value, and FASB ASC 820-10-50 details the disclosures that are required for items measured at fair value.

The Company has certain financial instruments that must be measured under the new fair value standard. The Company’s financial assets and liabilities are measured using inputs from the three levels of the fair value hierarchy. The three levels are as follows:

| - | Level 1 - Inputs are unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date. |

| - | Level 2 - Inputs include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates, yield curves, etc.), and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market corroborated inputs). |

| - | Level 3 - Unobservable inputs that reflect our assumptions about the assumptions that market participants would use in pricing the asset or liability. |

The following schedule summarizes the valuation of financial instruments at fair value on a recurring basis in the balance sheets as of June 30, 2024 and December 31, 2023, respectively:

| | Fair Value Measurements at June 30, 2024 | |

| | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | |

Cash | | $ | 3,390,604 | | | $ | - | | | $ | - | |

Marketable securities | | | 175,061 | | | | | | | | | |

Total Assets | | | 3,565,665 | | | | - | | | | - | |

Liabilities | | | | | | | | | | | | |

Total Liabilities | | | - | | | | - | | | | - | |

| | $ | 3,565,665 | | | $ | - | | | $ | - | |

| | Fair Value Measurements at December 31, 2023 | |

| | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | |

Cash | | $ | 3,667,617 | | | $ | - | | | $ | - | |

Marketable securities | | | | | | | | | | | | |

Total Assets | | | 332,082 | | | | - | | | | - | |

Liabilities | | | 3,999,699 | | | | | | | | | |

Total Liabilities | | | | | | | - | | | | - | |

| | | - | | | $ | - | | | $ | - | |

| | $ | 3,999,699 | | | | | | | | | |

Note 4 – Marketable Securities

The Company owns marketable securities (common stock) as outlined below:

Balance, December 31, 2023 | | $ | 332,082 | |

Fair value adjustment | | | (157,021 | ) |

| | | | |

Balance, June 30, 2024 | | $ | 175,061 | |

The Company classifies it’s marketable securities as available for sale.

During the six months ended June 30 2024, there were no receipts or sales of marketable securities.

During the year ended December 31, 2023, the Company received 20,333,575 common shares from a related party with a value of $85,224 related to the option of the Fish Lake Property.

During the year ended December 31, 2023, the Company received 19,741,685 common shares from a related party with a value of $82,774 related to the option of the North Big Smoky Property.

Note 5 – Prepaid Expenses

Prepaid expenses consisted of the following at June 30, 2024 and December 31, 2023:

| | June 30, 2024 | | | December 31, 2023 | |

Professional fees | | $ | - | | | $ | 5,500 | |

Other | | | 7,250 | | | | 15,150 | |

Transfer agent fees | | | 1,100 | | | | 2,200 | |

Total prepaid expenses | | $ | 8,350 | | | $ | 22,850 | |

Note 6 – Capital Stock

The Company is authorized to issue 3,000,000,000 shares of it $0.001 par value common stock.

Common Stock

During the six months ended June 30, 2024, the Company did not issue any common shares.

During the year-ended December 31, 2023, we issued 4,400,000 common shares for proceeds of $381,061.

Note 7 – Stock Options

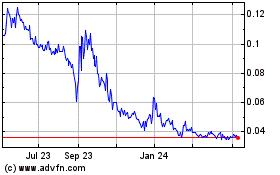

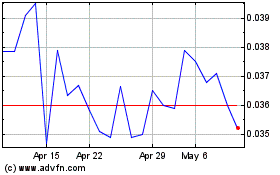

On May 26, 2022, the Company granted 3,700,000 stock options with an exercise price of $0.22, a term of 5 years and vest immediately. These options were vested on the date of grant and resulted in stock-based compensation of $696,397. Of the options granted, 1,600,000 were granted to 4 related parties including officers and directors and 2,100,000 were granted to 15 consultants of the Company. Due to the continuing decline of the company’s share price these options were repriced to $0.10 on January 24th 2023 (resulting in a stock based compensation expense of $69,337), and again to $0.04 on Jan 11th 2024 (resulting in a stock based compensation expense of $34,827). As of March 31, 2024 no stock options have been exercised, and none have been exercised up to and including the date of this document.

The fair value of options granted during the six months ended June 30, 2024 were determined using the Black Scholes method with the following assumptions:

| | Six Months Ended June 30, 2024 | |

Risk free interest rate | | | 4.0 | % |

Stock volatility factor | | | 98 | % |

Weighted average expected life of options | | | 5 years | |

Expected dividend yield | | | 0 | % |

A summary of the Company’s stock option activity and related information follows:

| | Period Ended June 30, 2024 | | | Year Ended December 31, 2023 | |

| | Options | | | Weighted Average Exercise Price | | | Options | | | Weighted Average Exercise Price | |

Outstanding, beginning of period | | | 3,700,000 | | | $ | 0.10 | | | | - | | | | - | |

Granted | | | 500,000 | | | | 0.04 | | | | 3,700,000 | | | $ | 0.22 | |

Repricing | | | - | | | | (0.06 | ) | | | - | | | | (0.12 | ) |

| | | | | | | | | | | | | | | | |

Outstanding, end of period | | | 4,200,000 | | | $ | 0.04 | | | | 3,700,000 | | | $ | 0.10 | |

As of June 30, 2024, the intrinsic value of the stock options was approximately $0. Stock option expense for the six months ended June 30, 2024 was $54,392 (2023: $69,337). As at June 30, 2024, 4,200,000 are exercisable (December 31, 2023: 3,700,000).

The following table summarizes the stock options outstanding at June 30, 2024:

Issue Date | | Number | | | Price | | | Expiry Date | | Outstanding at June 30, 2024 | | | Weighted Average Remaining Contractual Life (in years) | |

| | | | | | | | | | | | | | |

May 26, 2022 | | | 3,700,000 | | | $ | 0.04 | | | May 26, 2027 | | | 3,700,000 | | | | 1.90 | |

January 10, 2024 | | | 500,000 | | | $ | 0.04 | | | January 10, 2029 | | | 500,000 | | | | 4.51 | |

Note 8 – Mineral Properties

Fish Lake Valley

On April 29, 2021 we signed a Letter Of Intent (LOI) with Morella Corporation (formerly Altura Mining Limited) an Australian Lithium explorer and developer, and related party, whereby Morella can earn a 60% interest in the Fish Lake Valley property by paying the Company $675,000, issuing the equivalent of $500,000 worth of Altura stock, and expending $2,000,000 of exploration work in the next four years. To date Morella Corporation has paid $375,000 and issued 55,560,526 common shares with a fair value of $1,541,631.

The Letter of Intent was signed with a purchaser that has a common director as the Company.

San Emidio

On September 16th, 2021, Lithium Corporation signed an agreement with Surge Battery Metals whereby Surge could have earned an 80% interest in the Company’s San Emidio lithium-in-brine prospect in Washoe County Nevada. Surge paid Lithium Corporation $50,000 and issued 200,000 common shares valued at $51,260 on signing the agreement but relinquished all interest in the agreement and the property, so no further funds or shares were issued under the terms of the agreement. During the year-ended December 31, 2023, $101,260 was taken into income as a result of the cancellation of the agreement.

North Big Smokey

On May 24, 2022 our Company signed a Letter Of Intent (LOI) with Morella Corporation, an Australian Lithium explorer and developer, and related party, whereby Morella can earn a 60% interest in the Big North Smokey property by issuing the equivalent of $500,000 worth of Morella Corporation stock, and expending $1,000,000 of exploration work in the next four years. To date Morella Corporation has paid $65,000 and issued 26,791,685 common shares with a fair value of $209,441.

The Letter of Intent was signed with a purchaser that has a common director as the Company.

Note 9 – Allowance for Optioned Properties

Fish Lake Valley

On October 21, 2021 we signed an agreement with Morella Corporation, an Australian Lithium explorer and developer, and related entity whereby Morella Corporation can earn a 60% interest in the Fish Lake Valley property by paying the Company $675,000, issuing the equivalent of $500,000 worth of Altura stock, and expending $2,000,000 of exploration work in the next four years.

As of June 30, 2024, the Company has received $375,000 and received 55,560,526 common shares with a fair value of $1,541,631 in relation to the letter of intent. The Company recorded $1,916,631 as a liability against the property until either the purchaser returns the property to the Company or the purchaser has met all the obligations associated with the agreement, at which time the liability will be charged to the statement of operations.

The agreement was signed with a purchaser that has a common director as the Company.

North Big Smokey

On May 24, 2022 the Company signed a Letter Of Intent (LOI) with Morella Corporation, an Australian Lithium explorer and developer, and related party, whereby Morella can earn a 60% interest in the Big North Smokey property by issuing the equivalent of $500,000 worth of Morella Corporation stock, and expending $1,000,000 of exploration work in the next four years.

As of June 30, 2024, the Company has received $65,000 and our company has received 26,791,685 common shares with a fair value of $209,441. The Company recorded $274,471 as a liability against the property until either the purchaser returns the property to the Company or the purchaser has met all the obligations associated with the agreement, at which time the liability will be charged to the statement of operations.

The Letter of Intent was signed with a purchaser that has a common director as the Company.

San Emidio

On September 16th, 2021, Lithium Corporation signed an agreement with Surge Battery Metals whereby Surge could have earned an 80% interest in the Company’s San Emidio lithium-in-brine prospect in Washoe County Nevada. Surge paid Lithium Corporation $50,000 and issued 200,000 common shares valued at $51,260 on signing the agreement but relinquished all interest in the agreement and the property, so no further funds or shares were issued under the terms of the agreement. During the year-ended December 31, 2023, $101,260 was taken into income as a result of the cancellation of the agreement.

Note 10 – Related Party Transactions

The Company paid cash consulting fees totaling $72,000 and $144,000 (2023: $68,000 and $140,000) to related parties and non-cash stock option compensation expenses of $Nil and $Nil (2023: $Nil and $29,984) to related parties for the three and six months ended June 30, 2024, respectively.

The Company paid rent fees totaling $1,500 and $3,000 to related parties for the three and six months ended June 30, 2024 (2023: $1,500 and $3,000).

As at June 30, 2024, the Company had $33,868 (December 31, 2023: $26,489) owing to related parties.

During the year ended December 31, 2023, the company received $10,000 in distributions from Summa, LLC, a Limited Liability Corporation with some shared management. The Company holds a 25% investment in Summa LLC. The investment was written off in 2016 as there was significant doubt about the fair value of the investment in the period.

During the year ended December 31, 2023, the Company received 20,037,630 common shares with a fair value of $83,984 from a related party through common directors in relation to the letter of intent signed in relation to the North Big Smokey Property. See notes 4, 8 and 9.

During the year ended December 31, 2023, the Company received $150,000 and 35,226,951 common shares from a related party through common directors with a fair value of $1,456,407 in relation to the agreement signed in relation to the Fish Lake property. See note 4, 8 and 9.

Note 12 – Commitments and Contingencies

On July 1, 2021, the Company signed a rental agreement with a related party for office and storage space. The rental agreement is on a month-to-month basis for a monthly fee of $500 with no escalating payments. As the Company cannot determine the amount of time it will stay in the lease then a lease period cannot be determined and, as such, the agreement does not fall under ASC 842.

From time to time, we may be involved in routine legal proceedings, as well as demands, claims and threatened litigation that arise in the normal course of our business. The ultimate amount of liability, if any, for any claims of any type (either alone or in the aggregate) may materially and adversely affect our financial condition, results of operations and liquidity. In addition, the ultimate outcome of any litigation is uncertain. Any outcome, whether favorable or unfavorable, may materially and adversely affect us due to legal costs and expenses, diversion of management attention and other factors. We expense legal costs in the period incurred. We cannot assure you that additional contingencies of a legal nature or contingencies having legal aspects will not be asserted against us in the future, and these matters could relate to prior, current or future transactions or events. As of June 30, 2024, there were no pending or threatened litigation against the Company.

Note 13 – Subsequent Events

The Company has analyzed its operations subsequent to June 30, 2024 through the date these financial statements were issued, and has determined that it does not have any material subsequent events.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

FORWARD LOOKING STATEMENTS

This quarterly report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our unaudited financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this quarterly report.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this quarterly report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this quarterly report, the terms “we”, “us”, “our” and “our company” mean Lithium Corporation and our now defunct wholly-owned subsidiary Lithium Royalty Corp., a Nevada company, unless otherwise indicated.

General Overview

We were incorporated under the laws of the State of Nevada on January 30, 2007 under the name “Utalk Communications Inc.”. At inception, we were a development stage corporation engaged in the business of developing and marketing a call-back service using a call-back platform. Because we were not successful in implementing our business plan, we considered various alternatives to ensure the viability and solvency of our company.

On August 31, 2009, we entered into a letter of intent with Nevada Lithium Corporation regarding a business combination which could be effected in one of several different ways, including an asset acquisition, merger of our company and Nevada Lithium, or a share exchange whereby we would purchase the shares of Nevada Lithium from its shareholders in exchange for restricted shares of our common stock.

Effective September 30, 2009, we effected a 1 old for 60 new forward stock split of our issued and outstanding common stock. As a result, our authorized capital increased from 50,000,000 shares of common stock with a par value of $0.001 to 3,000,000,000 shares of common stock with a par value of $0.001 and our then issued and outstanding shares increased from 4,470,000 shares of common stock to 268,200,000 shares of common stock.

Also effective September 30, 2009, we changed our name from “Utalk Communications, Inc.” to “Lithium Corporation”, by way of a merger with our wholly owned subsidiary Lithium Corporation, which was formed solely for the change of name. The name change and forward stock split became effective with the Over-the-Counter Bulletin Board at the opening for trading on October 1, 2009 under the stock symbol “LTUM”. Our CUSIP number is 536804107.

On October 9, 2009, we entered into a share exchange agreement with Nevada Lithium and the shareholders of Nevada Lithium. The closing of the transactions contemplated in the share exchange agreement and the acquisition of all of the issued and outstanding common stock in the capital of Nevada Lithium occurred on October 19, 2009. In accordance with the closing of the share exchange agreement, we issued 12,350,000 shares of our common stock to the former shareholders of Nevada Lithium in exchange for the acquisition, by our company, of all of the 12,350,000 issued and outstanding shares of Nevada Lithium. Also, pursuant to the terms of the share exchange agreement, a director of our company cancelled 220,000,000 restricted shares of our common stock. Nevada Lithium’s corporate status was allowed to lapse and the company’s status with the Nevada Secretary of State has been revoked.

Our Current Business

We are an exploration stage mining company engaged in the identification, acquisition, and exploration of metals and minerals with a primary focus on lithium mineralization on properties located in Nevada, and Graphite and Rare Earth Element properties in British Columbia. Our current operational focus is to judiciously conduct exploration activities on all our mineral properties and generate additional prospects for our exploration portfolio.

In March of 2022 we staked a block of claims covering approximately 3400 acres which roughly corresponds to the lands previously held by Lithium Corporation’s former subsidiary Lithium Royalty Corp. in 2016/2017. On May 13, 2022 we signed a Letter of Intent (LOI) with Morella Corporation (a related party) whereby Morella can earn a 60% interest in the property by paying $65,000 US (done) to the Company on the signing of the LOI, and issuing $100,000 worth of Morella shares at the time of signing the formal agreement, and issuing $100,000 worth of shares at each anniversary of the signing of the formal agreement over the next four years. Additionally Morella must incur exploration expenditures of $100,000, $200,000, $300,000 and $400,000 in years one through four of the option agreement. Should they fulfill these obligations they will have earned an undivided 60% interest in the property and may purchase a further 20% interest within 1 year for $750,000, and purchase the remaining 20% interest within the following year for $750,000. Should Morella buy Lithium Corporation’s undivided working interest in the property, the Company will revert to a 2.5 % Net Smelter Royalty interest, ½ of which would be purchasable by Morella for $1,000,000. Since Optioning the property Morella has conducted Controlled Source Audio-Magnetotelluric geophysical and sediment geochemical surveys, staked more claims adjacent to the original option claim block as well as staking a non-contiguous area to the north and west of the earlier claims here. Most recently Morella has concluded a two-hole drilling program, testing for both lithium-in-brine and clay mineralization, where anomalous lithium-in-clay mineralization was discovered, but no lithium-in-brine mineralization was encountered. Morella is current with respect to all conditions pursuant to the option agreement.

On September 16th 2021 Lithium Corporation signed an agreement with Surge Battery Metals whereby Surge could have earned an 80% interest in the Company’s San Emidio lithium-in-brine prospect in Washoe County Nevada, by paying an initial $50,000 and issuing 200,000 shares of Surge (TSX-V:Nili). Surge had undertaken to make payments of $620,000 in cash and stock over 5 years while incurring expenditures on the property of $1,000,000 over that period. Upon fulfillment of the aforementioned commitments Surge would have been deemed to have earned their undivided 80% interest and could have formed a joint venture with the Company. The Company had optioned this property off before as effective May 3, 2016, our company entered in to an Exploration Earn-In Agreement with 1067323 B.C. Ltd. with respect to our San Emidio property. The terms of the formal agreement were; payment of $100,000, issuance of 300,000 common shares of 1067323 B.C. Ltd., or of the publicly traded company anticipated to result from a Going Public Transaction, and work performed on the property by the Optionee in the amount of $600,000 over the following three years to earn an 80% interest in the property. 1067323 then had a subsequent Earn-In option to purchase Lithium Corporation’s remaining 20% working interest within three years of earning the 80% by paying our company a further $1,000,000, at which point our company would retain a 2.5% Net Smelter Royalty, half of which could have been purchased by 1067323 for an additional $1,000,000. 1067323 B.C. Ltd. merged with American Lithium Corp., and the first tranche of cash and shares were issued in June of 2016. The Company waived the work requirement for the first year and received extra shares of American Lithium Corp as consideration for the amendment to the Agreement. In June 2018, the Company received notification that the purchaser was relinquishing any right to earn an interest in the property and, as such, $202,901 was taken into income. During the year-ended December 31, 2019, the Company recorded a $217,668 allowance for the property which then had a net book value of $Nil. Surge Battery Metals completed some geochemical work on the prospect block and gave Lithium Corporation formal notice in Summer 2022 that they were relinquishing all interest in the property. In Fall 2022 the Company completed a Controlled Source Audio- Magnetotelluric (CSAMT) survey on the property, and is currently considering next steps with respect to exploring and developing this property.

On April 29, 2021 we signed a Letter Of Intent (LOI) with Altura Mining Limited (now Morella Corporation after a name change) an Australian Lithium explorer and developer, and related company whereby Morella can earn a 60% interest in the Fish Lake Valley lithium-in-brine property in Esmeralda County, Nevada by paying the Company $675,000, issuing the equivalent of $500,000 worth of Morella stock, and expending $2,000,000 of exploration work over the next four years. To date Morella is current with its obligations under the formal agreement ratified on October 12th 2021, having paid our company $375,000 to date, and has issued 55,560,526 shares of Morella (1MC:ASX, Altaf:OTC-QB) common stock pursuant to the terms of the agreement. In the last couple of years Morella has completed two phases passive seismic and magnetotelluric (MT) surveys and most recently have received permits for drilling on both the south and northern blocks. Preparatory work for drilling was done during the summer of 2023, and drilling commenced in early October, on this initial two-hole exploratory program to the northeast of the playa, away from the area of known mineralization, where moderate lithium mineralization was encountered in clays and weak lithium mineralization encountered in brines. The Company had originally acquired this property through a June 2009 Option Agreement, and conducted geochemical, geological, geophysical and drilling work on it over the next several years eventually optioning the property off to the successors of American Lithium Corp in 2016, who conducted geophysical, and geochemical surveys and did some drilling work over the the next few years. The Company received formal relinquishment of American Lithium’s right to earn an interest in the property on April 30th 2019.

On March 2, 2017 we issued a news release announcing that we had signed a letter of intent with Bormal Resources Inc. with respect to three Tantalum-Niobium properties (Michael, Yeehaw, and Three Valley Gap) located in British Columbia, Canada. Bormal conducted a stream sediment sampling program on the Michael property in 2014, and determined that the tantalum-niobium in stream sediment anomaly here is bona fide, and in the order of 6 kilometers in length. In November of 2016 Lithium Corporation conducted a short soil geochemistry orientation program on the property as part of its due diligence, and determined that there are elevated levels of Niobium-Tantalum in soils here. Also in the general area of the Michael property the Yeehaw property had been staked over a similar but lower amplitude Tantalum/rare earth elements in stream sediment anomaly. Both properties are situated in the Eocene Coryell Batholith, and it is thought that these anomalies may arise from either Carbonatite or Pegmatite type deposits. The Company conducted a helicopter borne bio-geochemical survey on these two properties in June 2017, which did return anomalous results. This was followed up by a geological and geochemical examination of the Yeehaw property in early July 2017, and additional work of a similar nature subsequently in July 2017, and in early October 2017. The examination uncovered a zone roughly 30 meters wide which includes an interval that is mineralized with approximately 0.75% Total Rare Earth Elements (TREE’s). On February 23, 2018 we issued a news release announcing that we had dropped any interest in the Michael and Three Valley Gap properties, and had renegotiated the final share payment as required in the agreement from 750,000 to 400,000 shares. The final consideration shares were issued and the Yeehaw property was transferred by Bormal. During 2017 the Company conducted initial stream, rock and magnetometer surveys on the property, and discovered a 30 meter wide structure (Horseshoe Bend showing) that exhibits anomalous Titanium/REE mineralization. The company has staked an additional 5227 acre (2115.51 hectares) mineral claim and conducted a brief exploration program in Spring 2018 of geological mapping and rock and soil sampling on the property. This program discovered a slightly stronger zone of similar mineralization approximately 660 feet (200 meters) to the northwest of the Horseshoe Bend, and similar float mineralization another 0.75 miles (1.2 kms) further to the northwest. Work in 2019 discovered the extension to the west of the mineralized structure, and also similar mineralized float was found to the east that possibly indicates it strikes under cover in that direction also. Field work was done on this property over the past few field seasons, and the Company is currently determining what work will be done during the 2024 field season.

Effective April 23, 2014, we entered into an operating agreement with All American Resources, L.L.C and TY & Sons Investments Inc. with respect to Summa, LLC, a Nevada limited liability company incorporated on December 12, 2013, wherein we hold a 25% membership. Summa was formed to acquire and administer the residual lands that originated in the 60’s and 70’s through Howard Hughes’s – Hughes Corporation, which went on a mining property buying spree at that time. Our company's capital contribution to Summa, LLC was $125,000, of which $100,000 was in cash and the balance in services. To date we have contributed an additional $31,700 in cash, and also over the years an indeterminate amount of casual geological and land expertise to Summa, LLC. In recognition, Summa transferred five urban lots in Tonopah of indeterminate value in 2020, and since Jan 2021 have issued checks to the company for $150,500. The Tonopah property was optioned in early 2020, and the Optionee has earned a 100% interest in the property. Summa still retains a 1% (LTUM’s share 0.25%) Net Smelter Royalty on the property. Recently Summa entered into an agreement with North American Silver Corporation (TSX-V:NSC) whereby NSC can earn a 100% interest with respect to Summa’s Belmont Nevada claims (not to be confused with the Belmont mine in Tonopah) by paying $200,000 in cash or at Optionor’s discretion shares over 5 years, and election must be made by the sixth agreement anniversary to purchase the lands (69.96 acres) at $10,000 per acre. Should NSC earn their interest Summa, LLC would retain a 1% Net Smelter Royalty – 50% of which may be subsequently purchased by the Optionor. Summa, LLC still retains a 100% interest (subject to a 2% NSR in favor of Summa Corp. (the successor entity to the Hughes Corporation) in a further five project areas in the state of Nevada, and Lithium Corporation remains committed to casually helping them move the projects along so that they may be optioned eventually.

In April 2024 we announced we had recently staked a 5,178 acre (2095 hectare) property prospect for Fluorine mineralization in the Greenwood Mining Division in southern British Columbia. The property was subsequently expanded through the staking of two other blocks of claims bringing our total holdings in the area to approximately 11,068 acres (4479 hectares) that in part envelopes the claim block hosting the past producing Rock Candy Fluorspar mine. The Company has recently commenced geochemical and geological exploratory work on the property, and is compiling all data available from all open source.

Our company intends to continue identifying additional lithium properties in Nevada and to conduct exploration on our British Columbia properties. We will continue assessing our options with respect to our 25% interest in Summa, LLC, a private Nevada company, which holds the residue of Howard Hughes’s Summa Corporation, while generating new prospects and evaluating property submittals for option or purchase.

Fish Lake Valley Property

Fish Lake Valley is a lithium enriched playa (also known as a salar, or salt pan), which is located in northern Esmeralda County in west central Nevada, and the property is roughly centered at 417050E 4195350N (NAD 27 CONUS). We currently hold eighteen, 80-acre Association Placer claims that cover approximately 1,440 acres (582.75 hectares). Lithium-enriched Tertiary-era Fish Lake formation rhyolitic tuffs or ash flow tuffs have accumulated in a valley or basinal environment. Over time interstitial formational waters in contact with these tuffs, have become enriched in lithium, boron and potassium which could possibly be amenable to extraction by evaporative methods. Our claim block here has expanded and contracted twice, at times when the lithium market has contracted, and the prudent thing to do would be to only maintain essential claims, in order to preserve capital.

The property was originally held under mining lease purchase agreement dated June 1, 2009, between Nevada Lithium Corporation, and Nevada Alaska Mining Co. Inc., Robert Craig, Barbara Craig, and Elizabeth Dickman. Nevada Lithium issued to the vendors $350,000 worth of common stock of our company in eight regular disbursements. All disbursements were made of stock worth a total of $350,000, and claim ownership was transferred to our company.

The geological setting at Fish Lake Valley is highly analogous to the salars of Chile, Bolivia, and Peru, and more importantly Clayton Valley, where Albemarle has its Silver Peak lithium-brine operation. Access is excellent in Fish Lake Valley with all-weather gravel roads leading to the property from state highways 264, and 265, and maintained gravel roads ring the playa. Power is available approximately 10 miles from the property, and the village of Dyer is approximately 12 miles to the south, while the town of Tonopah, Nevada is approximately 50 miles to the east.

Our company completed a number of geochemical and geophysical studies on the property, and conducted a short drill program on the periphery of the playa in the fall of 2010. Near-surface brine sampling during the spring of 2011 outlined a boron/lithium/potassium anomaly on the northern portions of the northern playa, that is roughly 1.3 x 2 miles long, which has a smaller higher grade core where lithium mineralization ranges from 100 to 150 mg/L (average 122.5 mg/L), with boron ranging from 1,500 to 2,670 mg/L (average 2,219 mg/L), and potassium from 5,400 to 8,400 mg/L (average 7,030 mg/L). Wet conditions on the playa precluded drilling there in 2011, and for a good portion of 2012, however a window of opportunity presented itself in late fall 2012. In November/December 2012 we conducted a short direct push drill program on the northern end of the playa, wherein a total of 1,240.58 feet (378.09 meters) was drilled in 20 holes at 17 discrete sites, and an area of 3,356 feet (1,023 meters) by 2,776 feet (846 meters) was systematically explored by grid probing. The deepest hole was 81 feet (24.69 meters), and the shallowest hole that produced brine was 34 feet (10.36 meters). The average depth of the holes drilled during the program was 62 feet (18.90 meters). The program successfully demonstrated that lithium-boron-potassium-enriched brines exist to at least 62 feet (18.9 meters) depth in sandy or silty aquifers that vary from approximately three to ten feet (one to three meters) in thickness. Average lithium, boron and potassium contents of all samples are 47.05 mg/L, 992.7 mg/L, and 0.535% respectively, with lithium values ranging from 7.6 mg/L to 151.3 mg/L, boron ranging from 146 to 2,160.7 mg/L, and potassium ranging from 0.1 to 1.3%. The anomaly outlined by the program is 1,476 by 2,461 feet (450 meters by 750 meters), and is not fully delimited, as the area available for probing was restricted due to soft ground conditions to the east and to the south. A 50 mg/L lithium cutoff is used to define this anomaly and within this zone average lithium, boron and potassium contents are 90.97 mg/L, 1,532.92 mg/L, and 0.88% respectively. On September 3, 2013, we announced that drilling had commenced at Fish Lake Valley. Due to storms and wet conditions in the area which our company hoped to concentrate on, the playa was not passable, and so the program concentrated on larger step-out drilling well off the playa. This 11 hole, 1,025 foot program did prove that mineralization does not extend much, if at all, past the margins of the playa, as none of the fluids encountered in this program were particularly briny, and returned values of less than 5 mg/L lithium.

We signed an Exploration Earn-In Agreement in February 2016 with 1032701 B.C. Ltd., a private British Columbia company with respect to our Fish Lake Valley lithium brine property. 1032701 B.C. Ltd., had the option to acquire an initial 80% undivided interest in the Fish Lake Valley property through the payment of an aggregate of US$300,000 in cash, completing a Going Public Transaction on or before May 6, 2016, and subject to the completion of the Going Public Transaction, arranging for the issuance of a total of 400,000 common shares in the capital of the Resulting Issuer. The Optionee had to make qualified exploration or development expenditures on the property of $200,000 before the first anniversary, an additional $300,000 before the second anniversary, an additional $600,000 prior to the third anniversary, and make all payments and perform all other acts to maintain the Property in good standing before fully earning their 80% interest. Additionally, terms were to be negotiated for the Optionee to purchase our 20% interest in the property for $1,000,000, at which point our interest would revert to a 2 1/2% Net Smelter Royalty (NSR). The Optionee may then elect at any time to purchase one half of our NSR for $1,000,000.

On April 7, 2016, 1032701 B.C. Ltd. was acquired by Menika Mining Ltd., which subsequently changed its name to American Lithium Corp.(TSXV: LI) In connection with the acquisition of 1032701 and in accordance with the Exploration Earn-In Agreement, 200,000 common shares were issued to our company. In addition, we received payment of $130,000. In March of 2017 American Lithium Corp. issued 100,000 common shares and paid the company $100,000 to satisfy their option commitment. In March of 2018 American Lithium issued 10,000 common shares (as they had recently rolled their stock back on a 1 for 10 basis), and paid the company $100,000. In addition it was agreed that Lithium Corporation would extend the deadline for the year two exploration expenditure until September 30th 2018 for consideration of a further 80,000 shares.

American Lithium Corporation conducted confirmation shallow brine sampling on the property, and drilled two exploratory wells off the playa area in 2016. In Summer 2018 they reportedly completed a short seismic survey adjacent to the Company’s claims here, and attempted to drill a hole on the Company’s claims but were unsuccessful due to wet ground conditions. On April 30th 2019 American Lithium issued formal relinquishment of Purchasers right to earn the interest under the agreement.

On April 29, 2021 we signed a Letter Of Intent (LOI) with Altura Mining Limited (now Morella Corporation) an Australian Lithium explorer and developer, and related party. Under the formal agreement which was signed in October 2021 Morella can earn a 60% interest in the Fish Lake Valley property by paying the Company $675,000, issuing the equivalent of $500,000 worth of Morella stock, and expending $2,000,000 of exploration work in the next four years. To date Morella is current with its obligations under the formal agreement ratified on October 12th 2021, having paid our company $375,000 to date, and has issued 55,560,526 shares of Morella (1MC:ASX, Altaf:OTC-QB) common stock pursuant to the terms of the agreement. In the last couple of years Morella has completed two phases of passive seismic and magnetotelluric (MT) surveys and received permits for drilling on both the south and northern blocks. Preparatory work for drilling was done on the south block in fall 2022, and surface casing installed, while at the north block pad construction was done during the summer of 2023, and drilling commenced in early October. One hole was drilled here to the northeast of the playa, away from the area of known mineralization, and only moderate lithium mineralization was encountered in clays and weak lithium mineralization encountered in brines.

San Emidio Property

The San Emidio property, located in Washoe County in northwestern Nevada, was acquired through the staking of claims in September 2011. The four, 80-acre, Association Placer claims currently held here cover an area of approximately 320 acres (129.50 hectares). The claim block has expanded and contracted a couple of times, in accordance with the state of the Lithium market. The property is approximately 65 miles north-northeast of Reno, Nevada, and has excellent infrastructure.

We developed this prospect during 2009, and 2010 through surface sampling, and the early reconnaissance sampling determined that anomalous values for lithium occur in the playa sediments over a good portion of the playa. This sampling appeared to indicate that the most prospective areas on the playa may be on the newly staked block proximal to the southern margin of the basin, where it is possible the structures that are responsible for the geothermal system here may also have influenced lithium deposition in sediments.

Our company conducted near-surface brine sampling in the spring of 2011, and a high resolution gravity geophysical survey in summer/fall 2011. Our company then permitted a 7 hole drilling program with the Bureau of Land Management in late fall 2011, and a direct push drill program was commenced in early February 2012. Drilling here delineated a narrow elongated shallow brine reservoir which is greater than 2.5 miles length, and which is adjacent to a basinal feature outlined by the earlier gravity survey. Two values of over 20 milligrams/liter lithium were obtained from two holes located centrally in this brine anomaly.

Most recently we drilled this prospect in late October 2012, further testing the area of the property in the vicinity where prior exploration by our company discovered elevated lithium levels in subsurface brines. During the 2012 program a total of 856 feet (260.89 meters) was drilled at 8 discrete sites. The deepest hole was 160 feet (48.76 meters), and the shallowest hole that produced brine was 90 feet (27.43 meters). The average depth of the seven-hole program was 107 feet (32.61 meters). The program better defined a lithium-in-brine anomaly that was discovered in early 2012. This anomaly is approximately 0.6 miles (370 meters) wide at its widest point by more than 2 miles (3 kilometers) long. The peak value seen within the anomaly is 23.7 mg/l lithium, which is 10 to 20 times background levels outside the anomaly. Our company believes that, much like Fish Lake Valley, the playa at San Emidio may be conducive to the formation of a “Silver Peak” style lithium brine deposit, and the recent drilling indicates that the anomaly occurs at or near the intersection of several faults that may have provided the structural setting necessary for the formation of a lithium-in-brine deposit at depth.

In 2016 we signed an Exploration Earn-In Agreement with 1067323 B.C. Ltd. with respect to our San Emidio property.

1067323 B.C. Ltd., could have acquired an initial 80% undivided interest in the San Emidio property through the payment of an aggregate of US$100,000 in cash, completing a Going Public Transaction and subject to the completion of the Going Public Transaction, arranging for the issuance of a total of 300,000 common shares in the capital of the Resulting Issuer as follows:

| · | Within 30 days of the Effective Date pay $100,000 to our company and issue 100,000 common shares of the TSX-V listed public company. |

| · | On or before the first anniversary of the signing of the Definitive Agreement issue 100,000 common shares of the Optionee/TSX-V listed public company. |

| · | On or before the second anniversary of the signing of the definitive agreement issue 100,000 common shares of the Optionee/TSX-V listed public company. |

The Optionee had to have made qualified exploration or development expenditures on the property of $100,000 before the first anniversary, an additional $200,000 before the second anniversary, an additional $300,000 prior to the third anniversary, and make all payments and perform all other acts to maintain the Property in good standing before fully earning their 80% interest. Additionally, Optionee has the right to purchase our 20% interest in the property for $1,000,000, at which point the our interest would revert to a 2 1/2% Net Smelter Royalty (NSR). The Optionee may then elect at any time to purchase one half of our NSR for $1,000,000.

On May 24, 2016, 1067323 B.C. Ltd. was acquired by American Lithium Corp.(TSXV: LI) In connection with the acquisition of 1067323 and in accordance with the Exploration Earn-In Agreement, 100,000 common shares were issued to our company. In addition, we received payment of $100,000. To date the Company has received 200,000 shares of American Lithium as consideration under this option agreement.

American Lithium Corp did not conduct any appreciable exploration work on this prospect, and the Company waived the $100,000 exploration expenditure provision for Year 1 of the option agreement. In early June 2018 the Company was notified that American Lithium was allowing the option earn-in to lapse. The Company received a drilling permit from the BLM in Winnemucca, for up to 3 RC drill holes here, and the Company was intent on drilling these in 2019, however with the downturn in the Lithium market at that point exploration here was put on hold.

On September 16th 2021 Lithium Corporation signed an agreement with Surge Battery Metals whereby Surge may earn an 80% interest in the Company’s San Emidio lithium-in-brine prospect in Washoe County Nevada, by paying an initial $50,000 and issuing 200,000 shares of Surge (TSX-V:Nili). Surge had undertaken to make payments of $620,000 in cash and stock over 5 years while incurring expenditures on the property of $1,000,000 over that period. Upon fulfillment of the aforementioned commitments Surge would have been deemed to have earned their undivided 80% interest and could have formed a joint venture with the Company. Surge Battery Metals completed some geochemical work on the prospect block and gave Lithium Corporation formal notice in Summer 2022 that they were relinquishing all interest in the property. In Fall 2022 the Company completed a Controlled Source Audio-Magnetotelluric (CSAMT) survey on the property, and is currently considering next steps with respect to exploring and developing this property.

BC Sugar Flake Graphite Property

On June 6, 2013, we entered into a mining claim sale agreement with Herb Hyder wherein Mr. Hyder agreed to sell to our company a 50.829 acre (20.57 hectare) claim located in the Cherryville area of British Columbia. As consideration for the purchase of the property, we issued 250,000 shares of our company’s common stock to Mr. Hyder. In addition to the acquired claim, our company staked or acquired another 13 claims at various times over the subsequent months, to bring the total area held under tenure to approximately 19,816 acres (8,020 hectares). The flake graphite mineralization of interest here is hosted predominately in graphitic quartz/biotite, and lesser graphitic calc-silicate gneisses. The rocks in the general area of the BC Sugar prospect are similar to the host rocks in the area of the Crystal Graphite deposit 55 miles (90 kms) to the southeast. Over the past three years the claim block here has been strategically decreased, and the Company currently holds one tenure encompassing 203 acres (82.23 hectares).

The BC Sugar property is within in the Shushwap Metamorphic Complex, in a geological environment favorable for the formation of flake graphite deposits, and is in an area of excellent logistics, with a considerable network of logging roads within the project area. Additionally the town of Lumby is approximately 19 miles (30 kms) to the south of the property, while the City of Vernon is only 30 miles (50 kms) to the southwest of the western portions of the claim block.

We received final assays from the October 2013 prospecting and geological program at the BC Sugar property in December of 2013. That work increased the area known to be underlain by graphitic bearing gneisses, and further evaluations were made in the area of the Sugar Lake, Weather Station, and Taylor Creek showings. In the general vicinity of the Weather Station showing, a further 13 samples were taken, and hand trenching was performed at one of several outcrops in the area. In the trench a 5.2 meter interval returned an average of 3.14% graphitic carbon, all in an oxidized relatively friable gneissic host rock. Additionally a hydrothermal or vein type mineralized graphitic quartz boulder was discovered in the area which graded up to 4.19% graphitic carbon. The source of this boulder was not discovered during this program, but it is felt to be close to its point of origin. Samples representative of the mineralization encountered here were taken for petrographic study, which was received in late 2013. A brief assessment work program was performed in September 2014 to ensure all claims in the package were in good standing prior to the anticipated sale of this asset to Pathion Inc. Recommendations were made by the consulting geologist who wrote the assessment report with respect to trenching, and eventually drilling the Weather Station showing. Our company submitted a Notice of Work to the BC Government in early May 2015 to enable our company to conduct a program of excavator trenching, sampling and geological mapping on the Weather Station showing. In May of 2015 we signed an agreement with KLM Geosciences LLC of Las Vegas to conduct a short Ground Penetrating Radar (GPR) survey on the property in the Weather Station – Taylor Creek areas. The GPR survey as well as a GEM-2 electromagnetic (EM) survey took place in approximately mid-May 2015. The GPR survey did not provide useful data because of the moisture saturation in the shallow subsurface. The EM survey successfully generated an anomaly over known mineralization as well as extended the anomaly to the west under an area of cover consisting of glacial/fluvial till. Lithium Corporation is pleased with the results of the EM survey and has modified our work plans to include additional work that builds on the results of this survey.