Current Report Filing (8-k)

December 23 2021 - 10:01AM

Edgar (US Regulatory)

0001579010

false

0001579010

2021-12-17

2021-12-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 17, 2021

LIFE ON EARTH, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other

jurisdiction of incorporation)

|

|

000-55464

(Commission

File Number)

|

|

46-2552550

(I.R.S. Employer

Identification No.)

|

|

|

|

|

1345 6th Ave. 2nd Floor New York, NY 10105

|

|

|

(Address of principal executive offices)

|

|

|

|

|

|

(646) 844-9897

|

|

|

(Registrant’s Telephone Number)

|

|

|

|

|

|

|

|

|

(Former name or address, if changed since last report)

|

|

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

None

|

|

|

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 – Registrant’s Business

and Operations

Item 1.01 Entry into a Material Definitive

Agreement

On December 17, 2021, we entered into Stock Purchase

Agreement (the “Agreement”) with CareClix Holdings, Inc., a Florida corporation (“CareClix”). Under the Agreement,

we will acquire 100% ownership of the operating subsidiaries of CareClix, which in include CareClix, Inc., a Virginia corporation, CareClix

Services, Inc., a Florida corporation, My CareClix, Inc., a Florida corporation, and CareClix RPM, Inc., a Florida corporation (collectively,

the “CareClix Group”). In exchange for ownership of the CareClix Group, we will issue the following securities, to be issued

pro rata to the common shareholders of CareClix:

50,000,000 shares of our common stock; and Shares

of a new class of preferred stock to be designated as Series E Preferred Stock. The shares of Series E Preferred stock to be designated

and issued to the shareholders of CareClix shall be up to approximately 2,100,000 Preferred Shares with a convertibility ratio, under

the current share structure, of 100 to 1 into our shares of common stock.

In addition, the Agreement calls for us to issue

up to 4,000,000 shares of our Series A Preferred Stock, over a period of time, to Mr. Charles Scott, the Chairman and majority shareholder

of CareClix, with 2,500,000 shares to be issued at closing, 600,000 shares to be issued 45 days after closing, and 900,000 shares to be

issued 90 days after closing. Shares of our Series A Preferred Stock, which are not convertible and do not receive dividends, are entitled

to cast 50 votes per share on all matters submitted to the vote or consent of our shareholders. Upon the closing of the Agreement, the

shareholders of CareClix will hold approximately seventy percent of our issued and outstanding common equity on a fully diluted basis,and

will hold the majority of our total shareholder voting power.

The closing of the Agreement is subject to numerous

conditions, including the effectiveness of a registration statement on Form S-4 to be filed registering the issuance of our shares of

common stock and shares of Series E Preferred Stock to the common shareholders of CareClix, approval of the Agreement by a majority of

the shareholders of CareClix, and preparation and delivery of audited financial statements for the CareClix Group.

Upon closing of the Agreement, we intend

to continue pursuing the business of the CareClix Group. CareClix is a leading virtual telehealth platform. The company provides software

applications coupled with medical services enabling patients to receive care anytime at anyplace. More than 20 million individuals in

the U.S. in over 60 countries are currently utilizing CareClix's services. CareClix’s website is: www.careclix.com.

Section 7 – Regulation FD

Item 7.01 Regulation FD Disclosure

On December 23, 2021, we released the press release

furnished herewith as Exhibit 99.1.

Section 9 – Financial Statements and

Exhibits

Item. 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Date: December 23, 2021

|

LIFE ON EARTH, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Mahmood Khan

|

|

|

|

Name:

|

Mahmood Khan

|

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

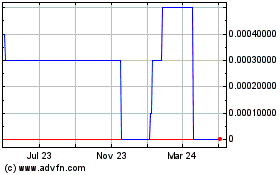

Life on Earth (CE) (USOTC:LFER)

Historical Stock Chart

From Mar 2024 to Apr 2024

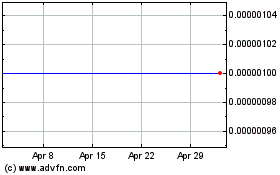

Life on Earth (CE) (USOTC:LFER)

Historical Stock Chart

From Apr 2023 to Apr 2024