0001579010

false

0001579010

2022-09-15

2022-09-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September

15, 2022

LIFE ON EARTH, INC.

(Exact name of registrant

as specified in its charter)

Delaware

(State or other

jurisdiction of incorporation) |

|

000-55464

(Commission

File Number) |

|

46-2552550

(I.R.S. Employer

Identification No.) |

|

1270 N. Wickham Road, Suite 13, No. 1019

Melbourne, FL

(Address of principal executive offices) |

|

32935

(Zip Code) |

Registrant’s telephone number, including

area code: (321) 306-0306

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Securities registered pursuant to Section 12(b) of the Act: |

| |

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| None |

|

|

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Section 1 - Registrant’s

Business and Operations

Item 1.02 Termination

of a Material Definitive Agreement

On December 31, 2021, Registrant entered into a Management

Operating Agreement with CareClix Holdings, Inc. (“SOLI”) which enabled Registrant to complete a provisional closing (the

“Interim Closing”) of the acquisition of four operating subsidiaries of SOLI, with the final closing of the transaction to

occur when a Form S-4 registration statement to register the consideration shares to be issued by Registrant, was filed by Registrant

with and declared effective by the SEC, but by no later than May 31, 2022. As part of the Interim Closing, Charles Scott and Dr. John

Korangy were appointed to Registrant’s Board of Directors. If the registration statement was not declared effective by May 31, 2022,

then the transaction failed, the Interim Closing became void, the CareClix subsidiaries again became subsidiaries of SOLI, and the mutual

release in the event of termination of the proposed transaction became effective. In April 2022, as a result of disagreements between

management of the CareClix subsidiaries and the now former management of Registrant (Mahmood Khan, John C. Romagosa, Robert Gunther and

Fernando Leonzo (collectively the “Former Management”)) ,and the multiple defaults by Registrant in meeting the terms and

conditions of the Stock Purchase Agreement of December 17, 2021 and the Management Operating Agreement as set forth in part in the Form

10-Q for the quarter ended February 28, 2022 as filed with the SEC, SOLI formally offered the option to Former Management to rescind and

terminate the Interim Closing on multiple occasions. Former Management refused these offers but continued to refuse to cure the defaults

by Registrant.

To undertake to cure the

continuing defaults and also to initiate the audits of the CareClix subsidiaries by Registrant as required by the Management Operating

Agreement, on April 26, 2022, acting as majority voting shareholder of Registrant, Charles O. Scott voted

to remove Fernando Leonzo and John C. Romagosa as directors and officers of Registrant. On April 29, 2022, again acting as majority voting

shareholder of Registrant, Charles O. Scott voted to remove Mahmood Kahn and Robert Gunther as directors and officers of Registrant. The

removals were done in compliance with Section 141(k) of the Delaware General Corporation Law. These removals left Charles Scott and Dr.

John Korangy as the remaining members of the Registrant’s Board of Directors.:

On May 2, 2022, the Board

of Directors of Registrant approved an Amended Management Operating Agreement, removing all further conditions to the Final Closing except

the obligation by Registrant to register and issue the balance of the common share consideration, and removing the automatic termination

provision in the event that certain conditions were not met by May 31, 2022. The share consideration, a total

of 300 million shares of Registrant’s common stock, were reserved for issuance as soon as the shares are registered on Form S-4,

and the remainder of the 4,000,000 shares of Registrant’s Series A Preferred stock, which votes with the common stock at 60 votes

per Series A Preferred share, were issued to Charles O. Scott, former control shareholder of SOLI, and 1,200,000 shares of Series A Preferred

previously held by Former Management, were cancelled and reissued to Mr. Scott, as agreed.

On September 9, 2022, Former Management of Registrant

filed a purported derivative action against Registrant and its purported Board of Directors, in the Court of Chancery of the State of

Delaware, seeking:

| 1. | A declaration that their removal as directors and officers was not valid; |

| 2. | Unspecified damages for “intentional mismanagement” by declaring

the Interim Closing of the CareClix acquisition as the Final Closing and seeking to rescind the acquisition transaction. |

Immediately on learning of the action filed by Former

Management, Registrant’s Board of Directors immediately rescinded the Board action on May 2, 2022 approving the Amended Management

Operating Agreement, resulting in a default of the Interim Closing of the proposed acquisition of the CareClix companies for failure of

consideration and failure by Registrant to register the common share consideration by May 31, 2022. Consequently,

ownership of the CareClix companies reverted to SOLI

effective May 31, 2022, Registrant and SOLI have severed all remaining connection except for a promissory note by Registrant in favor

of CareClix for $128,432 in funds voluntarily advanced to or for Registrant for payment of Registrant operating expenses from December

1, 2021 through September, 2022, and the mutual release of claims contained in the Share Purchase Agreement became effective. The Share

Purchase Agreement did not contain any early or other termination penalty on any party and an arbitration provision in both the Share

Purchase Agreement and the Management Operating Agreement survived termination and controls any future issues between the parties.

Section 5 - Corporate Governance and Management

Item 5.01 Changes in Control

of Registrant.

As a result

of the default by Registrant in the acquisition transaction referenced in Item 1.02, Charles O. Scott remained as the majority voting

shareholder of Registrant, holding 5,200,000 shares of Series A Preferred stock, with 312,000,000 total votes, resulting in voting control

as follows:

| |

|

Issued |

|

Vote |

|

Percent |

|

|

| Common |

|

|

71,822,753 |

|

|

|

71,822,753 |

|

|

|

18.7 |

|

|

|

| Preferred A |

|

|

5,200,000 |

|

|

|

312,000,000 |

|

|

|

81.3 |

|

|

|

| Preferred B |

|

|

100,000 |

|

|

|

0 |

|

|

|

0 |

|

|

|

| Preferred C |

|

|

2,613,375 |

|

|

|

0 |

|

|

|

0 |

|

|

|

| Preferred D |

|

|

16,236 |

|

|

|

0 |

|

|

|

0 |

|

|

|

Since the

shares of Series A Preferred stock held by Mr. Scott were part of the consideration for the proposed acquisition of the CareClix companies

by Registrant, which transaction has failed, Mr. Scott conveyed the Series A Preferred stock to Registrant for cancellation. The Series

A shares all have been cancelled and currently there are no Series A shares issued or outstanding. As a result, the current voting control

of Registrant will be based solely on the common stock, as to which no shareholder or group holds voting control of Registrant. The current

major common shareholders are:

| Name of beneficial owner |

|

Amount of

beneficial ownership |

|

Percent of class |

| Fernando Leonzo, Former Director & Officer |

|

|

4,517,726 |

|

|

|

6.29 |

| Robert Gunther, Former Director & Officer |

|

|

3,513,458 |

|

|

|

4.89 |

| John Romagosa, Former Director & Officer |

|

|

6,318,738 |

|

|

|

8.80 |

| Mahmood Khan, Former Director & Officer |

|

|

9,476,490 |

|

|

|

13.19 |

| Shircoo, Inc. |

|

|

14,084,334 |

|

|

|

19.61 |

Item 5.02 Departure of Directors

or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective

with the filing of this Current Report on Form 8-K with the SEC, Charles Scott and Dr. John Korangy have submitted their resignations

as directors and officers of Registrant and Jeffry Hollis has submitted his resignation as Controller of Registrant. The resignations

are the result of the action filed by the Former Management seeking to recover their former positions with Registrant and to terminate

the pending acquisition of the CareClix companies. Mr. Scott and Dr. Korangy have not appointed one or more successor directors or officers

as they have no equity or other interest in Registrant, the Former Management is currently suing Registrant, and there are concerns regarding

the conduct of Former Management before their termination, all of which indicate that new directors should appropriately be elected by

the common shareholders at a Special Meeting of Shareholders.

None of

Mr. Scott, Dr. Korangy or Mr. Hollis, and no other person or consultant affiliated with the CareClix companies, is a shareholder of Registrant,

or has earned, received, or been entitled to any compensation from Registrant. All of the resigning directors and officers have been furnished

with a copy of this disclosure by Registrant and all have expressed no need to respond to these disclosures.

Section 8 - Other Events

Item 8.01 Other Events.

As noted in Item 1.02 above, on September 9, 2022,

Registrant’s Former Management filed an action against Registrant, Charles Scott and Dr. John Korangy as directors of Registrant,

and against an independent consultant erroneously alleged to be a director of Registrant, seeking to rescind the acquisition of the CareClix

companies by Registrant. Registrant’s fiscal year ended May 31, 2022 and an Annual Report on Form 10-K was required to be filed

in 90 days, or on or before August 29, 2022. Following termination of the Former Management on April 26 and April 29, 2022, Registrant’s

remaining directors, Mr. Scott and Dr. Korangy, initiated for the first time, the audit of the books of Registrant and the preparation

of the Annual Report on Form 10-K, but were hampered in their efforts by the failure and refusal of Former Management to turn over corporate

records, documents and information needed for the audit and Annual Report, despite requests to do so. On August 29, 2022, Registrant filed

a Notice of Late Filing with the SEC, indicating the Annual Report would be filed within 15 days of the due date, or by September 13,

2022. The Form 10-K and audited financial statements to be included in the Form 10-K were prepared by Registrant on the basis of a completed

Final Closing of the CareClix acquisition as of May 2, 2022 and included discussion of management plans and analysis of Registrant’s

operations with the CareClix companies included. As a result of the lawsuit filed by Former Management against Registrant and its directors

on September 9, 2022, and the rescission and cancellation of

the Amended Management Operating Agreement, the CareClix acquisition terminated

as of May 31, 2021, and it was no longer appropriate to file the Annual Report on Form 10-K including, as it did, references and details

of the CareClix companies as the basis for Registrant to continue as a going concern. Accordingly, Registrant revised the Form 10-K to

remove all references to the CareClix companies as part of the on-going consolidated operations of Registrant and engaged an independent

audit firm to restate the audit to include only Registrant. Registrant owes the independent audit firm $25,000 for prior work unrelated

to the current Annual Report and will owe additional amounts, to be determined, for the audit to be included in the current Annual Report

and has had difficulty contacting the independent audit firm. Given the current resignations of Registrant’s directors and officers,

filing of the revised Form 10-K including only Registrant, which has been ready for filing except for the final audit opinion letter,

has been postponed pending, election of directors by the common shareholders of Registrant and appointment by them of new officers. A

copy of the revised unaudited Form 10-K in final EDGAR format is attached as Exhibit 13

9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

| |

(a) |

Financial statements of businesses acquired. |

The Final Closing of the acquisition of the CareClix subsidiaries

was terminated effective May 31, 2022. Required audited financial statements of the CareClix subsidiaries accordingly will notnot be filed

by an amendment to the Form 8-K Current Report filed May 6, 2022 and are not attached as an Exhibit to this Report.

| |

(b) |

Pro forma financial information |

(c) Shell company transactions

(d) Exhibits)

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 6, 2022 |

Life On Earth, Inc. |

|

| |

|

|

|

| |

By: |

/s/ Charles O. Scott |

|

| |

Name: |

Charles O. Scott |

|

| |

Title: |

Chairman and Chief Executive Officer |

|

Exhibit 10.1

Mutual Release

Please refer to the accompanying Exhibit 10.1. It is saved in PDF format.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_________________

FORM 10-K

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: May 31, 2022

OR

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________________ to

______________________

Commission file number: 001-34673

| LIFE ON EARTH, INC. |

| (Exact name of Registrant as Specified in Its Charter) |

| Delaware |

|

46-2552550 |

| (State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

| 1270 N. Wickham Road, #13A-1019, Melbourne, FL |

|

32935 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (833) 516-0606

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Name of each exchange on which registered |

| Common Stock, $0.001 Par Value |

|

OTC QB |

Securities registered pursuant to Section 12(g) of the Act: None

| Title of each class |

|

Trading Symbol |

|

Name of exchange on which registered |

| COMMON STOCK, $0.001 par value per share |

|

LFER |

|

OTC QB |

Indicate by check mark if the registrant

is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant

is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days

Yes ☒

No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of the registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act: ☐

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| Non-accelerated Filer |

¨ |

Smaller reporting company |

x |

| |

|

Emerging growth company |

x |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any news or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s

voting common equity held by non-affiliates of the registrant, based upon the closing price of the registrant’s common stock on

the last business day of the registrant’s most recently completed second fiscal quarter (November 30, 2021) was approximately $3,762,551.

The number of issued shares of the registrant’s

common stock was 71,822,753 shares at September 23, 2022.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| |

|

|

Page |

|

| Forward Looking Statements |

|

1 |

|

| |

|

|

| PART I |

|

|

|

|

| Item 1. |

Business |

|

1 |

|

| Item 1A . |

Risk Factors |

|

35 |

|

| Item 1B. |

Unresolved Staff Comments |

|

3 |

|

| Item 2. |

Properties |

|

3 |

|

| Item 3. |

Legal Proceedings |

|

4 |

|

| Item 4. |

Mine Safety Disclosures |

|

4 |

|

| |

|

|

|

|

| PART II |

|

|

|

|

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

4 |

|

| Item 6. |

Selected Financial Data |

|

5 |

|

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

6 |

|

| Item 7A . |

Quantitative and Qualitative Disclosures About Market Risk |

|

8 |

|

| Item 8. |

Financial Statements and Supplementary Data |

|

8 |

|

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

8 |

|

| Item 9A. |

Controls and Procedures |

|

8 |

|

| Item 9B. |

Other Information |

|

9 |

|

| |

|

|

|

|

| PART III |

|

|

|

|

| Item 10. |

Directors, Executive Officers and Corporate Governance |

|

10 |

|

| Item 11. |

Executive Compensation |

|

11 |

|

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

13 |

|

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

14 |

|

| Item 14. |

Principal Accountant Fees and Services |

|

15 |

|

| |

|

|

|

|

| PART IV |

|

|

|

|

| Item 15. |

Exhibits, Financial Statement Schedules |

|

16 |

|

| |

|

|

|

|

| SIGNATURES |

|

16 |

|

FORWARD - LOOKING STATEMENTS

This Annual Report on Form 10-K (Report) certain

forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) that reflect management’s current views and expectations with respect to our business, strategies, products,

future results and events, and financial performance. All statements made in this Report other than statements of historical fact, including

statements that address operating performance, the economy, events or developments that management expects or anticipates will or may

occur in the future, including statements related to sales, revenues, profitability, distributor channels, new products, adequacy of funds

from operations, cash flows and financing, our ability to continue as a going concern, potential strategic transactions, statements regarding

future operating results and non-historical information, are forward-looking statements. In particular, the words such as “believe,”

“expect,” “intend, ”anticipate,” “estimate,” “may,” “will,” “can,”

“plan,” “predict,” “could,” “future,” “continue,” variations of such words,

and similar expressions identify forward-looking statements, but are not the exclusive means of identifying such statements and their

absence does not mean that the statement is not forward-looking. Readers should not place undue reliance on these forward-looking statements,

which are based on management’s current expectations and projections about future events, are not guarantees of future performance,

are subject to risks, uncertainties and assumptions and apply only as of the date of this Report. Our actual results, performance or achievements

could differ materially from historical results as well as from the results expressed in, anticipated or implied by these forward-looking

statements. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

Readers are also urged to carefully review and consider

the various disclosures made by us in this Report and in our other reports we file with the Securities and Exchange Commission, including

our periodic reports on Forms 10-Q and current reports on Form 8-K.

All references in this Annual Report on Form 10-K

to “LFER,” “Life On Earth, Inc. the “Company,” “we,” “us” or “our” mean

Life On Earth, Inc.

PART I

ITEM 1. BUSINESS

COMPANY OVERVIEW

Life On Earth, Inc. is a holding company operating

through wholly owned subsidiaries. We were previously a brand accelerator and incubator company that was focused on building and scaling

concepts in the natural consumer products category (“CPG”). During the fiscal year ended May 31, 2021, we discontinued our

wholesale beverage distribution operations, and announced our intention to divest away from the previous business as a CPG company. Accordingly,

the Company’s results of operations for the year ended May 31, 2021, reflected a charge in the aggregate amount of $25,135 for the

discontinued operations. In May 2021, we acquired a wholly owned subsidiary, Smart Axiom, Inc. which we then divested effective December

31, 2021 (See, SmartAxiom). Effective January 1, 2022, we acquired conditional ownership of four subsidiary operations which included

CareClix, Inc., a Virginia corporation, CareClix Services, Inc., a Florida corporation, MyCareClix, Inc., a Florida corporation, and CareClix

RPM, Inc., a Florida corporation (collectively, the “CareClix Group”), in an Initial Closing, subject to several conditions,

with a May 31, 2022 drop dead automatic rescission if certain conditions were not met. Effective May 31, 2022, those conditions were not

met, the agreed consideration was not paid, and the CareClix Group has been removed as of May 31, 2022. (See, CareClix Group).

SmartAxiom

In May

2021, we acquired SmartAxiom, Inc. (“SA”) from its former shareholders in exchange for consideration consisting of 13,000,000

shares of our common stock; 210,000 shares of a new Series D Convertible Preferred stock, convertible,

over an eighteen month earn out schedule, into our common stock with a floor price of twenty cents. On March 8, 2022, we executed a Stock

Purchase and Mutual Release Agreement (the “Agreement”) under which we divested our ownership of SA, effective December 31,

2021. Under the Agreement, we agreed to transfer all ownership in SA to Amit Biyani, the CEO of SA, in exchange for Mr. Biyani’s

agreement to return for cancellation: (ii) 7,974,695 shares of common stock; and (ii) 128,822

shares of Series D Preferred Stock. In addition, SA and Mr. Biyani agreed to arrange for the return and cancellation of the remaining

outstanding 64,942 shares of Series D Preferred Stock currently held by other former shareholders of SA. By agreement among the parties,

the divestiture of SA was deemed legally effective as of December 31, 2021. The Agreement also contained mutual releases amongst the parties.

1

In connection with the Agreement, SA issued to the

Company an 8% Unsecured Convertible Note in the amount of $250,000 dated December 31, 2021 (the “Note”). The Note bears interest

at a rate of 8 percent per year, with all principal and interest due on or before February 28, 2024. All unpaid principal and interest

owing under the Note may, at our option, may be converted, in whole, into a number of fully paid and non-assessable shares of common stock

of SA having a value equal to the Note balance, converted at an assumed total valuation of SA of $6,250,000 on a fully diluted basis.

At May 31, 2022, the Company has determined that collection on the Note is doubtful and accordingly, has established an allowance for

doubtful accounts in the amount of $250,000 by recording a charge to discontinued operation for the year ended May 31, 2022.

During Fiscal 2022, through December 31, 2021, SA

incurred a net loss of $971,091, which has been recorded as a part of the loss on discontinued operations for the year ended May 31, 2022.

The following table summarizes the loss

on disposition of the SA subsidiary:

| Net assets sold |

|

$ |

1,669,584 |

|

| Sales Price |

|

$ |

534,305 |

|

| Loss from sale of Subsidiary |

|

$ |

1,135,279 |

|

The CareClix Group

On December 17, 2021, we entered into

a Stock Purchase Agreement (“SPA”) with CareClix Holdings, Inc., a Florida corporation (“SOLI”) to acquire four

operating subsidiaries of SOLI. On December 31, 2021, under the terms of a Management Operating Agreement, we agreed to a conditional

partial closing of the transaction set forth in the SPA (the “Interim Closing”) with the final closing conditioned on the

effectiveness of a registration statement to be filed by us with the SEC for the common shares to be issued by us as the consideration

for the acquisition. The Management Operating Agreement provided that i the registration statement was not filed by us and declared effective

by May 31, 2022, the Interim Closing would be rescinded, and the CareClix Group would not be part of the Company.

In the partial closing, we acquired 100% conditional

ownership of the operating subsidiaries of SOLI, which included CareClix, Inc., a Virginia corporation, CareClix Services, Inc., a Florida

corporation, MyCareClix, Inc., a Florida corporation, and CareClix RPM, Inc., a Florida corporation (collectively, the “CareClix

Group”). In exchange for ownership of the CareClix Group at the Interim Closing, we agreed to issue the following securities to

the common shareholders of SOLI:

| |

1. |

260,000,000 shares of our common stock*. |

| |

2. |

4,000,000 shares of our Series A Preferred Stock to Mr. Charles Scott, the Chairman and majority shareholder of SOLI, with 2,500,000 shares issued at the December 31, 2021 partial closing, 600,000 shares to be issued 45 days after closing, and 900,000 shares to be issued 90 days after closing. All of these shares have been issued. |

* In the original SPA, we

agreed to issue 50,000,000 shares of our common stock plus 2,100,000 shares of a new class of preferred stock to be designated as Series

E Preferred Stock. The shares of Series E Preferred stock would have a convertibility ratio of 100 to 1 into our shares of common stock

with conversion occurring automatically when our Articles of Incorporation had been amended to authorize sufficient common shares for

the conversion. Subsequently, our Articles of Incorporation have been amended so the need for the

Series E Convertible Preferred has been eliminated, and a total of 260 million common shares will be issued to the former Solei common

shareholders. The net effect of this issuance will be that common shares of SOLI held before the transaction will be exchanged

for our common shares on a 1 for 1 basis.

We also agreed to undertake an audit of the

financial statements of the CareClix Group for the registration statement, to appoint three new directors and, by a side agreement with

our former directors, Fernando Leonzo, John C. Romagosa, Mahmood Khan and Robert Gunther (collectively the “Former Management”),

to transfer the Series A Preferred shares held by them, with 600,000 shares cancelled and reissued to Charles Scott within 45 days and

the remaining 600,000 shares cancelled and reissued to Mr. Scott when the remaining holders were no longer directors but in no less than

one year. Each of the four members of Former Management also granted an irrevocable proxy to vote the Series A Preferred stock held by

each of them to Mr. Scott. Since the Series A Preferred stock carries voting rights equal to 50 (later amended to 60) votes per share,

voting with the common stock, voting control rests with the Series A Preferred, and the stated intent of the proposed acquisition was

that Charles Scott, principal shareholder of the CareClix Group, would acquire voting control of us, with 5,200,000 shares of Series A

Preferred stock. The proxies were irrevocable unless the CareClix Group audit was not completed within 75 days after closing of the acquisition,

which has not occurred.

2

The Interim Closing was designed to allow

the CareClix Group to be treated as our operating subsidiaries pending the Final Closing, which was subject to the effectiveness of a

registration statement on Form S-4 to be filed registering the issuance of our shares of common stock to the common shareholders of CareClix,

as the consideration for the acquisition of the CareClix Group. The initial 2,500,000 shares of Series A Preferred stock were issued as

agreed to Charles Scott by Former Management; however in March and April 2022, differences arose between the CareClix Group principals

and Former Management, resulting in several defaults under the Management Operating Agreement by

us, as disclosed in the Quarterly Report on Form 10-Q for the quarter ended February 28, 2022, filed for the Company by Former Management.

With the transaction drop dead date of May 31, 2022 approaching and no work on the required

audit of the CareClix Group or the required S-4 registration statement yet initiated by Former

Management, Charles Schott, as controlling shareholder and our director, proposed on several occasions in April 2022 to Former Management,

who were then four out of six of our directors and all of our corporate officers, that either the CareClix Croup transaction should be

rescinded or at least two but preferably four of the Former Management resign to allow Mr. Scott and his management team to assume full

operating control of the Company, by assuming all officer positions. Our Former Management initially agreed to resign but then advised

Mr. Scott that they intended to remain as a majority of the Board of Directors and as the

only corporate officers. On April 26, 2022, Mr. Scott as a director and majority voting shareholder, voted to remove Fernando Leonzo and

John Romagosa as directors and officers under Delaware law, and on April 29, 2022, voted to remove Robert Gunther and Mahmood Khan as

our officers and directors.

As previously reported, on May 2, 2022,

acting as our remaining directors, Mr. Scott and Dr. Korangy elected new corporate officers, caused the reported defaults in the Management

Operating Agreement to be cured, and extended the May 31, 2022 drop dead date for the CareClix Group acquisition by approving and executing

an Amended Management Operating Agreement. Thereafter, as our new management, they retained

our independent auditor to audit our financial results for the fiscal year ended May 31, 2022, retained the same independent audit firm

to audit the CareClix Group for the two fiscal years ended May 31, 2020 and 2021, a requirement

of the Management Operating Agreement and the required S-4 registration statement to complete the Final Closing. The CareClix Group also

advanced more than $120,000 in funds to the Company or for the Company to pay ongoing and accrued expenses which we are unable to pay

for lack of funds.

The required audits were completed and the

Annual Report for the fiscal year ended May 31, 2022 was completed and ready to file when Mr. Scott received an email copy of a purported

“derivative action” filed by the Former Management seeking to reinstate themselves as our officers and directors and seeking

to rescind the CareClix Group acquisition by rescinding the Amended Management Operating Agreement. Mr. Scott immediately responded that

he was agreeable to this, as he had previously offered in April 2022, and, on September 15, 2022, our Board of Directors voted to rescind

the Amended Management Operating Agreement retroactively. As a result, the Interim Closing drop dead date of May 31, 2022 resulted in

the termination of the CareClix Group acquisition for failure of consideration, and the CareClix Group accordingly is not a part of the

Company as of May 31, 2022. Therefore, the financial results of our operations contained in this Annual Report include only the results

of Life on Earth, Inc. for the fiscal year ended May 31, 2022.

Other Discontinued Operations

During the fiscal year, our Board of

Directors also resolved to dispose of our remaining non-operating subsidiaries Victoria’s Kitchen and The Chill Group

for a net loss of $261,110.

3

Our principal executive offices currently are virtual

offices located at 1270 N. Wickham Road, Suite 13A, No. 1019, Melbourne, FL 32935 and our telephone number (833) 516-0606.

Coronavirus Risks

In December 2019, a novel strain of coronavirus

was reported to have surfaced in Wuhan, China, which has and is continuing to spread throughout China and other parts of the world, including

the United States. On January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease (COVID-19) a “Public

Health Emergency of International Concern.” On January 31, 2020, U.S. Health and Human Services Secretary Alex M. Azar II declared

a public health emergency for the United States to aid the U.S. healthcare community in responding to COVID-19, and on March 11, 2020

the World Health Organization characterized the outbreak as a “pandemic”.

The ultimate extent of the impact of any

epidemic, pandemic or other health crisis on our business, financial condition and results of operations will depend on future developments,

which are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of such epidemic,

pandemic or other health crisis and actions taken to contain or prevent their further spread, among others. The significant outbreak of

COVID-19 has resulted in a widespread health crisis that has adversely affected the economies and financial markets worldwide, and may

continue to do so, which could adversely affect our business, results of operations and financial condition.

Employees

We currently have no direct employees and act solely

as a public holding company.

Going Concern Qualification

Several conditions and events may cast substantial

doubt about our ability to continue as a going concern. We have incurred net losses from inception of more than $23,000,000, have no cash

or other assets and will require additional financing in order to continue any business activities.

Intellectual Property Protection

We have secured a registered trademark for our name

and logo. We also hold trademarks registered for the Victoria’s Kitchen and Just Chill brands.

4

ITEM 1A. RISK FACTORS

As a “Smaller Reporting Company”, we are

not required to provide this information.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

ITEM 2. PROPERTIES

We currently maintain our principal office in Melbourne,

Florida

We maintain a website at http://www.lifeonearthinc.com/

and the information contained on that website is not deemed to be a part of this annual report.

ITEM 3. LEGAL PROCEEDINGS

Complaint by Note Holder

On December 14, 2020, we received a Complaint from

a note holder, L & H, Inc. (“L&H”), filed in the First Judicial District Court of Nevada, Carson City, alleging breaches

of contract regarding our failure to repay amounts due or failing to issuing shares upon demand and breach of Implied covenant of good

faith and fair dealing in connection with the $110,000 September 10, 2019 Convertible Promissory Note between L&H and the Company.

On May 26, 2022, the Court entered judgment against us in the total amount of $171,116, including the principal sum, accrued interest,

default interest of $44,428. Attorney’s fees of $10,000 and $1,127 in costs, which has been recorded as a current liability in our

condensed consolidated balance sheet for the year ended May 31, 2022.

See, Item 9B. Other Information regarding a “derivative

action” filed by our Former Management.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable.

PART II

ITEM 5.

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

We have two classes of stock outstanding, Common Stock

and Preferred Stock, in designated classes as Series A, Series B, Series C and Series D Preferred. Our Common Stock is quoted on the OTC

Bulletin Board under the symbol “LFER”.

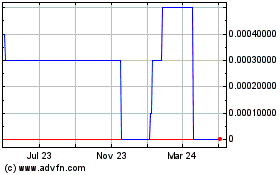

The following table sets forth the high and low reported

closing prices per share of our Common Stock for the period’s indicated. There is no established public trading market for our Series

A Preferred Stock, our Series B Preferred Stock, our Series C Preferred and our Series D Preferred Stock.

| |

|

2022 |

|

|

2021 |

|

| |

|

|

High |

|

|

|

Low |

|

|

|

High |

|

|

|

Low |

|

| First quarter (June 1 to August 31, 2021) |

|

$ |

0.165 |

|

|

$ |

0.080 |

|

|

$ |

0.035 |

|

|

$ |

0.014 |

|

| Second quarter (September 1 to November 30, 2021) |

|

$ |

0.135 |

|

|

$ |

0.058 |

|

|

$ |

0.083 |

|

|

$ |

0.021 |

|

| Third quarter (December 1, 2021,to February 28, 2022) |

|

$ |

0.120 |

|

|

$ |

0.061 |

|

|

$ |

0.125 |

|

|

$ |

0.026 |

|

| Fourth quarter (March 1 to May 31, 2022) |

|

$ |

0.068 |

|

|

$ |

0.016 |

|

|

$ |

0.211 |

|

|

$ |

0.070 |

|

The Company has not declared dividends and does not

intend to in the foreseeable future. The amount and frequency of future dividends will be determined by the Company’s Board of Directors

in light of the earnings and financial condition of the Company at such time, and no assurance can be given that dividends will be declared

or paid in the future.

5

Holders

As of September 23,

2022, there were 71,822,753 shares of Common Stock issued

and held by approximately 1,000 shareholders of record. As of September 23, 2022, there were 5,200,000 shares of Series A Preferred

Stock issued and outstanding held by one shareholder of record. As September 23, 2022, there were 100,000 Series B Preferred Share issued

and outstanding held by 3 holders; As of September 23, 2022, there were 2,613,375 Series C Preferred Shares issued to 10 Shareholders;

and there were 18,236 Series D Preferred Shares issued and outstanding to 3 shareholders.

During the year ended May 31, 2022, and May 31, 2021,

the Company issued 2,581,592 and 368,593 common shares, respectively, in exchange for financing and services provided by select individuals

and or vendors. The shares were issued at prices ranging from $0.07 to $0.156 per share.

Also, on February 4, 2022, we issued shares of common

stock and Series C preferred shares to our Former Management at par value in exchange for services provided. The following table summarizes

the shares issued to the Former Management. The difference between the fair value of the shares acquired and the acquisition price has

been recognized as officers’ compensation in the statement of operations for the year ended May 31, 2022:

| |

|

Number of Shares Acquired |

|

Acquisition Price |

|

Common Stock |

|

Compensation |

|

Common Stock |

|

|

| |

|

Common

Stock |

|

Series C

Preferred |

|

Consideration

Shares |

|

Common

Stock |

|

Series C

Preferred |

|

Consideration

Shares |

|

Common

Stock |

|

Series C

Preferred |

|

Consideration

Shares |

|

Total |

| Robert Gunther |

|

|

2,678,672 |

|

|

|

327,393 |

|

|

|

654,786 |

|

|

$ |

2,678 |

|

|

$ |

327 |

|

|

$ |

— |

|

|

$ |

204,115 |

|

|

$ |

327,066 |

|

|

$ |

50,549 |

|

|

$ |

581,731 |

|

| John Romagossa |

|

|

2,815,279 |

|

|

|

344,090 |

|

|

|

688,180 |

|

|

$ |

2,815 |

|

|

$ |

344 |

|

|

$ |

— |

|

|

$ |

214,525 |

|

|

$ |

343,746 |

|

|

$ |

53,127 |

|

|

$ |

611,398 |

|

| Fernando Leonzo |

|

|

3,019,602 |

|

|

|

369,062 |

|

|

|

738,124 |

|

|

$ |

3,020 |

|

|

$ |

369 |

|

|

$ |

— |

|

|

$ |

230,093 |

|

|

$ |

368,693 |

|

|

$ |

56,983 |

|

|

$ |

655,769 |

|

| Mahmood Kahn |

|

|

3,989,624 |

|

|

|

487,621 |

|

|

|

975,242 |

|

|

$ |

3,990 |

|

|

$ |

486 |

|

|

$ |

— |

|

|

$ |

304,009 |

|

|

$ |

487,135 |

|

|

$ |

75,289 |

|

|

$ |

866,433 |

|

| |

|

|

12,503,177 |

|

|

|

1,528,166 |

|

|

|

3,056,332 |

|

|

$ |

12,503 |

|

|

$ |

1,526 |

|

|

$ |

— |

|

|

$ |

952,742 |

|

|

$ |

1,526,640 |

|

|

$ |

235,949 |

|

|

$ |

2,715,331 |

|

A portion of the total compensation was allocated

to payment of accrued officer compensation for prior years reflected on the books, and the balance was charged to current compensation.

6

Dividends

We have never declared any cash dividends with respect

to our Common Stock. Future payment of dividends is within the discretion of the Board of Directors and will depend on earnings, capital

requirements, financial condition and other relevant factors. Although there are no material restrictions limiting or that are likely

to limit, our ability to pay dividends on our Common Stock, we presently intend to retain future earnings, if any, for use in our business.

We have no present intention to pay cash dividends on our Common Stock.

Recent Sales

or Issuances of Unregistered Securities

During the fiscal year ended May 31, 2022, we issued

the following equity:

Preferred Stock

A total of 4 million shares of Series A Preferred

Stock were issued to Charles O. Scott as part of the acquisition of the CareClix Group of companies. The other outstanding Series A Preferred

shares were cancelled and reissued to Mr. Scott as part of the acquisition of the CareClix Group of companies. Mr. Scott currently holds

all 5,200,000 of the issued and outstanding Series A Preferred stock.

A total of 2,393,375 Series C Preferred shares were

issued in the year ended May 31, 2022, all of which were issued at $1.00 per shares except for the shares issued to Former Management,

which were issued at $0.001 per share. On January 14, 2022, 50,000 Series C Preferred shares were converted into 525,000 common shares.

During June 2022, 20,000 Series C Preferred shares were cancelled.

Additional shares of common stock, referred to as

“Consideration Shares” were issued to Former Management based on the initial Series C shares issued to them.

Common Stock:

The following shares of common stock were issued during

the fiscal year ended May 31, 2022:

| # of Shares |

|

Reason |

| |

572,727 |

|

|

Chill Grp Contingency shares |

| |

5,822,063 |

|

|

Consideration shares |

| |

1,431,012 |

|

|

Services |

| |

15,784,793 |

|

|

Debt Settlement |

| |

650,000 |

|

|

Legal Settlement |

| |

525,000 |

|

|

Preferred C Conversion |

| |

13,000,000 |

|

|

SA Acquisition |

| |

12,503,177 |

|

|

Stock Purchase |

| |

50,288,772 |

|

|

Total |

Included in the above, the following shares were issued

to related parties during the year ended May 31, 2022:

| # of Shares |

|

Holder |

| |

3,757,726 |

|

|

Fernando Leonzo |

| |

4,391,571 |

|

|

John Romagosa |

| |

152,500 |

|

|

Juan Romagosa** |

| |

5,486,866 |

|

|

Mahmood Khan |

| |

183,000 |

|

|

Pirjo J. Polario Khan* |

| |

3,333,458 |

|

|

Robert Gunther |

| |

17,305,121 |

|

|

Total |

* Pirjo J. Polario Khan is the spouse of Mahmood Khan

** Juan Romagosa is the father of John Romagosa

During the year ended May 31, 2022, 8,014,695 shares

common stock were cancelled, of which, 7,974,695 shares of common stock were cancelled as a result of the SA Stock Purchase and Mutual

Release Agreement.

There were 29,548,676 shares of our common stock issued

and outstanding at May 31, 2021 and 71,822,753 shares issued at May 31, 2022 and at the date of this report.

7

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition

and results of operations contains forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives,

expectations and intentions. As described at the beginning of this Annual Report on Form 10-K, our actual results could differ materially

from those anticipated in these forward-looking statements. Factors that could contribute to such differences include those discussed

at the beginning of this Report, below in this section and in the section above entitled “Risk Factors.” You should not place

undue reliance on these forward-looking statements, which apply only as of the date of this Report. Except as required by law, we undertake

no obligation to update any forward-looking statements to reflect new information, events or circumstances after the date of this Report,

or to reflect the occurrence of unanticipated events. You should read the following discussion and analysis in conjunction with our consolidated

financial statements and the accompanying notes thereto included elsewhere in this Report.

CURRENT OPERATIONS

With the termination of the CareClix Companies’

acquisition at May 31, 2022, we have no current operations at May 31, 2022.

8

CRITICAL ACCOUNTING

POLICIES AND ESTIMATES

The preparation of financial statements and related

disclosures in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires

management to make judgments, assumptions and estimates that affect the amounts reported in our financial statements and accompanying

notes. The condensed financial statements included in this Report include the financial results of Life on Earth, Inc. for the full fiscal

year ended May 31, 2022. The discussion and analysis of our financial condition and results of operations is based upon our consolidated

financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation

of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues

and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical

experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form our basis

for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results

may differ from these estimates under different assumptions or conditions, or if management made different judgments or utilized different

estimates. Many of our estimates or judgments are based on anticipated future events or performance, and as such are forward-looking in

nature, and are subject to many risks and uncertainties, including those discussed below and elsewhere in this Report. We do not undertake

any obligation to update or revise this discussion to reflect any future events or circumstances. There are certain critical accounting

estimates that we believe require significant judgment in the preparation of our consolidated financial statements. We have identified

below our accounting policies that we use in arriving at key estimates that we consider critical to our business operations and the understanding

of our results of operations. This is not a complete list of all of our accounting policies, and there may be other accounting policies

that are significant to us. For a detailed discussion on the application of these and our other accounting policies, see Note 1 to Consolidated

Financial Statements of this Report.

Revenue Recognition

We recognize revenue under ASU No. 2014-09,

“Revenue from Contracts with Customers (Topic 606),” (“ASC 606”). The core principle of the revenue standard is

that a company should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the

consideration to which the company expects to be entitled in exchange for those goods or services. We only apply the five-step model (as

described in Note 1 to the Consolidated Financial Statements of this Report) to contracts when it is probable that we will collect the

consideration it is entitled to in exchange for the goods and services transferred to the customer.

We recognize when the promised goods or services are

transferred to the customer. The amount of revenue recognized should equal the total consideration expected to be received in return for

the goods or services. ASC 606 creates a five-step approach that should be applied when determining the amount and timing of revenue recognition:

• Step 1: Identify the contract with a customer

• Step 2: Identify the performance obligations

in the contract

• Step 3: Determine the transaction price

• Step 4: Allocate the transaction price to

the performance obligations in the contract

• Step 5: Recognize revenue when (or as) the

entity satisfies a performance obligation

9

Goodwill and Intangible

Assets

Goodwill represents

the excess of the purchase price of acquired businesses over the estimated fair value of the identifiable net assets acquired. Goodwill

and other intangibles are reviewed for impairment annually or more frequently when events or circumstances indicates that the carrying

value of a reporting unit more likely than not exceeds its fair value. The goodwill impairment test is applied by performing a qualitative

assessment before calculating the fair value of the asset. If, on the basis of qualitative factors, it is considered more likely than

not that the fair value of the asset is greater than the carrying amount, further testing of goodwill for impairment is not required.

If the carrying amount of the asset exceeds the asset’s fair value, an impairment loss is recognized in an amount equal to that

excess, limited to the total amount of goodwill allocated to that asset. Identifiable intangible assets acquired in business combinations

are recorded at the estimated acquisition date fair value. Finite lived intangible assets are amortized over the shorter of the contractual

life or their estimated useful life using the straight-line method, which is determined by identifying the period over which the cash

flows from the asset are expected to be generated.

Off-Balance Sheet

Arrangements

We have no significant off-balance sheet arrangements

that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues

or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Inflation

The amounts presented in the financial statements

do not provide for the effect of inflation on our operations or financial position. The net operating losses shown would be greater than

reported if the effects of inflation were reflected either by charging operations with amounts that represent replacement costs or by

using other inflation adjustments.

10

LIQUIDITY AND CAPITAL

RESOURCES

Several conditions and events may cast substantial

doubt about our ability to continue as a going concern. We have incurred net losses from inception of more than $23,000,000, have no cash

or operating assets and require additional financing on an ongoing basis to engage in business. We had negative working capital of more

than $1,700,000 as of May 31, 2022.

For the fiscal year ended May 31, 2022, our consolidated

loss from operations was $1,988,237, which included officers’ compensation expense of $1,545,526 to our Former Management.

Our future capital requirements will depend on

numerous factors including, but not limited to, continued progress in finding business opportunities. We have experienced recurring losses

from operations and negative cash flows from operating activities to date, but all of the unsuccessful prior operations have now been

closed. This situation creates uncertainties about our ability to execute our business plan, finance operations, and indicated substantial

doubt in the past about our ability to continue as a going concern.

CASH FLOW

Our primary sources of liquidity have been cash from

sales of common and preferred shares, the issuance of convertible promissory notes and from lines of credit. And the advance of more than

$120,000 from the CareClix Companies, represented by a promissory note.

WORKING CAPITAL

As of May 31, 2022, the Company had total current

assets of $0 as compared to $113,656 as of May 31, 2021, and total current liabilities of $1,703,942 as compared to $9,881,134 as of May

31, 2021. As of May 31, 2022, we had negative working capital of $1,703,942 as compared to $9,767,478 as of May 31, 2021. The decrease

in negative working capital during the year ended May 31, 2022, related, primarily to the decrease in the accrued cost of the acquisition

of Smart Axiom of approximately $5,044,127. In addition, there was a decrease in current assets in 2022 compared to 2021 of $113,656.

RESULTS OF OPERATIONS

FOR THE YEARS ENDED MAY 31, 2022 and 2021

Revenues

The Company recorded sales from continuing

operations for the year ended May 31, 2022 of approximately $0 as compared to $0 during 2021.

Cost of Goods Sold and Gross Profit

Gross profit during the year ended May 31, 2022, was

approximately $0 as compared to $0 for the year ended May 31, 2021.

11

Operating Expenses

Operating expenses from continuing operations were

approximately $1,948,000 for the year ended May 31, 2022 as compared to $664,000 for the year ended May 31, 2021. The increase in operating

expenses of approximately $1,285,000 resulted primarily from an increase in officers’ compensation of $1,361,000 and increased professional

fees of $60,000.

Other Expense

During the year ended May 31, 2022, the Company recorded

interest and finance costs from continuing operations of $502,832, as compared to $423,546 during the year ended May 31, 2021. The interest

and finance costs incurred by the Company reflect the cost of the debt incurred by the Company to finance operations. During the year

ended May 31, 2022, the Company recorded a credit for the change in the fair value of contingent consideration of $352,227 as compared

to a charge for the change in the fair value of contingent consideration by $357,955 during the year ended May 31, 2021, related to the

acquisition of JCG, which arose from the measurement of LFER stock on the 12-month anniversary of the acquisition and subsequent Balance

Sheet reporting dates. During the year ended May 31, 2022, the Company recorded a credit change in the fair value of derivative liability

of $110,588 as compared to $36,127 during the year ended May 31, 2021.

Net Loss

The Company recorded a net loss for the year ended

May 31, 2022, of $4,605,717 which was an increase from a net loss of $1,434,073 for the year ended May 31, 2021. In addition to the above

factors, during the year ended May 31, 2022, the Company recorded a loss on discontinued operations of $1,221,091 during 2022 as compared

to $25,135 during 2021, and, during the year ended May 31, 2022, the Company recorded a loss on the sale of a subsidiary of $1,135,279,

related to the sales of SA and a loss on the disposal of subsidiaries of $261,110 related to the disposal of VK and JCG.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET

RISK

As a “Smaller Reporting Company”, the

Company is not required to provide this information.

ITEM 8. FINANCIAL STATEMENTS

The audited financial statements are included beginning

immediately following the signature page to this report. See Item 15 for a list of the financial statements included herein.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH

ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None

12

ITEM 9A. CONTROLS

AND PROCEDURES

We maintain a system of disclosure controls

and procedures that are designed to ensure that information required to be disclosed by is in the reports we file or submit under the

Act is recorded, processed, summarized, and reported within the time periods specified in the Commission’s rules and forms, and

to ensure that such information is accumulated and communicated to our management, including our Chief Executive Officer and our Principal

Accounting Officer, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure.

Our management, including our Chief Executive

Officer and Principal Accounting Officer, or persons performing similar functions, as appropriate does not expect that our disclosure

controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act) (“Disclosure Controls”) will prevent

all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance

that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource

constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control

systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company

have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns

can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion

of two or more people, or by management override of the control. The design of any system of controls also is based in part upon certain

assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated

goals under all potential future conditions. Because of the inherent limitations in a cost-effective control system, misstatements due

to error or fraud may occur and not be detected. We monitor our Disclosure Controls and make modifications as necessary; our intent in

this regard is that the Disclosure Controls will be modified as systems change, and conditions warrant.

As of May 31, 2022, we carried out an evaluation,

under the supervision and with the participation of our principal executive officer and our principal accounting officer or persons performing

similar functions, as appropriate, of the effectiveness of the design and operation of our disclosure controls and procedures. Based on

this evaluation, we have concluded that our disclosure controls and procedures were not effective as of the end of the period covered

by this report.

The determination that our disclosure controls

and procedures were not effective as of May 31, 2022 is a result of inadequate staffing and supervision within our Company and failure

to adhere to corporate governance policy and applicable corporate law. The Company plans to expand its accounting and operations staff

as the business of the Company expands, to appoint Audit and Corporate Governance Committees of our Board made up of independent Board

members, and to review all corporate governance policies.

MANAGEMENT’S REPORT ON INTERNAL CONTROLS

OVER FINANCIAL REPORTING

CHANGES IN INTERNAL CONTROLS OVER FINANCIAL REPORTING

There have been no changes

in our internal controls over financial reporting during the year1 ended May 31, 2022, that

have materially affected or are reasonably likely to materially affect our internal controls.

13

ITEM 9B. OTHER INFORMATION

Change in Management

As part of the proposed acquisition of the CareClix

Companies, including the letter of intent in November 2021, the Stock Purchase Agreement of December 17, 2021, the Management Operating

Agreement of December 31, 2021 and thereafter through March 2022, the principal officers and management of the CareClix Companies and

our former management, discussed and agreed that following the acquisition, the CareClix Companies would continue to be managed and operated

by the CareClix management team but with the additional assistance and advice of our former management; and that we would be managed and

controlled by a new combined management team of seven directors, initially including our four Former Managements and three new directors

nominated by the CareClix Companies, The acquisition agreements expressly provided for this structures, as well as the change of control

of Life on Earth, Inc. by the issuance of 260 million common shares to the former CareClix Holdings shareholders, with transition voting

control transferred at the December 31, 2021 Interim Closing by the issuance of 4,000,000 Series A Preferred stock to Charles Scott and

the transfer of the then outstanding Series A Preferred stock held by the four former directors, to Mr. Scott. It was also represented

that two of the four former directors would be resigning to pursue other matters within 45 days but would remain available on a consulting

basis to assist with the transition and to support the growth of the new virtual health operations. Resignations of these two directors

and officers was not an express condition of the Interim Closing but surrender of the Series A Preferred stock held by them in that time

period was an express condition.

Unknown to the CareClix Companies management, our

four former directors voted on December 30, 2021, as the then four sole members of our Board of Directors, to issue our common shares

to themselves in payment and discharge of accrued compensation of more than $2,500,000, and authorized the issue of 12,503,177 common

shares and 1,528,166 Series C Preferred shares, both at par value, $0.001 per shares, with an additional 3,0586,332 common shares issued

as “consideration shares” for the preferred, issued for no consideration.. This action resulted in the total issued shares

of common stock to increase by 15,559,509 shares, an increase of approximately 33%. This action was not disclosed to CareClix Companies

management before the Interim Closing of the acquisition on December 31, 2022 for the common shares was $0.10 per share and the Series

C Preferred shares were being offered and sold to the public concurrently at $1.00 per share

Although the Form 8-K makes reference to an “agreement”

“effective February 4, 2022”, to undertake this stock issue, the only documentation is a copy of minutes of a Board of Directors

meeting approving the issuance on December 30, 2021. This stock issue and resulting compensation was reported in the Form 10-Q report

for the quarter ended February 28, 2022, signed by or on behalf of the former directors as follows:.

Accounting for Equity Awards

The cost of services received in exchange for an award

of equity instruments related to employees and non-employees is based on the grant-date unadjusted fair value of the award and allocated

over the requisite service period of the award.

Shares of common stock issued for services

The Company issues shares of common stock in exchange

for financing and services provided by select individuals and or vendors. During the year ended May 31, 2022, and 2021 the Company issued

2,581,592 and 0 shares, respectively. The shares were issued at prices ranging from $0.07 to $0.156 per share.

Also, on February 4, 2022, the Company issued shares

of common stock and Series C preferred shares to members of the Board of Directors at par value in exchange for services provided. The

following table summarizes the shares issued to the members of the Board of Directors. The difference between the fair value of the shares

acquired and the acquisition price has been recognized as officers’ compensation in the statement of operations for the year ended

May 31, 2022:

| |

|

Number of Shares Acquired |

|

Acquisition Price |

|

Common Stock |

|

Compensation |

|

Common Stock |

|

|

| |

|

Common

Stock |

|

Series C

Preferred |

|

Consideration

Shares |

|

Common

Stock |

|

Series C

Preferred |

|

Consideration

Shares |

|

Common

Stock |

|

Series C

Preferred |

|

Consideration

Shares |

|

Total |

| Robert Gunther |

|

|

2,678,672 |

|

|

|

327,393 |

|

|

|

654,786 |

|

|

$ |

2,678 |

|

|

$ |

327 |

|

|

$ |

— |

|

|

$ |

204,115 |

|

|

$ |

327,066 |

|

|

$ |

50,549 |

|

|

$ |

581,731 |

|

| John Romagossa |

|

|

2,815,279 |

|

|

|

344,090 |

|

|

|

688,180 |

|

|

$ |

2,815 |

|

|

$ |

344 |

|

|

$ |

— |

|

|

$ |

214,525 |

|

|

$ |

343,746 |

|

|

$ |

53,127 |

|

|

$ |

611,398 |

|

| Fernando Leonzo |

|

|

3,019,602 |

|

|

|

369,062 |

|

|

|

738,124 |

|

|

$ |

3,020 |

|

|

$ |

369 |

|

|

$ |

— |

|

|

$ |

230,093 |

|

|

$ |

368,693 |

|

|

$ |

56,983 |

|

|

$ |

655,769 |

|

| Mahmood Kahn |

|

|

3,989,624 |

|

|

|

487,621 |

|

|

|

975,242 |

|

|

$ |

3,990 |

|

|

$ |

486 |

|

|

$ |

— |

|

|

$ |

304,009 |

|

|

$ |

487,135 |

|

|

$ |

75,289 |

|

|

$ |

866,433 |

|

| |

|

|

12,503,177 |

|

|

|

1,528,166 |

|

|

|

3,056,332 |

|

|

$ |

12,503 |

|

|

$ |

1,526 |

|

|

$ |

— |

|

|

$ |

952,742 |

|

|

$ |

1,526,640 |

|

|

$ |

235,949 |

|

|

$ |

2,715,331 |

|

14

As noted, the shares were issued in payment of accrued

salaries and compensation of $2,061,676, with the excess of the fair value of the shares over the issuance price recorded as additional

current compensation. At the time the shares were issued in February 2022, the closing market price of our common shares was $0.077 and

the shares of Series A Preferred stock were then offered and sold at $1.00 per share, plus 10 common shares as “consideration shares”

and an annual dividend of $0.10 per share.

In addition to issuance of common and Series C Preferred

shares to themselves at par value, the four former directors refused to issue the Series A Preferred as agreed to transfer control of

the Company, refused and failed to resign as directors as agreed, and otherwise defaulted on the terms of the CareClix Companies’

acquisition. Following multiple discussions, of these and other actions concerning to new management, the four former directors agreed

to resign as officers and directors, but only if certain new conditions were first agreed to and completed by the Company.

In late April 2022, the four former directors and

officers all were terminated by action of the remaining Board of Directors and majority vote of the shareholders, as provided by Delaware

law. Following their termination, the four individuals then failed and refused to turn over corporate records, files and access to vendors

and creditors, resulting in our inability to complete a timely audit of our financial records for the year ended May 31, 2022.

15

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND

CORPORATE GOVERNANCE

Executive Officers and Directors

Below are the names and certain information regarding

our current and former executive officers and directors during fiscal year ended May 31, 2022:

| Name |

Age |

Title |

|

Date first appointed |

Date of Termination |

| Fernando Leonzo |

|

50 |

|

Former Chairman and Director |

|

April 15, 2013 (inception) |

April 26, 2022 |

| |

|

|

|

|

|

|

|

| Robert Gunther |

|

72 |

|

Former Chief Operations Officer, Treasurer, Secretary and Director |

|

April 15, 2013 (inception) |

April 29, 2022 |

| |

|

|

|

|

|

|

|

| John Romagosa |

|

42 |

|

Former President and Director |

|

October 10, 2014 |

April 26, 2022 |

| |

|

|

|

|

|

|

|

| Mahmood Khan |

|

70 |

|

Former CEO and Director |

|