UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the

Securities Exchange Act of 1934

Check the appropriate box:

|

☐

|

|

Preliminary Information Statement

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☒

|

|

Definitive Information Statement

|

KISSES FROM ITALY, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14c-5(g)

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

(2)

|

|

Form, Schedule, or Registration Statement No.:

|

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Regulation

14C

of the Securities Exchange Act of 1934, as amended

KISSES FROM ITALY, INC.

80 SW 8th Street

Suite 2000

Miami, Florida 33130

(305) 423-7129

February 11, 2022

WE ARE

NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A PROXY

NOTICE IS HEREBY GIVEN that, on January 25, 2022,

the members of the board of directors of Kisses from Italy, Inc., a Florida corporation (the “Company,” “we” or

“us”), and on January 27, 2022, the holders of approximately 59.8% of the voting stock (the “Consenting Shareholders”)

of the Company, approved an amendment to our Articles of Incorporation (the “Amendment”) described below without a meeting

of shareholders, in accordance with the Florida Business Corporation Law. The Amendment will increase the authorized share capital of

the Company from 200,000,000 shares of common stock, $0.001 par value per share (the “Common Stock”) to 300,000,000 shares

of Common Stock.

WE ARE NOT ASKING YOU FOR

A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No action is required by you. The enclosed

Information Statement is being furnished to furnished to all holders of record of the shares of the Common Stock of the Company, as of

the close of business on the record date, January 28, 2022 (the “Record Date”).

Section 607.0704 of the Florida Business Corporation

Act provides that any action required to be taken at any annual or special meeting of shareholders of a corporation, or any action which

may be taken at any annual or special meeting of such shareholders, may be taken without a meeting, without prior notice and without a

vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock, having

not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled

to vote thereon were present and voted. Because the Consenting Shareholders have voted in favor of the Amendment, and have sufficient

voting power to approve the Amendment, no other shareholder consents will be solicited in connection with the actions described in this

Information Statement. The Board is not soliciting your proxy, and proxies are not requested from shareholders.

On the Record Date, there were 183,913,582 shares of Common Stock outstanding,

and 139,610 shares of Series C Preferred stock outstanding.

The purpose of the Information Statement is to

notify our shareholders that the Amendment has been approved by the Consenting Shareholders. You are urged to read the Information Statement

in its entirety for a description of the actions taken by the Consenting Shareholders of the Company. The Amendment will become

effective on a date that is not earlier than twenty-one (21) calendar days after this Information Statement is first mailed to our shareholders.

This Information Statement is being mailed on

or about February 11, 2022 to shareholders of record on the Record Date. We have asked or will ask brokers and other custodians, nominees

and fiduciaries to forward this Information Statement to the beneficial owners of our common stock held of record by such persons.

This

is Not a Notice of a Meeting of SHAREHolders and No SHAREholders’ Meeting Will Be Held to Consider Any Matter Described Herein.

By Order of the Board of Directors

/s/ Claudio

Ferri

Claudio Ferri

Chief Executive Officer

KISSES FROM ITALY, INC.

80 SW 8th Street

Suite 2000

Miami, Florida 33130

(305) 423-7129

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

_____________________________________

NO VOTE OR OTHER ACTION OF THE COMPANY’S

SHAREHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being furnished

to the holders of record of the shares of the common stock, with a par value of $0.001 per share (the “Common Stock”), of

Kisses from Italy, Inc., a Florida corporation (the “Company”), as of the close of business on the record date, January 28,

2022 (the “Record Date”). The purpose of the Information Statement is to notify our shareholders that on January 25, 2022,

the Company received the written consent in lieu of a meeting (the “Board Consent”) from the members of the board of directors

of the Company (the “Board”) and on January 27, 2022, the Company received a written consent in lieu of a meeting from the

holders of approximately 59.8% of the voting stock (the “Consenting Shareholders”) of the Company.

The Board and the Consenting Shareholders adopted

resolutions that authorized an amendment (“Amendment”) to the Company’s Articles of Incorporation (the “Articles”)

to effect an increase in the authorized share capital of the Company from 200,000,000 shares of common stock, $0.001 par value per share

(the “Common Stock”) to 300,000,000 shares of Common Stock (the “Authorized Share Increase”).

The Authorized Share Increase will become effective

on a date that is not earlier than twenty-one (21) calendar days after this Information Statement is first mailed to our shareholders.

Because the Consenting Shareholders have voted

in favor of the Authorized Share Increase, and have sufficient voting power to approve such actions, no other consents will be solicited

in connection with the transactions described in this Information Statement. The Board is not soliciting proxies in connection with the

adoption of these actions, and proxies are not requested from shareholders.

This Information Statement is being mailed on

or about February 11, 2022 to shareholders of record on the Record Date. We have asked or will ask brokers and other custodians, nominees

and fiduciaries to forward this Information Statement to the beneficial owners of our common stock held of record by such persons.

Under provisions of the Florida Business Corporation

Act, shareholders have no appraisal or dissenters’ rights in connection with the matters described in this Information Statement

and we will not independently provide our shareholders with any such right. Section 607.0704 of the Florida Business Corporation Act provides

that any action required to be taken at any annual or special meeting of a corporation, or any action which may be taken at any annual

or special meeting of such shareholders, may be taken without a meeting, without prior notice and without a vote, if a consent or consents

in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock, having not less than the minimum number

of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present

and voted. Accordingly, pursuant to Section 607.0704 of the Florida Business Corporation Act, your approval is not required and is

not being sought.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY

SUMMARY INFORMATION

The purpose of the Amendment is to effect the

Authorized Share Increase. The following is Summary Information regarding the Amendment. This summary does not contain all of the information

that may be important to you. You should read in their entirety this Information Statement and the other documents included or referred

to in this Information Statement in order to fully understand the matters discussed in this Information Statement.

|

Why am I receiving this Information Statement?

|

It is for your information only. The Authorized Share Increase was approved on January 25 2022 by written consent of the Board, and on January 27, 2022, by written consent of the Consenting Shareholders. Under these circumstances, federal securities laws require us to furnish you with this Information Statement at least 21 calendar days before effecting the action.

|

|

Who is Entitled to Notice?

|

Each holder of record of outstanding shares of our Common Stock on the Record Date is entitled to notice of the actions taken pursuant to the written consent of the shareholders.

|

|

Why Did the Company Seek Shareholder Approval?

|

The approval of a majority of the voting power of the shareholders of the Company is required to approve the Amendment in order to implement the Authorized Share Increase pursuant to Section 607.0704 of the Florida Business Corporation Act.

|

|

Why was the Amendment adopted?

|

The Amendment was adopted for the purposes of increasing the authorized shares of Common Stock. The Amendment was approved by the Company for the reasons and benefits described below.

|

|

Am I being asked to approve the

Authorized Share Increase?

|

No. The Authorized Share Increase has already been approved by the holders of a majority of our voting power and the unanimous written consent of our Board of Directors. No further shareholder approval is required.

|

|

What will the Amendment do?

|

Our

Articles of Incorporation authorizes for issuance 200,000,000 shares of Common Stock, of which 183,913,582 shares of Common Stock

are outstanding as of the Record Date, and 25,000,000 shares of Preferred Stock, of which 139,610 Series C Preferred are

outstanding. The Amendment will increase our authorized capital stock from 200,000,000 to 300,000,000 shares of Common

Stock.

|

AUTHORIZED SHARE INCREASE

The Company is currently authorized to issue up

to 200,000,000 shares of Common Stock, and 25,000,000 shares of Preferred Stock, of which 1,500,000 shares of the Preferred Stock

are designed as Series A Preferred Stock, 5,000,000 shares as Series B Preferred Stock and 1,000,000 shares as Series

C Preferred Stock. As of the Record Date, we had 183,913,582 shares of Common Stock issued and outstanding and 139,610 shares of

Series C Preferred Stock issued and outstanding.

The Amendment will not affect the terms of the

outstanding Common Stock or the rights of the holders of the Common Stock. However, the Company’s current Articles of Incorporation

authorizes the issuance of 200,000,000 shares of Common Stock of which 183,913,582 shares are outstanding as of the Record Date.

The purpose of the Authorized Share Increase is

to make available additional shares of Common Stock for issuance of all the current obligations of the Company to issue Common Stock,

including the outstanding convertible securities, and for general corporate purposes without the requirement of further action by the

shareholders of the Company. The Series C Preferred Stock is convertible by the holder thereof on the basis of three times the price paid

for the shares divided by the floor price of $0.10 established by the Board of Directors. Also, we currently have 1,239,823 options outstanding

and 750,000 warrants issued and outstanding. We also hope to be able to require MacRab LLC, a Florida limited liability company, to purchase

shares of our common stock pursuant to the terms and provisions of the Standby Equity Commitment Agreement. See the Current Report on

Form 8-K filed by the Company with the Securities and Exchange Commission on November 30, 2021 for a description of our arrangement with

MacRab LLC.

Following the Authorized Share Increase, the Company

intends to treat shareholders holding the Common Stock in “street name,” through a bank, broker or other nominee, in the same

manner as registered shareholders whose shares are registered in their names. Shareholders who hold their shares with such a bank, broker

or other nominee and who have any questions in this regard are encouraged to contact their nominees.

Certain Risk Factors Associated with the Authorized Share Increase

In evaluating the Authorized Share Increase, the

Board also took into consideration negative factors associated with authorized share increases. These factors included the negative perception

of authorized share increases by some investors, analysts and other stock market participants, as well as various other risks and uncertainties

that surround the implementation of an authorized share increase, including but not limited to the following:

There can be no assurance that the market price

per share of the Common Stock after the Authorized Share Increase will remain unchanged. In the long term the price per share depends

on many factors, including our performance, prospects and other factors, some of which are unrelated to the number of shares outstanding.

If the Authorized Share Increase is consummated and the trading price of the Common Stock declines, the percentage decline as an absolute

number and as a percentage of the Company’s overall market capitalization may be greater than would occur in the absence of the

Authorized Share Increase. The history of similar authorized share increases for companies in similar circumstances is varied.

The Board, however, has determined that the potential

benefit of the Authorized Share Increase outweighs the potential disadvantages associated with the increase in the authorized shares of

Common stock and Preferred stock. The Board believes that such increase would provide greater flexibility to pursue corporate transactions

and relationships which have the potential to facilitate the Company’s growth and development and its ability to compete successfully.

If we fail to facilitate growth and development, we may not be able to generate revenues or achieve profitability, and our shareholders

may lose their entire investment in us.

The text of the proposed Amendment which

contains the Authorized Share Increase is attached hereto as Appendix A.

Appraisal Rights

Under the Florida Business Corporation Act, our shareholders are not

entitled to dissenters’ or appraisal rights with respect to the proposed Authorized Share Increase and the change to our Articles

of Incorporation and we will not independently provide our shareholders with any such rights.

THE AMENDMENT TO OUR ARTICLES OF INCORPORATION

HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED

UPON THE FAIRNESS OR MERIT OF THE AMENDMENT NOR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS INFORMATION STATEMENT

AND ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table lists, as of the Record Date,

the number of shares of common stock beneficially owned by (i) each person, entity or group (as that term is used in Section 13(d)(3)

of the Securities Exchange Act of 1934) known to the Company to be the beneficial owner of more than 5% of the outstanding Common Stock;

(ii) each officer and director of the Company; and (iii) all officers and directors as a group. Information relating to beneficial ownership

of Common Stock by our principal shareholders and management is based upon information furnished by each person using “beneficial

ownership” concepts under the rules of the Securities and Exchange Commission. Under these rules, a person is deemed to be a beneficial

owner of a security if that person directly or indirectly has or shares voting power, which includes the power to vote or direct the voting

of the security, or investment power, which includes the power to dispose or direct the disposition of the security. The person is also

deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under

the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and

a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary interest. Except as noted

below, each person has sole voting and investment power with respect to the shares.

|

Class of Shares

|

|

Name and Address

|

|

# of Shares

|

|

% of Class

|

|

|

|

|

|

|

|

|

|

Common

|

|

Michele Di Turi(1)

80 SW 8th St. Suite 2000

Miami, Florida 33130

|

|

65,600,000

|

|

36.3%

|

|

|

|

|

|

|

|

|

|

Common

|

|

Claudio Ferri(1)(2)

80 SW 8th St. Suite 2000

Miami, Florida 33130

|

|

42,600,000

|

|

23.5%

|

|

|

|

|

|

|

|

|

|

Common

|

|

Leonardo Fraccalvieri(1)

80 SW 8th St. Suite 2000

Miami, Florida 33130

|

|

1,000,000

|

|

0.6%

|

|

|

|

|

|

|

|

|

|

Common

|

|

All Officers and Directors as a Group (3 persons)

|

|

|

|

60.4%

|

|

|

|

|

|

|

|

|

|

5% Holders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

|

|

Denis Senecal Holdings(3)

|

|

21,671,153

|

|

12.0%

|

|

(1)

|

Officer and director of our Company.

|

|

(2)

|

Includes 410,000 shares of common stock held in the name of his wife.

|

|

(3)

|

Denis Senecal has voting and dispositive authority over these shares

|

DISTRIBUTION AND COST

We will pay all costs associated with the distribution

of this Information Statement, including the costs of printing and mailing. If hard copies of the materials are requested, we will send

only one Information Statement and other corporate mailings to shareholders who share a single address unless we received contrary instructions

from any shareholder at that address. This practice, known as “householding”, is designed to reduce our printing and postage

costs. However, the Company will deliver promptly upon written or oral request a separate copy of this Information Statement to a shareholder

at a shared address to which a single copy of this Information Statement was delivered. You may make such a written or oral request by

sending a written notification stating (a) your name, (b) your shared address, and (c) the address to which the Company should direct

the additional copy of this Information Statement, to Kissed from Italy, Inc. at the address above. Additionally, if current shareholders

with a shared address received multiple copies of this Information Statement or other corporate mailings and would prefer the Company

to mail one copy of future mailings to shareholders at the shared address, notification of such request may also be made in the same manner

by mail or telephone to the Company’s principal executive offices.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference”

information into this Information Statement, which means that we can disclose important information to you by referring you to other documents

that we have filed separately with the SEC. The information incorporated by reference is deemed to be part of this Information

Statement. This Information Statement incorporates by reference the following documents:

1. Our Annual Report on Form

10-K for the year ended December 31, 2020, filed with the SEC on April 15, 2021;

2. Our Quarterly Report on

Form 10-Q for the quarter ended March 31, 2021, filed with the SEC on May 17, 2021;

3. Our Quarterly Report on

Form 10-Q for the quarter ended June 30, 2021, filed with the SEC on August 16, 2021;

4. Our Quarterly Report on

Form 10-Q for the quarter ended September 30, 2021, filed with the SEC on November 15, 2021; and

6. Our Current Reports on

Form 8-K, dated April 28, 2021, filed with the SEC on each of April

28, 2021 and November

30, 2021.

Where

You Can Find More Information

You may read and copy any reports, statements

or other information filed by us at the public reference facilities maintained by the SEC in Room 1590, 100 F Street, N.E.,

Washington, D.C. 20549. The SEC maintains a website that contains reports, proxy and information statements and other information,

including those filed by us, at http://www.sec.gov. You may also access the SEC filings and obtain other information about us through

our website, which is http://www.kissesfromitaly.com. The information contained on the website is not incorporated by reference in,

or in any way part of, this Information Statement.

OTHER MATTERS

The Board knows of no other matters other than

those described in this Information Statement which have been approved or considered by the holders of a majority of the shares of the

Company’s voting stock.

IF YOU HAVE ANY QUESTIONS REGARDING THIS INFORMATION

STATEMENT, PLEASE CONTACT:

KISSES FROM ITALY, INC.

80 SW 8th Street

Suite 2000

Miami, Florida 33130

(305) 423-7129

Attn: Corporate Secretary

PLEASE NOTE THAT THIS IS NOT A REQUEST FOR YOUR

VOTE OR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF CERTAIN TRANSACTIONS ENTERED INTO BY THE COMPANY.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

By Order of the Board of Directors

/s/ Claudio

Ferri

Claudio Ferri

Chief Executive Officer

APPENDIX A

ATTACHMENT TO

ARTICLES OF AMENDMENT

TO

ARTICLES OF INCORPORATION

OF

KISSES FROM ITALY, INC.

Article IV of the Articles of Incorporation of

this corporation is hereby amended so that, as amended, the first sentence of said Article shall be read as follows:

ARTICLE IV SHARES:

The amount of the total authorized capital stock of the corporation

shall be three hundred twenty-five million (325,000,000) shares consisting of three hundred million (300,000,000) shares of Common Stock,

$0.001 par value per share, and twenty five million (25,000,000) shares of Preferred Stock, $0.010 par value per share.

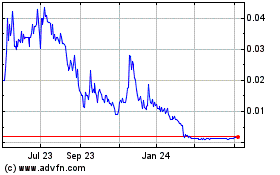

Kisses from Italy (QB) (USOTC:KITL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kisses from Italy (QB) (USOTC:KITL)

Historical Stock Chart

From Apr 2023 to Apr 2024