Hampered by limited prospects at home and getting a good

tailwind from the yen's rise, Kirin Holdings Co. (2503.TO) said

Tuesday it will spend about $2.56 billion to buy a majority stake

in Schincariol, Brazil's second biggest brewer, in bid to quench

its thirst in a market rich with growth potential.

The Tokyo-based company, which owns all of Australia's Lion

Nathan Ltd. and 48% of San Miguel Brewery Inc. of the Philippines,

said it has agreed to buy all outstanding shares of Aleadri-Schinni

Participacoes e Representacoes S.A., which holds a 50.45% stake in

family-run Schincariol for Y198.8 billion. The transaction,

scheduled to be completed later Tuesday, will be funded through

cash on hand and loans.

"The deal will enable us to build an ideal platform" to proceed

with establishing our beverage and beer business in the rapidly

expanding Brazilian market, Kirin President Senji Miyake said.

With the domestic situation curtailed by the nation's shrinking

population and a gradual shift away from beer drinking, Japan's

brewers are ramping up their overseas operations. Industry-wide

beer shipments ebbed 3.5% to 200.32 million cases in the first half

ended June.

Analysts say M&As are an attractive way to grow outside

Japan especially for the nation's cash rich food and beverage

sector. But Japanese companies still need to find local partners in

overseas markets that can effectively cater to local tastes.

The deal is the third biggest this year among global beverage

sector after SABMiller PLC's (SBMRY) $10 billion pursuit of

Foster's Group and Mexican Coca-Cola bottlers Embotelladoras Arca

SAB's (ARCA.MX) $2.8 billion purchase of Grupo Continental SAB

(CONTAL.MX), according to Dealogic data.

Brazil, where beer demand is expected to increase in keeping

with the nation's economic growth, is the third biggest beer market

after China and the U.S. and nearly double the size of Japan, which

places sixth.

Amid cutthroat competition striving to get a bigger slice of the

global market share, "this is a rare opportunity to buy an

influential company," said Miyake. With 13 breweries in Brazil,

Schincariol produces the Nova Schin beer brand and Schin soft drink

brand.

The deal comes at the time when the yen's rise is also creating

an opportunity for Japanese firms to get more bang for their buck

when they make acquisitions abroad.

However, Miyake said that the yen's strength was not a

particular reason behind the decision to buy Schincariol. He said

it just happened in at this time, playing down the beneficial

impact from the yen's strength and noting the Brazilian currency's

strength against the dollar.

There is one other reason for Kirin being on the M&A hunt.

The sector missed out on much-needed domestic consolidation and

more efficient business structures when Kirin and privately-held

Suntory Holdings Ltd. last year scrapped plans to merge.

In July last year, Kirin bounced back from the collapse of the

Suntory deal by buying close to 15% of Singapore's Fraser &

Neave Ltd. (F99.SG), in a deal valued at $970 million at the time

of purchase.

For Kirin, the latest deal is smaller than other recent

M&As, including a combined Y329.3 billion deal in two stages in

1998 and 2009 to buy Lion Nathan and a Y294.0-billion deal in 2007

to buy Australia's National Foods Ltd.

Schincariol approached leading global players earlier this year

about a possible bid, providing them with a complete "investment

kit" for review, according to analysts and industry sources. A

person familiar with the matter said Kirin beat out competing

offers from SABMiller (SBMRY) and Heineken (HINKY).

Brazil's beer consumption jumped 11% in 2010 from the year

before, according to the National Brewing Association, an industry

trade group.

Brazil's market, however, has long been dominated by AmBev,

which merged with Belgian brewer Interbrew in 2005 and then

swallowed Anheuser-Busch in 2008 to become the world's biggest

brewer.

Schincariol started out in 1939 as a soft-drink vender. Its

tutti-frutti-flavored soft drink Itubaina is still popular in the

interior of Sao Paulo state, where Schincariol's headquarters is

located.

Several analysts were surprised by the large acquisition price,

but added that having an overall objective of entering the

fast-growing South American market is positive amid an increasing

lack of targets in other parts of Asia and Australia following the

recent M&A spree by Japanese and other beverage makers in the

regions.

"The company certainly targets a high level of growth over the

next several years so if the company were able to achieve that

level of growth, then I can understand why they paid as much as

they did," said Toby Williams, an analyst at Macquarie in Tokyo,

citing Kirin's strong balance sheet.

But with labor costs also expected to increase, tapping into

market expansion alone is unlikely to lead to growth in the

company's bottom-line.

"It will have to grow its volumes and hopefully its share in a

market, which already has a dominant player," Williams said.

The deal is also the third biggest acquisition of foreign

companies by Japanese companies announced this year after Takeda

Pharmaceutical's $14 billion purchase of Nycomed and Terumo's

acquisition of CaridianBCT worth $2.6 billion, according to

Dealogic.

-By Hiroyuki Kachi and Kana Inagaki, Dow Jones Newswires;

813-6269-2795; kana.inagaki@dowjones.com

-Tom Murphy, Alison Tudor contributed to this report.

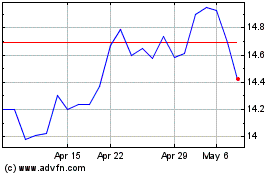

Kirin (PK) (USOTC:KNBWY)

Historical Stock Chart

From Jan 2025 to Feb 2025

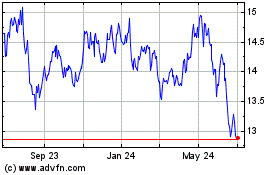

Kirin (PK) (USOTC:KNBWY)

Historical Stock Chart

From Feb 2024 to Feb 2025