false

0001527702

0001527702

2024-01-22

2024-01-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): January

22, 2024

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

Section 7 - Regulation FD

Item 7.01 Regulation FD Disclosure.

We have issued a press release and shareholder letter concerning our anticipated

revenue results for 2024, our agreement to acquire 51% of the capital stock of QXTEL, and other matters.

The press release and shareholder letter are furnished with this Current

Report on Form 8-K as Exhibits 99.1-99.2. The information furnished under this Item 7.01 and Item 9.01 of this Current Report on Form

8-K, including Exhibits 99.1-99.2, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in

any registration statement or other filing under the Securities Act of 1933, as amended, regardless of any general incorporation by reference

language in such filing, except as shall be expressly set forth by specific reference in any such filing.

SECTION 9 – Financial

Statements and Exhibits

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date January 25, 2024

IQST – iQSTEL and QXTEL Announce a Deal To Become Quarter Billion

Revenue Corporation

NEW

YORK, January 22, 2024 -- iQSTEL Inc. (OTC-QX: IQST), and QXTEL LTD. ("QXTEL"), a London, United Kingdom based Telecommunications

Services Provider (www.qxtel.com) announced an agreement for iQSTEL to acquire 51% of QXTEL adding

QXTEL to the iQSTEL Telecom Division which includes Etelix, Swisslink, Smartbiz, Whisl, QGlobal SMS,

IoTLabs, and itsBchain.

The addition of QXTEL

to iQSTEL’s Telecom Division is expected to add more than $80 million in annual revenue. iQSTEL management anticipates the combined

sales of the two companies to initially generate $250 million in annual revenue before the accelerated growth anticipated from the synergies

of the combination. iQSTEL achieved a consolidated positive operating income in Q3 of 2023 one fiscal quarter ahead of forecast, and

the addition of QXTEL will further boost the Telecom Division of iQSTEL to forecast $3 million of positive operating income annually.

The founders and management

of QXTEL share iQSTEL’s vision to become one of the major international wholesale telecommunications operators providing voice,

messaging (A2P SMS) and enhanced value-added services. This acquisition will put the combined company in the select list of top operators.

iQSTEL management indicates

an 8-K disclosure detailing of the agreement announced today and the financing will be forthcoming imminently. The two companies expect

to finalize and close the acquisition agreement within the next 60 days. The companies expect to release additional details on the transaction

before the IQSTEL shareholders meeting.

Mr.

Leandro Iglesias, the CEO of iQSTEL stated the following in regard to the transaction: “We are very excited about the combination

of QXTEL with iQSTEL. QXTEL has a stellar reputation and a very well-respected name in the industry. The addition of QXTEL accelerates

iQSTEL’s goal of becoming one of the top international wholesale telecom businesses within the next 3 years.”

Mr.

Tolga Alemdar, the CEO of QXTEL stated the following in regard to the transaction: “We have been looking for a strategic partner

capable of not only supporting but also accelerating our growth objectives. Consequently, we are elated to have identified iQSTEL

as the ideal partner. The QXTEL management team will persist in overseeing the current QXTEL operations while simultaneously leveraging

the financial and synergistic advantages that arise from being part of the iQSTEL family.”

In alignment with the

agreement announced today, Tolga Alemdar will retain his position as Chief Executive Officer and Managing Director of QXTEL. Additionally,

Fernando Diaz Romero, Gonzalo Henschien, and Rami Herzallah, Chief members of the QXTEL Management Team, will continue in their respective

roles at QXTEL. The acquisition agreement is designed to uphold the current operations of QXTEL independently, ensuring seamless continuity

in customer relationships & company operations.

iQSTEL

management expects the QXTEL acquisition to accelerate the company’s current initiative to uplist to Nasdaq.

Prior to today’s announcement, iQSTEL

filed a Definitive Proxy Statement in conjunction with

an upcoming annual shareholder meeting scheduled on Wednesday January 31, 2023, at 10 am (EDT).

The annual shareholder meeting will go on as scheduled.

About IQSTEL:

iQSTEL

Inc. (OTC-QX: IQST) (www.iQSTEL.com)

is a US-based, multinational publicly listed company preparing for a Nasdaq up-listing with an FY2023 $120 million revenue forecast.

iQSTEL's mission is to serve basic human needs in today's modern world by making the necessary tools accessible regardless of race, ethnicity,

religion, socioeconomic status, or identity. iQSTEL recognizes that in today's modern world, the pursuit of the human hierarchy

of needs (physiological, safety, relationship, esteem and self-actualization) is marginalized without access to ubiquitous communications,

the freedom of virtual banking, clean affordable mobility and information and content. iQSTEL has 4 Business Divisions delivering accessibly

to the necessary tools in today's pursuit of basic human needs: Telecommunications, Fintech, Electric Vehicles and Metaverse.

| · | The Enhanced Telecommunications Services Division (Communications)

includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Portability Blockchain Platform. |

| · | The Fintech Division (Financial Freedom) includes remittances

services, top up services, Master Card Debit Card, a US Bank Account (No SSN required), and a Mobile App. |

| · | The Electric Vehicles (EV) Division (Mobility) offers Electric

Motorcycles and plans to launch a Mid Speed Cars. |

| · | The Artificial Intelligence (AI)-Enhanced Metaverse Division

(information and content) includes an enriched and immersive white label proprietary AI-Enhanced Metaverse platform to access products,

services, content, entertainment, information, customer support, and more in a virtual 3D interface. |

The company continues

to grow and expand its suite of products and services both organically and through mergers and acquisitions. iQSTEL has completed

10 acquisitions since June 2018 and continues to develop an active pipeline of potential future acquisitions.

Safe Harbor Statement:

Statements in this news release may be "forward-looking statements". Forward-looking statements include, but are not limited

to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other information relating to our future

activities or other future events or conditions. These statements are based on current expectations, estimates, and projections about

our business based partly on assumptions made by management. These statements are not guarantees of future performance and involve risks,

uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may and are likely to differ materially

from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements speak only

as of the date of this news release, and iQSTEL Inc. undertakes no obligation to update any forward-looking statement to reflect events

or circumstances after the date of this news release. This press release does not constitute a public offer of any securities for sale.

Any securities offered privately will not be or have not been registered under the Act and may not be offered or sold in the United

States absent registration or an applicable exemption from registration requirements.

iQSTEL

Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact

Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company

Website

www.iqstel.com

IQST – iQSTEL CEO Presents Acquisition of QXTEL as Hockey

Stick Growth Curve Event

NEW YORK, January 24, 2024 --

iQSTEL Inc. (OTC-QX: IQST) today released a letter to shareholders form the iQSTEL CEO, Leandro Iglesias, following the acquisition of

QXTEL (www.qxtel.com) announced yesterday. The letter is intended to provide further details on the

acquisition and highlight the benefits of the acquisition. The letter is included in its entirety below:

Dear Shareholders:

Yesterday we announced a major milestone resulting in a hockey

stick growth curve event, the acquisition of QXTEL.

iQSTEL and QXTEL Announce A Deal To Become Quarter Billion

Revenue Corporation

iQSTEL and QXTEL have entered into a binding agreement for iQSTEL

to acquire 51% of the capital stock of QXTEL. We expect all terms and conditions of this binding purchase agreement to be executed within

no more than 60 days at which time 51% of QXTEL’s shares will be transfer to IQSTEL.

To further demonstrate the commitment of all parties involved,

see QXTEL’s post yesterday on LinkedIn:

IQSTEL AND QXTEL ANNOUNCE

A DEAL TO BECOME QUARTER BILLION REVENUE CORPORATION

As I noted in the first line of my letter here today, this agreement

is a major milestone resulting in a hockey stick growth curve. Let me highlight some of the key aspects driving the momentum behind this

milestone.

The addition of QXTEL’s revenue alone nearly doubles iQSTEL’s

annual revenue before the acquisition, but that is barely the tip of the iceberg on the list of contributions QXTEL brings to the vision

of iQSTEL becoming a $1 Billion company.

QXTEL’s commercial value is far greater than its revenue

contributions alone. QXTEL adds improved operating margins with the addition of further operating efficiencies and synergies to be cross

leveled across the combined operations. QXTEL brings new and unique customers, and expanded executive talent and experience. The combination

of QXTEL with iQSTEL is one of those situations where 1 + 1 > 2.

Here are some of the stunning numerical metrics of iQSTEL resulting

from the acquisition that illustrate the value of the QXTEL acquisition:

| · | Revenue of approximately $700,000 per day |

| · | Gross margin of approximately $160,000 per week |

| · | Telecom Division Operating income of approximately $60,000 per week |

| · | Revenue Per Share (RPS) increase of 75% from $0.81 per share EOY 2023 to $1.40

per share applied to the same EOY 2023 capitalization structure. |

In addition to the improved financial metrics, QXTEL brings to

iQSTEL new and active top 10 incumbent wholesale telecom customers that own their own networks and bring end users from the Middle East,

UK, Belgium, France, Italy, Germany, Turkey, Africa, the Caribbean, and India. QXTEL is also a member of the GSMA association and the

GLF Community (The ITW Global Leaders’ Forum), and they have a global presence, with offices in Miami, Buenos Aires, Istanbul, London,

Belgrade and Dubai.

The highest value of this acquisition is the top telecommunication

executive talent at QXTEL which is one of the key features that makes the acquisition so compelling for iQSTEL. The names of the QXTEL

executives are essentially independent brand names well recognized within the international telecom industry.

It is important to remark that the acquisition agreement is intended

to maintain QXTEL operational continuity ensuring a seamless transition for all QXTEL customers.

We are delighted to have Tolga Alemdar retain his role as the

Chief Executive Officer and Managing Director of QXTEL. We are also pleased to have Fernando Diaz Romero, Gonzalo Henschien, and Rami

Herzallah, remain on board as Chief members of the QXTEL management team continuing in their respective roles at QXTEL.

The leadership of both iQSTEL and QXTEL have the same vision

to become one of the 10 largest wholesale telecommunication service providers in the world. This deal graduates us on to that top ten

list.

With the execution of the purchase agreement finalized, we will

now begin to integrate operations to achieve operational efficiencies and seize market synergies. Our focus is now on the horizon beyond

a quarter billion in annual revenue.

Our Independent Board of Directors and the Management want to

thank all our shareholders and investors for their support which has led to our stunning growth.

The best is yet to come,

Leandro Iglesias

CEO and Chairman

iQSTEL, Inc.

About IQSTEL:

iQSTEL

Inc. (OTC-QX: IQST) (www.iQSTEL.com)

is a US-based, multinational publicly listed company preparing for a Nasdaq up-listing with an FY2023 $120 million revenue forecast.

iQSTEL's mission is to serve basic human needs in today's modern world by making the necessary tools accessible regardless of race, ethnicity,

religion, socioeconomic status, or identity. iQSTEL recognizes that in today's modern world, the pursuit of the human hierarchy

of needs (physiological, safety, relationship, esteem and self-actualization) is marginalized without access to ubiquitous communications,

the freedom of virtual banking, clean affordable mobility and information and content. iQSTEL has 4 Business Divisions delivering accessibly

to the necessary tools in today's pursuit of basic human needs: Telecommunications, Fintech, Electric Vehicles and Metaverse.

| · | The Enhanced Telecommunications Services Division (Communications)

includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Portability Blockchain Platform. |

| · | The Fintech Division (Financial Freedom) includes remittances

services, top up services, Master Card Debit Card, a US Bank Account (No SSN required), and a Mobile App. |

| · | The Electric Vehicles (EV) Division (Mobility) offers Electric

Motorcycles and plans to launch a Mid Speed Cars. |

| · | The Artificial Intelligence (AI)-Enhanced Metaverse Division

(information and content) includes an enriched and immersive white label proprietary AI-Enhanced Metaverse platform to access products,

services, content, entertainment, information, customer support, and more in a virtual 3D interface. |

The company continues

to grow and expand its suite of products and services both organically and through mergers and acquisitions. iQSTEL has completed

10 acquisitions since June 2018 and continues to develop an active pipeline of potential future acquisitions.

Safe Harbor Statement:

Statements in this news release may be "forward-looking statements". Forward-looking statements include, but are not limited

to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other information relating to our future

activities or other future events or conditions. These statements are based on current expectations, estimates, and projections about

our business based partly on assumptions made by management. These statements are not guarantees of future performance and involve risks,

uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may and are likely to differ materially

from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements speak only

as of the date of this news release, and iQSTEL Inc. undertakes no obligation to update any forward-looking statement to reflect events

or circumstances after the date of this news release. This press release does not constitute a public offer of any securities for sale.

Any securities offered privately will not be or have not been registered under the Act and may not be offered or sold in the United

States absent registration or an applicable exemption from registration requirements.

iQSTEL

Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact

Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company

Website

www.iqstel.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

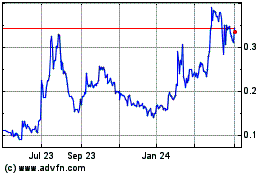

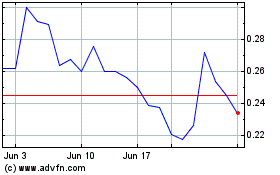

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Oct 2024 to Nov 2024

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Nov 2023 to Nov 2024