As filed with the Securities and Exchange Commission on October 17, 2019

Registration Statement No. 333-220419

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 2 TO FORM S-3 ON

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

|

INNOVATION PHARMACEUTICALS INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

2834

|

|

30-0565645

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

100 Cummings Center, Suite 151-B

Beverly, MA 01915

(978) 921-4125

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Leo Ehrlich, Chief Executive Officer and Chief Financial Officer

100 Cummings Center, Suite 151-B

Beverly, MA 01915

(978) 633-3623

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

David R. Crandall, Esq.

Hogan Lovells US LLP

1601 Wewatta Street, Suite 900

Denver, Colorado 80202

Telephone: (303) 899-7300

Facsimile: (303) 899-7333

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non‑accelerated filer

|

x

|

Smaller reporting company

|

x

|

|

|

|

Emerging growth company

|

¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On September 11, 2017, the registrant filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-3 (No. 333-220419), which was declared effective by the SEC on September 21, 2017 (the “Original Registration Statement”). The Original Registration Statement was filed to register shares of the registrant’s Class A common stock, preferred stock, debt securities, warrants and units, including shares of Class A common stock or preferred stock upon conversion of debt securities, Class A common stock upon the conversion of preferred stock, or Class A common stock, preferred stock or debt securities upon the exercise of warrants. In connection with the Original Registration Statement, the registrant offered and sold shares of Series B preferred stock, which shares are convertible into shares of Class A common stock, and warrants to purchase shares of Series B preferred stock pursuant to prospectus supplements filed with the U.S. Securities and Exchange Commission on October 9, 2018 and May 10, 2019.

Following the filing of the registrant’s Annual Report on Form 10-K for the fiscal year ended June 30, 2019, the registrant is no longer eligible to offer securities on Form S-3. This Post-Effective Amendment No. 2 to Form S-3 on Form S-1 is being filed to convert the Original Registration Statement into a Registration Statement on Form S-1, and contains an updated prospectus relating to the offering and sale of the shares of Series B preferred stock and Class A common stock that were registered on the Original Registration Statement.

All applicable registration and filing fees were paid by the registrant in connection with filing the Original Registration Statement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated October 17, 2019

PROSPECTUS

INNOVATION PHARMACEUTICALS INC.

7,000 Shares of Series B 5% Convertible Preferred Stock issuable upon the exercise of outstanding warrants

64,000,000 Shares of Class A Common Stock issuable upon the conversion of Series B Preferred Stock

This prospectus relates to (i) 7,000 shares of our Series B 5% convertible preferred stock, which we refer to as our Series B preferred stock, which are issuable upon the exercise of warrants described below, and (ii) 64,000,000 shares of Class A common stock, par value $0.0001 per share, which we refer to as our common stock, issuable from time to time upon conversion of Series B preferred stock.

Each share of Series B preferred stock has an initial stated value of $1,080 and may be converted at any time at the holder’s option into shares of our common stock at a conversion price equal of the lower of (i) $0.31625 per share and (ii) 85% of the lowest volume weighted average price of our common stock as reported on Bloomberg L.P. on a trading day during the ten trading days prior to and ending on, and including, the conversion date. The conversion price may be adjusted following certain triggering events and is subject to appropriate adjustment in the event of stock splits, stock dividends, recapitalization or similar events affecting our common stock.

The warrants are composed of four series and were originally issued as follows: (i) on October 9, 2018, series 1 warrants to purchase 1,563 shares of Series B preferred stock, series 2 warrants to purchase 1,563 shares of Series B preferred stock, and series 3 warrants to purchase 1,875 shares of Series B preferred stock, (ii) on October 12, 2018, series 1 warrants to purchase 937 shares of Series B preferred stock, series 2 warrants to purchase 937 shares of Series B preferred stock, and series 3 warrants to purchase 1,125 shares of Series B preferred stock, and (iii) on May 9, 2019, series 4 warrants to purchase 2,500 shares of Series B preferred stock. The holders of the warrants exercised 3,500 series 1 and series 2 warrants to purchase 3,500 shares of our Class B preferred stock prior to the date hereof, leaving 7,000 warrants outstanding as of the date of this prospectus. Each warrant entitles the holder thereof to purchase shares of Series B preferred stock at $982.50 per share. The series 1 and series 2 warrants each have an initial term of 15 months following issuance, the series 3 warrants have an initial term of 24 months following issuance, and the series 4 warrants have a term of 9 months following issuance.

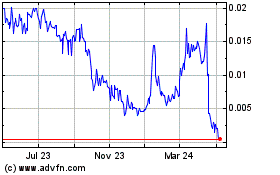

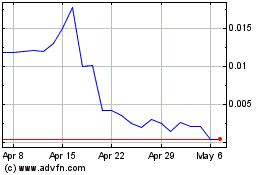

Our common stock is currently quoted on the OTCQB under the symbol “IPIX.” On October 14, 2019, the last reported sales price of our common stock on the OTCQB was $0.11 per share. There is no established public trading market for our Series B preferred stock and we do not expect a market to develop. In addition, we do not intend to apply for listing our Series B preferred stock on any national securities exchange or any other nationally recognized trading system.

Investing in our securities involves a high degree of risk. You should read “Risk Factors” beginning on page 3 of this prospectus and the reports we file with the Securities and Exchange Commission (the “SEC”) pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), incorporated by reference in this prospectus, to read about factors to consider before purchasing our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2019.

TABLE OF CONTENTS

We have not authorized anyone to provide you with information different from that contained in this prospectus, any applicable prospectus supplement or any free writing prospectus we prepare or authorize, and we do not take any responsibility for any other information that others may give you. This prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, the securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus, any applicable prospectus supplement or any free writing prospectus is accurate as of any date other than the date on the front cover of those documents, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

ABOUT THIS PROSPECTUS

This document is called a prospectus and is part of a registration statement on Form S-1 that we have filed with the SEC. From time to time, we may file one or more prospectus supplements to add, update or change information included in this prospectus. This prospectus covers offers and sales of our securities only in jurisdictions in which such offers and sales are permitted.

We urge you to carefully read this prospectus, any applicable prospectus supplement and any related free writing prospectus before buying any of the securities being offered.

The registration statement containing this prospectus, including exhibits to the registration statement, provides additional information about us and the securities offered under this prospectus. We have filed, and plan to continue to file, other documents with the SEC that contain information about us and our business. The registration statement and other reports can be read at the SEC Internet site mentioned under the heading “Where You Can Find More Information.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

The representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties and covenants were accurate only as of the date when made; therefore, such representations, warranties and covenants should not be relied on as accurate representations of the current state of our affairs.

References to “Innovation Pharmaceuticals,” the “Company”, “we,” “our” and “us” in this prospectus and any applicable prospectus supplement are to Innovation Pharmaceuticals Inc., unless the context otherwise requires. This document includes trade names and trademarks of other companies. All such trade names and trademarks appearing in this document are the property of their respective holders.

Our fiscal year ends on June 30. When we refer to a fiscal year or quarter, we are referring to the year in which the fiscal year ends and the quarters during that fiscal year. Therefore, fiscal 2019 refers to the fiscal year ended June 30, 2019.

GLOSSARY OF TERMS

Set forth below are definitions of certain technical terms used in this prospectus that are commonly used in the pharmaceutical and biotechnology industries.

ABSSSI: Acute Bacterial Skin and Skin Structure Infection.

Apoptosis: A type of cell death in which a series of molecular steps in a cell lead to its death. This is one method the body uses to get rid of unneeded or abnormal cells. The process of apoptosis may be blocked in cancer cells. Also called programmed cell death.

Cytotoxicity: The quality of being toxic to cells.

Defensin mimetics: Small compounds that mimic the structure and function of host defense proteins.

EMA: The European Medicines Agency.

FDA: The U.S. Food and Drug Administration.

HNC: Head and Neck Cancer. Head and neck cancer is a term used to define cancer that develops in the mouth, throat, nose, salivary glands, oral cancers or other areas of the head and neck. Most of these cancers are squamous cell carcinomas, or cancers that begin in the lining of the mouth, nose and throat.

IBD: Inflammatory Bowel Disease. An umbrella term for chronic, hard-to-treat conditions of the Gastrointestinal tract, with ulcerative colitis, and Crohn’s disease being common examples of extensive forms of the disease and ulcerative proctitis / proctosigmoiditis being more limited in distribution.

IND: Investigational New Drug. A substance that has been tested in the laboratory and has been approved by the FDA for testing in people.

In-vitro: Refers to the technique of performing a given experiment in a test tube, or, generally, in a controlled environment outside a living organism.

In-vivo: Refers to that which takes place inside an organism. In science, in-vivo refers to experimentation done in or on the living tissue of a whole, living organism as opposed to a partial or dead one. Animal testing and clinical trials are forms of in-vivo research.

NDA: A New Drug Application with the FDA.

OM: Oral Mucositis. Oral Mucositis is a common complication of cancer chemotherapy/ chemoradiation or radiation therapy. Oral mucositis causes the mucosal lining of the mouth to atrophy and break down, forming ulcers.

P21 (also known as protein 21): The expression of this gene is tightly controlled by the tumor suppressor protein p53, through which this protein mediates the p53-dependent cell cycle G1 phase arrest in response to a variety of stress stimuli. Used as a biomarker to detect change in p53.

P53 (also known as protein 53): A tumor suppressor gene that is mutated in many human cancers and results in the loss of a cell’s ability to check for DNA damage.

Small Molecule Drug: A medicinal drug compound having a molecular weight of less than 1,000 Daltons, and typically up to 500 Daltons.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any applicable prospectus supplement contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements convey our current expectations or forecasts of future events. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are generally identifiable by use of the words “estimate,” “project,” “believe,” “intend,” “plan,” “anticipate,” “expect” and similar expressions. These forward-looking statements include, but are not limited to, statements concerning our future drug development plans and projected timelines for the initiation and completion of preclinical and clinical trials; the potential for the results of ongoing preclinical or clinical trials; other statements regarding our future product development and regulatory strategies, including with respect to specific indications; any statements regarding our future financial performance, results of operations or sufficiency of capital resources to fund our operating requirements; and any other statements which are other than statements of historical fact. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Actual results could differ materially from those in forward-looking statements because of, among other reasons, the factors described below and in the periodic reports that we file with the SEC from time to time, including Forms 10-K, 10-Q and 8-K and any amendments thereto. The forward-looking statements are not guarantees of future performance. They are based on numerous assumptions that we believe are reasonable, but they are open to a wide range of uncertainties and business risks.

Key factors that could cause actual results to be different than expected or anticipated include, but are not limited to:

|

|

·

|

our capital needs and ability to continue as a going concern;

|

|

|

·

|

our ability to continue to fund and successfully progress internal research and development efforts;

|

|

|

·

|

our ability to create effective, commercially-viable drugs;

|

|

|

·

|

our ability to effectively and timely conduct clinical trials;

|

|

|

·

|

our ability to ultimately distribute our drug candidates;

|

|

|

·

|

compliance with regulatory requirements; and

|

|

|

·

|

other risks referred to in the section of this prospectus entitled “Risk Factors.”

|

In light of these risks, uncertainties and assumptions, you are cautioned not to place undue reliance on forward-looking statements, which are inherently unreliable and speak only as of the date of this prospectus or any prospectus supplement, as applicable. When considering forward-looking statements, you should keep in mind the cautionary statements in this prospectus and any applicable prospectus supplement. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus and any applicable prospectus supplement might not occur.

|

PROSPECTUS SUMMARY

This summary highlights selected information about Innovation Pharmaceuticals Inc. This summary does not contain all of the information that may be important to you in making an investment decision. For a more complete understanding of Innovation Pharmaceuticals Inc., you should read carefully this entire prospectus and any applicable prospectus supplement, including the “Risk Factors” section, and the other documents we refer to. Unless otherwise indicated, “common stock” means our Class A common stock, par value $0.0001 per share.

Innovation Pharmaceuticals Inc. Overview

We are a clinical stage biopharmaceutical company developing innovative therapies with dermatology, oncology, anti-inflammatory and antibiotic applications. We own the rights to numerous drug compounds, and we devote most of our efforts and resources on our compounds in clinical trials: Brilacidin for treatments of skin infections, ulcerative proctitis (inflammatory bowel disease) and prevention of oral mucositis complicating chemoradiation treatment for cancer, and Kevetrin for the treatment of ovarian cancer.

The Company was incorporated as Econoshare, Inc. on August 1, 2005 in the State of Nevada. On December 6, 2007, the Company acquired Cellceutix Pharma, Inc., a privately owned corporation formed under the laws of the State of Delaware on June 20, 2007. Following the acquisition, the Company changed its name to Cellceutix Corporation. Effective June 5, 2017, the Company amended its Articles of Incorporation and changed its name from Cellceutix Corporation to Innovation Pharmaceuticals Inc.

Our principal executive offices are located at 100 Cummings Center, Suite 151-B, Beverly, Massachusetts 01915, and our telephone number is (978) 921-4125. Our website is www.ipharminc.com. The information contained on or that can be accessed through or website is not incorporated in, and is not a part of, this prospectus, and you should not rely on any such information in connection with your investment decision to purchase our securities.

|

|

The Offering

The following summary is provided solely for your convenience and is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus and any applicable prospectus supplement.

|

|

|

|

|

Issuer

|

|

Innovation Pharmaceuticals Inc.

|

|

|

|

|

|

Securities offered by us

|

|

· 7,000 shares of our Series B 5% convertible preferred stock, which we refer to as our Series B preferred stock, which are issuable upon the exercise of outstanding warrants; and

· 64,000,000 shares of Class A common stock, par value $0.0001 per share, which we refer to as our common stock, issuable from time to time upon conversion of Series B preferred stock.

|

|

|

|

|

|

Shares of Class A common stock to be outstanding after this offering

|

|

Up to 275.6 million shares assuming sale of 7,000 shares of Series B preferred stock and conversion of such shares of Series B preferred stock into 64.0 million shares of our Class A common stock. Actual shares issued will vary, among other things, depending on the conversion price of our Series B preferred stock.(1)

|

|

|

|

|

|

Shares of Series B preferred stock to be outstanding after this offering

|

|

8,196 shares, assuming the exercise of all of the warrants.(1)

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering primarily for general working capital purposes. Accordingly, we will retain broad discretion over how these offering proceeds are used. See “Use of Proceeds” on page 25.

|

|

|

|

|

|

Warrant Restructuring and Additional Issuance Agreement

|

|

On May 9, 2019, we entered into a Warrant Restructuring and Additional Issuance Agreement with the Series B holders, pursuant to which the Series B holders agreed to exercise warrants to purchase up to $2.5 million of Series B preferred stock through November 2019, subject to the conditions described therein. In addition, we issued to the Series B holders 100 shares of Series B preferred stock following the execution of the Warrant Restructuring and Additional Issuance Agreement and agreed to issue up to an additional 400 shares of Series B preferred stock upon exercise of the warrants to purchase Series B preferred stock. We also issued warrants to purchase 2,500 shares of Series B preferred stock to the Series B holders following execution of the Issuance Agreement.

|

|

|

|

|

|

OTCQB symbol

|

|

IPIX

|

|

|

|

|

|

No Market for Series B preferred stock

|

|

There is no established public trading market for our Series B preferred stock, and we do not expect any such market to develop. In addition, we do not intend to apply for listing of the Series B preferred stock on any national securities exchange or other nationally recognized trading system.

|

|

|

|

|

|

Risk factors

|

|

An investment in our securities involves risks, and prospective investors should carefully consider the matters discussed under “Risk Factors” beginning on page 3 of this prospectus before making an investment in our securities.

|

_____________

|

(1)

|

The number of shares of common stock to be outstanding after this offering is based on 211,591,752 shares of Class A common stock outstanding as of September 23, 2019 and includes 64.0 million shares of common stock issuable upon the conversion of 7,000 shares of Series B preferred stock offered hereby. The number of shares of common stock excludes shares underlying stock options, warrants and other outstanding convertible securities or debt. The number of shares of Series B preferred stock to be outstanding after this offering is based on 1,196 shares of Series B preferred stock outstanding as of June 30, 2019.

|

RISK FACTORS

An investment in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks described below before deciding whether to buy our securities. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment. In addition, please read “Disclosure Regarding Forward-Looking Statements” in this prospectus, where we describe additional uncertainties associated with our business and the forward-looking statements included in this prospectus. Please note that additional risks not presently known to us or that we currently deem immaterial may also impair our business and operations.

Risks Related to Our Business

Substantial doubt exists as to our ability to continue as a going concern.

As described in Note 2 of our consolidated financial statements appearing elsewhere in this prospectus, our auditors have issued a going concern opinion regarding the Company. This means there is substantial doubt we can continue as an ongoing business for the next twelve months. Our financial statements have been prepared assuming we will continue as a going concern. We have experienced substantial and recurring losses from operations, which losses have caused an accumulated deficit of $95.0 million as of June 30, 2019. As of June 30, 2019, we had approximately $0.6 million in cash and current liabilities of $7.3 million, $3.7 million were payables to related parties with no immediate payment terms and $2.9 million was payable to one shareholder who is our former director and officer of the Company (see Note 9. Related Party Transactions and Note 10. Convertible Note Payable - Related Party). The Company’s net cash used in operating activities for the year ended June 30, 2019 was approximately $6.3 million, and current projections indicate that the Company will have continued negative cash flows from operating activities for the foreseeable future.

We have been funding our business principally through sales of equity securities, and we expect to continue to fund our business through the sale of additional equity securities. The current primary potential source of cash available to us is proceeds from the exercise of warrants to purchase shares of our Series B preferred stock, which warrants were issued in October 2018 and May 2019. In addition, we may receive payments upon the achievement of milestones pursuant to our license agreement with Alfasigma or similar license agreements in the future. There can be no assurance of the exercise of warrants or the receipt of milestone payments in the future.

Our ability to successfully raise sufficient funds through the sale of equity securities, when needed, is uncertain and subject to market conditions generally, the market for our common stock and other risks. These factors, among others, raise substantial doubt about our ability to continue as a going concern for the next 12 months. If we are unable to meet our financial obligations, we could be forced to cease all operations, in which event investors may lose their entire investment in the Company. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We need to raise substantial additional capital in the future to fund our operations and we may be unable to raise such funds when needed and on acceptable terms, which could prevent us from fully implementing our business, operating and development plans.

The Company has a history of losses, primarily due to being a mid-stage developmental pharmaceutical company. The Company intends on financing its future development activities largely from a variety of sources, including the sale of equity securities and seeking relationships with partners to help fund future clinical trial costs. However, there is no assurance these plans will be realized and that any additional financing will be available to us on satisfactory terms and conditions, if at all. In the event that we are unable to raise additional funds, we may be required to delay, reduce or severely curtail our operations or otherwise impede our ongoing efforts to develop our drug candidates, which could have a material adverse effect on our business, operating results, financial condition and long-term prospects.

We had an approximate $0.8 million cash balance in the bank as of September 30, 2019, but that is insufficient to complete the development and commercialization of any of our proposed products. We expect to incur costs of approximately $11.5 million in the upcoming fiscal year ending June 30, 2020 to operate our business in accordance with our business plans and budgets.

If we raise additional funds by issuing equity securities, our stockholders will experience dilution. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. Any debt financing or additional equity that we raise may contain terms, such as liquidation and other preferences, which are not favorable to us or our stockholders. If we raise additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish valuable rights to our technologies, future revenue streams or product candidates or to grant licenses on terms that may not be favorable to us.

Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, it may be necessary to significantly reduce our current rate of spending through reductions in staff and delaying, scaling back or stopping certain research and development programs, including costly Phase 2 and Phase 3 clinical trials, and our business, operating results, financial condition and prospects could be materially and adversely affected and we may be unable to continue our operations. As of the date of this prospectus, we have already delayed incurring additional expenses for Kevetrin and completing bridging toxicology work for oral dosing. In the event that we cannot obtain acceptable financing, we would be unable to complete preclinical development projects, and further clinical trials for Brilacidin and Kevetrin. This will delay:

|

|

●

|

research and development programs;

|

|

|

|

|

|

|

●

|

preclinical studies and clinical trials;

|

|

|

|

|

|

|

●

|

material characterization studies;

|

|

|

|

|

|

|

●

|

regulatory processes; and

|

|

|

|

|

|

|

●

|

establishment of our own laboratory or a search for third party marketing partners to market our products for us.

|

The amount of capital we may require will depend on many factors, including the:

|

|

●

|

progress, timing and scope of our research and development programs;

|

|

|

|

|

|

|

●

|

progress, timing and scope of our preclinical studies and clinical trials;

|

|

|

|

|

|

|

●

|

time and cost necessary to obtain regulatory approvals;

|

|

|

|

|

|

|

●

|

time and cost necessary to establish our own marketing capabilities or to seek marketing partners;

|

|

|

|

|

|

|

●

|

time and cost necessary to respond to technological and market developments;

|

|

|

|

|

|

|

●

|

changes made or new developments in our existing collaborative, licensing and other commercial relationships; and

|

|

|

|

|

|

|

●

|

new collaborative, licensing and other commercial relationships that we may establish.

|

Our fixed expenses, such as rent and other contractual commitments, may increase in the future, as we may:

|

|

●

|

enter into leases for new facilities and capital equipment; and

|

|

|

|

|

|

|

●

|

enter into additional licenses and collaborative agreements.

|

We have no products approved for commercial sale, have never generated any revenues, and may never achieve revenues or profitability.

We currently have no products approved for commercial sale and, to date, we have not generated any revenues. Our ability to generate revenue depends heavily on:

|

|

●

|

successful demonstration in clinical trials that our drug candidates, Brilacidin and Kevetrin are safe and effective;

|

|

|

|

|

|

|

●

|

our ability to seek and obtain regulatory approvals, including with respect to the indications we are seeking;

|

|

|

|

|

|

|

●

|

the successful commercialization of our product candidates; and

|

|

|

|

|

|

|

●

|

market acceptance of our products.

|

If we do not successfully develop and commercialize at least one of our compounds, we will not achieve revenues or profitability in the foreseeable future, if at all. If we are unable to generate revenues or achieve profitability, we may be unable to continue our operations.

In our existing or any future potential collaborations or partnerships, we will likely not be able to control all aspects of the development and commercialization of our compounds. This lack of control could subject us to additional risks that could harm our business.

Collaborations or license agreements involving our compounds, including our current license agreement with Alfasigma S.p.A. and any future collaboration or partnering arrangement with other pharmaceutical companies, are subject to numerous risks, which may include:

|

|

●

|

partners have significant discretion in determining the efforts and resources that they will apply to collaborations;

|

|

|

|

|

|

|

●

|

partners may not pursue development and commercialization of our compounds or may elect not to continue or renew development or commercialization programs based on clinical study results, changes in their strategic focus due to the acquisition of competitive products, availability of funding, or other external factors, such as a business combination that diverts resources or creates competing priorities;

|

|

|

|

|

|

|

●

|

partners may delay clinical studies, provide insufficient funding for a clinical study program, stop a clinical study, abandon a product candidate, repeat or conduct new clinical studies, or require a new formulation of a product candidate for clinical testing;

|

|

|

|

|

|

|

●

|

partners could independently develop, or develop with third parties, products that compete directly or indirectly with our compounds;

|

|

|

●

|

a partner with marketing, manufacturing, and distribution rights to one or more compounds may not commit sufficient resources to or otherwise not perform satisfactorily in carrying out these activities;

|

|

|

|

|

|

|

●

|

we could grant exclusive rights to our partners that would prevent us from collaborating with others;

|

|

|

|

|

|

|

●

|

partners may not properly maintain or defend our intellectual property rights or may use our intellectual property or proprietary information in a way that gives rise to actual or threatened litigation that could jeopardize or invalidate our intellectual property or proprietary information or expose us to potential liability;

|

|

|

|

|

|

|

●

|

partners may not aggressively or adequately pursue litigation concerning our compounds or may settle such litigation on unfavorable terms, as they may have different economic interests than ours, and such decisions could negatively impact any royalties we may receive under our license agreements;

|

|

|

|

|

|

|

●

|

disputes may arise between us and a partner that causes the delay or termination of the research, development, or commercialization of our current or future compounds or that results in costly litigation or arbitration that diverts management attention and resources;

|

|

|

|

|

|

|

●

|

agreements may be terminated, possibly at-will, without penalty, and, if terminated, may result in a need for additional capital to pursue further development or commercialization of the applicable compounds;

|

|

|

|

|

|

|

●

|

partners may own or co-own intellectual property covering our products that results from our collaborating with them, and in such cases, we would not have the exclusive right to commercialize such intellectual property; and

|

|

|

|

|

|

|

●

|

a partner’s sales and marketing activities or other operations may not be in compliance with applicable laws resulting in civil or criminal proceedings.

|

We depend on our license agreement with Alfasigma for the development and commercialization of Brilacidin for localized treatment of ulcerative proctitis/ulcerative proctosigmoiditis (UP/UPS).

On July 18, 2019, we entered into a license agreement with Alfasigma, under which we granted Alfasigma the worldwide right to develop, manufacture and commercialize locally-administered Brilacidin for the treatment of ulcerative proctitis/ulcerative proctosigmoiditis (UP/UPS). Pursuant to the terms of the license agreement, Alfasigma is obligated to use commercially reasonable efforts (as defined in the license agreement) to develop, manufacture and commercialize Brilacidin for UP/UPS, and to achieve specified developmental milestones.

Under the terms of the license agreement, Alfasigma will make payments of up to $24.0 million to the Company based upon the achievement of certain milestones. In addition, Alfasigma will pay a royalty to the Company equal to six percent of net sales of Brilacidin for UP/UPS, subject to adjustment as provided in the license agreement.

The right to potential future payments under the license agreement represents a significant portion of the value of the license agreement to us. We cannot be certain that we will receive any future payments under the license agreement, which would adversely affect the trading price of our common stock and our business prospects.

Additionally, if Alfasigma were to breach or terminate the license agreement, we may not be able to obtain, or may be delayed in obtaining, marketing approvals for Brilacidin for UP/UPS and will not be able to, or may be delayed in our efforts to, successfully commercialize Brilacidin for UP/UPS. We may not be able to seek and obtain a viable, alternative collaborator to partner for the development and commercialization of the licensed products on similar terms or at all.

We have limited experience in drug development and may not be able to successfully develop any drugs.

We have limited experience in drug development and may not be able to successfully develop any drugs. Our ability to achieve revenues and profitability in our business will depend, among other things, on our ability to:

|

|

●

|

develop products internally or obtain rights to them from others on favorable terms;

|

|

|

|

|

|

|

●

|

complete laboratory testing and human clinical studies;

|

|

|

|

|

|

|

●

|

obtain and maintain necessary intellectual property rights to our products;

|

|

|

|

|

|

|

●

|

successfully fulfill regulatory requirements to obtain requisite marketing approvals from governmental agencies;

|

|

|

|

|

|

|

●

|

enter into arrangements with third parties to manufacture our products on our behalf; and

|

|

|

|

|

|

|

●

|

enter into arrangements with third parties to provide sales and marketing functions.

|

We have limited experience conducting clinical trials and obtaining regulatory approvals, and we may not be successful in some or all of these activities. We have not previously conducted a Phase 3 or later stage clinical trial such as the Phase 3 clinical trials planned for our most advanced drug candidate. We expect to spend significant amounts to recruit and retain highly quality personnel with clinical development experience.

We have no experience as a company in the sales, marketing and distribution of pharmaceutical products and do not currently have a sales and marketing organization. To the extent we are unable to, or determine not to develop these resources internally, we may be forced to rely on third parties for these capabilities, which could subject us to costs and to delays that are outside our control. If we are unable to establish adequate capabilities independently or with others, we may be unable to generate product revenues for certain candidates. If we are unable to achieve revenues and profitability, then we will be forced to cease operations, which could cause you to lose all of your investment.

Development of pharmaceutical products is a risky and time-consuming process subject to a number of factors, many of which are outside of our control. We are subject to regulatory authority permissions and approvals, most importantly the FDA. Many of our drug candidates are at early and mid-stages of development. Consequently, we can provide no assurance of the successful and timely development of new drugs, and the failure to do so could cause us to cease operations.

The drug discovery and development process is highly uncertain and we have not developed, and may never develop, a drug candidate that ultimately leads to a commercially viable drug. Our drug candidates are in early and mid-stages of development, and our most advanced drug candidate has completed Phase 2 testing. Further development and extensive testing will be required to determine their technical feasibility and commercial viability.

Conducting clinical trials is a complex, time-consuming and expensive process that requires an appropriate number of trial sites and patients to support the product label claims being sought. The length of time, number of trial sites and number of patients required for clinical trials vary substantially according to their type, complexity, novelty and the drug candidate’s intended use, and we may spend several years completing certain trials. The time within which we can complete our clinical trials depends in large part on the ability to enroll eligible patients who meet the enrollment criteria and who are in proximity to the trial sites. We face competition with other clinical trials for eligible patients. As a result, there may be limited availability of eligible patients, which can result in increased development costs, delays in regulatory approvals and associated delays in drug candidates reaching the market. We experienced these issues in our psoriasis and oral mucositis clinical trials.

At any time, we, the FDA or an institutional review board (“IRB”), may temporarily or permanently stop a clinical trial, for a variety of reasons. We may experience numerous unforeseen events during, or as a result of, the clinical development process that could delay or prevent our drug candidates from being approved, including:

|

|

●

|

failure to achieve clinical trial results that indicate a candidate is effective in treating a specified condition or illness in humans;

|

|

|

|

|

|

|

●

|

presence of harmful side effects;

|

|

|

|

|

|

|

●

|

determination by the FDA that the submitted data do not satisfy the criteria for approval;

|

|

|

|

|

|

|

●

|

lack of commercial viability of the drug;

|

|

|

|

|

|

|

●

|

failure to acquire, on reasonable terms, intellectual property rights necessary for commercialization; and

|

|

|

|

|

|

|

●

|

existence of alternative therapeutics that are more effective.

|

As our product candidates advance to later stage clinical trials, it is customary that various aspects of the development program, such as manufacturing, formulation and other processes, and methods of administration, may be altered to optimize the candidates and processes for scale-up necessary for later stage clinical trials and potential approval and commercialization. These changes may not produce the intended optimization, including production of drug substance and drug product of a quality and in a quantity sufficient for Phase 3 clinical stage development or for commercialization, which may cause delays in the initiation or completion of clinical trials and greater costs. We may also need to conduct “bridging studies” to demonstrate comparability between newly manufactured drug substance and/or drug product for commercialization relative to previously manufactured drug substance and/or drug product for clinical trials. Demonstrating comparability may require us to incur additional costs or delay initiation or completion of clinical trials and, if unsuccessful, could require us to complete additional preclinical studies or clinical trials.

We learned during our completed Kevetrin Phase 1 study Kevetrin IV was almost completely out of plasma within 24 hours. Therefore, little drug remains for any substantial period of time afterwards. Having the patient receive multiple IV infusions per week is a difficult course of treatment. Therefore, an oral formulations for Kevetrin is needed. There is no assurance we will be successful in developing an oral formulation.

We used Brilacidin in a water base, administered by enema, in our ulcerative proctitis study. However, a commercial product for Inflammatory Bowel Disease will need a different formulation (e.g. Brilacidin in capsule or foam). Additional formulation development is needed. There is no assurance we will be successful in developing new formulations for possible commercialization.

If we fail to adequately manage the increasing number, size and complexity of clinical trials, the clinical trials and corresponding regulatory approvals may be delayed or we or our partners may fail to gain approval for our drug candidates altogether. Even if we successfully conduct clinical trials, we may not obtain favorable clinical trial results and may not be able to obtain regulatory approval on this basis. If we are unable to market and sell our drug candidates or are unable to obtain approvals in the time frame needed to execute our product strategies, our business and results of operations would be materially adversely affected.

Our success will depend on our ability to achieve scientific and technological advances and to translate such advances into reliable, commercially competitive drugs on a timely basis. The length of time required to complete clinical studies, submit an application for marketing approval, and obtain approval can vary considerably from one product to another, and may be difficult to predict or control. Drugs that we may develop are not likely to be commercially available for several years, if ever. The proposed development schedules for our drug candidates may be affected by a variety of factors, including technological difficulties, proprietary technology of others, and changes in government regulation, many of which will not be within our control.

Any delay in the development, introduction or marketing of our drug candidates could result either in such drugs being marketed at a time when their cost and performance characteristics would not be competitive in the marketplace or in the shortening of their commercial lives. In light of the long-term nature of our projects, the unproven technology involved and the other factors described elsewhere in “Risk Factors”, we may not be able to complete successfully the development or marketing of any of our drug candidates.

We may fail to successfully develop and commercialize our drug candidates for multiple reasons, including because they:

|

|

●

|

are found to be unsafe or ineffective in clinical trials;

|

|

|

|

|

|

|

●

|

do not receive necessary approval from the FDA or foreign regulatory agencies;

|

|

|

|

|

|

|

●

|

have manufacturing production problems, costs, pricing or reimbursement issues, or other factors that make the product not economical;

|

|

|

|

|

|

|

●

|

are hampered by the proprietary rights of others and their competing products and technologies;

|

|

|

|

|

|

|

●

|

fail to conform to a changing standard of care for the diseases they seek to treat; or

|

|

|

|

|

|

|

●

|

are less effective or more expensive than current or alternative treatment methods.

|

Drug development failure can occur at any stage of clinical trials and as a result of many factors and there can be no assurance that we will reach our anticipated clinical targets. Promising results in preclinical development or early clinical trials may not be predictive of results obtained in later clinical trials. Many pharmaceutical companies have experienced significant setbacks in advanced clinical trials, even after obtaining promising results in earlier preclinical studies and clinical trials. Clinical results are susceptible to varying interpretations that may delay, limit, or prevent regulatory approvals.

Even if we complete our clinical trials, we do not know what the long-term effects of exposure to our drug candidates will be. Furthermore, our drug candidates may be used in combination with other treatments and there can be no assurance that such use will not lead to unique safety issues. Failure to complete clinical trials or to prove that our drug candidates are safe and effective would have a material adverse effect on our ability to generate revenue and could require us to reduce the scope of or discontinue our operations, which could cause you to lose all of your investment.

At any time, we may decide to discontinue the development of, or to not commercialize, a drug candidate, such as our decision in December 2018 to discontinue the Prurisol psoriasis program. If we terminate a program in which we have invested significant resources, we will not receive any return on our investment and we will have missed the opportunity to allocate those resources to potentially more productive uses.

We have limited experience in conducting or supervising clinical trials and must outsource all clinical trials, which exposes us to risks which could have a materially adverse effect on our business.

We have limited experience in conducting and supervising clinical trials that must be performed to obtain data to submit in applications for approval by the FDA. Because we have limited experience in conducting or supervising clinical trials, we outsource a significant amount of the work relating to our clinical trials to third parties. We therefore have less control over the conduct of our clinical trials, the timing and completion of the trials, the required reporting of adverse events, and the management of data developed through the trials than would be the case if we were relying entirely upon our own staff. We also have more limited control over compliance with procedures and protocols used to complete clinical trials. If these contractors fail to meet applicable regulatory standards, the testing of our drugs would be adversely affected, causing a delay in our ability to engage in revenue-generating operations that could have a materially adverse effect on our business.

Communicating with outside parties can also be challenging, potentially leading to mistakes, as well as difficulties in coordinating activities. Outside parties may have staffing difficulties, may undergo changes in priorities or may become financially distressed, adversely affecting their willingness or ability to conduct our trials. We may experience unexpected cost increases that are beyond our control. Problems with the timeliness or quality of the work of a contract research organization may lead us to seek to terminate the relationship and use an alternative service provider. However, making this change may be costly and may delay our trials and contractual restrictions may make such a change difficult or impossible. Additionally, it may be impossible to find a replacement organization that can conduct our trials in an acceptable manner and at an acceptable cost.

Success in early clinical trials may not be predictive or indicative of results in current ongoing clinical trials or potential future clinical trials. Likewise, preliminary data from clinical trials should be considered carefully and with caution since the final data may be materially different from the preliminary data, particularly as more patient data become available.

A number of new drugs and biologics have shown promising results in preclinical studies and initial clinical trials, but subsequently have failed to establish sufficient safety and efficacy data to obtain necessary regulatory approvals to initiate commercial sale. There is typically an extremely high rate of attrition from the failure of product candidates proceeding through clinical trials. Data obtained from preclinical and clinical activities are subject to varying interpretations, which may delay, limit or prevent regulatory approval. Product candidates in later stages of clinical trials may fail to show the desired benefit-risk profile despite having progressed through preclinical studies and initial clinical trials. As a result, data from our preclinical studies and Phase 1 and Phase 2 clinical trials of our drug candidates Brilacidin and Kevetrin, as well as the results of the past or future internal data reviews, should not be relied upon as predictive or indicative of future clinical results. The results we have previously obtained, as well as any future results, may not predict the future therapeutic benefit of our drug candidates.

In addition, from time-to-time, preliminary or interim data from clinical trials, such as relating to the Brilacidin Phase 2, open-label, Proof-of-Concept (PoC) clinical trial, or potential future clinical trials, may be reported or announced by us or the clinical investigators and medical institutions with which we work. Such data are preliminary and the data from any final analysis may be materially different. Even if final safety and/or efficacy data are positive, significant additional clinical testing will be necessary to advance the future development of our drug candidates. Preliminary or interim results may also not be reproduced in any potential future clinical trials. Accordingly, preliminary or interim data should be considered carefully and with caution.

We are subject to risks inherent in conducting clinical trials. Non-compliance with the FDA’s good clinical practices by clinical investigators, clinical sites, or data management services could delay or prevent us from developing or commercializing our drug candidates, which could cause us to cease operations.

Agreements with clinical investigators and medical institutions for clinical testing and with other third parties for data management services place substantial responsibilities on these parties, which could result in delays in, or termination of, our clinical trials if these parties fail to perform as expected. For example, if any of our clinical trial sites fail to comply with FDA-approved good clinical practices, we may be unable to use the data gathered at those sites. If these clinical investigators, medical institutions or other third parties do not carry out their contractual duties or obligations or fail to meet expected deadlines, or if the quality or accuracy of the clinical data they obtain is compromised due to their failure to adhere to our clinical protocols or for other reasons, our clinical trials may be extended, delayed or terminated, and we may be unable to obtain regulatory approval for or successfully commercialize our drug candidates.

We or regulators may suspend or terminate our clinical trials for a number of reasons. We may voluntarily suspend or terminate our clinical trials if at any time we believe that they present an unacceptable risk to the patients enrolled in our clinical trials. In addition, regulatory agencies may order the temporary or permanent discontinuation of our clinical trials at any time if they believe that the clinical trials are not being conducted in accordance with applicable regulatory requirements or that they present an unacceptable safety risk to the patients enrolled in our clinical trials. In addition, clinical trials may have independent monitoring boards composed of experts in the field. These boards may also have the authority to suspend or terminate clinical trials.

Our clinical trial operations are and will be subject to regulatory inspections at any time. If regulatory inspectors conclude that we or our clinical trial sites are not in compliance with applicable regulatory requirements for conducting clinical trials, we may receive reports of observations or warning letters detailing deficiencies, and we will be required to implement corrective actions. If regulatory agencies deem our responses to be inadequate, or are dissatisfied with the corrective actions that we or our clinical trial sites have implemented, our clinical trials may be temporarily or permanently discontinued, we may be fined, we or our investigators may be precluded from conducting any ongoing or any future clinical trials, the government may refuse to approve our marketing applications or allow us to manufacture or market our drug candidates or we may be criminally prosecuted. If we are unable to complete clinical trials and have our products approved due to our failure to comply with regulatory requirements, we will be unable to commence revenue-generating operations, which could force us to cease operations.

Delays in the commencement or completion of clinical testing could result in increased costs to us and delay or limit our ability to generate revenues.

Delays in the commencement or completion of clinical testing of our products or products could significantly affect our product development costs and our ability to generate revenue. We do not know whether the FDA will agree with the trial designs for ongoing and planned clinical trials or whether planned clinical trials will begin on time or be completed on schedule, if at all. The commencement and completion of clinical trials can be delayed for a number of reasons, including delays related to our ability to do the following:

|

|

●

|

provide sufficient safety, efficacy or other data regarding a drug candidate to support the commencement of a Phase 3 or other clinical trial;

|

|

|

|

|

|

|

●

|

reach agreement on acceptable terms with prospective contract manufacturers, contract research organizations (CROs) and trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different third parties;

|

|

|

|

|

|

|

●

|

select CROs, trial sites and, where necessary, contract manufacturers that do not encounter any regulatory compliance problems;

|

|

|

|

|

|

|

●

|

manufacture sufficient quantities of a product candidate for use in clinical trials;

|

|

|

|

|

|

|

●

|

obtain IRB approval to conduct a clinical trial at a prospective site;

|

|

|

|

|

|

|

●

|

recruit and enroll patients to participate in clinical trials, which can be impacted by many factors outside our or our partners’ control, including competition from other clinical trial programs for the same or similar indications; and

|

|

|

|

|

|

|

●

|

retain patients who have initiated a clinical trial but may be prone to withdraw due to side effects from the therapy, lack of efficacy or personal issues.

|

Clinical trials may also be delayed as a result of ambiguous or negative interim results. In addition, a clinical trial may be suspended or terminated by us or our partner, the FDA, an IRB, a clinical trial site with respect to that site, or other regulatory authorities due to a number of factors, including:

|

|

●

|

failure to conduct the clinical trial in accordance with regulatory requirements, including GCP, or our protocols;

|

|

|

|

|

|

|

●

|

inspection of the clinical trial operations, trial sites or manufacturing facility by the FDA or other regulatory authorities resulting in findings of non-compliance and the imposition of a clinical hold;

|

|

|

|

|

|

|

●

|

unforeseen safety issues or results that do not demonstrate efficacy; and

|

|

|

|

|

|

|

●

|

lack of adequate funding to continue the clinical trial.

|

Additionally, we may need to amend clinical trial protocols for a variety of reasons, including changes in regulatory requirements and guidance. Such amendments may require us to, for example, resubmit our clinical trial protocols to IRBs for reexamination, which may impact the costs, timing or successful completion of a clinical trial. We may decide to terminate a clinical study for commercial reasons including increased market availability of generic treatments. If we experience delays in completion of, or if we terminate, any of our clinical trials, the commercial prospects for our product candidates may be harmed and our ability to generate product revenues will be delayed and/or reduced. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of a product candidate.

We must comply with significant and complex government regulations, compliance with which may delay or prevent the commercialization of our drug candidates, which could have a materially adverse effect on our business.

The R&D, manufacture and marketing of drug candidates are subject to regulation, primarily by the FDA in the United States, and by comparable authorities in other countries. These national agencies and other federal, state, local and foreign entities regulate, among other things, R&D activities (including testing in animals and in humans) and the testing, manufacturing, handling, labeling, storage, record keeping, approval, advertising and promotion of the products that we are developing. Noncompliance with applicable requirements can result in various adverse consequences, including approval delays or refusals to approve drug licenses or other applications, suspension or termination of clinical investigations, revocation of approvals previously granted, fines, criminal prosecution, recalls or seizures of products, injunctions against shipping drugs and total or partial suspension of production and/or refusal to allow a company to enter into governmental supply contracts.

The process of obtaining FDA approval for a drug has historically been costly and time consuming. Current FDA requirements for a new human drug or biological product to be marketed in the United States include: (i) the successful conclusion of pre-clinical laboratory and animal tests, if appropriate, to gain preliminary information on the product’s safety; (ii) filing with the FDA of an IND application to conduct human clinical trials for drugs or biologics; (iii) the successful completion of adequate and well-controlled human clinical investigations to establish the safety and efficacy of the product for its recommended use; and (iv) filing by a company and acceptance and approval by the FDA of a New Drug Application (“NDA”), for a drug product or a biological license application (“BLA”), for a biological product to allow commercial distribution of the drug or biologic. A delay in one or more of the procedural steps outlined above could be harmful to the Company in terms of getting our drug candidates through clinical testing and to market.

The FDA reviews the results of the clinical trials and may order the temporary or permanent discontinuation of clinical trials at any time if it believes the drug candidate exposes clinical subjects to an unacceptable health risk. Investigational drugs used in clinical studies must be produced in compliance with cGMP rules pursuant to FDA regulations.

Sales outside the United States of products that we may develop will also be subject to additional regulatory requirements governing human clinical trials and marketing for drugs and biological products and devices. The requirements vary widely from country to country, but typically the registration and approval process takes several years and requires significant resources.

We also are subject to the following risks and obligations, related to the approval of our products:

|

|

●

|

The FDA or foreign regulators may interpret data from pre-clinical testing and clinical trials in different ways than we interpret them.

|

|

|

|

|

|

|

●

|

If regulatory approval of a product is granted, the approval may be limited to specific indications or limited with respect to its distribution. In addition, many foreign countries control pricing and coverage under their respective national social security systems.

|

|

|

|

|

|

|

●

|

The FDA or foreign regulators may not approve our manufacturing processes or manufacturing facilities.

|

|

|

|

|

|

|

●

|

The FDA or foreign regulators may change their approval policies or adopt new regulations.

|

|

|

|

|

|

|

●

|

Even if regulatory approval for any of our product is obtained, the corresponding marketing license will be subject to continual review, and newly discovered or developed safety or effectiveness data may result in suspension or revocation of the marketing license.

|

|

|

|

|

|

|

●

|

If regulatory approval of the product candidate is granted, the marketing of that product would be subject to adverse event reporting requirements and a general prohibition against promoting products for unapproved uses.

|

|

|

|

|

|

|

●

|

In some foreign countries, we may be subject to official release requirements that require each batch of the product we produce to be officially released by regulatory authorities prior to its distribution by us.

|

|

|

|

|

|

|

●

|

We will be subject to continual regulatory review and periodic inspection and approval of manufacturing modifications, including compliance with cGMP regulations.

|

If we do not have the requisite resources to comply with all applicable regulations, then we could be forced to cease operations, which could cause you to lose all of your investment.

We or third-party manufacturers we rely on may encounter failures or difficulties in manufacturing or formulating clinical development and commercial supplies of drugs, which could delay the clinical development or regulatory approval of our drug candidates, or their ultimate commercial production if approved.

Currently, third parties manufacture our drug candidates on our behalf. Third-party manufacturers may lack capacity to meet our needs, go out of business or fail to perform. In addition, supplies of raw materials needed for manufacturing or formulation of clinical supplies may not be available or in short supply. Furthermore, should we obtain FDA or EMA approval for any of our drug candidates, we expect to rely, at least to some extent, on third-party manufacturers for commercial production. Our dependence on others for the manufacture of our drug candidates may adversely affect our ability to develop and deliver such drug candidates on a timely and competitive basis.

Any performance failure on the part of a third-party manufacturer could delay clinical development, regulatory approval or, ultimately, sales of our drug candidates. Our third-party manufacturers may encounter difficulties involving production yields, regulatory compliance, lot release, quality control and quality assurance, as well as shortages of qualified personnel. Approval of our drug candidates could be delayed, limited or denied if the FDA does not approve our or a third-party manufacturer’s processes or facilities. Moreover, the ability to adequately and timely manufacture and supply drug candidates is dependent on the uninterrupted and efficient operation of the manufacturing facilities, which is impacted by many manufacturing variables including:

|

|

●

|

availability or contamination of raw materials and components used in the manufacturing process, particularly those for which we have no other source or supplier;

|

|

|

|

|

|

|

●

|

capacity of our facilities or those of our contract manufacturers;

|

|

|

|

|

|

|

●

|

facility contamination by microorganisms or viruses or cross contamination;

|

|

|

|

|

|

|

●

|

compliance with regulatory requirements, including Form 483 notices and Warning Letters;

|

|

|

|

|

|

|

●

|

changes in forecasts of future demand;

|

|

|

|

|

|

|

●

|

timing and actual number of production runs;

|

|

|

|

|

|

|

●

|

production success rates and bulk drug yields; and

|

|

|

|

|

|

|

●

|

timing and outcome of product quality testing.

|

In addition, our third-party manufacturers may encounter delays and problems in manufacturing our drug candidates or drugs for a variety of reasons, including accidents during operation, failure of equipment, delays in receiving materials, natural or other disasters, political or governmental changes, or other factors inherent in operating complex manufacturing facilities. Supply chain management is complex, and involves sourcing from a number of different companies and foreign countries. Commercially available starting materials, reagents and excipients may become scarce or more expensive to procure, and we may not be able to obtain favorable terms in agreements with contractors or subcontractors. Our third-party manufacturers may not be able to operate our respective manufacturing facilities in a cost-effective manner or in a time frame that is consistent with our expected future manufacturing needs. If we or our third-party manufacturers cease or interrupt production or if our third-party manufacturers and other service providers fail to supply materials, products or services to us for any reason, such interruption could delay progress on our programs, or interrupt the commercial supply, with the potential for additional costs and lost revenues. If this were to occur, we may also need to seek alternative means to fulfill our manufacturing needs.

We may not be able to enter into agreements for the manufacture of our drug candidates with manufacturers whose facilities and procedures comply with applicable law. Manufacturers are subject to ongoing periodic unannounced inspection by the FDA and corresponding state and foreign authorities to ensure strict compliance with cGMP and other applicable government regulations and corresponding foreign standards. We do not have control over a third-party manufacturer’s compliance with these regulations and standards. If one of our manufacturers fails to maintain compliance, we or they could be subject to enforcement, the production of our drug candidates could be interrupted or suspended, and/or our product could be recalled or withdrawn, among other consequences. Any of these events could result in delays, additional costs and potentially lost revenues.

We can provide no assurance that our drug candidates will obtain regulatory approval or that the results of clinical studies will be favorable, and if we fail to obtain such approval or if clinical studies are not favorable, we could be forced to cease operations.

Our drug candidates Brilacidin and Kevetrin will require lengthy and costly studies in humans to obtain approval from the FDA before they can be marketed. We cannot predict with any certainty that the study results will be satisfactory to the FDA for approval to ultimately be granted. Preclinical and clinical trials may reveal that one or more products are ineffective or unsafe, in which event further development of such products could be seriously delayed or terminated.

Approval of a drug candidate as safe and effective for use in humans is never certain and regulatory agencies may delay or deny approval of drug candidates for commercialization. For example, even though our product candidate Brilacidin has received QIDP designation, such designation may not result in a faster development process, review, or approval than drugs considered for approval under conventional FDA procedures; nor does such designation assure ultimate approval by the FDA or related exclusivity benefits. Regulatory agencies also may delay or deny approval based on additional government regulation or administrative action, changes in regulatory policy during the period of clinical trials in humans and regulatory review, or the availability of alternative treatments.

Delays in obtaining, or failure to obtain, FDA or any other necessary regulatory approvals of any proposed drugs would have an adverse effect on the drug’s potential commercial success and on our business, prospects, financial condition and results of operations. In addition, it is possible that a proposed drug may be found to be ineffective or unsafe due to conditions or facts that arise after development has been completed and regulatory approvals have been obtained. In this event, we may be required to withdraw such drug from the market. To the extent that our success will depend on any regulatory approvals from government authorities outside of the United States that perform roles similar to that of the FDA, uncertainties similar to those stated above will also exist.