Current Report Filing (8-k)

September 17 2019 - 8:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported) September 12, 2019

INNERSCOPE HEARING TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified

in Charter)

|

Nevada

|

|

(State or Other Jurisdiction of Incorporation)

|

|

000-55754

|

|

46-3096516

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

2151 Professional Drive, 2nd

Floor

Roseville, CA

|

|

95661

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

|

(916) 218-4100

|

|

(Registrant’s telephone number, including area code)

|

|

Not applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☑

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into Material Definitive Agreement.

|

On

September 12, 2019, InnerScope Hearing Technologies, Inc. (the “Company”) entered into an Equity Purchase

Agreement (the “Equity Agreement”)

with Oscaleta Partners LLC, a Connecticut limited partnership (the “Investor”), with the Investor committing to purchase

up to $10,000,000 of the Company’s common stock, following an effective registration of the shares and subject to restrictions

regarding the total percentage stock ownership held by the Investor. The purchase price for each tranche of shares to be sold to

the Investor will be 85% of the lowest closing price of the common stock (the “Market Price”) for any trading day during

the five (5) trading days immediately following the date in which an estimated number of put shares (calculated pursuant to the

terms the Equity Agreement) have been deposited into the Investor’s brokerage account and cleared to trade (the “Valuation

Period”); provided, however, that if a Valuation Event (as defined in the Equity Agreement, and including dilutive events

like paying a dividend in shares of common stock, issuing Company securities convertible into common stock, and issuing shares

of common stock at a price per share less than purchase price being paid by the Investor) occurs during any Valuation Period, a

new Valuation Period shall begin on the trading day immediately after the occurrence of such Valuation Event and end on the fifth

(5th) t rading

day thereafter.

The obligation of the Investor to purchase

shares pursuant to the Equity Agreement is subject to several conditions, including (i) that the Company has filed a registration

statement (the “Registration Statement”) with the United States Securities and Exchange Commission (the “SEC”)

registering the shares to be sold to the Investor, with the Registration Statement being declared effective prior to sale of any

shares to the Investor; and (ii) that the purchase of shares by the Investor pursuant to the Equity Agreement shall not cause the

Investor to own more than 9.99% of the outstanding shares of the Company’s common stock.

In connection with the Equity Agreement,

on September 12, 2019, the Company also entered into a Registration Rights Agreement with the Investor (the “Registration

Rights Agreement”), requiring the Company to, within one hundred twenty (120) days after the date of the Registration Rights

Agreement, file a Registration Statement with respect to not less than the maximum number of shares of common stock that would

be allowed under Rule 415 promulgated under the Securities Act of 1933, and thereafter use all commercially reasonable efforts

to cause such Registration Statement relating to the Registered Securities to become effective within five (5) business days after

notice from the SEC that such Registration Statement may be declared effective, and keep the Registration Statement effective at

all times prior to the termination of the Equity Agreement until the earliest of (i) the date that is three months after the completion

of the last closing date under the Equity Agreement, (ii) the date when the Investor may sell all registered shares under Rule

144 without volume limitations, or (iii) the date the Investor no longer owns any of the registered shares (collectively, the "Registration

Period"), which Registration Statement (including any amendments or supplements, thereto and prospectuses contained therein)

shall not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary

to make the statements therein, in the light of the circumstances under which they were made, not misleading.

Additionally, on September 12, 2019,

the Company issued to the Investor a promissory note in the amount of $25,000 (“the Note”) which matures on March 31,

2020, and bears interest at the rate of 10% per annum.

The foregoing descriptions of the Equity

Agreement, Registration Rights Agreement and the Note are qualified in their entirety by the full text of such agreements, which

are filed as Exhibits 10.1, 10.2 and 10.3, respectively, to, and incorporated by reference in, this report.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information

regarding the Note in Item 1.01 above are incorporated by reference into this Item 2.03.

On

September 17, 2019, the Company issued a press release announcing the Equity Purchase Agreement, Registration

Rights Agreement and the Promissory Note. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated

by reference.

|

Item 9.01

|

Financial Statements and

Exhibits.

|

The exhibits listed in the following

Exhibit Index are filed as part of this Current Report on Form 8-K.

|

|

10.1

|

Equity Purchase Agreement by and between InnerScope Hearing Technologies, Inc. and Oscaleta Partners

LLC, dated September 12, 2019

|

|

|

10.2

|

Registration Rights Agreement by and between InnerScope Hearing Technologies, Inc. and Oscaleta

Partners, LLC, dated September 12, 2019

|

|

|

10.3

|

Promissory Note Due March 31, 2020, issued to Oscaleta Partners LLC, dated September 12, 2019

|

|

|

99.1

|

Press release dated September 17, 2019.

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: September 17, 2019

INNERSCOPE HEARING TECHNOLOGIES, INC.

By: /s/ Matthew Moore

Matthew Moore

Chief Executive Officer

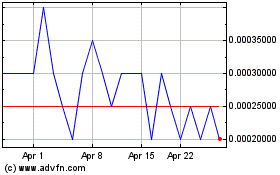

Innerscope Hearing Techn... (PK) (USOTC:INND)

Historical Stock Chart

From Mar 2024 to Apr 2024

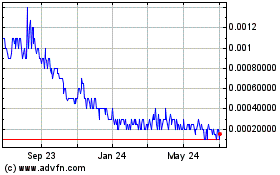

Innerscope Hearing Techn... (PK) (USOTC:INND)

Historical Stock Chart

From Apr 2023 to Apr 2024