0001349706

false

0001349706

2022-01-01

2022-06-30

0001349706

2021-12-31

0001349706

2020-12-31

0001349706

imhc:TURNONGREENINCMember

2021-12-31

0001349706

imhc:TURNONGREENINCMember

2020-12-31

0001349706

imhc:TURNONGREENINCMember

us-gaap:CommonClassAMember

2021-12-31

0001349706

imhc:TURNONGREENINCMember

us-gaap:CommonClassAMember

2020-12-31

0001349706

imhc:TURNONGREENINCMember

us-gaap:CommonClassBMember

2021-12-31

0001349706

imhc:TURNONGREENINCMember

us-gaap:CommonClassBMember

2020-12-31

0001349706

imhc:TURNONGREENINCMember

2022-06-30

0001349706

imhc:TURNONGREENINCMember

us-gaap:CommonClassAMember

2022-06-30

0001349706

imhc:TURNONGREENINCMember

us-gaap:CommonClassBMember

2022-06-30

0001349706

us-gaap:SeriesEPreferredStockMember

2021-12-31

0001349706

us-gaap:SeriesEPreferredStockMember

2020-12-31

0001349706

2021-01-01

2021-12-31

0001349706

2020-01-01

2020-12-31

0001349706

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

us-gaap:CommonStockMember

2019-12-31

0001349706

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001349706

us-gaap:RetainedEarningsMember

2019-12-31

0001349706

2019-12-31

0001349706

us-gaap:CommonStockMember

2020-12-31

0001349706

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001349706

us-gaap:RetainedEarningsMember

2020-12-31

0001349706

us-gaap:CommonStockMember

2020-01-01

2020-12-31

0001349706

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-31

0001349706

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001349706

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001349706

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001349706

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001349706

us-gaap:CommonStockMember

2021-12-31

0001349706

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001349706

us-gaap:RetainedEarningsMember

2021-12-31

0001349706

imhc:StockExchangeAgreementMember

2021-01-01

2021-12-31

0001349706

imhc:StockExchangeAgreementMember

2021-12-31

0001349706

imhc:MrPhilippeUhrikMember

2017-07-17

0001349706

us-gaap:CommonStockMember

2017-12-27

2017-12-28

0001349706

us-gaap:CommonStockMember

2017-12-28

0001349706

us-gaap:CommonStockMember

2018-02-21

2018-02-22

0001349706

us-gaap:CommonStockMember

2018-02-22

0001349706

imhc:CannacureMember

2019-04-01

2019-04-29

0001349706

srt:PresidentMember

2019-04-29

0001349706

imhc:StockExchangeAgreementMember

2021-12-09

2021-12-15

0001349706

imhc:DigitalPowerLendingLLCMember

2021-11-04

2021-11-05

0001349706

imhc:PromissoryNotesMember

2021-11-05

0001349706

2021-11-04

2021-11-05

0001349706

2021-11-05

0001349706

imhc:StockPurchaseAgreementMember

2021-12-10

2021-12-16

0001349706

2021-12-10

2021-12-16

0001349706

imhc:StockPurchaseAgreementMember

2021-12-16

0001349706

2020-01-01

2020-09-30

0001349706

srt:MinimumMember

2021-01-01

2021-12-31

0001349706

srt:MaximumMember

2021-01-01

2021-12-31

0001349706

us-gaap:CommonStockMember

2021-01-13

2021-02-22

0001349706

2021-02-22

0001349706

2021-01-13

2021-02-22

0001349706

us-gaap:CommonStockMember

2021-04-01

2021-12-31

0001349706

imhc:ServicesRenderedMember

2021-01-01

2021-12-31

0001349706

srt:ChiefExecutiveOfficerMember

2021-01-01

2021-12-31

0001349706

srt:ChiefExecutiveOfficerMember

2021-12-31

0001349706

imhc:OfficerLoanMember

2020-01-01

2020-12-31

0001349706

srt:ParentCompanyMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

srt:ParentCompanyMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

imhc:AllocationOfGeneralCorporateExpensesMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

imhc:AllocationOfGeneralCorporateExpensesMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

imhc:AllocationOfGeneralCorporateExpensesMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

imhc:AllocationOfGeneralCorporateExpensesMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

us-gaap:ParentMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

us-gaap:ParentMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

imhc:RelatedPartyMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

imhc:RelatedPartyMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

imhc:RelatedPartyMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

imhc:RelatedPartyMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

imhc:DigitalPowerLendingLLCMember

2021-11-05

0001349706

imhc:DigitalPowerLendingLLCMember

2021-11-03

0001349706

imhc:DigitalPowerLendingLLCMember

2021-08-18

0001349706

imhc:WexfordIndustriesMember

2020-06-11

0001349706

2020-06-10

2020-06-11

0001349706

imhc:WexfordIndustriesFourMember

2018-11-20

0001349706

imhc:WexfordIndustriesFourMember

2018-11-18

2018-11-20

0001349706

imhc:BlackridgeHoldingsMember

2018-10-12

0001349706

imhc:BlackridgeHoldingsMember

2018-10-10

2018-10-12

0001349706

imhc:WexfordIndustriesThreeMember

2018-10-02

0001349706

imhc:WexfordIndustriesThreeMember

2018-09-30

2018-10-02

0001349706

imhc:WexfordIndustriesMember

2018-08-27

2018-08-29

0001349706

2018-10-01

0001349706

2018-09-29

2018-10-01

0001349706

imhc:WexfordIndustriesTwoMember

2018-10-01

0001349706

imhc:WexfordIndustriesTwoMember

2018-09-29

2018-10-01

0001349706

imhc:WexfordIndustriesMember

2018-08-29

0001349706

imhc:DigitalPowerLendingLLCMember

imhc:ExchangeAgreementMember

imhc:PromissoryNotesMember

2021-12-15

0001349706

imhc:DigitalPowerLendingLLCMember

imhc:ExchangeAgreementMember

imhc:PromissoryNotesMember

2021-12-14

2021-12-15

0001349706

us-gaap:ConvertibleNotesPayableMember

2021-12-15

0001349706

2021-12-14

2021-12-15

0001349706

imhc:ConvertiblePromissoryNoteMember

2021-02-01

2021-02-03

0001349706

imhc:ConvertiblePromissoryNoteMember

2021-01-12

2021-01-14

0001349706

imhc:ConvertiblePromissoryNoteMember

2021-12-31

0001349706

imhc:ConvertiblePromissoryNoteMember

2021-01-01

2021-12-31

0001349706

imhc:IntermarketAssociatesLLCTwoMember

2019-10-18

0001349706

imhc:IntermarketAssociatesLLCTwoMember

2019-10-16

2019-10-18

0001349706

2019-10-16

2019-10-18

0001349706

imhc:GCEFOpportunityFundMember

2019-07-05

0001349706

imhc:GCEFOpportunityFundMember

2019-07-03

2019-07-05

0001349706

2019-07-03

2019-07-05

0001349706

imhc:GCEFOpportunityFundMember

2021-02-22

0001349706

imhc:GCEFOpportunityFundMember

2021-02-20

2021-02-22

0001349706

imhc:IntermarketAssociatesLLCMember

2019-05-22

0001349706

imhc:IntermarketAssociatesLLCMember

2019-05-20

2019-05-22

0001349706

2019-05-20

2019-05-22

0001349706

imhc:BitNilHoldingInceMember

2020-03-20

2020-03-21

0001349706

us-gaap:WarrantMember

2021-03-19

2021-03-21

0001349706

us-gaap:SubsequentEventMember

imhc:TURNONGREENINCMember

2021-11-04

2021-11-05

0001349706

us-gaap:SubsequentEventMember

imhc:TURNONGREENINCMember

2021-11-05

0001349706

2022-06-30

0001349706

2022-04-01

2022-06-30

0001349706

2021-04-01

2021-06-30

0001349706

2021-01-01

2021-06-30

0001349706

us-gaap:CommonStockMember

2022-03-31

0001349706

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001349706

us-gaap:RetainedEarningsMember

2022-03-31

0001349706

2022-03-31

0001349706

us-gaap:CommonStockMember

2021-03-31

0001349706

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001349706

us-gaap:RetainedEarningsMember

2021-03-31

0001349706

2021-03-31

0001349706

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001349706

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001349706

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001349706

2022-01-01

2022-03-31

0001349706

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001349706

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001349706

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001349706

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001349706

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-03-31

0001349706

us-gaap:RetainedEarningsMember

2021-01-01

2021-03-31

0001349706

2021-01-01

2021-03-31

0001349706

us-gaap:CommonStockMember

2021-04-01

2021-06-30

0001349706

us-gaap:AdditionalPaidInCapitalMember

2021-04-01

2021-06-30

0001349706

us-gaap:RetainedEarningsMember

2021-04-01

2021-06-30

0001349706

us-gaap:CommonStockMember

2022-06-30

0001349706

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001349706

us-gaap:RetainedEarningsMember

2022-06-30

0001349706

us-gaap:CommonStockMember

2021-06-30

0001349706

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0001349706

us-gaap:RetainedEarningsMember

2021-06-30

0001349706

2021-06-30

0001349706

us-gaap:CommonStockMember

2021-03-28

2021-04-02

0001349706

2021-03-28

2021-04-02

0001349706

us-gaap:ConvertibleNotesPayableMember

2022-01-01

2022-06-30

0001349706

us-gaap:ConvertibleNotesPayableMember

2021-01-01

2021-06-30

0001349706

us-gaap:ConvertibleNotesPayableMember

2022-06-30

0001349706

us-gaap:ConvertibleNotesPayableMember

2021-12-31

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2019-12-31

0001349706

us-gaap:CommonClassAMember

imhc:TURNONGREENINCMember

2019-12-31

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2019-12-31

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2019-12-31

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2020-12-31

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2020-12-31

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2020-12-31

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

us-gaap:CommonClassAMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

us-gaap:CommonClassAMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2021-12-31

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2021-12-31

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2021-12-31

0001349706

imhc:TURNONGREENINCMember

2019-12-31

0001349706

srt:MinimumMember

us-gaap:OfficeEquipmentMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

srt:MaximumMember

us-gaap:EquipmentMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

srt:MinimumMember

us-gaap:MachineryAndEquipmentMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

srt:MaximumMember

us-gaap:MachineryAndEquipmentMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

srt:MinimumMember

us-gaap:LeaseholdImprovementsMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

srt:MinimumMember

us-gaap:ComputerEquipmentMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

srt:MaximumMember

us-gaap:ComputerEquipmentMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

srt:MinimumMember

us-gaap:MachineryAndEquipmentMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

srt:MaximumMember

us-gaap:MachineryAndEquipmentMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

us-gaap:LeaseholdImprovementsMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

imhc:CustomerAMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

imhc:CustomerAMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

imhc:CustomerBMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

imhc:CustomerBMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

imhc:CustomerAMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

imhc:CustomerAMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

imhc:CustomerBMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

imhc:CustomerBMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

srt:NorthAmericaMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

srt:NorthAmericaMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

srt:EuropeMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

srt:EuropeMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

imhc:OtherMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

imhc:OtherMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

us-gaap:PublicUtilitiesInventorySuppliesMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

us-gaap:PublicUtilitiesInventorySuppliesMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

imhc:EVChargersMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

us-gaap:TransferredAtPointInTimeMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

us-gaap:TransferredAtPointInTimeMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

us-gaap:MachineryAndEquipmentMember

imhc:TURNONGREENINCMember

2021-12-31

0001349706

us-gaap:MachineryAndEquipmentMember

imhc:TURNONGREENINCMember

2020-12-31

0001349706

us-gaap:ComputerEquipmentMember

imhc:TURNONGREENINCMember

2021-12-31

0001349706

us-gaap:ComputerEquipmentMember

imhc:TURNONGREENINCMember

2020-12-31

0001349706

us-gaap:OfficeEquipmentMember

imhc:TURNONGREENINCMember

2021-12-31

0001349706

us-gaap:OfficeEquipmentMember

imhc:TURNONGREENINCMember

2020-12-31

0001349706

us-gaap:LeaseholdImprovementsMember

imhc:TURNONGREENINCMember

2021-12-31

0001349706

us-gaap:LeaseholdImprovementsMember

imhc:TURNONGREENINCMember

2020-12-31

0001349706

us-gaap:CommonStockMember

imhc:TURNONGREENINCMember

2021-12-31

0001349706

us-gaap:CommonStockMember

imhc:TURNONGREENINCMember

2020-12-31

0001349706

us-gaap:CommonStockMember

imhc:TURNONGREENINCMember

2022-06-30

0001349706

us-gaap:DomesticCountryMember

us-gaap:TaxYear2017Member

imhc:TURNONGREENINCMember

2021-12-31

0001349706

us-gaap:DomesticCountryMember

us-gaap:TaxYear2017Member

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

us-gaap:DomesticCountryMember

us-gaap:TaxYear2018Member

imhc:TURNONGREENINCMember

2021-12-31

0001349706

us-gaap:DomesticCountryMember

us-gaap:TaxYear2018Member

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

us-gaap:StateAndLocalJurisdictionMember

imhc:TURNONGREENINCMember

2021-12-31

0001349706

us-gaap:StateAndLocalJurisdictionMember

imhc:TURNONGREENINCMember

2021-01-01

2021-12-31

0001349706

us-gaap:DomesticCountryMember

us-gaap:TaxYear2017Member

imhc:TURNONGREENINCMember

2020-12-31

0001349706

us-gaap:DomesticCountryMember

us-gaap:TaxYear2017Member

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

us-gaap:DomesticCountryMember

us-gaap:TaxYear2018Member

imhc:TURNONGREENINCMember

2020-12-31

0001349706

us-gaap:DomesticCountryMember

us-gaap:TaxYear2018Member

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

us-gaap:StateAndLocalJurisdictionMember

imhc:TURNONGREENINCMember

2020-12-31

0001349706

us-gaap:StateAndLocalJurisdictionMember

imhc:TURNONGREENINCMember

2020-01-01

2020-12-31

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2022-03-31

0001349706

us-gaap:CommonClassAMember

imhc:TURNONGREENINCMember

2022-03-31

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2022-03-31

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2022-03-31

0001349706

imhc:TURNONGREENINCMember

2022-03-31

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2021-03-31

0001349706

us-gaap:CommonClassAMember

imhc:TURNONGREENINCMember

2021-03-31

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2021-03-31

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2021-03-31

0001349706

imhc:TURNONGREENINCMember

2021-03-31

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

us-gaap:CommonClassAMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

us-gaap:CommonClassAMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

us-gaap:CommonClassAMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

us-gaap:CommonClassAMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2022-06-30

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2022-06-30

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2022-06-30

0001349706

us-gaap:PreferredStockMember

imhc:TURNONGREENINCMember

2021-06-30

0001349706

us-gaap:CommonClassAMember

imhc:TURNONGREENINCMember

2021-06-30

0001349706

imhc:InvestmentByParentMember

imhc:TURNONGREENINCMember

2021-06-30

0001349706

us-gaap:RetainedEarningsMember

imhc:TURNONGREENINCMember

2021-06-30

0001349706

imhc:TURNONGREENINCMember

2021-06-30

0001349706

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

imhc:CustomerAMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

imhc:CustomerAMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

imhc:CustomerBMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

imhc:CustomerBMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

imhc:CustomerBMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

srt:NorthAmericaMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

srt:NorthAmericaMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

srt:NorthAmericaMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

srt:NorthAmericaMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

srt:EuropeMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

srt:EuropeMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

srt:EuropeMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

srt:EuropeMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

imhc:OtherMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

imhc:OtherMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

imhc:OtherMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

imhc:OtherMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

us-gaap:PublicUtilitiesInventorySuppliesMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

us-gaap:PublicUtilitiesInventorySuppliesMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

us-gaap:PublicUtilitiesInventorySuppliesMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

us-gaap:PublicUtilitiesInventorySuppliesMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

imhc:EVChargersMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

imhc:EVChargersMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

us-gaap:TransferredAtPointInTimeMember

imhc:TURNONGREENINCMember

2022-04-01

2022-06-30

0001349706

us-gaap:TransferredAtPointInTimeMember

imhc:TURNONGREENINCMember

2021-04-01

2021-06-30

0001349706

us-gaap:TransferredAtPointInTimeMember

imhc:TURNONGREENINCMember

2022-01-01

2022-06-30

0001349706

us-gaap:TransferredAtPointInTimeMember

imhc:TURNONGREENINCMember

2021-01-01

2021-06-30

0001349706

us-gaap:MachineryAndEquipmentMember

imhc:TURNONGREENINCMember

2022-06-30

0001349706

us-gaap:ComputerEquipmentMember

imhc:TURNONGREENINCMember

2022-06-30

0001349706

us-gaap:OfficeEquipmentMember

imhc:TURNONGREENINCMember

2022-06-30

0001349706

us-gaap:LeaseholdImprovementsMember

imhc:TURNONGREENINCMember

2022-06-30

0001349706

imhc:EVChargersMember

imhc:TURNONGREENINCMember

2022-06-30

0001349706

imhc:EVChargersMember

imhc:TURNONGREENINCMember

2021-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

imhc:Integer

(Address, including zip code, and telephone number, including

area code, of Registrant’s principal executive offices)

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

BitNile Holdings, Inc. (“BitNile”)

is hereby distributing shares of common stock and warrants to purchase common stock of Imperalis Holding Corp. (soon to change its name

to TurnOnGreen, Inc.) (“TurnOnGreen”), a publicly-traded company currently engaged in the design, development, manufacture

and sale of power system solutions and electric vehicle charging stations, on a pro rata basis to the holders of BitNile common stock

pursuant to the enclosed prospectus (the “Distribution”).

The prospectus sets forth

information about TurnOnGreen, its organization, business and properties and the background of its recent stock purchase involving BitNile’s

subsidiaries Imperalis Holding Corp. and TurnOnGreen, Inc., together with historical and pro forma financial statements. Due to the

importance of the information contained in this document, you are urged to read it carefully.

As explained in the prospectus,

each holder of record of BitNile common stock on ________ ___, 202_, the record date for the Distribution, is receiving one share of TurnOnGreen

common stock and a warrant to purchase one share of TurnOnGreen common stock for every ___ shares of BitNile common stock held as of such

date. No fractional shares of TurnOnGreen common stock are being issued. In lieu of receiving fractional shares, holders of BitNile common

stock who would otherwise be entitled to receive fractional shares of TurnOnGreen common stock will be receiving cash for their fractional

interests. A TurnOnGreen stock certificate or book-entry statement, a warrant certificate and, if applicable, a check for fractional interests,

are enclosed herewith.

The shares and warrants of

TurnOnGreen that you are receiving have been registered with the Securities and Exchange Commission, which permits you, subject to certain

securities laws and rules discussed in the prospectus, to sell these securities from time to time in either public or privately negotiated

transactions. This prospectus is being sent as information to all BitNile stockholders of record on the record date for the Distribution.

Holders are not required to do anything to become entitled to participate in this Distribution.

The information in this preliminary

prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities

and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities

in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS SUMMARY

The following is a brief

summary of certain information contained elsewhere in this prospectus. This summary is not intended to be complete and is qualified in

all respects by reference to the more detailed information appearing in this prospectus, including the documents incorporated by reference

herein. Unless otherwise indicated or where the context otherwise requires, references to “TurnOnGreen,” the “Company,”

”we,” ”us” and “our” shall mean the combined entity of Imperalis, which will be renamed TurnOnGreen,

Inc. (together with its subsidiaries) following the Acquisition, and references to “Imperalis” and “TOGI” shall

mean each respective corporation as it existed prior to the Acquisition.

The Company

TurnOnGreen Overview

TurnOnGreen, through its wholly

owned subsidiaries Digital Power Corp. (“Digital Power”) and TOG Technologies, Inc. (“TOG Technologies”), is engaged

in the design, development, manufacture and sale of highly engineered, feature-rich, high-grade power conversion and power system solutions

for mission-critical applications and processes. For more than 50 years, Digital Power has been devoted to the perfection of power solution

products that have enabled customer innovation in complex applications covering a wide range of industries. A natural outgrowth of its

development of these power systems has been TOG Technologies’ effort to apply the company’s proprietary core power technologies

to optimizing the design and performance of electric vehicle (“EV”) charging solutions. TOG Technologies began commercial

sales of its product line of high-speed charging solutions in mid-2021. We believe that our charging solutions represent an entire generation

of new chargers due to dramatic improvements in terms of size reduction in electronic circuitry and higher output density. We also believe

that, by leveraging our experience and expertise in power conversion and generation, we can rapidly become a leader in the high growth

EV charging solution market.

Digital

Power

At Digital Power, we provide

a comprehensive range of integrated power system solutions that are designed

to meet the diverse and precise needs of our customers with the highest levels of efficiency, flexibility and scalability. We design,

develop and manufacture custom power systems to meet performance and/or form factor requirements that cannot be met with standard products.

These power system solutions are designed to function reliably in harsh environments associated with defense and aerospace applications,

while also being utilized for applications ranging from industrial equipment to medical instrumentation. Our products are highly adaptive

and feature soft configurations in order to meet the requirements of both our customers and our original equipment manufacturers (“OEMs”).

These products include our Open-Frame series of products, which are the industry’s smallest open frame AC/DC switchers, high-performance

AC/DC desktop adaptor power supplies and a full range of compact AC or DC power supplies.

TOG Technologies

We recently formed TOG Technologies,

following more than two years of engineering design and product prototypes, to provide EV drivers of all types with easy access to convenient,

reliable and high-speed EV charging. TOG Technologies offers Level 2 AC charging infrastructure for use in single family homes, multi-family

unit developments, commercial retail properties and fleet environments. TOG Technologies provides Level 3 DC fast charger infrastructure

for high traffic, high density urban, suburban, exurban locations, and portable microgrid charging infrastructure. Prior to August 2021,

Digital Power operated the EV business presently conducted by TOG Technologies. Our EV charging solutions are designed

to address the expected rapid expansion of infrastructure required to support broad adoption of EVs globally. With more than 50

years of expertise in power technology, we provide EV charging solutions to enable the eMobility of tomorrow. Our innovative

charging solutions produce a full charge for an EV with a 150-mile range battery in approximately 30 minutes. We provide a wide

range of EV charging solutions, including a Level 2 AC charging product line compatible with the SAE J1772

standard, and a Level 3 DC fast charging product line compatible with the Combined Charging System (“CCS”)

standard and the CHArge de MOve (“CHAdeMO”) standard.

Our network is capable of

natively charging (i.e., charging without an adapter) all EV models and supports all charging standards currently available in the United

States. Our network can serve a wide variety of private, retail, commercial and fleet customers. Our charging systems maintain the highest

standards in the market and are backed by an internationally recognized certificate of safety and performance. We anticipate rapid growth

in the number of EVs in North America, and we intend to expand our network of charging stations to accommodate this growth while prioritizing

development of locations with favorable traffic and utilization characteristics. Below are renderings of our EV charging products and

related services:

Our strategy is to be the

supplier of choice across numerous markets that require high-quality power system solutions where custom design, superior product, high

quality, time to market and competitive prices are critical to business success. We believe that we provide advanced custom product design

services to deliver high-grade products that reach a high level of efficiency and density and can meet rigorous environmental requirements.

Our customers benefit from a direct relationship with us that supports all their needs for designing and manufacturing power solutions

and products. By implementing our proprietary core technology, including process implementation in integrated circuits, we can provide

cost reductions to our customers by replacing their existing power sources with our custom design cost-effective products.

Looking ahead, our mission

is to maintain our core business and existing relationships while leveraging the experience and expertise we have gained in the development

of power system solutions to introduce best-in-class EV charging solutions. By offering best-in-class EV charging solutions, as well as

a convenient, reliable and affordable EV charging e-mobility network through TOG Technologies, we intend to drive sustainable growth and

continue to be a recognized and trusted provider of advanced power technology.

Our Power System Markets and Customers

We sell our power systems

as integrated solutions to diverse customers for a wide range of applications in the global markets and sectors we serve, including medical

and healthcare, defense and aerospace, and industrial and telecommunications. We also sell our products as stand-alone products to our

commercial customers. Our current commercial customer base consists of approximately 220 companies, which are served through our direct

sales groups and our strategic partner channels. Our power supply products and related services sold through Digital Power accounted for

all of our operating revenues in the years ended December 31, 2020 and 2021 and the six months ended June 30, 2022. During these time

periods, approximately 83.7%, 87.6% and 82.8% of our revenues, respectively, were generated from customers located in North America. The

key industries for these products include the following:

Medical and Healthcare.

Our power solutions are ideal for healthcare and medical applications that require a high level of reliability and performance due to

their quality, output power and high-power density. Our power supplies meet the rigorous medical safety requirements and major industrial

safety standards related to such products to major industrial safety standards, including the EN60601-1-2 4.1 series of technical standards

for medical equipment and the Electromagnetic Compatibility (“EMC”) compliance requirements, and help medical device and system

manufacturers speed compliance testing of their own products. Our qualification testing facilities are also approved by various safety

agencies to test and qualify power products to be used in medical devices. We have obtained the medical quality management systems ISO

13485 certification to support rigorous design requirements and high-quality manufacturing of our medical power systems. Our medical power

products help OEMs minimize the risk of encountering unexpected development problems outside of their own areas of expertise. The typical

applications for our power products in the medical and healthcare industry include portable oxygen concentrators, patient monitoring systems,

pulsed lasers drivers for dental and surgical treatment, DNA sequencers, medical beds and ultrasounds. Revenues from the medical and healthcare

industry accounted for approximately 29%, 32% and 36% of all revenues received from our power supply products during the six months ended

June 30, 2022 and years ended December 31, 2021 and 2020, respectively.

Defense and Aerospace.

We offer a broad range of rugged power solutions for the defense and aerospace market. These solutions feature the ability to withstand

harsh environments. For more than 50 years, we have been providing rugged commercial off the shelf (“COTS”) products and custom

power solutions designed end-to-end for military and aerospace applications. We offer a wide variety of units designed to comply with

the most demanding United States and international Military Standards (“MIL-STDs”). Our military products meet all relevant

military standards in accordance with the Defense Standardization Program Policies and Procedures. This includes specifications related

to space, weight, output power, electromagnetic compatibility, power density and multiple output requirements, all of which we meet due

to decades of experience held by our engineering teams. Certain of our products that are specifically designed, modified, configured or

adapted for military systems are subject to the United State International Traffic in Arms Regulations (“ITAR”), which are

administered by the U.S. Department of State. We obtain required export licenses for any exports subject to ITAR. Our defense manufacturing

facilities are compliant with the international Quality Management System standard for the Aviation, Space and Defense (“AS&D”)

AS9100. The typical applications for our power products in the defense and aerospace industry include mobile and ground communications,

naval power conversion, automated test and simulation equipment for weapon systems, combat and airborne power supplies, radar arrays power

source, tactical gyro position and navigation systems and active protection of tactical vehicles. Revenues from the defense and aerospace

industry accounted for approximately 27%, 22% and 26% of all revenues received from our power supply products during the six months ended

June 30, 2022 and years ended December 31, 2021 and 2020, respectively.

Industrial and Telecommunications.

We build products for custom and standard applications used in industrial and telecommunication markets and set the standard in flexibility,

efficiency and reliability. Our compact, high-density and flexible power supplies and power converters allow optimal performance, boost

functionality and decrease costs. Due to the breadth of our experience, our products have proven to easily meet stringent design requirements.

Our industrial power solutions are designed to stand up to the extreme temperatures, input surges, vibration and shock found through uses

such as industrial automation, material handling, industrial lasers, robotics, agriculture, oil, and gas, mining and outdoor applications.

Our technology is designed for superior thermal management, reliability, EMI/EMC specifications and power density, with rugged performance

that is typically unavailable in standard power supplies. The typical applications for our power products in the industrial and telecommunications

industry include packaging equipment, laboratory and diagnostic equipment, industrial laser drivers, datacenter computing and turbomachinery

control solutions. Revenues from the industrial and telecommunications industry accounted for approximately 44%, 46% and 38% of all revenues

received from our power supply products during the six months ended June 30, 2022 and years ended December 31, 2021 and 2020, respectively.

Our Growth Strategies

We sell our power products

and charging solutions in the form of hardware, extended warranty purchases, recurring network subscriptions and related services. We

will continue to optimize our operating model, combining high-quality power and charging hardware and related services with appealing

business models for our customers. We believe that this approach creates significant customer network effects and provides the potential

for recurring revenue. Key elements of our growth strategies include:

|

· |

Continue to Innovate and Enhance Our EV Products. While maintaining our core business of power

system solutions for our existing markets, we intend to support the company’s growth by continuing to release advanced, new power

technologies with respect to our eMobility network and EV charging infrastructures. Specifically, we intend to take advantage of a significant

increase in eMobility market opportunities that we expect to see over the next five to ten years for our non-networked and networked Level

2 chargers and our high-power Level 3 DC fast charging solutions. We intend to invest in EV charging station components for use in connection

with installations of charging solutions at customer sites. We will expand our eMobility charging services through our TurnOnGreen Served

(“TOGS”) Software Platform as a Service (“PaaS”) for commercial and fleet customers and continue to design and

develop innovative products and services leveraging our knowledge of power electronics technology and advanced charging network management. |

|

· |

Develop Our Strategic Partnership Network. To achieve our goals – particularly with respect

to the rapid deployment of our EV charging products – we will evaluate and enter into strategic partnerships that facilitate our

ability to bring best-in-class solutions to a wider network of EV drivers than we would be able to reach on our own. Since the launch

of TOG Technologies, we have entered into several agreements, including an exclusive distribution agreement with Tesco Solutions LLC,

an Indiana based construction firm, and non-exclusive distribution agreements with Unique Electric Solutions (“UES”), a New

York based firm focused on re-powering school bus fleets, and EV-olution Charging Systems, an EVSE distributor based in Canada. |

|

· |

Expand Within Existing Customers. We are focused on maintaining our customer retention model,

which encourages existing customers to increase their utilization of our products and to renew their subscriptions due to the expansion

of our network. We expect additional growth to result from the breadth of ecosystem integrations that are enabled through our TurnOnGreen

Network. This eMobility network would integrate platforms such as in-vehicle infotainment systems, consumer mobile applications, payment

systems, mapping tools, home automation assistants, fleet fuel cards and residential utility programs. |

|

· |

Make Opportunistic Investments in Marketing. We intend to continue to aggressively market and

sell our core power products through our existing domestic and international markets, with an emphasis on the North American market. We

also intend to generate revenues by our eMobility charging services through various partnership and business models to reach new customers,

in each case coordinated through our dedicated sales groups. |

|

· |

Pursue Strategic Acquisitions for Growth. Through selective acquisitions of, or investments

in, complementary businesses, products, services and technologies in the power system solutions and EV charging industries, we aim to

broaden our existing product and technology base, build on our long-standing industry relationships and enhance our ability to penetrate

new markets. Along with our controlling stockholder, we are experienced at evaluating prospective operations in order to increase efficiencies

and capitalize on market and technological synergies. We currently have no commitments or agreements with respect to any such acquisitions

or investments. |

The Distribution

The TOGI Acquisition

On March 20, 2022, BitNile, Imperalis and

TOGI entered into a Securities Purchase Agreement (the “Acquisition Agreement”). Pursuant to the Acquisition Agreement, BitNile

agreed to (i) deliver to Imperalis all of the outstanding shares of common stock of TOGI held by BitNile (the “Acquisition”)

and (ii) forgive and eliminate the intracompany accounts between BitNile and TOGI evidencing historical equity investments made by BitNile

to TOGI, in the approximate amount of $36,000,000, in consideration for the issuance by Imperalis to BitNile of 25,000 shares of a new

issue of series A convertible redeemable preferred stock having an aggregate liquidation preference of $25,000,000 and the right to vote

with Imperalis common stock on an as-converted basis. On September 5, 2022, BitNile, Imperalis and TOGI entered into an amendment to the

Agreement (the “Amendment”), pursuant to which Imperalis agreed to (i) use commercially reasonable efforts to effectuate

a distribution by the Parent of 140 million shares of Common Stock beneficially owned by the Parent (the “Distribution”)

and, (ii) to issue to Parent warrants to purchase an equivalent number of shares of Common Stock to be issued in the Distribution (the

“Warrants”). The closing of the Acquisition occurred on September 6, 2022, following BitNile’s delivery to Imperalis

of audited historical financial statements of TOGI and satisfaction of other customary closing conditions. Immediately following the closing

of the Acquisition, TOGI became a wholly-owned subsidiary of Imperalis. The outstanding shares of common stock of Imperalis remained outstanding

and unaffected following the closing of the Acquisition, as were outstanding warrants and stock options to purchase Imperalis common stock.

Through an upstream merger, TOGI was merged with and into Imperalis. Additionally, Imperalis will dissolve its dormant subsidiary. The

corporate name of Imperalis will be changed to TurnOnGreen, Inc. as promptly as practicable.

Prior to the Acquisition,

BitNile owned 80.0% of the outstanding shares of Imperalis common stock. As a result of receiving shares of series A convertible redeemable

preferred stock of Imperalis, BitNile’s beneficial ownership of Imperalis’ voting shares increased to 91.1% of all voting

shares as of the date of this prospectus. Pursuant to the Acquisition Agreement, BitNile acknowledged that it would distribute to its

stockholders of record some or all of the shares of Imperalis common stock owned by it. Because BitNile controlled each of Imperalis and

TOGI, the Acquisition was accounted for as a reorganization of entities under common control. TurnOnGreen’s pro forma financial

statements included herein have been adjusted to give effect to the Acquisition on such basis. See “Introduction — The TOGI

Acquisition.”

The Distribution

The management of BitNile,

after extended study and analysis, has concluded that it is in the best interests of BitNile and its stockholders for BitNile to divest

a substantial portion of its interest in TurnOnGreen by distributing 81.1% (140 million shares) of all outstanding shares of TurnOnGreen

common stock and an equal number of warrants to purchase shares of TurnOnGreen common stock in the Distribution. At the time of the Distribution,

TurnOnGreen will comprise all of BitNile’s power system solutions operations and assets. Imperalis is a publicly traded company

and had operated in the past through three since discontinued subsidiaries in diverse businesses.

Reasons for the Distribution

In the opinion of the Board

of Directors of BitNile, the Distribution is in the best interests of BitNile and its stockholders. The principal considerations that

led BitNile to conclude that it should divest a substantial portion of its interest in TurnOnGreen are (i) BitNile’s desire to establish

both itself and TurnOnGreen as distinct investment alternatives in the financial community, (ii) the lack of an appropriate fit between

the power system and EV charging solutions businesses of TOGI and BitNile’s primary bitcoin mining operations and between the future

strategic directions of both companies, (iii) the manufacturing and high-end engineering nature of TOGI’s business, in part, in

mature industries, and (iv) the resulting differences in TurnOnGreen’s and BitNile’s financing strategies.

Manner of the Distribution

On or about _____ __, 2022

(the “Distribution Date”), BitNile will distribute to holders of record of BitNile common stock on ________ __, 2022 (the

“Distribution Record Date”), without any consideration being paid by such holders, one share of TurnOnGreen common stock and

a warrant to purchase one share of TurnOnGreen common stock for every ____ shares of BitNile common stock held on the Distribution Record

Date. The distribution of TurnOnGreen common stock and warrants is referred to as the “Distribution.”

For BitNile stockholders who

own BitNile common stock in registered form, in most cases the transfer agent will credit their shares of TurnOnGreen common stock and

warrant certificates to book-entry accounts established to hold their TurnOnGreen common stock and warrants. The distribution agent will

mail these stockholders a statement reflecting their TurnOnGreen common stock and warrant ownership shortly after the Distribution Date.

For stockholders who own BitNile common stock through a broker, bank or other nominee, their shares of TurnOnGreen common stock and warrants

will be credited to their accounts by that broker, bank or other nominee. See “The Distribution — Manner of the Distribution.”

Market Price and Trading

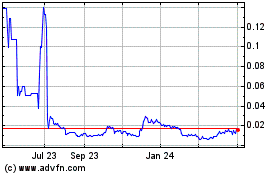

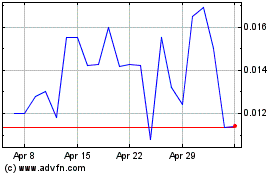

TurnOnGreen common stock is

quoted on the Pink Open Market, operated by OTC Market Group Inc., under the symbol IMHC. The last reported sale price for TurnOnGreen

common stock, as reported on the Pink Open Market, was $0.24 on October 12, 2022. Quotes of stock trading prices on any over-the-counter

market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual

transactions. Application has been submitted to have the shares of TurnOnGreen common stock to be received in the Distribution listed

for quotation on the OTCQB Market. See “Trading and Dividend Information.”

Results of the Distribution

Subsequent to the Distribution,

BitNile will continue to beneficially own approximately 370,000 shares of TurnOnGreen common stock and 25,000 shares of series A convertible

redeemable preferred stock, representing 52.4% of the then outstanding voting shares of TurnOnGreen, and remain TurnOnGreen’s largest

stockholder.

Relationship between BitNile and TurnOnGreen after the Distribution

After the Distribution, BitNile

may continue to perform certain administrative services for TurnOnGreen. These services will include certain use of BitNile’s management

information system, assist in the preparation of SEC filings and federal and state tax returns and handling of certain cash management

services.

The Board of Directors of

TurnOnGreen has three members, none of whom are directors of BitNile, and consists of Amos Kohn, Marcus Charuvastra and Douglas Gintz.

See “Directors and Executive Officers of TurnOnGreen.”

Federal Income Tax Aspects of the Distribution

If the fair market value of

the TurnOnGreen common stock and warrants to purchase shares of common stock distributed to BitNile stockholders exceeds the tax basis

of such TurnOnGreen common stock (in the hands of BitNile), then BitNile will recognize gain in the amount of such excess to the same

extent as if such TurnOnGreen common stock and warrants were sold to BitNile stockholders at fair market value. It is also anticipated

that the TurnOnGreen common stock and warrants distributed to BitNile stockholders in respect of their BitNile stock will be taxable to

such stockholders as a dividend to the extent of BitNile’s earnings and profits. See “The Distribution — Federal Income

Tax Aspects of the Distribution.” Stockholders are urged to consult their own advisors.

Risks Affecting Our Business

Stockholders should be aware

of certain risks related to ownership of shares of TurnOnGreen common stock and warrants. Below are the principal factors that make ownership

in the Company speculative:

| |

· |

Our business model will continue to evolve as we focus on our EV

charging operating segment, which increases the complexity of our business and places significant strain on our management, personnel,

operations, systems, technical performance, financial resources and internal financial control and reporting functions. |

|

| |

· |

Our growth strategy through acquisitions and partnerships involves

a significant degree of risk, and some of the companies that we have identified as acquisition targets or strategic partners may not have

a developed business or are experiencing inefficiencies and losses. |

|

| |

· |

If we fail to anticipate and adequately respond

to rapid technological changes in our industry, our business would be materially and adversely affected. |

|

| |

· |

Our future results will depend on our ability to maintain and expand

our existing sales channels and to put our marketing, business development and sales functions in place. |

|

| |

· |

We depend upon a few major customers for most of our revenues, and

the loss of any of these customers, or the substantial reduction in the quantity of products that any of them purchase from us, would

significantly reduce our revenues. |

|

| |

· |

We are heavily dependent on our senior management, and a loss

of a member of our senior management team could adversely affect our existing operations and future development. |

|

| |

· |

Our technology is generally unpatented and others may seek to copy

it. |

|

| |

· |

The COVID-19 pandemic has negatively impacted the global economy

and has impacted our supply chain for computer chips and other electronic components and material parts from vendors, particularly as

a result of disruptions from the temporary suspension of operations in locations where components are manufactured or held for distribution. |

|

| |

· |

We rely on charging station manufacturers and

other partners, and a loss of any such partner or interruption in the partner’s production could have a material adverse effect

on our business. |

|

| |

· |

We are dependent upon our and our contract manufacturers’

ability to timely procure electronic components. |

|

| |

· |

Our future results will depend on our ability to establish, maintain

and expand our manufacturers’ representative OEM relationships and our other relationships. |

|

| |

· |

We depend on international operations for a substantial portion

of our manufacturing components and products. These activities are subject to the uncertainties associated with international business

operations, including trade barriers and other restrictions. |

|

| |

· |

We face intense industry competition, price erosion and product

obsolescence, which could reduce our profitability, and many of our competitors are larger and have greater financial and other resources

than we do. |

|

| |

· |

As long as BitNile maintains a significant interest in our company,

your ability to influence matters requiring shareholder approval will be limited, and our historical financial information as a subsidiary

of BitNile may not be representative of our results as an independent public company. |

|

| |

· |

The price of our common stock may have little

or no relationship to the historical bid prices of our common stock on the Pink Open Market. There is currently only a limited trading

market for the TurnOnGreen common stock and there can be no assurance as to the extent of the trading market that will develop following

the Distribution.

Until September 6, 2022, we were a shell company

and stockholders cannot rely on the provisions of Rule 144 for the resale of their shares until certain additional conditions are

met. See “Risk Factors.” |

|

Corporate Information

We

were incorporated in Nevada in April 2005 under the original name of Coloured (US) Inc. We changed

our corporate name to Imperalis Holding Corp. in March 2011 and intend to change it to TurnOnGreen, Inc. as soon as practicable. As a

result of having no business or revenues from at least 2005 through September 6, 2022, we were previously deemed a shell company. As of

September 6, 2022, we are no longer a shell company. Our principal executive offices are located at 1421 McCarthy Blvd., Milpitas, California

95035 and its telephone number is (510) 657-2635. We maintain a corporate website at www.turnongreen.com.

Investors

and others should note that TurnOnGreen uses social media to communicate with the public about the company, its products, new product

developments and other matters. Any information that TurnOnGreen considers to be material to an evaluation of the company will be included

in filings on the SEC website, http://www.sec.gov, and may also be disseminated using TurnOnGreen’s investor relations website,

which can be found at http://www.turnongreen.com, and press releases. However, TurnOnGreen encourages investors, the media and others

interested in the company to also review its social media channels.

TurnOnGreen

does not incorporate the information on, or accessible through, its website into this prospectus, and you should not consider any information

on, or that can be accessed through, its website a part of this prospectus.

Implications of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in the Exchange Act. We may take advantage of certain of the scaled disclosures

available to smaller reporting companies so long as the market value of our voting and non-voting common stock held by non-affiliates

is less than $250.0 million measured on the last business day of our second fiscal quarter, or our annual revenue is less than $100.0 million

during the most recently completed fiscal year and the market value of our common stock held by non-affiliates is less than $700.0 million

measured on the last business day of our second fiscal quarter

Summary Historical and Pro Forma Financial Data

The

following summary historical financial data has been derived from the audited financial statements of Imperalis for the two fiscal years

ended December 31, 2021 and from the unaudited financial statements of Imperalis for the six months ended June 30, 2022. The following

summary historical financial data should be read in conjunction with the financial statements of Imperalis and the notes thereto included

in this prospectus.

Imperalis Summary Financial Data

Statements of Operations Data:

| |

|

For the Year Ended December 31, |

|

| |

|

2021 |

|

|

2020 |

|

| Total operating expenses |

|

$ |

156,000 |

|

|

$ |

12,000 |

|

| Loss from operations |

|

|

(156,000 |

) |

|

|

(12,000 |

) |

| Other expenses, net |

|

|

(52,000 |

) |

|

|

(34,000 |

) |

| Net loss |

|

$ |

(208,000 |

) |

|

$ |

(46,000 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted net loss per common share |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

| Weighted average common shares outstanding, basic and diluted |

|

|

161,704,695 |

|

|

|

133,702,938 |

|

| |

|

For the Six Months Ended June 30, |

|

| |

|

2022 |

|

|

2021 |

|

| Total operating expenses |

|

$ |

17,000 |

|

|

$ |

64,000 |

|

| Loss from operations |

|

|

(17,000 |

) |

|

|

(64,000 |

) |

| Other expenses, net |

|

|

(11,000 |

) |

|

|

(26,000 |

) |

| Net loss |

|

$ |

(28,000 |

) |

|

$ |

(90,000 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted net loss per common share |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

| Weighted average common shares outstanding, basic and diluted |

|

|

161,704,695 |

|

|

|

141,422,091 |

|

Balance Sheet Data:

| |

|

|

|

|

As of December 31, |

|

| |

|

June 30, 2022 |

|

|

2021 |

|

|

2020 |

|

| Cash and cash equivalent |

|

$ |

4,000 |

|

|

$ |

22,000 |

|

|

$ |

29,000 |

|

| Working capital |

|

$ |

(57,000 |

) |

|

$ |

(29,000 |

) |

|

$ |

(53,000 |

) |

| Total assets |

|

$ |

15,000 |

|

|

$ |

22,000 |

|

|

$ |

49,000 |

|

| Total liabilities |

|

$ |

173,000 |

|

|

$ |

152,000 |

|

|

$ |

102,000 |

|

| Total stockholders’ equity |

|

$ |

(158,000 |

) |

|

$ |

(130,000 |

) |

|

$ |

(53,000 |

) |

The

following summary historical financial data presented below has been derived from the audited combined financial statements of TOGI for

the two fiscal years ended December 31, 2021 and from the unaudited combined financial statements of TOGI for the six months ended June

30, 2022. The data should be read in conjunction with the financial statements of TOGI and the notes thereto included in this prospectus.

TOGI Summary Financial Data

Statements of Operations Data:

| |

|

For the Year Ended December 31, |

|

| |

|

2021 |

|

|

2020 |

|

| Revenues |

|

$ |

5,346,000 |

|

|

$ |

5,416,000 |

|

| Cost of revenue |

|

|

3,662,000 |

|

|

|

3,821,000 |

|

| Gross profit |

|

|

1,684,000 |

|

|

|

1,595,000 |

|

| Total operating expenses |

|

|

3,511,000 |

|

|

|

2,172,000 |

|

| Loss from operations |

|

|

(1,827,000 |

) |

|

|

(577,000 |

) |

| Interest income |

|

|

- |

|

|

|

9,000 |

|

| Net loss |

|

$ |

(1,827,000 |

) |

|

$ |

(568,000 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted net loss per common share |

|

$ |

(1,827 |

) |

|

$ |

(568 |

) |

| Weighted average common shares outstanding, basic and diluted |

|

|

1,000 |

|

|

|

1,000 |

|

| |

|

For the Six Months Ended June 30, |

|

| |

|

2022 |

|

|

2021 |

|

| Revenues |

|

$ |

2,191,000 |

|

|

$ |

3,213,000 |

|

| Cost of revenue |

|

|

1,338,000 |

|

|

|

1,837,000 |

|

| Gross profit |

|

|

853,000 |

|

|

|

1,376,000 |

|

| Total operating expenses |

|

|

2,790,000 |

|

|

|

1,640,000 |

|

| Net (loss) income |

|

$ |

(1,937,000 |

) |

|

$ |

(264,000 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted net (loss) income per common share |

|

$ |

(1,937 |

) |

|

$ |

(264 |

) |

| Weighted average common shares outstanding, basic and diluted |

|

|

1,000 |

|

|

|

1,000 |

|

Balance Sheet Data:

| |

|

|

|

|

As of December 31, |

|

| |

|

June 30, 2022 |

|

|

2021 |

|

|

2020 |

|

| Cash and cash equivalent |

|

$ |

320,000 |

|

|

$ |

112,000 |

|

|

$ |

258,000 |

|

| Working capital |

|

$ |

2,428,000 |

|

|

$ |

2,536,000 |

|

|

$ |

88,000 |

|

| Total assets |

|

$ |

7,197,000 |

|

|

$ |

4,430,000 |

|

|

$ |

2,004,000 |

|

| Total liabilities |

|

$ |

3,883,000 |

|

|

$ |

1,440,000 |

|

|

$ |

1,730,000 |

|

| Total stockholders’ equity |

|

$ |

3,314,000 |

|

|

$ |

2,990,000 |

|

|

$ |

274,000 |

|

_______________________________

The

following pro forma condensed combined financial information should be read in conjunction with the separate historical financial statements

of Imperalis and of TOGI and the notes thereto included in this prospectus. The pro forma condensed combined financial data is not necessarily

indicative of the operating results that would have been achieved had the Acquisition been effective during the periods presented or the

results that may be obtained in the future.

Summary Unaudited Pro Forma Condensed Combined

Financial Data of TurnOnGreen

Statements of Operations Data:

| |

|

For the Six Months Ended June 30, |

|

| |

|

2022 |

|

|

2021 |

|

| Revenues |

|

$ |

2,191,000 |

|

|

$ |

3,213,000 |

|

| Cost of revenue |

|

|

1,338,000 |

|

|

|

1,837,000 |

|

| Gross profit |

|

|

853,000 |

|

|

|

1,376,000 |

|

| Total operating expenses |

|

|

2,807,000 |

|

|

|

1,704,000 |

|

| Loss from operations |

|

|

(1,954,000 |

) |

|

|

(328,000 |

) |

| Other expenses, net |

|

|

(11,000 |

) |

|

|

(26,000 |

) |

| Net loss |

|

|

(1,965,000 |

) |

|

|

(354,000 |

) |

| Preferred dividends |

|

|

(1,000,000 |

) |

|

|

(1,000,000 |

) |

| Net loss available to common stockholders |

|

$ |

(2,965,000 |

) |

|

$ |

(1,354,000 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted net loss per common share |

|

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

| Weighted average common shares outstanding, basic and diluted |

|

|

161,704,695 |

|

|

|

141,422,091 |

|

| |

|

For the Year Ended December 31, |

|

| |

|

2021 |

|

|

2020 |

|

| Revenues |

|

$ |

5,346,000 |

|

|

$ |

5,416,000 |

|

| Cost of revenue |

|

|

3,662,000 |

|

|

|

3,821,000 |

|

| Gross profit |

|

|

1,684,000 |

|

|

|

1,595,000 |

|

| Total operating expenses |

|

|

3,667,000 |

|

|

|

2,184,000 |

|

| Loss from operations |

|

|

(1,983,000 |

) |

|

|

(589,000 |

) |

| Other expenses, net |

|

|

(52,000 |

) |

|

|

(34,000 |

) |

| Net loss |

|

|

(2,035,000 |

) |

|

|

(623,000 |

) |

| Preferred dividends |

|

|

(2,000,000 |

) |

|

|

(2,000,000 |

) |

| Net loss available to common stockholders |

|

$ |

(4,035,000 |

) |

|

$ |

(2,623,000 |

) |

| |

|

|

|

|

|

|

|

|

| Basic and diluted net loss per common share |

|

$ |

(0.02 |

) |

|

$ |

(0.02 |

) |

| Weighted average common shares outstanding, basic and diluted |

|

|

161,704,695 |

|

|

|

133,702,938 |

|

Balance Sheet Data:

| |

|

|

|

|

As of December 31, |

|

| |

|

June 30, 2022 |

|

|

2021 |

|

|

2020 |

|

| Cash and cash equivalent |

|

$ |

324,000 |

|

|

$ |

134,000 |

|

|

$ |

287,000 |

|

| Working capital |

|

$ |

2,371,000 |

|

|

$ |

2,507,000 |

|

|

$ |

36,000 |

|

| Total assets |

|

$ |

7,212,000 |

|

|

$ |

4,452,000 |

|

|

$ |

2,053,000 |

|

| Total liabilities |

|

$ |

4,056,000 |

|

|

$ |

1,592,000 |

|

|

$ |

1,832,000 |

|

| Total stockholders’ equity |

|

$ |

3,156,000 |

|

|

$ |

2,860,000 |

|

|

$ |

221,000 |

|

RISK FACTORS

Stockholders should be