UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14F-1

INFORMATION STATEMENT PURSUANT TO

SECTION 14(f) OF THE SECURITIES EXCHANGE ACT OF

1934

AND RULE 14f-1 THEREUNDER

Imperalis Holding Corp.

(Name of Registrant as Specified In Its Charter)

000-52140

(Commission File Number)

| Nevada |

20-5648820 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer Identification No.) |

1421 McCarthy Blvd., Milpitas, CA 95035

(Address of Principal Executive Offices)

Tel: (949) 444-5464

(Registrant’s Telephone Number)

WE ARE NOT SOLICITING YOUR PROXY. NO VOTE OR

OTHER ACTION BY THE COMPANY’S SHAREHOLDERS IS REQUIRED IN RESPONSE TO THIS INFORMATION STATEMENT.

IMPERALIS HOLDING CORP.

1421 McCarthy Blvd., Milpitas, CA 95035

Information Statement Pursuant to Section 14(f)

of the

Securities Exchange Act of 1934 and

Rule 14f-1 Thereunder

Notice of Proposed Change in the

Majority of the Board of Directors

INTRODUCTION

This Information Statement

is being mailed on or about September 7, 2022 by Imperalis Holding Corp. (“IMHC” or the "Company") to the holders

of record of shares of its common stock. This information statement (“Information Statement”) is provided to you

for information purposes only. We are not soliciting proxies in connection with the items described in this Information Statement. You

are urged to read this Information Statement carefully. You are not, however, required to take any action.

On March 20, 2022, the Company

and BitNile Holdings, Inc., a Delaware corporation (“BitNile” or the “Parent”) entered into a Securities Purchase

Agreement (as amended on September 5, 2022, the “Agreement”) with TurnOnGreen, Inc., a Nevada corporation (“TOGI”),

a wholly-owned subsidiary of the Parent. Pursuant to the Agreement, at the Closing (hereinafter defined), which occurred on September

6, 2022, the Parent (i) delivered to the Company all of the outstanding shares of common stock of TOGI held by the Parent, and (ii) eliminated

all of the intracompany accounts between the Parent and TOGI evidencing historical equity investments made by the Parent to TOGI, in the

approximate amount of $25,000,000, all in consideration for the issuance by the Company to the Parent (the “Acquisition”)

of an aggregate of 25,000 newly designated shares of Series A Preferred Stock (the “Series A Preferred Stock”), with each

such share having a stated value of $1,000. The Series A Preferred Stock has an aggregate liquidation preference of $25 million, is convertible

into shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) at the Parent’s option,

is redeemable by the Parent, and entitles the Parent to vote with the Common Stock on an as-converted basis.

Upon the closing of the Acquisition:

(i) Darren Magot resigned from his position as Chief Executive Officer but remains a member of the Company’s Board of Directors

(the “Board”); (ii) David Katzoff remained as the Company’s Chief Financial Officer, Secretary and Treasurer; (iii)

Marcus Charuvastra remained as the Company’s President; (iv) Douglas Gintz remained as the Company’s Chief Technology Officer,

and (v) the Board appointed Amos Kohn as the Company’s Chief Executive Officer and a member of the Board. The Parent intends to

cause IMHC to appoint additional individuals to its Board of Directors ten days after the filing this Information Statement.

Immediately following the

completion of the Acquisition, TOGI became a wholly-owned subsidiary of the Company. Further, the Company and TOGI intend to close an

upstream merger whereby TOGI shall cease to exist. Upon consummation of the merger, the Company shall have acquired two operating subsidiaries,

TOG Technologies, Inc. (“TOGT”) and Digital Power Corporation (“Digital Power”). The Company will continue the

existing business operations of TOGI as a publicly-traded company under the name Imperalis Holding Corp., but intends to change the registrant’s

name to TurnOnGreen, Inc. as soon as practicable. The Closing was subject to the Parent’s delivery to the Company of audited financial

statements of TOGI and other customary closing conditions.

The Company’s outstanding

shares of Common Stock remained outstanding and unaffected upon completion of the Acquisition. The Common Stock remains registered under

Section 12(g) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") immediately following the Acquisition.

The issuance of shares of the Company’s Series A Preferred Stock, and the underlying shares of Common Stock issuable upon conversion

thereof, to the Parent in connection with the Agreement was not registered under the Securities Act, in reliance upon the exemption from

registration provided by Section 4(a)(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering,

and Regulation D promulgated by the Securities and Exchange Commission (the “SEC”) thereunder. These securities may not be

offered or sold in the United States absent registration or an applicable exemption from the registration requirement.

This Information Statement

is being mailed to stockholders of the Company pursuant to Section 14(f) of the Exchange Act, and Rule 14f-1 thereunder.

You are urged to read this

Information Statement carefully. You are not, however, required to take any action with respect to the appointment of the new director.

CERTAIN INFORMATION REGARDING THE COMPANY

Voting Securities

There is currently one class

of voting securities of the Company entitled to be voted at a meeting, or by written consents or authorizations if no meeting is held.

As of the date of this Information Statement, the Company’s authorized capital stock included 200,000,000 shares of common stock,

of which 161,704,695 shares are issued and outstanding.

Security Ownership of Certain Beneficial

Owners and Management

The following table sets forth

certain information with respect to the beneficial ownership of the Company’s outstanding common stock following the consummation

of the Acquisition by (i) any holder of more than five (5%) percent; (ii) each of the named executive officers, directors, and director

nominees; and (iii) our directors, director nominees and named executive officers as a group. Except as otherwise indicated, each of the

stockholders listed below has sole voting and investment power over the shares beneficially owned.

Unless otherwise indicated

in the footnotes to the following table, each person named in the table has sole voting and investment power and that person’s address

is c/o TurnOnGreen, Inc., 1421 McCarthy Blvd., Milpitas, California 95035.

| Name and Address of Beneficial Owners of Common Stock (1) | |

Number of shares beneficially owned | | |

% of

Common

Stock | |

| Amos Kohn | |

| - | | |

| - - - | |

| Darren Magot | |

| | | |

| | |

| Marcus Charuvastra | |

| | | |

| | |

| David J. Katzoff | |

| - | | |

| - - - | |

| Douglas Gintz | |

| - | | |

| - - - | |

| Directors and Officers (Five persons) | |

| - | | |

| - - - | |

| BitNile Holdings, Inc. (2) | |

| 318,512,900 | | |

| 90.8 | % |

(1) Unless

otherwise indicated, the business address of each of the individuals is c/o TurnOnGreen, Inc., 1421 McCarthy Blvd., Milpitas, California

95035.

(2) Represents

(i) 129,363,756 shares held by BitNile, Inc., (ii) 10,000 shares held by DPL, (iii) 10,873,314 shares of Common Stock issuable upon conversion

of an outstanding convertible promissory note held by DPL in the principal face amount of $101,529, which is convertible into shares at

a conversion price of $0.01 per share, and (iv) 178,265,830 shares underlying the Series A Preferred Stock. Does not include shares that

are also issuable upon conversion of the note representing accrued but unpaid interest. BitNile may be deemed to beneficially own the

shares beneficially owned by BitNile, Inc. and DPL as BitNile, Inc. and DPL are wholly owned subsidiaries of BitNile. Milton C. Ault,

III, the Executive Chairman of BitNile, exercises voting and dispositive power over the shares owned by BitNile. The business address

of each of these entities and individuals is 11411 Southern Highlands Parkway, Suite 240, Las Vegas, Nevada 89141.

CURRENT DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth

the names and positions of our executive officers and directors. Directors will be elected at our annual meeting of stockholders and serve

for one year or until their successors are elected and qualify. Officers are elected by the Board and their terms of office are, except

to the extent governed by employment contract, at the discretion of the Board.

| Name |

|

Age |

|

|

Position |

| Amos Kohn |

|

|

62 |

|

|

Chief Executive Officer and Director |

| |

|

|

|

|

|

|

| Darren Magot |

|

|

53 |

|

|

Director |

| |

|

|

|

|

|

|

| Marcus Charuvastra |

|

|

44 |

|

|

President and Chief Revenue Officer |

| |

|

|

|

|

|

|

| David J. Katzoff |

|

|

61 |

|

|

Chief Financial Officer, Secretary and Treasurer |

| |

|

|

|

|

|

|

| Douglas Gintz |

|

|

55 |

|

|

Chief Technology Officer |

Set forth below is certain information with respect

to the above-named officers and directors:

Amos Kohn has been

our Chief Executive Officer and a member of our Board since the date of the Acquisition. Prior thereto, he was the Founder, Chief Executive

Officer and a member of the board of directors of the TOGI prior to the Acquisition (the “Former TOGI”), including when its

name was Coolisys Technologies, Inc., since its formation in January of 2020. He has led Digital Power, now part of TOGI, for more than

15 years, and currently he is leading TOGI as the chief executive officer and architect of its EVSE portfolio. He served as a director

of the Parent from 2003 to 2020, its President and Chief Executive Officer from 2008 to 2017 and President from 2017 to 2020. Prior to

his appointment as President and Chief Executive Officer of Digital Power, Mr. Kohn held executive roles with several U.S. and international

companies. For more than 30 years, Mr. Kohn has provided leadership, oversight and strategic direction for worldwide privately held and

publicly traded companies in the high-technology sector. He holds a Bachelor of Science degree in electrical and electronics engineering

and a Certificate of Business Administration from the University of California, Berkeley, and a Major (Ret) at IDF. He named as an inventor

on several United States and international patents. We believe that Mr. Kohn’s extensive executive-level management experience in

diversified industries expanding companies into new markets including power electronics, eMobility, telecommunications and defense give

him the qualifications and skills to serve as one of our directors.

Darren Magot served

as our Chief Executive Officer from March 2022 through the date of the Acquisition. He remains a member of the Board. Mr. Magot currently

serves the Senior Vice President of BitNile, Inc., a wholly owned subsidiary of the Parent (“BNI”), since February 2022, and

as a member of the board of directors of Ault & Company, Inc., since his appointment in July 2018. Mr. Magot has served as the Chief

Executive officer and sole member of the Board of Directors of AC Management, Inc., and AMRE Management, Inc., since October 2020 and

previously served as the Chief Executive Officer and as a director of Ault Alliance, Inc., a wholly owned subsidiary of the Parent, from

January 2019 to February 2022. Mr. Magot has over 30 years of experience in sales and sales management, financial management, and business

development with companies in both the private and public sector. A proven leader in all functional areas of both private and public organizations,

with a track record in successful financial and operational leadership, he holds a bachelor's degree in Finance from California State

University. We believe that Mr. Magot’s expertise in strategic planning, development, organizational change and efficiency for disruptive

and emerging technologies give him the qualifications and skills to serve as one of our directors.

Marcus Charuvastra has

served as our President since the Acquisition. Prior thereto, he served as the President of the Former TOGI since January 2022 and previously

served as its Chief Revenue Officer since June 2021. Mr. Charuvastra is an accomplished leader with 20 years of experience in strategic

planning, sales, services, marketing and business and organizational development. Mr. Charuvastra spent nine years at Targeted Medical

Pharma, Inc. serving as Vice President of Operations and as the Managing Director of this microcap biotech start-up, from 2012 to May

2021. During his tenure, he was instrumental in guiding Targeted Medical Pharma’s initial public offering. Mr. Charuvastra was previously

Director of Sales and Marketing at Physician Therapeutics from 2009 to 2012 and was responsible for building the sales and distribution

network in the United States and abroad. He is a graduate of University of California Los Angeles.

David J. Katzoff has

served as our Chief Financial Officer since December 2021. Mr. Katzoff has served as Senior Vice President of Finance for the Parent since

January 2019. Mr. Katzoff currently serves as the Chief Financial Officer of Alzamend Neuro, Inc., a biotechnology firm dedicated to finding

the treatment, prevention and cure for Alzheimer’s Disease, for which he served as its Chief Operating Officer from December 2020

to August 2022. From November 2019 to December 2020, Mr. Katzoff served as Alzamend’s Senior Vice President Operations. From 2015

to 2018, Mr. Katzoff served as Chief Financial Officer of Lumina Media, LLC, a privately held media company and publisher of life-style

publications. From 2003 to 2017, Mr. Katzoff served a Vice President Finance for Local Corporation, a publicly held local search company.

Mr. Katzoff received a B.S. in Business Management from the University of California at Davis.

Douglas Gintz has

served as our Chief Technology Officer since the Acquisition. Prior thereto, he served as the Chief Technology Officer of the Former TOGI

since February 2021. Mr. Gintz is responsible for driving strategic software initiatives and delivering key technologies essential to

the market penetration of our EV charging solutions business. Mr. Gintz has over 30 years of hands-on experience bringing products to

market. Specializing in emerging technologies, Mr. Gintz has developed manufacturing compliance systems, DNA reporting engines, medical

billing software, e-commerce applications, and retail software for companies ranging from startups to multinational corporations. Mr.

Gintz also currently serves as the Chief Technology Officer and Director of Global Technology Implementation for the Parent since February

2021. Mr. Gintz's previous leadership roles include Chief Executive Officer of Pacific Coders, LLC. from August 2002 to January 2022;

Chief Technology Officer of Endocanna Health, Inc. from January 2019 to January 2021; Mr. Gintz served at Targeted Medical Pharma, Inc.,

a publicly-traded microcap, as Chief Marketing Officer and Technology Officer from January 2018 to December 2019, and Chief Technology

Officer and Chief Information Officer from January 2012 to May 2016.

Election of Directors

and Officers

Directors

are elected to serve until the next annual meeting of stockholders and until their successors have been elected and qualified. Officers

are appointed to serve until the meeting of the Board following the next annual meeting of stockholders and until their successors have

been elected and qualified.

Audit Committee

We

do not have any committees of the Board. Consequently, the Board serves as the Audit Committee.

Director Independence

We

do not currently have any independent directors. We evaluate independence by the standards for director independence established by Marketplace

Rule 5605(a)(2) of the Nasdaq Stock Market, Inc.

Code of Ethics

Our

Board has not adopted a Code of Ethics due to our size and lack of employees.

Family Relationships

None.

Legal Proceedings

Our directors and executive

officers have not been involved in any of the following events during the past ten years:

| 1. | any bankruptcy petition filed by or against such person or any business of which such person was a general partner or executive officer

either at the time of the bankruptcy or within two years prior to that time; |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other

minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction,

permanently or temporarily enjoining him from or otherwise limiting his involvement in any type of business, securities or banking activities

or to be associated with any person practicing in banking or securities activities; |

| 4. | being found by a court of competent jurisdiction in a civil action, the Securities and Exchange Commission or the Commodity Futures

Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended,

or vacated; |

| 5. | being subject of, or a party to, any federal or state judicial or administrative order, judgment decree, or finding, not subsequently

reversed, suspended or vacated, relating to an alleged violation of any federal or state securities or commodities law or regulation,

any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud

or fraud in connection with any business entity; or |

| 6. | being subject of or party to any sanction or order, not subsequently reversed, suspended, or vacated, of any self-regulatory organization,

any registered entity or any equivalent exchange, association, entity or organization that has disciplinary authority over its members

or persons associated with a member. |

Change of Control Arrangements

We have no pension or compensatory

plans or other arrangements which provide for compensation to our directors or officers in the event of a change in our control. There

are no arrangements known to us the operation of which may at a later date result in a change in control of our company.

CERTAIN RELATIONSHIPS

AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

BitNile

will continue to perform certain administrative services for TOGI. These services include certain use of BitNile’s management information

system, assist in the preparation of federal and state tax returns and certain cash management services.

Imperalis Note

On

December 15, 2021, DP Lending, a wholly-owned subsidiary of BitNile, entered into an exchange agreement with Imperalis pursuant to which

Imperalis issued to DP Lending a convertible promissory note (the “Imperalis Note”) in the principal amount of $101,529, in

exchange for prior promissory notes dated August 18, 2021 and November 5, 2021 issued by IMHC to DP Lending in the aggregate principal

amount of $100,000, which had accrued and unpaid interest of $1,529 as of December 15, 2021. The terms of the Imperalis Note provide for

(i) an interest rate at 10% per annum, (ii) a maturity date of December 15, 2023, and (iii) conversion of the principal, together with

accrued but unpaid interest thereon, into shares of IMHC common stock at DP Lending’s option at a conversion price of $0.01 per

share.

Securities Purchase

Agreement

As

previously reported on a Current Report on Form 8-K filed by IMHC on March 21, 2022, on March 20, 2022, BitNile and IMHC entered into

a Securities Purchase Agreement (the “Agreement”) with TurnOnGreen, a wholly-owned subsidiary of BitNile. Pursuant to the

Agreement, at the closing of the Agreement (the “Closing”), which occurred on September 6, 2022, BitNile (i) delivered to

IMHC all of the outstanding shares of common stock of TurnOnGreen held by BitNile, and (ii) eliminated all of the intercompany accounts

between BitNile and TurnOnGreen evidencing historical equity investments made by BitNile to TurnOnGreen, in the approximate amount of

$36,000,000, all in consideration for the issuance by IMHC to BitNile (the “Acquisition”) of an aggregate of 25,000 newly

designated shares of Series A Preferred Stock (the “Series A Preferred Stock”), with each such share having a stated value

of $1,000. The Series A Preferred Stock has an aggregate liquidation preference of $25 million, is convertible into shares of IMHC’s

common stock, par value $0.001 per share (the “Common Stock”) at BitNile’s option, is redeemable by BitNile, and entitles

BitNile to vote with the Common Stock on an as-converted basis.

Immediately

following the Closing, TurnOnGreen became a wholly-owned subsidiary of IMHC. Following the Closing, IMHC shall dissolve its dormant subsidiary.

Further, IMHC and TurnOnGreen intend to close an upstream merger whereby TurnOnGreen shall cease to exist. Upon consummation of the merger,

IMHC shall have acquired two operating subsidiaries, TOG Technologies and Digital Power. IMHC will continue the existing business operations

of TurnOnGreen as a publicly-traded company under the name Imperalis Holding Corp., but intends to change the registrant’s name

to TurnOnGreen, Inc. as soon as practicable. The Closing was subject to BitNile’s delivery to IMHC of audited financial statements

of TurnOnGreen and other customary closing conditions.

On

September 5, 2022, BitNile, Imperalis and TurnOnGreen entered into an amendment to the Agreement (the “Amendment”), pursuant

to which Imperalis agreed to (i) use commercially reasonable efforts to effectuate a distribution by BitNile of approximately 140 million

shares of Common Stock beneficially owned by BitNile (the “Distribution”), including the filing of a registration statement

(the “Distribution Registration Statement”) with the SEC, (ii) to issue to BitNile warrants to purchase an equivalent number

of shares of Common Stock to be issued in the Distribution (the “Warrants”), and (iii) to register the Warrants and the shares

of Common Stock issuable upon exercise of the Warrants on the Distribution Registration Statement. TurnOnGreen and BitNile will mutually

agree to the terms and conditions of the Warrants and the Distribution Registration Statement after the Closing Date.

One

executive officer of TurnOnGreen is also an executive officer of BitNile. See “Directors, Executive Officers and Corporate Governance.”

Policies and Procedures

for Related Party Transactions

The

TurnOnGreen audit committee will have the primary responsibility for reviewing and approving or disapproving “related party transactions,”

which are transactions between TurnOnGreen and related persons in which the aggregate amount involved exceeds or may be expected to exceed

$120,000 and in which a related person has or will have a direct or indirect material interest. The policy regarding transactions between

TurnOnGreen and related persons will provide that a related person is defined as a director, executive officer or greater than 5% beneficial

owner of common stock, in each case since the beginning of the most recently completed year, and any of their immediate family members.

An investor may obtain a written copy of this policy, once adopted, by sending a written request to TurnOnGreen, Inc., 1421 McCarthy Blvd,

Milpitas, California 95035, Attention: Legal Department. TurnOnGreen’s audit committee charter that will be in effect will provide

that the audit committee shall review and approve or disapprove certain related party transactions, including material transactions with

BitNile.

CORPORATE GOVERNANCE

Director Independence

We do not have any independent

directors.

Board Committees

Our Board does not have any

committees, as companies whose securities are not traded on a national exchange are not required to have Board committees. However, at

such time in the future that we appoint independent directors on our Board, we expect to form the appropriate Board committees and identity

an audit committee financial expert. All functions of an audit committee, nominating committee and compensation committee are and have

been performed by our Board.

Board Oversight

Our management is responsible

for managing risk and bringing the most material risks facing the Company to the Board’s attention. Because we do not yet have separately

designated committees, the entire Board has oversight responsibility for the processes established to report and monitor material risks

applicable to the Company relating to (1) the integrity of the Company’s financial statements and review and approve the performance

of the Company’s internal audit function and independent accountants, (2) succession planning and risk related to the attraction

and retention of talent and to the design of compensation programs and arrangements, and (3) monitoring the design and administration

of the Company’s compensation programs to ensure that they incentivize strong individual and group performance and include appropriate

safeguards to avoid unintended or excessive risk taking by Company employees.

Director Nominations

There has not been any defined

policy or procedure requirements for stockholders to submit recommendations or nomination for directors. The Board of Directors does not

believe that a defined policy with regard to the consideration of candidates recommended by stockholders is necessary at this time because,

given the early stages of the Company’s development, a specific nominating policy would be premature and of little assistance until

the Company’s business operations are at a more advanced level.

Shareholder Communication with the Board

The Board of Directors does

not currently provide a process for shareholders to send communications to the Board of Directors because management of the Company believes

that until this point it has been premature to develop such processes given the limited liquidity of the common stock of the Company.

However, the new management of the Company may establish a process for shareholder communications in the future.

COMPENSATION OF DIRECTORS AND OFFICERS

Summary Compensation Table

IMHC did not pay any compensation to its Chief

Executive Officer during the last two fiscal years through the Acquisition and there were no executive officers serving as of the end

of the last two fiscal years whose compensation exceeded $100,000.

The following table sets forth summary compensation

information for the following persons: (i) all persons serving as our principal executive officer during the years ended December

31, 2021 and 2020, and (ii) our two other most highly compensated executive officers who received compensation during the years ended

December 31, 2021 and 2020 of at least $100,000 and who were executive officers on December 31, 2021. We refer to these persons as our

“named executive officers” in this Current Report. The following table includes all compensation earned by the named executive

officers for the respective period, regardless of whether such amounts were actually paid during the period:

| Name and principal position | |

Year | | |

Salary ($) | | |

Bonus ($) | | |

Stock

Awards

($) | | |

Option

Awards

($) | | |

All Other

Compensation ($) | | |

Total ($) | |

| Amos Kohn | |

| 2021 | | |

| 350,000 | | |

| 2,500 | | |

| | | |

| | | |

| 30,640 | | |

| 383,140 | |

| Chief Executive Officer | |

| 2020 | | |

| 350,000 | | |

| | | |

| | | |

| | | |

| 30,247 | | |

| 380,247 | |

| Marcus Charuvastra | |

| 2021 | | |

| 92,387 | (1) | |

| 27,250 | | |

| | | |

| | | |

| 751 | | |

| 120,388 | |

| President and Chief Revenue Officer | |

| 2020 | | |

| - | | |

| | | |

| | | |

| | | |

| | | |

| - | |

(1) Mr.

Charuvastra’s annual salary is $125,000. The figure in the table reflects the fact that he was hired on April 6, 2021.

Employment Agreements

As of the

date of this Current Report, we have no contract, agreement, plan or arrangement, whether written or unwritten, that provides for payments

to an executive officer at, following or in connection with any termination, including without limitation, resignation, severance, retirement

or a constructive termination of an executive officer, or a change in control of our company or a change in the executive officer’s

responsibilities, with respect to each executive officer.

Termination Provisions

As of the date of this

Current Report, we have no contract, agreement, plan, or arrangement, whether written or unwritten, that provides for payments to a Named

Executive Officer at, following, or in connection with any termination, including without limitation resignation, severance, retirement

or a constructive termination of a Named Executive Officer, or a change in control of the Company or a change in the Named Executive Officer’s

responsibilities, with respect to each Named Executive Officer, other than with respect to Mr. Kohn.

Outstanding Equity

Awards at Fiscal Year End

As of December 31, 2021

none of our Named Executive Officers held any unexercised options, stock that have not vested, or other equity incentive plan awards.

Director Compensation

To date, we have not

paid any of our directors any compensation for serving on our Board.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file reports with the SEC.

These reports, including annual reports, quarterly reports as well as other information we are required to file pursuant to securities

laws. You may read and copy materials we file with the SEC at the SEC’s Public Reference Room at 100 F. Street, N.E., Washington,

D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains

an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically

with the SEC at http://www.sec.gov.

NO STOCKHOLDER ACTION REQUIRED

This Information Statement

is being provided for informational purposes only, and does not relate to any meeting of stockholders. Neither applicable securities laws,

nor the corporate laws of the State of Nevada require approval of the any transaction referred to herein. No vote or other action is being

requested of the Company’s stockholders and no dissenters’ rights are available. This Information Statement is provided for

informational purposes only. This Information Statement has been filed with the Securities and Exchange Commission and is available electronically

on EDGAR at www.sec.gov.

SIGNATURES

In accordance with Section

13 or 15(d) of the Exchange Act, the registrant caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

IMPERALIS HOLDING CORP. |

|

| |

|

|

| |

|

|

| Date: September 7, 2022 |

/s/ Amos Kohn |

|

| |

Amos Kohn |

|

| |

Chief Executive Officer |

|

9

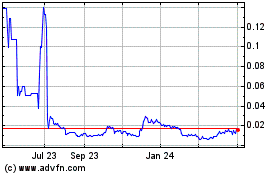

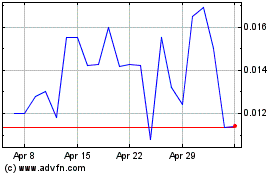

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Apr 2023 to Apr 2024