Current Report Filing (8-k)

December 21 2021 - 5:04PM

Edgar (US Regulatory)

0001349706

false

0001349706

2021-12-21

2021-12-21

0001349706

dei:FormerAddressMember

2021-12-21

2021-12-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

___________________________________________________________________

Date of Report (Date of earliest event reported): December

21, 2021

IMPERALIS HOLDING CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

000-52140

|

|

20-5648820

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

11411 Southern Highlands Parkway, Suite 240,

Las Vegas, NV 89141

(Address of principal executive offices) (Zip Code)

(949) 444-5464

(Registrant's telephone number, including area

code)

30

N Gould Street, Suite 11023, Sheridan, WY 82801

(Former address, if

changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act: None.

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On December 15, 2021 (the “Closing Date”),

Imperalis Holding Corp (the “Company”) entered into an exchange agreement (the “Exchange Agreement”)

with Digital Power Lending, LLC (“DPL”), pursuant to which the Company issued a convertible promissory note (the “Convertible

Note”) to DPL, in the principal amount of $101,528.77, in exchange for those certain promissory notes dated August 18, 2021

and November 5, 2021 (the “Promissory Notes”) issued to DPL in the aggregate principal amount of $100,000, which Promissory

Notes had accrued interest of $1,528.77 as of the Closing Date.

The Convertible Note accrues interest at 10% per

annum, is due on December 15, 2023, and the principal, together with any accrued but unpaid interest on the amount of principal, is convertible

into shares of the Company’s common stock, $0.001 par value per share (the “Common Stock”) at DPL’s option

at a conversion price of $0.01 per share.

The foregoing

descriptions of the Convertible Note and Exchange Agreement do not purport to be complete and are qualified in their entirety by reference

to their respective forms, which are annexed hereto as Exhibits 4.1 and 10.1, respectively, to this Current

Report on Form 8-K and are incorporated herein by reference. The foregoing does not purport to be a complete description of

the rights and obligations of the parties thereunder and such descriptions are qualified in their entirety by reference to such exhibits.

|

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

The information contained in Item 1.01 of this

Current Report on Form 8-K is incorporated herein by reference to this Item 3.02.

|

|

Item 5.01

|

Changes in Control of Registrant

|

On December 16, 2021 (the “Closing Date”),

Vincent Andreula, Michael Andreula and Kristie Andreula, each a stockholder of the Company (collectively, the “Sellers”),

entered into a stock purchase agreement (the “Stock Purchase Agreement”) with BitNile, Inc. (“BitNile”).

Pursuant to the Stock Purchase Agreement, BitNile purchased 129,363,756 shares of Common Stock from the Sellers in exchange for $200,000.

Upon the closing of the Stock Purchase Agreement, BitNile owns approximately 90% of the Company’s Common Stock, resulting in a change

in control of the Company.

The foregoing

description of the Stock Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the form,

which is annexed hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The

foregoing does not purport to be a complete description of the rights and obligations of the parties thereunder and such descriptions

are qualified in their entirety by reference to such exhibit.

Item 5.02 Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On the Closing Date, Messrs. Vincent Andreula

and Michael Andreula, and Ms. Kristie Andreula, resigned as the Company’s officers. In addition, Mr. Vincent Andreula resigned as

director on the Closing Date and his resignation is to be effective upon the 10th day after the mailing of a Schedule 14F-1, in accordance

with Rule 14f-1 under the Securities Exchange Act of 1934, to the Company’s stockholders.

On the Closing Date, the Company appointed Henry

Nisser as its Chief Executive Officer and a director and David J. Katzoff as its Chief Financial Officer, Secretary and Treasurer. Messrs.

Nisser and Katzoff will work for the Company on a part-time basis as needed and currently will not receive any compensation for such services.

Henry Nisser, 53, has served as General

Counsel of BitNile Holdings, Inc. (“BitNile Holdings”) since May 2019, as a Director since September 2020 and President

since January 2021. Between May 2019 and January 2021, Mr. Nisser also served as Executive Vice President. BitNile Holdings is the parent

company of BitNile and DPL. Mr. Nisser is also the President, General Counsel and a Director of Ault Disruptive Technologies Corporation.

Mr. Nisser has served as the Executive Vice President and General Counsel of Alzamend Neuro, Inc. (“Alzamend”) on a

part-time basis since May 2019, and has been a director of that company since September 2020. Mr. Nisser has also been the Executive Vice

President and General Counsel of Avalanche International Corp. since May 2019. Prior to joining BitNile Holdings and these companies,

Mr. Nisser practiced law at the New York law firm Sichenzia Ross Ference LLP from October 2011 to April 2019, concentrating on national

and international corporate law, with a focus on U.S. federal securities law compliance, mergers and acquisitions, equity and debt financings,

and corporate governance. Mr. Nisser earned a B.A. degree in international relations and economics from Connecticut College and an LL.B.

from University of Buckingham School of Law in the United Kingdom.

David Katzoff, 60, has served as Senior

Vice President of Finance of BitNile Holdings since January 2019. Mr. Katzoff joined Alzamend on a part-time basis in November 2019,

serving as its Senior Vice President of Operations from November 2019 to December 2020, and currently serves as its Chief Operating

Officer since December 2020. From 2015 to 2018, Mr. Katzoff served as Chief Financial Officer of Lumina Media, LLC, a privately-held

media company and publisher of life-style publications. From 2003 to 2017, Mr. Katzoff served a Vice President of Finance of Local

Corporation, a publicly-held local search company. Mr. Katzoff received a B.S. degree in Business Management from the University

of California at Davis.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

4.1

|

|

Convertible Promissory Note, dated December 15, 2021, made by Imperalis Holding Corp. in favor of Digital Power Lending, LLC.

|

|

10.1

|

|

Exchange Agreement between Imperalis Holding Corp. and Digital Power Lending, LLC, dated as of December 15, 2021.

|

|

99.1

|

|

Form of Stock Purchase Agreement among BitNile, Inc., Vincent Andreula, Michael Andreula and Kristie Andreula, dated as of December 16, 2021.

|

|

101

|

|

Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language).

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

IMPERALIS HOLDING CORP.

|

|

|

|

|

|

|

|

Dated: December 21, 2021

|

/s/ Henry Nisser

Henry Nisser

Chief Executive Officer

|

-4-

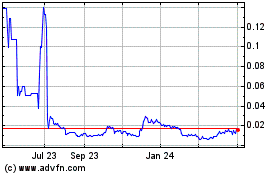

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

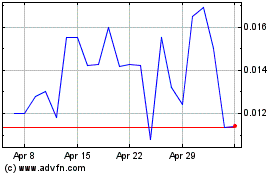

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Apr 2023 to Apr 2024