Securities Registration Statement (s-1/a)

July 22 2022 - 5:26PM

Edgar (US Regulatory)

0001119190

true

S-1/A

0001119190

2022-01-01

2022-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

HMBL:Integer

As

filed with the Securities and Exchange Commission on July 22, 2022

Registration

Statement No. 333-261403

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Amendment

No. 8 to

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

HUMBL,

INC.

(Exact

name of Registrant as specified in its charter)

| Delaware |

|

5500 |

|

91-2048019 |

(State

or other jurisdiction

of incorporation or organization) |

|

(Primary

Standard Industrial

Classification Code Number) |

|

(I.R.S.

Employer

Identification No.) |

600

B Street

Suite

300

San

Diego, California 92101

(786)

738-9012

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brian

Foote, CEO

600

B Street

Suite 300

San

Diego, California 92101

(786)

738-9012

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Ernest

M. Stern, Esq.

Culhane Meadows PLLC

1701

Pennsylvania Avenue, N.W.

Suite 200

Washington,

D.C. 20006

(301)

910-2030

Approximate

Date of Proposed Sale to the Public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

This

registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

HUMBL, Inc. (the “Company” or “we”)

hereby amends Amendment No. 7 to its Registration Statement on Form S-1as filed with the Securities and Exchange Commission (the “Commission”)

on July 20, 2022 S-1 (this “Registration Statement”) to revise Exhibit 5.1 in response to the comment letter dated July 22,

2022 from the Commission to clarify that the Company is excluded from the assumptions in connection with the warrants and convertible

notes held by the Selling Shareholders (as that term is defined in the prospectus which is included as part of this Registration Statement)

that such warrants and convertible notes have been duly executed and delivered by all parties thereto and that the parties to the warrants

and convertible notes have the power, corporate or otherwise, to enter into and perform their obligations under those documents.

EXHIBIT

INDEX

| Exhibit

No. |

|

Description |

| 2.1 |

|

Plan of Merger and Securities Exchange Agreement, dated as of December 2, 2020, by and between Tesoro Enterprises, Inc. and HUMBL LLC. |

| |

|

|

| 2.2 |

|

Certificate of Merger of Tesoro Enterprises, Inc. and HUMBL LLC dated December 3, 2020 |

| |

|

|

| 3.1 |

|

Certificate of Incorporation |

| |

|

|

| 3.2

|

|

Amendment to Certificate of Incorporation |

| |

|

|

| 3.3 |

|

Amendment to Certificate of Incorporation – Series B |

| |

|

|

| 3.4 |

|

Certificate of Withdrawal – Series C |

| |

|

|

| 3.5 |

|

Bylaws of HUMBL, Inc. |

| |

|

|

| 5.1 |

|

Opinion of Culhane Meadows PLLC (filed herein with Amendment #8) |

| |

|

|

| 10.1 |

|

Stock Purchase Agreement dated November 4, 2020 among Tesoro Enterprises, Inc., Henry J. Boucher and Brian Foote. |

| |

|

|

| 10.2 |

|

Warrant dated December 4, 2020 issued to Forwardly, Inc. |

| |

|

|

| 10.3 |

|

Warrant dated December 4, 2020 issued to Charger Corporation |

| |

|

|

| 10.4 |

|

Convertible Promissory Note dated December 23, 2020 issued to Kevin Levine |

| |

|

|

| 10.5 |

|

Warrant dated December 23, 2020 issued to Kevin Levine |

| |

|

|

| 10.6 |

|

Convertible Promissory Note dated December 23, 2020 Issued to Judith Levine |

| |

|

|

| 10.7 |

|

Warrant dated December 23, 2020 issued to Judith Levine |

| |

|

|

| 10.8 |

|

Warrant dated December 23, 2020 issued to Tuigamala Pty Ltd and subsequently assigned to Archumbl Pty Ltd |

| |

|

|

| 10.9 |

|

Securities Purchase Agreement dated March 15, 2021 between HUMBL, Inc. and HUMBL CL SpA |

| |

|

|

| 10.10 |

|

Securities Purchase Agreement dated April 14, 2021 between HUMBL, Inc. and Brighton Capital Partners, LLC |

| |

|

|

| 10.11 |

|

Convertible Promissory Note dated April 14, 2021 issued to Brighton Capital Partners, LLC |

| |

|

|

| 10.12 |

|

Equity Financing Agreement dated April 14, 2021 between HUMBL, Inc. and Brighton Capital Partners, LLC |

| |

|

|

| 10.13 |

|

Registration Rights Agreement dated April 14, 2021 between HUMBL, Inc. and Brighton Capital Partners, LLC |

| |

|

|

| 10.14 |

|

Convertible Promissory Note with an original issuance date of May 13, 2021 issued to The Strider Lir Trust |

| |

|

|

| 10.15 |

|

Warrant with an original issuance date of May 13, 2021 issued to The Strider Lir Trust |

| 10.16 |

|

Convertible Promissory Note with an original issuance date of May 13, 2021 issued to Scottish Isles Investing, LLC |

| |

|

|

| 10.17 |

|

Warrant with an original issuance date of May 13, 2021 issued to Scottish Isle Investing, LLC |

| |

|

|

| 10.18 |

|

Convertible Promissory Note dated May 13, 2021 issued to Maize and Gray, LLC |

| |

|

|

| 10.19 |

|

Warrant dated May 13, 2021 issued to Maize and Gray, LLC |

| |

|

|

| 10.20 |

|

Convertible Promissory Note issued on May 17, 2021 to Archura Capital Pty Ltd |

| |

|

|

| 10.21 |

|

Convertible Promissory Note dated May 19, 2021 issued to KWP50, LLC |

| |

|

|

| 10.22 |

|

Warrant dated May 19, 2021 issued to KWP50, LLC |

| |

|

|

| 10.23 |

|

Convertible Promissory Note dated May 19, 2021 issued to North Falls Investments, L.P. |

| |

|

|

| 10.24 |

|

Warrant dated May 19, 2021 issued to North Falls Investments, L.P. |

| |

|

|

| 10.25 |

|

Convertible Promissory Note dated May 19, 2021 issued to CMP76, LLC |

| |

|

|

| 10.26 |

|

Warrant dated May 19, 2021 issued to CMP76, LLC |

| |

|

|

| 10.27 |

|

Agreement and Plan of Merger dated June 3, 2021 among HUMBL, Inc., Tickeri, Inc., Tickeri I Acquisition Corp., Tickeri II Acquisition Corp., Javier Gonzalez and Juan Luis Gonzalez |

| |

|

|

| 10.28 |

|

Secured Promissory Note dated June 3, 2021 issued to Juan Luis Gonzalez |

| |

|

|

| 10.29 |

|

Secured Promissory Note dated June 3, 2021 issued to Javier Gonzalez |

| |

|

|

| 10.30 |

|

Stock Pledge Agreement dated June 3, 2021 among HUMBL, Inc., Javier Gonzalez and Juan Luis Gonzalez. |

| |

|

|

| 10.31 |

|

Employment Agreement dated June 3, 2021 between Tickeri, Inc. and Juan Luis Gonzalez |

| |

|

|

| 10.32 |

|

Employment Agreement dated June 3, 2021 between HUMBL, Inc. and Javier Gonzalez |

| |

|

|

| 10.33 |

|

Convertible Promissory Note dated June 21, 2021 issued to Infinity Block Investments, LLC |

| |

|

|

| 10.34 |

|

Warrant dated June 21, 2021 issued to Infinity Block Investments, LLC |

| |

|

|

| 10.35 |

|

Convertible Promissory Note dated June 21, 2021 issued to Murtaugh Group, LLC |

| |

|

|

| 10.36 |

|

Warrant dated June 21, 2021 issued to Murtaugh Group, LLC |

| |

|

|

| 10.37 |

|

Warrant dated May 21, 2021 issued to Athletes First, LLC |

| |

|

|

| 10.38 |

|

Membership Interest Purchase Agreement dated June 30, 2021 among HUMBL, Inc., Phantom Power, LLC and Kevin Childress |

| |

|

|

| 10.39 |

|

Convertible Promissory Note dated June 30, 2021 issued to Phantom Power, LLC |

| |

|

|

| 10.40 |

|

Convertible Promissory Note dated June 30, 2021 issued to Kevin Childress |

| 10.41 |

|

Promissory Note dated June 30, 2021 issued to Phantom Power, LLC |

| |

|

|

| 10.42 |

|

Promissory Note dated June 30, 2021 issued to Kevin Childress |

| |

|

|

| 10.43 |

|

Employment Agreement dated June 30, 2021 between HUMBL, Inc. and Doug Brandt |

| |

|

|

| 10.44 |

|

Employment Agreement dated June 30, 2021 between HUMBL, Inc. and Kevin Childress |

| |

|

|

| 10.45 |

|

Employment Agreement dated July 13, 2021 between HUMBL, Inc. and Brian Foote |

| |

|

|

| 10.46 |

|

Employment Agreement dated July 13, 2021 between HUMBL, Inc. and Jeffrey Hinshaw |

| |

|

|

| 10.47 |

|

Employment Agreement dated July 13, 2021 between HUMBL, Inc. and Michele Rivera |

| |

|

|

| 10.48 |

|

Employment Agreement dated July 13, 2021 between HUMBL, Inc. and Karen Garcia |

| |

|

|

| 10.49 |

|

Development Services Agreement dated July 29, 2021 between HUMBL, Inc. and Red Rock Development Group, LLC as amended on November 15, 2021 |

| |

|

|

| 10.50 |

|

Convertible Promissory Note dated August 30, 2021 issued to Hahanakai, LLC |

| |

|

|

| 10.51 |

|

Warrant dated August 30, 2021 issued to Hahanakai, LLC |

| |

|

|

| 10.52 |

|

Convertible Promissory Note dated November 13, 2021 issued to Joy Corbin |

| |

|

|

| 10.53 |

|

Warrant dated November 13, 2021 issued to Joy Corbin |

| |

|

|

| 10.54 |

|

Warrant dated November 22, 2021 issued to Charger Corporation |

| |

|

|

| 10.55 |

|

Warrant dated November 22, 2021 issued to Konop Enterprises Inc. |

| |

|

|

| 10.56 |

|

Warrant dated November 22, 2021 issued to Adel Wakil |

| |

|

|

| 10.57 |

|

Warrant dated November 22, 2021 issued to Antonio Dutra |

| |

|

|

| 10.58 |

|

Engagement Agreement for Advisory Services dated November 18, 2021 between HUMBL, Inc. and George Sharp |

| |

|

|

| 10.59 |

|

Asset Purchase Agreement dated February 12, 2022 among HUMBL, Inc., Alfonso Arana, Alfonso Rodriguez-Arana and Clement Danish. |

| |

|

|

| 10.60 |

|

Promissory Note dated February 12, 2022 issued to Sartorii, LLC. |

| |

|

|

| 10.61 |

|

Stock Purchase Agreement dated March 3, 2022 between HUMBL, Inc. and Gustavo Moya Ortiz. |

| |

|

|

| 10.62 |

|

Form of Exchange Agreement used in our March 28, 2022 note for common stock exchange transaction. |

| |

|

|

| 10.63 |

|

Promissory Note dated March 30, 2022 issued to Sartorii, LLC. |

| |

|

|

| 10.64 |

|

Amendment to Brighton Capital Partners, LLC Convertible Promissory Note dated June 11, 2022 |

| |

|

|

| 21.1 |

|

Subsidiaries of HUMBL, Inc. |

| |

|

|

| 23.1 |

|

Consent of B.F. Borgers CPA PC regarding HUMBL, Inc. |

| |

|

|

| 23.2 |

|

Consent of Culhane Meadows PLLC (included in Exhibit 5.1) |

| |

|

|

| 24.1 |

|

Power of Attorney (included on the signature page to this Registration Statement) |

| |

|

|

| 107 |

|

Filing Fee Table |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf

by the undersigned, thereunto duly authorized, in the City of San Diego, California, on July 22, 2022.

| |

HUMBL,

INC. |

| |

|

|

| |

By: |

/s/

Brian Foote |

| |

Name: |

Brian

Foote |

| |

Title: |

Chief

Executive Officer |

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Brian Foote as their true and

lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for them and in their name, place and stead,

in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, and to

sign any registration statement for the same offering covered by this registration statement that is to be effective on filing pursuant

to Rule 462(b) under the Securities Act of 1933, as amended, and all post-effective amendments thereto, and to file the same, with all

exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact

and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done

in connection therewith, as fully to all intents and purposes as they might or could do in person, hereby ratifying and confirming all

that said attorneys-in-fact and agents or any of them, or their substitute or substitutes, may lawfully do or cause to be done by virtue

hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement on Form S-1 has been signed by the following persons in

the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Brian Foote |

|

President,

CEO (principal executive officer) |

|

July 22, 2022 |

| Brian

Foote |

|

and

Director |

|

|

| |

|

|

|

|

| /s/

Jeffrey Hinshaw |

|

COO,

CFO (principal financial officer) |

|

July

22, 2022 |

| |

|

and

Director |

|

|

| |

|

|

|

|

| /s/

Michele Rivera |

|

Vice

President, Global Partnerships |

|

July

22, 2022 |

| |

|

and

Director |

|

|

| |

|

|

|

|

| /s/ William B. Hoagland |

|

Director |

|

July

22, 2022 |

| |

|

|

|

|

| |

|

|

|

|

| /s/ Peter Schulte |

|

Director |

|

July

22, 2022 |

| |

|

|

|

|

| |

|

|

|

|

| */s/

Brian Foote |

|

As

Attorney-In-Fact* |

|

July

22, 2022 |

| Brian

Foote |

|

|

|

|

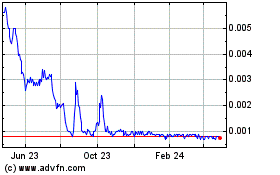

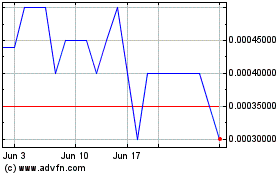

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024