0001119190

true

S-1/A

false

P1Y

15562500

22

22

22

22

22

22

22

22

22

P1Y

0001119190

2021-01-01

2021-09-30

0001119190

2020-12-31

0001119190

2019-12-31

0001119190

us-gaap:SeriesAPreferredStockMember

2020-12-31

0001119190

us-gaap:SeriesAPreferredStockMember

2019-12-31

0001119190

us-gaap:SeriesBPreferredStockMember

2020-12-31

0001119190

us-gaap:SeriesBPreferredStockMember

2019-12-31

0001119190

us-gaap:SeriesCPreferredStockMember

2020-12-31

0001119190

us-gaap:SeriesCPreferredStockMember

2019-12-31

0001119190

2021-09-30

0001119190

us-gaap:SeriesAPreferredStockMember

2021-09-30

0001119190

us-gaap:SeriesBPreferredStockMember

2021-09-30

0001119190

us-gaap:SeriesCPreferredStockMember

2021-09-30

0001119190

HMBL:TickeriIncMember

2021-03-31

0001119190

HMBL:TickeriIncMember

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

2019-12-31

0001119190

2020-01-01

2020-12-31

0001119190

2019-05-13

2019-12-31

0001119190

2020-01-01

2020-09-30

0001119190

2021-07-01

2021-09-30

0001119190

2020-07-01

2020-09-30

0001119190

HMBL:TickeriIncMember

2021-01-01

2021-03-31

0001119190

HMBL:TickeriIncMember

2020-01-02

2020-03-31

0001119190

HMBL:TickeriIncMember

2020-01-02

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

2021-01-01

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

2020-01-01

2020-06-30

0001119190

HMBL:MonsterCreativeLLCMember

2020-01-01

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

2019-01-01

2019-12-31

0001119190

2019-05-12

2019-12-31

0001119190

2019-05-11

0001119190

2020-09-30

0001119190

HMBL:TickeriMember

2021-01-01

2021-09-30

0001119190

HMBL:TickeriMember

2020-01-01

2020-09-30

0001119190

HMBL:MonsterCreativeMember

2021-01-01

2021-09-30

0001119190

HMBL:MonsterCreativeMember

2020-01-01

2020-09-30

0001119190

HMBL:TickeriIncMember

2020-01-01

0001119190

HMBL:TickeriIncMember

2020-03-31

0001119190

HMBL:MonsterCreativeLLCMember

2020-06-30

0001119190

HMBL:MonsterCreativeLLCMember

2018-12-31

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2019-05-13

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2019-05-13

0001119190

us-gaap:CommonStockMember

2019-05-13

0001119190

us-gaap:AdditionalPaidInCapitalMember

2019-05-13

0001119190

us-gaap:RetainedEarningsMember

2019-05-13

0001119190

HMBL:TickeriIncMember

2019-05-13

0001119190

HMBL:MonsterCreativeLLCMember

2019-05-13

0001119190

2019-05-13

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2019-12-31

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2019-12-31

0001119190

us-gaap:CommonStockMember

2019-12-31

0001119190

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001119190

us-gaap:RetainedEarningsMember

2019-12-31

0001119190

HMBL:TickeriIncMember

2019-12-31

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2020-12-31

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2020-12-31

0001119190

us-gaap:CommonStockMember

2020-12-31

0001119190

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001119190

us-gaap:RetainedEarningsMember

2020-12-31

0001119190

HMBL:TickeriIncMember

us-gaap:CommonStockMember

2020-01-01

0001119190

HMBL:TickeriIncMember

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

0001119190

HMBL:TickeriIncMember

us-gaap:RetainedEarningsMember

2020-01-01

0001119190

2020-01-01

0001119190

HMBL:TickeriIncMember

us-gaap:CommonStockMember

2020-12-31

0001119190

HMBL:TickeriIncMember

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001119190

HMBL:TickeriIncMember

us-gaap:RetainedEarningsMember

2020-12-31

0001119190

2018-12-31

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2019-05-14

2020-12-31

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2019-05-14

2020-12-31

0001119190

us-gaap:CommonStockMember

2019-05-14

2020-12-31

0001119190

us-gaap:AdditionalPaidInCapitalMember

2019-05-14

2020-12-31

0001119190

us-gaap:RetainedEarningsMember

2019-05-14

2020-12-31

0001119190

HMBL:TickeriIncMember

2019-05-14

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

2019-05-14

2020-12-31

0001119190

2019-05-14

2020-12-31

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2020-01-01

2020-12-31

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2020-01-01

2020-12-31

0001119190

us-gaap:CommonStockMember

2020-01-01

2020-12-31

0001119190

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-31

0001119190

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001119190

HMBL:TickeriIncMember

2020-01-01

2020-12-31

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2020-01-01

2020-09-30

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2020-01-01

2020-09-30

0001119190

us-gaap:CommonStockMember

2020-01-01

2020-09-30

0001119190

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-09-30

0001119190

us-gaap:RetainedEarningsMember

2020-01-01

2020-09-30

0001119190

HMBL:TickeriIncMember

2020-01-01

2020-09-30

0001119190

HMBL:MonsterCreativeLLCMember

2020-01-01

2020-09-30

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-09-30

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-09-30

0001119190

us-gaap:CommonStockMember

2021-01-01

2021-09-30

0001119190

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-09-30

0001119190

us-gaap:RetainedEarningsMember

2021-01-01

2021-09-30

0001119190

HMBL:TickeriIncMember

2021-01-01

2021-09-30

0001119190

HMBL:MonsterCreativeLLCMember

2021-01-01

2021-09-30

0001119190

HMBL:TickeriIncMember

us-gaap:CommonStockMember

2020-01-02

2020-03-31

0001119190

HMBL:TickeriIncMember

us-gaap:AdditionalPaidInCapitalMember

2020-01-02

2020-03-31

0001119190

HMBL:TickeriIncMember

us-gaap:RetainedEarningsMember

2020-01-02

2020-03-31

0001119190

2020-01-02

2020-03-31

0001119190

HMBL:TickeriIncMember

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001119190

HMBL:TickeriIncMember

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-03-31

0001119190

HMBL:TickeriIncMember

us-gaap:RetainedEarningsMember

2021-01-01

2021-03-31

0001119190

2021-01-01

2021-03-31

0001119190

HMBL:TickeriIncMember

us-gaap:CommonStockMember

2020-01-02

2020-12-31

0001119190

HMBL:TickeriIncMember

us-gaap:AdditionalPaidInCapitalMember

2020-01-02

2020-12-31

0001119190

HMBL:TickeriIncMember

us-gaap:RetainedEarningsMember

2020-01-02

2020-12-31

0001119190

2020-01-02

2020-12-31

0001119190

2020-01-01

2020-06-30

0001119190

2021-01-01

2021-06-30

0001119190

2019-01-01

2019-12-31

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2020-09-30

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2020-09-30

0001119190

us-gaap:CommonStockMember

2020-09-30

0001119190

us-gaap:AdditionalPaidInCapitalMember

2020-09-30

0001119190

us-gaap:RetainedEarningsMember

2020-09-30

0001119190

HMBL:TickeriIncMember

2020-09-30

0001119190

HMBL:MonsterCreativeLLCMember

2020-09-30

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2021-09-30

0001119190

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2021-09-30

0001119190

us-gaap:CommonStockMember

2021-09-30

0001119190

us-gaap:AdditionalPaidInCapitalMember

2021-09-30

0001119190

us-gaap:RetainedEarningsMember

2021-09-30

0001119190

HMBL:TickeriIncMember

2021-09-30

0001119190

HMBL:MonsterCreativeLLCMember

2021-09-30

0001119190

HMBL:TickeriIncMember

us-gaap:CommonStockMember

2020-03-31

0001119190

HMBL:TickeriIncMember

us-gaap:AdditionalPaidInCapitalMember

2020-03-31

0001119190

HMBL:TickeriIncMember

us-gaap:RetainedEarningsMember

2020-03-31

0001119190

2020-03-31

0001119190

HMBL:TickeriIncMember

us-gaap:CommonStockMember

2021-03-31

0001119190

HMBL:TickeriIncMember

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001119190

HMBL:TickeriIncMember

us-gaap:RetainedEarningsMember

2021-03-31

0001119190

2021-03-31

0001119190

2020-06-30

0001119190

2021-06-30

0001119190

HMBL:ShareExchangeAgreementMember

HMBL:FashionFloorCoveringAndTileIncMember

2009-11-11

2009-11-12

0001119190

HMBL:MergerAgreementMember

HMBL:HUMBLLLCMember

2020-12-03

0001119190

HMBL:MergerAgreementMember

HMBL:HUMBLLLCMember

us-gaap:SeriesBPreferredStockMember

2020-12-02

2020-12-03

0001119190

HMBL:HUMBLLLCMember

2020-12-03

0001119190

HMBL:HenryBoucherMember

us-gaap:SeriesAPreferredStockMember

us-gaap:NotesPayableOtherPayablesMember

2020-01-01

2020-12-31

0001119190

HMBL:BrianFooteMember

us-gaap:NotesPayableOtherPayablesMember

2020-01-01

2020-12-31

0001119190

HMBL:HUMBLLLCMember

us-gaap:SeriesAPreferredStockMember

2020-01-01

2020-12-31

0001119190

HMBL:HenryBoucherMember

us-gaap:SeriesAPreferredStockMember

us-gaap:NotesPayableOtherPayablesMember

2021-01-01

2021-09-30

0001119190

HMBL:HenryBoucherMember

us-gaap:CommonStockMember

us-gaap:NotesPayableOtherPayablesMember

2021-01-01

2021-09-30

0001119190

HMBL:BrianFooteMember

us-gaap:NotesPayableOtherPayablesMember

2021-01-01

2021-09-30

0001119190

HMBL:HUMBLLLCMember

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-09-30

0001119190

2021-06-02

2021-06-03

0001119190

2021-06-03

0001119190

us-gaap:CommonStockMember

2021-06-03

0001119190

HMBL:TickeriJuanGonzalezMember

2021-01-01

2021-09-30

0001119190

HMBL:JavierGonzalezMember

2021-01-01

2021-09-30

0001119190

HMBL:TickeriJuanGonzalezMember

2021-09-30

0001119190

HMBL:JavierGonzalezMember

2021-09-30

0001119190

2021-06-29

2021-06-30

0001119190

HMBL:DougBrandtAndKevinChildressMember

us-gaap:ConvertibleNotesPayableMember

2021-06-30

0001119190

HMBL:DougBrandtAndKevinChildressMember

us-gaap:ConvertibleNotesPayableMember

2021-09-30

0001119190

HMBL:DougBrandtAndKevinChildressMember

us-gaap:ConvertibleNotesPayableMember

2021-01-01

2021-09-30

0001119190

HMBL:DougBrandtAndKevinChildressMember

HMBL:NonConvertibleNotesPayableMember

2021-09-30

0001119190

HMBL:DougBrandtAndKevinChildressMember

HMBL:NonConvertibleNotesPayableMember

2021-01-01

2021-09-30

0001119190

HMBL:TickeriIncMember

us-gaap:SubsequentEventMember

HMBL:HUMBLIncMember

2021-06-03

0001119190

HMBL:TickeriIncMember

us-gaap:SubsequentEventMember

HMBL:HUMBLIncMember

2021-06-02

2021-06-03

0001119190

HMBL:TickeriIncMember

us-gaap:SubsequentEventMember

HMBL:HUMBLIncMember

us-gaap:CommonStockMember

2021-06-02

2021-06-03

0001119190

HMBL:TickeriIncMember

us-gaap:SubsequentEventMember

HMBL:HUMBLIncMember

HMBL:TwoPromissoryNotesMember

2021-06-02

2021-06-03

0001119190

HMBL:TickeriIncMember

us-gaap:SubsequentEventMember

HMBL:JuanGonzalezMember

2021-06-02

2021-06-03

0001119190

HMBL:TickeriIncMember

us-gaap:SubsequentEventMember

HMBL:JavierGonzalezMember

2021-06-02

2021-06-03

0001119190

HMBL:TickeriIncMember

us-gaap:SubsequentEventMember

HMBL:SecuredPromissoryNoteMember

HMBL:JuanAndJavierGonzalezMember

2021-06-03

0001119190

HMBL:TickeriIncMember

us-gaap:SubsequentEventMember

HMBL:SecuredPromissoryNoteMember

HMBL:JuanAndJavierGonzalezMember

2021-06-02

2021-06-03

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:OneConvertibleNoteAndOneNonConvertibleNoteMember

HMBL:DougBrandtMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:OneConvertibleNoteAndOneNonConvertibleNoteMember

HMBL:KevinChildressMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:ConvertibleNotesMember

HMBL:DougBrandtAndKevinChildressMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:ConvertibleNotesMember

HMBL:DougBrandtAndKevinChildressMember

2021-06-29

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:NonConvertibleNotesMember

HMBL:DougBrandtAndKevinChildressMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:NonConvertibleNotesMember

HMBL:DougBrandtAndKevinChildressMember

2021-06-29

2021-06-30

0001119190

HMBL:HUMBLLLCMember

2020-01-01

2020-12-31

0001119190

HMBL:HUMBLLLCMember

2021-01-01

2021-09-30

0001119190

HMBL:NotesPayableMember

2021-01-01

2021-09-30

0001119190

HMBL:NotesPayableMember

2020-12-31

0001119190

HMBL:NotesPayableMember

2019-12-31

0001119190

HMBL:NotesPayableMember

2021-09-30

0001119190

HMBL:NotesPayableOneMember

2021-09-30

0001119190

HMBL:NotesPayableOneMember

2020-12-31

0001119190

HMBL:PPPSBALoanTickeriMember

2021-09-30

0001119190

HMBL:PPPSBALoanTickeriMember

2020-12-31

0001119190

HMBL:PPPLoanMonsterMember

2021-09-30

0001119190

HMBL:PPPLoanMonsterMember

2020-12-31

0001119190

HMBL:EIDLLoanTickeriMember

2021-09-30

0001119190

HMBL:EIDLLoanTickeriMember

2020-12-31

0001119190

HMBL:TickeriIncMember

HMBL:PPPSBALoanMember

2021-03-31

0001119190

HMBL:TickeriIncMember

HMBL:PPPSBALoanMember

2020-12-31

0001119190

HMBL:TickeriIncMember

HMBL:EIDLLoanMember

2021-03-31

0001119190

HMBL:TickeriIncMember

HMBL:EIDLLoanMember

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:PPPSBALoanMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:PPPSBALoanMember

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:PPPSBALoanMember

2019-12-31

0001119190

HMBL:NotePayableMember

2020-12-31

0001119190

HMBL:NotePayableMember

2020-01-01

2020-12-31

0001119190

HMBL:NotePayableMember

2021-09-30

0001119190

HMBL:NotePayableMember

2021-01-01

2021-09-30

0001119190

HMBL:NotePayableTwoMember

2021-09-30

0001119190

HMBL:NotePayableTwoMember

2020-12-31

0001119190

HMBL:NotePayableTwoMember

2021-01-01

2021-09-30

0001119190

HMBL:NotesPayableMember

2020-01-01

2020-12-31

0001119190

HMBL:NotesPayableMember

2020-01-01

2020-09-30

0001119190

HMBL:ConvertiblePromissoryNotesMember

2020-01-01

2020-12-31

0001119190

HMBL:ConvertiblePromissoryNotesMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteOneMember

2020-12-31

0001119190

HMBL:ConvertibleNoteOneMember

2019-12-31

0001119190

HMBL:ConvertibleNoteTwoMember

2020-12-31

0001119190

HMBL:ConvertibleNoteTwoMember

2019-12-31

0001119190

HMBL:ConvertiblePromissoryNotesMember

2020-12-31

0001119190

HMBL:ConvertiblePromissoryNotesMember

2019-12-31

0001119190

HMBL:ConvertibleNoteOneMember

2021-09-30

0001119190

HMBL:ConvertibleNoteTwoMember

2021-09-30

0001119190

HMBL:ConvertibleNoteThreeMember

2021-09-30

0001119190

HMBL:ConvertibleNoteThreeMember

2020-12-31

0001119190

HMBL:ConvertibleNoteFourMember

2021-09-30

0001119190

HMBL:ConvertibleNoteFourMember

2020-12-31

0001119190

HMBL:ConvertibleNoteFiveMember

2021-09-30

0001119190

HMBL:ConvertibleNoteFiveMember

2020-12-31

0001119190

HMBL:ConvertibleNoteSixMember

2021-09-30

0001119190

HMBL:ConvertibleNoteSixMember

2020-12-31

0001119190

HMBL:ConvertibleNoteSevenMember

2021-09-30

0001119190

HMBL:ConvertibleNoteSevenMember

2020-12-31

0001119190

HMBL:ConvertibleNoteEightMember

2021-09-30

0001119190

HMBL:ConvertibleNoteEightMember

2020-12-31

0001119190

HMBL:ConvertibleNoteNineMember

2021-09-30

0001119190

HMBL:ConvertibleNoteNineMember

2020-12-31

0001119190

HMBL:ConvertibleNoteTenMember

2021-09-30

0001119190

HMBL:ConvertibleNoteTenMember

2020-12-31

0001119190

HMBL:ConvertibleNoteElevenMember

2021-09-30

0001119190

HMBL:ConvertibleNoteElevenMember

2020-12-31

0001119190

HMBL:ConvertibleNoteTwelveMember

2021-09-30

0001119190

HMBL:ConvertibleNoteTwelveMember

2020-12-31

0001119190

HMBL:ConvertiblePromissoryNotesMember

2021-09-30

0001119190

HMBL:ConvertibleNoteOneMember

2020-01-01

2020-12-31

0001119190

HMBL:ConvertibleNoteTwoMember

2020-01-01

2020-12-31

0001119190

HMBL:ConvertibleNoteOneMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteTwoMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteThreeMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteFourMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteFiveMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteSixMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteSevenMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteEightMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteNineMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteTenMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteElevenMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertibleNoteTwelveMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertiblePromissoryNoteMember

HMBL:BrightonCapitalPartnersLLCMember

2021-04-14

0001119190

HMBL:ConvertiblePromissoryNoteMember

HMBL:BrightonCapitalPartnersLLCMember

2021-04-01

2021-04-14

0001119190

HMBL:ConvertiblePromissoryNoteMember

HMBL:BrightonCapitalPartnersLLCMember

HMBL:EquityFinancingAgreementMember

2021-04-14

0001119190

HMBL:ConvertiblePromissoryNoteMember

HMBL:BrightonCapitalPartnersLLCMember

HMBL:EquityFinancingAgreementMember

srt:MaximumMember

2021-04-01

2021-04-14

0001119190

HMBL:ConvertiblePromissoryNoteMember

HMBL:BrightonCapitalPartnersLLCMember

HMBL:EquityFinancingAgreementMember

2021-04-01

2021-04-14

0001119190

HMBL:ConvertiblePromissoryNoteMember

HMBL:BrightonCapitalPartnersLLCMember

HMBL:EquityFinancingAgreementMember

srt:MinimumMember

2021-04-01

2021-04-14

0001119190

HMBL:ConvertiblePromissoryNoteOneMember

HMBL:InvestorsMember

2021-05-13

0001119190

HMBL:ConvertiblePromissoryNoteOneMember

HMBL:InvestorsMember

2021-05-01

2021-05-13

0001119190

HMBL:ConvertiblePromissoryNoteTwoMember

HMBL:InvestorsMember

2021-05-13

0001119190

HMBL:ConvertiblePromissoryNoteTwoMember

HMBL:InvestorsMember

2021-05-01

2021-05-13

0001119190

HMBL:ConvertiblePromissoryNoteThreeMember

HMBL:InvestorsMember

2021-05-17

0001119190

HMBL:ConvertiblePromissoryNoteThreeMember

HMBL:InvestorsMember

2021-05-01

2021-05-17

0001119190

HMBL:ConvertiblePromissoryNoteFourMember

HMBL:InvestorsMember

2021-05-19

0001119190

HMBL:ConvertiblePromissoryNoteFourMember

HMBL:InvestorsMember

2021-05-01

2021-05-19

0001119190

HMBL:ConvertiblePromissoryNoteFiveMember

HMBL:InvestorsMember

2021-05-19

0001119190

HMBL:ConvertiblePromissoryNoteFiveMember

HMBL:InvestorsMember

2021-05-01

2021-05-19

0001119190

HMBL:ConvertiblePromissoryNoteSixMember

HMBL:InvestorsMember

2021-05-19

0001119190

HMBL:ConvertiblePromissoryNoteSixMember

HMBL:InvestorsMember

2021-05-01

2021-05-19

0001119190

HMBL:ConvertiblePromissoryNoteSevenMember

HMBL:InvestorsMember

2021-06-21

0001119190

HMBL:ConvertiblePromissoryNoteSevenMember

HMBL:InvestorsMember

2021-06-01

2021-06-21

0001119190

HMBL:ConvertiblePromissoryNoteEightMember

HMBL:InvestorsMember

2021-06-21

0001119190

HMBL:ConvertiblePromissoryNoteEightMember

HMBL:InvestorsMember

2021-06-01

2021-06-21

0001119190

HMBL:ConvertiblePromissoryNoteNineMember

HMBL:InvestorsMember

2021-08-30

0001119190

HMBL:ConvertiblePromissoryNoteNineMember

HMBL:InvestorsMember

2021-08-01

2021-08-30

0001119190

HMBL:ConvertiblePromissoryNotesMember

2020-01-01

2020-09-30

0001119190

us-gaap:SeriesAPreferredStockMember

2020-01-01

2020-12-31

0001119190

us-gaap:SeriesAPreferredStockMember

HMBL:FormerOfficerMember

2020-01-01

2020-12-31

0001119190

us-gaap:SeriesBPreferredStockMember

2020-01-01

2020-12-31

0001119190

HMBL:RespectiveMembersMember

2020-12-31

0001119190

HMBL:RespectiveMembersMember

us-gaap:SeriesBPreferredStockMember

2020-01-01

2020-12-31

0001119190

HMBL:RespectiveMembersMember

us-gaap:SeriesBPreferredStockMember

us-gaap:SubsequentEventMember

2021-02-01

2021-02-26

0001119190

HMBL:RespectiveMembersMember

us-gaap:SeriesBPreferredStockMember

us-gaap:SubsequentEventMember

2021-02-26

0001119190

us-gaap:SeriesBPreferredStockMember

us-gaap:SubsequentEventMember

2021-02-01

2021-02-26

0001119190

us-gaap:SeriesCPreferredStockMember

2020-01-01

2020-12-31

0001119190

us-gaap:SubsequentEventMember

2021-02-25

0001119190

us-gaap:SubsequentEventMember

2021-02-26

0001119190

HMBL:PriorToMergerMember

2019-12-31

0001119190

us-gaap:CommonStockMember

2020-12-01

2020-12-31

0001119190

us-gaap:InvestorMember

2020-01-01

2020-12-31

0001119190

us-gaap:InvestorMember

2019-05-13

2019-12-31

0001119190

us-gaap:WarrantMember

HMBL:TwoSeparateHoldersMember

2020-12-01

2020-12-04

0001119190

us-gaap:WarrantMember

HMBL:TwoSeparateHoldersMember

2020-12-04

0001119190

us-gaap:WarrantMember

2020-12-01

2020-12-23

0001119190

us-gaap:WarrantMember

2020-12-23

0001119190

HMBL:ConvertibleNoteAgreementsMember

us-gaap:WarrantMember

2020-12-23

0001119190

HMBL:ConvertibleNoteAgreementsMember

us-gaap:WarrantMember

2020-12-01

2020-12-23

0001119190

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-09-30

0001119190

us-gaap:SeriesAPreferredStockMember

HMBL:FormerOfficerMember

2021-01-01

2021-09-30

0001119190

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-09-30

0001119190

HMBL:RespectiveMembersMember

2021-09-30

0001119190

HMBL:RespectiveMembersMember

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-09-30

0001119190

HMBL:RespectiveMembersMember

us-gaap:SeriesBPreferredStockMember

2021-02-01

2021-02-26

0001119190

HMBL:RespectiveMembersMember

us-gaap:SeriesBPreferredStockMember

2021-02-26

0001119190

us-gaap:SeriesBPreferredStockMember

2021-02-01

2021-02-26

0001119190

us-gaap:SeriesBPreferredStockMember

2021-04-01

2021-04-15

0001119190

us-gaap:SeriesBPreferredStockMember

HMBL:ImmediatelyMember

2021-04-01

2021-04-15

0001119190

us-gaap:SeriesBPreferredStockMember

HMBL:OverOneYearMember

2021-04-01

2021-04-15

0001119190

us-gaap:SeriesBPreferredStockMember

HMBL:OverTwoYearMember

2021-04-01

2021-04-15

0001119190

us-gaap:CommonStockMember

srt:ChiefExecutiveOfficerMember

2021-05-03

2021-05-06

0001119190

us-gaap:SeriesBPreferredStockMember

srt:ChiefExecutiveOfficerMember

2021-05-03

2021-05-06

0001119190

us-gaap:SeriesBPreferredStockMember

srt:ChiefExecutiveOfficerMember

2021-07-01

2021-07-06

0001119190

us-gaap:SubsequentEventMember

us-gaap:SeriesBPreferredStockMember

2021-10-29

0001119190

us-gaap:SubsequentEventMember

us-gaap:SeriesBPreferredStockMember

2021-10-01

2021-10-29

0001119190

us-gaap:SeriesCPreferredStockMember

2021-01-01

2021-09-30

0001119190

2021-02-25

0001119190

2021-02-26

0001119190

us-gaap:CommonStockMember

2021-03-01

2021-03-31

0001119190

us-gaap:CommonStockMember

HMBL:ChileCountryRightsMember

2021-04-01

2021-04-26

0001119190

us-gaap:CommonStockMember

HMBL:TickeriMember

2021-05-03

2021-05-06

0001119190

us-gaap:CommonStockMember

HMBL:ConsultantsAndAdvisorsMember

2021-06-18

2021-06-30

0001119190

HMBL:ConsultantsAndAdvisorsMember

2021-01-01

2021-09-30

0001119190

HMBL:ConsultantsAndAdvisorsMember

2021-09-30

0001119190

us-gaap:CommonStockMember

HMBL:SettlementOfLiabilityMember

2021-06-01

2021-06-30

0001119190

us-gaap:CommonStockMember

HMBL:ConsultantsAndAdvisorsMember

2021-07-01

2021-09-30

0001119190

us-gaap:CommonStockMember

HMBL:ConsultantsAndAdvisorsMember

2021-01-01

2021-09-30

0001119190

us-gaap:CommonStockMember

HMBL:ConsultantsAndAdvisorsMember

2021-09-30

0001119190

HMBL:TwoThousandTwentyStockIncentivePlanMember

2021-07-21

0001119190

us-gaap:SubsequentEventMember

us-gaap:WarrantMember

2020-10-01

2020-10-31

0001119190

HMBL:ConvertibleNoteAgreementsMember

us-gaap:WarrantMember

2021-05-13

0001119190

HMBL:ConvertibleNoteAgreementsMember

us-gaap:WarrantMember

2021-05-01

2021-05-13

0001119190

HMBL:ConvertibleNoteAgreementsMember

us-gaap:WarrantMember

2021-05-19

0001119190

HMBL:ConvertibleNoteAgreementsMember

us-gaap:WarrantMember

2021-05-18

2021-05-19

0001119190

HMBL:ConsultingAgreementMember

us-gaap:WarrantMember

2021-05-01

2021-05-21

0001119190

HMBL:ConsultingAgreementMember

us-gaap:WarrantMember

2021-05-21

0001119190

HMBL:ConvertibleNoteAgreementsMember

us-gaap:WarrantMember

2021-06-21

0001119190

HMBL:ConvertibleNoteAgreementsMember

us-gaap:WarrantMember

2021-06-01

2021-06-21

0001119190

HMBL:ConvertibleNoteAgreementsMember

us-gaap:WarrantMember

2021-08-30

0001119190

HMBL:ConvertibleNoteAgreementsMember

us-gaap:WarrantMember

2021-08-01

2021-08-30

0001119190

us-gaap:WarrantMember

2021-01-01

2021-09-30

0001119190

us-gaap:WarrantMember

2020-01-01

2020-09-30

0001119190

HMBL:TickeriIncMember

HMBL:ShareholdersMember

2020-02-01

2020-02-29

0001119190

HMBL:SecuritiesPurchaseAgreementMember

HMBL:TuigamalaGroupPtyLtdMember

2020-12-01

2020-12-23

0001119190

HMBL:SecuritiesPurchaseAgreementMember

HMBL:TuigamalaGroupPtyLtdMember

HMBL:InitialPaymentMember

2020-12-01

2020-12-23

0001119190

HMBL:SecuritiesPurchaseAgreementMember

HMBL:TuigamalaGroupPtyLtdMember

HMBL:SecondPaymentMember

2020-12-01

2020-12-23

0001119190

HMBL:SecuritiesPurchaseAgreementMember

HMBL:TuigamalaGroupPtyLtdMember

2020-12-23

0001119190

HMBL:SecuritiesPurchaseAgreementMember

HMBL:TuigamalaGroupPtyLtdMember

us-gaap:WarrantMember

2020-12-23

0001119190

HMBL:SecuritiesPurchaseAgreementMember

HMBL:TuigamalaGroupPtyLtdMember

HMBL:OptionsMember

2020-12-23

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

us-gaap:SubsequentEventMember

2021-02-26

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

us-gaap:SubsequentEventMember

2021-02-01

2021-02-26

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

us-gaap:SubsequentEventMember

2021-03-31

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

us-gaap:SubsequentEventMember

2021-03-01

2021-03-31

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

us-gaap:SubsequentEventMember

2021-09-30

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

us-gaap:SubsequentEventMember

2021-09-01

2021-09-30

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

2021-02-26

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

2021-02-01

2021-02-26

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

2021-03-31

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

2021-03-01

2021-03-31

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

2021-09-30

0001119190

srt:SubsidiariesMember

HMBL:TuigamalaGroupPtyLtdMember

2021-09-01

2021-09-30

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

2021-03-01

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

HMBL:AtFirstClosingDateMember

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

HMBL:AtFirstClosingDateMember

2021-03-01

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

HMBL:NineMonthsAfterClosingMember

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

HMBL:NineMonthsAfterClosingMember

2021-03-01

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

2021-03-01

2021-03-30

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

2021-04-05

2021-04-06

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

HMBL:EachTranchesMember

2021-04-05

2021-04-06

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

2021-04-05

2021-04-26

0001119190

HMBL:HUMBLLLCMember

2021-01-01

2021-12-31

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

us-gaap:SubsequentEventMember

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

us-gaap:SubsequentEventMember

2021-03-01

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

HMBL:AtFirstClosingDateMember

us-gaap:SubsequentEventMember

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

HMBL:AtFirstClosingDateMember

us-gaap:SubsequentEventMember

2021-03-01

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

HMBL:NineMonthsAfterClosingMember

us-gaap:SubsequentEventMember

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

HMBL:NineMonthsAfterClosingMember

us-gaap:SubsequentEventMember

2021-03-01

2021-03-02

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

us-gaap:SubsequentEventMember

2021-04-05

2021-04-06

0001119190

srt:SubsidiariesMember

HMBL:AureaGroupMember

HMBL:EachTranchesMember

us-gaap:SubsequentEventMember

2021-04-05

2021-04-06

0001119190

HMBL:TickeriIncMember

us-gaap:SubsequentEventMember

2021-03-02

0001119190

us-gaap:SubsequentEventMember

HMBL:ConsultantMember

2021-10-01

2021-10-31

0001119190

us-gaap:SubsequentEventMember

us-gaap:InvestorMember

2021-10-20

0001119190

us-gaap:SubsequentEventMember

us-gaap:SeriesBPreferredStockMember

2021-10-28

2021-10-29

0001119190

HMBL:FinancialServicesMember

2021-01-01

2021-09-30

0001119190

HMBL:FinancialServicesMember

2020-01-01

2020-09-30

0001119190

HMBL:MerchandiseMember

2021-01-01

2021-09-30

0001119190

HMBL:MerchandiseMember

2020-01-01

2020-09-30

0001119190

HMBL:TicketsMember

2021-01-01

2021-09-30

0001119190

HMBL:TicketsMember

2020-01-01

2020-09-30

0001119190

HMBL:MerchantFeesMember

2021-01-01

2021-09-30

0001119190

HMBL:MerchantFeesMember

2020-01-01

2020-09-30

0001119190

HMBL:NFTMember

2021-01-01

2021-09-30

0001119190

HMBL:NFTMember

2020-01-01

2020-09-30

0001119190

HMBL:ServiceProductionMember

2021-01-01

2021-09-30

0001119190

HMBL:ServiceProductionMember

2020-01-01

2020-09-30

0001119190

HMBL:NonResidentialPropertyMember

2021-09-30

0001119190

HMBL:NonResidentialPropertyMember

2020-12-31

0001119190

us-gaap:EquipmentMember

2021-09-30

0001119190

us-gaap:EquipmentMember

2020-12-31

0001119190

us-gaap:FurnitureAndFixturesMember

2021-09-30

0001119190

us-gaap:FurnitureAndFixturesMember

2020-12-31

0001119190

HMBL:NonResidentialPropertyMember

2021-01-01

2021-09-30

0001119190

us-gaap:EquipmentMember

2021-01-01

2021-09-30

0001119190

us-gaap:FurnitureAndFixturesMember

2021-01-01

2021-09-30

0001119190

HMBL:TickeriMember

2021-01-01

2021-09-30

0001119190

HMBL:TickeriMember

2021-09-30

0001119190

HMBL:TickeriMember

2020-12-31

0001119190

HMBL:MonsterCreativeMember

2021-09-30

0001119190

HMBL:MonsterCreativeMember

2020-12-31

0001119190

HMBL:DigitalCurrencyMember

2021-01-01

2021-09-30

0001119190

HMBL:NotesPayableMember

2021-09-30

0001119190

HMBL:NotesPayableRelatedPartiesMember

2021-01-01

2021-09-30

0001119190

HMBL:NotesPayableTwoMember

2021-09-30

0001119190

HMBL:NotesPayableTwoMember

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

srt:OfficerMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

srt:OfficerMember

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:KevinChildressMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:KevinChildressMember

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:DougBrandtMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:DougBrandtMember

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

srt:OfficerMember

2019-12-31

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:KevinChildressMember

2019-12-31

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:DougBrandtMember

2019-12-31

0001119190

HMBL:NotePayableRelatePartiesMember

2021-09-30

0001119190

HMBL:NotePayableRelatePartiesMember

2020-12-31

0001119190

HMBL:NotePayableRelatePartiesMember

2021-01-01

2021-09-30

0001119190

HMBL:NotePayableRelatePartiesOneMember

2021-09-30

0001119190

HMBL:NotePayableRelatePartiesOneMember

2020-12-31

0001119190

HMBL:NotePayableRelatePartiesOneMember

2021-01-01

2021-09-30

0001119190

HMBL:NotePayableRelatePartiesTwoMember

2021-09-30

0001119190

HMBL:NotePayableRelatePartiesTwoMember

2020-12-31

0001119190

HMBL:NotePayableRelatePartiesTwoMember

2021-01-01

2021-09-30

0001119190

HMBL:NotesPayableRelatedPartiesMember

2021-09-30

0001119190

HMBL:NotesPayableRelatedPartiesMember

2020-01-01

2020-09-30

0001119190

HMBL:ConvertiblePromissoryNotesRelatedPartiesMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertiblePromissoryNoteRelatedPartiesOneMember

2021-09-30

0001119190

HMBL:ConvertiblePromissoryNoteRelatedPartiesOneMember

2020-12-31

0001119190

HMBL:ConvertiblePromissoryNotesRelatedPartiesMember

2021-09-30

0001119190

HMBL:ConvertiblePromissoryNotesRelatedPartiesMember

2020-12-31

0001119190

HMBL:ConvertiblePromissoryNoteRelatedPartiesOneMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertiblePromissoryNoteRelatedPartiesOneMember

HMBL:NoteOneMember

2021-01-01

2021-09-30

0001119190

HMBL:ConvertiblePromissoryNoteRelatedPartiesOneMember

HMBL:NoteTwoMember

2021-01-01

2021-09-30

0001119190

HMBL:MonsterCreativeLLCMember

us-gaap:ConvertibleNotesPayableMember

HMBL:PhantomPowerLLCMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

us-gaap:ConvertibleNotesPayableMember

HMBL:PhantomPowerLLCMember

2021-06-01

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

us-gaap:ConvertibleNotesPayableMember

HMBL:KevinChildressMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

us-gaap:ConvertibleNotesPayableMember

HMBL:KevinChildressMember

2021-06-01

2021-06-30

0001119190

HMBL:ConvertiblePromissoryNotesRelatedPartiesMember

2020-01-01

2020-09-30

0001119190

HMBL:TickeriIncMember

2021-03-02

0001119190

HMBL:MonsterCreativeLLCMember

2021-05-03

2021-05-07

0001119190

HMBL:TwoFormerAssociatesMember

2021-06-28

2021-06-30

0001119190

HMBL:FormerAssociatesOneMember

2021-06-28

2021-06-30

0001119190

HMBL:FormerAssociatesTwoMember

2021-06-28

2021-06-30

0001119190

HMBL:TwoFormerAssociatesMember

HMBL:PromissoryNotesMember

2021-06-30

0001119190

HMBL:FormerAssociatesOneMember

HMBL:PromissoryNotesMember

2021-06-30

0001119190

HMBL:FormerAssociatesTwoMember

HMBL:PromissoryNotesMember

2021-06-30

0001119190

2021-07-28

2021-07-29

0001119190

HMBL:HUMBLPayMember

2021-01-01

2021-09-30

0001119190

HMBL:HUMBLMarketplaceMember

2021-01-01

2021-09-30

0001119190

HMBL:HUMBLFinancialMember

2021-01-01

2021-09-30

0001119190

HMBL:HUMBLPayMember

2021-07-01

2021-09-30

0001119190

HMBL:HUMBLMarketplaceMember

2021-07-01

2021-09-30

0001119190

HMBL:HUMBLFinancialMember

2021-07-01

2021-09-30

0001119190

HMBL:HUMBLPayMember

2021-09-30

0001119190

HMBL:HUMBLMarketplaceMember

2021-09-30

0001119190

HMBL:HUMBLFinancialMember

2021-09-30

0001119190

HMBL:TickeriIncMember

2021-06-03

0001119190

HMBL:TickeriIncMember

2021-06-02

2021-06-03

0001119190

HMBL:TickeriIncMember

us-gaap:CommonStockMember

2021-06-02

2021-06-03

0001119190

HMBL:TickeriIncMember

HMBL:TwoPromissoryNotesMember

2021-06-02

2021-06-03

0001119190

HMBL:TickeriIncMember

HMBL:JuanGonzalezMember

2021-06-02

2021-06-03

0001119190

HMBL:TickeriIncMember

HMBL:JavierGonzalezMember

2021-06-02

2021-06-03

0001119190

HMBL:TickeriIncMember

HMBL:SecuredPromissoryNoteMember

HMBL:JuanAndJavierGonzalezMember

2021-06-03

0001119190

HMBL:TickeriIncMember

HMBL:SecuredPromissoryNoteMember

HMBL:JuanAndJavierGonzalezMember

2021-06-02

2021-06-03

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:OneConvertibleNoteAndOneNonConvertibleNoteMember

HMBL:DougBrandtMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:OneConvertibleNoteAndOneNonConvertibleNoteMember

HMBL:KevinChildressMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:ConvertibleNotesMember

HMBL:DougBrandtAndKevinChildressMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:ConvertibleNotesMember

HMBL:DougBrandtAndKevinChildressMember

2021-06-29

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:NonConvertibleNotesMember

HMBL:DougBrandtAndKevinChildressMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:NonConvertibleNotesMember

HMBL:DougBrandtAndKevinChildressMember

2021-06-29

2021-06-30

0001119190

HMBL:TickeriIncMember

2021-01-01

2021-09-30

0001119190

HMBL:MonsterCreativeLLCMember

2021-01-01

2021-09-30

0001119190

HMBL:MonsterCreativeLLCMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

2021-06-29

2021-06-30

0001119190

HMBL:TickeriIncMember

HMBL:NotesPayableMember

2021-06-02

2021-06-03

0001119190

HMBL:MonsterCreativeLLCMember

us-gaap:ConvertibleNotesPayableMember

2021-06-29

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

HMBL:NonConvertibleNotesPayableMember

2021-06-29

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

2020-01-01

2020-09-30

0001119190

HMBL:MonsterCreativeLLCMember

srt:OfficerMember

2021-06-30

0001119190

HMBL:MonsterCreativeLLCMember

srt:OfficerMember

2020-06-30

0001119190

HMBL:MonsterCreativeLLCMember

srt:OfficerMember

2020-12-31

0001119190

HMBL:MonsterCreativeLLCMember

srt:OfficerMember

2019-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

HMBL:Integer

As

filed with the Securities and Exchange Commission on February 11, 2022

Registration

Statement No. 333-261403

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Amendment

No. 2 to

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

HUMBL,

INC.

(Exact

name of Registrant as specified in its charter)

|

Delaware

|

|

5500

|

|

91-2048019

|

(State

or other jurisdiction

of incorporation or organization)

|

|

(Primary

Standard Industrial

Classification Code Number)

|

|

(I.R.S.

Employer

Identification No.)

|

600

B Street

Suite

300

San

Diego, California 92101

(786)

738-9012

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brian

Foote, CEO

600

B Street

Suite 300

San

Diego, California 92101

(786)

738-9012

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Ernest

M. Stern, Esq.

Culhane Meadows PLLC

1701

Pennsylvania Avenue, N.W.

Suite 200

Washington,

D.C. 20006

(301)

910-2030

Approximate

Date of Proposed Sale to the Public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. [ ]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

[ ]

|

Accelerated

filer

|

[ ]

|

|

|

|

|

|

|

Non-accelerated

filer

|

[X]

|

Smaller

reporting company

|

[X]

|

|

|

|

|

|

|

|

|

Emerging

growth company

|

[X]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

CALCULATION

OF REGISTRATION FEE

|

Title of each Class of

Securities to be Registered

|

|

Shares to be

Registered(1)

|

|

|

Proposed Maximum

Aggregate Offering

Price Per Share

|

|

|

Maximum Aggregate

Offering Price(2)

|

|

|

Amount of

Registration Fee

|

|

|

Shares of Common Stock, par value $0.00001

|

|

|

51,783,294

|

|

|

$

|

0.166

|

|

|

|

8,596,027

|

|

|

|

796.85

|

|

|

Shares of Common Stock issuable upon exercise of warrants

|

|

|

123,275,000

|

|

|

$

|

0.166

|

|

|

|

20,463,650

|

|

|

|

1,896.98

|

|

|

Shares of Common Stock issuable upon conversion of Series B Preferred Stock

|

|

|

51,418,000

|

|

|

$

|

0.166

|

|

|

|

8,535,388

|

|

|

|

791.23

|

|

|

Shares of Common Stock issuable upon conversion of convertible notes

|

|

|

60,000,000

|

|

|

$

|

0.166

|

|

|

|

9,960,000

|

|

|

|

923.29

|

|

|

Total number of securities to be registered

|

|

|

286,476,294

|

|

|

$

|

0.166

|

|

|

|

47,555,065

|

|

|

|

4,408.35

|

|

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act, this registration statement shall be deemed to cover additional securities (i) to be offered

or issued in connection with any provision of any securities purported to be registered hereby pursuant to terms which provide for

a change in the amount of securities being offered or issued to prevent dilution resulting from stock splits, stock dividends, or

similar transactions and (ii) of the same class as the securities covered by this registration statement issued or issuable prior

to completion of the distribution of the securities covered by this registration statement as a result of a split of, or a stock

dividend on, the registered securities.

|

|

|

|

|

|

|

(2)

|

Estimated

solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) promulgated under the Securities

Act of 1933, as amended.

|

This

registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED FEBRUARY 11, 2022

Prospectus

286,476,294 Shares of Common Stock

HUMBL,

Inc.

This

prospectus covers 286,476,294 shares of our common stock that may be offered for resale or otherwise disposed of by the selling

stockholders listed on the Selling Stockholder table on page 26 (the “Selling Stockholders”).

We

will not receive any proceeds from the sale or other disposition of the securities by the Selling Stockholders. However, we may receive

up to approximately $39,237,500 in gross proceeds upon the cash exercise of the warrants by the Selling Stockholders. We will

use such proceeds, if and when received, for acquisitions and working capital.

We are an “emerging growth company” under

the federal securities laws and will be subject to reduced public company reporting requirements as set forth on page 9 of this prospectus.

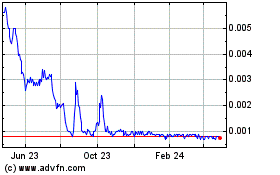

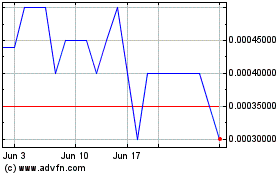

Our common stock is quoted under the symbol “HMBL” on the OTCQB (“OTCQB”). On February 9, 2022,

the last reported sale price of our common stock was $0.166.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 13 in this prospectus for a

discussion of information that should be considered in connection with an investment in our securities.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED

UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this prospectus is February 11, 2022

ADDITIONAL

INFORMATION

You

should rely only on the information contained or incorporated by reference in this prospectus and in any accompanying prospectus supplement.

No one has been authorized to provide you with different information. The shares are not being offered in any jurisdiction where the

offer is not permitted. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of

any date other than the date on the front of such documents.

TABLE

OF CONTENTS

Trademarks

This

prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience,

trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended

to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the

applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks

or service marks to imply a relationship with, or endorsement or sponsorship of us by any other companies.

PROSPECTUS

SUMMARY

The

following summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information

that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical financial

statements and related notes included elsewhere in this prospectus. In this prospectus, unless otherwise noted, the terms “the

Company,” “HUMBL”, “we,” “us,” and “our” refer to HUMBL, Inc.

The

Company

Overview

HUMBL

is a Web 3, digital commerce platform that was built to connect consumers, freelancers and merchants in the digital economy. HUMBL provides

simple tools and packaging for complex new technologies such as blockchain, in the same way that previous cycles of e-commerce and the

cloud were more simply packaged by companies such as Facebook, Apple, Amazon and Netflix over the past several decades.

Our

goal is to provide ready built tools and platforms for consumers and merchants to seamlessly participate in the digital economy. HUMBL

is built on a patent-pending decentralized technology stack that utilizes both core and partner technologies, to provide faster connections

to the digital economy and each other.

We

have three interconnected product verticals:

●

HUMBL Pay – A mobile app that allows peers, consumers and merchants to connect in the digital economy.

●

HUMBL Marketplace – A mobile marketplace that allows consumers and merchants to connect more seamlessly in the digital economy.

●

HUMBL Financial – Financial products and services, targeted for simplified investing on the blockchain.

HUMBL

Pay

We

are developing a mobile application that allows customers to migrate to digital forms of payment, along with services such as maps, ratings

and reviews. We are also working rapidly to integrate the use of search, discovery, peer-to-peer cash and ticketing around the world

as these services migrate into digital and blockchain-based modalities. The mobile application is designed to provide functionality to

the following groups:

●

Individuals - Consumers who want to discover, pay, rate and review experiences digitally versus paper bills and hardware point-of-sale

(“POS”);

●

Freelancers - Service providers and gig workers that want to get paid from anywhere they work vs. paper bills and hardware POS; and

●

Merchants – Primarily brick and mortar vendors that want to get paid digitally vs. paper bills and hardware POS.

HUMBL

Marketplace

Through

our online marketplace, we are developing the capability for merchants to list a wide range of physical products, that, when appropriate,

incorporate the benefits of blockchain. HUMBL is working on technologies to provides merchants with the ability to list and sell

goods with greater levels of authentication, to improve

the merchant’s ability to trade, track and receive payment for their products.

Through

our online marketplace we also allow for the listing of non-fungible tokens (NFTs). NFTs

allow entities and individuals such as athletes, celebrities, agencies, artists and companies to monetize their digital images, multimedia

content and catalogues on the blockchain. HUMBL provides a marketplace for artists and athletes to connect online in the sale of digital

collectibles to fans and collectors and provides a rigorous set of terms and conditions that govern what can and cannot be listed on

the marketplace. We currently review all listings to screen for graphic content, potential intellectual property rights violations, and

potential securities law violations. The NFT marketplace is operated through a third-party marketplace plug-in (OpenSea), electronic

wallet extensions (such as MetaMask), and the Ethereum blockchain. Users participate in the NFT marketplace by linking their digital

wallets to our platform and engaging (e.g., buying, selling, bidding) with the NFTs listed on our platform. The services provided by

HUMBL are administrative. HUMBL is a platform and does not act as a broker, financial institution, or creditor. We facilitate transactions

between the buyer and seller in the auction/sale process but we are not a party to any agreement between the buyer and seller or between

any users.

We

receive revenue from the NFT marketplace in two ways. First, for some clients HUMBL provides design services to help artists, athletes

and entertainers create NFTs to be sold to their fans. In these circumstances HUMBL typically receives a flat fee for providing such

services that is paid out of the sales price of the NFT. The size of the fee depends on the scope and complexity of the design services

provided. Second, HUMBL receives a transaction fee each time an NFT sells on the NFT marketplace.

The

NFT marketplace allows creators to mint NFTs using their own intellectual property and list those NFTs for sale (primary sales) on the

marketplace. The NFT marketplace also allows for NFTs to be resold (secondary sales) on the platform, but currently only NFTs that were

originally minted on the Company’s NFT Marketplace or are otherwise approved by the Company may be listed for secondary sales on

the Marketplace. The Company does not otherwise support or influence the market for the resale of NFTs sold on its platform. Other than

requiring creators to attest they own the IP used to create their NFTs and monitoring for obvious copyright violations, the Company does

not enforce any rights related to the primary or secondary sales of NFTs. Payment transactions for the purchase and sale of NFTs are

made through the use of smart contracts on the Ethereum blockchain. The Company does not handle separate, off-chain payments for NFTs.

Tracking and payment of resale royalty fees are accomplished automatically through the use of smart contracts. The Company is not responsible

for distributing or managing resale royalty fees.

In

September 2021, we launched HUMBL Tickets, initially focused on the offering of secondary (resale) tickets to thousands of live events

across North America. The inventory listings and ticket fulfilment are provided by Ticket Evolution and we earn a commission for

each sale. In addition to HUMBL’s subsidiary Tickeri, we will continue to work with clients to merge the realms of NFTs,

event tickets and blockchain authentication.

HUMBL

Financial

We

developed HUMBL Financial to package step-function technologies such as blockchain into “several clicks” for the customer.

With the total value of digital assets in excess of $1 trillion, there is increased conviction that investment markets will need to migrate

to more digital forms of asset tokenization. This will create opportunities for a new generation of market participants and provide access

to markets that have been historically reserved for high-net-worth individuals.

In 2021, HUMBL Financial

created BLOCK ETX products to simplify digital asset investing for customers and institutions seeking exposure to a new, 24/7

digital asset class. We have launched this product in 100 countries outside the United States. HUMBL Financial has developed proprietary,

multi-factor blockchain indexes, trading algorithms and financial services for the new digital asset trading markets to accommodate index,

active and thematic investment strategies. BLOCK ETXs are completely non-custodial, algorithmically driven software services that allow

customers to purchase and hold digital assets in pre-set allocations through their own digital asset exchange accounts. BLOCK ETXs are

compatible for United States customers who have accounts with Coinbase Pro, Bittrex US or Binance US and for non-US customers

who have accounts with Bittrex Global. BLOCK ETXs were served first on the desktop and web version of the HUMBL platform, with

the goal of future applications inside the HUMBL mobile application. HUMBL Financial is open to the licensing of the BLOCK ETXs to institutions

and exchanges. HUMBL Financial also plans to offer trusted, third-party financial services in areas such as payments, investments,

credit card services and lending across the HUMBL platform over time.

In February 2022, the Company

elected to suspend offering the BLOCK ETX products pending further legal analysis regarding how to offer the BLOCK ETXs in a fully compliant

manner with the evolving laws and regulatory treatment of such novel products.

Organizational

History

We

were formed under the name Ponca Acquisition Corporation in Nevada on May 3, 2000, as a “blank check” development stage company

that indicated that our business plan was to engage in a merger or acquisition with an unidentified company or companies. Following a

series of name changes and changes in the focus of our business, on November 18, 2008, we filed Form 15 with the SEC to terminate its

registration with the SEC.

On

March 12, 2009, we redomiciled to Oklahoma and on March 16, 2009, changed our name from IWT Tesoro Corporation to Tesoro Distributors,

Inc. Tesoro Enterprises, Inc., an Oklahoma corporation, was incorporated on November 12, 2009, as a subsidiary of Tesoro Distributors,

Inc.

On

March 11, 2010, we changed our name to Tesoro Enterprises, Inc. and received a new symbol of TSNP following FINRA review of our name

and symbol change request.

Effective

November 4, 2020, we entered into a Stock Purchase Agreement with Henry J. Boucher, then President, CEO and Chairman of the Board of

Directors, and Brian Foote under which Henry J. Boucher sold his controlling interest in the Company in the form of 7,000,000 shares

of the Company’s Series A preferred stock to Brian Foote in return for Brian Foote assigning a $40,000 promissory note from HUMBL

LLC to Henry J. Boucher. Our Board of Directors, following the change of control, appointed Brian Foote, Jeff Hinshaw and Michele Rivera

to be the members of the Board following the resignation of Henry J. Boucher as our sole director.

On

November 30, 2020, we changed our domicile to Delaware.

On

December 3, 2020, we merged with HUMBL LLC to conduct the business of HUMBL LLC through a reverse merger. Under the terms of the merger,

the members of HUMBL LLC exchanged their membership interests for 552,029 shares of our Series B Preferred Stock.

On

December 23, 2020, we filed a Certificate of Amendment to our Certificate of Incorporation (“Amended Certificate”) to effect

a 1:4 reverse split, change our name to HUMBL, Inc., increase our authorized common stock to 7,450,000,000 shares, reduce our authorized

number of “blank check” preferred stock from 25 million to 10 million and designate a Series B and Series C Preferred Stock.

Recent

Acquisitions

On

June 3, 2021 we acquired Tickeri, Inc. (“Tickeri”) in a debt and stock transaction totaling $20,000,000 following which Tickeri

became a subsidiary of HUMBL. Tickeri is a leading ticketing, live events and box office SaaS platform featuring Latin events and artists

throughout the United States, Latin America, and the Caribbean corridor. The purchase price for the stock purchase was $20,000,000 of

which we must pay $10,000,000 in our common stock and $10,000,000 was paid through two promissory notes. The shares had a deemed value

equal to the volume weighted average price per share of HUMBL common stock on the OTC Markets for the ten consecutive trading days ending

with the complete trading day ending two trading days prior to the closing. We issued the two shareholders of Tickeri, Juan Gonzalez

and Javier Gonzalez, 4,672,897 shares of our common stock each. We also issued to each of Juan and Javier Gonzalez a secured promissory

note in the face amount of $5,000,000. The promissory notes are due and payable on or before December 31, 2022, bear interest at the

rate of 5% per annum and are secured by the equity interests of Tickeri. In the event of an uncured default by HUMBL under the promissory

note, Juan and Javier have the right to recover the ownership of Tickeri and re-commence the business and operations of Tickeri free

and clear of any claims or encumbrances by HUMBL. We intend to limit the integration of Tickeri’s assets with our assets until

the promissory notes are paid in full. We agreed to register on Form S-1 within three months from the closing the shares issued to Juan

and Javier Gonzalez and have the registration statement declared effective within six months of the closing date. Following the closing,

Juan Gonzalez and Javier Gonzalez entered into employment agreements having a term of 18 months, appointing them CEO of Tickeri and CTO

of HUMBL, respectively

On

June 30, 2021, we acquired Monster Creative, LLC (“Monster”). Monster is a Hollywood production studio that specializes in

producing movie trailers and other related content. Monster was founded by Doug Brandt and Kevin Childress. Monster will collaborate

with HUMBL in the production of NFTs and other digital content. The purchase price for all of the membership interests in Monster was

paid through the issuance of one convertible note and one non-convertible note to each of Doug Brandt and Kevin Childress in the aggregate

principal amount of $8,000,000. The convertible notes were issued to Doug Brandt (through an entity owned by him) and Kevin Childress

in the aggregate principal amount of $7,500,000. The notes convert at the holder’s election at $1.20 per share, bear interest at

5% per annum and are due in 18 months from issuance. We also issued non-convertible notes to Doug Brandt and Kevin Childress in the aggregate

amount of $500,000. These notes bear interest at the rate of 5% per annum and are due on April 1, 2022. Doug Brandt and Kevin Childress

each entered into employment agreements with Monster having a term of three years. Doug Brandt was appointed as the CEO of Monster and

Kevin Childress was appointed as its President and Creative Director.

Recent

Financings and Material Agreements

Aurea

Group

On

March 15, 2021 we entered into a Securities Purchase Agreement with HUMBL CL SpA (“HUMBL CL”), an affiliate of

Aurea Group Ventures (“Aurea Group”), a Chilean multi-family office, under which Aurea Group purchased shares of our

common stock in return for exclusive country rights to Chile of our HUMBL products for a purchase price of up to

$7,500,000.

Under the terms of the Securities

Purchase Agreement, HUMBL CL agreed to purchase 437,500 shares of our common stock for $1,000,000. The payment for these shares

was due on or before March 30, 2021 but as a result of restrictions imposed due to COVID-19 was paid in two tranches of $500,000 each

on April 5, 2021 and April 6, 2021. In addition, HUMBL CL also received the right to purchase 1,562,500 shares of HUMBL common

stock for $6,500,000 by December 31, 2021 and to receive a 35% equity interest in a Chilean subsidiary HUMBL intends to form to conduct

its operations in Chile.

The Securities Purchase Agreement

provides that if HUMBL CL exercises its right to purchase the subsidiary interest, it will receive 35% of the profits from operations

of the HUMBL family of products in Chile. In addition, HUMBL CL also received a right of first refusal with respect to regional

or country rights sales in Latin America.

On January 3, 2022, we entered

into a Settlement Agreement with HUMBL CL whereby HUMBL agreed to issue HUMBL CL 4,000,000 shares of common stock and HUMBL CL agreed

to waive its right to purchase the Latin America territory rights.

We are still working with

Aurea Group on Latin American business development opportunities for our products in key verticals such as: banking, merchant

and financial services, real estate, hospitality, tourism, sports, festivals, entertainment and ticketing services in the region.

Brighton

Capital Partners, LLC

On

April 14, 2021 we received bridge financing in the form of a loan in the principal amount of $3,300,000 from Brighton Capital Partners,

LLC (“Brighton Capital”) for which we issued them a convertible promissory note due 15 months after April 14, 2021. The note

bears interest at 10% per annum and is convertible at Brighton Capital’s election at a fixed price of $3.15 per share.

Under

the terms of the note, Brighton Capital has a right of redemption commencing on the earlier of the effective date of this Registration

Statement and the 12-month anniversary of the note, to cause us to redeem all or any portion of the note in cash or shares of our common

stock, at our election. Any redemption with shares of our common stock shall be at the “market price” which is defined as

80% of our lowest closing trade price for the 10 consecutive trading days prior to the date on which the market price is measured. The

Company and Brighton Capital also entered into an Equity Financing Agreement for the purchase of up to $50,000,000 of the Company’s

common stock by Brighton Capital. The Company and Brighton Capital agreed to terminate the Equity Financing Agreement on October 26,

2021. The Company paid a termination fee of 3,000,000 shares of its common stock to Brighton Capital.

Next

Generation Wealth Management LLC

On

May 13, 2021, we entered into a Securities Purchase Agreement with Next Generation Wealth Management LLC (“Next Generation”)

under which we received a loan of $382,500 for which we issued a convertible note to Next Generation. in the principal amount of $382,500

bearing interest at 8% per annum with a maturity date 22 months from the date of the note. The note is convertible into shares of our

common stock at $1.00 per share. The note is subject to customary default provisions. Under the terms of the Securities Purchase Agreement,

we also issued a warrant to allow Next Generation to purchase 750,000 shares of our common stock during a two-year period ending May

13, 2023 at an exercise price of $1.00 per share. On June 24, 2021, the note was split into two separate notes and warrants and assigned

to The Strider Lir Trust and Scottish Isles Investing, LLC, the notes being in the principal amount of $336,600 and $45,900, respectively,

and two separate warrants to purchase 660,000 and 90,000 shares of our common stock, respectively.

Maize

and Gray, LLC

On

May 13, 2021, we entered into a Securities Purchase Agreement with Maize and Gray LLC (“Maize”) under which we received a

loan of $402,750 for which we issued a convertible note to Maize in the principal amount of $402,750 bearing interest at 8% per annum

with a maturity date 22 months from the date of the note. The note is convertible into shares of our common stock at $1.00 per share.

The note is subject to customary default provisions. Under the terms of the Securities Purchase Agreement, we also issued a warrant to

allow Maize to purchase 825,000 shares of our common stock during a two-year period ending May 13, 2023 at an exercise price of $1.00

per share.

Archura

Capital Pty Ltd

On

May 17, 2021, we entered into a Securities Purchase Agreement with Archura Capital Pty Ltd (“Archura”) under which we received

a loan in the amount of $1,020,000 for which we issued a convertible note in the principal amount of $1,020,000 bearing interest at 8%

per annum with a maturity date 22 months from the date of the note. The note is convertible into shares of our common stock at $1.00

per share. The note is subject to customary default provisions.

KWP

50, LLC

On