As

filed with the Securities and Exchange Commission on June 17, 2019

Registration

No. 333-217309

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Post-Effective

Amendment No. 2

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HealthLynked

Corp.

(Exact

Name of Registrant as specified in its charter)

|

Nevada

|

|

7373

|

|

47-1634127

|

(State

or other Jurisdiction of

Incorporation or Organization)

|

|

(Primary

Standard Industrial

Classification Code Number)

|

|

(I.R.S.

Employer

Identification No.)

|

1726

Medical Blvd Suite 101

Naples,

Florida 34110

Telephone:

(239) 513-1992

Facsimile:

(239) 513-9022

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Michael

Dent, M.D.

Chief

Executive Officer

1726

Medical Blvd Suite 101

Naples,

Florida 34110

Telephone:

(239) 513-1992

Facsimile:

(239) 513-9022)

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

With

copies to:

Andrea

Cataneo

Sheppard,

Mullin, Richter & Hampton LLP

30

Rockefeller Plaza

New

York, NY 10012

Telephone:

(212) 653-8700

Facsimile:

(212) 653-8701

Approximate

date of commencement of proposed sale to the public:

As

soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box.

þ

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration

statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

þ

|

Smaller reporting company

|

þ

|

|

|

|

Emerging

growth company

|

þ

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount to be Registered (1)

|

|

|

Proposed Maximum Offering

Price per

Share

|

|

|

Proposed

Maximum

Aggregate

Offering

Price (2)

|

|

|

Amount of Registration Fee

|

|

|

Common Stock, par value $0.0001 per share

|

|

|

21,000,000

|

|

|

$

|

0.20

|

|

|

$

|

4,200,000

|

|

|

$

|

486.78

|

*

|

|

(1)

|

This

registration statement shall also cover any additional shares of common stock which become issuable by reason of any stock

dividend, stock split, recapitalization or any other similar transaction effected without the receipt of consideration which

results in an increase in the number of the registrant’s outstanding shares of common stock.

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

|

|

|

|

|

*

|

Previously

paid

|

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL

THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME

EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE

ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

EXPLANATORY

NOTE

This Post-Effective Amendment

No. 2 (this “Post-Effective Amendment”) to the registration statement on

Form S-1

(File No. 333- 217309) (the “Registration Statement”), is being filed pursuant to Section 10(a)(3) of the Securities

Act of 1933, as amended (the “Securities Act”) to update the Registration Statement by, among other things, including

(i) the audited consolidated financial statements of HealthLynked Corp. (the “Registrant”) as at and for the year

ended December 31, 2018 which were filed with the Securities and Exchange Commission (the “Commission”) on April 1,

2019 as part of the Registrant’s Annual Report on

Form 10-K

, and (ii) the unaudited condensed consolidated financial statements

as at and for the three month period ended March 31, 2019.

This

Post-Effective Amendment covers only the resale, from time to time, of up to 21,000,000 shares of common stock issuable to the

Selling Stockholder listed herein under an Investment Agreement by and between the Company and the Selling Stockholder. The Registrant

previously paid to the Commission the entire registration fee relating to the shares of common stock that are the subject of this

Post-Effective Amendment. The Registrant paid a fee of $486.78 in connection with the registration of 21,000,000 shares of common

stock in connection with the Registration Statement.

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount to be Registered (1)

|

|

|

Proposed Maximum Offering

Price per

Share

|

|

|

Proposed

Maximum

Aggregate

Offering

Price (2)

|

|

|

Amount of Registration Fee

|

|

|

Common Stock, par value $0.0001 per share

|

|

|

21,000,000

|

|

|

$

|

0.20

|

|

|

$

|

4,200,000

|

|

|

$

|

486.78

|

*

|

|

(1)

|

This

registration statement shall also cover any additional shares of common stock which become issuable by reason of any stock

dividend, stock split, recapitalization or any other similar transaction effected without the receipt of consideration which

results in an increase in the number of the registrant’s outstanding shares of common stock.

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

|

|

|

|

|

*

|

Previously

paid

|

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL

THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME

EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE

ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we

are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY

PROSPECTUS

Subject

To Completion, Dated June 17, 2019

21,000,000

Shares

HEALTHLYNKED

CORP.

Common

Stock

This

prospectus relates to shares of common stock of HealthLynked Corp. that may be sold by the selling stockholder identified in this

prospectus. The shares of common stock offered under this prospectus by the selling stockholder are issuable to Iconic Holdings

LLC, or Iconic, pursuant to an investment agreement between Iconic and ourselves entered into in July 2016 and amended in March

2017. We are registering the offer and sale of the shares to satisfy registration rights we have granted. We will not receive

any of the proceeds from the sale of shares by the selling stockholder.

The

selling stockholder may sell the shares of common stock described in this prospectus in a number of different ways and at varying

prices. We provide more information about how the selling stockholder may sell its shares of common stock in the section titled

“Plan of Distribution.” Iconic is an “underwriter” within the meaning of the Securities Act of 1933, as

amended, in connection with sales of shares offered pursuant to this prospectus. We will pay the expenses incurred in registering

the shares, including legal and accounting fees.

Our

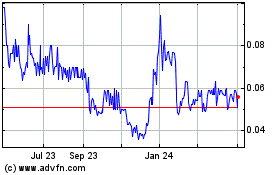

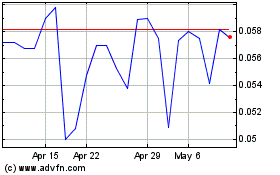

common stock has been traded on the OTCQB under the symbol “HLYK” since May 10, 2017. The last reported sale price

of our common stock on the OTCQB on June 13, 2019 was $0.2499.

In

addition, we qualify as an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act of 1933

and, as such, are allowed to provide in this prospectus more limited disclosures than an issuer that would not so qualify. Furthermore,

for so long as we remain an emerging growth company, we will qualify for certain limited exceptions from investor protection laws

such as the Sarbanes Oxley Act of 2002 and the Investor Protection and Securities Reform Act of 2010. Please read “Risk

Factors” and “Prospectus Summary—Emerging Growth Company Status.”

Investing

in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties

described under the heading “Risk Factors” beginning on page 4 of this prospectus before making a decision to purchase

our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2019

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with

different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not

making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the

information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business,

financial condition, results of operations and prospects may have changed since that date.

PROSPECTUS

SUMMARY

The following summary

highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be

important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical

financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless the context provides

otherwise, the terms “HealthLynked,” “HLKD,” “HLYK,” “the Company,” “we,”

“us,” and “our” refer to HealthLynked Corp.

Overview

HealthLynked Corp.

is a growth stage company incorporated in the state of Nevada on August 6, 2014. We operate a cloud-based Patient Information

Network (PIN) and record archiving system, referred to as the “HealthLynked Network”, which enables patients and doctors

to keep track of medical information via the Internet in a cloud based system. Through our website, www.HealthLynked.com and our

mobile apps, patients can complete a detailed online personal medical history including past surgical history, medications, allergies,

and family medical history. Once this information is entered, patients and their treating physicians are able to update the information

as needed, to provide a comprehensive and up to date medical history.

We believe that the

HealthLynked Network offers several advantages to patients and physicians not available in the market today. We provide a comprehensive

marketing solution allowing physicians to market to both active and inactive patients, and an easy to use connection at the point

of care through our patient access HUB. Patient members can access medical newsfeeds and groups. Our real-time appointment scheduling

application allows for patients to book appointments online with participating healthcare providers. Our database and record archives

allow for seamless sharing of medical records between healthcare providers and keeps patients in control of shared access. In

the HealthLynked Network, parents can create accounts for their children that are linked to their family account, allowing them

to provide access to healthcare providers, track vaccination records, allow hospitals and schools access to important medical

information in case of emergencies. The HealthLynked Network will be accessible 24 hours a day, 7 days a week, via the internet

and on mobile applications for both Android and iOS devices. We believe this type of accessibility is important for schools and

during office visits, but more important, in times of a medical emergency.

We anticipate that

our system will also provide for 24-hour access to medical specialist healthcare providers who can answer medical questions and

direct appropriate care to paying members. In addition to 24-hour access, patients may also schedule telemedicine consultations

at set times with participating healthcare providers who have expertise in various specialized areas of medicine. Participating

physicians can elect to allow patients to request online appointments either via our real-time app or by setting, in their administrator

dashboard panel, times and days of the week that patients may request appointments. Appointment requests are then sent by our

system to an email address specified by the physician’s office, who are then requested to follow up to confirm these appointment

requests or automatically accept the appointment request.

HealthLynked has created

880,000 physician base profiles for most physicians in the United States. Physicians’ HealthLynked profiles are searchable

on the Internet. Physicians claim their profiles confirming the accuracy of the information free of charge.

There are three type

of providers in the HealthLynked Network: in-network, out of network and participating providers. All physicians can claim their

profile and update basic information online and add videos and images of their profile. Once a provider has claimed their profile

they are considered in-network. Providers that opt pay a monthly fee for access to the full range of HealthLynked Network services,

which include online scheduling, marketing services and analytics about their practice performance.

HealthLynked provider

profiles enable participating providers to market directly to patients through our patient access HUB and online marketing services

to recruit new patients and reengage with former patients. Physician practices generate more income the more patients they treat,

so maximizing efficiency and patient turnover is critical to increasing total revenues and profitability. As such, we believe

that our system will enable physicians to reduce the amount of time required to process patient intake forms, as patients will

no longer be required to spend ten to thirty minutes filling out forms at each visit, and the practices’ staffs will not

need to input this information multiple times into their electronic medical records systems. Patients complete their online profiles

once, and thereafter, they and their physicians are able to update their profiles as needed. Physicians’ participating in

the HealthLynked Network are required to update the patient records within 24 hours of seeing the patient. The information is

organized in an easy to read format in order that a physician be able to review the necessary information quickly during, and

prior to, patient visits, which in turn facilitates a more comprehensive and effective patient encounter.

Patient data is stored

in conformity with the

Health Insurance Portability and Accountability Act

of 1996,

the Health Information

Technology for Economic and Clinical Health Act, and the regulations promulgated under each by the U.S. Department of Health and

Human Services, Office of Civil Rights

(collectively, “HIPAA”). The network utilizes Amazon AWS infrastructure

which uses Amazon “HIPPA” complaint servers along with Amazon RDS with LAMP, HTML5 and several JavaScript frameworks,

including Angular and React. Recommendations for end users are 512 kbps+ internet connection speed and a web browser such as Google

Chrome, Internet Explorer, Mozilla Firefox, Safari or handheld devices such as iOS devices, android phones or tablets. Our developers

utilize third party controls for functionality and user interface where the use of those controls adds value to the system beyond

custom creation of new tools. We intend to adjust forward compatibility for major browser version updates, new browsers, operating

system updates or new operating system as needed. The HealthLynked Network is EMR agnostic, and is compatible with all electronic

medical records systems, allowing for minimal barriers to participation and broader penetration of the market.

Emerging Growth Company Status

We are an “emerging

growth company” as defined in the Jumpstart Our Business Startups Act, or “JOBS Act.” For as long as we are

an emerging growth company, unlike other public companies, we will not be required to:

|

|

●

|

provide

an auditor’s attestation report on management’s assessment of the effectiveness

of our system of internal control over financial reporting pursuant to Section 404(b)

of the Sarbanes-Oxley Act of 2002;

|

|

|

●

|

comply with

any new requirements adopted by the Public Company Accounting Oversight Board, or the

PCAOB, requiring mandatory audit firm rotation or a supplement to the auditor’s

report in which the auditor would be required to provide additional information about

the audit and the financial statements of the issuer;

|

|

|

●

|

comply with

any new audit rules adopted by the PCAOB after April 5, 2012, unless the Securities and

Exchange Commission, or SEC, determines otherwise;

|

|

|

●

|

provide

certain disclosure regarding executive compensation required of larger public companies;

or

|

|

|

●

|

obtain shareholder

approval of any golden parachute payments not previously approved.

|

We will cease to be an “emerging

growth company” upon the earliest of:

|

|

●

|

when we

have $1.0 billion or more in annual revenues;

|

|

|

●

|

when we

have at least $700 million in market value of our common stock held by non-affiliates;

|

|

|

●

|

when we

issue more than $1.0 billion of non-convertible debt over a three-year period; or

|

|

|

●

|

the last

day of the fiscal year following the fifth anniversary of our initial public offering.

|

In addition, Section

107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided

in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging

growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1),

which will allow us to delay the adoption of new or revised accounting standards that have different effective dates for public

and private companies until those standards apply to private companies. As a result of this election, our financial statements

may not be comparable to companies that comply with public company effective dates.

Business Address and Telephone Number

Our address is 1726

Medical Blvd Suite 101, Naples, Florida 34110 and our telephone number is: 800-938-7144.

THE OFFERING

|

Common stock offered by selling security holder

|

|

21,000,000 shares of our common stock issuable to

Iconic under the Investment Agreement.

|

|

|

|

|

|

Offering price

|

|

The prices at which Iconic may sell shares will be determined

by the prevailing market price for the shares or in privately negotiated transactions.

|

|

|

|

|

|

Common stock outstanding before the offering

|

|

101,068,541 shares

(1)

|

|

|

|

|

|

Common stock outstanding after the offering

|

|

116,709,019 shares

(2)

|

|

|

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale of the common

stock by the selling stockholder. However, we expect to receive up to $3,000,000 upon the exercise of the Put Right

granted to us under the Investment Agreement, which we expect we would use primarily for working capital purposes such as

sales, marketing and product development costs related to the commercialization of the HealthLynked Network, to supplement

the operations of NWC, and for overhead costs. In order to access cash available under the Investment Agreement, our common

stock must be listed on a recognized stock exchange or market and the shares underlying the arrangement must be subject to

an effective registration statement and we must meet other requirements as described herein. If we are unable to meet these

requirements, we will not have access to funds under this arrangement. There can be no assurances that we will be able to

meet these requirements.

|

|

|

|

|

|

Trading Symbol

|

|

HLYK

|

|

|

|

|

|

Risk Factors

|

|

You should carefully consider the information set forth in this

prospectus and, in particular, the specific factors set forth in the “Risk Factors” section of this prospectus

before deciding whether or not to invest in our common stock.

|

|

(1)

|

Represents the number of shares of our common stock outstanding as of June 13, 2019. Excludes (i) all shares issuable under the Investment Agreement, (ii) 9,479,643 shares of common stock issuable upon conversion of fixed-rate convertible notes held by the Selling Shareholder (the “Convertible Notes”), (iii) 5,896,565 shares of common stock issuable upon conversion of other convertible notes issued by us, (iv) 4,036,750 shares of common stock issuable upon exercise of outstanding options, and (v) 43,658,874 shares of common stock issuable upon exercise of outstanding warrants.

|

|

|

|

|

(2)

|

Includes (i) 101,068,541 shares of common stock and (ii) 15,640,478 shares of common stock issuable under the Investment Agreement. Excludes (i) 9,479,643 shares of common stock issuable upon conversion of the Convertible Notes, (ii) 5,896,565 shares of common stock issuable upon conversion of other convertible notes issued by us, (iii) 4,036,750 shares of common stock issuable upon exercise of outstanding options, and (iv) 43,658,874 shares of common stock issuable upon exercise of outstanding warrants.

|

RISK

FACTORS

FINANCIAL

AND GENERAL BUSINESS RISKS

Our

subsidiary the Naples Women’s Center, currently our only source of income, has incurred losses in the past and may not be

able to achieve profitability in the future.

Even

though our NWC subsidiary was established in 1996, it is subject to many of the risks inherent in the practice of medicine. We

cannot give any assurance that NWC’s operations will continue as currently intended and no assurance can be given that we

can continue to receive reimbursement from third party payers. Further, changes in Healthcare regulations in the coming years

may negatively impact our operations. NWC realized segment loss from operations for the years ended December 31, 2017 and 2018

and the three months ended March 31, 2019. During the second half of 2018, we had one physician who did not renew her contract,

one leave due to an unexpected disability, and a third leave due to early retirement. Even with these losses, NWC experienced

7% revenue growth in 2018. By the second quarter of 2019, we expect to have all three physicians replaced and then we plan to

hire approximately two to five additional new physicians over the next two to five years, which will result in increased costs

and expenses, which may result in future operating losses.

We

may never be able to implement our proposed online personal medical information and archiving system and as such, an investment

in us at this stage of our business is extremely risky.

The

HealthLynked Network was launched in 2018 with positive early results. We have over 200 physicians “in network” and

over 475,000 patients. We continually develop additional functionality of the Network. However, we cannot predict the scale of

how many physicians and patients will adopt our technology, or even when they do, the timing of such large scale adoption. Further,

it is possible that other competitors with greater resources could enter the market and make it more difficult for us to attract

or keep customers. Consequently, at this phase of our development, our future is speculative and depends on the proper execution

of our business model, including our deployment of the Patient Access Hub.

No

assurance can be given that we will be able to timely repay the amounts due on convertible notes outstanding.

At

the present time, no assurance can be given that we will earn sufficient revenues or secure the necessary financing, if needed,

to timely pay the amounts owed under convertible notes outstanding. Our convertible notes outstanding issued in 2016 and 2017

with an aggregate face value of $711,000 are secured by substantially all of our assets, including, but not limited to, receivables

of NWC, machinery, equipment, contracts rights, and letters of credits. If we fail to timely repay the amounts owed under the

these convertible notes, which mature on December 31, 2019, a default may allow the lender under the relevant instruments to accelerate

the related debt and to exercise their remedies under these agreements, which will typically include the right to declare the

principal amount of that debt, together with accrued and unpaid interest and other related amounts, immediately due and payable,

to exercise any remedies the lender may have to foreclose on assets that are subject to liens securing that debt. As of December

31, 2018, we had convertible notes payable with an aggregate face value of $1,394,500 with maturities between July 30, 2019 and

December 31, 2019. We expect to repay these obligations from outside funding sources, including but not limited to amounts available

upon the exercise of the Put Right granted to us under the Investment Agreement, sales of our equity, loans from related parties

and others, or to satisfy convertible notes payable through the issuance of shares upon conversion pursuant to the terms of the

respective convertible notes payable. No assurances can be given that we will be able to access sufficient outside capital in

a timely fashion in order to repay the convertible notes payable before they mature. In order to access cash available under the

Investment Agreement or satisfy the convertible notes payable through the issuance of shares upon conversion, our common stock

must be listed on a recognized stock exchange or market and the shares underlying the arrangement must be subject to an effective

registration statement. If we are unable to meet these requirements, we will not have access to funds under this arrangement.

We

have substantial future capital needs and our ability to continue as a going concern depends upon our ability to raise additional

capital and achieve profitable operations.

We

currently anticipate that our available cash resources will be sufficient to meet our presently anticipated working capital requirements

through the third quarter of 2019. As of December 31, 2018, we had a working capital deficit of $2,983,926 and accumulated deficit

$10,501,055. For the year ended December 31, 2018, we had a net loss of $5,790,835 and net cash used by operating activities of

$2,356,186. As of March 31, 2019, we had a working capital deficit of $2,778,539 and accumulated deficit $11,561,772. For the

three months ended March 31, 2019, we had a net loss of $1,060,717 and net cash used by operating activities of $600,393. We anticipate

that we will need an additional $3,500,000 in 2019 to properly execute our business and acquisition plan and service debt maturing

in 2019 of which most matures December 31, 2019. We may also need to raise additional funds in order to support more rapid expansion,

develop new or enhanced services and products, make acquisitions, hire employees, respond to competitive pressures, acquire technologies

or respond to unanticipated requirements. Management’s plans include attempting to improve our profitability and our ability

to generate sufficient cash flow from operations to meet our operating needs on a timely basis, obtaining additional working capital

funds through equity and debt financing arrangements, and restructuring on-going operations to eliminate inefficiencies to increase

our cash balances. However, there can be no assurance that these plans and arrangements will be sufficient to fund our ongoing

capital expenditures, working capital, and other requirements. Management intends to make every effort to identify and develop

sources of funds. The outcome of these matters cannot be predicted at this time. There can be no assurance that any additional

financings will be available to the Company on satisfactory terms and conditions, if at all. If adequate funds are not available

on acceptable terms, we may be unable to develop or enhance our services and products, take advantage of future opportunities

or respond to competitive pressures or unanticipated requirements, which could have a material adverse effect on our business,

financial condition and operating results. Further, we may seek to raise additional funds through the issuance of equity securities,

in which case, the percentage ownership of our shareholders will be reduced and holders may experience additional dilution in

net book value per share.

Our

future success depends on our ability to execute our business plan by fully developing our online medical records platform and

recruiting physicians and patients to adopt and use the system. However, there is no guarantee that we will be able to successfully

implement our business plan.

Our

operations to date have been limited to the medical services provided by the NWC. We have not yet demonstrated our ability to

successfully develop or market the online medical records platform we seek to provide through the HealthLynked Network. We have

not entered into any agreements with third party doctors or patients to use our system for their medical records and there is

no assurance that we will be able to enter into such agreements in the future.

We

may not be able to effectively control and manage our growth.

Our

strategy envisions a period of potentially rapid growth in our physician network over the next five years based on aggressively

increasing our marketing efforts. We currently maintain a small in house programming, IT, administrative and sales personnel.

The capacity to service the online medical records platform and our expected growth, including growth via acquisition, may impose

a significant burden on our future planned administrative and operational resources. The growth of our business may require significant

investments of capital and increased demands on our management, workforce and facilities. We will be required to substantially

expand our administrative and operational resources and attract, train, manage and retain qualified employees, management and

other personnel. Failure to do so, or to satisfy such increased demands would interrupt or have a material adverse effect on our

business and results of operations.

The

departure or loss of Dr. Michael Dent could disrupt our business.

During

2018, we depended heavily on the continued efforts of Dr. Michael Dent, Chief Executive Officer and Chairman of the Board, who

provided us with a total of $101,450 and $338,470 in working capital during the year ended December 31, 2018 and 2017, respectively.

Dr. Dent is also essential to our strategic vision and day-to-day operations and would be difficult to replace. While we have

entered into a four-year written employment contract with Dr. Dent effective July 1, 2016, we cannot be certain that Dr. Dent

will continue with us for any particular period of time. The departure or loss of Dr. Dent, or the inability to hire and retain

a qualified replacement, could negatively impact our ability to manage our business.

We

recently eliminated our direct sales force and moved to a telesales model, which may not be successful.

We

eliminated our entire sales force in the fourth quarter of 2018 and adopted a telesales model. Although this change reduced our

annual burn rate by an estimated $650,000 annually, there is no assurance that our more cost-efficient telesales model will be

effective, and this could have a negative effect on the business and its growth.

The

healthcare industry is highly regulated, and government authorities may determine that we have failed to comply with applicable

laws, rules or regulations.

The

healthcare industry, healthcare information technology, the online medical records platform services that we provide and the physicians’

medical practices we engage in through NWC are subject to extensive and complex federal, state and local laws, rules and regulations,

compliance with which imposes substantial costs on us. Of particular importance are the provisions summarized as follows:

|

|

●

|

federal

laws (including the federal False Claims Act) that prohibit entities and individuals

from knowingly or recklessly making claims to Medicaid, Medicare and other government-funded

programs that contain false or fraudulent information or from improperly retaining known

overpayments;

|

|

|

●

|

a

provision of the Social Security Act, commonly referred to as the “anti-kickback”

statute, that prohibits the knowing and willful offer, payment, solicitation or receipt

of any bribe, kickback, rebate or other remuneration, in cash or in kind, in return for

the referral or recommendation of patients for items and services covered, in whole or

in part, by federal healthcare programs, such as Medicaid and Medicare;

|

|

|

●

|

a

provision of the Social Security Act, commonly referred to as the Stark Law, that, subject

to limited exceptions, applies when physicians refer Medicare patients to an entity for

the provision of certain “designated health services” if the physician or

a member of such physician’s immediate family has a direct or indirect financial

relationship (including a compensation arrangement) with the entity;

|

|

|

●

|

similar

state law provisions pertaining to anti-kickback, fee splitting, self-referral and false

claims issues, which typically are not limited to relationships involving government-funded

programs;

|

|

|

●

|

provisions

of the federal Health Insurance Portability and Accountability Act of 1996, as amended

(“HIPAA”) that prohibit knowingly and willfully executing a scheme or

artifice to defraud a healthcare benefit program or falsifying, concealing or covering

up a material fact or making any material false, fictitious or fraudulent statement in

connection with the delivery of or payment for healthcare benefits, items or services;

|

|

|

●

|

state

laws that prohibit general business corporations from practicing medicine, controlling

physicians’ medical decisions or engaging in certain practices, such as splitting

fees with physicians;

|

|

|

●

|

federal

and state healthcare programs may deny our application to become a participating provider

that could in turn cause us to not be able to treat those patients or prohibit us from

billing for the treatment services provided to such patients;

|

|

|

●

|

federal

and state laws that prohibit providers from billing and receiving payment from Medicaid

or Medicare for services unless the services are medically necessary, adequately and

accurately documented and billed using codes that accurately reflect the type and level

of services rendered;

|

|

|

●

|

federal

and state laws pertaining to the provision of services by non-physician practitioners,

such as advanced nurse practitioners, physician assistants and other clinical professionals,

physician supervision of such services and reimbursement requirements that may be dependent

on the manner in which the services are provided and documented; and

|

|

|

●

|

federal

laws that impose civil administrative sanctions for, among other violations, inappropriate

billing of services to federally funded healthcare programs, inappropriately reducing

hospital care lengths of stay for such patients, or employing individuals who are excluded

from participation in federally funded healthcare programs.

|

In

addition, we believe that our business, including the business conducted through NWC, will continue to be subject to increasing

regulation, the scope and effect of which we cannot predict.

We

may in the future become the subject of regulatory or other investigations or proceedings, and our interpretations of applicable

laws, rules and regulations may be challenged. For example, regulatory authorities or other parties may assert that our arrangements

with the physicians using the HealthLynked Network constitute fee splitting and seek to invalidate these arrangements, which could

have a material adverse effect on our business, financial condition, results of operations, cash flows and the trading price of

our common stock. Regulatory authorities or other parties also could assert that our relationships violate the anti-kickback,

fee splitting or self-referral laws and regulations. Such investigations, proceedings and challenges could result in substantial

defense costs to us and a diversion of management’s time and attention. In addition, violations of these laws are punishable

by monetary fines, civil and criminal penalties, exclusion from participation in government-sponsored healthcare programs, and

forfeiture of amounts collected in violation of such laws and regulations, any of which could have a material adverse effect on

our overall business, financial condition, results of operations, cash flows and the trading price of our common stock.

Federal

and state laws that protect the privacy and security of protected health information may increase our costs and limit our ability

to collect and use that information and subject us to penalties if we are unable to fully comply with such laws.

Numerous

federal and state laws and regulations govern the collection, dissemination, use, security and confidentiality of individually

identifiable health information. These laws include:

|

|

●

|

Provisions

of HIPAA that limit how healthcare providers may use and disclose individually identifiable

health information, provide certain rights to individuals with respect to that information

and impose certain security requirements;

|

|

|

●

|

The

Health Information Technology for Economic and Clinical Health Act (“HITECH”),

which strengthens and expands the HIPAA Privacy Standards and Security Standards and

imposes data breach notification obligations;

|

|

|

●

|

Other

federal and state laws restricting the use and protecting the privacy and security of

protected health information, many of which are not preempted by HIPAA;

|

|

|

●

|

Federal

and state consumer protection laws; and

|

|

|

●

|

Federal

and state laws regulating the conduct of research with human subjects.

|

Through

the HealthLynked Network, we collect and maintain protected health information in paper and electronic format. New protected health

information standards, whether implemented pursuant to HIPAA, HITECH, congressional action or otherwise, could have a significant

effect on the manner in which we handle healthcare-related data and communicate with third parties, and compliance with these

standards could impose significant costs on us, or limit our ability to offer certain services, thereby negatively impacting the

business opportunities available to us.

In

addition, if we do not comply with existing or new laws and regulations related to protected health information, we could be subject

to remedies that include monetary fines, civil or administrative penalties, civil damage awards or criminal sanctions.

RISKS

RELATED TO THE HEALTHLYNKED NETWORK

The

market for Internet-based personal medical information and record archiving systems may not develop substantially further or develop

more slowly than we expect, harming the growth of our business.

It

is uncertain whether personal medical information and record archiving systems will achieve and sustain the high levels of demand

and market acceptance we anticipate. Further, even though we expect NWC patients and physicians to use the HealthLynked Network,

our success will depend, to a substantial extent, on the willingness of unaffiliated patients, physicians and hospitals to use

our services. Some patients, physicians and hospitals may be reluctant or unwilling to use our services, because they may have

concerns regarding the risks associated with the security and reliability, among other things, of the technology model associated

with these services. If our target users do not believe our systems are secure and reliable, then the market for these services

may not expand as much or develop as quickly as we expect, either of which would significantly adversely affect our business,

financial condition, or operating results.

If

we do not continue to innovate and provide services that are useful to our target users, we may not remain competitive, and our

revenues and operating results could suffer.

Our

success depends on our ability to keep pace with technological developments, satisfy increasingly sophisticated client requirements,

and obtain market acceptance. Our competitors are constantly developing products and services that may become more efficient or

appealing to our clients and users. As a result, we will be required to invest significant resources in research and development

in order to enhance our existing services and introduce new high-quality services that clients and users will want, while offering

these services at competitive prices.

If

we are unable to predict user preferences or industry changes, or if we are unable to modify our services on a timely or cost-effective

basis, we may lose clients and target users. Our operating results would also suffer if our innovations are not responsive to

the needs of our clients and users, are not appropriately timed with market opportunity, or are not effectively brought to market.

As technology continues to develop, our competitors may be able to offer results that are, or that are perceived to be, substantially

similar to or better than those generated by our services. This may force us to compete on additional service attributes and to

expend significant resources in order to remain competitive.

Failure

to manage our rapid growth effectively could increase our expenses, decrease our revenue, and prevent us from implementing our

business strategy.

To

manage our anticipated future growth effectively, we will need to enhance our information technology infrastructure and financial

and accounting systems and controls, as well as manage expanded operations in geographically distributed locations. We also must

engage and retain a significant number of qualified professional services personnel, software engineers, technical personnel,

and management personnel. Failure to manage our rapid growth effectively could lead us to over-invest or under-invest in technology

and operations; result in weaknesses in our infrastructure, systems, or controls; give rise to operational mistakes, losses, or

loss of productivity or business opportunities; reduce client or user satisfaction; limit our ability to respond to competitive

pressures; and could also result in loss of employees and reduced productivity of remaining employees. Our growth could require

significant capital expenditures and may divert financial resources and management attention from other projects, such as the

development of new or enhanced services. If our management is unable to effectively manage our growth, our expenses may increase

more than expected, our revenue could decline or may grow more slowly than expected, and we may be unable to implement our business

strategy.

We

may be unable to adequately protect, and we may incur significant costs in enforcing, our intellectual property and other proprietary

rights.

Our

success depends in part on our ability to enforce our intellectual property and other proprietary rights. We expect to rely upon

a combination of copyright, trademark, trade secret, and unfair competition laws, as well as license and access agreements and

other contractual provisions, to protect these rights.

Our

attempts to protect our intellectual property through copyright, patent, and trademark registration may be challenged by others

or invalidated through administrative process or litigation. While we have submitted the application for our first provisional

patent for our Patient Access Hub and intend to submit other patent applications covering our integrated technology during 2019,

the scope of issued patents, if any, may be insufficient to prevent competitors from providing products and services similar to

ours, our patents may be successfully challenged, and we may not be able to obtain additional meaningful patent protection in

the future. There can be no assurance that our patent registration efforts will be successful.

Our

expected agreements with clients, users, vendors and strategic partners will limit their use of, and allow us to retain our rights

in, our intellectual property and proprietary information. Further, we anticipate that these agreements will grant us ownership

of intellectual property created in the performance of those agreements to the extent that it relates to the provision of our

services. In addition, we require certain of our employees and consultants to enter into confidentiality, non-competition, and

assignment of inventions agreements. We also require certain of our vendors and strategic partners to agree to contract provisions

regarding confidentiality and non-competition. However, no assurance can be given that these agreements will not be breached,

and we may not have adequate remedies for any such breach. Further, no assurance can be given that these agreements will be effective

in preventing the unauthorized access to, or use of, our proprietary information or the reverse engineering of our technology.

Agreement terms that address non-competition are difficult to enforce in many jurisdictions and may not be enforceable in any

particular case. In any event, these agreements do not prevent our competitors from independently developing technology or authoring

clinical information that is substantially equivalent or superior to our technology or the information we distribute.

To

the extent that our intellectual property and other proprietary rights are not adequately protected, third parties might gain

access to our proprietary information, develop and market products or services similar to ours, or use trademarks similar to ours,

each of which could materially harm our business. Existing U.S. federal and state intellectual property laws offer only limited

protection. In addition, if we resort to legal proceedings to enforce our intellectual property rights or to determine the validity

and scope of the intellectual property or other proprietary rights of others, the proceedings could be burdensome and expensive,

even if we were to prevail. Any litigation that may be necessary in the future could result in substantial costs and diversion

of resources and could have a material adverse effect on our business, operating results, or financial condition.

In

addition, our platforms incorporate “open source” software components that are licensed to us under various public

domain licenses. While we believe that we have complied with our obligations under the various applicable licenses for open source

software that we use, open source license terms are often ambiguous, and there is little or no legal precedent governing the interpretation

of many of the terms of certain of these licenses. Therefore, the potential impact of such terms on our business is somewhat unknown.

For example, some open source licenses require that those using the associated code disclose modifications made to that code and

such modifications be licensed to third parties at no cost. We monitor our use of open source software in an effort to avoid uses

in a manner that would require us to disclose or grant licenses under our proprietary source code. However, there can be no assurance

that such efforts will be successful, and such use could inadvertently occur.

We

may be sued by third parties for alleged infringement of their proprietary rights.

The

software and Internet industries are characterized by the existence of a large number of patents, trademarks, and copyrights and

by frequent litigation based on allegations of infringement or other violations of intellectual property rights. We may receive

in the future communications from third parties claiming that we, our technology, or components thereof, infringe on the intellectual

property rights of others. We may not be able to withstand such third-party claims against our technology, and we could lose the

right to use third-party technologies that are the subject of such claims. Any intellectual property claims, whether with or without

merit, could be time-consuming and expensive to resolve, divert management attention from executing our business plan, and require

us to pay monetary damages or enter into royalty or licensing agreements. Although we intend that many of our third-party service

providers will be obligated to indemnify us if their products infringe the rights of others, such indemnification may not be effective

or adequate to protect us or the indemnifying party may be unable to uphold its contractual obligations.

Moreover,

any settlement or adverse judgment resulting from such a claim could require us to pay substantial amounts of money or obtain

a license to continue to use the technology or information that is the subject of the claim, or otherwise restrict or prohibit

our use of the technology or information. There can be no assurance that we would be able to obtain a license on commercially

reasonable terms, if at all, from third parties asserting an infringement claim; that we would be able to develop alternative

technology on a timely basis, if at all; that we would be able to obtain a license to use a suitable alternative technology or

information to permit us to continue offering, and our clients to continue using, our affected services; or that we would not

need to change our product and design plans, which could require us to redesign affected products or services or delay new offerings.

Accordingly, an adverse determination could prevent us from implementing our strategy or offering our services and products, as

currently contemplated.

We

may not be able to properly safeguard the information on the HealthLynked Network.

Information

security risks have generally increased in recent years because of new technologies and the increased activities of perpetrators

of cyber-attacks resulting in the theft of protected health, business or financial information. A failure in, or a breach of our

information systems as a result of cyber-attacks could disrupt our business, result in the release or misuse of confidential or

proprietary information, damage our reputation, and increase our administrative expenses. Although we plan to have robust information

security procedures and other safeguards in place, as cyber threats continue to evolve, we may be required to expend additional

resources to continue to enhance our information security measures or to investigate and remediate any information security vulnerabilities.

Any of these disruptions or breaches of security could have a material adverse effect on our business, financial condition and

results of operations.

Our

employees may not take all appropriate measures to secure and protect confidential information in their possession.

Each

of our employees is advised that they are responsible for the security of the information in our systems and to ensure that private

information is kept confidential. Should an employee not follow appropriate security measures, including those that have been

put in place to prevent cyber threats or attacks, the improper release of protected health information could result. The release

of such information could have a material adverse effect our reputation and our business, financial condition, results of operations

and cash flows.

RISKS

RELATED TO THE PROVISION OF MEDICAL SERVICES BY NWC

Any

state budgetary constraints could have an adverse effect on our reimbursement from Medicaid programs

.

As

a result of slow economic growth and volatile economic conditions, many states are continuing to collect less revenue than they

did in prior years and as a consequence are facing budget shortfalls and underfunded pension and other obligations. Although the

shortfalls for the more recent budgetary years have declined, they are still significant by historical standards. The financial

condition in Florida or other states in which we may in the future could lead to reduced or delayed funding for Medicaid programs

and, in turn, reduced or delayed reimbursement for physician services, which could adversely affect our results of operations,

cash flows and financial condition.

The

Affordable Care Act may have a significant effect on our business.

The

Affordable Care Act contains a number of provisions that could affect us over the next several years. These provisions include

the establishment of health insurance exchanges to facilitate the purchase of qualified health plans. Other provisions contain

changes to healthcare fraud and abuse laws and expand the scope of the FCA.

The

Affordable Care Act contains numerous other measures that could affect us. For example, payment modifiers are being developed

that will differentiate payments to physicians under federal healthcare programs based on quality and cost of care. In addition,

other provisions authorize voluntary demonstration projects relating to the bundling of payments for episodes of hospital care

and the sharing of cost savings achieved under the Medicare program.

The

Centers for Medicare and Medicaid Services (“CMS”) issued a final rule under the Affordable Care Act that is intended

to allow physicians, hospitals and other health care providers to coordinate care for Medicare beneficiaries through Accountable

Care Organizations (“ACOs”). ACOs are entities consisting of healthcare providers and suppliers organized to deliver

services to Medicare beneficiaries and eligible to receive a share of any cost savings the entity can achieve by delivering services

to those beneficiaries at a cost below a set baseline and based upon established quality of care standards. We will continue to

evaluate the impact of the ACO regulations on our business and operations.

The

Affordable Care Act also allows states to expand their Medicaid programs through an increase in the Medicaid eligibility income

limit from a state’s current eligibility levels to 133% of the federal poverty level. It remains unclear to what extent

states will expand their Medicaid programs by raising the income limit to 133% of the federal poverty level.

The

Affordable Care Act also remains subject to continuing legislative scrutiny, including efforts by Congress to further amend or

repeal a number of its provisions as well as administrative actions delaying the effectiveness of key provisions. As a result,

we cannot predict with any assurance the ultimate effect of the Affordable Care Act on our Company, nor can we provide any assurance

that its provisions will not have a material adverse effect on our business, financial condition, results of operations or cash

flows.

Government-funded

programs or private insurers may limit, reduce or make retroactive adjustments to reimbursement amounts or rates.

A

portion of the net patient service revenue derived from services rendered through NWC is from payments made by Medicare and Medicaid and

other government-sponsored or funded healthcare programs (the “GHC Programs”). These government-funded programs, as

well as private insurers, have taken and may continue to take steps, including a movement toward increased use of managed care

organizations, value-based purchasing, and new patient care models to control the cost, eligibility for, use and delivery of healthcare

services as a result of budgetary constraints and cost containment pressures due to unfavorable economic conditions, rising healthcare

costs and for other reasons. These government-funded programs and private insurers may attempt other measures to control costs,

including bundling of services and denial of, or reduction in, reimbursement for certain services and treatments. As a result,

payments from government programs or private payors may decrease significantly. Also, any adjustment in Medicare reimbursement

rates may have a detrimental impact on our reimbursement rates not only for Medicare patients, but also because Medicaid and other

third-party payors often base their reimbursement rates on a percentage of Medicare rates. Our business may also be materially

affected by limitations on, or reductions in, reimbursement amounts or rates or elimination of coverage for certain individuals

or treatments. Moreover, because government-funded programs generally provide for reimbursements on a fee-schedule basis rather

than on a charge-related basis, we generally cannot increase our revenues from these programs by increasing the amount we charge

for services rendered by NWC’s physicians. To the extent our costs increase, we may not be able to recover our increased

costs from these programs, and cost containment measures and market changes in non-government-funded insurance plans have generally

restricted our ability to recover, or shift to non-governmental payors, these increased costs. In addition, funds we receive from

third-party payors are subject to audit with respect to the proper billing for physician and ancillary services and, accordingly,

our revenue from these programs may be adjusted retroactively. Any retroactive adjustments to our reimbursement amounts could

have a material effect on our financial condition, results of operations, cash flows and the trading price of our common stock.

Government-funded

programs or private insurers may limit, reduce or make retroactive adjustments to reimbursement amounts or rates.

A

portion of the net patient service revenue derived from services rendered through NWC is from payments made by Medicare and Medicaid and

other government-sponsored or funded healthcare programs (the “GHC Programs”). These government-funded programs, as

well as private insurers, have taken and may continue to take steps, including a movement toward increased use of managed care

organizations, value-based purchasing, and new patient care models to control the cost, eligibility for, use and delivery of healthcare

services as a result of budgetary constraints and cost containment pressures due to unfavorable economic conditions, rising healthcare

costs and for other reasons. These government-funded programs and private insurers may attempt other measures to control costs,

including bundling of services and denial of, or reduction in, reimbursement for certain services and treatments. As a result,

payments from government programs or private payors may decrease significantly. Also, any adjustment in Medicare reimbursement

rates may have a detrimental impact on our reimbursement rates not only for Medicare patients, but also because Medicaid and other

third-party payors often base their reimbursement rates on a percentage of Medicare rates. Our business may also be materially

affected by limitations on, or reductions in, reimbursement amounts or rates or elimination of coverage for certain individuals

or treatments. Moreover, because government-funded programs generally provide for reimbursements on a fee-schedule basis rather

than on a charge-related basis, we generally cannot increase our revenues from these programs by increasing the amount we charge

for services rendered by NWC’s physicians. To the extent our costs increase, we may not be able to recover our increased

costs from these programs, and cost containment measures and market changes in non-government-funded insurance plans have generally

restricted our ability to recover, or shift to non-governmental payors, these increased costs. In addition, funds we receive from

third-party payors are subject to audit with respect to the proper billing for physician and ancillary services and, accordingly,

our revenue from these programs may be adjusted retroactively. Any retroactive adjustments to our reimbursement amounts could

have a material effect on our financial condition, results of operations, cash flows and the trading price of our common stock.

We

may become subject to billing investigations by federal and state government authorities.

Federal

and state laws, rules and regulations impose substantial penalties, including criminal and civil fines, exclusion from participation

in government healthcare programs and imprisonment, on entities or individuals (including any individual corporate officers or

physicians deemed responsible) that fraudulently or wrongfully bill government-funded programs or other third-party payors for

healthcare services. CMS issued a final rule requiring states to implement a Medicaid Recovery Audit Contractor (“RAC”)

program effective January 1, 2012. States are required to contract with one or more eligible Medicaid RACs to review Medicaid

claims for any overpayments or underpayments, and to recoup overpayments from providers on behalf of the state. In addition, federal

laws, along with a growing number of state laws, allow a private person to bring a civil action in the name of the government

for false billing violations. We believe that audits, inquiries and investigations from government agencies will occur from time

to time in the ordinary course of NWC’s operations, which could result in substantial defense costs to us and a diversion

of management’s time and attention. We cannot predict whether any future audits, inquiries or investigations, or the public

disclosure of such matters, would have a material adverse effect on our business, financial condition, results of operations,

cash flows and the trading price of our common stock.

We

may not appropriately record or document the services provided by our physicians.

We

must appropriately record and document the services our doctors provide to seek reimbursement for their services from third-party

payors. If our physicians do not appropriately document, or where applicable, code for their services, we could be subjected to

administrative, regulatory, civil, or criminal investigations or sanctions and our business, financial condition, results of operations

and cash flows could be adversely affected.

We

may not be able to successfully recruit and retain qualified physicians, who are key to NWC’s revenues and billing.

During

the second half of 2018, we had one physician who did not renew her contract, one leave due to an unexpected disability, and a

third leave due to early retirement. Although, we expect to have these three physicians replaced by the second quarter of 2019,

this physician turnover negatively impacted our third and fourth quarter 2018 revenues. As part of our business plan, we may acquire

other medical practices as we see fit to further develop, test and deploy the HealthLynked Network into new strategic regional

areas throughout the country. We compete with many types of healthcare providers, including teaching, research and government

institutions, hospitals and health systems and other practice groups, for the services of qualified doctors. We may not be able

to continue to recruit new physicians or renew contracts with existing physicians on acceptable terms. If we do not do so, our

ability to service execute our business plan may be adversely affected.

A

significant number of NWC physicians could leave our practice and we may be unable to enforce the non-competition covenants of

departed employees.

We

have entered into employment agreements with the current NWC physicians. Certain of our employment agreements can be terminated

without cause by any party upon prior written notice. In addition, substantially all of our physicians have agreed not to compete

with us within a specified geographic area for a certain period after termination of employment. The law governing non-compete

agreements and other forms of restrictive covenants varies from state to state. Although we believe that the non-competition and

other restrictive covenants applicable to our affiliated physicians are reasonable in scope and duration and therefore enforceable

under applicable state law, courts and arbitrators in some states are reluctant to strictly enforce non-compete agreements and

restrictive covenants against physicians. Our physicians may leave our practices for a variety of reasons, including providing

services for other types of healthcare providers, such as teaching, research and government institutions, hospitals and health

systems and other practice groups. If a substantial number of our physicians leave our practices or we are unable to enforce the

non-competition covenants in the employment agreements, our business, financial condition, results of operations and cash flows

could be materially, and adversely affected. We cannot predict whether a court or arbitration panel would enforce these covenants

in any particular case.

We

may be subject to medical malpractice and other lawsuits not covered by insurance.

Our

business entails an inherent risk of claims of medical malpractice against our affiliated physicians and us. We may also be subject

to other lawsuits which may involve large claims and significant defense costs. Although we currently maintain liability insurance

coverage intended to cover professional liability and other claims, there can be no assurance that our insurance coverage will

be adequate to cover liabilities arising out of claims asserted against us. Liabilities in excess of our insurance coverage, including

coverage for professional liability and other claims, could have a material adverse effect on our business, financial condition,

results of operations, cash flows and the trading price of our common stock. See “Professional and General Liability Coverage.”

We

may not be able to collect reimbursements for our services from third-party payors in a timely manner.

A

significant portion of our net patient service revenue is derived from reimbursements from various third-party payors, including GHC

Programs, private insurance plans and managed care plans, for services provided by NWC physicians. We are responsible for submitting

reimbursement requests to these payors and collecting the reimbursements, and we assume the financial risks relating to uncollectible

and delayed reimbursements. In the current healthcare environment, payors continue their efforts to control expenditures for healthcare,

including revisions to coverage and reimbursement policies. Due to the nature of our business and our participation in government-funded

and private reimbursement programs, we are involved from time to time in inquiries, reviews, audits and investigations by governmental

agencies and private payors of our business practices, including assessments of our compliance with coding, billing and documentation

requirements. We may be required to repay these agencies or private payors if a finding is made that we were incorrectly reimbursed,

or we may be subjected to pre-payment reviews, which can be time-consuming and result in non-payment or delayed payment for the

services we provide. We may also experience difficulties in collecting reimbursements because third-party payors may seek to reduce

or delay reimbursements to which we are entitled for services that our affiliated physicians have provided. In addition, GHC Programs

may deny our application to become a participating provider that could prevent us from providing services to patients or prohibit

us from billing for such services. If we are not reimbursed fully and in a timely manner for such services or there is a finding

that we were incorrectly reimbursed, our revenue, cash flows and financial condition could be materially, adversely affected.

Certain

federal and state laws may limit our effectiveness at collecting monies owed to us from patients.

We

utilize third parties to collect from patients any co-payments and other payments for services that are provided by NWC physicians.

The federal Fair Debt Collection Practices Act restricts the methods that third-party collection companies may use to contact

and seek payment from consumer debtors regarding past due accounts. State laws vary with respect to debt collection practices,

although most state requirements are similar to those under the Fair Debt Collection Practices Act. The Florida Consumer Collection

Practices Act, is broader than the federal legislation, applying the regulations to “creditors” as well as “collectors,”

whereas the Fair Debt Collection Practices Act is applicable only to collectors. This prohibits creditors who are attempting

to collect their own debts from engaging in behavior prohibited by the Fair Debt Collection Practices Act and Florida

Consumer Collection Practices Act. The Act has very specific guidelines regarding which actions debt collectors and creditors

may engage in to collect unpaid debt. If our collection practices or those of our collection agencies are inconsistent with

these standards, we may be subject to actual damages and penalties. These factors and events could have a material adverse effect

on our business, financial condition and results of operations.

We

may not be able to maintain effective and efficient information systems.

The

profitability of our business, including the services provided by NWC, is dependent on uninterrupted performance of our information

systems. Failure to maintain reliable information systems, disruptions in our existing information systems or the implementation

of new systems could cause disruptions in our business operations, including errors and delays in billings and collections, disputes

with patients and payors, violations of patient privacy and confidentiality requirements and other regulatory requirements, increased

administrative expenses and other adverse consequences.

RISKS

RELATING TO OUR ORGANIZATION

Our

articles of incorporation authorize our board to create a new series of preferred stock without further approval by our stockholders,

which could adversely affect the rights of the holders of our common stock.

Our

board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our board of

directors also has the authority to issue preferred stock without further stockholder approval. As a result, our board of directors

could authorize the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon

liquidation, the right to receive dividend payments before dividends are distributed to the holders of common stock and the right

to the redemption of the shares, together with a premium, prior to the redemption of our common stock. In addition, our board

of directors could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or

that is convertible into our common stock, which could decrease the relative voting power of our common stock or result in dilution

to our existing stockholders.