AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION August 15, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO THE

FORM 10

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

| HALBERD CORPORATION |

| (Exact name of Registrant as specified in its charter) |

| Colorado | | 8731 | | 87-3538414 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer ID No., if applicable) |

P.O. Box 25

Jackson Center, Pennsylvania 16133

(814) 786--8849

(Address and telephone number of Registrant’s principal executive offices)

William A. Hartman (814) 786-8849

1362 Springfield Church Rd, Jackson Center, Pennsylvania 16133

(Name, address (including zip code) and telephone number (including area code) of contact person and agent for service in the United States)

Securities to Be Registered Pursuant to Section 12(b) of the Act: None

Securities to Be Registered Pursuant to Section 12(g) of the Act:

Title of Class to Be So Registered: Common Stock

Indicate by check mark whether the Registrant is a large accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definition of “large accelerated filer,” ‘accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large, Accelerated Filer | ☐ | Accelerated Filer | ☐ |

| Non-Accelerated Filer | ☒ | Emerging Growth Company | ☐ |

| Smaller Reporting Company | ☒ | | |

If an emerging growth company, indicate by check mark if the Registrant elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

ITEM 1 BUSINESS

Halberd Corporation (“Halberd,” “HALB” or the “Company”) was originally incorporated in Nevada January 26, 2009 and, after going through multiple prior reorganizations was re-incorporated in Colorado in May 2020. By way of background, HALB changed its name to Tykhe Corporation on April 22, 2014. It then redomiciled to Colorado and changed its name to Alaric Corporation on January 25, 2017. Finally, on March 22, 2020, it changed its name to HALB Transition Corporation, before engaging in a reorganization whereby the name of the public company again became Halberd Corporation with a subsidiary named Alaric Corporation.

Halberd believes its extracorporeal technological approach is both unique and adaptable to many disease states. Accordingly, Halberd’s team of professionals has employed its skills, resources and focus to concentrate on developing treatments against some of the world’s more persistent diseases, including Alzheimer’s Disease, PTSD, Parkinson’s Disease, epilepsy and other neurodegenerative diseases, sepsis, meningitis and pandemics. Except for select trade secrets, Halberd’s technology is incorporated into three issued U.S. Patents covering extracorporeal treatment of disease, and 20 related provisional patent applications.

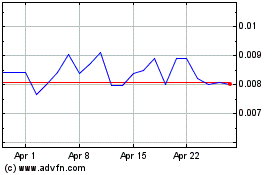

The Company’s trading symbol is HALB, currently a Pink Sheet/OTC Markets-traded security. Only HALB’s common stock ($0.0001 par value) is traded at this time. The total shares authorized as of March 31, 2022 is 800,000,000 shares. HALB’s shares outstanding as of March 31, 2022 are 513,650,338 shares. The Company has 83 shareholders of record (common stock). There are no outstanding promissory, convertible notes or debt arrangements. There are 484,350,000 net warrants at varying exercise prices and 10,000,000 net outstanding preferred shares (with voting rights) outstanding as described in the footnotes to Item 4 below. Neither the Company nor any affiliate, director or officer is the subject of an any criminal or civil action (the so-called “bad boy” provisions), nor is any pending or threated.

Halberd’s technology is based on the philosophy that the best way to treat any disease is to eliminate the pathophysiologic basis (or cause) of the disease. This is done through extracorporeal treatment of the applicable bodily fluid – blood or cerebral spinal fluid (CSF). This approach can be applied to eliminate virtually any disease, without the use of potentially harmful chemical drugs injected or ingested into a patient, and with virtually zero side effects.

Through Halberd’s extracorporeal treatment, no disease can escape elimination, including diseases previously considered “incurable”. This approach seeks to remove the basis of the disease, instead of adding things to the body and, in our opinion has the potential to revolutionize medicine. For example, this approach could eventually eliminate the need for medications and drugs as we know them today. In that context, management believes that every pharmaceutical company has to ask themselves two questions: 1) What happens to us if we do partner with Halberd? and 2) What happens to us if we don’t partner with Halberd…and the competition does?

Halberd has demonstrated the extracorporeal elimination from CSF, in vitro, of ten key proteins/cytokines associated with the principal neurodegenerative diseases which affect nearly 40 million people in the US alone. This elimination was accomplished by exposing the treated CSF (conjoined antibodies and metallic nanoparticles) to a tuned laser, for 20 minutes or less, or exposure to radio frequency energy. It also accomplished this by chemically binding antibodies against the target antigen to the surfaces of a filtering cartridge (similar to dialysis). Halberd also accomplished the successful elimination of E. coli in buffer solution through this same process.

Halberd faces numerous challenges going forward, including proof of safety and efficacy to FDA standards. To that end, Halberd has been approved as a government contractor and has applied for a $75,000,000 development contract in the area of PTSD and traumatic brain injury for the Department of Defense.

Our next phase of development will be to eliminate a subset of the target neuro-degenerative disease antigens from blood serum, followed immediately by animal testing in conjunction with a major university.

Halberd is seeking an experienced partner in the development, FDA approval and commercialization of biomedical products. If Halberd cannot secure a viable relationship with such a partner, Halberd plans to secure the services of CRO’s and/or CMO’s. hiring the talent necessary to achieve commercialization.

Halberd has in fact engaged the services of the Phoenix Group, Inc. (“Phoenix”), an experienced government contract organization skilled in securing contracts for deserving companies seeking contracts with the Department of Defense (“DoD”). A $20,000 retainer has been paid and the associated engagement agreement is now an exhibit to this Form 10 filing. The Phoenix representative has met with DoD and various agencies within the DoD. Phoenix has advised us we were determined by the Department of Defense to be compliant with the requirements of The National Defense Authorization Act – 116 Congress; 10 U.S.C. 2371b Prototype is Sec 819 to carry out Prototype Projects. Halberd, through Phoenix, has also taken preliminary actions in that shepherding process, including the issuance of a DUNS number (117910200) and COMMERCIAL AND GOVERNMENT ENTITY (CAGE) CODE (97PF7), the first step in seeking approval of its formal whitepaper submission for a $75,000,000 contract under the National Defense Authorization Act (made permanent and codified by 10 U.S.C 2371b).

Previous diseases classified as “uncurable” are labeled such due to the fact that no drug or treatment exists to alleviate the symptoms or root cause of a given disease. Halberd’s patented extracorporeal treatment is designed to eliminate the root cause of the disease. By creating “designer antibodies” with a strong affinity to the targeted disease antigen (and, in turn, conjugate them to metallic nanoparticles), these conjugates (to date) have acted like a magnet to the target disease antigen. This combination of antibody-metallic nanoparticle-antigen can then be irradiated with laser emissive energy, causing the metallic nanoparticles to generate localized heating-- which kills the target antigen. (It has been well known for over a century that elevated temperatures kill germs, whether viral, bacterial and disease antigens). Halberd’s methoology is highly selective and only targets the desired elements for elimination and subsequent removal from blood or cerebro-spinal fluid. Our experience suggests that no disease can develop a resistance to this treatment since the elimination method is flash sterilization via elevated temperature of the disease antigen molecule.

This methodology can also be applied through bonding of the “designer antibody” to a surface over which the select bodily fluid is flowed. The antibody again acts like a magnet attracting and retaining the target antigens--and only the target antigens--to the bonding surface. This can be accomplished through a process similar to dialysis, albeit with different filter cartridges for different diseases. After treatment, the cartridges are disposed of through normal biohazard waste disposal means. As with the laser eradication described above, no disease can develop a resistance to this elimination method since it a removal process, without the use of drugs.

Halberd is also developing a treatment methodology which does not even require conjoining of metallic nanoparticles to the body or laser heating of the anti-body complex. –with high affinity for disposable collection. Halberd in fact is developing s simpler methodology than the process described above. That would eliminate the need for metallic nanoparticles and laser heating, a process that we are confident would be less costly and with reduced both complexity and training required.

See Exhibit 10.4 for our list of patents issued over time as well as the attached 3 page Patent Office foundational patents list (Exhibit 10.7) summarizing Halberd’s underlying technology The first patent was issued in 2014 and the most recent patent was issued in 2021. All patents expire by their terms 20 years from the date of issuance. That means the HALB protections will roll off/expire between 2034 and 2041. The patents are owned by MARV Enterprises, LLC (“MARV”). MARV, in turn, is owned by Dr. Mitchell S. Felder, Halberd’s Chief Technology Officer.) The patents are licensed to Halberd per the attached Exhibit 10.8. Halberd is responsible for the protection of these patents. The pre-issued patents embody Halberd’s structural base for our business (augmented by Halberd which has had international protection of its patents under the Patent Cooperation Treaty (“PCT”) in approximately 150 countries). Halberd has executed an exclusive License Agreement with Dr. Felder/MARV under which MARV is paid a royalty of 5% of the net profits associated with Halberd’s commercialization of the protected patents.

Diseases classified as “uncurable” are labeled such due to the fact that no drug or treatment exists to alleviate the symptoms or root cause of a given disease. Halberd’s patented extracorporeal treatment is designed to eliminate the root cause of the disease. By creating “designer antibodies” with a strong affinity to the targeted disease antigen (and, in turn, conjugate them to metallic nanoparticles), these conjugates (to date) have acted like a magnet to the target disease antigen. This combination of antibody-metallic nanoparticle and antigen can then be irradiated with laser emissive energy, causing the metallic nanoparticles to generate localized heating-- which kills the target antigen. Halberd’s methodology is highly selective and only targets the desired elements for elimination and subsequent removal from blood or cerebro-spinal fluid. Our experience suggests that no disease can develop a resistance to this treatment since the elimination method is flash sterilization via elevated temperature of the disease antigen molecule.

we are confident would be simpler, less costly and with reduced complexity and training required.

This methodology can also be applied through bonding of the “designer antibody” to a surface over which the select bodily fluid is flowed. The antibody again acts like a magnet attracting and retaining the target antigens, and only the target antigens, to the bonding surface. This can be accomplished through a process similar to dialysis, but with different filter cartridges for different diseases. After treatment, the cartridges are disposed of through normal biohazard waste disposal means. As with the laser eradication described above, no disease can develop a resistance to this elimination method since it a removal process, without the use of drugs

Since our initial Form 10 filing with the SEC, HALB has continued negotiations related to entering into a Sponsored Research Agreement with Mississippi State University (“Mississippi”) to guide and potentially conduct animal testing for Halberd . (This is in addition to the research work well underway with both Arizona State University and Youngstown State University.) Halberd, relative to its competitors in this space, has limited funds. As a result, animal testing at a reasonable price and special efficiency is essential. Very specifically, Halberd believes that its “optimal strategy” requires judicious use of animal tests and taking advantage of Mississippi’s acknowledged expertise in animal testing expertise will result in savings in cost and timing. In due course, we expect to engage Mississippi and, in fact, we have already had substantive discussions regarding costs of clinical trials, timing and alternatives that might reduce costs apropos to CTE, PTSD and suicides within the military.

Moreover, Halberd is diligently working hard to find potential partners in the pharmaceutical industry, whether individuals or organizations. In that context, since our initial filing with SEC, the Company has engaged the services of mdi Consultants, Inc (“mdi”), an FDA process consulting firm. mdi has represented companies with over 4,000 products that have gone through the FDA protocols. Such Consulting Research Agreement is attached as Exhibit 10.6.. mdi specializes in assisting companies which need to navigate the FDA’s complex requirements and protocols to obtain authorization to market medical devices and services. As part of its outreach to the industry, Halberd issues press releases frequently to keep pharmaceutical companies aware of our research efforts. As a further example, we are convinced that the HALB extracorporeal treatments would increase the efficacy of existing “monoclonal anti-bodies” cocktaisl. [Such outreach has resulted in Halberd getting an endorsement from the NFL Retired Players Association regarding the use of Halberd’s extracorporeal treatment relating to CTE and traumatic brain injuries: Halberd expects to work with mdi to obtain FDA Emergency Use Authorization of Halberd’s technology for select conditions and afflictions. Our objective, ultimately, is for our extracorporeal treatment to become “accepted practice” or “normal care. To get to that objective, we actively seek out joint ventures, partnerships, contract relationships and consultants or advisors which could bring revenue to the Company.

The support we have received to date has only come from Epidemiologic Solutions Corporation (“ESC”), approximately $1,200,000 in total, and a$150,000 SBA loan. Management meanwhile continues active pursuit of grants, contracts, partnerships and related sources of third-party funding to complement the monthly charitable payments. The cornerstone of our effort is Arizona State University (“ASU”), a leader in molecular sciences, the discipline underlying Halberd’s extracorporeal treatment. After doing a thorough review of what was most needed in the way of educational and pharmaceutical connections, ASU became the winner…over and above ASU’s leadership in molecular science. (ASU also complements the expertise offered by Youngstown State University and Mississippi State. University.) Upon ASU’s engagement in August 2020, patent counsel was engaged and Halberd directed ASU to commence work from among multiple research projects, the research targeting antigens.

Halberd’s broad technical capabilities are embodied in its key personnel listed below, the first group being officers and directors and the second group being consultants and advisors.

William A. Hartman is our Chairman of the Board of Directors, President and Chief Executive Officer. From March 2008 until May 2020, Mr. Hartman was President and CEO of Premier Biomedical, Inc. From October 2006 to March 2008, Mr. Hartman was the Chief Operating Officer of Nanologix, Inc. From July 1991 to July 2000, Mr. Hartman was a Director at TRW Automotive. From 1984 to 1991, Mr. Hartman was Chief Engineer at TRW Automotive and from 1979 to 1984, he was Division Quality Compliance Manager at Ford Motor Company. At TRW Automotive, Mr. Hartman was one of the auto industry pioneers of the concept of grouping related components into systems and modules and shipping just-in-time to the vehicle assembly plants. He founded and headed a separate business group within TRW Automotive with plants in the U.S., Mexico and Europe with combined annual sales of $1.3 Billion. Academic credentials include a BSME degree from Youngstown State University and a MSIA degree (Industrial Administration/Management) from the University of Michigan.

Contact: W.Hartman@halberdcorporation.com

Mitchell S. Felder, MD, is our Chief Technology Officer, Member of the Scientific Advisory Board and a prolific inventor. He is a Board Certified Neurologist, former Chairman of the Board of Premier Biomedical, former CEO, President, Chairman and founder of Infectech and Nanologix. Dr. Felder acquired a B.A. Degree from the University of Pennsylvania in 1975 and a M.D. Degree from the University of Rome, Faculty of Medicine in 1983. Dr. Felder did his residency at Saint Vincent Hospital in New York, New York, where he was chosen to be Chief Resident in Neurology. He has been Board Certified by both the American Academy of Clinical Neurology and the American Board of Psychiatry and Neurology. Dr. Felder is a Clinical Assistant Professor in the Department of Neurology at the Texas Tech University Health Sciences Center. Dr. Felder has authored or co-authored six publications, three studies and has currently 18 issued patents. Dr. Felder was the Acting Chief of the Department of Neurology, Sharon Regional Health System from 1989 until 2001. Dr. Felder served as the Acting Chief of the Department of Neurology at the William Beaumont Army Medical Center in 2011.

Mitchell S. Felder, MD, is our Chief Technology Officer, Member of the Scientific Advisory Board and a prolific inventor. He is a Board Certified Neurologist, former Chairman of the Board of Premier Biomedical, former CEO, President, Chairman and founder of Infectech and Nanologix. Dr. Felder acquired a B.A. Degree from the University of Pennsylvania in 1975 and a M.D. Degree from the University of Rome, Faculty of Medicine in 1983. Dr. Felder did his residency at Saint Vincent Hospital in New York New York, where he was chosen to be Chief Resident in Neurology. He has been Board Certified by both the American Academy of Clinical Neurology and the American Board of Psychiatry and Neurology. Dr. Felder is a Clinical Assistant Professor in the Department of Neurology at the Texas Tech University Health Sciences Center. Dr. Felder has authored or co-authored six publications, three studies and has currently 18 issued patents. Dr. Felder was the Acting Chief of the Department of Neurology, Sharon Regional Health System from 1989 until 2001. Dr. Felder served as the Acting Chief of the Department of Neurology at the William Beaumont Army Medical Center in 2011.

Contact: M.Felder@halberdcorporation.com

Patricio F. Reyes, MD, FAAN , is our Chief Technical Officer and a member of our Board of Directors. He is board certified and a neuropathologist who is Chief Medical Officer and Board Member of the Retired National Football League Players Association. He is a board member, and former Chair of the Education Committee and 2009 Distinguished Educator of the Association of Ringside Physicians. He is a Fellow of the American Academy of Neurology and was former Professor of Neurology and Neuropathology at Thomas Jefferson Medical School in Philadelphia, Pennsylvania and Professor of Neurology, Pathology and Psychiatry at Creighton University School of Medicine in Omaha, Nebraska.

Dr. Reyes is a co-founder, Chief Medical Officer and Chair of the Scientific Advisory Board of Yuma Therapeutics, Inc., a Harvard Medical School affiliated Biotechnology Company that develops new diagnostic markers and treatment for Alzheimer’s disease and traumatic brain injury. Dr. Reyes is a pioneer in the fields of Aging, Alzheimer’s disease and other neurodegenerative diseases. He established the first Dementia and Alzheimer’s disease clinic and Rapid Brain Autopsy System in the country while he was in Texas and subsequently in Pennsylvania and Nebraska. He was one of the principal investigators who worked on multiple clinical trials that led to the first US FDA approved drug for Alzheimer’s disease and the only skin patch treatment for the same disorder. He and his co-workers were one of the first to describe the olfactory deficits and their anatomical and neuropathological changes in Alzheimer’s disease.

Dr. Reyes obtained his medical degree from the University of the Philippines and started his residency in Internal Medicine and Neurology at the Philippine General Hospital. He pursued his training in Adult and Child Neurology at the University of Kentucky Medical Center, and Neuropathology at the University of Miami School of Medicine. His first academic position was to head the Neurology Division of Audie Murphy VA Hospital and as an assistant professor of Neurology and Pathology at the University of Texas Health Science Center in San Antonio.

Contact: P.Reyes@halberdcorporation.com

John S. Borza, PE, MBA, VMA, is our Chief Operating Officer and a member of our Board of Directors. Prior to May 2020, Mr. Borza was Executive Vice President and a member of Premier Biomedical’s Board of Directors. Mr. Borza is currently the President and Chief Executive Officer of Value Innovation, LLC, a consulting firm focused on value engineering and creative problem solving, where he has served since August 2009. Prior to Value Innovation, Mr. Borza was a Specialist with TRW Automotive from September 2007 to September 2009, and a Director at TRW Automotive from May 1999 to September 2007. Earlier in his career, Mr. Borza worked in R&D for 12 years on a variety of products and technologies, in various capacities ranging from Engineer to Chief Engineer, before moving into launch and production support roles. Mr. Borza is a Registered Professional Engineer (Michigan), an Altshuller Institute certified TRIZ Practitioner, and a SAVE International certified Value Management Associate. He is active in the local chapter of SAVE International. Mr. Borza holds a BS degree in Electrical Engineering and an MBA from the University of Michigan.

Contact: J.Borza@halberdcorporation.com

Heidi H. Carl is our accounting director . From May 2009 to May 2020, Ms. Carl was the Chief Financial Officer and Board Member of Premier Biomedical, Inc. From June 2007 to May 2009, Ms. Carl was the Product Development Specialist at General Motors Corporation. From May 2006 to May 2007, she idi was the Associate Marketing Manager at General Motors Corporation. From May 2003 to May 2006, Ms. Carl was a Marketing Specialist at General Motors Corporation and, from May 1999 to May 2003, she was the District Area Parts Manager over 40 dealerships in three states in the southeast at General Motors Corporation. Academic credentials include a BSBA Degree from Madonna University and an ASBA Degree from Oakland Community College.

Heidi H. Carl is our accounting director. From May 2009 to May 2020, Ms. Carl was the Chief Financial Officer and Board Member of Premier Biomedical, Inc. From June 2007 to May 2009, Ms. Carl was the Product Development Specialist at General Motors Corporation. From May 2006 to May 2007, she idi was the Associate Marketing Manager at General Motors Corporation. From May 2003 to May 2006, Ms. Carl was a Marketing Specialist at General Motors Corporation and, from May 1999 to May 2003, she was the District Area Parts Manager over 40 dealerships in three states in the southeast at General Motors Corporation. Academic credentials include a BSBA Degree from Madonna University and an ASBA Degree from Oakland Community College.

Contact: H.Carl@halberdcorporation.com

Advisors and Consultants

Abdon Luiz Goncalves Nanhay, MD: Dr. Nanhay is a Brazilian physician with over 25 years of experience in general health care and biological sciences. Dr. Nanhay’s experience includes emergency medicine, pediatrics, primary care and mental epidemiology, health management and coordination of clinical research. Dr. Nanhay also worked for medical and educational institutions including the World Health Organization (WHO), UERJ - State University of Rio de Janeiro, State Secretary of Education and Health Secretariat of São João de Meriti City and in the Brazilian Navy. Dr. Nanhay is a technical and biological sciences consultant in South and Central American medicine (including the Amazon rain forest) as well as regulatory requirements in the Southern Hemisphere. Dr. Nanhay is a technical and biological sciences consultant in South and Central American medicine (including the Amazon rain forest) as well as regulatory requirements in the Southern Hemisphere.

Currently, he is a Senior Fellow at the New Westminster College of the Caucasus University in Tbilisi, Georgia and elected Member of the British Royal Society of Biology, London, UK, in 2020. He is also an International Volunteer of the Royal College of General Practitioners of Canada.

Edson Luís de Brito, MIBMM: Mr. de Brito is CEO and Chief Business Development Officer of Cellybri Advanced Therapies in Brazil. Mr. Brito graduated with a Chemistry degree from Faculdade São Bernardo and went on to study Pharmacology and Biochemistry at the Universidade Bandeirante de São Paulo, Brazil. He is a registered member of the Conselho Regional de Farmacia de São Paulo. Mr. Brito obtained a Master’s degree in International Business Management and Marketing from the Instituto Paulista de Ensino e Pesquisa (IPEP) in São Paulo.

Edson Luís de Brito: Mr. Brito is a technical consultant skilled in international pharmacology business, CEO and owner of a pharmaceutical distribution company and is familiar with the international pharmaceutical industry (Central and South America as well as Korea). Mr. Brito graduated with a Chemistry degree from Faculdade São Bernardo and went on to study Pharmacology and Biochemistry at the Universidade Bandeirante de São Paulo, Brazil. He is a registered member of the Conselho Regional de Farmacia de São Paulo. Mr. Brito obtained a Master’s degree in International Business Management and Markerting from the Instituto Paulista de Ensino e Pesquisa (IPEP) in São Paulo.Mr. Brito has held various positions in sales and business development for a number of prominent pharma and biochemical companies in Brazil, and currently holds the position of Chief Business Development Officer and CEO of Cellybri Advanced Therapies in Brazil. Prior to his current position, Mr. Brito was Executive Consultant for Central and South America for the Korea Health Industry Development Institute – KHIDI of Seoul, South Korea. Prior to that, he held the position of Director of Business Development for Auramedi Farmaceutica, in Brazil.

Mr. Brito has held various positions in sales and business development for a number of prominent pharma and biochemical companies in Brazil, and currently holds the position of Chief Business Development Officer and CEO of Cellybri Advanced Therapies in Brazil. Prior to his current position, Mr. Brito was Executive Consultant for Central and South America for the Korea Health Industry Development Institute – KHIDI of Seoul, South Korea. Prior to that, he held the position of Director of Business Development for Auramedi Farmaceutica, in Brazil.

David Wilson, M Ed: Mr. Wilson is a Clinically Certified Forensics Counselor. Wilson was Chief Administrative Officer and an instructor in the Department of Psychiatry at the University of Mississippi Medical Center. He has been responsible for the coordination of research and research grants, securing funding for research in school violence, addiction behavior and special projects. He has served as Director of three Mental Health Centers in Arkansas and assisted The Southern Research Group in Jackson on assigned projects. He maintains a private practice mainly in the area of forensic s while still engaging in patient treatment. Mr. Wilson is a business and technical consultant to the Company and a member of Halberd’s Advisory Board. His extensive network of professional contacts contribute to his value to the Company. Mr. Wilson was Chief Administrative Officer in the Department of Psychiatry at the University of Mississippi Medical Center. Mr. Wilson has served as Director of three Mental Health Centers in Arkansas and assisted The Southern Research Group in Jackson on assigned projects.

Ned Kronfol, MD, is certified by the American Board of Internal Medicine and retired in 2019 as Adjunct Clinical Professor from the William Carey University College of Osteopathic Medicine. Among many other notable accomplishments, Dr. Kronfol served as Medical Director- Renal Care Group/Fresenius Kidney Cat Lake Village, AR from 1987-2017.

Carl Eller: Mr. Eller is a retired, six time Pro Bowl Player and NFL Pro Football Hall of Famer as well as President of the NFL Retired Players Association, was drafted in 1964 as the league’s 6th pick overall by the Minnesota Vikings, he became a major factor as a defensive end with the unit known as the “Purple People Eaters.” Eller became a six-time Pro Bowl player who appeared in four Super Bowls and is currently focused on helping former players transition into retirement. He is also a champion for raising awareness of Chronic Traumatic Encephalopathy (CTE) and PTSD, which is recognized as a growing problem in many professional, college, and even high school sports. Mr. Eller is a licensed drug and alcohol counselor, and founded a group of substance-abuse clinics in the Twin Cities called Triumph Life Centers. He obtained a college degree in Human Services from Metropolitan State University in 1994. He is currently focused on helping former players transition into retirement and suicides in the military.

ITEM 1A RISK FACTORS

Risks Related to Our Business

We are substantially dependent on revenue from our products and services, grants/contract awards.

Our revenue depends upon continued sales of our products as well as the financial rights we have in our therapeutic products and services existing or under development, and grants/contracts from the government or philanthropic organizations. A significant portion of our future revenue will be concentrated on sales of our products/technology. Any of the following negative developments relating to any of our products may adversely affect our revenue and results of operations or could cause a decline in our stock price:

| · | the introduction or greater acceptance of competing products, including new originator therapies, generics, prodrugs and biosimilars of existing products and products approved under abbreviated regulatory pathways; |

| · | safety or efficacy issues; |

| · | limitations and additional pressures on product pricing or price increases, including those resulting from governmental or regulatory requirements; increased competition, including from generic or biosimilar versions of our products; or changes in, or implementation of, reimbursement policies and practices of payors and other third-parties; |

| · | adverse legal, administrative, regulatory or legislative developments; |

| · | our ability to maintain a positive reputation among patients, healthcare providers and others, which may be impacted by our pricing and reimbursement decisions; or |

| · | the inability or reluctance of patients to receive a diagnosis, prescription or administration of our products or a decision to prescribe and administer competitive products. |

Some of our products and services are in the early stages of commercial launch in the U.S. In addition to risks associated with new product launches and the other factors described in these Risk Factors, our ability to successfully commercialize our prospective products and services may be adversely affected due to:

| · | the lack of readiness of healthcare providers to initiate treatment as well as our ability to successfully identify eligible patients based on the information included in the respective products and services label(s); |

| · | concern regarding any accelerated approval of our products or services and associated data; |

| · | our ability to obtain and maintain reimbursement for our prospective products or services; |

| · | the lack of market acceptance of our products or services; |

| · | the effectiveness of our commercial strategy for marketing our products or services; |

| · | delays in the manufacturing, distribution and supply of our products and services; |

| · | the approval of other new products for the same or similar indications; and |

| · | our ability to maintain a positive reputation among patients, healthcare providers and others in the disease community we seek to serve--which may be impacted by our pricing and reimbursement decisions. |

Our long-term success depends upon the successful development of new products and additional indications for our existing products.

Our long-term success will depend upon the successful development of new products and/or services from our research and development activities or our licensees or acquisitions from third-parties, including our commercialization agreements as well as additional indications for our existing products.

Product development is very expensive and involves a high degree of uncertainty and risk and may not be successful. Only a small number of research and development programs result in the commercialization of a product.

It is difficult to predict the success and the time and cost of product development of novel approaches for the treatment of diseases. The development of novel approaches for the treatment of diseases, including development efforts in new modalities such as those based on the antisense oligonucleotide platform and gene therapy, may present additional challenges and risks, including obtaining approval from regulatory authorities that have limited experience with the development of such therapies.

Clinical trial data are subject to differing interpretations and, even if we view data as sufficient to support the safety, effectiveness and/or approval of an investigational therapy, regulatory authorities may disagree and may require additional data, limit the scope of the approval or deny approval altogether. Furthermore, the approval of a product candidate by one regulatory agency does not mean that other regulatory agencies will also approve such product candidate.

Success in preclinical work or early-stage clinical trials does not ensure that later stage or larger scale clinical trials will be successful. Clinical trials may indicate that our product candidates lack efficacy, have harmful side effects, result in unexpected adverse events or raise other concerns that may significantly reduce the likelihood of regulatory approval. This may result in terminated programs, significant restrictions on use and safety warnings in an approved label, adverse placement within the treatment paradigm or significant reduction in the commercial potential of the product candidate.

Even if we could successfully develop new products or indications, we may make a strategic decision to discontinue development of a product candidate or indication if, for example, we believe commercialization will be difficult relative to the standard of care or we prefer to pursue other opportunities in our pipeline.

Sales of new products or services or products or services with additional indications may not meet investor expectations.

If we fail to compete effectively, our business and market position would suffer.

The biopharmaceutical industry and the markets in which we operate are intensely competitive. We compete in the marketing and sale of our products, the development of new products and processes, the acquisition of rights to new products with commercial potential and the hiring and retention of personnel. We compete with biotechnology and pharmaceutical companies that have a greater number of products and services in the market than in our pipeline, and many have substantially greater financial, marketing, research and development and other resources and other technological or competitive advantages than do we.

Our products continue to face increasing competition from the introduction of new originator therapies, generics, prodrugs and biosimilars of existing products and products approved under abbreviated regulatory pathways. Some of these products are likely to be sold at substantially lower prices than our branded products. The introduction of such products as well as other lower-priced competing products has reduced, and may in the future, significantly reduce both the price that we are able to charge for our products and the volume of products we sell, which will negatively impact our revenue. In addition, in some markets, when a generic or biosimilar version of one of our products is commercialized, it may be automatically substituted for our product and significantly reduce our revenue in a short period of time.

Our ability to compete, maintain and grow our business may also be adversely affected due to a number of factors, including:

| · | the introduction of other products, including products that may be more efficacious, safer, less expensive or more convenient alternatives to our products, including our own products and products of our collaborators; |

| · | the off-label use by physicians of therapies indicated for other conditions to treat patients; |

| · | patient dynamics, including the size of the patient population and our ability to identify, attract and maintain new and current patients to our therapies; |

| · | the reluctance of physicians to prescribe, and patients to use, our products without additional data on the efficacy and safety of such products; |

| · | damage to physician and patient confidence in any of our products, generic or biosimilars of our products or any other product from the same class as one of our products, or to our sales and reputation as a result of label changes, pricing and reimbursement decisions or adverse experiences or events that may occur with patients treated with our products or generic or biosimilars of our products; |

| · | inability to obtain appropriate pricing and reimbursement for our products compared to our competitors in key international markets; or |

| · | our ability to obtain and maintain patent, data or market exclusivity for our products. See as well our overview as to competition discussion in “business.” |

Our business may be adversely affected if we do not successfully execute or realize the anticipated benefits of our strategic and growth initiatives.

The successful execution of our strategic and growth initiatives may depend upon internal development projects, commercial initiatives and external opportunities, which may include the acquisition and in-licensing of products, technologies and companies or the entry into strategic alliances and collaborations.

While we believe we have a number of promising products and services in our pipeline, failure or delay of internal development projects to advance or difficulties in executing on our commercial initiatives could impact our current and future growth, resulting in additional reliance on external development opportunities for growth.

Supporting the further development of our existing products and potential new products in our pipeline will require significant capital expenditures and management resources, including investments in research and development, sales and marketing, manufacturing capabilities and other areas of our business. We have made, and may continue to make, significant operating and capital expenditures for potential new products prior to regulatory approval with no assurance that such investment will be recouped, which may adversely affect our financial condition, business and operations.

The availability of high quality, fairly valued external product development is limited and the opportunity for their acquisition is highly competitive. As such, we are not certain that we will be able to identify suitable candidates for acquisition or if we will be able to reach agreement.

We may fail to initiate or complete transactions for many reasons, including failure to obtain regulatory or other approvals as well as disputes or litigation. Furthermore, we may not be able to achieve the full strategic and financial benefits expected to result from transactions, or the benefits may be delayed or not occur at all. We may also face additional costs or liabilities in completed transactions that were not contemplated prior to completion.

Any failure in the execution of a transaction, in the integration of an acquired asset or business or in achieving expected synergies could result in slower growth, higher than expected costs, the recording of asset impairment charges and other actions which could adversely affect our business, financial condition and results of operations.

Sales of our products depend, to a significant extent, on adequate coverage, pricing and reimbursement from third-party payors, which are subject to increasing and intense pressure from political, social, competitive and other sources. Our inability to obtain and maintain adequate coverage, or a reduction in pricing or reimbursement, could have an adverse effect on our business, reputation, revenue and results of operations.

Sales of our products and services depend, to a significant extent, on adequate coverage, pricing and reimbursement from third-party payors. When a new pharmaceutical product is approved, the availability of government and private reimbursement for that product may be uncertain, as is the pricing and amount for which that product will be reimbursed.

Pricing and reimbursement for our products may be adversely affected by a number of factors, including:

| · | changes in, and implementation of, federal, state or foreign government regulations or private third-party payors’ reimbursement policies; |

| · | pressure by employers on private health insurance plans to reduce costs; |

| · | consolidation and increasing assertiveness of payors seeking price discounts or rebates in connection with the placement of our products on their formularies and, in some cases, the imposition of restrictions on access or coverage of particular drugs or pricing determined based on perceived value; |

| · | our ability to receive reimbursement for our products; and |

| · | our value-based contracting program pursuant to which we aim to tie the pricing of our products to their clinical values by either aligning price to patient outcomes or adjusting price for patients who discontinue therapy for any reason, including efficacy or tolerability concerns. |

Our ability to set the price for our products varies significantly from country to country and, as a result, so can the price of our products. Certain countries set prices by reference to the prices in other countries where our products are marketed. Our inability to obtain and maintain adequate prices in a particular country may not only limit the revenue from our products within that country but may also adversely affect our ability to secure acceptable prices in existing and potential new markets, which may limit market growth. This may create the opportunity for trade or otherwise influence our decision to sell or not to sell a product or service, thus adversely affecting our geographic expansion plans and revenue.

Drug prices are under significant scrutiny in the markets in which our products are prescribed. We expect drug pricing and other health care costs to continue to be subject to intense political and societal pressures on a global basis. Competition from current and future competitors may negatively impact our ability to maintain pricing and our market share. New products marketed by our competitors could cause our revenue to decrease due to potential price reductions and lower sales volumes. Additionally, the introduction of generic or biosimilar versions of our products, follow-on products, prodrugs or products approved under abbreviated regulatory pathways may significantly reduce the price that we are able to charge for our products and the volume of products we sell.

Many payors continue to adopt benefit plan changes that shift a greater portion of prescription costs to patients, including more limited benefit plan designs, higher patient co-pay or co-insurance obligations and limitations on patients’ use of commercial manufacturer co-pay payment assistance programs (including through co-pay accumulator adjustment or maximization programs). Significant consolidation in the health insurance industry has resulted in a few large insurers and pharmacy benefit managers exerting greater pressure in pricing and usage negotiations with drug manufacturers, significantly increasing discounts and rebates required of manufacturers and limiting patient access and usage. Further consolidation among insurers, pharmacy benefit managers and other payors would increase the negotiating leverage such entities have over us and other drug manufacturers. Additional discounts, rebates, coverage or plan changes, restrictions or exclusions as described above could have a material adverse effect on sales of our affected products.

Our failure to obtain or maintain adequate coverage, pricing or reimbursement for our products could have an adverse effect on our business, reputation, revenue and results of operations.

We depend on relationships with collaborators, joint venture partners and other third-parties for revenue, and for the development, regulatory approval, commercialization and marketing of certain of our products and product candidates, which are outside of our full control.

We rely on a number of collaborators, joint ventures and other third-party relationships for revenue and the development, regulatory approval, commercialization and marketing of certain of our products and product candidates. We also outsource certain aspects of our regulatory affairs and clinical development relating to our products and product candidates to third-parties. Reliance on third-parties subjects us to a number of risks, including:

| · | we may be unable to control the resources our collaborators, joint venture partners or third-parties devote to our programs, products or product candidates; |

| · | disputes may arise under an agreement, including with respect to the achievement and payment of milestones, payment of development or commercial costs, ownership of rights to technology developed, and the underlying agreement may fail to provide us with significant protection or may fail to be effectively enforced if the collaborators, joint ventures partners or third-parties fail to perform; |

| · | the interests of our collaborators, joint venture partners or third-parties may not always be aligned with our interests, and such parties may not pursue regulatory approvals or market a product in the same manner or to the same extent that we would, which could adversely affect our revenue, or may adopt tax strategies that could have an adverse effect on our business, results of operations or financial condition; |

| · | third-party relationships require the parties to cooperate, and failure to do so effectively could adversely affect product sales or the clinical development or regulatory approvals of product candidates under joint control, could result in termination of the research, development or commercialization of product candidates or could result in litigation or arbitration; |

| · | any failure on the part of our collaborators, joint venture partners or third-parties to comply with applicable laws, including tax laws, regulatory requirements and/or applicable contractual obligations or to fulfill any responsibilities they may have to protect and enforce any intellectual property rights underlying our products could have an adverse effect on our revenue as well as involve us in possible legal proceedings; and |

| · | any improper conduct or actions on the part of our collaborators, joint venture partners or third-parties could subject us to civil or criminal investigations and monetary and injunctive penalties, impact the accuracy and timing of our financial reporting and/or adversely impact our ability to conduct business, our operating results and our reputation. |

Given these risks, there is considerable uncertainty regarding the success of our current and future collaborative efforts. If these efforts fail, our product development or commercialization of new products could be delayed, revenue from products could decline and/or we may not realize the anticipated benefits of these arrangements.

Our results of operations may be adversely affected by current and potential future healthcare reforms.

In the U.S., federal and state legislatures, health agencies and third-party payors continue to focus on containing the cost of health care. Legislative and regulatory proposals, enactments to reform health care insurance programs and increasing pressure from social sources could significantly influence the manner in which our products are prescribed and purchased. For example, provisions of the Patient Protection and Affordable Care Act (“PPACA”) have resulted in changes in the way health care is paid for by both governmental and private insurers, including increased rebates owed by manufacturers under the Medicaid Drug Rebate Program, annual fees and taxes on manufacturers of certain branded prescription drugs, the requirement that manufacturers participate in a discount program for certain outpatient drugs under Medicare Part D and the expansion of the number of hospitals eligible for discounts under Section 340B of the Public Health Service Act. These changes have had and are expected to continue to have a significant impact on our business.

We may face uncertainties as a result of efforts to repeal, substantially modify or invalidate some or all of the provisions of the PPACA. There is no assurance that the PPACA, as currently enacted or as amended in the future, will not adversely affect our business and financial results, and we cannot predict how future federal or state legislative or administrative changes relating to healthcare reform will affect our business.

There is increasing public attention on the costs of prescription drugs and we expect drug pricing and other health care costs to continue to be subject to intense political and societal pressures on a global basis. For example, two committees of the U.S. House of Representatives are investigating the approval and price of Aduhelm. In addition, there have been, and are expected to continue to be, legislative proposals to address prescription drug pricing. Some of these proposals could have significant effects on our business, including an executive order issued in September 2020 to test a “most favored nation” model for Part B and Part D drugs that tie reimbursement rates to international drug pricing metrics. These actions and the uncertainty about the future of the PPACA and healthcare laws may put downward pressure on pharmaceutical pricing and increase our regulatory burdens and operating costs.

There is also significant economic pressure on state budgets, including as a result of the COVID-19 pandemic, that may result in states increasingly seeking to achieve budget savings through mechanisms that limit coverage or payment for our drugs. In recent years, some states have considered legislation and ballot initiatives that would control the prices of drugs, including laws to allow importation of pharmaceutical products from lower cost jurisdictions outside the U.S. and laws intended to impose price controls on state drug purchases. State Medicaid programs are increasingly requesting manufacturers to pay supplemental rebates and requiring prior authorization by the state program for use of any drug for which supplemental rebates are not being paid. Government efforts to reduce Medicaid expense may lead to increased use of managed care organizations by Medicaid programs. This may result in managed care organizations influencing prescription decisions for a larger segment of the population and a corresponding limitation on prices and reimbursement for our products.

In the E.U. and some other international markets, the government provides health care at low cost to consumers and regulates pharmaceutical prices, patient eligibility or reimbursement levels to control costs for the government-sponsored health care system. Many countries have announced or implemented measures and may in the future implement new or additional measures, to reduce health care costs to limit the overall level of government expenditures. These measures vary by country and may include, among other things, patient access restrictions, suspensions on price increases, prospective and possible retroactive price reductions and other recoupments and increased mandatory discounts or rebates, recoveries of past price increases and greater importation of drugs from lower-cost countries. These measures could negatively impact our revenue and results of operations in the future.

Our success in commercializing biosimilars is subject to risks and uncertainties inherent in the development, manufacture and commercialization of biosimilars. If we are unsuccessful in such activities, our business may be adversely affected.

The development, manufacture and commercialization of biosimilar products require specialized expertise and are very costly and subject to complex regulation. Our success in commercializing biosimilars is subject to a number of risks, including:

| · | Reliance on Third-Parties. We are dependent, in part, on the efforts of collaboration partners and other third-parties over whom we have limited or no control in the development and manufacturing of biosimilar products. If these third-parties fail to perform successfully, our biosimilar product development or commercialization of biosimilar products could be delayed, revenue from biosimilar products could decline and/or we may not realize the anticipated benefits of these arrangements; |

| · | Regulatory Compliance. Biosimilar products may face regulatory hurdles or delays due to the evolving and uncertain regulatory and commercial pathway of biosimilar products in certain jurisdictions; |

| · | Intellectual Property and Regulatory Challenges. Biosimilar products may face extensive patent clearances, patent infringement litigation, injunctions or regulatory challenges, which could prevent the commercial launch of a product or delay it for many years or result in imposition of monetary damages, penalties or other civil sanctions and damage our reputation; |

| · | Failure to Gain Market and Patient Acceptance. Market success of biosimilar products will be adversely affected if patients, physicians and/or payors do not accept biosimilar products as safe and efficacious products offering a more competitive price or other benefit over existing therapies; |

| · | Ability to Provide Adequate Supply. Manufacturing biosimilars is complex. If we encounter any manufacturing or supply chain difficulties, we may be unable to meet higher than anticipated demand. We are dependent on a third-party for the manufacture of our biosimilar products and such third-party may not perform its obligations in a timely and cost-effective manner or in compliance with applicable regulations and may be unable or unwilling to increase production capacity commensurate with demand for our existing or future biosimilar products; and |

| · | Competitive Challenges. Biosimilar products face significant competition, including from innovator products and biosimilar products offered by other companies. Local tendering processes may restrict biosimilar products from being marketed and sold in some jurisdictions. The number of competitors in a jurisdiction, the timing of approval and the ability to market biosimilar products successfully in a timely and cost-effective manner are additional factors that may impact our success. |

Risks Related to Intellectual Property

If we are unable to obtain and maintain adequate protection for our data, intellectual property and other proprietary rights, our business may be harmed.

Our success, including our long-term viability and growth, depends, in part, on our ability to obtain and defend patent and other intellectual property rights, including certain regulatory forms of exclusivity, that are important to the commercialization of our products and product candidates. Patent protection and/or regulatory exclusivity in the U.S. and other important markets remains uncertain and depends, in part, upon decisions of the patent offices, courts, administrative bodies and lawmakers in these countries. We may fail to obtain or preserve patent and other intellectual property rights, including certain regulatory forms of exclusivity, or the protection we obtain may not be of sufficient breadth and degree to protect our commercial interests in all countries where we conduct business, which could result in financial, business or reputational harm to us or could cause a decline or volatility in our stock price. In addition, settlements of such proceedings often result in reducing the period of patent and other protections, resulting in a reduction in revenue from affected products.

In many markets, including the U.S., manufacturers may be allowed to rely on the safety and efficacy data of the innovator’s product and do not need to conduct clinical trials before marketing a competing version of a product after there is no longer patent or regulatory exclusivity. In such cases, manufacturers often charge significantly lower prices and a major portion of the company’s revenue may be reduced in a short period of time. In addition, manufacturers of generics and biosimilars may choose to launch or attempt to launch their products before the expiration of our patent or other intellectual property protections.

Furthermore, our products may be determined to infringe patents or other intellectual property rights held by third-parties. Legal proceedings, administrative challenges or other types of proceedings are and may in the future be necessary to determine the validity, scope or non-infringement of certain patent rights claimed by third-parties to be pertinent to the manufacture, use or sale of our products. Such proceedings are unpredictable and are often protracted and expensive. Negative outcomes of such proceedings could hinder or prevent us from manufacturing and marketing our products, require us to seek a license for the infringed product or technology or result in the assessment of significant monetary damages against us that may exceed amounts, if any, accrued in our financial statements. A failure to obtain necessary licenses for an infringed product or technology could prevent us from manufacturing or selling our products. Furthermore, payments under any licenses that we are able to obtain would reduce our profits from the covered products and services. Any of these circumstances could result in financial, business or reputational harm to us or could cause a decline or volatility in our stock price.

Risks Related to Development, Clinical Testing and Regulation of Our Products and Product Candidates

Successful preclinical work or early-stage clinical trials does not ensure success in later stage trials, regulatory approval or commercial viability of a product.

Positive results in a clinical trial may not be replicated in subsequent or confirmatory trials. Additionally, success in preclinical work or early-stage clinical trials does not ensure that later stage or larger scale clinical trials will be successful or that regulatory approval will be obtained. Even if later stage clinical trials are successful, regulatory authorities may delay or decline approval of our product candidates. Regulatory authorities may disagree with our view of the data, require additional studies or disagree with our trial design or endpoints. Regulatory authorities may also fail to approve the facilities or processes used to manufacture a product candidate, our dosing or delivery methods or companion devices. Regulatory authorities may grant marketing approval that is more restricted than anticipated, including limiting indications to narrow patient populations and the imposition of safety monitoring, educational requirements, requiring confirmatory trials and risk evaluation and mitigation strategies. The occurrence of any of these events could result in significant costs and expense, have an adverse effect on our business, financial condition and results of operations and/or cause our stock price to decline or experience periods of volatility.

Clinical trials and the development of biopharmaceutical products is a lengthy and complex process. If we fail to adequately manage our clinical activities, our clinical trials or potential regulatory approvals may be delayed or denied.

Conducting clinical trials is a complex, time-consuming and expensive process. Our ability to complete clinical trials in a timely fashion depends on a number of key factors, including protocol design, regulatory and institutional review board approval, patient enrollment rates and compliance with current Good Clinical Practices. If we or our third-party clinical trial providers or third-party CROs do not successfully carry out these clinical activities, our clinical trials or the potential regulatory approval of a product candidate may be delayed or denied.

We anticipate opening clinical trial sites and enrolling patients in a number of countries where our experience is limited. In most cases, we will use the services of third-parties to carry out our clinical trial related activities and rely on such parties to accurately report their results. Our reliance on third-parties for these activities may impact our ability to control the timing, conduct, expense and quality of our clinical trials. In the event a given CRO were to have responsibility for a substantial portion of our activities and clinical trials, many of our trials may be adversely affected if such CRO does not adequately perform. If we needed to replace our CRO(s), delays of the affected trials may result or otherwise adversely affect our efforts to obtain regulatory approvals and commercialization of our products and services candidates.

Adverse safety events or restrictions on use and safety warnings for our products can negatively affect our business, product sales and stock price.

Adverse safety events involving our marketed products, generic or biosimilar versions of our marketed products or products from the same class as one of our products may have a negative impact on our business. Discovery of safety issues with our products could create product liability and could cause additional regulatory scrutiny and requirements for additional labeling or safety monitoring, withdrawal of products from the market and/or the imposition of fines or criminal penalties. Adverse safety events may also damage physician, patient and/or investor confidence in our products and our reputation. Any of these could result in adverse impacts on our results of operations.

Regulatory authorities are making greater amounts of stand-alone safety information directly available to the public through periodic safety update reports, patient registries and other reporting requirements. The reporting of adverse safety events involving our products or products similar to ours and public rumors about such events may increase claims against us and may also cause our product sales to decline or our stock price to experience periods of volatility. Restrictions on use or safety warnings that may be required to be included in the label of our products may significantly reduce expected revenue for those products and require significant expense and management time.

The illegal distribution and sale by third-parties of counterfeit or unfit versions of our products or stolen products could have a negative impact on our reputation and business.

Third-parties might illegally distribute and sell counterfeit or unfit versions of our products and services, especially if such parties did not meet our rigorous manufacturing, distribution and testing standards. A patient who receives a counterfeit or unfit drug may be at risk for a number of dangerous health consequences. Our reputation and business could suffer harm as a result of counterfeit or unfit drugs sold under our brand name. Inventory that is stolen from warehouses, plants or while in-transit, and that is subsequently improperly stored and sold through unauthorized channels, could adversely impact patient safety, our reputation and our business.

The increasing use of social media platforms presents new risks and challenges.

Social media is increasingly being used to communicate about our products and the diseases our therapies are designed to treat. Social media practices in the biopharmaceutical industry continue to evolve and regulations relating to such use are not always clear and creates uncertainty and risk of noncompliance with regulations applicable to our business. For example, patients may use social media channels to comment on the effectiveness of a product or to report an alleged adverse event. When such disclosures occur, there is a risk that we fail to monitor and comply with applicable adverse event reporting obligations or we may not be able to defend the company or the public’s legitimate interests in the face of the political and market pressures generated by social media due to restrictions on what we may say about our products. There is also a risk of inappropriate disclosure of sensitive information or negative or inaccurate posts or comments about us on social media. We may also encounter criticism on social media regarding our company, management, product candidates or products. The immediacy of social media precludes us from having real-time control over postings made regarding us via social media, whether matters of fact or opinion. Our reputation could be damaged by negative publicity or if adverse information concerning us is posted on social media platforms or similar mediums, which we may not be able to reverse. If any of these events were to occur or we otherwise fail to comply with applicable regulations, we could incur liability, face restrictive regulatory actions or incur other harm to our business.

Risks Related to Our Operations

A breakdown or breach of our technology systems could subject us to liability or interrupt the operation of our business.

We are increasingly dependent upon technology systems and data to operate our business. Breakdowns, invasions, corruptions, destructions and/or breaches of our technology systems, including our cloud technologies, and/or unauthorized access to our data and information could subject us to liability, negatively impact our business operations, and/or require replacement of technology and/or ransom payments. Our technology systems, including our cloud technologies, continue to increase in multitude and complexity, increasing our vulnerability when breakdowns, malicious intrusions and random attacks occur. Data privacy or security breaches also pose a risk that sensitive data, including intellectual property, trade secrets or personal information belonging to us, patients, customers or other business partners, may be exposed to unauthorized persons or to the public.

Cyber-attacks are increasing in their frequency, sophistication and intensity, and are becoming increasingly difficult to detect, when they impact vendors, customers or companies, including vendors, suppliers and other companies in our supply chain. They are often carried out by motivated, well-resourced, skilled and persistent actors, including nation states, organized crime groups, “hacktivists” and employees or contractors acting with careless or malicious intent. Cyber-attacks include deployment of harmful malware and key loggers, ransomware, a denial-of-service attack, a malicious website, the use of social engineering and other means to affect the confidentiality, integrity and availability of our technology systems and data. Cyber-attacks also include manufacturing, hardware or software supply chain attacks, which could cause a delay in the manufacturing of products or products produced for contract manufacturing or lead to a data privacy or security breach. Our key business partners face similar risks and any security breach of their systems could adversely affect our security posture. In addition, our increased use of cloud technologies heightens these and other operational risks, and any failure by cloud or other technology service providers to adequately safeguard their systems and prevent cyber-attacks could disrupt our operations and result in misappropriation, corruption or loss of confidential or propriety information.

While we continue to build and improve our systems and infrastructure, including our business continuity plans, there can be no assurance that our efforts will prevent breakdowns or breaches in our systems that could adversely affect our business and operations and/or result in the loss of critical or sensitive information, which could result in financial, legal, operational or reputational harm to us, loss of competitive advantage or loss of consumer confidence. Our liability insurance may not be sufficient in type or amount to cover us against claims related to security breaches, cyber-attacks and other related breaches.

Regulators are imposing new data privacy and security requirements, including new and greater monetary fines for privacy violations. For example, the E.U.’s General Data Protection Regulation established regulations regarding the handling of personal data and provides an enforcement authority and imposes large penalties for noncompliance. New U.S. data privacy and security laws, such as the California Consumer Privacy Act (“CCPA”), and others that may be passed, similarly introduce requirements with respect to personal information, and non-compliance with the CCPA may result in liability through private actions (subject to statutorily defined damages in the event of certain data breaches) and enforcement. Failure to comply with these current and future laws, policies, industry standards or legal obligations or any security incident resulting in the unauthorized access to, or acquisition, release or transfer of personal information may result in governmental enforcement actions, litigation, fines and penalties or adverse publicity and could cause our customers to lose trust in us, which could have a material adverse effect on our business and results of operations.

Management and other personnel changes may disrupt our operations and, as a result, we may have difficulty retaining personnel or attracting and retaining qualified replacements on a timely basis for the management and other personnel who may leave the Company.

Changes in management, other personnel and our overall retention rate may disrupt our business, and any such disruption could adversely affect our operations, programs, growth, financial condition or results of operations. New members of management may have different perspectives on programs and opportunities for our business, which may cause us to focus on new opportunities or reduce or change emphasis on our existing programs.

Our success is dependent upon our ability to attract and retain qualified management and key personnel in a highly competitive environment. Qualified individuals are in high demand, and we may incur significant costs to attract or retain them. We may face difficulty in attracting and retaining talent for a number of reasons, including management changes, the underperformance or discontinuation of one or more marketed or late-stage programs, recruitment by competitors or changes in the overall labor market. In addition, changes in our organizational structure or in our flexible working arrangements could impact employees’ productivity and morale as well as our ability to attract, retain and motivate employees. We cannot ensure that we will be able to hire or retain the personnel necessary for our operations or that the loss of any personnel will not have a material impact on our financial condition and results of operations.

If we fail to comply with the extensive legal and regulatory requirements affecting the health care industry, we could face increased costs, penalties and a loss of business.

Our activities, and the activities of our collaborators, distributors and other third-party providers, are subject to extensive government regulation and oversight in the U.S. and in foreign jurisdictions, and are subject to change and evolving interpretations, which could require us to incur substantial costs associated with compliance or to alter one or more of our business practices. The FDA and comparable foreign agencies directly regulate many of our most critical business activities, including the conduct of preclinical and clinical studies, product manufacturing, advertising and promotion, product distribution, adverse event reporting, product risk management and our compliance with good practice quality guidelines and regulations. Our interactions with physicians and other health care providers that prescribe or purchase our products are also subject to government regulation designed to prevent fraud and abuse in the sale and use of products and place significant restrictions on the marketing practices of health care companies. Health care companies are facing heightened scrutiny of their relationships with health care providers and have been the target of lawsuits and investigations alleging violations of government regulation, including claims asserting submission of incorrect pricing information, impermissible off-label promotion of pharmaceutical products, payments intended to influence the referral of health care business, submission of false claims for government reimbursement, antitrust violations or violations related to environmental matters. There is also enhanced scrutiny of company-sponsored patient assistance programs, including insurance premium and co-pay assistance programs and donations to third-party charities that provide such assistance. If we, or our vendors or donation recipients, are found to fail to comply with relevant laws, regulations or government guidance in the operation of these programs, we could be subject to significant fines or penalties. Risks relating to compliance with laws and regulations may be heightened as we continue to expand our global operations and enter new therapeutic areas with different patient populations, which may have different product distribution methods, marketing programs or patient assistance programs from those we currently utilize or support.

Conditions and regulations governing the health care industry are subject to change, with possible retroactive effect, including:

| · | new laws, regulations or judicial decisions, or new interpretations of existing laws, regulations or judicial decisions, related to health care availability, pricing or marketing practices, compliance with employment practices, method of delivery, payment for health care products and services, compliance with health information and data privacy and security laws and regulations, tracking and reporting payments and other transfers of value made to physicians and teaching hospitals, extensive anti-bribery and anti-corruption prohibitions, product serialization and labeling requirements and used product take-back requirements; |

| · | changes in the FDA and foreign regulatory approval processes or perspectives that may delay or prevent the approval of new products and result in lost market opportunity; |

| · | government shutdowns or relocations may result in delays to the review and approval process, slowing the time necessary for new drug candidates to be reviewed and/or approved, which may adversely affect our business; |

| · | requirements that provide for increased transparency of clinical trial results and quality data, such as the EMA’s clinical transparency policy, which could impact our ability to protect trade secrets and competitively-sensitive information contained in approval applications or could be misinterpreted leading to reputational damage, misperception or legal action, which could harm our business; and |

| · | changes in FDA and foreign regulations that may require additional safety monitoring, labeling changes, restrictions on product distribution or use or other measures after the introduction of our products to market, which could increase our costs of doing business, adversely affect the future permitted uses of approved products or otherwise adversely affect the market for our products. |