0000924515true30092223160001000.03300.0800.01000.01400.03200.000012600050000000013138000136730000.0010.0010.0010.0010.0010.0010.0010.0019000.09000.020300.050000006000.05000.01500.03500.03500.000001049000326300076300017360000000300.01000.03300.0800.01700.03200.00003300.03300.0800.0800.01700.01700.01400.001000.01000.0300.0300.0300.01000086428290000000000000000000000000000000000000000000000010684231313828213673583535301131804171360760913138282223164122231641214360009.9932620.25100015000009800021140002260000925000000.250.25Each share of Series F-2 Preferred is convertible, at any time for a period of 5 years after issuance, into that number of shares of Common Stock, determined by dividing the Stated Value by $0.25, subject to certain adjustments set forth in the Series F-2 Certificate of Designation (the “Series F-2 Conversion Price”). The conversion of Series F-2 Preferred is subject to a 4.99% beneficial ownership limitation, which may be increased to 9.99% at the election of the holders of the Series F-2 Preferred. If the average of the VWAPs (as defined in the Series F-2 Certificate of Designation) for any consecutive 5 trading day period (“Measurement Period”) exceeds 200% of the then Series F-2 Conversion Price and the average daily trading volume of the Common Stock on the primary trading market exceeds 1,000 shares per trading day during the Measurement Period (subject to adjustments), the Company may redeem the then outstanding Series F-2 Preferred, for cash in an amount equal to aggregate Stated Value then outstanding plus accrued but unpaid dividends. As of December 31, 2021, the Company had not issued shares as payment of Series F-2 Preferred Stock dividends. As of December 31, 2021, the Company had accrued dividends of $94,907.400075000075000015000004000763968141110003237During February 2021, the Company finalized an investment by Power Up Lending Group Ltd. Power Up invested $53,500, net to the Company is $50,000, for 62,000 shares of Series G preferred stock with additional tranches of financing up to $925,000 in the aggregate over the terms of the Series G preferred stock. Series G will be non-voting on any matters requiring shareholder vote. The Series G Preferred Stock will have cumulative dividends at the rate per share of 8% per annum. At any time during the period indicated below, after the date of the issuance of shares of Series G preferred stock, the Company will have the right, at the Company’s option, to redeem all of the shares of Series G preferred stock by paying an amount equal to: (i) the number of shares of Series G preferred stock multiplied by then stated value (including accrued dividends); (ii) multiplied by the corresponding percentage as follows: Day 1-60, 105%; Day 61-90, 110%; Day 91-120, 115%; and Day 121-180, 122%. After the expiration of the 180 days following the issuance date, except for mandatory redemption, the Company shall have no right to redeem the Series G preferred stock. Mandatory redemption occurs within 24 months. In addition, if the Company does not redeem the Series G preferred stock then Power Up will have the option to convert to common stock shares. The variable conversion price will be the value equal to a discount of 19% off of the trading price; which is calculated as the average of the three lowest closing bid prices over the last fifteen trading days. The conversion of Series G Preferred is subject to a 4.99% beneficial ownership limitation, which may be increased to 9.99% at the election of the holder of the Series G Preferred.1411153000007630000.00150001000104910497500010491024925400014261.0000.502000910001000124327109930700000.09990.09995 years5 years5 years1049143665245002098500535003262326215600001998915929250009250000.190.0615866225540195535368505143600010000750006600018 months500000ten yearsfour years35000071500004800026400The notes carried annual interest rates between 0% and 10% and have default rates as high as 20%.The notes were initially issued with 0% interest, however interest increased to 6.0% interest04100050001000000400000350000161000148970002400000.02400000.06477840000016118436428250000318891000000.160.12The exchange price will be on a $1 for $1 basis such that Auctus will receive $2,349,997 of units consisting of common stock745972200075000006350000.206350006500057000089250680003500003500007000007000003500003500007000004000003130000.10.24The variable conversion prices equaled the lesser of: (i) the lowest trading price on the issue date, and (ii) the variable conversion price. The variable conversion price was 95% multiplied by the market price (the market price means the average of the five lowest trading prices during the period beginning on the issue date and ending on the maturity date), minus $0.04 per share, provided however that in no event could the variable conversion price be less than $0.15. If an event of default under this note occurred and/or the note was not extinguished in its entirety prior to December 17, 2020 the $0.15 price floor no longer applied0.24The variable conversion prices shall equal the lesser of: (i) the lowest trading price on the issue date, and (ii) the variable conversion price. The variable conversion price shall mean 95% multiplied by the market price (the market price means the average of the five lowest trading prices during the period beginning on the issue date and ending on the maturity date), minus $0.04 per share, provided however that in no event shall the variable conversion price be less than $0.15. If an event of default under this note occurs and/or the note is not extinguished in its entirety prior to December 17, 2020 the $0.15 price shall no longer apply. The last tranche of $1.3 million will be received within 60 days of the S-1 registration statement becoming effective. The conversion price of the notes will be at market value with a minimum conversion amount of $0.15. In addition, as part of this transaction the Company was required to pay a 2.0% fee to a registered broker-dealer. 0.12021-12-172022-05-272021-12-170.10.15000P5Y035000022360.68925025000060000.08500007500113069241820623230.4936670.50187182930.501260166100016210002640016210001990008400002350004320006.0183600592006.0008500000168170700009245152022-01-012022-03-310000924515us-gaap:SeriesFPreferredStockMember2021-01-012021-12-310000924515us-gaap:SeriesEPreferredStockMember2021-01-012021-12-310000924515gthp:SeriesDExchangeAgreementsMember2022-03-310000924515gthp:SeriesFPreferredShareDividendMember2022-03-310000924515gthp:SeriesFTwoPreferredSharesMember2022-03-310000924515gthp:SeriesEPreferredShareDividendMember2022-03-310000924515gthp:SeriesDPreferredShareDividendMember2022-03-310000924515us-gaap:SeriesFPreferredStockMember2022-03-310000924515gthp:TenPercentSeniorUnsecuredConvertibleDebenturesMember2022-03-310000924515us-gaap:SeriesEPreferredStockMember2022-03-310000924515gthp:SeriesDExchangeAgreementsMember2022-01-012022-03-310000924515gthp:AuctusMembergthp:ExchangeAgreementsMember2021-06-020000924515gthp:AuctusOneMembergthp:ExchangeAgreementsMember2022-06-010000924515gthp:AuctusMembergthp:ExchangeAgreementsMember2021-05-302021-06-020000924515gthp:AuctusOneMembergthp:ExchangeAgreementsMember2022-05-302022-06-010000924515gthp:SeriesEPreferredShareDividendMember2021-12-310000924515gthp:SeriesDPreferredShareDividendMember2021-12-310000924515gthp:TenPercentSeniorUnsecuredConvertibleDebenturesMember2021-12-310000924515gthp:SeriesFAndSeriesFTwoPreferredSharesMember2021-12-310000924515gthp:EllenOfGrossmanAndScholeLLPMember2022-06-060000924515gthp:ExecutiveExchangeAgreementsMemberus-gaap:SubsequentEventMember2022-01-012022-03-310000924515gthp:ExecutiveExchangeAgreementsMemberus-gaap:SubsequentEventMember2022-06-172022-06-220000924515gthp:EllenOfGrossmanAndScholeLLPMember2022-06-042022-06-0600009245152017-12-310000924515gthp:WarrantsMember2020-01-012020-12-310000924515us-gaap:ConvertibleDebtMember2020-01-012020-12-310000924515us-gaap:ConvertibleDebtMember2021-01-012021-12-310000924515gthp:PreferredStocksMember2021-01-012021-12-310000924515us-gaap:StockOptionMember2021-01-012021-12-310000924515gthp:PreferredStocksMember2020-01-012020-12-310000924515us-gaap:StockOptionMember2020-01-012020-12-310000924515gthp:WarrantsMember2021-01-012021-03-310000924515gthp:WarrantsMember2022-01-012022-03-310000924515us-gaap:ConvertibleDebtMember2021-01-012021-03-310000924515us-gaap:ConvertibleDebtMember2022-01-012022-03-310000924515gthp:PreferredStocksMember2022-01-012022-03-310000924515us-gaap:StockOptionMember2022-01-012022-03-310000924515gthp:PreferredStocksMember2021-01-012021-03-310000924515gthp:JulyTwentyFourTwoThousandNinteenMembergthp:DrFaupelAndMrCartwrightMember2021-01-012021-12-310000924515gthp:PaycheckProtectionProgramMember2020-05-012020-05-040000924515gthp:PaycheckProtectionProgramMember2021-01-012021-12-310000924515gthp:LongTermDebtRelatedPartiesMembergthp:MrFowlerMember2021-03-012021-03-220000924515srt:MaximumMembergthp:DebtExchangesTwoThousandTwentyOneMembergthp:MrFowlerMember2021-03-012021-03-220000924515gthp:DrFaupelMember2021-02-012021-02-190000924515gthp:DrCartwrightMember2021-02-012021-02-190000924515gthp:DrCartwrightMember2018-01-012018-12-310000924515gthp:DrFaupelMember2018-01-012018-12-310000924515gthp:MrFowlerMember2021-03-012021-03-220000924515gthp:DrCartwrightMember2018-09-040000924515gthp:DrFaupelMember2018-09-040000924515gthp:DrFaupelMember2016-12-210000924515gthp:TenPercentSeniorUnsecuredConvertibleDebentureMember2021-01-012021-12-310000924515gthp:PaycheckProtectionProgramMember2020-12-310000924515gthp:LongTermDebtRelatedPartiesMembergthp:MrFowlerMember2021-03-220000924515gthp:MrFowlerMember2021-03-220000924515gthp:PaycheckProtectionProgramMember2021-12-310000924515gthp:TenPercentSeniorUnsecuredConvertibleDebentureMember2020-12-310000924515gthp:TenPercentSeniorUnsecuredConvertibleDebentureMember2021-12-310000924515gthp:TenPercentSeniorUnsecuredConvertibleDebentureMember2021-05-170000924515gthp:PaycheckProtectionProgramMember2022-01-012022-03-310000924515gthp:TenPercentSeniorUnsecuredConvertibleDebentureMember2021-05-012021-05-170000924515gthp:TenPercentSeniorUnsecuredConvertibleDebentureMember2022-03-310000924515gthp:DrFaupelMember2022-01-012022-03-310000924515gthp:DrCartwrightMember2022-01-012022-03-310000924515gthp:MrFowlerMember2022-01-012022-03-310000924515gthp:MrBillWellsMember2022-01-012022-03-310000924515gthp:MrBillWellsMember2022-03-310000924515gthp:PaycheckProtectionProgramMember2022-03-310000924515gthp:LongTermDebtRelatedPartiesMembergthp:MrFowlerMember2021-12-310000924515gthp:DrCartwrightMember2021-02-190000924515gthp:DrFaupelMember2021-01-012021-12-310000924515gthp:DrFaupelMember2021-02-190000924515gthp:DrFaupelMember2022-03-310000924515gthp:GHSMember2018-05-012018-05-170000924515gthp:GHSMember2018-05-170000924515gthp:GHSMembergthp:MaySeventeenTwoTHousandEighteenMember2020-12-310000924515gthp:GHSMembergthp:MayNineteenTwoTHousandSeventeenMember2020-12-310000924515gthp:GHSMember2017-05-012017-05-170000924515gthp:GHSMember2017-05-190000924515gthp:GHSMember2019-12-170000924515gthp:AuctusMembergthp:MayTwentyTwoTwoThousandTwentyMember2020-05-012020-05-220000924515gthp:AuctusMembergthp:MayTwentyTwoTwoThousandTwentyMember2020-05-220000924515gthp:AuctusMembergthp:NoteThreeMember2020-05-220000924515gthp:AuctusMembergthp:NoteTwoMember2020-05-220000924515gthp:AuctusMembergthp:NoteOneMember2020-05-220000924515gthp:GHSMembergthp:JuneTwentytwoTwoTHousandEighteenMember2020-12-310000924515gthp:GHSMember2018-06-012018-06-220000924515gthp:GHSMember2018-06-220000924515gthp:GPBMember2021-01-012021-12-310000924515gthp:TroubledDebtRestructuringMember2019-12-170000924515gthp:TroubledDebtRestructuringMember2021-12-310000924515gthp:AuctusMember2021-12-310000924515gthp:AuctusMember2020-04-012020-04-030000924515gthp:AuctusMember2020-01-012020-12-310000924515gthp:AuctusMember2020-03-012020-03-310000924515gthp:AuctusTrancheTwoMember2019-12-170000924515gthp:AuctusMember2020-05-012020-05-220000924515gthp:AuctusTrancheTwoMember2020-05-012020-05-270000924515gthp:AuctusTrancheTwoMember2020-05-270000924515gthp:AuctusMember2020-05-220000924515gthp:AuctusMember2019-12-012019-12-170000924515gthp:AuctusTrancheOneMember2019-12-012019-12-170000924515gthp:AuctusTrancheOneMember2019-12-170000924515gthp:AuctusMember2019-12-170000924515gthp:SeniorSecuredPromissoryNoteMember2016-12-070000924515gthp:SeniorSecuredPromissoryNoteMembergthp:GPBMember2016-02-012016-02-120000924515gthp:SeniorSecuredPromissoryNoteMember2016-05-012016-05-280000924515gthp:SeniorSecuredPromissoryNoteMembergthp:GPBMember2020-01-012020-01-160000924515gthp:SeniorSecuredPromissoryNoteMember2020-12-310000924515gthp:SeniorSecuredPromissoryNoteMember2016-02-012016-02-120000924515gthp:FirstTrancheMember2022-03-310000924515gthp:FirstTrancheMember2021-06-300000924515gthp:TroubledDebtRestructuringMember2022-03-310000924515gthp:FirstTrancheMember2019-12-170000924515gthp:FirstTrancheMember2019-12-310000924515gthp:SeniorSecuredPromissoryNoteMember2016-02-120000924515gthp:JuneTwentyTwoTwoThousandEighteenMembergthp:GHSMember2021-12-310000924515gthp:FirstTrancheMember2019-12-012019-12-170000924515gthp:AuctusFundLLCMember2020-03-310000924515gthp:AuctusFundLLCMember2020-03-012020-03-310000924515gthp:AuctusFundLLCMember2021-06-300000924515gthp:AuctusFundLLCMember2021-06-012021-06-300000924515gthp:AuctusFundLLCMember2022-01-012022-03-310000924515gthp:AuctusFundLLCMember2021-12-310000924515gthp:AuctusFundLLCMember2022-03-310000924515gthp:SecondTrancheMember2020-05-012020-05-270000924515gthp:AuctusFundLLCMember2019-12-012019-12-170000924515gthp:AuctusFundsLLCMember2020-12-310000924515gthp:GHSMember2020-12-310000924515gthp:GHSMember2021-12-310000924515gthp:AuctusTrancheOneMember2020-12-310000924515gthp:AuctusTrancheOneMember2021-12-310000924515gthp:AuctusPrepaymentPenaltyMember2021-12-310000924515gthp:AuctusTrancheTwoMember2021-12-310000924515gthp:AuctusMarch312020NoteMember2021-12-310000924515gthp:AuctusMarch312020NoteMember2020-12-310000924515gthp:TotalMember2020-12-310000924515gthp:TotalMember2022-03-310000924515gthp:DebtDiscountAndIssuanceCostsToBeAmortizedMember2020-12-310000924515gthp:DebtDiscountAndIssuanceCostsToBeAmortizedMember2022-03-310000924515gthp:AuctusMember2020-12-310000924515gthp:AuctusMember2022-03-310000924515gthp:AuctusPrepaymentPenaltyMember2020-12-310000924515gthp:AuctusPrepaymentPenaltyMember2022-03-310000924515gthp:AuctusTrancheTwoMember2020-12-310000924515gthp:AuctusTrancheTwoMember2022-03-310000924515gthp:DrCartwrightMember2021-01-012021-12-310000924515gthp:ExchangeAgreementMembergthp:MrFowlerMember2021-12-310000924515gthp:MrFowlerMember2017-01-190000924515gthp:MrFowlerMember2016-12-210000924515gthp:PremiumFinanceAgreementMember2021-12-310000924515gthp:ExchangeAgreementMembergthp:MrFowlerMember2021-01-012021-12-310000924515gthp:PremiumFinanceAgreementMember2020-07-012020-07-040000924515gthp:PremiumFinanceAgreementMember2021-07-012021-07-040000924515us-gaap:ShortTermDebtMember2020-12-310000924515us-gaap:ShortTermDebtMember2021-12-310000924515gthp:DrFaupelMember2019-01-012019-12-310000924515gthp:ExchangeAgreementMembergthp:MrFowlerMember2019-01-012019-12-310000924515us-gaap:ShortTermDebtMember2021-01-012021-12-310000924515gthp:DrCartwrightMember2019-01-012019-12-3100009245152021-09-300000924515gthp:PremiumFinanceAgreementMember2022-03-310000924515gthp:ExchangeAgreementMembergthp:MrFowlerMember2022-01-012022-03-310000924515gthp:ExchangeAgreementMembergthp:MrFowlerMember2022-03-310000924515gthp:LongTermDebtRelatedPartiesMembergthp:MrFowlerMember2022-03-310000924515gthp:MrFowlerMember2019-01-012019-12-310000924515gthp:PremiumFinanceMember2020-12-310000924515gthp:PremiumFinanceMember2021-12-310000924515gthp:DrFaupelMember2020-12-310000924515gthp:DrFaupelMember2021-12-310000924515gthp:GPBMember2020-12-310000924515gthp:GPBMember2021-12-310000924515gthp:MrFowlerMember2020-12-310000924515gthp:MrFowlerMember2021-12-310000924515gthp:DrCartwrightMember2020-12-310000924515gthp:DrCartwrightMember2021-12-310000924515gthp:MrMermelsteinMember2020-12-310000924515gthp:MrMermelsteinMember2021-12-310000924515gthp:PremiumFinanceInsuranceMember2020-12-310000924515gthp:PremiumFinanceInsuranceMember2022-03-310000924515gthp:MrFowlerMember2022-03-310000924515gthp:DrCartwrightMember2022-03-310000924515gthp:ShenghuoMedicalLLCMember2016-06-012016-06-050000924515gthp:RoyaltyAgreementMember2016-09-012016-09-060000924515gthp:PromotionalAgreementMember2020-01-012020-01-220000924515gthp:PromotionalAgreementMember2020-12-310000924515gthp:PromotionalAgreementMember2020-01-012020-12-310000924515gthp:PromotionalAgreementMember2021-01-012021-12-310000924515gthp:ShandongYaohuaMedicalInstrumentCorporationMember2019-07-240000924515gthp:ShandongYaohuaMedicalInstrumentCorporationMember2021-12-310000924515gthp:ConsultingAgreementMembergthp:MrBlumbergMember2021-03-100000924515gthp:ConsultingAgreementMembergthp:MrBlumbergMember2021-09-300000924515gthp:ConsultingAgreementMembergthp:MrBlumbergMember2021-03-012021-03-1000009245152020-01-012020-01-2200009245152016-06-012016-06-0500009245152019-07-2400009245152009-12-012009-12-310000924515gthp:PromotionalAgreementMember2022-01-012022-01-220000924515gthp:PromotionalAgreementMember2022-01-012022-03-310000924515gthp:ShandongYaohuaMedicalInstrumentCorporationMember2022-03-310000924515gthp:ConsultingAgreementMembergthp:MrBlumbergMember2021-03-310000924515gthp:GHSInvestmentsLLCMember2014-09-012014-09-100000924515gthp:GHSInvestmentsLLCMember2020-12-310000924515gthp:GHSInvestmentsLLCMember2014-09-100000924515gthp:GHSInvestmentsLLCMember2020-01-012020-12-310000924515gthp:TwoThosandTwentyExchangeAgreementsMember2020-01-012020-06-300000924515gthp:TwoThosandTwentyExchangeAgreementsMember2020-06-022020-06-030000924515gthp:TwoThosandTwentyExchangeAgreementsMember2020-01-012020-01-080000924515gthp:TwoThosandTwentyExchangeAgreementsMember2020-06-030000924515gthp:TwoThosandTwentyExchangeAgreementsMember2020-06-300000924515gthp:TwoThosandTwentyExchangeAgreementsMember2020-01-080000924515gthp:MrBillWellsMember2021-12-310000924515gthp:MrBillWellsMember2020-07-090000924515gthp:MrBillWellsMember2021-01-012021-12-310000924515gthp:MrBillWellsMember2020-07-012020-07-090000924515gthp:ShandongYaohuaMedicalInstrumentCorporationMember2020-12-310000924515gthp:PowerUpLendingGroupLtdMembergthp:SeriesGPreferredSharesMember2021-01-012021-12-310000924515gthp:PowerUpLendingGroupLtdMembergthp:SeriesGPreferredSharesMember2021-07-012021-07-080000924515gthp:PowerUpLendingGroupLtdMembergthp:SeriesGPreferredSharesMember2021-02-012021-02-280000924515gthp:PowerUpLendingGroupLtdMembergthp:SeriesGPreferredSharesMember2021-01-012021-01-310000924515gthp:PowerUpLendingGroupLtdMembergthp:SeriesGPreferredSharesMember2021-02-280000924515gthp:PowerUpLendingGroupLtdMembergthp:SeriesGPreferredSharesMember2021-01-310000924515gthp:PowerUpLendingGroupLtdMembergthp:SeriesGPreferredSharesMember2021-12-310000924515gthp:MsRosenstockMembergthp:TwoThosandTwentyExchangeAgreementsMember2021-01-012021-12-310000924515gthp:PowerUpLendingGroupLtdMembergthp:SeriesGPreferredSharesMember2022-01-012022-03-310000924515gthp:SeriesGPreferredSharesMember2022-01-012022-03-310000924515gthp:SeriesFAndSeriesFTwoSharesMember2021-01-012021-12-310000924515gthp:SeriesFConvertiblePreferredSharesMember2021-01-012021-12-310000924515gthp:SeriesCTwoPreferredSharesMember2021-01-012021-12-310000924515gthp:SeriesCTwoPreferredSharesMember2020-01-012020-12-310000924515gthp:SeriesCPreferredSharesMember2018-08-012018-08-020000924515gthp:SeriesCPreferredSharesMember2021-01-012021-12-310000924515gthp:PreferredStockSharesMember2022-03-310000924515gthp:SeriesFPreferredSharesMember2021-01-012021-12-310000924515gthp:SeriesFPreferredSharesMember2021-12-310000924515gthp:PowerUpLendingGroupLtdMembergthp:SeriesGPreferredSharesMember2022-03-310000924515gthp:SeriesCOnePreferredSharesMember2021-01-012021-12-310000924515gthp:SeriesEPreferredSharesMember2021-01-012021-12-310000924515gthp:SeriesEPreferredSharesMember2021-12-310000924515gthp:PreferredStockSharesMember2021-12-310000924515gthp:SeriesGPreferredSharesMember2021-01-012021-12-310000924515gthp:SeriesFTwoConvertiblePreferredSharesMember2020-01-012020-01-080000924515gthp:SeriesFTwoConvertiblePreferredSharesMember2022-01-012022-03-310000924515gthp:SeriesFPreferredSharesMember2022-01-012022-03-310000924515gthp:SeriesEPreferredSharesMember2022-01-012022-03-310000924515gthp:SeriesFTwoConvertiblePreferredSharesMember2021-01-012021-12-310000924515gthp:SeriesDPreferredSharesMember2022-01-012022-03-310000924515gthp:SeriesCOnePreferredSharesMember2022-01-012022-03-310000924515gthp:SeriesCTwoPreferredSharesMember2022-01-012022-03-310000924515gthp:SeriesCPreferredSharesMember2022-01-012022-03-310000924515gthp:SeriesFPreferredSharesMember2022-03-310000924515gthp:SeriesEPreferredSharesMember2022-03-310000924515gthp:SeriesDPreferredSharesMember2022-03-310000924515us-gaap:InvestmentsMember2021-01-012021-12-310000924515us-gaap:InvestmentsMember2021-12-310000924515gthp:DebtExchangesTwoThousandTwentyOneMember2021-01-080000924515gthp:SeriesDPreferredSharesMember2020-12-310000924515gthp:SeriesDPreferredSharesMember2021-01-012021-12-310000924515gthp:SeriesDPreferredSharesMember2021-12-310000924515gthp:WarrantsExchangesTwoThousandTwentyThreeMember2021-01-012021-12-310000924515gthp:WarrantsExchangesTwoThousandTwentyOneMember2021-12-310000924515gthp:WarrantsExchangesTwoThousandTwentyThreeMember2021-12-310000924515gthp:WarrantsExchangesTwoThousandTwentyTwoMember2021-12-3100009245152020-01-2200009245152020-01-160000924515gthp:WarrantsExchangesTwoThousandTwentyTwoMember2021-01-012021-12-310000924515gthp:MrWellsMember2021-01-012021-12-310000924515gthp:MrWellsMember2021-12-310000924515gthp:MrClavijoMember2021-01-012021-12-310000924515gthp:MrClavijoMember2021-12-310000924515gthp:AuctusFundsLLCMember2021-01-012021-12-310000924515gthp:AuctusFundsLLCMember2021-12-310000924515gthp:MrJamesMember2021-01-012021-12-310000924515gthp:MrJamesMember2021-12-310000924515gthp:MsRosenstockMember2021-01-012021-12-310000924515gthp:MsRosenstockMember2021-12-310000924515gthp:DrImhoffMember2021-01-012021-12-310000924515gthp:DrImhoffMember2021-12-310000924515gthp:MrMamulaMember2021-01-012021-12-310000924515gthp:MrMamulaMember2021-12-310000924515gthp:MrGouldMember2021-01-012021-12-310000924515gthp:MrGouldMember2021-12-310000924515gthp:MrGrimmMember2021-01-012021-12-310000924515gthp:MrGrimmMember2021-12-310000924515gthp:MrCaseMember2021-01-012021-12-310000924515gthp:MrCaseMember2021-12-310000924515gthp:MrBlumbergMember2021-01-012021-12-310000924515gthp:MrBlumbergMember2021-12-310000924515gthp:KTwoMedicalShenghuoMember2021-01-012021-12-310000924515gthp:KTwoMedicalShenghuoMember2021-12-310000924515gthp:AquariusMember2021-01-012021-12-310000924515gthp:AquariusMember2021-12-3100009245152019-01-012019-12-310000924515gthp:DecemberSeventeenTwoThousandNineteenMember2020-01-012020-12-310000924515gthp:DecemberSeventeenTwoThousandNineteenMember2021-01-012021-12-310000924515us-gaap:FairValueInputsLevel3Member2021-01-012021-12-310000924515gthp:DerivativesMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-12-310000924515gthp:SeniorSecuredDebtMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-12-310000924515us-gaap:FairValueInputsLevel3Member2022-01-012022-03-310000924515gthp:DerivativesMemberus-gaap:FairValueInputsLevel3Member2022-01-012022-03-310000924515gthp:SeniorSecuredDebtMemberus-gaap:FairValueInputsLevel3Member2022-01-012022-03-310000924515us-gaap:FairValueInputsLevel3Member2020-12-310000924515us-gaap:FairValueInputsLevel2Member2020-12-310000924515us-gaap:FairValueInputsLevel1Member2020-12-310000924515gthp:AuctusLoanMember2020-12-310000924515gthp:AuctusLoanMemberus-gaap:FairValueInputsLevel2Member2020-12-310000924515gthp:AuctusLoanMemberus-gaap:FairValueInputsLevel1Member2020-12-310000924515gthp:SeniorSecuredDebtMember2020-12-310000924515gthp:SeniorSecuredDebtMemberus-gaap:FairValueInputsLevel3Member2020-12-310000924515us-gaap:FairValueInputsLevel3Member2021-12-310000924515us-gaap:FairValueInputsLevel2Member2021-12-310000924515us-gaap:FairValueInputsLevel1Member2021-12-310000924515gthp:AuctusLoanMember2021-12-310000924515gthp:AuctusLoanMemberus-gaap:FairValueInputsLevel2Member2021-12-310000924515gthp:AuctusLoanMemberus-gaap:FairValueInputsLevel1Member2021-12-310000924515gthp:AuctusLoanMemberus-gaap:FairValueInputsLevel3Member2020-12-310000924515gthp:AuctusLoanMemberus-gaap:FairValueInputsLevel3Member2021-12-310000924515gthp:AuctusLoanMember2022-03-310000924515gthp:AuctusLoanMemberus-gaap:FairValueInputsLevel2Member2022-03-310000924515gthp:AuctusLoanMemberus-gaap:FairValueInputsLevel3Member2022-03-310000924515gthp:AuctusLoanMemberus-gaap:FairValueInputsLevel1Member2022-03-310000924515us-gaap:FairValueInputsLevel3Member2022-03-310000924515us-gaap:FairValueInputsLevel2Member2022-03-310000924515us-gaap:FairValueInputsLevel1Member2022-03-310000924515us-gaap:ConstructionInProgressMember2020-12-310000924515gthp:LeaseholdImprovementsOneMember2020-12-310000924515gthp:LeaseholdImprovementsOneMember2021-12-310000924515us-gaap:FurnitureAndFixturesMember2020-12-310000924515us-gaap:FurnitureAndFixturesMember2021-12-310000924515gthp:SoftwareLicenseArrangementOneMember2020-12-310000924515gthp:SoftwareLicenseArrangementOneMember2021-12-310000924515gthp:EquipmentOneMember2021-12-310000924515gthp:EquipmentOneMember2020-12-310000924515us-gaap:ConstructionInProgressMember2021-12-310000924515us-gaap:ConstructionInProgressMember2022-03-310000924515gthp:LeaseholdImprovementsOneMember2022-03-310000924515us-gaap:FurnitureAndFixturesMember2022-03-310000924515gthp:SoftwareLicenseArrangementOneMember2022-03-310000924515gthp:EquipmentOneMember2022-03-310000924515srt:MaximumMembergthp:WarrantsMember2021-12-310000924515srt:MinimumMembergthp:WarrantsMember2021-12-310000924515gthp:WarrantsMember2021-01-012021-12-310000924515gthp:WarrantsMember2021-12-310000924515gthp:TenPercentConvertibleDebenturesMember2021-01-012021-12-310000924515srt:MaximumMembergthp:WarrantsMember2022-03-310000924515srt:MinimumMembergthp:WarrantsMember2022-03-310000924515gthp:WarrantsMemberus-gaap:ExchangeClearedMember2022-01-012022-03-310000924515gthp:WarrantsMemberus-gaap:ExchangeClearedMember2022-03-310000924515gthp:AccumulatedDeficitMember2022-03-310000924515gthp:TreasuryStocksMember2022-03-310000924515us-gaap:AdditionalPaidInCapitalMember2022-03-310000924515us-gaap:CommonStockMember2022-03-310000924515gthp:PreferredStockSeriesFTwoMember2022-03-310000924515gthp:PreferredStockSeriesFMember2022-03-310000924515gthp:PreferredStockSeriesEMember2022-03-310000924515gthp:PreferredStockSeriesDMember2022-03-310000924515gthp:PreferredStockSeriesCTwoMember2022-03-310000924515gthp:PreferredStockSeriesCOneMember2022-03-310000924515gthp:PreferredStockSeriesCMember2022-03-310000924515gthp:AccumulatedDeficitMember2022-01-012022-03-310000924515gthp:TreasuryStocksMember2022-01-012022-03-310000924515us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000924515gthp:PreferredStockSeriesFMember2022-01-012022-03-310000924515gthp:PreferredStockSeriesEMember2022-01-012022-03-310000924515us-gaap:CommonStockMember2022-01-012022-03-310000924515gthp:AccumulatedDeficitMember2021-12-310000924515gthp:TreasuryStocksMember2021-12-310000924515us-gaap:AdditionalPaidInCapitalMember2021-12-310000924515us-gaap:CommonStockMember2021-12-310000924515gthp:PreferredStockSeriesGMember2021-12-310000924515gthp:PreferredStockSeriesFTwoMember2021-12-310000924515gthp:PreferredStockSeriesFMember2021-12-310000924515gthp:PreferredStockSeriesEMember2021-12-310000924515gthp:PreferredStockSeriesDMember2021-12-310000924515gthp:PreferredStockSeriesCTwoMember2021-12-310000924515gthp:PreferredStockSeriesCOneMember2021-12-310000924515gthp:PreferredStockSeriesCMember2021-12-310000924515gthp:PreferredStockSeriesDMember2021-01-012021-12-310000924515gthp:PreferredStockSeriesCTwoMember2021-01-012021-12-310000924515gthp:PreferredStockSeriesCOneMember2021-01-012021-12-310000924515gthp:PreferredStockSeriesCMember2021-01-012021-12-310000924515gthp:PreferredStockSeriesGMember2021-01-012021-12-310000924515gthp:PreferredStockSeriesFTwoMember2021-01-012021-12-310000924515gthp:PreferredStockSeriesFMember2021-01-012021-12-310000924515gthp:PreferredStockSeriesEMember2021-01-012021-12-310000924515gthp:AccumulatedDeficitMember2021-01-012021-12-310000924515gthp:TreasuryStocksMember2021-01-012021-12-310000924515us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000924515us-gaap:CommonStockMember2021-01-012021-12-310000924515gthp:AccumulatedDeficitMember2021-03-310000924515gthp:TreasuryStocksMember2021-03-310000924515us-gaap:AdditionalPaidInCapitalMember2021-03-310000924515us-gaap:CommonStockMember2021-03-310000924515gthp:PreferredStockSeriesGMember2021-03-310000924515gthp:PreferredStockSeriesFMember2021-03-310000924515gthp:PreferredStockSeriesEMember2021-03-310000924515gthp:PreferredStockSeriesDMember2021-03-310000924515gthp:PreferredStockSeriesCTwoMember2021-03-310000924515gthp:PreferredStockSeriesCOneMember2021-03-310000924515gthp:PreferredStockSeriesCMember2021-03-310000924515gthp:PreferredStockSeriesFMember2021-01-012021-03-310000924515gthp:PreferredStockSeriesGMember2021-01-012021-03-310000924515gthp:PreferredStockSeriesEMember2021-01-012021-03-310000924515gthp:AccumulatedDeficitMember2021-01-012021-03-310000924515us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310000924515us-gaap:CommonStockMember2021-01-012021-03-310000924515gthp:AccumulatedDeficitMember2020-12-310000924515gthp:TreasuryStocksMember2020-12-310000924515us-gaap:AdditionalPaidInCapitalMember2020-12-310000924515us-gaap:CommonStockMember2020-12-310000924515gthp:PreferredStockSeriesGMember2020-12-310000924515gthp:PreferredStockSeriesFTwoMember2020-12-310000924515gthp:PreferredStockSeriesEMember2020-12-310000924515gthp:PreferredStockSeriesDMember2020-12-310000924515gthp:PreferredStockSeriesCTwoMember2020-12-310000924515gthp:PreferredStockSeriesCOneMember2020-12-310000924515gthp:PreferredStockSeriesCMember2020-12-310000924515gthp:AccumulatedDeficitMember2020-01-012020-12-310000924515us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000924515gthp:PreferredStockSeriesGMember2020-01-012020-12-310000924515gthp:PreferredStockSeriesFTwoMember2020-01-012020-12-310000924515gthp:PreferredStockSeriesFMember2020-01-012020-12-310000924515us-gaap:CommonStockMember2020-01-012020-12-310000924515gthp:PreferredStockSeriesEMember2020-01-012020-12-310000924515gthp:PreferredStockSeriesDMember2020-01-012020-12-310000924515gthp:PreferredStockSeriesCTwoMember2020-01-012020-12-310000924515gthp:PreferredStockSeriesCOneMember2020-01-012020-12-310000924515gthp:PreferredStockSeriesCMember2020-01-012020-12-310000924515gthp:AccumulatedDeficitMember2019-12-310000924515gthp:TreasuryStocksMember2019-12-310000924515us-gaap:AdditionalPaidInCapitalMember2019-12-310000924515us-gaap:CommonStockMember2019-12-310000924515gthp:PreferredStockSeriesDMember2019-12-310000924515gthp:PreferredStockSeriesCTwoMember2019-12-310000924515gthp:PreferredStockSeriesCOneMember2019-12-310000924515gthp:PreferredStockSeriesCMember2019-12-3100009245152021-03-3100009245152019-12-3100009245152020-01-012020-12-3100009245152021-01-012021-12-3100009245152021-01-012021-03-310000924515gthp:SeriesGPreferredSharesMember2021-12-310000924515gthp:SeriesCTwoConvertiblePreferredSharesMember2021-12-310000924515gthp:SeriesCOneConvertiblePreferredSharesMember2021-12-310000924515gthp:SeriesGPreferredSharesMember2020-12-310000924515gthp:SeriesCTwoConvertiblePreferredSharesMember2020-12-310000924515gthp:SeriesCOneConvertiblePreferredSharesMember2020-12-310000924515gthp:SeriesGPreferredSharesMember2022-03-310000924515gthp:SeriesCTwoConvertiblePreferredSharesMember2022-03-310000924515gthp:SeriesCOneConvertiblePreferredSharesMember2022-03-310000924515gthp:SeriesGConvertiblePreferredSharesMember2020-12-310000924515gthp:SeriesGConvertiblePreferredSharesMember2022-03-310000924515gthp:SeriesGConvertiblePreferredSharesMember2021-12-310000924515gthp:SeriesFTwoConvertiblePreferredSharesMember2020-12-310000924515gthp:SeriesFTwoConvertiblePreferredSharesMember2022-03-310000924515gthp:SeriesFTwoConvertiblePreferredSharesMember2021-12-310000924515gthp:SeriesFConvertiblePreferredSharesMember2020-12-310000924515gthp:SeriesFConvertiblePreferredSharesMember2022-03-310000924515gthp:SeriesFConvertiblePreferredSharesMember2021-12-310000924515gthp:SeriesEConvertiblePreferredSharesMember2020-12-310000924515gthp:SeriesEConvertiblePreferredSharesMember2022-03-310000924515gthp:SeriesEConvertiblePreferredSharesMember2021-12-310000924515gthp:SeriesDConvertiblePreferredSharesMember2020-12-310000924515gthp:SeriesDConvertiblePreferredSharesMember2022-03-310000924515gthp:SeriesDConvertiblePreferredSharesMember2021-12-310000924515gthp:SeriesCTwoPreferredSharesMember2020-12-310000924515gthp:SeriesCTwoPreferredSharesMember2022-03-310000924515gthp:SeriesCTwoPreferredSharesMember2021-12-310000924515gthp:SeriesCOnePreferredSharesMember2020-12-310000924515gthp:SeriesCOnePreferredSharesMember2022-03-310000924515gthp:SeriesCOnePreferredSharesMember2021-12-310000924515gthp:SeriesCPreferredSharesMember2020-12-310000924515gthp:SeriesCPreferredSharesMember2022-03-310000924515gthp:SeriesCPreferredSharesMember2021-12-3100009245152020-12-3100009245152022-03-3100009245152021-12-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

As filed with the Securities and Exchange Commission on June 29, 2022

Registration No. 333-259871

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form S-1/A

Amendment No. 3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GUIDED THERAPEUTICS, INC. |

(Exact name of Registrant as specified in its charter) |

Delaware | | 3845 | | 58-2029543 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

5835 Peachtree Corners East, Suite B

Norcross, Georgia

(770) 242-8723

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Mr. Gene S. Cartwright, Ph.D.

President and Chief Executive Officer

5835 Peachtree Corners East, Suite B

Norcross, Georgia

(770) 242-8723

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert F. Charron, Esq. Sarah E. Williams, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, New York 10105 Phone: (212) 370-1300 Fax: (212) 370-7889 | | M. Ali Panjwani, Esq. Michael T. Campoli, Esq. Pryor Cashman LLP 7 Times Square New York, New York 10036 Phone: (212) 421-4100 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED June 29, 2022

PRELIMINARY PROSPECTUS

Up to 890,000 Shares of Common Stock

and

Up to 178,000 Pre-Funded Warrants to Purchase Shares of Common Stock

and

890,000 Warrants to Purchase Shares of Common Stock

Guided Therapeutics, Inc.

We are offering 890,000 shares of common stock pursuant to this prospectus at a public offering price of $10.00 per share, together with warrants (“Public Warrants”) to purchase shares of common stock. Each Public Warrant is exercisable to purchase one share of common stock at an exercise price of $12.40, exercisable upon issuance and will expire five years from the date of issuance. The shares of common stock and Public Warrants will be separately issued, but the shares and warrants will be issued and sold to purchasers together. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of Public Warrants.

We are also offering to certain purchasers whose purchase of common stock in this offering that would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of the outstanding shares of our common stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, up to 178,000 pre-funded warrants, in lieu of shares of common stock that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of the outstanding shares of our common stock. Each pre-funded warrant will be exercisable for one share of common stock. The purchase price of each pre-funded warrant and the accompanying Public Warrant will be equal to the price at which a share of common stock and accompanying Public Warrant are sold to the public in this offering, minus $0.001, and the exercise price of each pre-funded warrant will be $0.001 per share of common stock. The pre-funded warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering. Each pre-funded warrant is being sold together with one Public Warrant. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because we will issue one Public Warrant for each share of common stock and for each pre-funded warrant to purchase one share of common stock sold in this offering, the number of Public Warrants sold in this offering will not change as a result of a change in the mix of the shares of common stock and pre-funded warrants sold. The shares of common stock and pre-funded warrants, and the accompanying Public Warrants, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance.

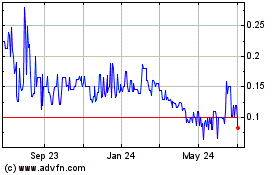

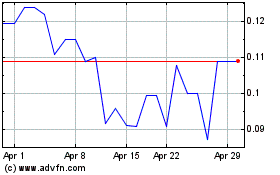

Our common stock is currently quoted under the symbol “GTHP” on the OTC Markets. We have applied to list our common stock and the Public Warrants offered pursuant to this prospectus on the Nasdaq Capital Market (“Nasdaq”) under the symbols “GTHP” and “GTHPW”, respectively. The successful listing of our common stock and Public Warrants on Nasdaq is a condition of this offering. No assurance can be given that our application will be approved. We do not intend to apply for listing of the pre-funded warrants on any national securities exchange or trading system.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page 11 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | Per Common Share and related Public Warrant | | | Per Pre-Funded Warrant and related Public Warrant | | | Total | |

Public offering price | | $ | 10.00 | | | $ | 10.00 | | | $ | 8,900,000 | |

Underwriting discount(1)(2) | | $ | .70 | | | $ | .70 | | | $ | 541,000 | |

Proceeds, before expenses, to us | | $ | 9.30 | | | $ | 9.30 | | | $ | 8,359,000 | |

(1) | Does not include our obligation to reimburse the underwriters for their expenses in an amount not to exceed $100,000. We refer you to “Underwriting” beginning on page 94 of this prospectus for information regarding expenses reimbursable by us to the underwriter. |

| |

(2) | The public offering price and underwriting discount corresponds to (x)(i) a public offering price per share of common stock of $9.99 and (ii) a public offering price per Public Warrant of $0.01, and (y)(i) a public offering price per pre-funded warrant of $9.989 and (ii) a public offering price per Public Warrant of $0.01. |

| |

(3) | The underwriters may also exercise their option to purchase up to an additional shares of common stock and/or Public Warrants to purchase up to an aggregate of shares of common stock from us, in any combination thereof, at the public offering price, less the underwriting discounts and commissions, for 45 days after the date of this prospectus. |

Roth Capital Partners

Prospectus dated , 2022.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

Neither we nor the underwriters have authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any free writing prospectus prepared by or on behalf of us or to which we may have referred you in connection with this offering. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the underwriters are making an offer to sell or seeking offers to buy these securities in any jurisdiction where, or to any person to whom, the offer or sale is not permitted. The information in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our securities and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus. Our business, financial condition, results of operations and future growth prospects may have changed since those dates.

We obtained the industry, market and competitive position data in this prospectus from our own internal estimates and research as well as from industry and general publications and research surveys and studies conducted by third parties. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors,” that could cause results to differ materially from those expressed in these.

This prospectus contains references to our trademark and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Unless otherwise indicated, references in this prospectus to “$”, “dollars”, “USD” or “United States dollars” are to United States dollars.

PROSPECTUS SUMMARY

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Investing in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our financial statements and related notes, before investing in our securities. If any of the following risks materialize, our business, financial condition, operating results and prospects could be materially and adversely affected. In that event, the price of our securities could decline, and you could lose part or all of your investment.

Unless the context indicates otherwise, as used in this prospectus, the terms “Guided,” “Guided Therapeutics,” “we,” “us,” “our,” “our company” and “our business” refer to Guided Therapeutics, Inc.

On December 30, 2021 our Board approved a 1-for-20 reverse stock split of all outstanding shares of our common stock, and the Company filed a Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Company with the Secretary of State of the State of Delaware (the “Certificate of Amendment”) to effect the Reverse Stock Split. An Issuer Company Related Action Notification regarding a reverse stock split (the “Reverse Stock Split”) was submitted to Financial Industry Regulatory Authority (“FINRA”) on November 18, 2021, which was approved on May 9, 2022 and will be effective on the approximate date of the Nasdaq uplisting and financing, expected to be on or near June 30, 2022. Throughout this prospectus, references to a number of our issued and outstanding shares of common gives effect to the Reverse Stock Split, unless otherwise indicated.

Our Company

Overview

We are a medical technology company focused on developing innovative medical devices that have the potential to improve healthcare. Our primary focus is the sales and marketing of our LuViva® Advanced Cervical Scan non-invasive cervical cancer detection device. The underlying technology of LuViva primarily relates to the use of biophotonics for the non-invasive detection of cancers. LuViva is designed to identify cervical cancers and precancers painlessly, non-invasively and at the point of care by scanning the cervix with light, then analyzing the reflected and fluorescent light.

LuViva is designed to provide a less invasive and painless alternative to conventional tests for cervical cancer screening and detection. Additionally, LuViva is designed to improve patient well-being not only because it eliminates pain, but also because it is convenient to use and provides rapid results at the point of care. We focus on two primary applications for LuViva: first, as a cancer screening tool in the developing world, where infrastructure to support traditional cancer-screening methods is limited or non-existent, and second, as a triage following traditional screening in the developed world, where a high number of false positive results cause a high rate of unnecessary and ultimately costly follow-up tests.

Screening for cervical cancer represents one of the most significant demands on the practice of diagnostic medicine. As cervical cancer is linked to a sexually transmitted disease -the human papillomavirus (HPV)-every woman essentially becomes “at risk” for cervical cancer simply after becoming sexually active. In the developing world, there are approximately 2.0 billion women aged 15 and older who are potentially eligible for screening with LuViva. Guidelines for screening intervals vary across the world, but U.S. guidelines call for screening every three years. Traditionally, the Pap smear screening test, or Pap test, is the primary cervical cancer screening methodology in the developed world. However, in developing countries, cancer screening using Pap tests is expensive and requires infrastructure and skill not currently existing, and not likely to be developed in the near future, in these countries.

We believe LuViva is the answer to the developing world’s cervical cancer screening needs. Screening for cervical cancer in the developing world often requires working directly with foreign governments or non-governmental agencies (NGOs). By partnering with governments or NGOs, we can provide immediate access to cervical cancer detection to large segments of a nation’s population as part of national or regional governmental healthcare programs, eliminating the need to develop expensive and resource-intensive infrastructures.

In the developed world, we believe LuViva offers a more accurate and ultimately cost-effective triage medical device, to be used once a traditional Pap test or HPV test indicates the possibility of cervical cancer. Due to the high number of false positive results from Pap tests, traditional follow-on tests entail increased medical treatment costs. We believe these costs can be minimized by utilizing LuViva as a triage to determine whether and to what degree follow-on tests are warranted.

We believe our non-invasive cervical cancer detection technology can be applied to the early detection of other cancers as well. For example, we have developed prototypes and conducted limited clinical studies using our biophotonic technology for the detection of esophageal cancer. We believe that skin cancer detection is also a promising target for our biophotonic technology, but currently we are focused primarily on the large-scale commercialization of LuViva.

Our Potential Market

The Developing World

According to the most recent data published by the World Health Organization (WHO), cervical cancer is the fourth most frequent cancer in women worldwide, with an estimated 570,000 new cases in 2018, an increase of 40,000 cases from 2012. For women living in less developed regions, however, cervical cancer is the second most common cancer, and 9 out of 10 women who die from cervical cancer reside in low- and middle-income countries. In 2018, GLOBOCAN, the international cancer tracking agency, estimated that approximately 311,000 women died from cervical cancer, with 85% of these deaths occurring in low- and middle-income countries.

As noted by the WHO, in developed countries, programs are in place that enable women to get screened, making most pre-cancerous lesions identifiable at stages when they can easily be treated. Early treatment prevents up to 80% of cervical cancers in these countries. In developing countries, however, limited access to effective screening means that the disease is often not identified until it is further advanced and symptoms develop. In addition, prospects for treatment of such late-stage disease may be poor, resulting in a higher rate of death from cervical cancer in these countries.

We have executed formal distribution agreement covering 40 countries, some of which have since expired. Presently, we still have active contracts in place for 24 countries that cover roughly half of the world’s population, including China and certain countries in Southeast Asia (including Indonesia), and certain countries in Eastern Europe and Russia.

We believe that the greatest need and market opportunity for LuViva lies in screening for cervical cancer in developing countries where the infrastructure for traditional screening may be limited or non-existent.

In addition to private care markets, we are actively working with distributors in the following countries to implement government-sponsored screening programs: Turkey, Indonesia and several countries in Eastern Europe. The number of screening candidates in those countries is approximately 155 million.

The Developed World

The Pap test, which involves a sample of cervical tissue being placed on a slide and observed in a laboratory, is currently the most common form of cervical cancer screening. Since the introduction of screening and diagnostic methods, the number of cervical cancer deaths in the developed world has declined dramatically, due mainly to the increased use of the Pap test. However, the Pap test has a wide variation in sensitivity, which is the ability to detect the disease, and specificity, which is the ability to exclude false positives. A study by Duke University for the U.S. Agency for Health Care Policy and Research published in 1999 showed Pap test performance ranging from a 22%-95% sensitivity and 78%-90% specificity, although new technologies improving the sensitivity and specificity of the Pap test have recently been introduced and are finding acceptance in the marketplace. Currently, about 50 million Pap tests are given annually in the United States, and combined with a pelvic exam as the standard of care, has an average price of approximately $380 per exam.

After a Pap test returns a positive result for cervical cancer, accepted protocol calls for a visual examination of the cervix using a colposcope, usually followed by a biopsy, or tissue sampling, at one or more locations on the cervix. This method looks for visual changes attributable to cancer. There are about two million colposcope examinations annually in the United States and Europe. According to industry reports by MD Save and Costhelper Health, leading online medical service providers, the average cost of a colposcopy examination with biopsy in the United States is currently $943.

Given this landscape, we believe that there is a material need and market opportunity for LuViva as a triage device in the developed world where LuViva represents a more cost- effective method of verifying a positive Pap test than the alternatives.

The LuViva Advanced Cervical Scan

LuViva is designed to identify cervical cancers and precancers painlessly, non-invasively and at the point of care by scanning the cervix with light, then analyzing the light reflected from the cervix. The information presented by the light would be used to indicate the likelihood of cervical cancer or precancers. Our product, in addition to detecting the structural changes attributed to cervical cancer, is also designed to detect the biochemical changes that precede the development of visual lesions. In this way, cervical cancer may be detected earlier in its development, which should increase the chances of effective treatment. In addition to the device itself, operation of LuViva requires employment of our single-use, disposable calibration and alignment cervical guide.

To date, thousands of women in multiple international clinical settings have been tested with LuViva. As a result, more than 25 papers and presentations have been published regarding LuViva in a clinical setting, including at the International Federation of Gynecology and Obstetrics Congress in London in 2015 and at the Indonesian National Obstetrics and Gynecology (POGI) Meeting in Solo in 2016.

Internationally, we contract with country-specific or regional distributors. We believe that the international market will be significantly larger than the U.S. market due to the international demand for cervical cancer screening. We have executed formal distribution agreements covering over 40 countries, some of which have expired. We still have active contracts in place for countries including China and Southeast Asia (including Indonesia), Eastern Europe and Russia. In 2022, we intend to focus on other large markets such as those in the European Union, India and certain Latin American countries, such as Mexico. The ongoing conflict in Ukraine may delay filing and approval to market in Russia.

We currently have regulatory approval to sell LuViva in 44 countries, including the 33 countries in Europe under our Edition 3 CE Mark. In addition, we have approval to sell LuViva in 11 additional countries under country specific approvals including India, Indonesia, Singapore and Kenya. Finally, several non-EU countries such as Saudi Arabia, Egypt and South Africa rely on the CE Mark for medical devices. LuViva has also previously obtained marketing approval from Health Canada and COFEPRIS in Mexico but these have expired. In addition, in 2018, we were approved for sales and marketing in India. We currently are seeking regulatory approval to market LuViva in the United States but have not yet received approval from the U.S. Food and Drug Administration (“FDA”). As of March 31, 2022, we have sold 144 LuViva devices and approximately 76,980 single-use disposable cervical guides to international distributors.

We believe our non-invasive cervical cancer detection technology can be applied to the early detection of other cancers as well. As we develop LuViva as a commercial product, we continue to seek new collaborative partners focused on marketing and sales of our biophotonic technology.

Manufacturing, Sales, Marketing and Distribution

We manufacture LuViva at our Norcross, Georgia facility. Most of the components of LuViva are custom made for us by third-party manufacturers. We adhere to ISO 13485:2003 quality standards in our manufacturing processes. Our single-use cervical guides are manufactured by a vendor that specializes in injection molding of plastic medical products. On January 22, 2017, we entered into a license agreement with Shandong Yaohua Medical Instrument Corporation (“SMI”), as amended on March 28, 2017, pursuant to which we granted SMI an exclusive global license to manufacture the LuViva device and related disposables (subject to a carve-out for manufacture in Turkey). On December 18, 2018, we entered into a co-development agreement with Newmars Technologies, Inc. (“NTI”), whereby NTI will perform final assembly of the LuViva device for its contracted distribution countries in Eastern Europe and Russia at its ISO 13485 facility in Hungary. This additional carve out has been agreed to by SMI. On August 12, 2021 the Company entered into a second amendment with SMI pursuant to which the Company has continued to grant SMI exclusive distribution, sales and manufacturing rights of the LuViva for China, Taiwan, Hong Kong and Macau.

We rely on distributors to sell our products. Distributors can be country exclusive or cover multiple countries in a region. We manage these distributors, provide them marketing materials and train them to demonstrate and operate LuViva. We seek distributors that have experience in gynecology and in introducing new technology into their assigned territories. Currently, we rely on SMI in distributing our products in the People's Republic of China, Macau, Hong Kong and Taiwan; we rely on NTI in distributing our products in Eastern Europe and Russia.

We have only limited experience in the production planning, quality system management, facility development, and production scaling that will be needed to bring production to increased sustained commercial levels. We will likely need to develop additional expertise in order to successfully manufacture, market, and distribute any future products.

Our Team

Our management team is comprised of highly experienced pharmaceutical and biotechnology executives with successful track records in researching, developing, gaining approval for and commercializing novel medicines to treat serious diseases. Each member of our management team has over 20 to 30 years of industry experience, including our CEO and COO. These individuals have held leadership positions with industry leaders such as Abbott Laboratories, and GE Health among others, and also with early stage biotechnology and emerging technology companies such as Biofield Corp and SpectRx, Inc. Additionally, the team has significant experience in company formation, capital raises, mergers/acquisitions, business development, and sales and marketing in the pharmaceutical industry. Our board of directors (the “Board”) is constituted by individuals with significant experience in the pharmaceutical and biotechnology industries.

Our Strengths

Currently, we are the only commercial stage company with a biophotonic technology that potentially addresses a large primary screening market and a potential R&D pipeline that could improve the early detection of numerous cancers that afflict men and women. Key strengths include:

| · | The engineering and production risks have been largely addressed as we have sold over 100 working systems worldwide. |

| | |

| · | Regulatory approvals have been granted covering over 40 countries. |

| | |

| · | We have legitimate pathways for securing marketing approvals in the two largest medical markets - the US and China, within a 2-3 year period. |

| | |

| · | The clinical results of our technology have been published in leading peer-reviewed journals by world-famous, thought-leading physicians. |

Our Business Strategy

Our near term goals are to accomplish the following over the next two years by pursuing the following strategies:

| · | Seek US FDA approval by completing a clinical trial. |

| | |

| · | Contingent upon FDA approval, discuss opportunities to partner with a larger U.S. based company for distribution in the U.S. At the same time, we intend to build a small dedicated sales force based near major metropolitan centers and focused on generating sales at large centralized Ob-Gyn practices. |

| | |

| · | Seek Chinese FDA approval working with our existing partner in China, Shandong Medical Instrumentation Co. Ltd. |

| | |

| · | Pursue regulatory approval in Russia and work with our partner in Eastern Europe, Newmars Technology, Inc. to generate sales in Europe. |

| | |

| · | Continue to selectively support sales through our distributors in large countries such as Indonesia. |

While we plan to pursue regulatory approval in Russia, the ongoing conflict in Ukraine may delay filing and approval to market.

Risk Factor Summary

Our ability to implement our business strategy is subject to numerous risks that you should be aware of before making an investment decision. These risks are described more fully in the section entitled “Risk Factors” in this prospectus. These risks include, among others:

| · | Although we will be required to raise additional funds in 2022, there is no assurance that such funds can be raised on terms that we would find acceptable, on a timely basis, or at all. |

| | |

| · | If we cannot obtain additional funds when needed, we will not be able to implement our business plan. |

| | |

| · | We have a history of losses, and we expect losses to continue. |

| | |

| · | Our ability to sell our products is controlled by government regulations, and we may not be able to obtain any necessary clearances or approvals. |

| | |

| · | In foreign countries, including European countries, we are subject to government regulation, which could delay or prevent our ability to sell our products in those jurisdictions. |

| | |

| · | In the United States, where we are subject to regulation by the U.S. FDA, our product has not yet been approved which could prevent us from selling our products domestically. |

| | |

| · | Even if we obtain clearance or approval to sell our products, we are subject to ongoing requirements and inspections that could lead to the restriction, suspension or revocation of our clearance. |

| | |

| · | We are currently delinquent on our federal payroll and unemployment taxes. |

Listing on the Nasdaq Capital Market

Our common stock is currently quoted on the OTC Markets under the symbol “GTHP”. In connection with this offering, we have applied to list our common stock and Public Warrants offered in the offering on the Nasdaq under the symbols “GTHP” and “GTHPW”, respectively. If our listing application is approved, we expect to list our common stock and the Public Warrants offered in the offering on Nasdaq upon consummation of the offering, at which point our common stock will cease to be traded on the OTC Markets. No assurance can be given that our listing application will be approved. Nasdaq listing requirements include, among other things, a stock price threshold. As a result, in order to meet such requirement, on December 20, 2021 we approved a 1-for-20 reverse stock split of our common stock. There can be no assurance that our common stock and Public Warrants will be listed on the Nasdaq. However, we will not complete this offering if we are not so listed. We do not intend to apply for listing of the pre-funded warrants on any national securities exchange or trading system.

Corporate Information

We were incorporated in the state of Delaware in 1992, under the Delaware General Corporation Law, or “DGCL”, under the name “SpectRx, Inc.” and subsequently changed our name to Guided Therapeutics, Inc. on February 22, 2008. At the same time, we renamed our wholly owned subsidiary, InterScan, Inc. which originally had been incorporated as “Guided Therapeutics, Inc.” Our telephone number is (770) 242-8723. Our website address is https://www.guidedinc.com/. The information contained in or accessible from our website is not incorporated into this prospectus, and you should not consider it part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

The Offering

Common stock offered by us | | 890,000 shares, based on a public offering price of $10.00 per share of common stock and related Public Warrant. |

| | |

Pre-funded warrants offered by us | | We are also offering to certain purchasers whose purchase of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of the outstanding shares of our common stock immediately following the consummation of this offering, the opportunity to purchase, if such purchasers so choose, up to 178,000 pre-funded warrants, in lieu of shares of common stock that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of the outstanding shares of our common stock. Each pre-funded warrant will be exercisable for one share of common stock. The purchase price of each pre-funded warrant and the accompanying Public Warrant will equal the price at which the shares of common stock and the accompanying Public Warrant are being sold to the public in this offering, and the exercise price of each pre-funded warrant will be $0.001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until all of the pre-funded warrants are exercised in full. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because we will issue one Public Warrant for each share of common stock and for each pre-funded warrant to purchase one share of common stock sold in this offering, the number of Public Warrants sold in this offering will not change as a result of a change in the mix of the shares of common stock and pre- funded warrants sold. For additional information, see “Description of Securities—Pre-Funded Warrants to be Issued as Part of this Offering” on page 73 of this prospectus. |

| | |

Description of Public Warrants | | We are offering Public Warrants to purchase an aggregate of 890,000 shares of common stock. Each share of common stock and each pre-funded warrant to purchase one share of common stock is being sold together with one Public Warrant to purchase one share of common stock. Each Public Warrant will have an exercise price of $12.40 per share, will be upon issuance exercisable and will expire on the fifth anniversary of the original issuance date. The shares of common stock and pre-funded warrants, and the accompanying Public Warrants, as the case may be, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the Public Warrants. For additional information, see “Description of Securities—Public Warrants to be Issued as Part of this Offering” on page 70 of this prospectus. |

| | |

Shares of common stock to be outstanding after this offering | | 2,269,174 shares (or 2,402,674 shares if the underwriters exercise their option to purchase additional shares in full). |

| | |

Underwriters’ option to purchase additional securities | | We have granted the underwriters a 45-day option to purchase up to 133,500 additional shares of common stock and/or Public Warrants at the public offering price, less underwriting discounts and commissions on the same terms as set forth in this prospectus. |

Use of proceeds | | We estimate that the proceeds to us from the sale of shares of our common stock in this offering will be approximately $8,900,000, or $10,235,000 if the underwriters exercise their option to purchase additional shares in full, assuming an initial public offering price of $10 per share and related Public Warrants as set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to fund completion of the US FDA clinical trial and application for FDA approval for LuViva, sales and marketing, debt repayment, and general corporate purposes. See “Use of Proceeds.” |

| | |

Proposed Nasdaq Capital Market symbols | | We have applied to list our common stock and Public Warrants offered pursuant to this prospectus on the Nasdaq under the symbols “GTHP” and “GTHPW”, respectively. The successful listing of our common stock and Public Warrants on Nasdaq is a condition of this offering. However, there can be no assurance that Nasdaq will approve our listing application. |

| | |

No Listing of Pre-funded Warrants | | We do not intend to apply for listing of the pre-funded warrants on any national securities exchange or trading system. Without an active trading market, the liquidity of the pre-funded warrants will be limited. |

| | |

Risk Factors | | Investment in our securities involves substantial risks. You should read this prospectus carefully, including the section entitled “Risk Factors” and the financial statements and the related notes to those statements included in this prospectus, before investing in our common stock. |

The number of shares of common stock to be outstanding after this offering is based on an aggregate of 1,379,174 shares outstanding as of June 5, 2022. The disclosure above does not include:

| · | 75,000 shares of common stock issuable upon exercise of outstanding options as of March 31, 2022, at a weighted average exercise price of $9.80 per share, of which 52,261 shares were vested as of such date; |

| | |

| · | 250,470 shares of common stock reserved for future issuance under our stock option plan as of March 31, 2022, plus any future increases in the number of shares of common stock reserved for issuance under our stock option plan pursuant to evergreen provisions; |

| | |

| · | shares of common stock that may be issued upon the exercise of pre-funded warrants and Public Warrants issued in this offering; and |

| | |

| · | 1,552,227 shares of common stock underlying warrants and convertible debt at a weighted average exercise price of $6.24 per share. |

Except as otherwise indicated herein, all information in this prospectus, including the number of shares that will be outstanding after this offering, assumes no exercise by the underwriters of their option to purchase additional securities.

GUIDED THERAPEUTICS, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited, in thousands)

| | Three Months Ended | |

| | March 31, | |

| | 2022 | | | 2021 | |

| | | | | | |

Sales - devices and disposables | | $ | 5 | | | $ | - | |

Cost of goods sold | | | 1 | | | | - | |

Gross profit | | | 4 | | | | - | |

| | | | | | | | |

Operating expenses: | | | | | | | | |

Research and development | | | 21 | | | | 16 | |

Sales and marketing | | | 40 | | | | 36 | |

General and administrative | | | 386 | | | | 771 | |

Total operating expenses | | | 447 | | | | 823 | |

| | | | | | | | |

Loss from operations | | | (443 | ) | | | (823 | ) |

| | | | | | | | |

Other income (expenses): | | | | | | | | |

Interest expense | | | (101 | ) | | | (141 | ) |

Change in fair value of derivative liability | | | (6 | ) | | | (88 | ) |

Gain from extinguishment of debt | | | 41 | | | | 87 | |

Change in fair value of warrants | | | - | | | | 448 | |

Other expenses | | | 2 | | | | - | |

Total other income (expense) | | | (64 | ) | | | 306 | |

| | | | | | | | |

Loss before income taxes | | | (507 | ) | | | (517 | ) |

Provision for income taxes | | | - | | | | - | |

| | | | | | | | |

Net loss | | | (507 | ) | | | (517 | ) |

Preferred stock dividends | | | (548 | ) | | | (55 | ) |

| | | | | | | | |

NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS | | $ | (1,055 | ) | | $ | (572 | ) |

SUMMARY FINANCIAL DATA

GUIDED THERAPEUTICS, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands)

| | Years Ended | |

| | December 31, | |

| | 2021 | | | 2020 | |

| | | | | | |

| Sales - devices and disposables | | $ | 81 | | | $ | 102 | |

| Cost of goods sold (recovered) | | | 61 | | | | (41 | ) |

Gross profit | | | 20 | | | | 143 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

Research and development | | | 69 | | | | 143 | |

Sales and marketing | | | 141 | | | | 139 | |

General and administrative | | | 2,172 | | | | 913 | |

Total operating expenses | | | 2,382 | | | | 1,195 | |

| | | | | | | | |

| Loss from operations | | | (2,362 | ) | | | (1,052 | ) |

| | | | | | | | |

Other income (expenses): | | | | | | | | |

Interest expense | | | (1,150 | ) | | | (1,056 | ) |

Change in fair value of derivative liability | | | (91 | ) | | | (25 | ) |

Gain (loss) from extinguishment of debt | | | 578 | | | | (296 | ) |

Change in fair value of warrants | | | 448 | | | | 1,879 | |

Other income | | | 507 | | | | 271 | |

Total other income | | | 292 | | | | 773 | |

| | | | | | | | |

| Loss before income taxes | | | (2,070 | ) | | | (279 | ) |

| Provision for income taxes | | | - | | | | - | |

| | | | | | | | |

| Net loss | | | (2,070 | ) | | | (279 | ) |

| Preferred stock dividends | | | (361 | ) | | | (122 | ) |

| | | | | | | | |

| NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS | | $ | (2,431 | ) | | $ | (401 | ) |

| | Year ended December 31, | |

| | 2021 | | | 2020 | |

| Balance Sheet Data: | | | | | | |

| Total current assets | | $ | 1,637 | | | $ | 896 | |

| Total noncurrent assets | | | 403 | | | | 454 | |

| Working capital | | | (4,057 | ) | | | (8,066 | ) |

| Total assets | | | 2,040 | | | | 1,350 | |

| Current liabilities | | | 5,694 | | | | 8,962 | |

| Non current liabilities | | | 1,791 | | | | 3,243 | |

| Total liabilities | | | 7,485 | | | | 12,205 | |

| Accumulated deficit | | | (142,387 | ) | | | (139,956 | ) |

| Total stockholders deficit | | $ | (5,445 | ) | | $ | (10,855 | ) |

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider each of the following risks, together with all other information set forth in this prospectus, including the consolidated financial statements and the related notes, before making a decision to buy our securities. If any of the following risks actually occurs, our business could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

Although we may be required to raise additional funds in 2022, if the proceeds of this offering is not sufficient to carry out our business, there is no assurance that such funds can be raised on terms that we would find acceptable, on a timely basis, or at all.

Additional debt or equity financing may be required for us to continue as a going concern. We may seek to obtain additional funds for the financing of our cervical cancer detection business through additional debt or equity financings and/or new collaborative arrangements. Management believes that additional financing, if obtainable, will be sufficient to support planned operations only for a limited period. Management has implemented operating actions to reduce cash requirements. Any required additional funding may not be available on terms attractive to us, on a timely basis, or at all. If we cannot obtain additional funds or achieve profitability, we may not be able to continue as a going concern.