UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

Notification of Late Filing

SEC FILE NUMBER

000-53548

CUSIP NUMBER

399818103

(Check One):

[ ] Form 10-K [ ] Form 20-F [ ] Form 11-K [X] Form 10-Q [ ] Form 10-D [ ] Form N-SAR [ ]Form N-CSR

For Period Ended: March 31, 2020

[ ] Transition Report on Form 10-K

[ ] Transition Report on Form 20-F

[ ] Transition Report on Form 11-K

[ ] Transition Report on Form 10-Q

[ ] Transition Report on Form N-SAR

For the Transition Period Ended: _______________________

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

Part I - Registrant Information

Grow Capital, Inc.

Full Name of Registrant

N/A

Former Name if Applicable

2485 Village View Drive, Suite 180

Address of Principal Executive Office (Street and Number)

Henderson, NV 89074

City, State and Zip Code

Part II - Rules 12b-25(b) and (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should

be completed. (Check box, if appropriate)

[X](a) The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

[X](b) The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, 11-K, Form N- SAR, or Form N-CSR, or portion thereof will be

filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q, or subject distribution report on Form 10-D, or portion thereof will be filed on or before the fifth

calendar day following the prescribed due date; and

[ ](c) The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

Part III - Narrative

State below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof could not be

filed within the prescribed period.

We are filing this extension in order to provide more time for a final review of our quarterly financial statements and the notes to those statements by our

independent registered public accounting firm.

Part IV - Other Information

(1) Name and telephone number of person to contract in regard to this notification.

(2) Have all other periodic reports required under section 13 or 15(d) of the Securities Exchange Act of 1934 or section 30 of the Investment Company Act of

1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

[X] Yes [ ] No

(3) Is it anticipated that any significant change in

results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? If so, attach an explanation of the anticipated change, both

narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

[X] Yes [ ] No

During the nine months ended March 31, 2020 we generated gross revenues of $1,927,251, of which $1,657,909 was derived from related party

customers, compared to $545,752 in the comparative nine months ended March 31, 2019, of which $372,627 was derived from related party customers. Costs of sales in the current nine months totaled $939,179 of which $186,354 were costs of related party

services, compared to $222,093 for the nine months ended March 31, 2019, of which $96,213 were costs of related party services. Net revenues for the comparative nine-month periods ended March 31, 2020 and 2019, respectively totaled $988,072 and

$323,659. During the nine months ended March 31, 2020 and 2019, operations of the Resort at Lake Selmac contributed gross profit of $87,796 and $99,922 respectively, while operations of Bombshell contributed gross profit of $900,276 and $223,737,

respectively.

The Company experienced a substantial increase in operating expenses from $1,038,567 during the nine months ended March 31, 2019 compared to

$2,700,801 during the nine months ended March 31, 2020. The increase in operating expenses is predominantly attributable to an increase in professional fees and stock-based compensation in the current period, as well as an increase in general and

administrative expenses incurred by related parties as a result of the acquisition of Bombshell Technologies Inc. During fiscal 2019, the Company issued common stock to certain board members, employees and consultants for services rendered at rates below market, the total combined value of which was $616,344 for the nine months ended March 31, 2019 compared to $1,508,278 in the current

nine months ended March 31, 2020. Professional fees also increased substantially period over period from $165,312 to $745,943 as the Company undertook various corporate actions and acquisitions in the period. General and administrative fees were also

increased in the current nine-month period ended March 31, 2020 from $218,430 (2019) to $267,640 in fiscal 2020. This was as a direct result of the increase in the operations as a result of our wholly owned subsidiary, Bombshell. General and

administrative fees incurred from related parties increased substantially in the comparative periods from $36,208 in 2019 to $167,261 in 2020 as the Company’s operations included the expanding operations of Bombshell. Depreciation, amortization and

impairment also increased from $2,273 to $11,679 in the current nine-month periods.

Net losses from continuing operations in the nine months ended March 31, 2020 and 2019 totaled $1,734,923 and $753,520, respectively.

Net losses in the nine months ended March 31, 2020 and 2019 totaled $1,243,038 and $743,549, respectively.

Grow Capital, Inc.

(Name of Registrant as specified in charter)

has caused this notification to be signed on its behalf by the undersigned thereunto duly authorized.

3

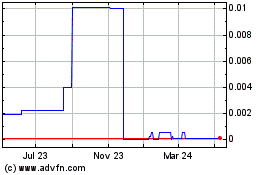

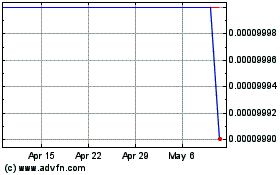

Grow Capital (CE) (USOTC:GRWC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Grow Capital (CE) (USOTC:GRWC)

Historical Stock Chart

From Apr 2023 to Apr 2024