Current Report Filing (8-k)

August 07 2019 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 Or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2019

Grow Capital, Inc.

(Exact name of Registrant as specified in its charter)

|

Nevada

|

000-53548

|

86-0970023

|

|

(State or other Jurisdiction of Incorporation or organization)

|

(Commission File Number)

|

(IRS Employer I.D. No.)

|

2485 Village View Drive, Suite 180

Henderson, NV 89074

Phone: (702) 830-7919

(Address, including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule l 4a- l 2 under the Exchange Act ( 17 CFR 240. l 4a- l 2)

o

Pre-commencement communications pursuant to Rule l 4d-2(b) under the Exchange Act (17 CFR 240. l 4d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. l 3e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

On August 1, 2019, Grow Capital, Inc. (the “Company”), a Nevada corporation, issued and sold 1,215,278 shares (the “Shares”) of the Company’s common stock, par value $0.001 (“Common Stock”), to two individual accredited investors (the “Purchasers”), pursuant to separate securities purchase agreements (the “Purchase Agreements”). At the closing, the Company received aggregate gross proceeds of $200,000. The Purchase Agreements contain customary representations, warranties and covenants of the parties. The proceeds of the offering will be used for the Company’s ongoing operations and execution of its current business plan which is focused on moving the Company away from

cannabis related activities and into an acquisition strategy focused on financial technology, or “fintech” and complementary opportunities.

The foregoing description of the Purchase Agreements is a summary and is qualified in its entirety by reference to the form of Securities Purchase Agreement filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on April 12, 2019 and incorporated herein by reference.

The shares of Common Stock issued and sold under the Purchase Agreements were offered and sold by the Company in reliance upon an exemption from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506(b) under Regulation D promulgated under the Securities Act. Each of the Purchasers represented that he was acquiring the Shares for investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof. Accordingly, the Shares have not been registered under the Securities Act and such securities may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws.

SIGNATURE PAGE

Pursuant to the requirement of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Grow Capital, Inc.

By:

/s/ Jonathan Bonnette

Jonathan Bonnette

Chief Executive Officer

Dated: August 7, 2019

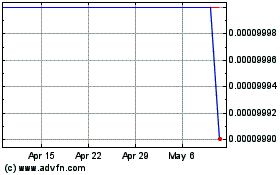

Grow Capital (CE) (USOTC:GRWC)

Historical Stock Chart

From Mar 2024 to Apr 2024

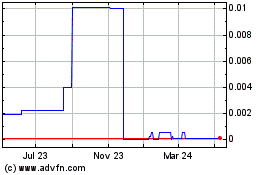

Grow Capital (CE) (USOTC:GRWC)

Historical Stock Chart

From Apr 2023 to Apr 2024