Current Report Filing (8-k)

June 14 2019 - 6:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 Or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 8, 2019

Grow Capital, Inc.

(Exact name of Registrant as specified in its charter)

|

Nevada

|

000-53548

|

86-0970023

|

|

(State or other Jurisdiction of Incorporation or organization)

|

(Commission File Number)

|

(IRS Employer I.D. No.)

|

2485 Village View Drive, Suite 180

Henderson, NV 89074

Phone: (702) 830-7919

(Address, including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule l 4a- l 2 under the Exchange Act ( 17 CFR 240. l 4a- l 2)

☐

Pre-commencement communications pursuant to Rule l 4d-2(b) under the Exchange Act (17 CFR 240. l 4d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. l 3e-4(c))

Item 3.02. Unregistered Sales of Equity Securities.

The information required by this Item is included under Item 8.01 of this Current Report on Form 8-K and incorporated herein by reference.

Item 8.01. Other Events.

On June 8, 2019, Grow Capital, Inc. (the “Company”) entered into a Fee Agreement (the “Fee Agreement”) with AF1 Public Relations LLC, a Nevada limited liability company (“AF1”), pursuant to which AF1 will provide outside business marketing, branding, publishing, and investor relations services (the “Services”). The Fee Agreement has an effective date of June 1, 2019, and has a one year term. AF1 is wholly-owned by Amanda Kennedy, the wife of Terry Kennedy, a beneficial owner of more than 10% of the Company’s outstanding common stock, par value $0.001 (“Common Stock”).

During the term of the Fee Agreement, the Company will pay AF1 a monthly fee of $5,000, payable through the issuance of shares of Common Stock to AF1 at a per share price determined at the end of each month. If the shares issued to AF1 are not registered, they will be issued at a per share price equal to 75% of the average of the three lowest closing prices in the last ten market trading days of each month. If the shares issued to AF1 are registered and freely tradeable, the shares will be issued at a per share price equal to the closing market price on the final trading day of each month less a 10% discount. The shares will be issued quarterly.

Additionally, the Company issued 131,465 shares of unregistered Common Stock to AF1 on June 7, 2019 as payment for Services previously provided by AF1. 54,661 shares were issued at a price of $0.0869 per share as payment for Services provided for the period ending August 9, 2019, and 76,805 shares were issued at a price of $0.09765 per share as payment for the Services provided for the period ending May 16, 2019. The shares of Common Stock were issued at a per share price equal to 75% of the average of the three lowest closing prices in the last ten market trading days prior to August 9, 2018 and May 16, 2019, the respective end dates of the periods in which the Services were provided.

The unregistered shares of Common Stock issued pursuant to the Fee Agreement will be issued by the Company in reliance upon an exemption from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). Accordingly, the shares of Common Stock have not been registered under the Securities Act and such shares may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws.

A copy of the Fee Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE PAGE

Pursuant to the requirement of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Grow Capital, Inc.

By:

/s/ Jonathan Bonnette

Jonathan Bonnette

Chief Executive Officer

Dated: June 13, 2019

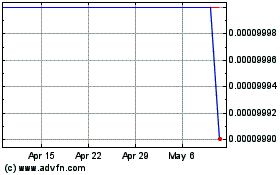

Grow Capital (CE) (USOTC:GRWC)

Historical Stock Chart

From Mar 2024 to Apr 2024

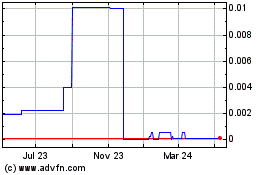

Grow Capital (CE) (USOTC:GRWC)

Historical Stock Chart

From Apr 2023 to Apr 2024