Glencore Hit by Geotechnical Issues at DRC, Slow Kazakhstan Ramp-Up -- Commodity Comment

April 28 2022 - 3:28AM

Dow Jones News

By Jaime Llinares Taboada

Glencore on Thursday downgraded production guidance for copper

and cobalt due to geotechnical constraints at the Katanga mine in

the Democratic Republic of the Congo, whereas the zinc outlook was

hit by a slower ramp-up of Zhairem in Kazakhstan. Here's what the

commodity mining and trading giant had to say:

On 1Q performance:

"For the most part, the group's quarterly production was in line

with our expectations. However, production in Q1 2022 reflects a

number of temporary impacts, including geotechnical challenges at

Katanga and Covid-19 absenteeism, particularly in Australia.

Koniambo's Q4 2021 higher operating rates continued into Q1 this

year, while overall coal production, on a like-for-like basis,

reflecting our increased Cerrejon ownership, was broadly flat

period-on-period."

"Own sourced copper production of 257,800 tonnes was 43,400

tonnes (14%) lower than Q1 2021, reflecting temporary geotechnical

constraints at Katanga (14,000 tonnes), the basis change arising

from the sale of Ernest Henry in January 2022 (11,000 tonnes) and

lower copper units produced within Glencore's zinc business."

"Own sourced zinc production of 241,500 tonnes was 41,000 tonnes

(15%) lower than Q1 2021, reflecting Mount Isa Covid-19 related

absenteeism (21,300 tonnes) and the planned mining cessation of

Iscaycruz in Peru in Q3 2021 (20,300 tonnes)."

"Own sourced nickel production of 30,700 tonnes was 5,500 tonnes

(22%) higher than Q1 2021, primarily reflecting Koniambo operating

both production lines in 2022."

"Attributable ferrochrome production of 387,000 tonnes was

12,000 tonnes (3%) below Q1 2021."

"Coal production of 28.5 million tonnes was 4.0 million tonnes

(16%) higher than Q1 2021, mainly reflecting higher attributable

production from Cerrejon, following the acquisition in January 2022

of the remaining two-thirds interest that Glencore did not already

own."

"Entitlement interest oil production of 1.5 million barrels of

oil equivalent was 0.4 million barrels (40%) higher than Q1 2021,

due to commencement of the gas phase of the Alen project in

Equatorial Guinea from March 2021."

On 2022 guidance:

"Reflecting the Q1 production performance, full-year guidance is

reduced for copper and cobalt, but increased for nickel and

ferrochrome, while the slower than expected ramp-up at Zhairem

reduces full-year zinc production guidance by 9%."

"Changes to guidance mainly reflect:

-- Copper: down 40kt (3%) and cobalt down 3kt (6%) - Katanga's

temporary geotechnical constraints

-- Nickel: up 3kt (3%) and ferrochrome up 40kt (3%) - Q1

quarterly performance

-- Zinc: down 100kt (9%) - persistent challenges in ramping up

processing capabilities at Kazzinc's Zhairem operation"

"Our marketing activities were supported during the quarter by

tight physical market conditions and periods of extreme volatility.

Extrapolating our Q1 performance would see our marketing segment's

full-year earnings comfortably exceeding the top end of our

long-term adjusted EBIT guidance range of $2.2-3.2bn p.a."

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

April 28, 2022 03:13 ET (07:13 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

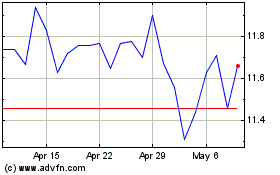

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Aug 2024 to Sep 2024

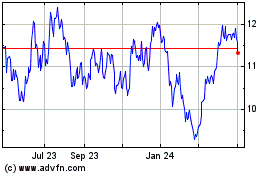

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Sep 2023 to Sep 2024