Metals Acquisition to Buy Glencore's CSA Copper Mine in Australia

March 17 2022 - 7:37AM

Dow Jones News

By Robb M. Stewart

Metals Acquisition Corp. has struck a deal to buy Glencore PLC's

CSA copper mine in Australia for $1.1 billion, a move by the

blank-check company to tap into expected demand for copper in the

global energy transition away from fossil fuels.

The company said Thursday it entered a definitive agreement with

Glencore to buy the producing mine for $1.05 billion in cash and

$50 million in equity, plus a 1.5% copper net smelter royalty that

will be paid to Glencore.

CSA is an established copper mine in New South Wales state that

is expected to produce more than 40,000 metric tons of copper this

year, with an estimated mine life of more than 15 years, Metals

Acquisition said.

The company said that during the due diligence process for the

acquisition, it identified opportunities that could improve

production and reduce costs at the mine. CSA will benefit from

about $130 million of recent capital investment expected prior to

the acquisition's completion, the company said.

Metals Acquisition, which listed last year after an initial

public offering, said the $1.1 billion purchase price for CSA

implies a multiple of 4.5 times estimated 2022 earnings before

interest, tax, depreciation and amortization.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

March 17, 2022 07:22 ET (11:22 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

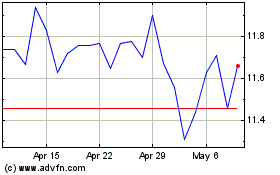

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Aug 2024 to Sep 2024

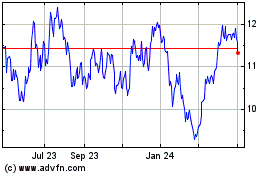

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Sep 2023 to Sep 2024