Amended Current Report Filing (8-k/a)

December 19 2022 - 8:38AM

Edgar (US Regulatory)

0000867028

true

Amendment No. 1

0000867028

2022-11-07

2022-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K/A

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 7, 2022

FOMO

WORLDWIDE, INC.

(Exact

name of Registrant as specified in its Charter)

| california |

|

001-13126 |

|

83-3889101 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

No.) |

1

E Erie St, Ste 525 Unit #2250, Chicago, IL 60611

(Address

of principal executive offices)

(630)

708-0750

(Registrant’s

Telephone Number)

(Former

name or address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Background.

This

Amendment to Form 8-K filed November 10, 2022 updates investors on our restructuring of obligations due to the CEO and founder of our

wholly owned subsidiaries SMARTSolution Technologies L.P. and SMARTSolution Technologies, Inc. (together “SST”), which we

acquired on February 28, 2022. Through early payback and assignment of assets, amounts due to Mr. Schwartz under his $185,000 March 31,

2022 loan to us are expected to be reduced to $26,250 from $185,000 (including success fees and expenses) and the maturity date is expected

to be extended to December 31, 2025. Under our Agreement with Mr. Schwartz and based on the audit of SST, which is nearing completion,

we estimate we owe him $139,000 based on 1.5% of signed purchase orders generated in 2021, which is agreed to be due December 31, 2025.

Further, we owe Mr. Schwartz $19,230 based on the remainder of his employment contract through February 28, 2023, which is agreed to

be due December 31, 2025. Further, we have agreed to issue Mr. Schwartz a $100,000 0% junior note in exchange for one million (1) Series

B Preferred shares (convertible into one billion common shares) which will mature December 31, 2025. Altogether, these actions and amendments

are expected to aggregate to a three (3) year 0% junior note with principal amount of $284,480, paying straight line amortization of

$7,902 per month, and convertible into 200,000,000 common shares. Altogether, these actions, when completed, would reduce our fully diluted

shares issued and outstanding by 800,000,000, or approximately 5%. There are no assurances that these actions will be consummated in

a timely fashion, in the manner described above, or at all.

FOMO

WORLDWIDE, INC. is referred to in this Current Report on Form 8-K as “FOMO,” the “Company,” “we,”

or “us.”

Item

8.01 Other Events.

We

have agreed to assign a $100,000 15% August 2023 real estate development loan owed to FOMO CORP. to Mitchell Schwartz, Founder/CEO of

our 100%-owned subsidiary SMARTSolution Technologies LP. The assignment is partial payment against a $185,000 11.5% September 2022 loan

made by Mr. Schwartz to FOMO CORP. on March 31, 2022. Adjusted for a prepayment of $50,000 cash made earlier this year to Mr. Schwartz

and the loan assignment, we will have reduced our debt to Mitchell Schwartz to $35,000 from $185,000 and eliminated a $10,000 success

fee attached to his loan on maturity. The early payments and assignments reduce our collateral against the Schwartz loan pro rata to

35,897,436 common shares from 200,000,000 common shares. Mr. Schwartz has agreed to extend the maturity of his remaining loan balance

to February 28, 2023, at which time his SST employment contract ends. The borrower of the real estate loan, Mr. Schwartz and FOMO CORP.

have agreed to the transaction and are papering it for execution. Upon payoff of the Schwartz loan, there will be no shares issued to

Mr. Schwartz or held as collateral.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

FOMO

WORLDWIDE, INC. |

| |

|

| Date:

December 19, 2022 |

By:

|

/s/

Vikram Grover |

| |

|

Vikram

Grover |

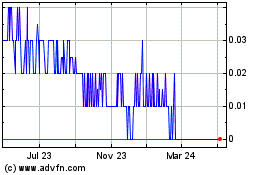

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

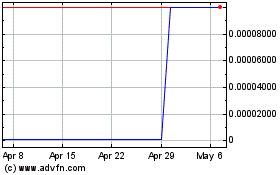

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Apr 2023 to Apr 2024