Mortgage Rates Inch Lower, Freddie Mac Says

July 01 2021 - 10:15AM

Dow Jones News

By Dave Sebastian

Mortgage rates dropped slightly over the past week, according to

Freddie Mac's latest survey.

For the week ended Thursday, the rate on a 30-day fixed rate

mortgage averaged 2.98%, down from 3.02% last week and lower than

the 3.07% rate it averaged a year earlier.

"Economic growth remains steady and is bolstering more segments

of the economy," said Sam Khater, Freddie Mac's chief economist.

"Although low and stable mortgage rates have kept the housing

market booming over recent months, a deterioration in affordability

and for-sale inventory has led to a market slowdown."

Rates on 15-year fixed-rate mortgages averaged 2.26%, down from

2.34% in the previous week. Rates averaged 2.56% a year earlier,

according to Freddie Mac.

Five-year Treasury-indexed hybrid adjustable-rate mortgages, or

ARMs, on average stood at 2.54%, up slightly from 2.53% last week

and lower than the 3% rate a year earlier.

Mortgage rates fell throughout most of 2020 after the Covid-19

pandemic ravaged the economy. That helped power a boom in mortgage

lending, fueled by refinancings. When rates hit 2.98% in July 2020,

it was their first time under the 3% mark in some 50 years of

record-keeping.

Mortgage rates tend to move in the same direction as the yield

on the 10-year Treasury, which has been rising. Treasury yields

rise when investors feel confident enough in the economy to forgo

safe-haven assets such as bonds for riskier ones including

stocks.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

July 01, 2021 10:14 ET (14:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

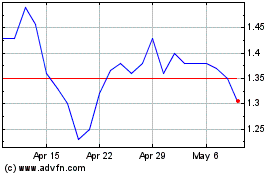

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Apr 2023 to Apr 2024