Current Report Filing (8-k)

June 24 2022 - 9:10AM

Edgar (US Regulatory)

X10000310522falseFEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE00003105222022-06-242022-06-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 24, 2022

Federal National Mortgage Association

(Exact name of registrant as specified in its charter)

Fannie Mae

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Federally chartered corporation | 0-50231 | 52-0883107 | | 1100 15th Street, NW | | 800 | | 232-6643 |

| | | | Washington, | DC | 20005 | | | | |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) | | (Address of principal executive offices, including zip code) | | (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§203.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Fannie Mae announced on June 24, 2022 that it has commenced fixed-price cash tender offers (each, an “Offer” and, collectively, the “Offers”) for the purchase of certain Connecticut Avenue Securities® (CAS) Debt Notes. The Offers are being conducted upon the terms and subject to the conditions set forth in an offer to purchase and related notice of guaranteed delivery, each dated as of June 24, 2022. The Offers will expire at 5:00 p.m. New York City time on Thursday, June 30, 2022 unless extended or earlier terminated.

Attached as Exhibit 99.1 and incorporated by reference herein is a press release announcing the Offers. The information in this report, including information contained in the exhibit submitted with this report, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of Section 18, nor shall it be deemed incorporated by reference into any disclosure document relating to Fannie Mae, except to the extent, if any, expressly incorporated by specific reference in that document.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are being submitted with this report:

| | | | | | | | |

| | |

| Exhibit Number | | Description of Exhibit |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | FEDERAL NATIONAL MORTGAGE ASSOCIATION |

| | |

| By | /s/ Wells M. Engledow |

| | Wells M. Engledow |

| | Enterprise Deputy General Counsel—Senior Vice President |

Date: June 24, 2022

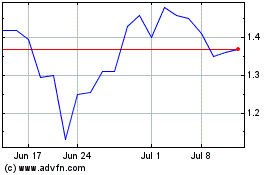

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

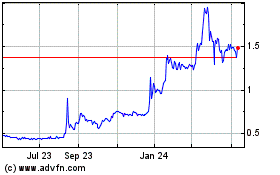

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Apr 2023 to Apr 2024