Current Report Filing (8-k)

January 31 2020 - 1:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

——————

FORM 8-K

——————

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 29, 2020

——————

Energy and Water Development Corp.

(Exact name of registrant as specified in its charter)

——————

|

|

|

|

Florida

|

000-56030

|

30-0781375

|

|

(State or Other Jurisdiction

|

(Commission

|

(I.R.S. Employer

|

|

of Incorporation)

|

File Number)

|

Identification No.)

|

7901 4th St. N, Suite 4174

St. Petersburg, FL 33702

(Address of Principal Executive Office) (Zip Code)

305-517-7330

(Registrant’s telephone number, including area code)

(Former Name or Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

None

|

|

None

|

|

None

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company þ

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

Amendment to Articles of Incorporation

On or about January 29, 2020, Energy and Water Development Corp. (the “Company”) filed Amended and Restated Articles of Incorporation (the “A&R Articles”) to designate 3,780,976 shares of its authorized preferred stock as Series A Preferred Stock (“Series A Preferred Stock”).

The foregoing description of the A&R Articles does not purport to be complete and is qualified in its entirety by reference to the provisions of the A&R Articles filed as Exhibit 3.1 to this Report, which is incorporated by reference herein.

Summary of Series A Preferred Stock Rights

Conversion Rights

Each share of Series A Preferred Stock shall be convertible into five (5) shares of the Company’s common stock, par value $0.001 per share (“Common Stock”) (i) at the option of the holder or (ii) mandatorily upon either (a) the closing of the sale of shares of Common Stock to the public in a firm-commitment underwritten public offering pursuant to an effective registration statement under the Securities Act of 1933, as amended, resulting in at least $25,000,000.00 of gross proceeds to the Company or (b) the date and time, or the occurrence of an event, specified by vote or written consent of the holders of at least sixty-five percent (65%) of the then outstanding shares of Series A Preferred Stock.

Liquidation Rights

In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, Series A Preferred Stock shall be treated pari passu, with Common Stock except that the payment on each share of Series A Preferred Stock shall be equal to the amount of the payment on each share of Common Stock multiplied by the conversion rate then in effect.

Voting Rights

On any matter presented to the shareholders of the Corporation for their action or consideration at any meeting of shareholders of the Corporation (or by written consent of shareholders in lieu of meeting), each holder of outstanding shares of Series A Preferred Stock shall be entitled to cast the number of votes equal to the number of shares of Series A Preferred Stock held by such holder as of the record date for determining shareholders entitled to vote on such matter multiplied by the conversion rate then in effect.

Dividends

Series A Preferred Stock shall be treated pari passu with Common Stock except that the dividend on each share of Series A Preferred Stock shall be equal to the amount of the dividend declared and paid on each share of Common Stock multiplied by the conversion rate then in effect.

The foregoing description of the Series A Preferred Stock does not purport to be complete and is qualified in its entirety by reference to the provisions of the A&R Articles filed as Exhibit 3.1 to this Report, which is incorporated by reference herein.

All 3,780,976 shares of the Series A Preferred Stock are currently issued and outstanding.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Energy and Water Development Corp.

|

|

|

|

|

Dated: January 31, 2020

|

By:

|

|

|

|

Name:

Title:

|

Ralph Hofmeier

President, Chief Executive Officer

|

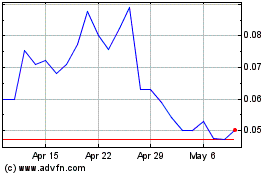

Energy and Water Develop... (QB) (USOTC:EAWD)

Historical Stock Chart

From Mar 2024 to Apr 2024

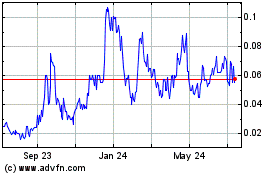

Energy and Water Develop... (QB) (USOTC:EAWD)

Historical Stock Chart

From Apr 2023 to Apr 2024