Current Report Filing (8-k)

January 16 2019 - 5:02PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 11, 2019

Earth

Science Tech Inc.

(Exact

name of Registrant as Specified in its Charter)

|

Nevada

|

|

000-55000

|

|

80-0961484

|

|

(State

or Other Jurisdiction

of

Incorporation or Organization)

|

|

(Commission

file

number)

|

|

(I.R.S.

Employer

Identification

Number)

|

8000

NW 31st Street, Unit 19

Doral,

FL 33122, USA

(Address

of Principal Executive Offices including Zip Code)

(305)

615-2118

(Registrant’s

Telephone Number, including Area Code)

Former

name or former address, if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item

1.01 Entry into a Material Definitive Agreement

Effective

January 11, 2019, the Registrant entered into an agreement with Aaron Decker. An individual and Derrick West, an individual. Upon

execution the registrant will transfer, set over and sign Mr. Decker and Mr. West 95% of the all the issued and outstanding shares

of stock in and to Kannabidioid, Inc. and the resignations of any and all present officers and directors. The latter shall include

a statement of such officers and directors that they are not owed and do not claim any obligations of any kind of or from Kannabidioid,

Inc. and do not know of any obligation of any nature not disclosed in the books and records of the company to be delivered. This

transfer of Kannabidioid, Inc. and it’s business places Mr. Decker and Mr. West or their corporate nominee in full control

of Kannabidioid, Inc. for all purposes, subject to their undertaking aggressively and assiduously to pursue the growth of Kannabidioid,

Inc.’s business and to maximize its customer base, product line, and profitability. The Registrant entered into this agreement

because management determined that the substantial opportunities for the growth of its other product lines will require that it

deploy its resources on these other product lines such that it’s better to allow another management team to build the Kannabidioid

business. In allowing another management team to build the Kannabidioid business, Earth Science will not only continue to benefit

from the sales but it will be in a position be benefit from its growth without the necessity of depoloying additional resources

to realize that growth.

Consideration

:

The

Registrant retained a perpetual interest in 5% of Kannabidioid’s revenue which entitles it, unconditionally, to receive

5% of gross earnings on a monthly basis. The Registrant has the right, on demand, to audit the records of Kananbidioid, Inc. to

confirm accuracy of calculations and remittances. Kannabidioid, Inc. will have all its products manufactured and distributed including,

“CBD derived by ETST” on its label.

Re-evaluation

:

After

6 months from product launch, Kananbidioid, Inc. shall provide the Registrant accurate and complete data reflecting the gross

amount of product sales through such date and the amount actually invested in product advancement. The latter amount shall not

include wages, salaries or other distributions to employees. If such amount does not equal or exceed $20,000, the Registrant shall

have the option of repealing and terminating the agreement.

Item 1.03

Entry into Receivership

On

January 11, 2019 the Registrant received notice that Strongbow Advisors, Inc., and Robert Stevens (the “Receiver”)

had been appointed by the Nevada District Court, Clark County Nevada as receiver for the Registrant in Case No. A-18-784952-C.

In addition, the Court issued a Writ of Injunction or “Blanket Stay” covering Registrant and its assets during the

time that the Registrant is in receivership. The Blanket Stay will remain in place unless otherwise waived by the Receiver, or

it is vacated by the Court or alternatively, lifted by the Court, upon a “motion to lift stay” duly made and approved

by the Nevada District Court. The purpose of the “Blanket Stay” is to protect the estate and prevent interference

with its administration while the Registrant’s financial issued are fully analyzed and resolved. As part of this process,

creditors will be notified and required to provide claims in writing under oath on or before the deadline stated in the notice

provided by the Receiver or those claims will be barred under NRS §78.675.

The

Registrant determined that it was in its best interest and those of its shareholders and creditors to seek protection under receivership

after evaluating its options following the order for judgment in favor of Cromogen in the matter entitled Cromogen Biotechnology

Corporation vs. Earth Science Tech, Inc.. The appointment of Strongbow Advisors, Inc. and Robert Stevens as Receiver was approved

unanimously by the Registrant’s Board of Directors and a majority of its debt holders. Strongbow and Stevens were selected

because of their reputation of helping companies restructure and continue to execute on their business plans, albeit under a debt

and capital structure that allows them to succeed. Unlike many receivers who simply look to wind up the affairs of a company and

liquidate its assets, Stevens and Strongbow have built a reputation and differentiated themselves by assisting companies with

financings and working in the capital markets to help companies raise the capital needed not only to pay debts but to build and

grow their businesses. As a result, they are almost hyper-vigilant in protecting their companies’ shareholders and are not

focused solely on creditors.

About

Strongbow Advisors, Inc.

After

lengthy discussions with its principal, Robert Stevens, and after having had an opportunity to research the history of some of

the companies for which he and his firm were judicially appointed as receiver, Earth Science’s management is optimistic

about having Strongbow Advisors serve as its Receiver. As stated, unlike many receivers who take a liquidation approach to their

judicial roles, Stevens has a pragmatic philosophy of helping companies to restructure and use, what is generally considered,

a negative situation as an opportunity for them to become better, stronger, more vibrant, operating companies. Stevens has a firm

commitment to protecting creditors and shareholders alike; however, it’s his attention to an enterprise as a whole and in

particular on the business’ shareholders that truly differentiates Strongbow Advisors and him from other receivers.

In

his role as receiver, Stevens has reorganized companies that emerge from receivership having fully settled all of their liabilities

and recovered significant value for their shareholders, to continue as stronger successful companies. As an example, in one case

we reviewed, while in receivership the company was not only able to raise capital and pay its creditors in full, it was also able

to recover all of the value for the investing shareholders dating back to its IPO in 2008; and in that case, those IPO investors

had not only not lost money, but were able to realize substantial returns on their investments as shareholders.

In

short, Stevens has a breadth of experience as a receiver helping companies and their creditors, shareholders and other constituents

who have effectively “found themselves with lemons,” to “make high quality lemonade.” As such Earth Science

is optimistic that it will be another one of Strongbow’s success stories.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated:

January 16, 2019

|

|

EARTH

SCIENCE TECH, INC.

|

|

|

|

|

|

|

By:

|

/s/

Nickolas S. Tabraue

|

|

|

Name:

|

Nickolas

S. Tabraue

|

|

|

Title:

|

President

|

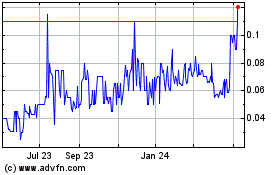

Earth Science Tech (PK) (USOTC:ETST)

Historical Stock Chart

From Mar 2024 to Apr 2024

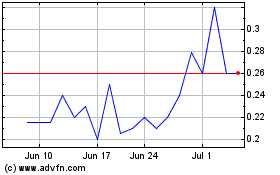

Earth Science Tech (PK) (USOTC:ETST)

Historical Stock Chart

From Apr 2023 to Apr 2024