Current Report Filing (8-k)

December 17 2020 - 5:03PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 11, 2020

DATA443

RISK MITIGATION, INC.

(Exact

Name of Registrant as Specified in Charter)

|

Nevada

|

|

000-30542

|

|

86-0914051

|

|

(State

or Other Jurisdiction

of

Incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

101

J Morris Commons Lane, Suite 105

Morrisville,

North Carolina 27560

(Address

of Principal Executive Offices)

Registrant’s

telephone number, including area code: 919-858-6542

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

none

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

ITEM

1.01

|

ENTRY

INTO A MATERIAL DEFINITIVE AGREEMENT.

|

On

December 11, 2020, Data443 Risk Mitigation, Inc., a Nevada corporation (the “Company”) entered into a Common

Stock Purchase Agreement (the “Purchase Agreement”) with Triton Funds LP, a Delaware limited partnership (“Triton”).

Pursuant to the Purchase Agreement, subject to certain conditions set forth in the Purchase Agreement, Triton is obligated to

purchase up to One Million Dollars ($1,000,000) of the Company’s common stock from time-to-time. The term of Triton’s

obligation to purchase the Company’s shares commences on the effectiveness of a registration statement on Form S-1, to be

filed by the Company (the “Registration Statement”), and ends on the earlier of (i) Triton having purchased

an aggregate of $1,000,000 of the Company’s common stock under the Purchase Agreement; or, (ii) 30 June 2021.

Each

time the Company wishes to issue and sell common stock to Triton under the Purchase Agreement, the Company is required to provide

Triton with a purchase notice (the “Purchase Notice”), which Purchase Notice sets forth the total number of

shares of common stock that the Company elects to sell to Triton (the “Purchased Shares”). The total purchase

price to be paid by Triton at each closing will be determined by multiplying the number of Purchased Shares to be sold by the

Company in the Purchase Notice by the purchase price per share, which is $0.006 per share. However, in no event will Triton be

obligated to purchase common stock when the closing price for the Company’s common stock is less than $0.009 per share.

Triton is obligated to acquire no more than an aggregate offering price of $1 million. Further, the Company shall not effect any

sales to Triton, and Triton shall not have the right to purchase any shares, to the extent that after giving effect to such sales,

Triton (together with its affiliates, and any other persons acting as a group together with Triton or any of Triton affiliates)

would beneficially own in excess of 9.99% of the outstanding shares of the Company’s common stock.

Closing for sales of the

Company’s common stock under the Purchase Agreement will occur no later than five (5) business days following the

date on which the Purchased Shares are received by Triton’s custodian. In addition, the Company has agreed to pay to Triton

(i) $5,000 upon execution of the Purchase Agreement to reimburse Triton’s expenses related to the transaction; and, (ii)

$10,000 at the initial closing under the Purchase Agreement as additional reimbursement for Triton’s expenses.

The

Company also granted to Triton warrants to purchase 100,000,000 shares of the Company’s Common Stock pursuant to the terms

and conditions of a Common Stock Purchase Warrant dated December 11, 2020 (the “Warrant Agreement”). The exercise

price for the warrants is $0.01 per share, and may be exercised at any time, in whole or in part, prior to December 11, 2025.

The Warrant Agreement provides for certain adjustments that may be made to the exercise price and the number of shares issuable

upon exercise due to future corporate events. The Warrant Agreement also contains a limited cashless exercise feature, providing

for the cashless exercise of 20,000,000 shares only upon the Company’s failure to secure the effectiveness of the Registration

Statement, which is to include all shares under the Warrant Agreement.

The

foregoing descriptions of the Purchase Agreement and the Warrant Agreement do not purport to be complete and are qualified in

their entirety by the terms and conditions of the Purchase Agreement and the Warrant Agreement. A copy of the form of the Purchase

Agreement and the Warrant Agreement is attached hereto as Exhibit 10.1 and 4.1, respectively, and are incorporated herein by reference.

|

ITEM

1.02

|

TERMINATION

OF A MATERIAL DEFINITIVE AGREEMENT.

|

On

December 17, 2020 the Company declared terminated the following agreements it previously entered into with PAG Group LLC (“PAG”)

on January 3, 2020: (i) Equity Financing Agreement; and, (ii) Registration Rights Agreement (collectively, the “PAG Agreements”).

Pursuant to the PAG Agreements, the Company was to file a registration statement under Form S-1, which was in fact filed on January

30, 2020 (the “PAG S-1”). The PAG S-1 sought to register shares of the Company’s common stock which could

be purchased by PAG under the PAG Agreements and resold by PAG. A condition of the PAG Agreements was the effectiveness of the

PAG S-1 within 90-days of its filing. Since the PAG S-1 was never declared effective by the SEC, the PAG Agreements terminated.

No fees or penalties are owed by the Company as a result of the termination of the PAG Agreements.

In

connection with the termination of the PAG Agreements, the Company has also sought to withdraw the PAG S-1. On December 16, 2020

the Company filed, via the SEC Edgar filing system, Form RW in order to request the withdrawal of the PAG S-1.

|

ITEM

3.02

|

UNREGISTERED

SALES OF EQUITY SECURITIES.

|

The

applicable information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.02.

The foregoing securities under the Warrant Agreement were offered and sold without registration under the Securities Act of 1933

(the “Securities Act”) in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act and/or

Regulation D promulgated thereunder, and in reliance on similar exemptions under applicable state laws.

|

ITEM

5.03

|

AMENDMENTS

TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCAL YEAR

|

On December 15, 2020,

following receipt of written approval from stockholders acting without a meeting and holding at least the minimum number of votes

that would be necessary to authorize or take such action at a meeting, the Company filed a Certificate of Amendment to the Articles

of Incorporation with the Secretary of State of the State of Nevada to increase the number of authorized shares of common stock

from 1,500,000,000 to 1,800,000,000, effective December 15, 2020. The Certificate of Amendment is attached to this Current

Report as Exhibit 3.1. All descriptions of the Certificate of Amendment herein are qualified in their entirety to the text of

Exhibit 3.1 hereto, which is incorporated herein by reference.

|

ITEM

5.07

|

SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS.

|

On December 15, 2020,

the holders of 69.9% of the issued and outstanding shares of stock of the Company entitled to vote took action by their written

consent and without a meeting, pursuant to Nevada Revised Statute 78.320. The number of shares entitled to vote was deemed to

be 3,226,952,126, representing the total number of issued and outstanding shares of (i) common stock; and, (ii) Series A Preferred

Stock converted into common stock for purposes of voting. Shares of Series B Preferred Stock were not entitled to vote on this

matter. The Certificate of Amendment to the Company’s Articles of Incorporation to increase the number of authorized shares

of common stock from 1,500,000,000 to 1,800,000,000 was approved. 2,256,048,075 shares were voted in favor of the Amendment,

and such stockholders signed a written consent taking such action without a meeting or involvement of the Company. The written

consent was delivered to the Company on December 15, 2020.

|

ITEM

7.01

|

Regulation

FD Disclosure.

|

On

December 17, 2020, the Company issued a press release (the “Press Release”) announcing the Purchase Agreement

with Triton, and the termination of the PAG Agreements and the withdrawal of the PAG S-1. A copy of the Press Release is attached

hereto as Exhibit 99.1 and incorporated herein by this reference.

|

ITEM

9.01

|

Financial

Statements and Exhibits.

|

The

following exhibits are furnished with this report:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

December 17, 2020

|

DATA443

RISK MITIGATION, INC.

|

|

|

|

|

|

By:

|

/S/

JASON REMILLARD

|

|

|

|

Jason

Remillard,

|

|

|

|

Chief

Executive Officer

|

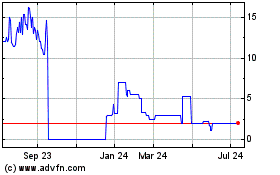

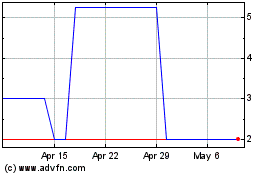

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Historical Stock Chart

From Apr 2023 to Apr 2024