Data443 Risk Mitigation, Inc. (OTCMKTS: ATDS) Soars on Proposed Up-list and FileFacets Acquisition

September 02 2020 - 9:27AM

InvestorsHub NewsWire

September 2, 2020 -- InvestorsHub NewsWire -- via Microcap Daily

-- BY JUSTIN KINNEY ON SEPTEMBER

2, 2020

Data443 Risk Mitigation, Inc. (OTCMKTS:

ATDS) continues to surge higher in recent trading as the

Company makes big progress on several fronts including engaging

Maxim Group LLC to assist the Company in up-listing to a national

exchange. ATDS has exploded out of sub penny land and is now

running up the penny charts quickly attracting legions of new

shareholders who continue to accumulate. ATDS is getting noticed as

its “Open Source” data security platform is rapidly catching on

with a number of major fortune 500 companies recently adopting it;

recently both the Miami Dolphins and Pittsburgh Steelers adopted

Data443 Risk Mitigation’s ARALOC™ Secure Sports Management platform

and Zoom Video Communications (ZM) adopted DATA443 cyber security

and places it at top of the first page.

Data443 Risk has been busy in recent weeks announcing record

revenues of $466,000 during the second quarter of fiscal year 2020,

compared to $359,000 of revenue during the second quarter of fiscal

year 2019. The Company also closed on the acquisition of the

intellectual property rights and assets of FileFacets®, a

Software-as-a-Service (SaaS) platform that performs sophisticated

data discovery and content search of structured and unstructured

data within corporate networks, servers, content management

systems, email, desktops and laptops

Data443 Risk Mitigation, Inc. (OTCMKTS:

ATDS) is the industry leader in Data Privacy Solutions

for All Things Data Security, providing software and

services to enable secure data across local devices, network,

cloud, and databases, at rest and in flight. Its suite of products

and services is highlighted by: (i) ARALOC™, which is a

market leading secure, cloud-based platform for the management,

protection and distribution of digital content to the desktop and

mobile devices, which protects an organization’s confidential

content and intellectual property assets from leakage — malicious

or accidental — without impacting collaboration between all

stakeholders; (ii) ArcMail ™, which is a leading

provider of simple, secure and cost-effective email and enterprise

archiving and management solutions; (iii) ClassiDocs™,

the Company’s award-winning data classification and governance

technology, which supports CCPA, LGPD and GDPR compliance; (iv)

ClassiDocs™ for Blockchain, which provides an

active implementation for the Ripple XRP that protects blockchain

transactions from inadvertent disclosure and data leaks; (v)

Data443™ Global Privacy Manager, the privacy

compliance and consumer loss mitigation platform which is

integrated with ClassiDocs™ to do the delivery

portions of GDPR and CCPA as well as process Data Privacy Access

Requests – removal request – with inventory by

ClassiDocs™; (vi) Data443™ Chat History

Scanner, which scans chat messages for Compliance, Security, PII,

PI, PCI & custom keywords; (vii) DATAEXPRESS®, the

leading data transport, transformation and delivery product trusted

by leading financial organizations worldwide; (viii)

FileFacets®, a Software-as-a-Service (SaaS) platform

that performs sophisticated data discovery and content search of

structured and unstructured data within corporate networks,

servers, content management systems, email, desktops and laptop;

(ix) The CCPA Framework WordPress plugin, which enables

organizations of all sizes to comply with the CCPA privacy

framework; and (x) the GDPR Framework WordPress plugin, with over

30,000 active users it enables organizations of all sizes to comply

with the GDPR and other privacy frameworks.

In August Data443 announced record operational and financial

results for its second quarter (ended June 30, 2020), and for its

first half of fiscal year 2020. Management stated: “We recorded net

billings of $869,000 for the three months ended June 30, 2020,

compared to $483,000 in the prior year period. We recognized

$466,000 of revenue during the second quarter of fiscal year 2020,

compared to $359,000 of revenue during the second quarter of fiscal

year 2019. Deferred revenues were $1,212,000 as of June 30, 2020,

an increase of $303,000 from $954,000 as of December 31, 2019.”

The Company closed on the acquisition of the intellectual

property rights and assets of FileFacets®, a Software-as-a-Service

(SaaS) platform that performs sophisticated data discovery and

content search of structured and unstructured data within corporate

networks, servers, content management systems, email, desktops and

laptops. FileFacets®is a data discovery, privacy compliance and

enterprise analytics company with vast experience in GDPR

Compliance. The Company was originally part of the L-SPARK

accelerator, secured significant venture capital funding in 2016

and won numerous industry awards for information governance and

data privacy

ATDS got a boost on September 1 after CEO Jason Remillard

presented at the LD Micro 500 Virtual Conference. Mr. Remillard

provided an overview of Data443, discussing the recent acquisition

of FileFacets®, along with recent contract wins with the NFL’s

Pittsburgh Steelers and the launch of the first privacy scanner for

the world’s leading video communications platform, Zoom. Data443

also engaged Maxim Group LLC as its financial advisor to assist the

Company in articulating its growth strategy to the investment

community and with its aspiration to up-list to a national

exchange. Data443 is looking to list on a national exchange in

order to gain exposure to the broad and developed investor base of

the major capital markets. The Company believes that an up-listing

could enhance its visibility in the marketplace, increase the

liquidity of their stock, and build long term shareholder

value.

Currently moving northbound on a surge of volume

ATDS is an exciting story developing in small caps;

the Company is in the right place at the right time as the cyber

security market continues to see rapid growth especially in the

face of the current pandemic, ATDS is making big moves and seeing

its “Open Source” data security platform rapidly catching on as

several major fortune 500 companies have already adopted it;

recently both the Miami Dolphins and Pittsburgh Steelers adopted

Data443 Risk Mitigation’s ARALOC™ Secure Sports Management

platform. Zoom Video Communications (ZM) also recently

adopted DATA443 cyber security and places it at top of the first

page. ATDS is looking to uplist and has engaged Maxim Group LLC to

assist the Company in up-listing process. The Company recenlty

reported record revenues of $466,000 during the second quarter of

fiscal year 2020, compared to $359,000 of revenue during the second

quarter of fiscal year 2019 as well as closed on the acquistion of

the intellectual property rights and assets of FileFacets®, a

Software-as-a-Service (SaaS) platform that performs sophisticated

data discovery and content search of structured and unstructured

data within corporate networks, servers, content management

systems, email, desktops and laptops. We will be

updating on ATDS on a daily basis so make sure you are subscribed

to microcapdaily.com so you know what is going on with

ATDS.

Disclosure: we hold no position in ATDS either long or short and we

have not been compensated for this article.

Source: https://microcapdaily.com/data443-risk-mitigation-inc-otcmkts-atds-soars-on-proposed-up-list-and-filefacets-acquisition/127683/

SOURCE: Microcap Daily

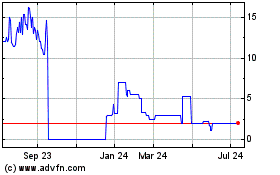

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

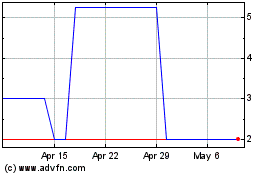

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Historical Stock Chart

From Apr 2023 to Apr 2024