How to Navigate the Fog of Sustainable Investing -- Heard on the Street

September 07 2020 - 5:46AM

Dow Jones News

By Stephen Wilmot

Can environmental, social and governance risks be quantified?

With the notable exception of carbon emissions, probably not -- but

that doesn't mean the exercise isn't useful for investors.

Interest in so-called sustainable investment is ballooning. One

sign is the money given to mutual funds: In the first half of 2020,

net flows into sustainable funds totaled $20.9 billion in the U.S.,

according to Morningstar, compared with $21.4 billion for 2019 as a

whole -- which was itself four times the previous record for a

calendar year.

Fund managers that don't specialize in ESG strategies are

scrambling to incorporate them into their investment frameworks.

There is an established industry of risk ratings, but these come

with a well-documented problem: The correlation between different

companies' ratings of the same stock is low because they measure

performance differently. An infamous example is Tesla. MSCI rates

the electric-car maker highly because of its environmentally

friendly products, while FTSE Russell gives it a middling score for

other reasons. This kind of confusion gives ESG ratings a

reputation for fuzziness.

Quantifying the risk to earnings from a given concern is a

pleasingly sharp-edged alternative. London-based fund manager

Schroders has developed a tool, SustainEx, to put a value on a

company's "externalities" -- the unpaid costs of its activity borne

by society. The rationale is that pressure is building on companies

to assume a greater share of these costs, which it estimated last

year at $2.2 trillion or 55% of corporate profits globally.

For example, SustainEx sees the tobacco sector as most at risk,

given the health problems caused by smoking. The market agrees:

After many years of stellar stock-market performance, tobacco

stocks have fallen from grace since 2017 as the U.S. Food and Drug

Administration has toughened its stance. Other conclusions, such as

the social risk to the earnings of highly rated alcoholic drinks

producers such as Diageo, are more surprising.

Such an approach has the advantage of bridging the gap between

ESG analysis and conventional stock analysis, which revolves around

earnings estimates. Some companies have made similar efforts:

Sportswear brand Puma has published a survey of what its products

cost the environment for almost a decade. Yogurt maker Danone this

year started to report earnings per share adjusted for its carbon

footprint.

Ultimately, though, putting a number on ESG risks isn't so

different from issuing a qualitative rating. Schroders used

academic studies to estimate costs in as objective a way as it

could, but another investor could package the same or other studies

differently and come up with different numbers.

"It would be nice to have comparability, but things are often

not comparable," says Alex Edmans, a finance professor at the

London Business School and author of " Grow the Pie: How Great

Companies Deliver Both Purpose and Profit." He usually prefers a

framework based on broad principles to a quantitative approach.

The real advantage of SustainEx for Schroders, which previously

used MSCI's ratings, is that having an in-house system allows ESG

factors to be better integrated into its existing processes. "We're

trying to help our investors think differently about the

ingredients that go into an investment decision," says Andy Howard,

global head of sustainable investment at Schroders.

One area where ESG risks can easily be compared is the carbon

emissions held responsible for climate change -- a problem that has

rapidly risen up the political agenda in recent years. Tougher

carbon cap-and-trade programs in particular could crystallize risks

to earnings identified in models such as SustainEx. Amid the

confusion around how to approach ESG factors, comparing companies'

carbon footprints is a good place to start.

Write to Stephen Wilmot at stephen.wilmot@wsj.com

(END) Dow Jones Newswires

September 07, 2020 05:31 ET (09:31 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

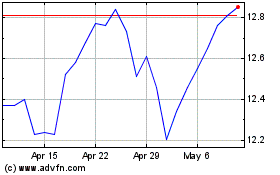

Danone (QX) (USOTC:DANOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Danone (QX) (USOTC:DANOY)

Historical Stock Chart

From Apr 2023 to Apr 2024