Amended Current Report Filing (8-k/a)

August 06 2019 - 2:00PM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August

6, 2019 (July 30, 2019)

Cuentas Inc.

(Exact name of registrant as specified in

its charter)

|

Florida

|

|

333-148987

|

|

20-3537265

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

File Number)

|

|

Identification Number)

|

19 W. Flagler St., Suite 902

Miami, FL

(Address of principal executive offices)

33130

(Zip Code)

(800) 611-3622

(Registrant’s telephone number, including

area code)

Cuentas Inc.

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

As used in this Current Report, all references

to the terms “we”, “us”, “our”, “Cuentas” or the “Company” refer to

Cuentas Inc. and its direct and indirect wholly-owned subsidiaries, unless the context clearly requires otherwise.

Explanatory Note

This Current Report on Form 8-K/A is being

filed to amend the Current Report on Form 8-K filed by the Company on March 4, 2019.

|

|

Item 1.01

|

Entry into a Definitive Material Agreement.

|

As previously reported,

On

February 28, 2019, the Company signed a Binding Term Sheet with Optima Fixed Income LLC (“Optima”) for a total investment

of $2,500,000 over one year and received $500,000 on the same date. Under the Binding Term Sheet, it was agreed that the initial

invested amount of $500,000 will in consideration of 166,667 shares of Common Stock of the Company. It was also agreed that Optima

may purchase a Convertible Note in the amount of $2,000,000 which may be funded on a quarterly basis. The term of the Convertible

Note shall be three years and it may be converted with a discount of 25% on the share price at date of conversion, but in any case,

not less than $3 per share. Optima will additionally get rights to vote some of the Series B Preferred. In any case, the total

investment in the Company shall be not be less than 25% of the outstanding shares at the first anniversary of the Binding Term

Sheet. On May 10, 2019 the Company and Optima executed the first Amendment of the Binding Term Sheet with Optima whereas Optima

will make an additional deposit of $550,000 to the Company and whereas that additional deposit will be provided to the Company

in the form of a Convertible Note as discussed in the Binding Term Sheet.

On July 30, 2019 Optima assigned its rights

under the Binding Term Sheet to Dinar Zuz LLC. On the same date, the Company and Dinar Zuz LLC executed a Subscription Agreement

with the same terms as reflected in the Binding Term Sheet and its First Amendment. Under the Subscription Agreement Dinar Zuz

LLC made an additional deposit of $250,000 and agreed to provide an additional amount of $1,000,000 to the Company which will be

provided in a form of a Convertible Note at the following dates:

|

Date

|

|

Amount

|

|

|

10/26/2019

|

|

$

|

500,000

|

|

|

01/26/2020

|

|

$

|

500,000

|

|

On August 2, 2019, Dinar Zuz LLC converted

the outstanding note with the Company in the amount of $1,000,000 at a conversion rate of $3 per share. On August 5, 2019, the

Company issued 500,000 shares of its common stock pursuant to a Securities Purchase Agreement which it entered on July 30, 2019.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CUENTAS INC.

|

|

|

|

|

|

Date: August 6, 2019

|

By:

|

/s/

Arik Maimon

|

|

|

|

Arik Maimon

|

|

|

|

Chief Executive Officer

|

2

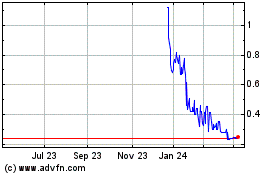

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

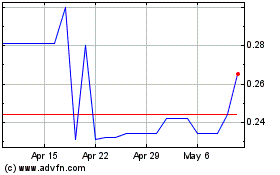

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Apr 2023 to Apr 2024