Filed Pursuant to Rule 424(b)(3)

Registration No. 333- 254256

PROSPECTUS

THE CORETEC GROUP INC.

163,500,000 Shares of Common Stock Offered by the Selling Stockholders

This prospectus relates to the offering and resale by the selling stockholders identified herein of up to 163,500,000 shares of common stock issued or issuable to such selling stockholders including (i) 23,500,000 shares of our common stock, (ii) 82,500,000 shares of common stock issuable upon the exercise of outstanding warrants and (iii) 51,500,000 shares of common stock issuable upon the exercise of outstanding pre-funded warrants, which were issued by us on March 5, 2021 pursuant to a Securities Purchase Agreement entered into on March 2, 2021 with one institutional investor (the “March 2, 2021 Private Placement”) and (iv) 6,000,000 shares of common stock that may be acquired at an exercise price of $0.10 per share upon the exercise of outstanding unregistered warrants previously issued by us in connection with the March 2, 2021 Private Placement as placement agent consideration. Please see “Private Placement of Shares of Common Stock, Warrants and Pre-Funded Warrants” beginning on page 39 of this prospectus.

We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. Upon the cash exercise of the warrants however, we will receive the exercise price of such warrants, for an aggregate of approximately $7,205,150.

The selling stockholders may sell all or a portion of the shares of common stock beneficially owned by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. Please see the section entitled “Plan of Distribution” on page 41 of this prospectus for more information. For information on the selling stockholders, see the section entitled “Selling Stockholders” on page 40 of this prospectus. We will bear all fees and expenses incident to our obligation to register the shares of common stock.

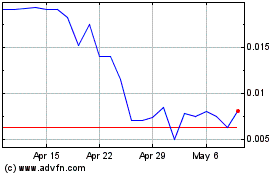

Our common stock is quoted on the OTCQB under the symbol “CRTG.” On March 11, 2021, the last reported sale price per share of our common stock was $0.2147.

The selling stockholders will offer their shares at prevailing market prices or privately negotiated prices.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 22, 2021

TABLE OF CONTENTS

|

|

Page

|

|

|

|

|

About this Prospectus

|

3

|

|

Prospectus Summary

|

4

|

|

The Offering

|

5

|

|

Risk Factors

|

6

|

|

Special Note Regarding Forward-Looking Statements

|

15

|

|

Use of Proceeds

|

15

|

|

Dividends Policy

|

15

|

|

Our Business

|

16

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

23

|

|

Management

|

28

|

|

Executive and Director Compensation

|

33

|

|

Security Ownership of Certain Beneficial Owners and Management

|

34

|

|

Certain Relationships and Related Transactions

|

36

|

|

Description of Capital Stock

|

36

|

|

Private Placement of Shares of Common Stock, Warrants and Pre-Funded Warrants

|

39

|

|

Selling Stockholders

|

40

|

|

Plan of Distribution

|

41

|

|

Legal Matters

|

43

|

|

Experts

|

43

|

|

Where You Can Find More Information

|

43

|

|

Index to Financial Statements

|

44

|

ABOUT THIS PROSPECTUS

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus. For investors outside the United States: Neither we nor the selling stockholders have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

Unless the context otherwise requires, references to “we,” “our,” “us,” the “Group”, or the “Company” in this prospectus mean The Coretec Group, Inc., an Oklahoma corporation and its subsidiary.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Company Overview –

Coretec’s Technology. Coretec’s underlying technology is based on the production of a high value liquid silicon precursor, cyclohexasilane (“CHS”). A key advantage of CHS is that it remains in liquid form at room temperature and does not convert to a gas until heated above 450°F. CHS is a superior silicon precursor in many ways compared to materials commonly used for manufacturing silicon-based semiconductors and solar cells (monosilane or trichlorosilane) that have much lower boiling points which leads to higher cost handling and shipping. There are several technical advantages of using CHS versus common silicon precursors and one is that the production rate of the silicon-forming step can be increased by a factor of six, and relative to process temperature up to 10X or more, which leads to significant cost savings. We anticipate that CHS will first be used as an alternative to monosilane or trichlorosilane when adding silicon to lithium ion batteries or when used in manufacturing silicon-based semiconductors.

We also see longer term potential in several emerging markets where there are opportunities in the conversion of CHS into nanoparticles and nanowires for use in such emerging, high-growth markets as:

|

|

●

|

Authentication of critical documentation

|

|

|

●

|

Building-integrated solar energy

|

Enhancement of CSpace. A key challenge in the development of CSpace® is the development of the material used for the image chamber. The Company has explored a variety of glass alternatives. While progress has been made, it has been concluded that limitations remain, primarily in the weight and cost of a glass medium.

A key virtue of having our IP portfolio of silicon-based materials is that we use all of the manufacturing infrastructure and knowledge that is available for optical plastics for the CSpace® image chamber. The benefit to CSpace® is that silicon-based optical plastics can be molded into a broad range of shapes and allow the image chamber to be much lighter and much lower in cost than the glass material we worked with before.

Corporate Information

We were incorporated in the State of Oklahoma on August 11, 1995, as First Keating Corporation. Our name was changed to 3DIcon Corporation on August 1, 2003. Our name was changed to The Coretec Group, Inc. on June 22, 2017. Our principal executive offices are located at 333 Jackson Plaza, Suite 1200, Ann Arbor, MI 48103, and our telephone number is (918) 494-0505. Our fiscal year end is December 31.

THE OFFERING

|

Issuer

|

|

The Coretec Group, Inc.

|

|

|

|

|

|

Securities Offered by the Selling Stockholders

|

|

23,500,000 shares of our common stock, including 82,500,000 shares common stock issuable upon the exercise of warrants, 51,500,000 shares of common stock issuable upon the exercise of pre-funded warrants and 6,000,000 shares of common stock issuable upon the exercise of placement agent warrants.

|

|

|

|

|

|

Trading Market

|

|

The common stock offered in this prospectus is quoted on the OTCQB under the symbol “CRTG”.

|

|

|

|

|

|

Common Stock Outstanding Before this Offering

|

|

239,267,102 shares

|

|

|

|

|

|

Common Stock Outstanding After this Offering

|

|

379,267,102 shares1

|

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any of the proceeds from the sale of the shares of our common stock being offered for sale by the selling stockholders. Upon the exercise of the warrants for an aggregate of 82,500,000 shares of common stock by payment of cash however, we will receive the exercise price of the warrants, or an aggregate of approximately $6,000,000 from the investor in the March 2, 2021 Private Placement and $600,000 from the exercise of the placement agent warrants issued to the placement agent in the March 2, 2021 Private Placement.

|

|

|

|

|

|

Plan of Distribution

|

|

The selling stockholders may sell all or a portion of the shares of common stock beneficially owned by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. Registration of the common stock covered by this prospectus does not mean, however, that such shares necessarily will be offered or sold. See “Plan of Distribution.”

|

|

|

|

|

|

Risk Factors

|

|

Please read “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the securities offered in this prospectus.

|

|

1

|

The number of shares of common stock shown above to be outstanding after this offering is based on 239,267,102 shares outstanding as of March 12, 2021 and assumes the exercise of the warrants into 82,500,000 shares of common stock, pre-funded warrants held by the selling stockholders into 51,500,000 shares of common stock and placement agent warrants issued as consideration into 6,000,000 shares of common stock.

|

RISK FACTORS

An investment in the Company’s common stock involves a high degree of risk. In determining whether to purchase the Company’s common stock, an investor should carefully consider all the material risks described below, together with the other information contained in this prospectus before deciding to purchase the Company’s securities. An investor should only purchase the Company’s securities if he or she can afford to suffer the loss of his or her entire investment.

Risks Relating to Our Businesses

We have a limited operating history, as well as a history of operating losses.

We have a limited operating history. We cannot assure you that we can achieve revenue or sustain revenue growth or profitability in the future. We have a cumulative net loss of $7,339,175 for the period from inception (June 2, 2015) to December 31, 2020. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. Unanticipated problems, expenses, and delays are frequently encountered in establishing a new business and marketing and developing products. These include, but are not limited to, competition, the need to develop customers and market expertise, market conditions, sales, marketing and governmental regulation. Our failure to meet any of these conditions would have a materially adverse effect upon us and may force us to reduce or curtail our operations. Revenues and profits, if any, will depend upon various factors. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on our business.

We may be unable to successfully integrate and develop the vertical synergies anticipated by or complete all obligations under the May 31, 2016 Share Exchange Agreement.

We may not realize all the anticipated benefits from the May 31, 2016 Share Exchange Agreement, such as increased earnings, cost savings and revenue enhancements, for various reasons, including difficulties integrating operations and personnel, higher than expected acquisition and operating costs, unknown liabilities, inaccurate reserve estimates and fluctuations in markets. If these benefits do not meet the expectations of financial or industry analysts, the market price of our shares may decline.

Our research and development efforts with respect to new technologies may not result in customer or market acceptance. Some or all of those technologies may not successfully make the transition from the research and development stage to cost-effective production as a result of technology problems, competitive cost issues, yield problems, and other factors. Even if we successfully complete a research and development effort with respect to a particular technology, our customers may decide not to introduce or may terminate products utilizing the technology for a variety of reasons, including difficulties with other suppliers of components for the products, superior technologies developed by our competitors and unfavorable comparisons of our solutions with these technologies, price considerations and lack of anticipated or actual market demand for the products.

Our business could be harmed if we are unable to develop and utilize new technologies that address the needs of our customers, or our competitors or customers develop and utilize new technologies more effectively or more quickly than we can. Any investments made to enhance or develop new technologies that are not successful could have an adverse effect on our net revenue and operating results.

Fluctuations in direct or indirect raw material costs could have an adverse impact on our business.

The availability and prices of raw material inputs may be influenced by supply and demand, changes in world politics, unstable governments in exporting nations, the COVID-19 pandemic and inflation. The prices of our direct and indirect raw materials have been, and we expect them to continue to be, volatile. If the cost of direct or indirect raw materials increases significantly and we are unable to offset the increased costs with higher selling prices, our profitability will decline. Additionally, we may not be able to obtain lower prices from our suppliers should our sale prices decrease. Increases in prices for our products could also hurt our ability to remain both competitive and profitable in the markets in which we compete.

Future raw material prices may be impacted by new laws or regulations, suppliers’ allocations to other purchasers, changes in our supplier manufacturing processes as some of our products are byproducts of these processes, interruptions in production by suppliers, natural disasters, volatility in the price of crude oil and related petrochemical products and changes in exchange rates.

We operate in industries that are subject to significant fluctuation in supply and demand and ultimately pricing that affects our revenue and profitability.

Many of the markets we intend to serve, such as the LED lighting industry and the Electric Vehicle battery market, are in the relatively early stages of adoption and are characterized by constant and rapid technological change, rapid product obsolescence and price erosion, evolving standards, short product life cycles and fluctuations in product supply and demand. These types of LED industries have experienced significant fluctuations, often in connection with, or in anticipation of, product cycles and changes in general economic conditions. As the markets for our products mature, additional fluctuations may result from variability and consolidations within the industry’s customer base. These fluctuations have been characterized by lower product demand, production overcapacity, higher inventory levels and increased pricing pressure. These fluctuations have also been characterized by higher demand for key components and equipment expected to be used in, or in the manufacture of, our products resulting in longer lead times, supply delays and production disruptions.

We operate in a highly competitive industry.

The silane chemical markets are global, capital intensive and highly competitive. Our competitors may have greater financial resources, as well as other strategic advantages, to maintain, improve and possibly expand their facilities, and as a result, they may be better positioned to adapt to changes in the industry or the global economy. The advantages that our competitors have over us could have a material adverse effect on our business. In addition, new entrants may increase competition in our industry, which could have a material adverse effect on our business. An increase in the use of substitutes for certain of our products could also have a material adverse effect on our financial condition and operations.

Environmental, health and safety regulation—Compliance with extensive environmental, health and safety laws could require material expenditures or changes in our operations.

Our operations are subject to extensive environmental, health and safety laws and regulations at national, international and local levels in numerous jurisdictions. In addition, our production facilities require operating permits that are subject to renewal and, in some circumstances, revocation. The nature of the chemicals industry exposes us to risks of liability under these laws and regulations due to the production, storage, transportation, disposal and sale of chemicals and materials that can cause contamination or personal injury if released into the environment.

A reduction or disruption in our supplies, or an incorrect forecast, could negatively impact our business.

Our production capacity could be affected by manufacturing problems. Difficulties in the production process could reduce yields or interrupt production, and, as a result of such problems, we may not be able to deliver products on time or in a cost-effective, competitive manner. As the complexity of both our products and our fabrication processes has become more advanced, manufacturing tolerances have been reduced and requirements for precision have become more demanding. In the past, we have experienced delays in delivery and product quality. Our failure to adequately manage our capacity or maintain product quality could have a negative impact on net sales and harm our customer relationships.

Furthermore, we may suffer disruptions in our manufacturing operations, either due to production difficulties such as those described above or as a result of external factors beyond our control. We manufacture combustible materials in our manufacturing process and are therefore subject to the risk of explosions and fires, which can cause major disruptions to our operations. If operations at a manufacturing facility are interrupted, we may not be able to shift production to other facilities on a timely basis or at all. In addition, certain of our products are only capable of being produced at a single manufacturing facility due to unique manufacturing requirements and to the extent that any of these facilities fail to produce these products, this risk will be increased. Even if a transfer is possible, transitioning production of a particular material can take between three to six months to accomplish, and in the interim period we would likely suffer extensive or total supply disruption and incur substantial costs. Such an event could have a material negative impact on our business, financial condition and results of operations.

Our ability to meet customer demands also depends on our ability to obtain timely and adequate delivery of materials, parts and components from our suppliers. From time to time, suppliers may extend lead times, limit the amounts supplied to us or increase prices due to capacity constraints or other factors. Supply disruptions may also occur due to shortages in critical resources, such as lithium aluminum hydride, other specialized chemicals or energy or other general supplier disruptions. A reduction or interruption in supplies or a significant increase in the price of one or more supplies could have a material negative impact on our business, financial condition and results of operations.

If we do not keep pace with technological innovations, our future products may not remain competitive and our operating results may suffer.

We operate in rapidly changing highly competitive markets. Technological advances, the introduction of new products and new design techniques could adversely affect our business unless we are able to adapt to changing conditions. Technological advances could render our solutions less competitive or obsolete, and we may not be able to respond effectively to the technological requirements of evolving markets. Therefore, we will be required to expend substantial funds for and commit significant resources to enhancing and developing new technology which may include purchasing advanced design tools and test equipment, hiring additional highly qualified engineering and other technical personnel, and continuing and expanding research and development activities on existing and potential human interface solutions.

We may not be able to achieve the target specifications for the second and third generation CSpace laboratory prototypes.

The process of developing new highly technical products and solutions is inherently complex and uncertain. It requires accurate anticipation of customers’ changing needs and emerging technological trends. We must make long-term investments and commit significant resources before knowing whether these investments will eventually result in products that achieve customer acceptance and generate the revenues required to provide desired returns. If we fail to achieve and meet our target specifications in the development of the second and third generation CSpace laboratory prototypes, we could lose market position and customers to our competitors and that could have a material adverse effect on our results of operations and financial condition.

We may not be able to secure funding necessary to develop our CSpace technology

An important part of our business strategy related to CSpace is the development of a new polymer medium. If we are unable to secure research and development funding or customer funded development contracts to support polymer advancement, we will likely not be able to develop our CSpace technology. Without a new polymer medium for CSpace we will not be able to successfully implement our business strategy for our volumetric 3D Display products, which could cause harm to our competitive position and financial condition.

We may not be able to successfully license the Coretec technology to customers.

A significant portion of our expected future revenues will be generated through licensing our technology to third parties such as Boeing, Lockheed Martin, Siemens, and General Electric. However, there is no guarantee we will be able to successfully license our technology to such companies or to other third parties. If we fail to successfully license our technology, it could negatively impact our revenue stream and financial condition.

We may not be able to compete successfully in the markets applicable to our volumetric 3D display and silicon products technology.

Although the volumetric 3D display and silicon products technology that we are attempting to develop is new, and although at present we are aware of only a limited number of companies that have publicly disclosed their attempts to develop similar technology, we anticipate several companies are or will attempt to develop technologies/products that compete or will compete with our technologies. Further, even if we are the first to market with a technology of this type, and even if the technology is protected by patents or otherwise, because of the vast market and communications potential of such a product, we anticipate the market will be flooded by a variety of competitors (including traditional display companies and silicon companies), many of which will offer a range of products in areas other than those in which we compete, which may make such competitors more attractive to prospective customers. In addition, many if not all of our competitors and potential competitors will initially be larger and have greater financial resources than we do. Some of the companies with which we may now be in competition, or with which we may compete in the future, have or may have more extensive research, marketing and manufacturing capabilities and significantly greater technical and personnel resources than we do, and may be better positioned to continue to improve their technology to compete in an evolving industry. Further, technology in this industry may evolve rapidly once an initially successful product is introduced, making timely product innovations and use of new technologies essential to our success in the marketplace. The introduction by our competitors of products with improved technologies or features may render any product we initially market obsolete and unmarketable. If we or our partners are not able to deliver to market products that respond to industry changes in a timely manner, or if our products do not perform well, our business and financial condition will be adversely affected.

The technologies being developed may not gain market acceptance.

The products that we are currently developing utilize new technologies. As with any new technologies, in order for us to be successful, these technologies must gain market acceptance. Since the technologies that we anticipate introducing to the marketplace will exploit or encroach upon markets that presently utilize or are serviced by products from competing technologies, meaningful commercial markets may not develop for our technologies.

In addition, the development efforts of the Company and the University of Oklahoma (the “University”) on the 3D technology are subject to unanticipated delays, expenses or technical or other problems, as well as the possible insufficiency of funding to complete development. Our success will depend upon the ultimate products and technologies meeting acceptable cost and performance criteria, and upon their timely introduction into the marketplace. The proposed products and technologies may never be successfully developed, and even if developed, they may not satisfactorily perform the functions for which they are designed. Additionally, these may not meet applicable price or performance objectives. Unanticipated technical or other problems may occur which would result in increased costs or material delays in their development or commercialization.

If we are unable to successfully retain existing management and recruit qualified personnel having experience in our business, we may not be able to continue our operations.

Our success depends to a significant extent upon the continued services of our Board of Directors, management officers and other technical advisors. Our success also depends on our ability to attract and retain key executive officers and team members. Currently, we have a full business team covering all functional areas. If we are unable to successfully retain existing management and recruit qualified personnel having experience in our business, we may not be able to continue our operations.

In the past, we have identified conditions and events that raise substantial doubt about our ability to continue as a going concern and it is possible that we may identify conditions and events in the future that raise substantial doubt about our ability to continue as a going concern.

We have identified conditions and events that raise substantial doubt about our ability to continue as a going concern for a year following the balance sheet date of our consolidated financial statements at December 31, 2020. With the completion of the private placement in March 2021, we believe that our existing cash and cash equivalents will enable us to fund our operating expenses and capital expenditure requirements more than one year from the date of this registration statement. Consequently, the substantial doubt about the Company's ability to continue as a going concern has been alleviated. However, we have based this estimate on assumptions that may prove to be wrong, and we could exhaust our available capital resources sooner than we expect. In the future, if we are unable to obtain sufficient funding to support our operations, we could be forced to delay, reduce or eliminate all our research and development programs, product portfolio expansion or commercialization efforts, and our financial condition and results of operations will be materially and adversely affected and we may be unable to continue as a going concern. In the future, reports from our independent registered public accounting firm may also contain statements expressing substantial doubt about our ability to continue as a going concern. If we seek additional financing to fund our business activities in the future and there remains substantial doubt about our ability to continue as a going concern, investors or other financing sources may be unwilling to provide additional funding to us on commercially reasonable terms or at all. See Part II, Item 5, Recent Sales of Unregistered Securities for a description of the private placement.

We will need significant additional capital, which we may be unable to obtain.

Our capital requirements in connection with our development activities and transition to commercial operations have been and will continue to be significant. As of March 12, 2021, we do not expect to require additional funding for more than one year in order to continue research, development and testing of our technologies, to obtain intellectual property protection relating to our technologies when appropriate, and to improve and market our technologies. However, there can be no assurances that we will not need additional funding in the future or that our current cash position will be sufficient to fund any future plans to accelerate our commercialization efforts. In the event additional funding is necessary, there can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all.

Risks Related to Our Intellectual Property

If we fail to establish, maintain and enforce intellectual property rights with respect to our technology and/or licensed technology, our financial condition, results of operations and business could be negatively impacted.

Our ability to establish, maintain and enforce intellectual property rights with respect to our technology will be a significant factor in determining our future financial and operating performance. We seek to protect our intellectual property rights by relying on a combination of patent, trade secret and copyright laws. We also use confidentiality and other provisions in our agreements that restrict access to and disclosure of its confidential know-how and trade secrets.

Outside the patents and pending patent applications directly granted to us, we seek to protect our technology as trade secrets and technical know-how. However, trade secrets and technical know-how are difficult to maintain and do not provide the same legal protections provided by patents. In particular, only patents will allow us to prohibit others from using independently developed technologies that are similar. If competitors develop knowledge substantially equivalent or superior to our trade secrets and technical know-how or gain access to our knowledge through other means such as observation of our technology that embodies trade secrets at customer sites that we do not control, the value of our trade secrets and technical know-how would be diminished.

While we strive to maintain systems and procedures to protect the confidentiality and security of our trade secrets and technical know-how, these systems and procedures may fail to provide an adequate degree of protection. For example, although we generally enter into agreements with our employees, consultants, advisors, and strategic partners restricting the disclosure and use of trade secrets, technical know-how and confidential information, we cannot provide any assurance that these agreements will be sufficient to prevent unauthorized use or disclosure. In addition, some of the technology deployed at customer sites in the future, which we do not control, may be readily observable by third parties who are not under contractual obligations of non-disclosure, which may limit or compromise our ability to continue to protect such technology as a trade secret.

While we are not currently aware of any infringement or other violation of our intellectual property rights, monitoring and policing unauthorized use and disclosure of intellectual property is difficult. If we learned that a third party was in fact infringing or otherwise violating our intellectual property, we may need to enforce our intellectual property rights through litigation. Litigation relating to our intellectual property may not prove successful and might result in substantial costs and diversion of resources and management attention.

If our technology is licensed to customers at some point in the future, the strength of the intellectual property under which we would grant licenses can be a critical determinant of the value of such potential licenses. If we are unable to secure, protect and enforce our intellectual property now and in the future, it may become more difficult for us to attract such customers. Any such development could have a material adverse effect on our business, prospects, financial condition and results of operations.

We may face claims that we are violating the intellectual property rights of others.

Although we are not aware of any potential violations of others’ intellectual property rights, we may face claims, including from direct competitors, other companies, scientists or research universities, asserting that our technology or the commercial use of such technology infringes or otherwise violates the intellectual property rights of others. We cannot be certain that our technologies and processes do not violate the intellectual property rights of others. If we are successful in developing technologies that allow us to earn revenues and our market profile grows, we could become increasingly subject to such claims.

We may also face infringement claims from the employees, consultants, agents and outside organizations we have engaged to develop our technology. While we have sought to protect ourselves against such claims through contractual means, we cannot provide any assurance that such contractual provisions are adequate, and any of these parties might claim full or partial ownership of the intellectual property in the technology that they were engaged to develop.

If we were found to be infringing or otherwise violating the intellectual property rights of others, we could face significant costs to implement work-around methods, and we cannot provide any assurance that any such work-around would be available or technically equivalent to our potential technology. In such cases, we might need to license a third party’s intellectual property, although any required license might not be available on acceptable terms, or at all. If we are unable to work around such infringement or obtain a license on acceptable terms, we might face substantial monetary judgments against us or an injunction against continuing to use or license such technology, which might cause us to cease operations.

In addition, even if we are not infringing or otherwise violating the intellectual property rights of others, we could nonetheless incur substantial costs in defending ourselves in suits brought against us for alleged infringement. Also, if we are to enter into a license agreement in the future and it provides that we will defend and indemnify our customer licensees for claims against them relating to any alleged infringement of the intellectual property rights of third parties in connection with such customer licensees’ use of such technologies, we may incur substantial costs defending and indemnifying any customer licensees to the extent they are subject to these types of claims. Such suits, even if without merit, would likely require our management team to dedicate substantial time to addressing the issues presented. Any party bringing claims might have greater resources than we do, which could potentially lead to us settling claims against which we might otherwise prevail on the merits.

Any claims brought against us or any customer licensees alleging that we have violated the intellectual property of others could have negative consequences for our financial condition, results of operations and business, each of which could be materially adversely affected as a result.

At this time, we do not own all of the intellectual property in Volumetric Liquid Crystal Display or Light Surface Display for Rendering Three-Dimensional Images, and, apart from the SRA with the University and the exclusive worldwide marketing rights thereto, we have no contracts or agreements pending to acquire the intellectual property. Also, at this time, we do not own all of the intellectual property in silicon precursor uses or poly-silanes and apart from the provisional patents we have filed, which have claims which may or may not be granted, we have no contracts or agreements pending to acquire additional intellectual property in this arena.

Although we have obtained exclusive worldwide marketing rights to “Volumetric Liquid Crystal Display” and “Light Surface Display for Rendering Three-Dimensional Images”, two technologies vital to our business and growth strategy, we do not own all of the intellectual property in these technologies. Although our exclusive worldwide marketing rights to these technologies stand alone and are independent of the SRA, outside of our SRA with the University, we have no pending agreements to obtain or purchase ownership over all intellectual property in these technologies. Should the University lose their rights in such technologies or we are otherwise unable to utilize the rights obtained in such agreements it would be difficult to successfully implement our business strategy going forward and our stock value would likely decrease. In addition, we have filed two provisional patents in the cyclohexasilane (CHS) space, and although we anticipate filing additional provisional patents as we develop applications using CHS, these patents have claims within that may or may not be granted and any such change to these patent applications would make it difficult to successfully implement our business strategy going forward and our stock value would likely decrease.

We do not currently own any patents related to our silicon-based business.

We do not currently own any patents related to our silicon-based businesses; however, The Coretec Group has filed two provisional patents in the silicon-based business.

Risks Relating to Our Current Financing Arrangements:

There are a large number of shares underlying our convertible debt and warrants that may be available for future sale and the sale of these shares may depress the market price of our common stock.

As of March 12, 2021, we had 239,267,102 shares of common stock issued and outstanding and convertible debt outstanding that may be converted into an estimated 49,240,122 shares of common stock and outstanding pre-funded warrants to purchase 51,500,000 shares of common stock at an exercise price of $0.0001. We also have outstanding warrants issued to purchase 2,604,000 shares of common stock at an exercise price of $0.052, outstanding warrants issued to purchase 82,500,000 shares of common stock at an exercise price of $0.08, and outstanding warrants issued to purchase 6,000,000 shares of common stock at an exercise price of $0.010. The sale of the shares underlying the convertible debt and warrants may adversely affect the market price of our common stock.

As of March 12, 2021, we have 1,260,732,898 unissued authorized shares available.

The issuance of shares upon conversion of outstanding Series A Stock, the convertible debt or the exercise of outstanding warrants may cause immediate and substantial dilution to our existing stockholders.

The issuance of shares upon conversion of our outstanding Series A Convertible Preferred Stock, convertible debt and exercise of warrants would result in substantial dilution to the interests of other stockholders since the selling stockholders may ultimately exercise and sell the full amount issuable upon exercise of their warrants.

Risks Relating to Our Common Stock:

The price of our common stock is volatile and fluctuations in our operating results and announcements and developments concerning our business affect our stock price, which may cause investment losses for our stockholders.

The market for our common stock is highly volatile and the trading price of our stock on the OTCQB Marketplace is subject to wide fluctuations in response to, among other things, operating results, the number of stockholders desiring to sell their shares, changes in general economic conditions and the financial markets, the execution of new contracts and the completion of existing agreements and other developments affecting us. In addition, statements or changes in opinions, ratings, or earnings estimates made by brokerage firms or industry analysts relating to our market or relating to us could result in an immediate and adverse effect on the market price of our common stock. The highly volatile nature of our stock price may cause investment losses for our shareholders. In the past, securities class action litigation has often been brought against companies following periods of volatility in the market price of their securities. If securities class action litigation is brought against us, such litigation could result in substantial costs while diverting management’s attention and resources.

Our common stock is subject to the "Penny Stock" rules of the Securities and Exchange Commission and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The Securities and Exchange Commission (the “SEC”) has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

|

●

|

That a broker or dealer approve a person's account for transactions in penny stocks; and

|

|

|

●

|

The broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

|

|

●

|

Obtain financial information and investment experience objectives of the person; and

|

|

|

●

|

Make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

|

|

●

|

Sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

|

●

|

That the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also must be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Financial Industry Regulatory Authority, Inc. (“FINRA”) sales practice requirements may limit a shareholder’s ability to buy and sell our common stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Our stock is thinly traded, so you may be unable to sell your shares at or near the quoted bid prices if you need to sell a significant number of your shares.

The shares of our common stock are thinly traded on the OTCQB Marketplace, meaning that the number of persons interested in purchasing our common stock at or near bid prices at any given time may be relatively small or non-existent. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained. Due to these conditions, we can give you no assurance that you will be able to sell your shares at or near bid prices or at all if you need money or otherwise desire to liquidate your shares.

Shares eligible for future sale may adversely affect the market.

From time to time, certain of our stockholders may be eligible to sell all or some of their shares of common stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144 promulgated under the Securities Act, subject to certain limitations. In general, pursuant to amended Rule 144, non-affiliate stockholders may sell freely after six months subject only to the current public information requirement. Affiliates may sell after six months subject to Rule 144 volume, manner of sale (for equity securities), and current public information and notice requirements. Any substantial sales of our common stock pursuant to Rule 144 may have a material adverse effect on the market price of our common stock.

We could issue additional common stock, which might dilute the book value of our common stock.

Our Board of Directors has authority, without action or vote of our shareholders, to issue all or a part of our authorized but unissued shares. Such stock issuances could be made at a price that reflects a discount or a premium from the then-current trading price of our common stock. In addition, in order to raise capital, we may need to issue securities that are convertible into or exchangeable for a significant amount of our common stock. These issuances would dilute the percentage ownership interest, which would have the effect of reducing your influence on matters on which our shareholders vote and might dilute the book value of our common stock.

Our common stock could be further diluted as a result of the issuance of convertible securities, warrants or options.

In the past, we have issued convertible securities (such as convertible debentures and notes), warrants and options in order to raise money or as compensation for services and incentive compensation for our employees and directors. We have shares of common stock reserved for issuance upon the exercise of certain of these securities and may increase the shares reserved for these purposes in the future. Our issuance of these convertible securities, options and warrants could affect the rights of our stockholders, could reduce the market price of our common stock or could result in adjustments to exercise prices of outstanding warrants (resulting in these securities becoming exercisable for, as the case may be, a greater number of shares of our common stock), or could obligate us to issue additional shares of common stock to certain of our stockholders.

We do not intend to pay dividends.

We do not anticipate paying cash dividends on our common stock in the foreseeable future. We may not have sufficient funds to legally pay dividends. Even if funds are legally available to pay dividends, we may nevertheless decide in our sole discretion not to pay dividends. The declaration, payment and amount of any future dividends will be made at the discretion of our board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors our board of directors may consider relevant. There is no assurance that we will pay any dividends in the future, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

Our internal control over financial reporting may have weaknesses and conditions that could require correction or remediation, the disclosure of which may have an adverse impact on the price of our common stock. We are required to establish and maintain appropriate internal controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely affect our public disclosures regarding our business, prospects, financial condition or results of operations. In addition, management’s assessment of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed in our internal controls over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting or disclosure of management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact. These forward-looking statements are based on our current expectations and projections about future events and they are subject to risks and uncertainties known and unknown that could cause actual results and developments to differ materially from those expressed or implied in such statements.

In some cases, you can identify forward-looking statements by terminology, such as “expects”, “anticipates”, “intends”, “estimates”, “plans”, “potential”, “possible”, “probable”, “believes”, “seeks”, “may”, “will”, “should”, “could” or the negative of such terms or other similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this prospectus.

You should read this prospectus and the documents that we reference herein and have filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Because the risk factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus, and particularly our forward-looking statements, by these cautionary statements.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of the shares of our common stock being offered for sale by the selling stockholders. Upon the exercise of the warrants for an aggregate of 82,500,000 shares of common stock assuming all payments are made by cash and there is no reliance on cashless exercise provisions, however, we will receive the exercise price of the warrants, or an aggregate of approximately $6,600,000, from the investor in the March 2, 2021 Private Placement and $600,000 from the exercise for cash of the Placement Agent Warrants. We will bear all fees and expenses incident to our obligation to register the shares of common stock. Brokerage fees, commissions and similar expenses, if any, attributable to the sale of shares offered hereby will be borne by the selling stockholder.

There is no assurance the warrants will be exercised for cash. We intend to use such proceeds, if any, for general corporate and working capital purposes.

DIVIDENDS POLICY

We have never declared or paid any cash dividends on our common stock. We do not anticipate paying any cash dividends to stockholders in the foreseeable future. In addition, any future determination to pay cash dividends will be at the discretion of our Board of Directors and will be dependent upon our financial condition, results of operations, capital requirements, and such other factors as our Board of Directors deem relevant. There are no restrictions in our articles of incorporation or bylaws that restrict us from declaring dividends.

OUR BUSINESS

Organizational History

On June 22, 2017, the Group filed an Amended Certificate of Incorporation with the Secretary of State of the State of Oklahoma to change its name from “3DIcon Corporation” to “The Coretec Group Inc.”, which became effective on June 29, 2017.

The Group, formerly known as 3DIcon Corporation, was incorporated on August 11, 1995, under the laws of the State of Oklahoma. Prior to September 30, 2016, the Group’s primary activity had been the raising of capital in order to pursue its goal of becoming a significant participant in the development, commercialization and marketing of next generation 3D display technologies.

On September 30, 2016, Coretec Industries LLC became a wholly owned subsidiary of the Group, and the Group issued an aggregate 15,870 shares of the Group’s Series B Convertible Preferred Stock, which shares were subsequently converted into 30,374,363 shares of common stock.

Overview of the Company.

Coretec’s Technology. Coretec’s underlying technology is based on the production of a high value liquid silicon precursor, cyclohexasilane (“CHS”). A key advantage of CHS is that it remains in liquid form at room temperature and does not convert to a gas until heated above 450°F. CHS is a superior silicon precursor in many ways compared to materials commonly used for manufacturing silicon-based semiconductors and solar cells (monosilane or trichlorosilane) that have much lower boiling points which leads to higher cost handling and shipping. There are several technical advantages of using CHS versus common silicon precursors and one is that the production rate of the silicon-forming step can be increased by a factor of six, and relative to process temperature up to 10X or more, which leads to significant cost savings. We anticipate that CHS will first be used as an alternative to monosilane or trichlorosilane when adding silicon to lithium ion batteries or when used in manufacturing silicon-based semiconductors.

We also see longer term potential in several emerging markets where there are opportunities in the conversion of CHS into nanoparticles and nanowires for use in such emerging, high-growth markets as:

|

|

●

|

Energy storage

|

|

|

●

|

Solid state lighting

|

|

|

●

|

Authentication of critical documentation

|

|

|

●

|

Printable electronics

|

|

|

●

|

Building-integrated solar energy

|

Enhancement of CSpace. A key challenge in the development of CSpace® is the development of the material used for the image chamber. The Company has explored a variety of glass alternatives. While progress has been made, it has been concluded that limitations remain, primarily in the weight and cost of a glass medium.

A key virtue of having our IP portfolio of silicon-based materials is that we use all of the manufacturing infrastructure and knowledge that is available for optical plastics for the CSpace® image chamber. The benefit to CSpace® is that silicon-based optical plastics can be molded into a broad range of shapes and allow the image chamber to be much lighter and much lower in cost than the glass material we worked with before.

Near-Term Revenue Opportunities. Opportunities for near-term revenue continue to be explored in battery and microelectronic markets. Interest in the use of silicon in Li-ion batteries continues to increase driven by the growing demand for electrical vehicles, the exploitation of mobile electronics, and energy storage systems for backup power and improved efficiency of home and commercial wind and solar systems. Discussions are ongoing with suppliers of Li-ion battery anode materials that are seeking next generation materials to further increase performance while improving lifetime, charging time, safety and reliability. We believe these suppliers will be well positioned to take advantage of the benefits provided by CHS when combined as a liquid with other solid-based materials. While we believe the use of CHS in Li-ion batteries will provide near term revenue, we also continue to explore revenue opportunities in microelectronics and especially those early adopter markets where advanced microelectronics are being developed in lower volumes and with less price sensitivity.

Recent Developments.

On October 4, 2019 the Company entered into a credit agreement (the “Credit Agreement”) and related convertible promissory note with Diversified Alpha Fund of Navigator Global Fund Manager Platform SPC, a Grand Cayman entity (the “Lender”). As of December 31, 2020, there was outstanding principal under the Credit Agreement and related convertible promissory note in the amount of $1,275,000.

The securities above were offered and sold pursuant to an exemption from the registration requirements under Section 4(a)(2) of the Securities Act since, among other things, the transactions did not involve a public offering.

On June 30, 2020, the Company accepted the retirement and resignations of Ron Robinson, Chief Financial Officer (CFO) and Judith Keating, Corporate Secretary of the Company. Matthew Hoffman, who joined the Company in May of 2020, was appointed CFO and Corporate Secretary effective June 30, 2020.

On June 30, 2020 the Company moved headquarters and operations from Tulsa, Oklahoma to Ann Arbor, Michigan.

On June 25, 2020, the Company entered into a supply agreement with Evonik Operations GmbH to purchase 500 grams of cyclohexasilane, Si6H12 (CHS) for $185,000. The supply agreement will enable the Company to deliver initial quantities of CHS for sales and R&D evaluation to its customer base. The supply agreement is valid until March 31, 2021. The Company paid Evonik Operations GmbH $92,500 on July 20, 2020, to initiate production of CHS, in accordance with the agreement. Delivery is expected during the months of March and April 2021, at which time the Company will owe the remaining $92,500.

On October 29, 2020, the Company moved the trading of its securities to the OTCQB, also known as the Venture Market, from OTC Pink market. The fee for listing on the OTCQB market is $12,000 per annum, with a one-time application fee of $2,500. The OTCQB market is the middle tier of the OTC Markets and consists of early-stage and developing U.S. and international companies.

On March 2, 2021 (the “Signing Date”), Company entered into a securities purchase agreement (the “Purchase Agreement”) with a single institutional investor (the “Investor”) pursuant to which the Company agreed to sell to the Investor in a private placement (i) 23,500,000 shares of its common stock (the “Shares”), (ii) pre-funded warrants to purchase up to an aggregate of 51,500,000 shares of its common stock (the “Pre-Funded Warrants”), and (iii) warrants (the “Warrants”) to purchase up to an aggregate of 82,500,000 shares of its common stock for gross proceeds of approximately $6,000,000. The combined purchase price for one share of common stock and associated Warrant is $0.08 and for one Pre-Funded Warrant and associated Warrant is $0.0799. The sale of the securities under the Purchase Agreement closed on March 5, 2021.

The Warrants are exercisable for a period of five-and one-half years from the date of issuance and have an exercise price of $0.08 per share, subject to adjustment as set forth in the Warrants for stock splits, stock dividends, recapitalizations and similar events. The Investor may exercise the Warrant on a cashless basis if the shares of common stock underlying the Warrants (the “Warrant Shares”) are not then registered pursuant to an effective registration statement. The Investor has contractually agreed to restrict its ability to exercise the Warrants such that the number of shares of the Company’s common stock held by the Investor and its affiliates after such exercise does not exceed the Beneficial Ownership Limitation set forth in the Warrants which may not exceed initially 4.99% of the Company’s then issued and outstanding shares of common stock.

The Pre-Funded Warrants have an exercise price of $0.0001 per share, subject to adjustment as set forth in the Pre-Funded Warrants for stock splits, stock dividends, recapitalizations and similar events. The Pre-Funded Warrants will be exercisable immediately and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full.

In connection with the Purchase Agreement, the Company entered into a registration rights agreement (the “Registration Rights Agreement”) with the Investor. Pursuant to the Registration Rights Agreement, the Company will be required to file a resale registration statement (the "Registration Statement") with the Securities and Exchange Commission (the “SEC”) to register for resale of the Shares, Warrant Shares and shares issuable upon exercise of the Pre-Funded Warrants, within 20 days of the Signing Date, and to have such Registration Statement declared effective within 45 days after the Signing Date in the event the Registration Statement is not reviewed by the SEC, or 90 days of the Signing Date in the event the Registration Statement is reviewed by the SEC.

In support of the Purchase Agreement, the Company entered into an engagement with H.C. Wainwright & Co. (HCW) to act as exclusive agent, advisor or underwriter in any offering of securities by the Company. Compensation to HCW includes 8.0% cash fee of gross proceeds and warrant coverage equal to 8% of the aggregate number of shares of common stock placed in each offering at an exercise price equal to 125% of the offering price per share available over a 5-year term. The Company will also pay HCW (a) a management fee equal to 1.0% of the gross proceeds raised in each Offering; (b) $35,000 for non-accountable expenses; (c) up to $50,000 for fees and expenses of legal counsel and other out-of-pocket expenses. The initial term of the agreement is for one month.

Cyclohexasilane Business

The Company’s business model is to identify and commercialize disruptive technologies in silicon serving advanced technology markets. Sources of disruptive technology are licensed technology created by major universities, institutes, national laboratories and other research centers. Where technology does not already exist, research is to be sponsored and jointly developed with our customers. The initial candidates for commercialization center around CHS, and a source of this technology includes silicon technologies.

Coretec is developing, testing, and providing new and/or improved technologies and resulting product solutions for energy-related industries including, but not limited to oil/gas, renewable energy, energy conservation, and distributed energy industries. Many of these technologies and resulting product solutions also have application to the broader markets of anti-counterfeit packaging, medical devices, electronics, photonics, and displays. The initial technologies and product solutions are based on new innovations in cyclohexasilane (Si6H12), Si QDs, “stacked” polysilane ((R2Si)n), their alloys with various dopants, and in the future, high refractive index siloxane polymers (HRISP). Early adoption of these technologies and resulting product solutions is anticipated in markets for energy storage (Li-ion batteries), solid-state lighting (LEDs), solar energy (BIPV) and printable electronics (Asset Monitoring).

Coretec’s management leverages years of expertise and experience in equipment and services for the oil/gas industries, procuring and managing investments and financial services, and in R&D and commercialization of material and chemical technologies.

CHS Business Model

Coretec’s business model includes monitoring the ever-growing catalogue of new technologies and valuable IP for licensing opportunities that could lead to incremental improvements and/or additional features in resulting products or lead to next generation products for use by energy-related industries and is created and held within universities and other parties that may lack financial resources and/or interest to further develop and commercialize them.

Additionally, where needs exist, but new technologies and resulting products are not currently available, conduct research and development (“R&D”) activities through sponsored projects performed at major universities, institutes, national laboratories and other research centers. Coretec will leverage existing, world-class expertise, experience, and laboratory facilities that reside in these non-profit, R&D entities for R&D, testing, and “proof of concept” studies up to and including at the device level that may be required to create commercialization opportunities.

Following these “proof of concept studies”, commercialization opportunities (e.g., manufacturing, marketing, sales) created for its technologies and IP will include, but are not limited to:

|

|

●

|

joint ventures or other business collaborations with Coretec’s joint development partners who can manufacture, market and sell new or improved products (based upon Coretec’s technologies and IP) into existing or new supply chains (that the partner company/companies already have an established, significant presence or can capture and grow market share); or

|

|

|

●

|

manufacturing, marketing and selling its own products; or

|

|

|

●

|

creating “exit strategies” such as:

|

|

|

o

|

sale of one or more technologies and IP to the private sector;

|

|

|

o

|

license and/or sublicense one or more technologies and IP to the private sector; or

|

|

|

o

|

other business transactions, e.g., merger, acquisition, spinoffs.

|

CHS Research & Development

Coretec’s priorities for R&D and commercialization are customer/market-driven and guided by the needs and specifications of the energy-related industries served. Identified customer/market-driven opportunities include:

|

|

●

|

New and novel silicon-based materials that facilitate “greener” more eco-friendly energy production, including:

|

|

|

o

|

lower cost, longer life, higher capacity battery energy storage systems, e.g., Li-ion batteries (LiBs), for use in transportation and distributed power generation systems

|

|

|

o

|

more aesthetically appealing, lower cost building integrated photovoltaics (BIPV); and

|

|

|

o

|

flexible and/or printable electronics for use in monitoring the condition of distributed or remote assets, e.g., wind power and embedded, wireless sensors to detect corrosion and other changes in pipelines.

|

|

|

●

|

New and novel silicon-based materials that facilitate “greener” more energy efficient products, including encapsulation of high brightness LEDs to improve light extraction and solar cells to improve full spectrum light collection;

|

|

|

●

|

New and novel silicon-based materials that facilitate more efficient and eco-friendly exploration and monitoring of distributed energy industries, including imaging materials for visualizing oil and gas exploration and distribution data using volumetric 3D displays; and

|

|

|

●

|

New and novel silicon-based materials that prevent illegal imitation or reproduction of a product or service used within energy-related industries, including trusted supply (anti-counterfeit packaging) products for supply chain assurance, currency, identity documents, lottery tickets, etc.

|

Future CHS Revenue

In the future, we foresee revenue coming from one or more business transactions such as:

|

|

●

|

sale of Coretec’s novel silicon-based materials that improve or otherwise enhance performance of various products, e.g., Li-ion batteries, electronics, PV/solar cells, and displays and/or other optical-based devices;

|

|

|

●

|

a share of the revenue coming from the sale of jointly developed product(s) and/or from one or more joint ventures with strategic partners; and/or

|

|

|

●

|

sale or licensing of technology/technologies and associated IP to joint development partners or other companies.

|

CHS Competition

Based on our market research and competitive analysis, we have concluded that our CHS technology is unique and provides an advantage in that it should allow 1) production at high yields at low cost using readily available raw materials, 2) storage, transport and use as a liquid at room temperature 3) processing of the liquid into fibers, particles, and films that when heated forms silicon, and 4) the simple addition of dopants to the liquid at an atomic level that when heated forms doped silicon. Competing silanes provided by numerous manufacturers exist as a gas at room temperature and are explosive resulting in greater cost during storage, handling, transportation and use. Our closest competitor is cyclopentasilane which exists as a gas at room temperature and has proven costly and difficult to manufacture. Other competitors exist in specific applications. For example, graphene and carbon nanotubes are potential competitors in printable electronics but are only now emerging and require purification that is proving costly.

Coretec’s business and commercialization model is based in part upon establishing joint development partnerships with companies that are commercially successful and financially sound as well as deeply embedded in the supply chains for the aforementioned energy-related products. For example, Coretec is developing a strategic partnership with a domestic supplier of silicon-based materials that will facilitate further development and scale-up of Si6H12 plus chemical derivatives and other materials based on Si6H12. This strategic partnership will enable Coretec to supply large quantities of these novel silicon materials to those companies interested in producing prototype batteries, electronics, and PV/solar cells for testing and commercial evaluation. Coretec will continue to seek other such strategic partnerships within the private sector.

Volumetric 3D Display Business

The Company owns the rights to a patented volumetric 3D display technology that was developed by and with the University under a Sponsored Research Agreement (“SRA”). The development to date has resulted in multiple technologies, two working laboratory prototypes (Lab Proto 1 and Lab Proto 2), and eight provisional patents; five of the eight provisional patents have been combined and converted to five utility patents. Under the SRA, the Company has obtained the exclusive worldwide marketing rights to these 3D display technologies.

On May 26, 2009, the United States Patent and Trademark Office ("USPTO") approved the patent called "Volumetric Liquid Crystal Display" for rendering a three-dimensional image and converted it to U.S. patent No. 7,537,345. On December 28, 2010, USPTO approved the patent called “Light Surface Display for Rendering a Three-Dimensional Image,” and issued the United States Patent No. 7,858,913. On August 21, 2012, the USPTO approved a continuation patent called “3D Volumetric Display” and issued the US Patent No. 8,247,755. These patents describe the foundation of what is called CSpace® technology (“CSpace”).

Overview of Volumetric 3D Display Technology

Commercialization Strategy and Target Applications

The Company plans to commercialize the CSpace volumetric 3D technology through customer funded research and development contracts and technology licensing agreements for high value applications like air traffic control, design visualization, and medical imaging. The Company plans to develop products for contract engineering and with joint development customers. At this time the Company does not have any commercialized products and does not plan to develop its own products based on the CSpace technology due to the high value / low volume nature of the best-fit initial applications for this technology. These applications include but are not limited to the following:

|

|

●

|

Healthcare (diagnostics, surgical planning, training, telemedicine, bio surveillance);

|

|

|

●

|

Cyber security data visualization;

|

|

|

●

|

Military (operational planning, training, modeling and simulation, battlespace awareness, damage assessment, autonomous piloting);

|

|

|

●

|

Physical security (passenger, luggage & cargo screening);

|

|

|

●

|

Mining, oil & gas exploration; or

|

|

|

●

|

Meteorological and oceanographic data visualization.

|

CSpace Competition