Current Report Filing (8-k)

July 16 2021 - 8:00AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 12, 2021

CLUBHOUSE

MEDIA GROUP, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

333-140645

|

|

99-0364697

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

3651

Lindell Road, D517

Las

Vegas, Nevada 89103

(Address

of principal executive offices) (Zip code)

(702)

479-3016

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

|

|

|

|

[ ]

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

|

|

|

|

[ ]

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01. Entry into Material Definitive Agreement.

On

July 12, 2021, Clubhouse Media Group, Inc. (the “Company”) entered into a Joint Services Agreement (the “Agreement”)

with FinTekk AP, LLC, a Texas limited liability company (“FinTekk”), and Rick Ware Racing, LLC, a North Carolina limited

liability company (“RWR”). FinTekk and RWR are professional motorsports racing and marketing companies providing services

focused specifically in the NASCAR Cup Series, NASCAR Xfinity Series, the IndyCar Racing Series, and the IMSA Sports Car Championship

Series. Pursuant to the Agreement, FinTekk and RWR agreed to provide certain services to the Company, and the Company agreed to provide

certain services to RWR.

In

general, FinTekk will provide the Company with marketing and branding consulting services utilizing the RWR racing platform, and will

promote the Company as the primary brand for the NASCAR race events in which RWR participates in conjunction with the RWR platform.

RWR

will provide racing car drivers as well as NASCAR and development team drivers and athletes currently competing in motor racing; and

RWR will engage and integrate its social media team with the Company team members to collaborate, promote and market the Company to the

racing fan bases of NASCAR and IndyCar through the use of each other’s social and digital media platforms.

The

Company will engage and integrate its social media/influencer member network and production teams with RWR team members to collaborate,

promote and market RWR racing efforts and racing and driver story lines through various media platforms operated or familiar to the Company.

The

respective services of the parties under the Agreement will apply with respect to 11 races occurring from July 18, 2021 to September

26, 2021 (the “Events”); and the compensation under the Agreement for the respective services is payable with respect to

each of the Events, as follows:

|

|

●

|

In return for

the provision by FinTekk of its services, for each Event the Company will issue FinTekk 51,146 shares of the Company’s common

stock, which will be issued on the first business day following the completion of the applicable Event.

|

|

|

●

|

In return for the provision

by RWR of its services, for each Event the Company will pay RWR $113,636, which shall be due and payable to RWR on the first business

day following the completion of the applicable Event.

|

|

|

●

|

In return for the provision

by the Company of its services, for each Event RWR will pay the Company $90,909, which will be due and payable to the Company on

the second business day following the completion of the applicable Event.

|

Any

party may terminate the Agreement for convenience after 50% of the events have concluded and with two weeks’ prior written notice

to the other parties. In addition, the Agreement may be terminated at any time by a party, with notice to the other parties, in the event

that another other party materially breaches the terms or conditions of the Agreement, and such breach is either not capable of cure

or, if capable of cure, is not cured within three days of written notice to the breaching party. Upon the termination or expiration of

the Agreement, the parties will have no further obligations hereunder other than those which arose prior to such termination or which

are explicitly set forth in the Agreement as surviving any such termination or expiration.

The

Agreement contains customary representations and warranties of the parties, and customary provisions relating to confidentiality obligations,

indemnification, and miscellaneous provisions.

The

foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement,

a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and which is incorporated herein by reference.

Item

9.01 Financial Statement and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

Date: July 16, 2021

|

CLUBHOUSE MEDIA GROUP, INC.

|

|

|

|

|

|

|

By:

|

/s/ Amir

Ben-Yohanan

|

|

|

|

Amir Ben-Yohanan

|

|

|

|

Chief Executive Officer

|

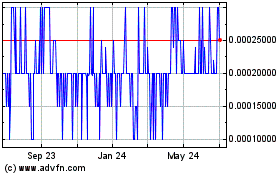

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

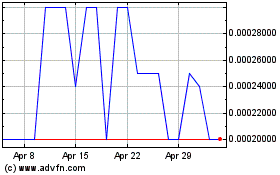

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Apr 2023 to Apr 2024