Filed

Pursuant to Rule 253(g)(3)

File

No. 024-11447

SUPPLEMENT

NO. 2 DATED JULY 15, 2021

to

the Offering Circular dated June 11, 2021

(as

supplemented by Supplement No. 1 dated June 24, 2021)

CLUBHOUSE

MEDIA GROUP, INC.

3651

Lindell Road, D517

Las

Vegas, Nevada, 89103

(702)

479-3016

$1,000,000

Minimum Offering Amount (250,000 Shares of Common Stock)

$30,000,000

Maximum Offering Amount (7,500,000 Shares of Common Stock)

EXPLANATORY

NOTE

This

Offering Circular Supplement No. 2 (“Supplement”) contains information which amends, supplements, or modifies certain information

contained in the Offering Circular of Clubhouse Media Group, Inc. (the “Company”) qualified by the Securities and Exchange

Commission on June 11, 2021, as previously supplemented by Supplement No. 1 dated June 24, 2021 (as supplemented, the “Offering

Circular”), relating to the Company’s public offering under Regulation A of Section 3(b) of the Securities Act of 1933, as

amended, for Tier 2 offerings, pursuant to which the Company is offering a minimum of 250,000 shares of common stock and a maximum of

7,500,000 shares of common stock, par value of $0.001 per share, on a “best efforts” basis, at a public offering price of

$4.00 per share. Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Offering

Circular. This Supplement should be read in conjunction with the Offering Circular, and is qualified by reference to the Offering Circular

except to the extent that the information contained herein supplements or supersedes the information contained in the Offering Circular,

and may not be delivered without the Offering Circular.

The

purpose of this Supplement is to disclose:

|

|

●

|

An update to

the forms of acceptable payment throughout the Offering Circular to permit payment for subscriptions by crypto currency, such as

Bitcoin or Ether;

|

|

|

|

|

|

|

●

|

An update to the number

of social media followers throughout the Offering Circular;

|

|

|

|

|

|

|

●

|

An update to disclose recent

issuances of securities by the Company;

|

|

|

|

|

|

|

●

|

An update to the recent developments disclosure regarding

the Company entering into a Joint Services Agreement with FinTekk AP, LLC and Rick Ware Racing, LLC; and

|

|

|

|

|

|

|

●

|

An update to the form of

Subscription Agreement to permit payment by crypto currency for subscriptions.

|

Front

Cover of Offering Circular

This

Supplement updates the third paragraph on the front cover of the Offering Circular to include crypto currency (such as Bitcoin or Ether

as an acceptable form of payment for subscriptions in the Offering, as follows:

After

the qualification by the SEC of the Offering Statement of which this Offering Circular is a part, investors can make payment of the purchase

price by ACH debit transfer, wire transfer, credit card or check into the Offering Escrow Account. Credit card subscription shall not

exceed the lesser of $5,000 or the amount permitted by applicable law, per subscriber. Investors contemplating using their credit card

to invest are urged to carefully review “Risk Factors – Risks of investing using a credit card.” We

may also permit payment to be made in crypto currency (such as Bitcoin or Ether) if and to the extent we can establish and maintain relationships

with licensed crypto-currency exchange services providers to facilitate such transactions and provided, further, we are able to do so

in accordance with SEC and FINRA guidelines. We currently have an account with Kraken Bitcoin Exchange (“Kraken”), though

we continue to seek additional exchange relationships that will enable us to accept crypto currency (such as Bitcoin or Ether) and conduct

a spot exchange to U.S. dollars. The exchange rate will be determined by Kraken or such other third-party exchange and we will honor

that exchange rate at the time of exchange. The investment platform will provide either a hyperlink to the then current exchange rate

published by the third-party exchange service or include a current quote, such that before making payment in crypto currency (such as

Bitcoin or Ether), an investor will be able to view the then current exchange rate. However, as will be indicated on the investment platform,

exchange rates are constantly changing and there will be a time lag between the time we receive a payment in crypto currency (such as

Bitcoin or Ether) and its automatic conversion to U.S. dollars through the exchange service. Accordingly, an investor that elects to

pay in crypto currency (such as Bitcoin or Ether) will have exchange rate risk for that time period. Details about the method of effecting

the exchange and how an investor can determine the exchange rate in effect at the time of subscription will be available on the investment

platform. Common stock will be allocated to a purchaser based on the actual exchange rate in effect when the exchange occurs. We will

use the third-party service to convert any subscription payment made in crypto currency (such as Bitcoin or Ether) into U.S. dollars

at the time a subscription agreement is executed, and then deposit such funds in a segregated account. On the closing date, the funds

in the segregated account will be released to us and the associated common stock will be issued to the investors in this Offering. If

there is no closing of this Offering following the date of this Supplement, the funds deposited by the exchange service into the segregated

account will be returned to subscribers by mail via a check in U.S. dollars, without interest. The third-party service used to convert

crypto currency (such as Bitcoin or Ether) into U.S. dollars may charge a conversion fee or offer a reduced exchange rate to provide

for its fees. Prior to accepting payment in crypto currency (such as Bitcoin or Ether), the investment platform will display or link

to the name of the third-party exchange, the then current exchange rate and any third-party conversion fees applicable to such transaction.

If any funds are returned by us if we choose to reject a subscription or elect not to proceed with the Offering, such funds will be returned

by mail via a check in U.S. dollars. See “Risk Factor – If you pay part or all of the purchase price for the common stock

in this Offering in crypto currency (such as Bitcoin or Ether), and we do not close the Offering, or choose to reject the subscription,

you could have exposure for currency risk.”

SUMMARY

This

Supplement updates certain disclosures regarding the number of social media followers by replacing the disclosure under “Summary—Principal

Products and Services—The Clubhouses” of the Offering Circular with the following:

The

Clubhouses

Through

WOHG, we are the sole owner of “The Clubhouse,” which is an integrated social media influencer incubator with a physical

and digital footprint in Southern California and Europe. The Clubhouse is a collection of content creation houses located in scenic mansions

in Southern California (3 locations), Las Vegas, Nevada (1 location) and Europe (1 location) that houses who we believe to be some of

the most prominent and widely followed social media influencers, together carrying a currently estimated follower base of approximately

400 million social media followers as of July 10, 2021 across all Clubhouse influencers. The foregoing consists of approximately 290.0

million followers on TikTok, 51.7 million followers on Instagram, 56 million followers on YouTube, 2.6 million followers on Snapchat

and 2.0 million followers on Twitter. The influencers who live in our Clubhouses, as well as the number of their social media followers,

can fluctuate significantly at any given time, and we cannot predict the increase or decline of the number of influencers who live in

our Clubhouses or the number of followers for our Clubhouse influencers at any given time in the future.

This

Supplement updates certain disclosures regarding the number of social media followers by replacing the disclosure under “Summary—Principal

Products and Services—The Clubhouses—‘The Clubhouse” Online Presences and Plans for Expansion of the Physical

Clubhouses” of the Offering Circular with the following:

“The

Clubhouse” Online Presence and Plans for Expansion of the Physical Clubhouses

While

“The Clubhouse” network consists of physical locations (as described above), there are numerous “Clubhouse” accounts

owned by The Clubhouse, with a combined following of over 5.8 million followers as of July 10, 2021 across Instagram, Snapchat, YouTube,

and TikTok. These accounts are directly held by us (as opposed to the Clubhouse team of influencers) and therefore we have direct access

to the followers of these accounts, which we consider to be our followers.

This

Supplement updates certain disclosures regarding the number of social media influencers that the Company represents through Doiyen LLC

and the number of combined social media followers by replacing the disclosure under “Summary—Principal Products and Services—Talent

Management Services” of the Offering Circular with the following:

Talent

Management Services

Doiyen

LLC, our indirectly wholly owned subsidiary, is a talent management company for social media influencers and generates revenues based

on the earnings of its influencer-clients (or “Creators”) by receiving a percentage of the earnings of its Creators. Certain

influencers who live in our various Clubhouses enter into an Exclusive Management Agreement (the “Management Agreement(s)”).

Through Doiyen, we seek to represent some of the world’s top talent in the world of social media. We plan to hire experienced talent

and management agents as well as build our support and administrative resources seeking to expand operations. Our influencers include

entertainers, content creators, and style icons.

Through

Doiyen, we currently represent approximately 24 social media influencers, with a combined number of followers on Instagram, TikTok, and

YouTube of over 64 million. We are dedicated to helping Doiyen’s influencer-clients build their brands, maintain creative control

of their destinies, and diversify and grow their businesses through “The Clubhouse,” providing them opportunities to increase

their monetization potential and amplify their reach.

We

also may enter into non-exclusive management agreements with certain Creators, however this is extremely rare, as we prefer to only

enter into exclusive management agreements.

This

Supplement adds the following as the third to the last bullet point in the list of bullet points under the section “Summary —

Risk Factors” of the Offering Circular:

|

|

●

|

Investors

using crypto currency (such as Bitcoin or Ether) to pay for their common stock in this Offering,

if such payment methods are accepted by us, may face currency risks and will also incur fees

in connection with the conversion of their crypto currency to U.S. dollars.

|

THE

OFFERING

This

Supplement modifies the subsection “Payment for Offered Shares” to permit payment by crypto currency (such as Bitcoin or

Ether) under “The Offering – Payment for Offered Shares” as follows:

After

the qualification by the SEC of the Offering Statement of which this Offering Circular is a part, investors can make payment of the purchase

price by ACH debit transfer, wire transfer, credit card or check into a segregated non-interest-bearing account at Pacific Mercantile

Bank (the “Offering Escrow Account”). Sutter Securities Clearing, LLC will serve as the Offering Escrow Account agent. Credit

card subscription shall not exceed the lesser of $5,000 or the amount permitted by applicable law, per subscriber. Investors contemplating

using their credit card to invest are urged to carefully review “Risk Factors – Risks of investing using a credit card.”

Checks should be made payable to Sutter Securities Clearing, LLC (the “Deposit Account Agent”) as deposit account agent for

the Company.

We

may also permit payment to be made in crypto currency (such as Bitcoin or Ether) if and to the extent we can establish and maintain relationships

with licensed crypto-currency exchange services providers to facilitate such transactions and provided, further, we are able to do so

in accordance with SEC and FINRA guidelines. We currently have an account with Kraken Bitcoin Exchange (“Kraken”), though

we continue to seek additional exchange relationships that will enable us to accept crypto currency (such as Bitcoin or Ether) and conduct

a spot exchange to U.S. dollars. The exchange rate will be determined by Kraken or such other third-party exchange and we will honor

that exchange rate at the time of exchange. The investment platform will provide either a hyperlink to the then current exchange rate

published by the third-party exchange service or include a current quote, such that before making payment in crypto currency (such as

Bitcoin or Ether), an investor will be able to view the then current exchange rate. However, as will be indicated on the investment platform,

exchange rates are constantly changing and there will be a time lag between the time we receive a payment in crypto currency (such as

Bitcoin or Ether) and its automatic conversion to U.S. dollars through the exchange service. Accordingly, an investor that elects to

pay in crypto currency (such as Bitcoin or Ether) will have exchange rate risk for that time period. Details about the method of effecting

the exchange and how an investor can determine the exchange rate in effect at the time of subscription will be available on the investment

platform. Common stock will be allocated to a purchaser based on the actual exchange rate in effect when the exchange occurs. We will

use the third-party service to convert any subscription payment made in crypto currency (such as Bitcoin or Ether) into U.S. dollars

at the time a subscription agreement is executed, and then deposit such funds in a segregated account. On the closing date, the funds

in the segregated account will be released to us and the associated common stock will be issued to the investors in this Offering. If

there is no closing of this Offering following the date of this Supplement, the funds deposited by the exchange service into the segregated

account will be returned to subscribers by mail via a check in U.S. dollars, without interest. The third-party service used to convert

crypto currency (such as Bitcoin or Ether) into U.S. dollars may charge a conversion fee or offer a reduced exchange rate to provide

for its fees. Prior to accepting payment in crypto currency (such as Bitcoin or Ether), the investment platform will display or link

to the name of the third-party exchange, the then current exchange rate and any third-party conversion fees applicable to such transaction.

If any funds are returned by us if we choose to reject a subscription or elect not to proceed with the Offering, such funds will be returned

by mail via a check in U.S. dollars. See “Risk Factor – If you pay part or all of the purchase price for the common stock

in this Offering in crypto currency (such as Bitcoin or Ether), and we do not close the Offering, or choose to reject the subscription,

you could have exposure for currency risk.”

Until

we achieve the Minimum Offering Amount, the proceeds for the offering will be kept in the Offering Escrow Account. Upon achievement of

the Minimum Offering Amount and the closing (“Initial Closing”) on such amount, the proceeds from the Minimum Offering Amount

will be distributed to us and the associated Offered Shares will be issued to the investors. Following the Initial Closing of this offering,

we expect to have several subsequent closings (“Additional Closings”) of this offering until the Maximum Offering Amount

is raised or the offering is terminated. Our Company and the Placement Agent will consider various factors in determining the timing

of any Additional Closings, including the amount of proceeds received at the Initial Closing, any Additional Closings that have already

been held, the level of additional valid subscriptions received after the Initial Closing, and the eligibility of additional investors

under applicable laws. We expect to have Additional Closings on a monthly basis and expect that we will accept all funds subscribed for

each month subject to our working capital and other needs consistent with the use of proceeds described in this Offering Circular. Investors

should expect to wait approximately one month and no longer than forty-five days before we accept their subscriptions and they receive

the Offered Shares subscribed for. An investor’s subscription is binding and irrevocable and investors will not have the right

to withdraw their subscription or receive a return of funds prior to the next closing unless we reject the investor’s subscription.

You will receive a confirmation of your purchase promptly following the closing in which you participate. Upon each Additional Closing,

if any, the proceeds subject to that Additional Closing will be distributed to us and the associated Offered Shares will be issued to

the investors in such Offered Shares. If the offering does not close, the proceeds for the offering will be promptly returned to investors,

without deduction and without interest.

RISK

FACTORS

This

Supplement adds the following as the third to the last bullet point in the list of bullet points under “Risk Factors”:

|

|

●

|

Investors

using crypto currency (such as Bitcoin or Ether) to pay for their common stock if such payment

methods are accepted by us may face currency risks and will also incur fees in connection

with the conversion of their crypto currency to U.S. dollars.

|

This

Supplement adds the following risk factor as the third risk factor under “Risk Factors - Risks Related to Our Common Stock and

the Offering” of the Offering Circular:

If

you pay part or all of the purchase price for the common stock in this Offering in crypto currency (such as Bitcoin or Ether), and we

do not close on your subscription, or choose to reject the subscription, you could have exposure for currency risk.

Investors

in this Offering may be able to make payment of the purchase price in the form of crypto currency (such as Bitcoin or Ether) if we are

able to forge and maintain relationships with licensed crypto-currency exchange services providers and provided we are able to do so

in accordance with SEC and FINRA guidelines. For those investors who pay in crypto currency (such as Bitcoin or Ether), we plan to use

a third-party service to convert such payment into U.S. dollars at the time a subscription agreement is executed, and then deposit such

funds into a segregated non-interest-bearing account. If any funds are returned by us or if we choose to reject a subscription or elect

not to proceed with the Offering, such funds will be returned by mail via a check in U.S. dollars. Because the crypto currency markets

are extremely volatile, and the U.S. dollar value of the crypto currency (such as Bitcoin or Ether) is speculative and the value of the

crypto currency at the time you make your subscription may differ substantially from its U.S. dollar value in the future. You may lose

money if we choose to reject a subscription or elect not to proceed with the Offering and refund your subscription. Any investor who

chooses to pay for the common stock in this Offering in crypto currency (such as Bitcoin or Ether) is subject to such fluctuations in

the value of the crypto currency (such as Bitcoin or Ether) and the currency risks stemming therefrom.

MARKET

PRICE FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

This

Supplement updates the subsection “Issuances” to disclose for following additional issuances of securities:

On

July 1, 2021, the Company issued 257,625 shares of Company unrestricted common stock to nine investors for a purchase price of $4.00

per share (for an aggregate of $1,030,500) in connection with the initial closing of this Regulation A offering.

On

July 9, 2021, the Company issued 6,069 shares of Company common stock to Adam Miguest with a value of $0.001 per share as compensation

for bringing in brand deals for influencers.

On

July 9, 2021, the Company issued 1,585 shares of Company common stock to Wilfred Man with a value of $0.001 per share as compensation

for services to the Company.

On

July 9, 2021, the Company issued 8,268 shares of Company common stock to Lindsay Brewer with a value of $0.001 per share as compensation

for services to the Company.

On

July 9, 2021, the Company issued 1,014 shares of Company common stock to Arlene G. Todd with a value of $0.001 per share as compensation

for services to the Company.

On

July 9, 2021, the Company issued 3,275 shares of Company common stock to Andrew Omori with a value of $0.001 per share as compensation

for services to the Company.

On

July 9, 2021, the Company issued 2,027 shares of Company common stock to Tommy Shek with a value of $0.001 per share as compensation

for services to the Company.

On

July 9, 2021, the Company issued 250,000 shares of Company common stock to Amir Ben-Yohanan, Chief Executive Officer of the Company,

with a value of $0.001 per share as compensation for services to the Company.

On

July 9, 2021, the Company issued 6,000 shares of Company common stock to Arlene G. Todd with a value of $0.001 per share as compensation

for services to the Company.

On

July 9, 2021, the Company issued 1,014 shares of Company common stock to Arlene G. Todd with a value of $0.001 per share as compensation

for services to the Company.

On

July 9, 2021, the Company issued 1,686 shares of Company common stock to Andrew Omori with a value of $0.001 per share as compensation

for services to the Company.

On

July 9, 2021, the Company issued 16,666 shares of Company common stock to Phoenix Media & Entertainment with a value of $0.001 per

share as compensation for services to the Company.

On

July 9, 2021, the Company issued 7,500 shares of Company common stock to G Money, Inc. with a value of $0.001 per share as compensation

for services to the Company.

On

July 13, 2021, the Company issued 4,030 shares of Company common stock to Amir Ben-Yohanan, Chief Executive Officer of the Company, with

a value of $6.20 per share as compensation for services to the Company.

On

July 13, 2021, the Company issued 4,030 shares of Company common stock to Chris Young, President of the Company, with a value of $6.20

per share as compensation for services to the Company.

On

July 13, 2021, the Company issued 4,030 shares of Company common stock to Simon Yu, Chief Operating Officer of the Company, with a value

of $6.20 per share as compensation for services to the Company.

On

July 13, 2021, the Company issued 4,030 shares of Company common stock to Harris Tulchin, Chief Legal Counsel of the Company, with a

value of $6.20 per share as compensation for services to the Company.

On

July 13, 2021, the Company issued 4,030 shares of Company common stock to Gary Marenzi, a director of the Company, with a value of $6.20

per share as compensation for services to the Company.

On

July 13, 2021, the Company issued 7,671 shares of Company common stock to Laura Anthony with a value of $0.0001 per share for legal services

rendered to the Company.

On

July 13, 2021, the Company issued 28,670 shares of Company common stock to Heather Ferguson with a value of $0.0001 per share as compensation

for services to the Company.

PLAN

OF DISTRIBUTION

This

Supplement modifies the following disclosure under “Plan of Distribution - Procedures for Subscribing” to permit payment

by crypto currency (such as Bitcoin or Ether) as follows:

If

you decide to subscribe for any common stock in this offering, you should:

Go

to the offering page at https://invest.clubhousemediagroup.com/clubhousemedia, click on the “Invest” button

and follow the procedures as described.

|

|

1.

|

Electronically

receive, review, execute and deliver to us through DocuSign, a Subscription Agreement; and

|

|

|

|

|

|

|

2.

|

Deliver

funds only by ACH, wire transfer, credit card or check (or by such alternative payment method, such as crypto currency, as may be

indicated on the investment platform) for the amount set forth in the Subscription Agreement directly to the specified bank account

maintained by the Deposit Account Agent.

|

The

Clubhouse Media website will redirect interested investors via the “Invest Now” button to a site operated by Sutter Securities

group, Inc., where investors can receive, review, execute and deliver subscription agreements electronically.

Any

potential investor will have ample time to review the Subscription Agreement, along with their counsel, prior to making any final investment

decision. We shall only deliver such Subscription Documents upon request after a potential investor has had ample opportunity to review

this Offering Circular. Further, we will not accept any money until the SEC declares the Offering Statement qualified.

Following

the Initial Closing on the Minimum Offering Amount, we anticipate that we may hold one or more additional closings for purchases of the

Offered Shares until the offering is fully subscribed or we terminate the offering. Our Company and the Placement Agent will consider

various factors in determining the timing of any Additional Closings, including the amount of proceeds received at the Initial Closing,

any Additional Closings that have already been held, the level of additional valid subscriptions received after the Initial Closing,

and the eligibility of additional investors under applicable laws. We expect to have Additional Closings on a monthly basis and expect

that we will accept all funds subscribed for each month subject to our working capital and other needs consistent with the use of proceeds

described in this Offering Circular. Investors should expect to wait approximately one month and no longer than forty-five days

before we accept their subscriptions and they receive the Offered Shares subscribed for. An investor’s subscription is binding

and irrevocable and investors will not have the right to withdraw their subscription or receive a return of funds prior to the next closing

unless we reject the investor’s subscription. You will receive a confirmation of your purchase promptly following the closing

in which you participate. Upon each Additional Closing, if any, the proceeds subject to that Additional Closing will be distributed to

us and the associated Offered Shares will be issued to the investors in such Offered Shares. If the offering does not close, the proceeds

for the offering will be promptly returned to investors, without deduction and without interest.

Further,

for those investors who pay in crypto currency (such as Bitcoin or Ether), we plan to use a third-party service to convert such payment

into U.S. dollars at the time a crypto currency (such as Bitcoin or Ether) subscription is received, and then deposit such funds in the

account. We currently have an account with Kraken Bitcoin Exchange (“Kraken”), though we continue to seek additional exchange

relationships that will enable us to accept crypto currency (such as Bitcoin or Ether) and do a spot exchange to U.S. dollars. The exchange

rate will be determined by Kraken or such other exchange and we will honor that exchange rate at the time of exchange. Details about

the method of effecting the exchange and how an investor can determine the exchange rate in effect at the time of subscription will be

available on the investment platform. Common stock will be allocated to a purchaser based on the actual exchange rate. If any funds are

returned by us if we choose to reject a subscription or elect not to proceed with the Offering, such funds will be returned by mail in

the form of U.S. dollars.

Proceeds

will be held with the Deposit Account Agent in an Offering Deposit Account subject to compliance with Exchange Act Rule 15c2-4 until

closing occurs. The Placement Agent and/or the participating broker-dealers will submit a subscriber’s form(s) of payment in compliance

with Exchange Act Rule 15c2-4, generally by noon of the next business day following receipt of the subscriber’s subscription agreement

and form(s) of payment.

You

will be required to represent and warrant in your subscription agreement that you are an accredited investor as defined under Rule 501

of Regulation D or that your investment in the shares of common stock does not exceed 10% of your net worth or annual income, whichever

is greater, if you are a natural person, or 10% of your revenues or net assets, whichever is greater, calculated as of your most recent

fiscal year if you are a non-natural person. By completing and executing your subscription agreement you will also acknowledge and represent

that you have received a copy of this Offering Circular, you are purchasing the shares of common stock for your own account and that

your rights and responsibilities regarding your shares of common stock will be governed by our chart and bylaws, each filed as an exhibit

to the Offering Statement of which this Offering Circular is a part.

Right

to Reject Subscriptions. After we receive your complete, executed subscription agreement and the funds required under the subscription

agreement have been transferred to the Deposit Account Agent, we have the right to review and accept or reject your subscription in whole

or in part, for any reason or for no reason. We will return all monies from rejected subscriptions immediately to you, without interest

or deduction.

Acceptance

of Subscriptions. Upon our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the shares

subscribed at closing. Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription

or request your subscription funds. All accepted subscription agreements are irrevocable.

Under

Rule 251 of Regulation A, non-accredited, non-natural investors are subject to the investment limitation and may only invest funds which

do not exceed 10% of the greater of the purchaser’s revenue or net assets (as of the purchaser’s most recent fiscal year

end). A non-accredited, natural person may only invest funds which do not exceed 10% of the greater of the purchaser’s annual income

or net worth (please see below on how to calculate your net worth).

NOTE:

For the purposes of calculating your Net Worth, it is defined as the difference between total assets and total liabilities. This calculation

must exclude the value of your primary residence and may exclude any indebtedness secured by your primary residence (up to an amount

equal to the value of your primary residence). In the case of fiduciary accounts, net worth and/or income suitability requirements may

be satisfied by the beneficiary of the account or by the fiduciary, if the fiduciary directly or indirectly provides funds for the purchase

of the Offered Shares.

In

order to purchase Offered Shares and prior to the acceptance of any funds from an investor, an investor will be required to represent,

to our satisfaction, that he is either an accredited investor or is in compliance with the 10% of net worth or annual income limitation

on investment in this offering.

Non-U.S.

investors may participate in this offering by depositing their funds in the Offering Deposit Account held at Pacific Mercantile Bank.

Sutter Securities Clearing, LLC will serve as the Deposit Account Agent. Any such funds that the Deposit Account Agent receives shall

be held on deposit until the applicable closing of the offering or such other time as mutually agreed between the Company and the Placement

Agent, and then used to complete securities purchases, or returned if this offering fails to close.

DESCRIPTION

OF BUSINESS

This

Supplement updates certain disclosures regarding the number of social media followers by replacing the disclosure under “Description

of Business—Principal Products and Services—The Clubhouses” of the Offering Circular with the following:

The

Clubhouses

Through

WOHG, we are the sole owner of “The Clubhouse,” which is an integrated social media influencer incubator with a physical

and digital footprint in Southern California and Europe. The Clubhouse is a collection of content creation houses located in scenic mansions

in Southern California (3 locations), Las Vegas, Nevada (1 location) and Europe (1 location) that houses who we believe to be some of

the most prominent and widely followed social media influencers, together carrying a currently estimated follower base of approximately

400 million social media followers as of July 10, 2021 across all Clubhouse influencers. The foregoing consists of approximately 290.0

million followers on TikTok, 51.7 million followers on Instagram, 56 million followers on YouTube, 2.6 million followers on Snapchat

and 2.0 million followers on Twitter. The influencers who live in our Clubhouses, as well as the number of their social media followers,

can fluctuate significantly at any given time, and we cannot predict the increase or decline of the number of influencers who live in

our Clubhouses or the number of followers for our Clubhouse influencers at any given time in the future.

This

Supplement updates certain disclosures regarding the number of social media followers by replacing the disclosure under “Description

of Business—Principal Products and Services—The Clubhouses—‘The Clubhouse’ Online Presences and Plans for

Expansion of the Physical Clubhouses” of the Offering Circular with the following:

“The

Clubhouse” Online Presence and Plans for Expansion of the Physical Clubhouses

While

“The Clubhouse” network consists of physical locations (as described above), there are numerous “Clubhouse” accounts

owned by The Clubhouse, with a combined following of over 5.8 million followers as of July 10, 2021 across Instagram, Snapchat, YouTube,

and TikTok. These accounts are directly held by us (as opposed to the Clubhouse team of influencers) and therefore we have direct access

to the followers of these accounts, which we consider to be our followers.

This

Supplement updates certain disclosures regarding the number of social media influencers that the Company represents through Doiyen LLC

and the number of combined social media followers by replacing the disclosure under “Description of Business—Principal Products

and Services—Talent Management Services” of the Offering Circular with the following:

Talent

Management Services

Doiyen

LLC, our indirectly wholly owned subsidiary, is a talent management company for social media influencers and generates revenues based

on the earnings of its influencer-clients (or “Creators”) by receiving a percentage of the earnings of its Creators. Certain

influencers who live in our various Clubhouses enter into an Exclusive Management Agreement (the “Management Agreement(s)”).

Through Doiyen, we seek to represent some of the world’s top talent in the world of social media. We plan to hire experienced talent

and management agents as well as build our support and administrative resources seeking to expand operations. Our influencers include

entertainers, content creators, and style icons.

Through

Doiyen, we currently represent approximately 24 social media influencers, with a combined number of followers on Instagram, TikTok, and

YouTube of over 64 million. We are dedicated to helping Doiyen’s influencer-clients build their brands, maintain creative control

of their destinies, and diversify and grow their businesses through “The Clubhouse,” providing them opportunities to increase

their monetization potential and amplify their reach.

We

also may enter into non-exclusive management agreements with certain Creators, however this is extremely rare, as we prefer to only enter

into exclusive management agreements.

This

Supplement updates certain disclosures regarding Clubhouse Creator Affiliate Program by replacing the disclosure under “Description

of Business—Recent Developments— Clubhouse Creator Affiliate Program” of the Offering Circular with the following:

Clubhouse

Creator Affiliate Program

In

June 2021, we launched the Clubhouse Creator Affiliate Program. Through this program, we invite young social media creators from all

over the world to join the Clubhouse network, promote the Clubhouse brand and grow their social media network with us. To date, over

33 creators with a total reach of well over 186 million followers have signed up and partnered with us and we expect many more to do

the same. These creators will serve as Clubhouse ambassadors worldwide and we plan to invite them to visit our content houses and collaborate

with our creators.

This

Supplement adds certain disclosure regarding recent developments immediately below “Description of Business—Recent Developments—

Clubhouse Creator Affiliate Program” of the Offering Circular as follows:

Joint

Services Agreement

On

July 12, 2021, the Company entered into a Joint Services Agreement (the “Agreement”) with FinTekk AP, LLC, a Texas limited

liability company (“FinTekk”), and Rick Ware Racing, LLC, a North Carolina limited liability company (“RWR”).

FinTekk and RWR are professional motorsports racing and marketing companies providing services focused specifically in the NASCAR Cup

Series, NASCAR Xfinity Series, the IndyCar Racing Series, and the IMSA Sports Car Championship Series. Pursuant to the agreement, FinTekk

and RWR agreed to provide certain services to the Company, and the Company agreed to provide certain services to RWR.

In

general, FinTekk will provide the Company with marketing and branding consulting services utilizing the RWR racing platform, and will

promote the Company as the primary brand for the NASCAR race events in which RWR participates in conjunction with the RWR platform.

RWR

will provide racing car drivers as well as NASCAR and development team drivers and athletes currently competing in motor racing; and

RWR will engage and integrate its social media team with the Company team members to collaborate, promote and market the Company to the racing fan

bases of NASCAR and IndyCar through the use of each other’s social and digital media platforms.

The

Company will engage and integrate its social media/influencer member network and production teams with RWR team members to

collaborate, promote and market RWR racing efforts and racing and driver story lines through various media platforms operated or

familiar to the Company.

The

respective services of the parties under the Agreement will apply with respect to 11 races occurring from July 18, 2021 to September

26, 2021 (the “Events”); and the compensation under the Agreement for the respective services is payable with respect to

each of the Events, as follows:

|

|

●

|

In

return for the provision by FinTekk of its services, for each Event the Company will issue FinTekk 51,146 shares of Common Stock,

which will be issued on the first business day following the completion of the applicable Event.

|

|

|

●

|

In

return for the provision by RWR of its services, for each Event the Company will pay RWR $113,636, which shall be due and payable

to RWR on the first business day following the completion of the applicable Event.

|

|

|

●

|

In

return for the provision by the Company of its services, for each Event RWR will pay the Company $90,909, which will be due and payable

to the Company on the second business day following the completion of the applicable Event.

|

Any

party may terminate the Agreement for convenience after 50% of the events have concluded and with 2 weeks prior written notice to the

other parties. In addition, the Agreement may be terminated at any time by a party, with notice to the other parties, in the event that

another other party materially breaches the terms or conditions of the Agreement, and such breach is either not capable of cure or, if

capable of cure, is not cured within 3 days of written notice to the breaching party. Upon the termination or expiration of the Agreement,

the parties will have no further obligations hereunder other than those which arose prior to such termination or which are explicitly

set forth in the Agreement as surviving any such termination or expiration.

The

Agreement contains customary representations and warranties of the parties, and customary provisions relating to confidentiality obligations,

indemnification, and miscellaneous provisions.

Form

of Subscription Agreement

The

Form of Subscription Agreement found in Appendix A to this Supplement replaces in its entirety the corresponding Form

of Subscription Agreement found in Exhibit 4.1 of the offering statement of which the Offering Circular forms a part.

The date

of this Offering Circular Supplement No. 2 is July 15, 2021.

APPENDIX

A

Subscription

Agreement of Clubhouse Media Group, Inc. Common Stock

This

subscription (this “Subscription”) is dated ,

2021, by and between the investor identified on the signature page hereto (the “Investor”) and Clubhouse Media Group,

Inc., a Nevada corporation (the “Company”), whereby the parties agree as follows:

1. Subscription

Investor

agrees to buy and the Company agrees to sell and issue to Investor such number of shares (the “Shares”) of the Company’s

common stock, $0.001 par value per share, as set forth on the signature page hereto, for an aggregate purchase price (the “Purchase

Price”) equal to the product of (x) the aggregate number of Shares the Investor has agreed to purchase and (y) the purchase

price per share (the “Purchase Price”) as set forth on the signature page hereto. The Purchase Price is set forth

on the signature page hereto. The Shares are being offered pursuant to an offering statement on Form 1-A, File No. 024-11447 (the “Offering

Statement”). The Offering Statement will have been qualified by the Securities and Exchange Commission (the “Commission”)

prior to issuance of any Shares and acceptance of Investor’s subscription. The offering circular (the “Offering Circular”)

which forms a part of the Offering Statement, however, is subject to change. A final Offering Circular and/or supplement to Offering

Circular will be delivered to the Investor as required by law. The Shares are being offered by Boustead Securities, LLC (the “Placement

Agent”) as placement agent on a “best efforts, minimum/maximum” basis. The completion of the purchase and sale

of the Shares (the “Closing”) shall take place at a place and time (the “Closing Date”) to be specified

by the Company and Placement Agent in accordance with Rule 15c6-1 promulgated under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”).

The

Purchase Price for the Shares shall be paid simultaneously with the execution and delivery to the Company of the signature page of this

Subscription Agreement. Subscriber shall deliver a signed copy of this Subscription Agreement, along with payment for the aggregate Purchase

Price of the Shares by a check for available funds made payable to “Sutter Securities Clearing, LLC as Agent for the Investors

in the Clubhouse Media Group Offering”, by ACH electronic transfer, wire transfer or crypto currency (such as Bitcoin or Ether)

to an account designated by the Company, or by any combination of such methods. For those investors who pay in crypto currency (such

as Bitcoin or Ether), we plan to use a third-party service to convert such payment into U.S. dollars at the time a crypto currency (such

as Bitcoin or Ether) subscription is received, and then deposit such funds in the account.

Payment

for the Shares shall be received by Sutter Securities Clearing, LLC (the “Deposit Account Agent”) from the undersigned

by transfer of immediately available funds, or other means approved by the Company at least two days prior to the closing date, in the

amount as set forth on the signature page hereto. Upon satisfaction or waiver of all the conditions to closing set forth in the Placement

Agent Agreement and Offering Statement, at the Closing, (i) the Deposit Account Agent shall release such funds to the Company, and (ii)

the Company shall cause the Shares to be delivered to the Investor with the delivery of the Shares to be made through the facilities

of The Depository Trust Company’s DWAC system in accordance with the instructions set forth on the signature page attached hereto

under the heading “DWAC Instructions.”

The

Placement Agent and any participating broker dealers (the “Members”) shall confirm, via the selected dealer agreement

or master selected dealer agreement that it will comply with Exchange Act Rule 15c2-4. As per Exchange Act Rule 15c2-4 and FINRA Notice

to Members Rule 84-7 (the “Rule”), all checks that are accompanied by a subscription agreement will be promptly sent

along with the subscription agreements to the escrow account by noon the next business day. In regard to monies being wired from an investor’s

bank account, the Members shall request the investors send their wires by the next business day, however, the Company cannot insure the

investors will forward their respective monies as per the Rule. In regard to monies being sent from an investor’s account held

at the participating broker, the funds will be “promptly transmitted” to the escrow agent following the receipt of a completed

subscription document and completed wire instructions by the investor to send funds to the escrow account. Absent unusual circumstances,

funds in customer accounts will be transmitted by noon of the next business day. In the event that funds are sent in and the offering

does not close for any reason prior to the offering termination date set forth in the final Offering Statement, all funds will be returned

to investors promptly in accordance with the escrow agreement terms and applicable law. If a subscription was made in a form of currency

other than U.S. dollars (such as crypto currency), you will receive the payment in the form of a check in U.S. dollars via U.S. mail.

2. Certifications,

Representations and Warranties

In

order to induce the Company to accept this Subscription Agreement for the Shares and as further consideration for such acceptance, the

undersigned hereby makes, adopts, confirms and agrees to all of the following covenants, acknowledgments, representations and warranties

with the full knowledge that the Company and its affiliates will expressly rely thereon in making a decision to accept or reject this

Subscription Agreement:

I

understand that to purchase Shares, I must either be an “accredited investor” as such term is defined in Rule 501 of Regulation

D promulgated under the Securities Act of 1933, as amended, or I must limit my investment in the Shares to a maximum of: (i) 10% of my

net worth or annual income, whichever is greater, if I am a natural person; or (ii) 10% of my revenues or net assets, whichever is greater,

for my most recently completed fiscal year, if I am a non-natural person.

I

understand that if I am a natural person I should determine my net worth for purposes of these representations by calculating the difference

between my total assets and total liabilities. I understand this calculation must exclude the value of my primary residence and may exclude

any indebtedness secured by my primary residence (up to an amount equal to the value of my primary residence). In the case of fiduciary

accounts, net worth and/or income suitability requirements may be satisfied by the beneficiary of the account or by the fiduciary, if

the fiduciary directly or indirectly provides funds for the purchase of the Shares.

I

hereby represent and warrant that I meet the qualifications to purchase Shares because:

|

[ ]

|

The aggregate

purchase price for the Shares I am purchasing in the Offering does not exceed 10% of my net worth or annual income, whichever is

greater.

|

|

|

|

|

[ ]

|

I am an accredited investor.

|

I

understand that the Company reserves the right to, in its sole discretion, accept or reject this Subscription, in whole or in part, for

any reason whatsoever, and to the extent not accepted, unused funds transmitted herewith shall be returned to the undersigned in full,

with any interest accrued thereon.

I

have received the Offering Circular.

I

am purchasing the Shares for my own account.

I

hereby represent and warrant that I am not, and am not acting as an agent, representative, intermediary or nominee for any person identified

on the list of blocked persons maintained by the Office of Foreign Assets Control, U.S. Department of Treasury. In addition, I have complied

with all applicable U.S. laws, regulations, directives, and executive orders relating to anti-money laundering including but not limited

to the following laws: (1) the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism

Act of 2001, Public Law 107-56; and (2) Executive Order 13224 (Blocking Property and Prohibiting Transactions with Persons Who Commit,

Threaten to Commit, or Support Terrorism) of September 23, 2001.

By

making the foregoing representations you have not waived any right of action you may have under federal or state securities law. Any

such waiver would be unenforceable. The Company will assert your representations as a defense in any subsequent litigation where such

assertion would be relevant. This Subscription Agreement and all rights hereunder shall be governed by, and interpreted in accordance

with, the laws of the State of New York without giving effect to the principles of conflict of laws.

3. FINRA

Rules 5130 and 5131

This

rule states that “restricted persons” are prohibited from participating in Syndicate or new issue offerings. Please review

the following definition of a “restricted person” on Schedule A prior to signing this form acknowledging you do not fall

into “restricted person” status.

The

undersigned hereby represents and warrants as of the date set forth below that:

|

|

i.

|

The undersigned

is the holder of the account identified below or is authorized to represent the beneficial holders of the account;

|

|

|

ii.

|

Neither the undersigned

nor any beneficial holder of the account is a “restricted person” as that term is described in FINRA Rule 5130 (described

in Schedule A); and

|

|

|

iii.

|

The undersigned understands

FINRA Rule 5130 and the account is eligible to purchase new issues in compliance with such rule.

|

4. Miscellaneous.

This

Subscription Agreement may be executed in any number of counterparts, all of which taken together shall constitute one and the same instrument

and shall become effective when counterparts have been signed by each party and delivered to the other parties hereto, it being understood

that all parties need not sign the same counterpart. Execution may be made by delivery by facsimile or via electronic format.

All

communications hereunder, except as may be otherwise specifically provided herein, shall be in writing and shall be mailed, hand delivered,

sent by a recognized overnight courier service such as FedEx, or sent via facsimile and confirmed by letter, to the party to whom it

is addressed at the following addresses or such other address as such party may advise the other in writing:

To

the Company: as set forth on the signature page hereto.

To

the Investor: as set forth on the signature page hereto.

All

notices hereunder shall be effective upon receipt by the party to which it is addressed.

If

the foregoing correctly sets forth the parties’ agreement, please confirm this by signing and returning to the Company the duplicate

copy of this Subscription Agreement.

[Signature

Page Follows]

[Signature

Page to Investor Subscription Agreement for Clubhouse Media Group, Inc.]

If

the foregoing correctly sets forth the parties’ agreement, please confirm this by signing and returning to us the duplicate copy

of this Subscription Agreement.

Number

of Shares:___________________________

Purchase

Price per Share: $4.00

Aggregate

Purchase Price: $____________________

Investor

Signature:

___________________________________________

Print

Name Above

____________________________________________

Sign

Above

If

Holder is an Entity, specify name and title below:

Name:______________________________________

Title:_______________________________________

[ ]

Check Method of Payment: Check enclosed or

[ ]

Please wire $__________________ from my account held at:________________________________

Account

Title:____________________________ ; Account Number:___________________________

To

the following instructions:

|

Deposit

Account Agent Name

|

Sutter Securities

Clearing, LLC

|

|

Address

|

6

Venture, Suite 265

Irvine,

CA 92618

|

|

Routing Number

|

122242869

|

|

Account Number

|

To Be Provided to Investor

|

|

Account Name

|

Sutter Securities Clearing

as Agent for the Investors in Clubhouse Media Group. Inc.

|

|

Reference

|

REF: Clubhouse Media Group

– [Investor Name]

|

Select

method of delivery of Shares: DRS or DWAC

DWAC

DELIVERY DWAC Instructions:

|

1.

|

Name of DTC

Participant (broker dealer at which the account or accounts to be credited with the Shares are maintained):

|

|

|

|

|

|

|

2.

|

DTC Participant Number:

|

|

|

|

|

|

|

|

|

3.

|

Name of Account at DTC

Participant being credited with the Shares:

|

|

|

|

|

|

|

|

|

4.

|

Account Number of DTC Participant

being credited with the Shares:

|

|

|

|

|

|

|

|

Or

DRS Electronic Book Entry Delivery Instructions:

Name

in which Shares should be issued:

Address:___________________________________;

Street__________________________________

City/State/Zip:_________________________________;

Attention:_______________________________

Telephone

No.:_____________________________________

The

foregoing subscription is hereby accepted by the Company:

|

Clubhouse Media Group, Inc.

|

|

|

|

|

By:

|

|

|

|

Name:

|

|

|

|

Title:

|

|

|

|

|

|

Address Notice: 3651 Lindell Road, D517,

Las Vegas, NV 89103

|

SCHEDULE

A

Rule

5130 defines a “restricted person” as:

|

a)

|

FINRA Member

Firms or other Broker/Dealers

|

|

|

|

|

b)

|

Broker-Dealer Personnel

|

|

●

|

Any officer,

director, General partner, associated person or employee of a member firm or any other Broker/dealer.

|

|

|

|

|

●

|

Any agent of a member firm

or any other Broker/dealer that is engaged in the investment banking or securities business

|

|

|

|

|

●

|

Any immediate family member

of a person specified above. Immediate family members include a person’s parents, mother-in-law or father-in-law, spouse, brother

or sister, brother-in-law or sister-in-law, son-in-law or daughter-in law, and children.

|

|

|

i.

|

Person that

materially supports or receives material support from the immediate family member.

|

|

|

|

|

|

|

ii.

|

Person employed by or associated

with the member, or an affiliate of the member, selling the new issue to the immediate family member.

|

|

|

|

|

|

|

iii.

|

Person that has an ability

to control the allocation of the new issue.

|

|

c)

|

Finders

and Fiduciaries. With respect to the security being offered, a finder or any person acting in a fiduciary capacity to the managing

underwriter, including, but not limited to, attorneys, accountants, and financial consultants; and any immediate family members (or

person(s) receiving material support or receives material support from the family member) of a person identified as a Finder or Fiduciary.

|

|

|

|

|

d)

|

Portfolio Managers

|

|

|

a.

|

Any person

who has authority to buy or sell securities for a bank, savings and loan institution, insurance company, investment company, investment

advisor, or collective investment account.

|

|

|

|

|

|

|

b.

|

Any immediate family member

of a person specified under portfolio Managers that materially supports, or receives material support from such person.

|

|

e)

|

Persons Owning a Broker/Dealer

|

|

|

a.

|

Any person

listed, or required to be listed, in Schedule A of a Form BD, except persons identified by ownership of less than 10%.

|

|

|

|

|

|

|

b.

|

Any person listed, or required

to be listed, in Schedule B of a Form BD, except persons identified by ownership of less than 10%.

|

|

|

|

|

|

|

c.

|

Any person listed, or required

to be listed, in Schedule C of a Form BD that meets the criteria of (e)(bullet point 1) or (e) (bullet point 2)

above.

|

|

|

|

|

|

|

d.

|

Any person that directly

or indirectly owns 10% or more of a public reporting company listed, or required to be listed, in Schedule B of a Form BD.

|

|

|

|

|

|

|

e.

|

Any person that directly

or indirectly owns 25% or more of a public reporting company listed, or required to be listed, in Schedule B of a Form BD.

|

|

|

|

|

|

|

f.

|

Any immediate family member

of a person specified in (5) (bullet points 1-5) unless the person owning the Broker/dealer:

|

|

|

i.

|

Does not materially

support, or receive material support from the immediate family member.

|

|

|

|

|

|

|

ii.

|

Is not an owner of the

member, or an affiliate of the member, selling the new issue to the immediate family member.

|

|

|

|

|

|

|

iii.

|

Has no ability to control

the allocation of the new issue.

|

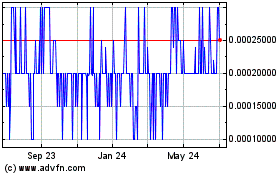

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

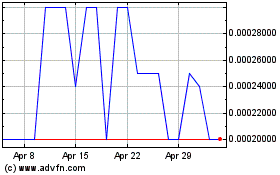

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Apr 2023 to Apr 2024