Amended Current Report Filing (8-k/a)

August 06 2018 - 12:32PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 18, 2018

CARDIFF

LEXINGTON CORPORATION

(Exact

name of Registrant as specified in its charter)

|

Florida

|

000-49709

|

84-1044583

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

401 E. Las Olas Blvd. Suite 1400

Ft. Lauderdale, FL 33301

(Address

of principal executive offices, including zip code)

(844)

628-2100

(Registrant's

telephone number, including area code)

____________________________________________________

(Former Name or former address

if changed from last report.)

Check the appropriate box below

if the 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

☐

|

|

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c)).

|

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 Completion of Acquisition or Disposition of Assets

Cardiff

Lexington Corporation (OTCQB:CDIX) and Platinum Tax Defenders (Private: “Platinum Tax Defenders”) as previously announced

on July 18

th

, 2018 signing a definitive merger agreement under which Platinum Tax Defenders will merge into Cardiff

Lexington as its wholly owned subsidiary has been completed effected July 30

th

, 2018. Audited financials will follow

in an upcoming 8K within the required 75-day period following the closing.

Platinum

Tax Defenders (http://www.platinumtaxdefenders.com) a forward-thinking leader in the Tax Resolution Industry, that not only has

no limit to the size of the tax debt they can assist with, but also provides services to the under-served taxpayer owing less than$10,000.

This unique yet proven business model has enabled Platinum Tax Defenders to experience tremendous growth.

Platinum Tax Defenders

offers a wide variety of

tax resolution

,

bookkeeping

, and

tax preparation

services for individuals and businesses

that are dealing with back taxes or are having issues paying off their current year tax bill. For those owing back taxes it can

be a stressful time when the taxman comes knocking. Taxes are simply a part of life, and they must be paid; yet in today’s

economy, many people of all backgrounds and financial classes are having issues with back tax payments as well as current year

tax bills. The IRS is very aware of the issues that many hard-working individuals and business owners are facing, and today more

than ever they are offering a variety of options to pay down

tax debt

. These include

payment plans

,

Offer in Compromise

(

one-time lump sum payment

),

Currently non-Collectible

hardship status and penalty abatement. The issue that many

people have when it comes to paying taxes is simple financial anxiety. They may worry that the IRS won’t accept their terms,

or they are simply not knowledgeable on how the IRS operates.

In connection with the closing of the acquisition, on July 30

th

,

2018 a Preferred “L” Class of stock with a par value of $0.001was established and issued. The Preferred “L”

Class of stock rights and privileges include voting rights, a conversion ratio of 1:1.25 and were distributed at the adjusted rate

of $0.013 per share for a total of 98.307,692 representing a value of $1,278,000. These Preferred “L” shares have a

lock-up/leak-out limiting the sale of stock for12 months after which conversions and sales are limited to 20% of their portfolio

per year, pursuant to the terms of the Acquisition Agreement.

On June 8, 2018, CDIX’s Board of Directors approved retaining

current founders to serve as senior management of Platinum Tax Defenders.

There are no family relationships of our directors or executive

officers.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Cardiff International, Inc.

By:

/s/ Daniel Thompson

Daniel Thompson

Title:

Chairman

Dated: August

6, 2018

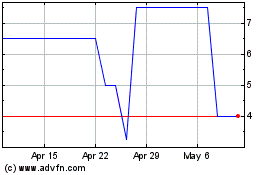

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

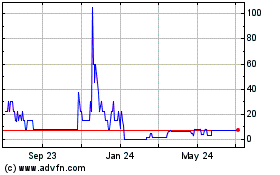

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Apr 2023 to Apr 2024