Reflects Information That Constitutes a Substantive Change From or Addition to the Information Set Forth in the Last Offering Circular (253g2)

December 07 2021 - 6:02AM

Edgar (US Regulatory)

Filed

Pursuant to Rule 253(g)(2)

File

No. 024-11619

OFFERING

CIRCULAR SUPPLEMENT NO. 2

Date

of Qualification of the Offering Circular: October 8, 2021

December

6, 2021

CarbonMeta

Technologies, Inc.

f/k/a

CoroWare,

Inc.

13110

NE 177th Place, Suite 145

Woodinville,

WA 98072

This

document (the “Supplement”) supplements the Offering Circular of CarbonMeta Technologies, Inc. (f/k/a/ CoroWare,

Inc.) (the “Company”) filed on August 31, 2021, as amended on September 3, 2021, September 17, 2021 and October

5, 2021 and as qualified by the Securities and Exchange Commission on October 8, 2021 (the “Offering Circular”) relating

to the offer and sale by us of up to 10,000,000,000 shares of our common stock (the “Common Stock”) at an offering price

per share equal to $0.0005, for an offering amount of $5,000,000 (the “Offering”). Unless otherwise defined in this Supplement,

capitalized terms used herein shall have the same meanings as set forth in the Offering Circular, including the disclosures incorporated

by reference therein.

The

purpose of this supplement is to:

|

|

●

|

Provide

details of a Debt Settlement Agreement; and

|

|

|

●

|

Provide details of a Technology License Agreement entered

into by the Company.

|

Debt

Settlement Agreement

On

October 25, 2021, CarbonMeta Technologies, Inc. (f/k/a/ CoroWare, Inc.) (the “Company”) entered into a Debt Settlement

Agreement (the “Agreement”) with RBB Capital, LLC (the “Creditor”). Under the terms of the Agreement, the Creditor

agreed to accept payment in the amount of $20,000 as full consideration of all outstanding principal and interest ($50,936) on the Convertible

Promissory Note (the “Note”) issued by the Company dated June 2, 2011 and subsequently assigned to the Creditor on April

1, 2014. Payment was made to the Creditor on November 12, 2021.

Technology

License Agreement

On

December 2, 2021, CarbonMeta Technologies, Inc. (f/k/a/ CoroWare, Inc.) (the “Licensee”) entered into a License of

Technology Agreement (the “Agreement”) with Ecomena Limited (the “Licensor”). Under the terms of the Agreement,

the Licensor shall grant the Licensee a five-year license related to the recycling of industrial byproduct and demolition materials into

manufacturing cement free pavers and mortars that absorb carbon dioxide. As consideration for the Licensee granting the Licensor the

license, the Licensee shall pay to the Licensor a £20,000 signing fee and issue the Licensor 160,000,000 share of common stock.

In addition, the Licensor shall pay the Licensee a 5% royalty based on gross revenues generated by product sales.

The Agreement

includes representations, warranties and covenants, and conditions to closing, royalty and payment obligations and termination provisions.

SIGNATURES

Pursuant

to the requirements of Regulation A, the Issuer certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form 1-A and has duly caused this Supplement No.2 to the Offering Circular to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Woodinville, Washington, on December 6, 2021.

|

|

CarbonMeta

Technologies, Inc.

|

|

|

|

|

|

By:

|

/s/

Lloyd Spencer

|

|

|

Name:

|

Lloyd

Spencer

|

|

|

Title:

|

Chief

Executive Officer and Director

|

This

offering statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/

Lloyd Spencer

|

|

Director

|

|

December 6, 2021

|

|

Lloyd

Spencer

|

|

|

|

|

CarbonMeta

Technologies, Inc.

f/k/a

CoroWare,

Inc.

13110

NE 177th Place, Suite 145

Woodinville,

WA 98072

$5,000,000.00

10,000,000,000

SHARES OF COMMON STOCK

$0.0005

PER SHARE

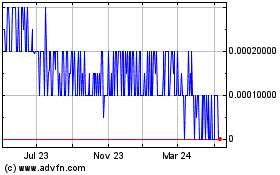

Carbonmeta Technologies (PK) (USOTC:COWI)

Historical Stock Chart

From Mar 2024 to Apr 2024

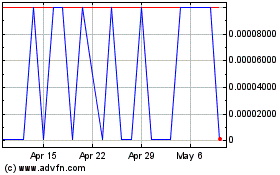

Carbonmeta Technologies (PK) (USOTC:COWI)

Historical Stock Chart

From Apr 2023 to Apr 2024