UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CANNABIS GLOBAL, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

|

|

2836

|

|

83-1754057

|

|

(State or Other Jurisdiction of

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

Incorporation)

|

|

Classification Code Number)

|

|

Identification No.)

|

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Arman Tabatabaei

520 S Grand Avenue, Suite 320

Los Angeles, California 90071

(310) 986-4929

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Mailander Law Office, Inc.

Tad Mailander

4811 49th Street

San Diego, CA 92115

(619) 239-9034

Approximate date of commencement of proposed sale

to the public: From time to time after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check

the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act Registration Statement number of the earlier Registration Statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act Registration Statement number of the earlier Registration Statement for the same offering. ☐

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

Emerging growth company

|

☐

|

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

Calculation of Registration Fee

|

Title of Each Class of

Securities to be Registered

|

|

Amount to be Registered

(1)

|

|

Proposed

Maximum Offering Price Per Unit (2)

|

|

Proposed

Maximum Aggregate Offering Price (1)

|

|

Amount of

Registration Fee

|

|

Common Stock, par value $0.001

|

|

15,000,000 Shares

|

|

$

|

0.04

|

|

|

$

|

600,000

|

|

|

$

|

65.46

|

(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

This

preliminary prospectus relates to the registration of 15,000,000 of common stock in Cannabis Global, Inc. a Nevada Corporation (referred

to herein as the “Company,” “CBGL,” “we,” “our,” “us,” or other similar

pronouns). The Company is registering 15,000,000 shares of common stock, par value $0.001 under a stock purchase

agreement with Dutchess Capital Growth Fund LP, a Delaware limited partnership (“Dutchess”) and an indeterminate

number of additional shares of Common Stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended (the

“Securities Act”) to prevent dilution resulting from stock splits, stock dividends or similar transactions, and in such

an event the number of shares registered shall automatically be increased to cover the additional shares in accordance with Rule

416.

|

|

(2)

|

|

Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities Act. The actual offering price shall equal ninety three percent (93%) of the lowest traded price of the Common Stock the five (5) Business Day prior to the closing date of the sales of the common shares (the “Closing Date”). The Closing Date shall mean the date that is five (5) days after first entire business day Dutchess holds the purchased common shares in its brokerage account and is eligible to trade purchase common shares. Please see sections designated Summary of this Offering and The Offering.

|

|

(3)

|

|

The Registrant formerly filed a Form S-1 registration statement on July 26, 2021(file number 333-258171) and withdrew the registration on August 4, 2021. The registration statement was not made effective. No securities were sold pursuant to the registration statement. Pursuant to Rule 457(p), the Registrant hereby applies the aggregate total dollar amount of the filing fees associated with its prior withdrawn S-1 registration, equaling $109.10 as an offset against the filing fee associated with this registration statement.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION

STATEMENT ON SUCH DATES OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH

SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES

ACT OF 1933 OR UNTIL THE REGISTRATION SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION ACTING PURSUANT TO SECTION 8(a) MAY DETERMINE.

The information in this Prospectus

is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange

Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

Subject to completion, dated August

27, 2021

PRELIMINARY PROSPECTUS

CANNABIS GLOBAL, INC.

520 S. Grand Avenue, Suite 320

Los Angeles, California 90071

(310) 986-4929

This preliminary prospectus relates

to the registration of 15,000,000 shares of the Common Stock of Cannabis Global, Inc., a Nevada corporation (referred to herein as the

“Company,” “we,” “our,” “us,” or other similar pronouns) by Dutchess Capital Growth Fund

LP a Delaware limited partnership (“Dutchess” or the “Investor” or the “Selling Security Holder”)

pursuant to a Common Stock Purchase Agreement (the “Purchase Agreement”), dated August 23, 2021 and an indeterminate number

of additional shares of Common Stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities

Act”) to prevent dilution resulting from stock splits, stock dividends or similar transactions, and in such an event the number

of shares registered shall automatically be increased to cover the additional shares in accordance with Rule 416, pursuant to the Purchase

Agreement.

We will not receive any proceeds

from the sale of the Shares by Dutchess. However, we will receive proceeds from our initial sale of the Common Shares to Dutchess pursuant

to the Purchase Agreement Agreement. Subject to the terms of the Purchase Agreement, we have the right to “drawdown,” or sell

an amount of Common Shares equal to the lesser of ; (i) $250,000 or (ii) 200% of the Average Daily Traded Value of the Stock during the

five (5) days immediately preceding the Drawdown Notice date or (iii) the Beneficial Ownership Limitation defined as shall be 4.99% of

the number of shares of the Common Stock outstanding immediately prior to the issuance of shares of Common Stock issuable pursuant to

a Drawdown Notice. The Purchase Agreement is attached as an exhibit to this registration statement.

The price at which the Company

will sell the Common Shares to Dutchess shall be ninety three percent (93%) of the lowest traded price of the Common Stock the five (5)

Business Days prior to the Closing Date of the sales of the Common Shares. The Closing Date shall the date that is five (5) business days

after the Clearing Date. The Clearing Date is defined as the first entire Business Day that Dutchess holds the purchased Common Shares

in its brokerage account and is eligible to the Purchased Common Shares.

If issued presently, the 15,000,000

Shares registered for resale by Dutchess would represent approximately 17.7% of our issued and outstanding shares of Common Stock as

of August 26, 2021 (84,940,028). Subject to the terms and conditions of the Purchase Agreement, we have the right to sell up to $5,000,000

of shares of our Common Stock to Dutchess.

The Company will be registering

all common stock under the Exchange Act in connection with this Offering. Discounts, concessions, commissions and similar selling expenses

attributable to the sale of common stock covered by this prospectus will be borne by the selling stockholders. We will pay all expenses

(other than discounts, concessions, commissions and similar selling expenses) relating to the registration of the common stock with the

Securities and Exchange Commission.

Dutchess is an “underwriter”

within the meaning of the Securities Act in connection with the resale of the Shares under the Purchase Agreement, and any broker-dealers

or agents that are involved in such resales may be deemed to be “underwriters” within the meaning of the Securities Act in

connection therewith. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the Shares

purchased by Dutchess may be deemed to be underwriting commissions or discounts under the Securities Act. For more information, please

see the section of this Prospectus titled “Plan of Distribution” beginning on page 30.

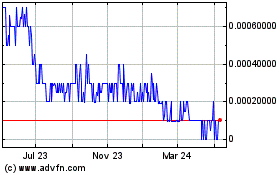

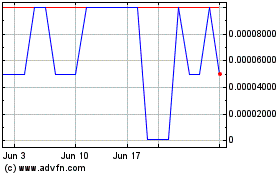

Our Common Stock is currently

quoted on the OTC Markets Pink under the symbol “CBGL”. On August 26, 2021, the closing price as reported was $0.04 per

share.

INVESTING IN OUR SECURITIES

INVOLVES RISKS. YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED UNDER THE HEADING “RISK FACTORS” CONTAINED

ON PAGE 6 HEREIN AND IN OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED AUGUST 31, 2020, AS WELL AS OUR SUBSEQUENTLY FILED PERIODIC

AND CURRENT REPORTS, WHICH WE FILE WITH THE SECURITIES AND EXCHANGE COMMISSION AND ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS.

YOU SHOULD READ THE ENTIRE PROSPECTUS CAREFULLY BEFORE YOU MAKE YOUR INVESTMENT DECISION.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS

IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is August 27, 2021

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY

|

5

|

|

SUMMARY FINANCIAL INFORMATION

|

9

|

|

SUMMARY OF THIS OFFERING

|

10

|

|

RISK FACTORS

|

11

|

|

USE OF PROCEEDS

|

26

|

|

THE OFFERING

|

26

|

|

DILUTION

|

28

|

|

PLAN OF DISTRIBUTION

|

30

|

|

DESCRIPTION OF SECURITIES

|

32

|

|

INTERESTS OF EXPERTS

|

33

|

|

DESCRIPTION OF BUSINESS

|

34

|

|

DESCRIPTION OF PROPERTY

|

46

|

|

LEGAL PROCEEDINGS

|

46

|

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

47

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS

|

48

|

|

CRITICAL ACCOUNTING POLICIES INVOLVING MANAGEMENT ESTIMATES AND ASSUMPTIONS

|

53

|

|

INTERIM FINANCIAL STATEMENTS

|

57

|

|

DIRECTORS AND EXECUTIVE OFFICERS

|

58

|

|

EXECUTIVE AND DIRECTOR COMPENSATION

|

65

|

|

CERTAIN RELATIONSHIPS AND FEE TRANSACTIONS

|

69

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

F-2

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

72

|

You should rely only on the information contained

or incorporated by reference to this Prospectus in deciding whether to purchase our Shares. We have not authorized anyone to provide you

with information different from that contained in this Prospectus. Under no circumstances should the delivery to you of this Prospectus

or any sale made pursuant to this Prospectus create any implication that the information contained in this Prospectus is correct as of

any time after the date of this Prospectus. Our business, financial condition, operating results and prospects may have changed since

that date. To the extent that any facts or events arising after the date of this Prospectus, individually or in the aggregate, represent

a fundamental change in the information presented in this Prospectus, this Prospectus will be updated to the extent required by law.

Cannabis Global, Inc., the Cannabis Global logo,

Hemp You Can Feel™, Gummies You Can Feel™, Comply Bag™ and other trademarks or service marks of Cannabis Global, Inc.

appearing in this Prospectus are the property of Cannabis Global, Inc. This Prospectus also includes trademarks, tradenames and service

marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this Prospectus appear

without the ® and ™ symbols, but those references are not intended to indicate, that we will not assert, to the fullest extent

under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

GENERAL MATTERS

Unless otherwise noted or the

context indicates otherwise “we,” “us,” “our,” “Company” or “CBGL” refers

to Cannabis Global, Inc., a Nevada corporation. On December 4, 2019, our shareholders approved and authorized (i) re-domiciling the Company

from Delaware to Nevada; (ii) changing the name of the Company from MCTC Holdings, Inc. to Cannabis Global, Inc.; and, (iii) seeking a

corresponding change of name and new trading symbol for the Company with FINRA. On March 30, 2020, we filed Articles of Conversion with

the Delaware Secretary of State, electing to convert and re-domicile the Company from a Delaware corporation to a newly formed Nevada

corporation named Cannabis Global, Inc. Concurrently, we filed Articles of Incorporation and Articles of Domestication with the Nevada

Secretary of State incorporating the Company in Nevada under the name Cannabis Global, Inc. and accepting the re-domicile of our former

Delaware corporation. There is no change to our fiscal year end. On August 1, 2020, FINRA approved our name change to Cannabis Global,

Inc. with a corresponding new trading symbol: “CBGL.”

References to “Management”

in this Prospectus mean the senior officers of the Company. See “Directors and Executive Officers.” Any statements in this

Prospectus made by or on behalf of Management are made in such persons’ capacities as officers of the Company and not in their individual

capacities.

Prospective purchasers should

rely only on the information contained in this Prospectus. We have not authorized any other person to provide prospective purchasers with

additional or different information. If anyone provides prospective purchasers with additional or different or inconsistent information,

including information or statements in media articles about us, prospective purchasers should not rely on it. Prospective purchasers should

assume that the information appearing in this Prospectus is accurate only as the date of filing, regardless of its time of delivery or

of any distribution of the Offered Shares. Our business, financial conditions, results of operations and prospects may have changed since

that date.

Our Consolidated Financial Statements

included with this Prospectus are presented in United States dollars.

CAUTIONARY NOTE TO INVESTORS

Our business is focused on the

research and development of cannabis, hemp and associated products, and on the legal sales of cannabis permitted under California law.

Cannabis is a Schedule 1 illegal drug under the Controlled Substances Act, 21 U.S.C. § 811 (hereafter referred to as the “CSA”).

As is discussed below, Hemp containing less than 0.3 percent THC is not a Schedule 1 drug under the CSA.

As of the date of this filing,

thirty-five states, the District of Columbia and four U.S. Territories currently have laws broadly legalizing cannabis in some form for

either medicinal or recreational use governed by state specific laws and regulations. Although legalized in some states, cannabis and

hemp containing more than 0.3 percent THC are “Schedule 1” drugs under the CSA and are illegal under federal law. Active enforcement

of the current CSA regarding cannabis and hemp containing more than 0.3 percent THC may directly and adversely affect our revenues and

profits. The risk of strict enforcement of the CSA in light of Congressional activity, judicial holdings, and stated federal policy remains

uncertain; See “Risk Factors” and “Government Regulation of Cannabis.”

On August 29, 2013, The Department

of Justice set out its prosecutorial priorities in light of various states legalizing cannabis for medicinal and/or recreational use.

The “Cole Memorandum” provided that when states have implemented strong and effective regulatory and enforcement systems to

control the cultivation, distribution, sale, and possession of cannabis, conduct in compliance with those laws and regulations is less

likely to threaten the federal priorities. Indeed, a robust system may affirmatively address those priorities by, for example, implementing

effective measures to prevent diversion of cannabis outside of the regulated system and to other states, prohibiting access to cannabis

by minors, and replacing an illicit cannabis trade that funds criminal enterprises with a tightly regulated market in which revenues are

tracked and accounted for. In those circumstances, consistent with the traditional allocation of federal-state efforts in this area, the

Cole Memorandum provided that enforcement of state law by state and local law enforcement and regulatory bodies should remain the primary

means of addressing cannabis-related activity. If state enforcement efforts are not sufficiently robust to protect against the harms set

forth above, the federal government may seek to challenge the regulatory structure itself in addition to continuing to bring individual

enforcement actions, including criminal prosecutions, focused on those harms.

On January 4, 2018, Attorney General

Jeff Sessions issued a memorandum for all United States Attorneys concerning cannabis enforcement under the CSA. Mr. Sessions rescinded

all previous prosecutorial guidance issued by the Department of Justice regarding cannabis, including the August 29, 2013 “Cole

Memorandum”.

In rescinding the Cole Memorandum,

Mr. Sessions stated that U.S. Attorneys must decide whether or not to pursue prosecution of cannabis activity based upon factors including:

the seriousness of the crime, the deterrent effect of criminal prosecution, and the cumulative impact of particular crimes on the community.

Mr. Sessions reiterated that the cultivation, distribution and possession of marijuana continues to be a crime under the U.S. Controlled

Substances Act.

On March 23, 2018, President Donald

J. Trump signed into law a $1.3 trillion-dollar spending bill that included an amendment known as “Rohrabacher-Blumenauer,”

which prohibits the Justice Department from using federal funds to prevent certain states “from implementing their own State laws

that authorize the use, distribution, possession or cultivation of medical cannabis.”

On December 20, 2018, President

Donald J. Trump signed into law the Agriculture Improvement Act of 2018, otherwise known as the “Farm Bill”. Prior to its

passage, hemp, a member of the cannabis family, was classified as a Schedule 1 controlled substance, and so illegal under the federal

CSA.

With the passage of the Farm Bill,

hemp cultivation containing less than 0.3 percent THC is now broadly permitted. The Farm Bill explicitly allows the transfer of hemp-derived

products across state lines for commercial or other purposes. It also puts no restrictions on the sale, transport, or possession of hemp-derived

products, so long as those items are produced in a manner consistent with the law.

Under Section 10113 of the Farm

Bill, hemp cannot contain more than 0.3 percent THC. THC refers to the chemical compound found in cannabis that produces the psychoactive

“high” associated with cannabis. Any cannabis plant that contains more than 0.3 percent THC would be considered non-hemp cannabis—or

marijuana—under the CSA and would not be legally protected under this new legislation and would be treated as an illegal Schedule

1 drug.

Additionally, there will be significant,

shared state-federal regulatory power over hemp cultivation and production. Under Section 10113 of the Farm Bill, state departments of

agriculture must consult with the state’s governor and chief law enforcement officer to devise a plan that must be submitted to

the Secretary of the United States Department of Agriculture (hereafter referred to as the “USDA”). A state’s plan to

license and regulate hemp can only commence once the Secretary of USDA approves that state’s plan. In states opting not to devise

a hemp regulatory program, USDA will construct a regulatory program under which hemp cultivators in those states must apply for licenses

and comply with a federally run program. This system of shared regulatory programming is similar to options states had in other policy

areas such as health insurance marketplaces under Affordable Care Act, or workplace safety plans under Occupational Health and Safety

Act—both of which had federally-run systems for states opting not to set up their own systems.

The Farm Bill outlines actions

that are considered violations of federal hemp law (including such activities as cultivating without a license or producing cannabis with

more than 0.3 percent THC). The Farm Bill details possible punishments for such violations, pathways for violators to become compliant,

and even which activities qualify as felonies under the law, such as repeated offenses.

One of the goals of the previous

2014 Farm Bill was to generate and protect research into hemp. The 2018 Farm Bill continues this effort. Section 7605 re-extends the protections

for hemp research and the conditions under which such research can and should be conducted. Further, section 7501 of the Farm Bill extends

hemp research by including hemp under the Critical Agricultural Materials Act. This provision recognizes the importance, diversity, and

opportunity of the plant and the products that can be derived from it, but also recognizes that there is a still a lot to learn about

hemp and its products from commercial and market perspectives.

As a result of the November 2020

federal elections, and the election of Joseph R. Biden as President, it is expected that the federal government will move to amend parts

of the CSA and de-schedule cannabis as a Schedule 1 drug.

In late January 2021, Senate Majority

Leader Chuck Schumer said lawmakers are in the process of merging various cannabis bills, including his own legalization legislation.

He is working to enact reform in this Congressional session. This would include the Marijuana Freedom and Opportunity Act, that would

federally de-schedule cannabis, reinvest tax revenue into communities most affected by the drug war, and fund efforts to expunge prior

cannabis records. It is likely that the Marijuana Opportunity, Reinvestment, and Expungement (MORE) Act would be incorporated.

Other federal legislation under

review for possible submission includes the SAFE Banking Act (or Secure and Fair Enforcement Act), a bill that would allow cannabis companies

to access the federally insured banking system and capital markets without the risk of federal enforcement action, and the Strengthening

the Tenth Amendment Through Entrusting States Act (or STATES Act), a bill that seeks protections for businesses and individuals in states

that have legalized and comply with state laws).

Active enforcement of the current

CSA on cannabis and hemp containing more than 0.3 percent THC may directly and adversely affect our revenues and profits. The risk of

strict enforcement of the CSA considering Congressional activity, judicial holdings, and stated federal policy remains uncertain; See

sections entitled “Risk Factors” and “Government Regulation of Cannabis.”

PROSPECTUS SUMMARY

The following summary highlights

material information contained in this Prospectus. This summary does not contain all of the information you should consider before investing

in the securities. Before making an investment decision, you should read the entire Prospectus carefully, including the risk factors section,

the financial statements and the notes to the financial statements. You should also review the other available information referred to

in the section entitled “Where You Can Find More Information” in this Prospectus and any amendment or supplement hereto.

Our Business and Corporate History

Current Operations

Cannabis Global operates multiple

cannabis businesses in California and hemp-related business in the United States. The Company also has an active research and development

program in the areas of cannabis and hemp.

The Company operates and manages

Natural Plant Extract of California, Inc. (NPE) which operates a licensed cannabis manufacturing and distribution business in Lynwood,

California, holding a Type 7 California Manufacturing and a distribution license, allowing for cannabis product distribution anywhere

in the state. We plan to use the Lynwood NPE operation, combined with our internally developed technologies, as a testbed to launch multi-state

operations as soon as possible after the expected removal of cannabis as a Scheduled substance from the federal CSA is completed, and

interstate commerce in cannabis is approved by the federal government. The Company recently commenced operations at the NPE facility effective

immediately with emphasis on product manufacturing and distribution. The Company began taking customer orders for its product manufactured

by NPE on April 21, 2021. These products included several types of cannabis products.

The Company also operates Northern

Lights Distribution, Inc. (NLD) out of its Lynwood facility. During April of 2021, the Company signed a distribution agreement relating

to the distribution of cannabis and products containing cannabis with a local licensed, permitted, and compliant, cannabis delivery services.

The Company is seeking to further expand its business opportunities for both NPE and NLD for its Lynwood location.

We are located at 520 S. Grand

Avenue, Suite 320, Los Angeles, California 90071. Our telephone number is (310) 986-4929 and our website is www.cannabisglobalinc.com.

Our shares of Common Stock are quoted on the OTC Markets Pink Tier, operated by OTC Markets Group, Inc., under the ticker symbol “CBGL.”

Historical Operations

We incorporated in Nevada in 2005

under the name MultiChannel Technologies Corporation, a wholly owned subsidiary of Octillion Corporation, a development stage technology

company focused on the identification, acquisition and development of emerging solar energy and solar related technologies. In April 2005,

we changed our name to MicroChannel Technologies, Inc., and in June 2008, began trading on the OTC Markets under the trading symbol “MCTC.”

On June 27, 2018, we changed domiciles

from the State of Nevada to the State of Delaware, and thereafter reorganized under the Delaware Holding Company Statute. On or about

July 12, 2018, we formed two subsidiaries for the purpose of effecting the reorganization. We incorporated MCTC Holdings, Inc. and MCTC

Holdings Inc. incorporated MicroChannel Corp. We then effected a merger involving the three constituent entities, and under the terms

of the merger we were merged into MicroChannel Corp., with MicroChannel Corp. surviving and our separate corporate existence ceasing.

Following the merger, MCTC Holdings, Inc. became the surviving publicly traded issuer, and all of our assets and liabilities were merged

into MCTC Holdings, Inc.’s wholly owned subsidiary MicroChannel Corp. Our shareholders became the shareholders of MCTC Holdings,

Inc. on a one for one basis.

On May 25, 2019, Lauderdale Holdings,

LLC, a Florida limited liability company, and beneficial owner 70.7% of our issued and outstanding common stock, sold 130,000,000 common

shares, to Mr. Robert Hymers, Mr. Edward Manolos and Mr. Dan Nguyen, all of whom were previously unaffiliated parties of the Company.

Each individual purchased 43,333,333 common shares for $108,333 or an aggregate of $325,000. These series of transactions constituted

a change in control.

On August 9, 2019, we filed a

DBA in California registering the operating name Cannabis Global. On July 1, 2019, the Company entered into a 100% business acquisition

with Action Nutraceuticals, Inc., a company owned by our CEO, Arman Tabatabaei in exchange for $1,000 (see “Related Party Transactions”).

Subsequent to the closing of the

fiscal year ending August 31, 2019, we affected a reverse split of our common shares effective as of September 30, 2019, at the rate of

1:15.

On September 11, 2019, we formed

a subsidiary Aidan & Co, Inc. (“Aidan”) a California corporation as a wholly owned subsidiary of the Company. Aidan will

be engaged in various related business opportunities. Currently Aidan has no operations.

On December 4, 2019, our shareholders

approved and authorized (i) re-domiciling the Company from Delaware to Nevada; (ii) changing the name of the Company from MCTC Holdings,

Inc. to Cannabis Global, Inc.; and, (iii) seeking a corresponding change of name and new trading symbol for the Company with FINRA.

On March 30, 2020, we filed Articles

of Conversion with the Delaware Secretary of State, electing to convert and re-domicile the Company from a Delaware corporation to a newly

formed Nevada corporation named Cannabis Global, Inc. Concurrently, the Registrant filed Articles of Incorporation and Articles of Domestication

with the Nevada Secretary of State incorporating the Registrant in Nevada under the name Cannabis Global, Inc. and accepting the re-domicile

of Registrant’s Delaware corporation. There was no change to the Registrant’s fiscal year end. As a result of our FINRA

corporate action, our name was changed to Cannabis Global, Inc. and our trading symbol changed to “CBGL.”

On April 18, 2020, we formed

a subsidiary Hemp You Can Feel, Inc., a California corporation (“HYCF”), as a wholly owned subsidiary of the Company. HYCF

will be engaged in various related business opportunities. Currently HYCF has no operations.

On May 6, 2020, we signed a joint

venture agreement with RxLeaf, Inc. (“RxLeaf”) a Delaware corporation, creating a joint venture for the purpose of marketing

the Company’s products to consumers. Under the terms of the agreement, the Company will produce products, which will be sold by

RX Leaf via its digital marketing assets. The Company agreed to share the profits from the joint venture on a 50/50 basis.

On July 22, 2020, we signed a

management agreement with Whisper Weed, Inc., a California corporation (“Whisper Weed”). Edward Manolos, our director, is

a shareholder in Whisper Weed (see “Related Party Transactions”). Whisper Weed conducts licensed delivery of cannabis products

in California. The material definitive agreement requires the parties to create a separate entity, CGI Whisper W, Inc. in California as

a wholly owned subsidiary of the Company. The business of CGI Whisper W, Inc. will be to provide management services for the lawful delivery

of cannabis in the State of California. The Company will manage CGI Whisper W, Inc. operations. In exchange for the Company providing

management services to Whisper Weed through the auspices of CGI Whisper W, Inc., the Company will receive as consideration a quarterly

fee of 51% of the net profits earned by Whisper Weed. As separate consideration for the transaction, the Company agreed to issue to Whisper

Weed $150,000 in the Company’s restricted common stock, valued for purposes of issuance based on the average closing price of the

Company’s common stock for the twenty days preceding the entry into the material definitive agreement. Additionally, the Company

agreed to amend its articles of incorporation to designate a new class of preferred shares. The preferred class will be designated and

issued to Whisper Weed in an amount equal to two times the quarterly payment made to the Company. The preferred shares will be convertible

into the Company’s common stock after 6 months and shall be senior to other debts of the Company. The conversion to common stock

will be based on a value of common stock equal to at least two times the actual sales for the previous 90-day period The Company agreed

to include in the designation the obligation to make a single dividend payment to Whisper Weed equal to 90% of the initial quarterly net

profits payable by Whisper Weed. As of August 27, 2021, the Company has not issued the common or preferred shares, and the business is

in the development stage.

On August 31, 2020, we entered

into a stock purchase agreement with Robert L. Hymers III (“Hymers”). Pursuant to the Stock Purchase Agreement, the Company

purchased from Hymers 266,667 shares of common stock of Natural Plant Extract of California Inc., a private California corporation (“NPE”),

in exchange for $2,040,000. The purchased shares of common stock represents 18.8% of the outstanding capital stock of NPE on a fully diluted

basis. NPE operates a licensed psychoactive cannabis manufacturing and distribution business operation in Lynwood, California. In connection

with the stock purchase agreement, we became a party to a Shareholders Agreement, dated June 5, 2020, by and among Alan Tsai, Hymers,

Betterworld Ventures, LLC, Marijuana Company of America, Inc. and NPE. The Shareholders Agreement contains customary rights and obligations,

including restrictions on the transfer of the Shares. On June 11, 2021, the Company and Hymers amended the stock purchase agreement to

exchange the Registrant’s obligations to make monthly payments, for our issuance of a Convertible Note for the same amount, with

principal and interest due on June 11, 2022. The Convertible Note also provides Hymers with the right to convert outstanding principal

and interest into our common stock at a fixed price of $0.04 per share, unless, at the time the amounts due under this Note are eligible

for conversion, the Securities and Exchange Commission has not enacted any amendment to the provisions of Rule 144(d)(iii) or other provision

in a manner that would adversely affect the tacking of variable rate securities. In such event the Conversion Price shall equal 60% of

the lowest trading price of the Company’s Common Stock for the 10 trading days immediately preceding the delivery of a Notice of

Conversion to the Company. The Company also agreed, in the event that it determined to prepare and file a registration statement concerning

its common stock, to include all the shares issuable upon conversion of this Note.

On September 30, 2020, the Company

entered into a securities exchange agreement with Marijuana Company of America, Inc., a Utah corporation (“MCOA”). By virtue

of the agreement, the Company issued 7,222,222 shares of its unregistered common stock to MCOA in exchange for 650,000,000 shares of MCOA

unregistered common stock. The Company and MCOA also entered into a lock up leak out agreement which prevents either party from sales

of the exchanged shares for a period of 12 months. Thereafter the parties may sell not more than the quantity of shares equaling an aggregate

maximum sale value of $20,000 per week, or $80,000 per month until all Shares and Exchange Shares are sold. On June 9, 2021, the parties

amended their securities exchange agreement to delete the lock up leak out agreement, and the requirement to conduct quarterly reviews

of each party’s respective stock price for purposes of evaluating whether additional share issuances are required to maintain the

value of exchanged common shares equal to $650,000. As consideration for the amendment, we issued MCOA 618,000 shares of restricted common

stock. We issued the common stock pursuant to the exemption from the registration requirements of the Securities Act of 1933, as

amended, available to the Company by Section 4(a)(2) promulgated thereunder due to the fact that it was an isolated issuance and did not

involve a public offering of securities.

On November 16, 2020, we entered

into a business acquisition agreement with Ethos Technology LLC, dba Comply Bag, a California limited liability company (“Ethos”).

Ethos is a development stage business in the process of entering the market for cannabis trackable storage bags. By virtue of the agreement,

Ethos sold, assigned, and transferred to the Company all of Ethos’ business, including all of its assets and associated liabilities,

in exchange for the Company’s issuance of an aggregate of 6,000,000 common shares. 3,000,000 shares were due at signing, with 1,500,000

shares being issued to Edward Manolos, and 1,500,000 shares being issued to Thang Nguyen. Mr. Manolos is our director and a related party.

Mr. Nguyen is the brother of Dan Van Nguyen, our director and a related party. After Ethos ships orders for Ethos products equaling $1,000,000

to unaffiliated parties, the Company will issue to Messrs. Manolos and Nguyen an additional 1,500,000 shares of common stock each. At

the closing we sold an aggregate 3,000,000 shares of Company common stock, par value $0.001, equal in value to $177,000 based on the closing

price on November 16, 2020. Of the total sold, 1,500,000 shares of common stock were sold to Edward Manolos and 1,500,000 shares of common

stock were sold to Thang Nguyen. We issued the above shares of its common stock pursuant to the exemption from the registration

requirements of the Securities Act of 1933, as amended, available to the Company by Section 4(a)(2) promulgated thereunder since it was

an isolated issuance and did not involve a public offering of securities.

On January 27, 2021, we closed

a material definitive agreement (MDA) with Edward Manolos, our director and related party. Pursuant to the MDA, the Company purchased

from Mr. Manolos 266,667 shares of common stock in Natural Plant Extract of California Inc., a California corporation (“NPE”),

representing 18.8% of the outstanding capital stock of NPE on a fully diluted basis. NPE operates a licensed psychoactive cannabis manufacturing

and distribution business operation in Lynwood, California. NPE is a privately held corporation. Under the terms of the MDA, we acquired

all beneficial ownership over the NPE shares in exchange for a purchase price of two million forty thousand dollars ($2,040,000). In lieu

of a cash payment, we agreed to issue Mr. Manolos 11,383,929 restricted common shares, valued for purposes of the MDA at $0.1792 per share.

In connection with the MDA, we became a party to a Shareholders Agreement by and among Alan Tsai, Hymers, Betterworld Ventures, LLC, Marijuana

Company of America, Inc. and NPE. The Shareholders Agreement contains customary rights and obligations, including restrictions on the

transfer of the Shares. Mr. Manolos is our director as well as a directly of Marijuana Company of America and is therefore a related party.

On February 16, 2021, we purchased

266,667 shares of common stock of Natural Plant Extract of California Inc., a California corporation (“NPE”), from Alan Tsai,

in exchange for the issuance of 1,436,368 common shares. Other than with respect to the transaction, there was no material relationship

between Mr. Tsai and the Registrant. By virtue of the transaction, the Registrant acquired 18.8% of the outstanding capital stock of NPE,

bringing its total beneficial ownership in NPE to 56.5%. NPE operates a licensed psychoactive cannabis manufacturing and distribution

business operation in Lynwood, California. By virtue of its 56.5% ownership over NPE, the Company will control production, manufacturing

and distribution of both NPE and Company products. In connection with the MDA, the Registrant became a party to a Shareholders Agreement

by and among Edward Manolos, a director of the Company, Robert L. Hymers III, Betterworld Ventures, LLC, Marijuana Company of America,

Inc. and NPE. The Shareholders Agreement contains customary rights and obligations concerning operations, management, including restrictions

on the transfer of the Shares.

On May 12, 2021, The Company

and Marijuana Company of America (MCOA) agreed to operate a joint venture through a new Nevada corporation named MCOA Lynwood

Services, Inc. The parties agreed to finance a regulated and licensed laboratory to produce various cannabis products under the

legal framework outlined by the City of Lynwood, California, Los Angeles County and the State of California. We own a controlling

interest in Natural Plant Extract of California, Inc., which operates a licensed cannabis manufacturing operation in Lynwood,

California. As its contribution the joint venture, MCOA agreed to purchase and install equipment for joint venture operations, which

will then be rented to the joint venture, and also provide funding relating to marketing the products produced by the capital

equipment. We agreed to provide use of our manufacturing and distribution licenses; access to the Lynwood, California facility; use

of the specific areas within the Lynwood Facility suitable for the types of manufacturing selected by the joint venture; and,

management expertise require to carry on the joint venture’s operations. Our ownership of the joint venture was agreed to be

60% to us and 40% with MCOA. Royalties from profits realized as the result of sales of products from the joint venture were also

agreed to be distributed as 60% to us and 40% to MCOA. MCOA contributed $135,000 of cash to the joint venture for its

operations.

For more information about current

business operations, please see the section of this Prospectus entitled “Description of Business” beginning on page 34.

SUMMARY FINANCIAL INFORMATION

The following tables summarize

our financial data for the periods presented and should be read together with the sections of this Prospectus entitled “Risk Factors,”

“Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

as well as our financial statements and related notes appearing elsewhere in this Prospectus. We derived the summary financial information

for the period ended August 31, 2020, from our audited financial statements and related notes appearing elsewhere in this Prospectus.

The audited historical results are not necessarily indicative of the results we expect in the future.

The Company sustained continued

operating losses during the fiscal years ended August 31, 2020, and 2019. The Company’s continuation as a going concern is dependent

on its ability to generate sufficient cash flows from operations to meet its obligations, in which it has not been successful, and/or

obtaining additional financing from its shareholders or other sources, as may be required.

The Company’s consolidated

financial statements have been prepared assuming that the Company will continue as a going concern; however, the above condition raises

substantial doubt about the Company’s ability to do so. The consolidated financial statements do not include any adjustments to

reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities

that may result should the Company be unable to continue as a going concern.

|

CONSOLIDATED BALANCE SHEETS

|

|

May 31,

2021

|

|

Aug. 31,

2020

|

|

Aug. 31,

2019

|

|

Cash

|

|

$

|

268,007

|

|

|

$

|

2,338

|

|

|

$

|

152,082

|

|

|

Total Current Assets

|

|

|

909,888

|

|

|

|

77,676

|

|

|

|

154,381

|

|

|

TOTAL ASSETS

|

|

|

12,247,405

|

|

|

|

2,325,185

|

|

|

|

214,829

|

|

|

Total Liabilities

|

|

|

8,671,622

|

|

|

|

3,760,471

|

|

|

|

153,414

|

|

|

Working Capital (Deficit)

|

|

|

(6,430,490

|

)

|

|

|

(3,682,795

|

)

|

|

|

967

|

|

|

Stockholder’s Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Stockholder’s Deficit

|

|

|

(365,828

|

)

|

|

|

(1,435,286

|

)

|

|

|

61,415

|

|

|

Accumulated Deficit

|

|

|

(11,329,224

|

)

|

|

|

(6,056,949

|

)

|

|

|

(1,127,601

|

)

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

9 Months Ended

|

|

|

|

May, 31,

2021

|

|

May 31,

2020

|

|

Revenues

|

|

$

|

970,717

|

|

|

$

|

24,753

|

|

|

Total Operating Expenses

|

|

|

1,585,866

|

|

|

|

2,023,358

|

|

|

Operating Loss

|

|

|

(1,352,691

|

)

|

|

|

(2,013,293

|

)

|

|

Total Other Income (Expense)

|

|

|

(3,827,266)

|

|

|

|

(1,882,909

|

)

|

|

Net Income (Loss)

|

|

$

|

(5,179,957

|

)

|

|

$

|

(3,896,202

|

)

|

|

Basic & Diluted Loss per Common Share

|

|

$

|

(0.11)

|

|

|

$

|

(0.31

|

)

|

|

Weighted Average Common Shares

|

|

|

49,661,819

|

|

|

|

12,549,491

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

12 Months Ended

|

|

|

|

Aug 31,

2020

|

|

Aug 31,

2019

|

|

Revenues

|

|

$

|

27,004

|

|

|

$

|

-

|

|

|

Total Operating Expenses

|

|

|

3,626,375

|

|

|

|

549,918

|

|

|

Operating Loss

|

|

|

(3,623,892

|

)

|

|

|

(549,918

|

)

|

|

Total Other Income (Expense)

|

|

|

(1,305,456

|

)

|

|

|

160,321

|

|

|

Net Income (Loss)

|

|

$

|

(4,929,348

|

)

|

|

$

|

(389,597

|

)

|

|

Basic & Diluted Loss per Common Share

|

|

$

|

(0.29

|

)

|

|

$

|

(0.03

|

)

|

|

Weighted Average Common Shares

|

|

|

17,101,743

|

|

|

|

12,261,293

|

|

SUMMARY OF THIS OFFERING

|

Securities being offered by the Selling Security Holder

|

|

Up to 15,000,000 shares of Common Stock. Our Common Stock is described in further detail in the section of this Prospectus titled “Description of Securities – Common Stock.”

|

|

|

|

|

|

Common Stock Outstanding Before the Offering

|

|

84,940,028 Shares

|

|

|

|

|

|

Common Stock Outstanding After the Offering

|

|

99,940,028 Shares, assuming the sale of all of

the Shares being registered in this Registration Statement.

|

|

|

|

|

|

Offering Price per Share

|

|

The Selling Security Holder may sell all or

a portion of the Shares being offered pursuant to this Prospectus at fixed prices, at prevailing market prices at the time of sale, at

varying prices or at negotiated

prices.

|

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any proceeds from the resale

or other disposition of the Shares covered by this Prospectus by the Selling Security Holder.

We will receive proceeds from the sale of Shares

to the Selling Security Holder and it has committed to purchase up to $5,000,000 of shares of our Common Stock over a period of time

terminating on the earlier of the date on which Dutchess shall have purchased Shares under the Purchase Agreement for an aggregate purchase

Price of $5,000,000 or for a period of 36 months, beginning on the effective date of this Registration Statement.

The price at which the Company will sell the Common Shares To Dutchess

shall be ninety three percent (93%) of the lowest Traded price of the Common Stock the five (5) Business Days prior to the Closing Date

of the sales of the Common Shares as reported by Bloomberg Finance L.P. The Closing Date shall be the date that is five (5) business

days after the Clearing Date. The Clearing Date is defined as the first entire Business Day that Dutchess holds the purchased Common

Shares in its brokerage account and is eligible to sell the Purchased Common Shares. For further information, see “The Offering”

beginning on page 26.

|

|

|

|

|

|

OTC Markets Symbol

|

|

CBGL: OTC Markets PINK

|

|

Plan of Distribution

|

|

Dutchess may, from time to time, sell any or

all of the Shares on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These

sales may be at fixed or negotiated prices.

For further information, see “Plan of

Distribution” beginning on page 30.

|

|

|

|

|

|

|

|

Risk Factors

|

|

You should read the “Risk Factors” section of this Prospectus and the other information in this Prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our Common Stock.

|

RISK FACTORS

Investing in our Common Stock

involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this Prospectus,

including our financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations,” before deciding whether to invest in our shares of Common Stock. The occurrence of any of the events

or developments described below could harm our business, financial condition, operating results, and growth prospects. In such an event,

the market price of our shares of Common Stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial also may impair our business operations.

There could be unidentified risks involved with

an investment in our securities.

The following risk factors are

not a complete list or explanation of the risks involved with an investment in our securities. Additional risks will likely be experienced

that are not presently foreseen by the Company. Prospective investors must not construe the information provided herein as constituting

investment, legal, tax or other professional advice. Before making any decision to invest in our securities, you should read this entire

prospectus and consult with your own investment, legal, tax and other professional advisors. An investment in our securities is suitable

only for investors who can assume the financial risks of an investment in the Company for an indefinite period and who can afford to lose

their entire investment. The Company makes no representations or warranties of any kind with respect to the likelihood of the success

or the business of the Company, the value of our securities, any financial returns that may be generated or any tax benefits or consequences

that may result from an investment in the Company.

RISKS RELATED TO OUR BUSINESS

The novel coronavirus (COVID-19)

pandemic may have unexpected effects on our business, financial condition and results of operations.

In March 2020, the World Health

Organization declared COVID-19 a global pandemic, and governmental authorities around the world have implemented measures to reduce the

spread of COVID-19. These measures have adversely affected workforces, customers, supply chains, consumer sentiment, economies, and financial

markets, and, along with decreased consumer spending, have led to an economic downturn across many global economies.

The COVID-19 pandemic has rapidly

escalated in the United States, creating significant uncertainty and economic disruption, and leading to record levels of unemployment

nationally. Numerous state and local jurisdictions have imposed, and others in the future may impose, shelter-in-place orders, quarantines,

shut-downs of non-essential businesses, and similar government orders and restrictions on their residents to control the spread of COVID-19.

Such orders or restrictions have resulted in temporary facility closures (including certain of our third-party VRCs), work stoppages,

slowdowns and travel restrictions, among other effects, thereby adversely impacting our operations. In addition, we expect to be impacted

by a downturn in the United States economy, which could have an adverse impact on discretionary consumer spending and may have a significant

impact on our business operations and/or our ability to generate revenues and profits.

In response to the COVID-19 disruptions,

we have implemented a number of measures designed to protect the health and safety of our staff and contractors. These measures include

restrictions on non-essential business travel, the institution of work-from-home policies wherever feasible and the implementation of

strategies for workplace safety at our facilities that remain open. We are following the guidance from public health officials and government

agencies, including implementation of enhanced cleaning measures, social distancing guidelines and wearing of masks.

The extent to which COVID-19 ultimately

impacts our business, financial condition and results of operations will depend on future developments, which are highly uncertain and

unpredictable, including new information which may emerge concerning the severity and duration of the COVID-19 outbreak and the effectiveness

of actions taken to contain the COVID-19 outbreak or treat its impact, among others. Additionally, while the extent to which COVID-19

ultimately impacts our operations will depend on a number of factors, many of which will be outside of our control. The COVID-19 outbreak

is evolving and new information emerges daily; accordingly, the ultimate consequences of the COVID-19 outbreak cannot be predicted with

certainty.

In addition to the COVID-19 disruptions

possibility adversely impacting our business and financial results, they may also have the effect of heightening many of the other risks

described in “Risk Factors,” including risks relating to changes due to our limited operating history; our ability to generate

sufficient revenue, to generate positive cash flow; our relationships with third parties, and many other factors. We will endeavor to

minimize these impacts, but there can be no assurance relative to the potential impacts that may be incurred.

Uncertainty of profitability

Our business strategy may result

in meaningful volatility of revenues, loses and/or earnings. As we will only develop a limited number of business efforts, services and

products at a time, our overall success will depend on a limited number of business initiatives, which may cause variability and unsteady

profits and losses depending on the products and/or services offered and their market acceptance.

Our revenues and our profitability

may be adversely affected by economic conditions and changes in the market for our products. Our business is also subject to general economic

risks that could adversely impact the results of operations and financial condition.

Because of the anticipated nature

of the products that we offer and attempt to develop, it is difficult to accurately forecast revenues and operating results and these

items could fluctuate in the future due to a number of factors. These factors may include, among other things, the following:

|

•

|

|

Our ability to raise sufficient capital to take advantage of opportunities and generate sufficient

revenues to cover expenses.

|

|

•

|

|

Our ability to source strong opportunities with sufficient risk adjusted returns.

|

|

•

|

|

Our ability to manage our capital and liquidity requirements based on changing market conditions.

|

|

•

|

|

The amount and timing of operating and other costs and expenses.

|

|

•

|

|

The nature and extent of competition from other companies that may reduce market share and

create pressure on pricing and investment return expectations.

|

We have incurred losses

since our inception, have yet to achieve profitable operations and anticipate that we will continue to incur losses for the foreseeable

future.

Even if we obtain more customers

or increase sales to our existing customers, there is no guarantee we will be able to generate a profit. Because we are a small company

and have limited capital, we must limit our products and services. Because we will be limiting our marketing activities, we may not be

able to attract enough customers to buy our products to operate profitably.

We do not have sufficient

cash on hand.

As of May 31, 2021, we had $358,813

of cash on hand. Our cash resources are not sufficient for us to execute our business plan. If we do not generate sufficient

cash from our intended financing activities and sales, we will be unable to continue our operations. We estimate that within the

next 12 months we will need approximately $3,335,129 in cash from either investors or operations to fully execute our business plan and

to repay debts. While we intend to engage in future financings, there is no assurance that these will occur. Nor can we assure

our shareholders that we will not be required to obtain additional financing on terms that are dilutive of their interests. You should

recognize that if we are unable to generate sufficient revenues or obtain debt or equity financing, we will not be able to earn profits

and may not be able to continue operations.

We may not be able to continue

our business as a going concern.

The Company's financial statements

are prepared using the generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets

and liquidation of liabilities in the normal course of business. However, the Company has accumulated a deficit of $11,329,224 as of May

31, 2021. Management plans to raise additional capital through the sale of shares of Common Stock to pursue business development activities,

but there are no assurances of success relative to the efforts.

If we are not able to raise

enough funds, we may not be able to successfully develop and market our products and our business may fail.

We do not have any commitments

for financing, and we will need additional financing to meet our obligations and to continue our business.

Our business may suffer

if we are unable to attract or retain talented personnel.

Our success will depend in large

measure on the abilities, expertise, judgment, discretion, integrity, and good faith of Management, as well as other personnel. We have

a small management team, and the loss of a key individual or our inability to attract suitably qualified replacements or additional staff

could adversely affect our business. Our success also depends on the ability of Management to form and maintain key commercial relationships

within the marketplace. No assurance can be given that key personnel will continue their association or employment with us or that replacement

personnel with comparable skills will be found. If we are unable to attract and retain key personnel and additional employees, our business

may be adversely affected. We do not maintain key-man life insurance on any of our executive employees.

The loss of key Management

personnel could adversely affect our business.

We depend on the continued services

of our executive officer and senior consulting team and are responsible for our day-to-day operations. Our success depends in part on

our ability to retain executive officers, to compensate executive officers at attractive levels, and to continue to attract additional

qualified individuals to our management team. Although we have entered into an employment agreement with our Chief Executive Officer and

Chief Financial Officer, and do not believe our Chief Executive Officer or Chief Financial Officer is planning to leave or retire in the

near term, we cannot assure you that he will remain with us. The loss or limitation of the services of any of our executives or members

of our senior management team, or the inability to attract additional qualified management personnel, could have a material adverse effect

on our business, financial condition, results of operations, or independent associate relations.

The lack of available and

cost-effective directors and officer’s insurance coverage in our industry may cause us to be unable to attract and retain qualified

executives, and this may result in our inability to further develop our business.

Our business depends on attracting

independent directors, executives, and senior management to advance our business plans. We currently do not have directors and officer’s

insurance to protect our directors, officers, and the company against the possible third-party claims. This is due to the significant

lack of availability of such policies in the cannabis industry at reasonably competitive prices. As a result, the Company and our executive

directors and officers are susceptible to liability claims arising by third parties, and as a result, we may be unable to attract and

retain qualified independent directors and executive management causing the development of our business plans to be impeded as a result.

If we fail to maintain satisfactory

relationships with future customers, our business may be harmed.

Due to competition or other factors,

we could lose business from our future customers, either partially or completely. The future loss of one or more of our significant customers

or a substantial future reduction of orders by any of our significant customers could harm our business and results of operations. Moreover,

our customers may vary their order levels significantly from period to period and customers may not continue to place orders with us in

the future at the same levels as in prior periods. In the event that in the future we lose any of our larger customers, we may not be

able to replace that revenue source. This could harm our financial results.

Management of growth will

be necessary for us to be competitive.

Successful expansion of our business

will depend on our ability to effectively attract and manage staff, strategic business relationships, and shareholders. Specifically,

we will need to hire skilled management and technical personnel as well as manage partnerships to navigate shifts in the general economic

environment. Expansion has the potential to place significant strains on financial, management, and operational resources, yet failure

to expand will inhibit our profitability goals.

We cannot guarantee that

we will succeed in achieving our goals, and our failure to do so would have a material adverse effect on our business, prospects, financial

condition, and operating results.

Some of business initiatives in

the hemp and cannabis sectors are new and are only in the early stages of commercialization. As is typical in a new and rapidly evolving

industry, demand and market acceptance for recently introduced products and services are subject to a high level of uncertainty and risk.

Because the market for our Company is new and evolving, it is difficult to predict with any certainty the size of this market and its

growth rate, if any. We cannot guarantee that a market for our Company will develop or that demand for our products will emerge or be

sustainable. If the market fails to develop, develops more slowly than expected or becomes saturated with competitors, our business, financial

condition, and operating results would be materially adversely affected.

We are attempting to enter

into several new business areas. We plan to address these new business areas with unproven technologies. Our inability to master the technical

details of these new technologies could negatively impact our business.

We are attempting to enter several

new areas of the hemp and cannabis markets, including THC remediation, the production of highly bioavailable cannabis infused drinks and

the production of functional foods based on nanoparticle technologies. These businesses will require extensive technical expertise. There

can be no assurances we will have the capital, personnel resources, or expertise to be successful relative to these advanced technologies.

Our chosen method for cannabinoid

delivery is controversial with an unproven safety of efficacy.

The safety profile relative to

oral consumption of polymeric or other forms of nanoparticles is unproven. There can be no guarantee of a proven safety profile for any

of our emerging technologies.

We may be unable to respond

to the rapid technological change in the industry and such change may increase costs and competition that may adversely affect our business.

Rapidly changing technologies,

frequent new product and service introductions and evolving industry standards characterize our market. The continued growth of the Internet

and intense competition in our industry exacerbates these market characteristics. Our future success will depend on our ability to adapt

to rapidly changing technologies by continually improving the performance features and reliability of our products and services. We may

experience difficulties that could delay or prevent the successful development, introduction or marketing of our products and services.

In addition, any new enhancements must meet the requirements of our current and prospective customers and must achieve significant market

acceptance. We could also incur substantial costs if we need to modify our products and services or infrastructures to adapt to these

changes. We also expect that new competitors may introduce products or services that are directly or indirectly competitive with us. These

competitors may succeed in developing products and services that have greater functionality or are less costly than our products and services

and may be more successful in marketing such products and services. This competition could increase price competition and reduce anticipated

profit margins.

The failure to enforce and

maintain our intellectual property rights could adversely affect the value of the Company.

The success of our business will

partially depend on our ability to protect our intellectual property. As of the date hereof, we do not own any federally registered patents

or trademarks. We do have provisional patent and trademark applications pending. The unauthorized use of our intellectual property could

diminish the value of our business, which would have a material adverse effect on our financial condition and results of operation.

We have incurred losses

since our inception, have yet to achieve profitable operations and anticipate that we will continue to incur losses for the foreseeable

future.

Even if we obtain customers, there

is no guarantee that we will be able to generate a profit. Because we are a small company and have limited capital, we must limit our

products and services. Because we will be limiting our marketing activities, we may not be able to attract enough customers to buy our

products to operate profitably. Further, we are subject to raw material pricing which can erode the profitability of our products and

put additional negative pressure on profitability. If we cannot operate profitably, we may have to suspend or cease operations.

For the fiscal year ended August

31, 2020 we incurred an operating loss of $3,623,892. For the fiscal year ended August 31, 2019, we incurred an operating loss of $549,918.

At August 31, 2020 we had an accumulated deficit of $6,056,949. Although we anticipate generating revenue in future periods, such revenues

may be insufficient to make the Company profitable. We plan to increase our expenses associated with the development of our business.

There is no assurance we will be able to derive revenues from the development of our business to successfully achieve positive cash flow

or that our business will be successful. If we achieve profitability, we may be unable to sustain or increase profits on a quarterly or

annual basis.

We may not able to deduct

some of our business expenses.

Section 280E of the Internal Revenue

Code prohibits marijuana businesses from deducting their ordinary and necessary business expenses, forcing us to pay higher effective

federal tax rates than similar companies in other industries. The effective tax rate on a marijuana business depends on how large its

ratio of nondeductible expenses is to its total revenues. Therefore, our marijuana business may be less profitable than it could otherwise

be.

Laws and regulations affecting

the medical and adult use marijuana industry are constantly changing, which could detrimentally affect our operation.

Local, state, and federal medical

and adult use marijuana laws and regulations are broad in scope and subject to evolving interpretations, which could require us to incur

substantial costs associated with compliance or alter certain aspects of our business plan. In addition, violations of these laws, or

allegations of such violations, could disrupt certain aspects of our business plan and result in a material adverse effect on certain

aspects of our planned operations. In addition, it is possible that regulations may be enacted in the future that will be directly applicable

to certain aspects of our businesses. We cannot predict the nature of any future laws, regulations, interpretations, or applications,

nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated,

could have on our business.

We are reliant on single

source suppliers for several components of our products. In the future, such supplies could be difficult or impossible to obtain, which

would affect our ability to produce our products.

We purchase components for our

products from several larger corporations and from single source providers. Any difficulty in obtaining such supplies could restrict our

ability to manufacture products for sales, which would affect our ability to generate revenues. There can be no assurances such suppliers

of the components we require will not become difficult or impossible to obtain in the future.

If we incur substantial

liability from litigation, complaints, or enforcement actions, our financial condition could suffer.

Our participation in the medical

and adult use marijuana industry may lead to litigation, formal or informal complaints, enforcement actions, and inquiries by various

federal, state, or local governmental authorities against us. Litigation, complaints, and enforcement actions could consume considerable

amounts of financial and other corporate resources, which could have a negative impact on our sales, revenue, profitability, and growth

prospects.

RISKS OF GOVERNMENT ACTION AND REGULATORY UNCERTAINTY

We could be found to be

violating laws related to cannabis.

Our future business activities,

including providing management services for cannabis delivery services in California, and the research and development of cannabis infused

drinks, will fall outside of the CSA and Farm Bill. Currently, many U.S. states plus the District of Columbia and Guam, have laws and/or

regulations that recognize, in one form or another, legitimate medical and adult uses for cannabis and consumer use of cannabis in connection

with medical treatment or for recreational use. Many other states are considering similar legislation. Conversely, under the CSA, the

policies and regulations of the federal government and its agencies are that cannabis has no medical benefit and a range of activities

including cultivation and the personal use of cannabis is illegal and prohibited. Unless and until Congress amends the CSA with respect

to cannabis, as to the timing or scope of any such potential amendments there can be no assurance, there is a risk that federal authorities

may enforce current federal law, and we may be deemed to be producing, cultivating, dispensing and/or aiding or abetting the possession

and distribution of cannabis in violation of federal law. Active enforcement of the current CSA on cannabis may thus directly and adversely

affect our revenues and profits.

High tax rates on cannabis

and compliance costs in California may limit our customer base.