false

Q3

--12-31

0001509957

0001509957

2024-01-01

2024-09-30

0001509957

2024-11-19

0001509957

2024-09-30

0001509957

2023-12-31

0001509957

us-gaap:SeriesAPreferredStockMember

2024-09-30

0001509957

us-gaap:SeriesAPreferredStockMember

2023-12-31

0001509957

us-gaap:SeriesCPreferredStockMember

2024-09-30

0001509957

us-gaap:SeriesCPreferredStockMember

2023-12-31

0001509957

us-gaap:SeriesDPreferredStockMember

2024-09-30

0001509957

us-gaap:SeriesDPreferredStockMember

2023-12-31

0001509957

2024-07-01

2024-09-30

0001509957

2023-07-01

2023-09-30

0001509957

2023-01-01

2023-09-30

0001509957

us-gaap:ProductMember

2024-07-01

2024-09-30

0001509957

us-gaap:ProductMember

2023-07-01

2023-09-30

0001509957

us-gaap:ProductMember

2024-01-01

2024-09-30

0001509957

us-gaap:ProductMember

2023-01-01

2023-09-30

0001509957

us-gaap:ServiceMember

2024-07-01

2024-09-30

0001509957

us-gaap:ServiceMember

2023-07-01

2023-09-30

0001509957

us-gaap:ServiceMember

2024-01-01

2024-09-30

0001509957

us-gaap:ServiceMember

2023-01-01

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2024-06-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2024-06-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2024-06-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2024-06-30

0001509957

us-gaap:CommonStockMember

2024-06-30

0001509957

CANB:CommonStockIssuableMember

2024-06-30

0001509957

us-gaap:TreasuryStockCommonMember

2024-06-30

0001509957

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001509957

us-gaap:RetainedEarningsMember

2024-06-30

0001509957

2024-06-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-06-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-06-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-06-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2023-06-30

0001509957

us-gaap:CommonStockMember

2023-06-30

0001509957

CANB:CommonStockIssuableMember

2023-06-30

0001509957

us-gaap:TreasuryStockCommonMember

2023-06-30

0001509957

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001509957

us-gaap:RetainedEarningsMember

2023-06-30

0001509957

2023-06-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-12-31

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-12-31

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-12-31

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2023-12-31

0001509957

us-gaap:CommonStockMember

2023-12-31

0001509957

CANB:CommonStockIssuableMember

2023-12-31

0001509957

us-gaap:TreasuryStockCommonMember

2023-12-31

0001509957

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001509957

us-gaap:RetainedEarningsMember

2023-12-31

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2022-12-31

0001509957

us-gaap:CommonStockMember

2022-12-31

0001509957

CANB:CommonStockIssuableMember

2022-12-31

0001509957

us-gaap:TreasuryStockCommonMember

2022-12-31

0001509957

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001509957

us-gaap:RetainedEarningsMember

2022-12-31

0001509957

2022-12-31

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2024-07-01

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2024-07-01

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2024-07-01

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2024-07-01

2024-09-30

0001509957

us-gaap:CommonStockMember

2024-07-01

2024-09-30

0001509957

CANB:CommonStockIssuableMember

2024-07-01

2024-09-30

0001509957

us-gaap:TreasuryStockCommonMember

2024-07-01

2024-09-30

0001509957

us-gaap:AdditionalPaidInCapitalMember

2024-07-01

2024-09-30

0001509957

us-gaap:RetainedEarningsMember

2024-07-01

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-07-01

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-07-01

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-07-01

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2023-07-01

2023-09-30

0001509957

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001509957

CANB:CommonStockIssuableMember

2023-07-01

2023-09-30

0001509957

us-gaap:TreasuryStockCommonMember

2023-07-01

2023-09-30

0001509957

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001509957

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2024-01-01

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2024-01-01

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2024-01-01

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2024-01-01

2024-09-30

0001509957

us-gaap:CommonStockMember

2024-01-01

2024-09-30

0001509957

CANB:CommonStockIssuableMember

2024-01-01

2024-09-30

0001509957

us-gaap:TreasuryStockCommonMember

2024-01-01

2024-09-30

0001509957

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-09-30

0001509957

us-gaap:RetainedEarningsMember

2024-01-01

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-01-01

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-01-01

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-01-01

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2023-01-01

2023-09-30

0001509957

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001509957

CANB:CommonStockIssuableMember

2023-01-01

2023-09-30

0001509957

us-gaap:TreasuryStockCommonMember

2023-01-01

2023-09-30

0001509957

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-09-30

0001509957

us-gaap:RetainedEarningsMember

2023-01-01

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2024-09-30

0001509957

us-gaap:CommonStockMember

2024-09-30

0001509957

CANB:CommonStockIssuableMember

2024-09-30

0001509957

us-gaap:TreasuryStockCommonMember

2024-09-30

0001509957

us-gaap:AdditionalPaidInCapitalMember

2024-09-30

0001509957

us-gaap:RetainedEarningsMember

2024-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-09-30

0001509957

us-gaap:PreferredStockMember

us-gaap:SeriesDPreferredStockMember

2023-09-30

0001509957

us-gaap:CommonStockMember

2023-09-30

0001509957

CANB:CommonStockIssuableMember

2023-09-30

0001509957

us-gaap:TreasuryStockCommonMember

2023-09-30

0001509957

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001509957

us-gaap:RetainedEarningsMember

2023-09-30

0001509957

2023-09-30

0001509957

CANB:NascentPharmaLLCMember

2024-02-29

0001509957

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2024-03-01

2024-03-31

0001509957

2023-12-31

2023-12-31

0001509957

us-gaap:FairValueInputsLevel1Member

2024-09-30

0001509957

us-gaap:FairValueInputsLevel2Member

2024-09-30

0001509957

us-gaap:FairValueInputsLevel3Member

2024-09-30

0001509957

us-gaap:FairValueInputsLevel1Member

2023-12-31

0001509957

us-gaap:FairValueInputsLevel2Member

2023-12-31

0001509957

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputSharePriceMember

2024-09-30

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputSharePriceMember

2023-12-31

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputExercisePriceMember

2024-09-30

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputExercisePriceMember

2023-12-31

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputExpectedTermMember

2024-09-30

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputExpectedTermMember

2023-12-31

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputPriceVolatilityMember

2024-09-30

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputPriceVolatilityMember

2023-12-31

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2024-09-30

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-12-31

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-09-30

0001509957

us-gaap:WarrantMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-12-31

0001509957

CANB:ASOPNoteIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2020-12-31

0001509957

CANB:ASOPNoteIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2020-12-01

2020-12-31

0001509957

CANB:ASOPNoteIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2024-01-01

2024-09-30

0001509957

CANB:ASOFNoteIMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2020-12-31

0001509957

CANB:ASOFNoteIMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2020-12-01

2020-12-31

0001509957

CANB:ASOFNoteIMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2024-01-01

2024-09-30

0001509957

CANB:ASOPNoteIIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-31

0001509957

CANB:ASOPNoteIIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-01

2021-05-31

0001509957

CANB:ASOPNoteIIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2024-01-01

2024-09-30

0001509957

CANB:ASOFNoteIIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-31

0001509957

CANB:ASOFNoteIIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-01

2021-05-31

0001509957

CANB:ASOFNoteIIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2024-01-01

2024-09-30

0001509957

CANB:ASOFNoteIIMember

CANB:HoldersMember

2022-04-14

2022-04-14

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:EmpirePropertiesLLCMember

2022-01-01

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:EmpirePropertiesLLCMember

2022-01-01

2022-01-01

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:EmpirePropertiesLLCMember

2024-06-30

2024-06-30

0001509957

CANB:BLNoteMember

CANB:BlueLakePartnersLLCMember

2022-03-31

0001509957

CANB:BLNoteMember

CANB:BlueLakePartnersLLCMember

2022-03-01

2022-03-31

0001509957

CANB:BLNoteMember

CANB:BlueLakePartnersLLCMember

2023-02-27

2023-02-27

0001509957

CANB:BLNoteMember

CANB:BlueLakePartnersLLCMember

srt:MaximumMember

2023-02-27

2023-02-27

0001509957

CANB:BLNoteMember

CANB:BlueLakePartnersLLCMember

srt:MinimumMember

2023-02-27

2023-02-27

0001509957

CANB:BLNoteMember

CANB:BlueLakePartnersLLCMember

2024-01-01

2024-09-30

0001509957

CANB:FMNoteMember

CANB:FourthManLLCMember

2022-04-30

0001509957

CANB:FMNoteMember

CANB:FourthManLLCMember

2022-04-01

2022-04-30

0001509957

CANB:FMNoteMember

CANB:FourthManLLCMember

2023-02-27

2023-02-27

0001509957

CANB:FMNoteMember

CANB:FourthManLLCMember

srt:MaximumMember

2023-02-27

2023-02-27

0001509957

CANB:FMNoteMember

CANB:FourthManLLCMember

srt:MinimumMember

2023-02-27

2023-02-27

0001509957

CANB:FMNoteMember

CANB:FourthManLLCMember

2023-06-30

2023-06-30

0001509957

CANB:AlumniNoteMember

CANB:AlumniCapitalLPMember

2022-06-30

0001509957

CANB:AlumniNoteMember

CANB:AlumniCapitalLPMember

2022-06-01

2022-06-30

0001509957

CANB:AlumniNoteMember

CANB:AlumniCapitalLPMember

2024-01-01

2024-09-30

0001509957

CANB:WalleyeOpportunitiesMasterFundMember

CANB:WalleyeOpportunitiesMasterFundNoteMember

2022-08-31

0001509957

CANB:WalleyeOpportunitiesMasterFundMember

CANB:WalleyeOpportunitiesMasterFundNoteMember

2022-08-01

2022-08-31

0001509957

CANB:WalleyeOpportunitiesMasterFundNoteMember

CANB:WalleyeOpportunitiesMasterFundMember

2024-01-01

2024-09-30

0001509957

CANB:TysadcoPartnersMember

CANB:TysadcoNoteVIMember

2023-01-31

0001509957

CANB:TysadcoNoteVIMember

CANB:TysadcoPartnersMember

2023-01-01

2023-01-31

0001509957

CANB:TysadcoNoteVIMember

CANB:TysadcoPartnersMember

2024-01-01

2024-09-30

0001509957

CANB:SecuritiesPurchaseAgreementMember

CANB:WOMFMember

2023-03-02

0001509957

CANB:SecuritiesPurchaseAgreementMember

CANB:WOMFMember

2023-03-02

2023-03-02

0001509957

CANB:SecuritiesPurchaseAgreementMember

us-gaap:InvestorMember

srt:MaximumMember

2023-03-02

0001509957

CANB:WOMFMember

CANB:SecuritiesPurchaseAgreementMember

us-gaap:CommonStockMember

2023-03-02

0001509957

CANB:WOMFMember

CANB:SecuritiesPurchaseAgreementMember

us-gaap:CommonStockMember

2024-06-30

0001509957

CANB:WOMFMember

CANB:SecuritiesPurchaseAgreementMember

us-gaap:CommonStockMember

srt:MinimumMember

2023-03-02

0001509957

CANB:WOMFMember

CANB:SecuritiesPurchaseAgreementMember

us-gaap:CommonStockMember

2023-03-02

2023-03-02

0001509957

us-gaap:InvestorMember

2023-03-02

0001509957

us-gaap:InvestorMember

2023-03-02

2023-03-02

0001509957

us-gaap:InvestorMember

srt:MinimumMember

2023-03-02

0001509957

us-gaap:InvestorMember

srt:MaximumMember

2023-03-02

0001509957

CANB:PromissoryNoteMember

2023-05-31

0001509957

CANB:PromissoryNoteMember

2023-05-01

2023-05-31

0001509957

CANB:PromissoryNoteMember

2024-01-01

2024-09-30

0001509957

CANB:ForbearanceAgreementMember

2023-05-31

0001509957

CANB:ForbearanceAgreementMember

CANB:DuramedMILLCMember

2023-05-01

2023-05-31

0001509957

CANB:HolderMember

CANB:WOMFMember

2023-05-31

0001509957

CANB:HolderMember

CANB:WOMFMember

2023-05-01

2023-05-31

0001509957

CANB:PromissoryNoteMember

CANB:WOMFMember

2023-05-31

0001509957

CANB:WOMFMember

2023-05-31

0001509957

CANB:HolderMember

CANB:WOMFMember

CANB:PromissoryNoteMember

2023-05-01

2023-05-31

0001509957

CANB:HolderMember

CANB:PromissoryNoteMember

CANB:WOMFMember

2023-05-31

0001509957

CANB:EquipmentAcquisitionAgreementMember

2021-08-12

0001509957

CANB:EquipmentAcquisitionAgreementMember

2021-08-12

2021-08-12

0001509957

CANB:EquipmentAcquisitionAgreementMember

2024-09-30

0001509957

CANB:SecuritiesPurchaseAgreementMember

us-gaap:InvestorMember

2023-10-27

0001509957

CANB:InitialNoteMember

CANB:StockPurchaseAgreementMember

srt:MaximumMember

2023-10-27

0001509957

CANB:SecuritiesPurchaseAgreementMember

us-gaap:InvestorMember

2024-09-30

0001509957

CANB:InitialNoteMember

CANB:StockPurchaseAgreementMember

us-gaap:CommonStockMember

2023-10-27

2023-10-27

0001509957

CANB:NotesMember

us-gaap:InvestorMember

2023-10-27

0001509957

CANB:StockPurchaseAgreementMember

2023-10-27

2023-10-27

0001509957

CANB:StockPurchaseAgreementMember

2023-10-27

0001509957

CANB:InitialNoteMember

CANB:StockPurchaseAgreementMember

2023-10-27

0001509957

CANB:InitialNoteMember

CANB:StockPurchaseAgreementMember

2023-10-27

2023-10-27

0001509957

2023-10-27

0001509957

CANB:ConsolidatedNoteMember

2023-10-27

2023-10-27

0001509957

CANB:HolderMember

CANB:ClearThinkMember

2023-09-30

0001509957

CANB:PromissoryNoteMember

2023-09-30

2023-09-30

0001509957

CANB:HolderMember

CANB:ClearThinkMember

2023-12-31

0001509957

CANB:PromissoryNoteMember

2023-12-01

2023-12-31

0001509957

CANB:PromissoryNoteMember

2023-12-31

0001509957

CANB:HolderMember

CANB:ClearThinkMember

2024-02-29

0001509957

CANB:PromissoryNoteMember

2024-02-29

2024-02-29

0001509957

CANB:PromissoryNoteMember

2024-02-29

0001509957

CANB:HolderMember

CANB:ClearThinkMember

2024-02-13

0001509957

CANB:PromissoryNoteMember

2024-02-13

2024-02-13

0001509957

CANB:PromissoryNoteMember

2024-02-13

0001509957

CANB:NoteExtensionAgreementMember

2024-05-01

2024-05-31

0001509957

2022-01-01

2022-12-31

0001509957

srt:MaximumMember

2022-01-01

2022-12-31

0001509957

srt:MinimumMember

2022-01-01

2022-12-31

0001509957

CANB:LenderMember

CANB:UnsecuredPromissoryNoteAgreementMember

CANB:DueWithinSixMonthsMember

2022-02-11

0001509957

CANB:LenderMember

CANB:UnsecuredPromissoryNoteAgreementMember

CANB:DueWithinSixMonthsMember

2022-02-11

2022-02-11

0001509957

CANB:LenderMember

CANB:UnsecuredPromissoryNoteAgreementMember

CANB:DueWithinSixMonthsMember

2024-09-30

0001509957

CANB:PatFerroMember

2024-09-30

0001509957

us-gaap:SeriesAPreferredStockMember

2024-01-01

2024-09-30

0001509957

us-gaap:SeriesDPreferredStockMember

2024-01-01

2024-09-30

0001509957

us-gaap:SeriesDPreferredStockMember

2021-03-27

0001509957

us-gaap:SeriesDPreferredStockMember

2021-02-08

2021-02-08

0001509957

srt:MinimumMember

2024-09-30

0001509957

srt:MaximumMember

2024-09-30

0001509957

srt:MinimumMember

2024-01-01

2024-09-30

0001509957

srt:MaximumMember

2024-01-01

2024-09-30

0001509957

2023-01-01

2023-12-31

0001509957

us-gaap:CommonStockMember

CANB:SettlementAgreementMember

2024-06-01

2024-06-30

0001509957

srt:MinimumMember

CANB:ConsultingAgreementMember

2024-07-01

2024-07-31

0001509957

srt:MaximumMember

CANB:ConsultingAgreementMember

2024-07-01

2024-07-31

0001509957

CANB:RevenueShareAgreementsMember

2024-07-31

0001509957

CANB:ConsultingAgreementMember

2024-07-01

2024-07-31

0001509957

CANB:RevenueShareAgreementsMember

us-gaap:PatentsMember

2024-07-01

2024-07-31

0001509957

CANB:RevenueShareAgreementsMember

2024-07-01

2024-07-31

0001509957

CANB:RevenueShareAgreementsMember

srt:MaximumMember

2024-07-01

2024-07-31

0001509957

CANB:SettlementAgreementMember

2024-07-01

2024-07-31

0001509957

CANB:SettlementAgreementMember

us-gaap:PatentsMember

2024-07-01

2024-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:lb

CANB:Segment

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended September 30, 2024

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from __________ to __________

COMMISSION

FILE NUMBER: 000-55753

Can

B Corp.

(Exact

name of registrant as specified in its charter)

| Florida |

|

20-3624118 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

960

South Broadway, Suite 120

Hicksville,

NY 11801

(Address

of principal executive offices)

516-595-9544

(Registrant’s

telephone number, including area code)

(Former

name, former address and former fiscal, if changed since last report)

Securities

Registered Pursuant to Section 12(b) of the Act:

| Tile

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

CANB |

|

N/A |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| Emerging

Growth Company |

☐ |

|

|

| (Do

not check if smaller reporting company) |

|

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As

of November 19, 2024, there were 75,841,988 shares of common stock of Nascent Pharma Holdings, Inc (the successor issuer pursuant to

Rule 12g-3(a) under the Exchange Act as of October 25, 2024) outstanding.

Can

B Corp.

FORM

10-Q

September

30, 2024

TABLE

OF CONTENTS

PART

1 – FINANCIAL INFORMATION

Item

1. Financial Statements

Can

B̅ Corp. and Subsidiaries

Condensed

Consolidated Balance Sheets (Unaudited)

| | |

September

30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash

equivalents | |

$ | 7,879 | | |

$ | 34,006 | |

| Accounts receivable, less

allowance for doubtful accounts of $4,774,088 and $2,818,395, respectively | |

| 1,419,978 | | |

| 3,723,344 | |

| Inventory | |

| 155,917 | | |

| 1,619,542 | |

| Prepaid

expenses and other current assets | |

| 10,065 | | |

| 4,137 | |

| Total current assets | |

| 1,593,839 | | |

| 5,381,029 | |

| | |

| | | |

| | |

| Other assets: | |

| | | |

| | |

| Deposits | |

| 245,755 | | |

| 235,418 | |

| Intangible assets, net | |

| - | | |

| 95,144 | |

| Property and equipment,

net | |

| - | | |

| 4,106,283 | |

| Right of use assets, net | |

| - | | |

| 295,151 | |

| Other

noncurrent assets | |

| 16,555 | | |

| 13,139 | |

| Total other assets | |

| 262,310 | | |

| 4,745,135 | |

| | |

| | | |

| | |

| Total

assets | |

$ | 1,856,149 | | |

$ | 10,126,164 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’

Equity (Deficit) | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,630,697 | | |

$ | 1,997,643 | |

| Due to related party | |

| 457,850 | | |

| 357,243 | |

| Notes and loans payable,

net | |

| 8,555,243 | | |

| 9,372,714 | |

| Warrant liabilities | |

| - | | |

| 1,766 | |

| Operating

lease liability - current | |

| - | | |

| 254,391 | |

| Total current liabilities | |

| 11,643,790 | | |

| 11,983,757 | |

| | |

| | | |

| | |

| Total

liabilities | |

| 11,643,790 | | |

| 11,983,757 | |

| | |

| | | |

| | |

| Commitments and contingencies

(Note 12) | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity (deficit): | |

| | | |

| | |

| Preferred stock, authorized 5,000,000 shares: | |

| | | |

| | |

| Series A Preferred stock,

no par value: 20 shares authorized, 5 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| 5,320,000 | | |

| 5,320,000 | |

| Series C Preferred stock,

$0.001 par value: 2,000 shares authorized, 1,100 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| 2,900,039 | | |

| 2,900,039 | |

| Series D Preferred stock,

$0.001 par value: 4,000 shares authorized, 4,000 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| 4 | | |

| 4 | |

| Preferred stock, value | |

| 4 | | |

| 4 | |

| | |

| | | |

| | |

| Common stock, no par value;

1,500,000,000 shares authorized, 70,122,981 and 32,753,196 issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| 84,818,600 | | |

| 82,459,880 | |

| Common stock issuable, no par value; 36,248

shares at September 30, 2024 and December 31, 2023, respectively | |

| 119,586 | | |

| 119,586 | |

| Treasury stock | |

| (572,678 | ) | |

| (572,678 | ) |

| Additional paid-in capital | |

| 11,559,910 | | |

| 10,396,274 | |

| Accumulated

deficit | |

| (113,933,102 | ) | |

| (102,480,698 | ) |

| Total stockholders’

equity (deficit) | |

| (9,787,641 | ) | |

| (1,857,593 | ) |

| | |

| | | |

| | |

| Total

liabilities and stockholders’ equity (deficit) | |

$ | 1,856,149 | | |

$ | 10,126,164 | |

See

notes to condensed consolidated financial statements

Can

B̅ Corp. and Subsidiaries

Condensed

Consolidated Statements of Operations (Unaudited)

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three Months

Ended | | |

Nine Months

Ended | |

| | |

September

30, | | |

September

30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| Product

sales | |

$ | - | | |

$ | 196,082 | | |

$ | - | | |

$ | 1,259,972 | |

| Service

revenue | |

| 15,269 | | |

| 222,875 | | |

| 656,652 | | |

| 518,883 | |

| Total revenues | |

| 15,269 | | |

| 418,957 | | |

| 656,652 | | |

| 1,778,855 | |

| Cost

of revenues | |

| 415,816 | | |

| 1,235,647 | | |

| 2,274,448 | | |

| 2,694,649 | |

| Gross

profit | |

| (400,547 | ) | |

| (816,690 | ) | |

| (1,617,796 | ) | |

| (915,794 | ) |

| Selling, general and administrative | |

| 2,432,413 | | |

| 2,761,523 | | |

| 5,294,307 | | |

| 5,918,933 | |

| Loss on sale of assets | |

| - | | |

| - | | |

| 3,142,769 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Total

operating expenses | |

| 2,432,413 | | |

| 2,761,523 | | |

| 8,437,076 | | |

| 5,918,933 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss

from operations | |

| (2,832,960 | ) | |

| (3,578,213 | ) | |

| (10,054,872 | ) | |

| (6,834,727 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Change in fair value

of warrant liability | |

| - | | |

| - | | |

| 1,766 | | |

| 180,468 | |

| Interest expense | |

| (430,173 | ) | |

| (585,417 | ) | |

| (1,399,721 | ) | |

| (1,335,799 | ) |

| Other

income (expense) | |

| 521 | | |

| (1,747 | ) | |

| 423 | | |

| 68,227 | |

| Other

income (expense) | |

| (429,652 | ) | |

| (587,164 | ) | |

| (1,397,532 | ) | |

| (1,087,104 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income

taxes | |

| - | | |

| - | | |

| - | | |

| 9,596 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net

loss | |

$ | (3,262,612 | ) | |

$ | (4,165,377 | ) | |

$ | (11,452,404 | ) | |

$ | (7,931,427 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss

per share - basic and diluted | |

$ | (0.05 | ) | |

$ | (0.36 | ) | |

$ | (0.22 | ) | |

$ | (1.08 | ) |

| Weighted average shares

outstanding - basic and diluted | |

| 65,435,733 | | |

| 11,589,937 | | |

| 52,526,379 | | |

| 7,358,006 | |

See

notes to condensed consolidated financial statements

Can

B̅ Corp. and Subsidiaries

Condensed

Consolidated Statements of Stockholders’ Equity (Deficit) (Unaudited)

Three

Months Ended September 30, 2024 and 2023

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Issuable | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| | |

Series

A | | |

Series

B | | |

Series

C | | |

Series

D | | |

| | |

| | |

Common | | |

Treasury | | |

Additional | | |

| | |

| |

| | |

Preferred

Stock | | |

Preferred

Stock | | |

Preferred

Stock | | |

Preferred

Stock | | |

Common

Stock | | |

Stock | | |

Stock | | |

Paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Issuable | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| Balance, June 30, 2024 | |

| 5 | | |

$ | 5,320,000 | | |

| - | | |

$ | - | | |

| 1,100 | | |

$ | 2,900,039 | | |

| 4,000 | | |

$ | 4 | | |

| 61,872,981 | | |

$ | 84,591,075 | | |

$ | 119,586 | | |

| 36,248 | | |

$ | (572,678 | ) | |

$ | 11,559,910 | | |

$ | (110,670,490 | ) | |

$ | (6,752,554 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for payables | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6,500,000 | | |

| 97,500 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 97,500 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock in lieu of note repayments | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,750,000 | | |

| 130,025 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 130,025 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| - | | |

| - | | |

| - | | |

| (3,262,612 | ) | |

| (3,262,612 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, September

30, 2024 | |

| 5 | | |

$ | 5,320,000 | | |

| - | | |

$ | - | | |

| 1,100 | | |

$ | 2,900,039 | | |

| 4,000 | | |

$ | 4 | | |

| 70,122,981 | | |

$ | 84,818,600 | | |

$ | 119,586 | | |

| 36,248 | | |

$ | (572,678 | ) | |

$ | 11,559,910 | | |

$ | (113,933,102 | ) | |

$ | (9,787,641 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2023 | |

| 5 | | |

$ | 5,320,000 | | |

| - | | |

$ | - | | |

| 1,100 | | |

$ | 2,900,039 | | |

| 4,000 | | |

$ | 4 | | |

| 5,700,792 | | |

$ | 80,300,211 | | |

$ | 119,586 | | |

| 36,248 | | |

$ | (572,678 | ) | |

$ | 8,944,609 | | |

$ | (96,456,884 | ) | |

$ | 554,887 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for payables | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,004,510 | | |

| 321,887 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 321,887 | |

| Issuance of common stock for inventory | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 675,000 | | |

| 175,500 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 175,500 | |

| Issuance of common stock for legal settlement | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 45,835 | | |

| 7,792 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7,792 | |

| Issuance of common stock in lieu of note repayments | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 8,795,461 | | |

| 1,029,942 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,029,942 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for wages and salaries | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6,940,118 | | |

| 589,216 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 589,216 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock in lieu of interest

payments | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,085,134 | | |

| 254,090 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 254,090 | |

| Stock-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,451,665 | | |

| - | | |

| 1,451,665 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| - | | |

| - | | |

| - | | |

| (4,165,377 | ) | |

| (4,165,377 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, September

30, 2023 | |

| 5 | | |

$ | 5,320,000 | | |

| - | | |

$ | - | | |

| 1,100 | | |

$ | 2,900,039 | | |

| 4,000 | | |

$ | 4 | | |

| 26,246,850 | | |

$ | 82,678,638 | | |

$ | 119,586 | | |

| 36,248 | | |

$ | (572,678 | ) | |

$ | 10,396,274 | | |

$ | (100,622,261 | ) | |

$ | 219,602 | |

Nine

Months Ended September 30, 2024 and 2023

| | |

Series

A | | |

Series

B | | |

Series

C | | |

Series

D | | |

| | |

| | |

Common | | |

Treasury | | |

Additional | | |

| | |

| |

| | |

Preferred

Stock | | |

Preferred

Stock | | |

Preferred

Stock | | |

Preferred

Stock | | |

Common

Stock | | |

Stock | | |

Stock | | |

Paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Issuable | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| Balance, December 31, 2023 | |

| 5 | | |

$ | 5,320,000 | | |

| - | | |

$ | - | | |

| 1,100 | | |

$ | 2,900,039 | | |

| 4,000 | | |

$ | 4 | | |

| 32,753,196 | | |

$ | 82,459,880 | | |

$ | 119,586 | | |

| 36,248 | | |

$ | (572,678 | ) | |

$ | 10,396,274 | | |

$ | (102,480,698 | ) | |

$ | (1,857,593 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for payables | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 12,249,398 | | |

| 584,928 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 584,928 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for note repayments | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 13,616,995 | | |

| 1,094,789 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,094,789 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for contract settlement | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,825,000 | | |

| 579,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 579,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock with note extension | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,000,000 | | |

| 3,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock in lieu of interest

payments | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,678,392 | | |

| 97,003 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 97,003 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,163,636 | | |

| - | | |

| 1,163,636 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (11,452,404 | ) | |

| (11,452,404 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, September

30, 2024 | |

| 5 | | |

$ | 5,320,000 | | |

| - | | |

$ | - | | |

| 1,100 | | |

$ | 2,900,039 | | |

| 4,000 | | |

$ | 4 | | |

| 70,122,981 | | |

$ | 84,818,600 | | |

$ | 119,586 | | |

| 36,248 | | |

$ | (572,678 | ) | |

$ | 11,559,910 | | |

$ | (113,933,102 | ) | |

$ | (9,787,641 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2022 | |

| 5 | | |

$ | 5,320,000 | | |

| - | | |

$ | - | | |

| 1,100 | | |

$ | 2,900,039 | | |

| 4,000 | | |

$ | 4 | | |

| 4,422,584 | | |

$ | 79,614,986 | | |

$ | 119,586 | | |

| 36,248 | | |

$ | (572,678 | ) | |

$ | 8,006,822 | | |

$ | (92,690,834 | ) | |

$ | 2,697,925 | |

| Balance | |

| 5 | | |

$ | 5,320,000 | | |

| - | | |

$ | - | | |

| 1,100 | | |

$ | 2,900,039 | | |

| 4,000 | | |

$ | 4 | | |

| 4,422,584 | | |

$ | 79,614,986 | | |

$ | 119,586 | | |

| 36,248 | | |

$ | (572,678 | ) | |

$ | 8,006,822 | | |

$ | (92,690,834 | ) | |

$ | 2,697,925 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for services rendered | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,732,360 | | |

| 917,694 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 917,694 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for purchase of equipment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 125,000 | | |

| 46,875 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 46,875 | |

| Warrants issued in connection with the issuance

of convertible note | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 937,787 | | |

| - | | |

| 937,787 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for wages and

salaries | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6,940,118 | | |

| 589,216 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 589,216 | |

| Issuance of common stock for inventory | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 675,000 | | |

| 175,500 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 175,500 | |

| Issuance of common stock for legal settlement | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 45,835 | | |

| 7,792 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7,792 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock in lieu of interest

payments | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,510,492 | | |

| 296,633 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 296,633 | |

| Issuance of common stock in lieu of note repayments | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 8,795,461 | | |

| 1,029,942 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,029,942 | |

| Stock-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,451,665 | | |

| - | | |

| 1,451,665 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (7,931,427 | ) | |

| (7,931,427 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, September

30, 2023 | |

| 5 | | |

$ | 5,320,000 | | |

| - | | |

$ | - | | |

| 1,100 | | |

$ | 2,900,039 | | |

| 4,000 | | |

$ | 4 | | |

| 26,246,850 | | |

$ | 82,678,638 | | |

$ | 119,586 | | |

| 36,248 | | |

$ | (572,678 | ) | |

$ | 10,396,274 | | |

$ | (100,622,261 | ) | |

$ | 219,602 | |

| Balance | |

| 5 | | |

$ | 5,320,000 | | |

| - | | |

$ | - | | |

| 1,100 | | |

$ | 2,900,039 | | |

| 4,000 | | |

$ | 4 | | |

| 26,246,850 | | |

$ | 82,678,638 | | |

$ | 119,586 | | |

| 36,248 | | |

$ | (572,678 | ) | |

$ | 10,396,274 | | |

$ | (100,622,261 | ) | |

$ | 219,602 | |

See

notes to condensed consolidated financial statements

Can

B̅ Corp. and Subsidiaries

Condensed

Consolidated Statements of Cash Flows (Unaudited)

| | |

2024 | | |

2023 | |

| | |

Nine Months

Ended | |

| | |

September

30, | |

| | |

2024 | | |

2023 | |

| Operating activities: | |

| | | |

| | |

| Net loss | |

$ | (11,452,404 | ) | |

$ | (7,931,427 | ) |

| Adjustments to reconcile

net loss to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Stock-based compensation | |

| 1,163,636 | | |

| 1,451,665 | |

| Stock-based wages and salaries | |

| - | | |

| 589,216 | |

| Depreciation | |

| 343,607 | | |

| 1,040,915 | |

| Amortization of intangible

assets | |

| - | | |

| 9,000 | |

| Amortization of original-issue-discounts | |

| 488,740 | | |

| 522,274 | |

| Contract settlement | |

| 579,000 | | |

| - | |

| Impairment of assets | |

| 715,051 | | |

| - | |

| Loss on sale of property

and equipment | |

| 3,142,769 | | |

| - | |

| Bad debt expense | |

| 1,997,560 | | |

| 38,631 | |

| Cancellation of debt | |

| - | | |

| (110,000 | ) |

| Change in fair value of

warrant liability | |

| (1,766 | ) | |

| (180,468 | ) |

| Stock-based interest expense | |

| 97,003 | | |

| 296,633 | |

| Stock-based consulting

expense | |

| - | | |

| 917,694 | |

| Changes in operating assets

and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 305,806 | | |

| (64,960 | ) |

| Inventory | |

| 1,463,625 | | |

| 1,239,847 | |

| Prepaid expenses | |

| (5,928 | ) | |

| (8,115 | ) |

| Operating lease right-of-use

asset | |

| 40,760 | | |

| 140 | |

| Other non-current assets | |

| (3,416 | ) | |

| - | |

| Accounts payable | |

| 1,220,983 | | |

| 733,022 | |

| Accrued

expenses | |

| - | | |

| - | |

| Net

cash provided by (used in) operating activities | |

| 95,026 | | |

| (1,455,933 | ) |

| | |

| | | |

| | |

| Investing activities: | |

| | | |

| | |

| Purchase of property and

equipment | |

| - | | |

| (15,000 | ) |

| Deposits

paid | |

| (10,337 | ) | |

| (70,000 | ) |

| Net

cash used in investing activities | |

| (10,337 | ) | |

| (85,000 | ) |

| | |

| | | |

| | |

| Financing activities: | |

| | | |

| | |

| Net proceeds received from

notes and loans payable | |

| 150,000 | | |

| 2,255,000 | |

| Repayments of notes and

loans payable | |

| (361,423 | ) | |

| (630,943 | ) |

| Deferred financing costs | |

| - | | |

| (178,000 | ) |

| Amounts

received from/repaid to related parties, net | |

| 100,607 | | |

| 53,000 | |

| Net

cash (used in) provided by financing activities | |

| (110,816 | ) | |

| 1,499,057 | |

| | |

| | | |

| | |

| Decrease in cash and cash

equivalents | |

| (26,127 | ) | |

| (41,876 | ) |

| Cash and cash equivalents,

beginning of period | |

| 34,006 | | |

| 73,194 | |

| Cash and cash equivalents,

end of period | |

$ | 7,879 | | |

$ | 31,318 | |

| | |

| | | |

| | |

| Supplemental Cash Flow Information: | |

| | | |

| | |

| Income

taxes paid | |

$ | - | | |

$ | - | |

| Interest

paid | |

$ | - | | |

$ | - | |

| Non-cash Investing and Financing

Activities: | |

| | | |

| | |

| Issuance

of common stock in lieu of repayment of notes payable | |

$ | 1,094,764 | | |

$ | 1,029,942 | |

| Issuance

of common stock for contract settlement | |

$ | 579,000 | | |

$ | - | |

| Issuance

of note payable in connection with note extension | |

$ | 250,000 | | |

$ | - | |

| Issuance

of common stock for property and equipment | |

$ | - | | |

$ | 46,875 | |

| Issuance

of common stock for payables | |

$ | 584,928 | | |

| | |

| Debt

discount associated with convertible note | |

$ | - | | |

$ | 273,529 | |

| Issuance

of common stock warrants in connection with convertible promissory note | |

$ | - | | |

$ | 937,787 | |

See

notes to consolidated financial statements

Can

B̅ Corp. and Subsidiaries

Condensed

Notes to Unaudited Consolidated Financial Statements

September

30, 2024

Note

1 – Organization and Description of Business

Can

B̅ Corp. was originally incorporated as WrapMail, Inc. (“WRAP”) in Florida on October 11, 2005. On May 15, 2017, WRAP

changed its name to Canbiola, Inc. On January 16, 2020 Canbiola, Inc. changed its name to Can B̅ Corp. (the “Company”,

“we”, “us”, “our”, “CANB”, “Can B̅” or “Registrant”).

The

Company acquired 100% of the membership interests in Pure Health Products, LLC, a New York limited liability company (“PHP”

or “Pure Health Products”) effective December 28, 2018. The Company runs its manufacturing operations through PHP and holds

and sells several of its brands through PHP as well. The Company’s durable equipment products, such as Sam® units are marketed

and sold through its wholly-owned subsidiaries, Duramed Inc. (incorporated on November 29, 2018) and Duramed MI LLC (fka DuramedNJ, LLC)

(incorporated on May 29, 2019) (collectively, “Duramed”). Duramed began operating on or about February 1, 2019. Most of the

Company’s consumer products include hemp derived cannabidiol (“CBD”) are available online. Additional hemp derived

isolate is available for wholesale to third-parties looking to incorporate such compounds into their products through the Company’s

wholly owned subsidiary CO Botanicals LLC (incorporated in August 2021). In February of 2024, Can B̅ Corp’s 67% owned subsidiary,

Nascent Pharma, LLC, acquired certain Patents using liquid formulations containing cannabinoids which are used in such products as vape

cartridges, edibles, pills, gummies, tinctures, oils, concentrates and more.

Prior

to September 2024 , the Company was in the business of promoting health and wellness through its development, manufacture and sale of

products containing cannabinoids derived from hemp biomass and the licensing of durable medical devises. Can B̅’s products

included oils, creams, moisturizers, isolate, gel caps, spa products, and concentrates. Can B̅ developed its own line of proprietary

products and sought synergistic value through acquisitions in the hemp industry. In June 2024, Can B̅ shifted its business focus

to commercializing and enforcing the patents recently acquired by Nascent Pharma, LLC (“Nascent”), continuing to collect

Duramed receivables and reestablishing the Company’s production of the Longevity Brand Superfood drink mix for Brooke Burke Body,

Inc.

On

October 25, 2015, Can B̅ implemented a legal reorganization which resulted in Nascent Pharma Holdings, Inc. (“NPH”)

owning all of the outstanding stock of Can B̅. Consequently, Can B̅ became a direct, wholly owned subsidiary of NPH. Each share

of each class of Can B̅ stock issued and outstanding immediately prior to the legal reorganization automatically converted into

an equivalent corresponding share of NPH stock, having the same designations, rights, powers and preferences and the qualifications,

limitations and restrictions as the corresponding share of Can B̅ stock being converted. Asa result, Can B̅’s stockholders

immediately prior to the consummation of the legal reorganization became stockholders of NPH.

Note

2 – Going Concern

The

condensed consolidated financial statements have been prepared on a “going concern” basis, which contemplates the realization

of assets and liquidation of liabilities in a normal course of business. As of September 30, 2024, the Company had cash and cash equivalents

of $7,879 and negative working capital of $10,049,951. For the nine months ended September 30, 2024, the Company incurred losses of $11,452,404

which made the total accumulated deficit $113,933,102 through September 30, 2024. These factors raise substantial doubt as to the Company’s

ability to continue as a going concern.

The

Company is currently funding its operations on a month-to-month basis through third party loans. In March 2024, certain equipment used

in the operation of the Company’s hemp division was sold in an auction conducted under Article 9 of the Uniform Commercial Code.

The auction resulted in proceeds of approximately $300,000 which were applied to the Company’s obligations under convertible notes

held by Arena Special Opportunities Partners I, L.P. and its affiliates. In June 2024, the Company’s Board of Directors concluded

that as a result of the impact of the auction on the hemp division, it is no longer feasible to continue the Company’s hemp operations.

As a result, the Company will no longer pursue the development, manufacture or sale of hemp derived products.

Historically,

revenues from the Company’s hemp division supported, in part, its durable medical equipment business conducted through Duramed.

Due to the elimination of support from the hemp division, Duramed is operating with reduced staff which has adversely impacted revenues.

The

Company’s ability to continue its operations is dependent on the execution of management’s plans, which include

protecting and commercializing the cannabis patents recently acquired by Nascent, raising litigation funding to support

Nascent’s patent protection efforts, continuing to collect Duramed receivables, reestablishing the Company’s production

of the Longevity Brand Superfood drink mix for Brooke Burke Body, Inc., restructuring outstanding indebtedness and raising of

capital through the debt and/or equity markets. The condensed consolidated financial statements do not include any adjustments that

might be necessary should the Company be unable to continue as a going concern. If the Company is not to continue as a going

concern, it would likely not be able to realize its assets at values comparable to the carrying value or the fair value estimates

reflected in the balances set out in its financial statements.

There

can be no assurances that the Company will be successful in generating additional cash from equity or debt financings or other sources

to be used for operations. Should the Company not be successful in obtaining the necessary financing to fund its operations, it would

need to curtail certain or all operational activities and/or contemplate the sale of its assets, if necessary.

Can

B̅ Corp. and Subsidiaries

Condensed

Notes to Unaudited Consolidated Financial Statements

September

30, 2024

Note

3 – Basis of Presentation and Summary of Significant Accounting Policies

Basis

of Financial Statement Presentation

The

accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally

accepted in the United States of America (“GAAP”) for interim financial information, and with the rules and regulations of

the Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Accordingly, these interim consolidated

financial statements do not include all the information and footnotes required by GAAP for complete financial statements. In the opinion

of the management of the Company, as defined below, these unaudited consolidated financial statements include all adjustments necessary

to present fairly the information set forth therein. Results for interim periods are not necessarily indicative of results to be expected

for a full year.

The

consolidated balance sheet information as of December 31, 2023 was derived from the consolidated financial statements included in

the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (“2023 Form 10-K”). The interim

condensed consolidated financial statements contained herein should be read in conjunction with the 2023 Form 10-K.

Principles

of Consolidation

The

unaudited condensed consolidated financial statements contained herein include the accounts of Can B Corp. and its wholly owned subsidiaries.

All significant intercompany balances and transactions have been eliminated.

Use

of Estimates

The

preparation of financial statements and related disclosures in conformity with GAAP requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the

financial statements and the reported amounts of revenues and expenses in those financial statements. Certain significant accounting

policies that contain subjective management estimates and assumptions include those related to revenue recognition, inventory, intangible

assets and other long-lived assets, income taxes and deferred taxes. Descriptions of these policies are discussed in the Company’s

2023 Form 10-K. Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors,

including the current economic environment, and adjusts when facts and circumstances dictate. As future events and their effects cannot

be determined with precision, actual results could differ significantly from those estimates and assumptions. Significant changes, if

any, in those estimates resulting from continuing changes in the economic environment will be reflected in the consolidated financial

statements in future periods.

Significant

Accounting Policies

The

Company’s significant accounting policies are described in “Note 3: Summary of Significant Accounting Policies” of

our 2023 Form 10-K.

Can

B̅ Corp. and Subsidiaries

Notes

to Consolidated Financial Statements

September

30, 2024

Segment

reporting

As

of September 30, 2024, the Company reports operating results and financial data in one operating and reportable segment. The Chief Executive

Officer, who is the chief operating decision maker, manages the Company as a single profit center in order to promote collaboration,

provide comprehensive service offerings across the entire customer base, and provide incentives to employees based on the success of

the organization as a whole. Although certain information regarding selected products or services is discussed for purposes of promoting

an understanding of the Company’s business, the chief operating decision maker manages the Company and allocates resources at the

consolidated level.

Correction

of Immaterial Errors

Subsequent

to June 30, 2024, the Company identified an error related to the total principal outstanding on its notes payable. The error

identified resulted in an increase of $803,225

of notes payable as of December 31, 2023 and corresponding decrease to stockholder’s equity/(deficit). The error was a result of improper accounting for certain conversions of principal to common stock. Amounts were

corrected via reconciliation to supporting documentation from each lender. Going forward, the Company is implementing a more stringent

debt reconciliation process and a lender by lender basis.

In

accordance with the SEC Staff Accounting Bulletin (SAB) No. 99, “Materiality,” and SAB No. 108, “Considering the Effects

of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements,” the Company evaluated the materiality

of the error from qualitative and quantitative perspectives and concluded that the error was immaterial to the September 30, 2024 and

December 31, 2023, financial statements. Consequently, only the December 31, 2023, consolidated balance sheet and the December 31, 2023,

balance in the statement of stockholders’ equity contained in these financial statements have been restated.

Reclassifications

Certain

amounts in the prior year consolidated financial statements have been reclassified to conform to the current year presentation. These

reclassification adjustments had no effect on the Company’s previously reported net loss. December 2023 revenues and accounts payable

were misstated and a correction of $52,400 was made related to a transaction reversal with a vendor.

Note

4 – Fair Value Measurements

The

carrying value and fair value of the Company’s financial instruments are as follows:

Schedule of Carrying Value and Fair Value

| | |

Level

1 | | |

Level

2 | | |

Level

3 | | |

Total | |

| September

30, 2024 | |

| | |

| | |

| | |

| |

| | |

Level

1 | | |

Level

2 | | |

Level

3 | | |

Total | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

| Warrant liabilities | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | — | |

| | |

Level

1 | | |

Level

2 | | |

Level

3 | | |

Total | |

| As of December

31, 2023 | |

| |

| | |

Level

1 | | |

Level

2 | | |

Level

3 | | |

Total | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

| Warrant liabilities | |

$ | — | | |

$ | — | | |

$ | 1,766 | | |

$ | 1,766 | |

The

fair value of the warrants outstanding was estimated using the Black-Scholes model. The application of the Black-Scholes model requires

the use of a number of inputs and significant assumptions including volatility. The following reflects the inputs and assumptions used:

Schedule of Fair Value Assumptions

| As of | |

| | |

| |

| | |

September

30, 2024 | | |

December

31, 2023 | |

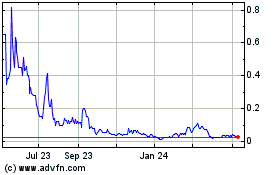

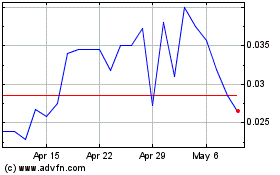

| Stock price | |

$ | 0.013 | | |

$ | 0.07 | |

| Exercise price | |

$ | 6.40 | | |

$ | 6.40 | |

| Remaining term (in years) | |

| 2.75 | | |

| 3.50 | |

| Volatility | |

| 188.4 | % | |

| 171.8 | % |

| Risk-free rate | |

| 3.58 | % | |

| 3.84 | % |

| Expected dividend yield | |

| — | % | |

| — | % |

| Warrant measurement input | |

| — | % | |

| — | % |

The

warrant liabilities will be remeasured at each reporting period with changes in fair value recorded in other income (expense), net on

the consolidated statements of operations. The change in fair value of the warrant liabilities was as follows:

Schedule of Change in Fair Value of the Warrant Liabilities

| Warrant liabilities | |

| | |

| Estimated fair value at December 31, 2022 | |

$ | 203,043 | |

| Issuance of warrant liabilities | |

| - | |

| Change in fair value | |

| (180,468 | ) |

| Estimated fair value at September 30, 2023 | |

$ | 123,625 | |

| | |

| | |

| Estimated fair value at December 31, 2023 | |

$ | 1,766 | |

| Estimated fair value at beginning balance | |

$ | 1,766 | |

| | |

| | |

| | |

| | |

| Change in fair value | |

| (1,766 | ) |

| Estimated fair value at September 30,

2024 | |

$ | - | |

| Estimated fair value at ending balance | |

$ | - | |

Can

B̅ Corp. and Subsidiaries

Condensed

Notes to Unaudited Consolidated Financial Statements

September

30, 2024

Note

5 – Inventories

Inventories

consist of:

Schedule of Inventories

| | |

September

30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Raw materials | |

$ | 26,827 | | |

$ | 1,196,112 | |

| Finished goods | |

| 129,090 | | |

| 423,430 | |

| Total | |

$ | 155,917 | | |

$ | 1,619,542 | |

Note

6 – Property and Equipment

Property

and equipment consist of:

Schedule of Property and Equipment

| | |

September

30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Furniture and fixtures | |

$ | - | | |

$ | 21,724 | |

| Office equipment | |

| - | | |

| 12,378 | |

| Manufacturing equipment | |

| - | | |

| 6,828,083 | |

| Medical equipment | |

| - | | |

| 776,396 | |

| Leasehold improvements | |

| - | | |

| 26,902 | |

| Total | |

| - | | |

| 7,665,483 | |

| Accumulated depreciation | |

| - | | |

| (3,559,200 | ) |

| Net | |

$ | - | | |

$ | 4,106,283 | |

Depreciation expense related to property and equipment was $0 and $348,224

for the three months ended September 30, 2024 and 2023, respectively

Depreciation