false

--12-31

0001509957

0001509957

2024-10-25

2024-10-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported)

October

25, 2024

CAN

B CORP.

(Exact

name of registrant as specified in its charter)

| Florida |

|

000-5573 |

|

20-3624118 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

960

Broadway, Suite 118

Hicksville,

NY 11801

(Address

of principal executive offices, including zip code)

(516)

595-9544

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item

1.01. |

Entry

into a Material Definitive Agreement. |

Adoption

of Agreement and Plan of Merger and Consummation of Holding Company Reorganization

On

October 25, 2024, Can B Corp. (“Can B”) implemented a holding company reorganization (the “Nascent Merger”)

pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), dated as of October 23, 2024, among Can B,

Nascent Pharma Holdings, Inc., a Florida corporation (“Nascent”), and Nascent Merger Sub, Inc., a Florida corporation

(“Merger Sub”), which resulted in Nascent owning all of the outstanding capital stock of Can B. Pursuant to the Nascent

Merger, Merger Sub, a direct, wholly owned subsidiary of Nascent and an indirect, wholly owned subsidiary of Can B, merged with and into

Can B, with Can B surviving as a direct, wholly owned subsidiary of Nascent. Each share of each class of Can B stock issued and outstanding

immediately prior to the Nascent Merger automatically converted into an equivalent corresponding share of Nascent stock, having the same

designations, rights, powers and preferences and the qualifications, limitations and restrictions as the corresponding share of Can B

stock being converted. Accordingly, upon consummation of the Nascent Merger, Can B’s stockholders immediately prior to the consummation

of the Nascent Merger became stockholders of Nascent. The stockholders of Can B will not recognize gain or loss for U.S. federal income

tax purposes upon the conversion of their shares in the Nascent Merger.

The

Nascent Merger was conducted pursuant to Section 607.11045 of the Florida Business Corporation Act (the “FBCA”), which

provides for the formation of a holding company without a vote of the stockholders of the constituent corporation. The conversion of

stock occurred automatically without an exchange of stock certificates. After the Nascent Merger, unless exchanged, stock certificates

that previously represented shares of a class of Can B stock now represent the same number of shares of the corresponding class of Nascent

stock. Immediately after consummation of the Nascent Merger, Nascent has, on a consolidated basis, the same assets, businesses and operations

as Can B had immediately prior to the consummation of the Nascent Merger.

As

a result of the Nascent Merger, Nascent became the successor issuer to Can B pursuant to 12g-3(a) of the Exchange Act and as a result

the shares of Nascent Common Stock are deemed registered under Section 12(g) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”).

The

foregoing descriptions of the Nascent Merger and Merger Agreement do not purport to be complete and are qualified in their entirety by

reference to the full text of the Merger Agreement, which is filed as Exhibit 2.1 and which is incorporated by reference herein.

| Item

3.01. |

Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

In

connection with the Nascent Merger, Can B notified the Financial Industry Regulatory Authority (“FINRA”) that it planned

to complete the Nascent Merger and, in connection therewith, requested that a new trading symbol be assigned to Nascent. FINRA requested

that a new notice be submitted to FINRA after the Nascent Merger is complete. As a result, the change in issuer name and trading symbol

on the OTCQB Market will not occur until FINRA completes the processing of the name change and assigns Nascent a trading symbol.

On

October 28, 2024,

Can B filed a

certificate on Form 15 with the U.S. Securities and Exchange Commission (the “Commission”) under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”) requesting that Can B shares be deregistered under the Exchange Act, and that

Can B’s reporting obligations under the Exchange Act be suspended (except to the extent of the succession of Nascent to the Exchange

Act Section 12(g) registration and reporting obligations of Can B).

| Item

3.03. |

Material

Modification of Rights of Securityholders. |

Upon

consummation of the Nascent Merger, each share of each class of Can B stock issued and outstanding immediately prior to the Nascent Merger

automatically converted into an equivalent corresponding share of Nascent stock, having the same designations, rights, powers and preferences

and the qualifications, limitations and restrictions as the corresponding share of Can B stock that was converted.

The

information set forth in Item 1.01 and Item 5.03 is hereby incorporated by reference in this Item 3.03.

| Item

5.02. |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

In

connection with the Nascent Merger, on October 25, 2024, Can B also entered into the Compensation Plan Agreement with Nascent pursuant

to which Nascent assumed (including sponsorship of) the Can B 2021 Incentive Stock Option Plan and any subplans, appendices or addendums

thereunder (together, the “Can B Equity Compensation Plans”), and all obligations of Can B pursuant to each stock option

to purchase a share of Can B stock (a “Can B Option”) that was outstanding immediately prior to October 25, 2024 and issued

under the Can B Equity Compensation Plans and underlying grant agreements (each such grant agreement, a “Can B Stock Option Agreement”

and such grant agreements together with the Can B Equity Compensation Plans, the “Can B Equity Compensation Plans and Agreements”).

On October 25, 2024, each such Can B Option was converted into an option to purchase a Nascent share at an exercise price per share equal

to the exercise price per share of the Can B stock subject to such Can B Option immediately prior to October 25, 2024. On October 25,

2024, the Can B Options and the Can B Equity Compensation Plans and Agreements were automatically deemed to be amended (and, in the case

of the Can B 2021 Incentive Stock Plan, formally amended), to the extent necessary or appropriate, to provide that references to Can

B in such awards, documents and provisions will be read to refer to Nascent and references to shares of Can B stock in such awards, documents

and provisions will be read to refer to Nascent shares.

The

foregoing descriptions of the Compensation Plan Agreement do not purport to be complete and are qualified in their entirety by reference

to the full text of the Compensation Plan Agreement which is filed as Exhibit 10.1 and which is incorporated by reference herein.

| Item

5.03. |

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On

October 25, 2015, the Articles of Incorporation of Can B (the “Can B Charter”) was amended pursuant to the Nascent Merger

to add a provision, which is required by Section 607.11045(g)_ of the FBCA, that provides that any act or transaction by or involving

Can B, other than the election or removal of directors, that requires for its adoption under the FBCA or the Can B Charter the approval

of the stockholders of Can B shall require the approval of the stockholders of Nascent by the same vote as is required by the FBCA and/or

the Can B Charter.

| Item

9.01. |

Financial

Statements and Exhibits. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

CAN

B CORP. |

| |

|

| Date:

October 28, 2024 |

/s/

Marco Alfonsi |

| |

Marco

Alfonsi |

| |

Chief

Executive Officer |

INDEX

TO EXHIBITS

EXHIBIT

2.1

AGREEMENT

AND PLAN OF MERGER

This

AGREEMENT AND PLAN OF MERGER (the “Agreement”), entered into as of October 23, 2024, by and among Can B Corp., a Floridacorporation

(the “Company”), Nascent Pharma Holdings, Inc., a Florida corporation (“Holdco”) and a direct,

wholly owned subsidiary of the Company, and Nascent Merger Sub, Inc., a Florida corporation (“Merger Sub”) and a direct,

wholly owned subsidiary of Holdco.

RECITALS

WHEREAS,

on the date hereof, the Company has the authority to issue 1,505,000,000 shares, consisting of: (i) 1,500,000,000 shares of Common Stock,

par value $0.001 per share (the “Company Common Stock”), of which 71,239,311 shares are issued and outstanding (ii)

20 shares of Series A Preferred Stock, par value $0.001 per share (the “Company Series A Preferred Stock”), of which

5 shares are issued and outstanding; (iii) 2,000 shares of Series C Preferred Stock, par value $0.001 per share (the “Company

Series C Preferred Stock”), of which 1,100 shares are issued and outstanding; and (iv) 4,000 shares of Series D Preferred Stock,

par value $0.001 per share (the “Company Series D Preferred Stock”), of which 4,000 shares are issued and outstanding.

WHEREAS,

as of the Effective Time (as defined below), Holdco will have the authority to issue 1,505,000,000 shares, consisting of: (i) 1,500,000,000

shares of Common Stock, par value $0.001 per share (the “Holdco Common Stock”) (ii) 20 shares of Series A Preferred

Stock, par value $0.001 per share (the “Holdco Series A Preferred Stock”); (iii) 2,000 shares of Series C Preferred

Stock, par value $0.001 per share (the “Holdco Series C Preferred Stock”); and (iv) 4,000 shares of Series D Preferred

Stock, par value $0.001 per share (the “Holdco Series D Preferred Stock”).

WHEREAS,

as of the date hereof, Merger Sub has the authority to issue 1,000 shares of common stock, par value $0.001 per share (the “Merger

Sub Common Stock”), of which 100 shares are issued and outstanding on the date hereof and owned by Holdco.

WHEREAS,

as of the Effective Time, the designations, rights, powers and preferences, and the qualifications, limitations and restrictions of the

Holdco Series A Preferred Stock, Holdco Series C Preferred Stock and Holdco Series D Preferred Stock will be the same as those of the

Company Series A Preferred Stock, Company Series C Preferred Stock and Company Series D Preferred Stock, respectively.

WHEREAS,

the Articles of Incorporation of Holdco (the “Holdco Charter”) and the Bylaws of Holdco (the “Holdco Bylaws”),

which will be in effect immediately following the Effective Time, contain provisions substantially identical to the Articles of Incorporation

of the Company (the “Company Charter”) and the Bylaws of the Company (the “Company Bylaws”), in

effect as of the date hereof and that will be in effect immediately prior to the Effective Time, respectively (other than as permitted

by Section 607.11045 of the Florida Business Corporation Act (the “FBCA”))., except to th extent permitted by Section

607.11045 of the FBCA.

WHEREAS,

Holdco and Merger Sub are newly formed corporations organized for the sole purpose of participating in the transactions herein contemplated

and actions related thereto, own no assets (other than Holdco’s ownership of Merger Sub and nominal capital) and have taken no

actions other than those necessary or advisable to organize the corporations and to effect the transactions herein contemplated and actions

related thereto.

WHEREAS,

the Company desires to reorganize into a holding company structure pursuant to Section 607.11045 of the FBCA, under which Holdco would

become a holding company, by the merger of Merger Sub with and into the Company, and with each share of Company Common Stock Company

Series A Preferred Stock, Company Series C Preferred Stock and Company Series D Preferred Stock being converted in the Merger (as defined

below) into a share of Holdco Common Stock, Holdco Series A Preferred Stock, Holdco Series C Preferred Stock, or Holdco Series D Preferred

Stock, respectively.

WHEREAS,

on or about the date hereof, the Company and Holdco will enter or have entered into a Compensation Plan Agreement, pursuant to which,

among other things, the Company will, at the Effective Time, transfer to Holdco, and Holdco will assume, sponsorship of all of the Company’s

Equity Plans (as defined below) and all of the Company’s rights and obligations thereunder.

WHEREAS,

the boards of directors of Holdco and the Company have approved and declared advisable this Agreement and the transactions contemplated

hereby, including, without limitation, the Merger.

WHEREAS,

the board of directors of Merger Sub has (i) approved and declared advisable this Agreement and the transactions contemplated hereby,

including, without limitation, the Merger, (ii) resolved to submit the approval of the adoption of this Agreement and the transactions

contemplated hereby, including, without limitation, the Merger, to its sole stockholder, and (iii) resolved to recommend to its sole

stockholder that it approve the adoption of this Agreement and the transactions contemplated hereby, including, without limitation, the

Merger.

WHEREAS,

the parties intend, for United States federal income tax purposes, the Merger shall qualify as an exchange described in Section 351 of

the Internal Revenue Code.

NOW,

THEREFORE, in consideration of the premises and the covenants and agreements contained in this Agreement, and intending to be legally

bound hereby, the Company, Holdco and Merger Sub hereby agree as follows:

1.

THE MERGER. In accordance with Section 11045 of the FBCA and subject to, and upon the terms and conditions of, this Agreement, Merger

Sub shall be merged with and into the Company (the “Merger”), the separate corporate existence of Merger Sub shall

cease, and the Company shall continue as the surviving corporation of the Merger (the “Surviving Corporation”). At

the Effective Time, the effects of the Merger shall be as provided in this Agreement and in Section 607.1106 of the FBCA.

2.

EFFECTIVE TIME. As soon as practicable on or after the date hereof, the Company shall file articles of merger executed in accordance

with the relevant provisions of the FBCA, with the Secretary of State of the State of Florida (the “Secretary of State”)

and shall make all other filings or recordings required under the FBCA to effectuate the Merger. The Merger shall become effective at

such time as the certificate of merger is duly filed with the Secretary of State or at such later date and time as the parties shall

agree and specify in the certificate of merger (the date and time the Merger becomes effective being referred to herein as the “Effective

Time”).

3.

CERTIFICATE OF INCORPORATION. At the Effective Time, the Company Charter shall be amended in the Merger as set forth below, and as

so amended, shall be the certificate of incorporation of the Surviving Corporation (the “Surviving Corporation Charter”)

until thereafter amended as provided therein or by the FBCA.

(a)

The Company Charter shall be amended by adding a new Artcile VIII to read in its entirety as follows:

ARTICLE

VIII

Any

act or transaction by or involving the Corporation, other than the election or removal of directors of the Corporation, that requires

for its adoption under the Florida Business Corporation Act or these Articles of Incorporation the approval of the stockholders of the

Corporation shall, in accordance with Section 607.11045 of the Florida Business Corporation Act, require, in addition, the approval of

the stockholders of Nascent Pharma Holdings, Inc. (or any successor thereto by merger), by the same vote as is required by the Florida

Business Corporation Act and/or these Articles of Incorporation.

4.

BYLAWS. From and after the Effective Time, the Company Bylaws, as in effect immediately prior to the Effective Time, shall constitute

the Bylaws of the Surviving Corporation (the “Surviving Corporation Bylaws”) until thereafter amended as provided

therein or by applicable law.

5.

DIRECTORS. The directors of the Company in office immediately prior to the Effective Time shall be the directors of the Surviving

Corporation and will continue to hold office from the Effective Time until the earlier of their resignation or removal or until their

successors are duly elected or appointed and qualified in the manner provided in the Surviving Corporation Charter and Surviving Corporation

Bylaws, or as otherwise provided by law.

6.

OFFICERS. The officers of the Company in office immediately prior to the Effective Time shall be the officers of the Surviving Corporation

and will continue to hold office from the Effective Time until the earlier of their resignation or removal or until their successors

are duly elected or appointed and qualified in the manner provided in the Surviving Corporation Charter and Surviving Corporation Bylaws,

or as otherwise provided by law.

7.

ADDITIONAL ACTIONS. If, at any time after the Effective Time, the Surviving Corporation shall consider or be advised that any deeds,

bills of sale, assignments, assurances or any other actions or things are necessary or desirable to vest, perfect or confirm, of record

or otherwise, in the Surviving Corporation its right, title or interest in, to or under any of the rights, properties or assets of either

Merger Sub or the Company acquired or to be acquired by the Surviving Corporation as a result of, or in connection with, the Merger or

otherwise to carry out this Agreement, the officers and directors of the Surviving Corporation shall be authorized to execute and deliver,

in the name and on behalf of each of Merger Sub and the Company, all such deeds, bills of sale, assignments and assurances and to take

and do, in the name and on behalf of each of Merger Sub and the Company or otherwise, all such other actions and things as may be necessary

or desirable to vest, perfect or confirm any and all right, title and interest in, to and under such rights, properties or assets in

the Surviving Corporation or otherwise to carry out this Agreement.

8.

CONVERSION OF SECURITIES. At the Effective Time, by virtue of the Merger and without any action on the part of Holdco, Merger Sub,

the Company or any holder of any securities thereof:

(a)

Conversion of Company Common Stock, Company Series A Preferred Stock, Company Series C Preferred Stock and Company Series D Preferred

Stock. Each share of Company Common Stock, Company Series A Preferred Stock, Company Series C Preferred Stock and Company Series

D Preferred Stock issued and outstanding immediately prior to the Effective Time shall be converted into one validly issued, fully paid

and nonassessable share of Holdco Common Stock, Holdco Series A Preferred Stock, Holdco Series C Preferred Stock and Holdco Series D

Preferred Stock, respectively.

(b)

Conversion of Company Common Stock Held as Treasury Stock. Each share of Company Common Stock held in the Company’s treasury

shall be converted into one validly issued, fully paid and nonassessable share of Holdco Common Stock, to be held immediately after completion

of the Merger in the treasury of Holdco.

(c)

Conversion of Capital Stock of Merger Sub. Each share of Merger Sub Common Stock issued and outstanding immediately prior to the

Effective Time shall be converted into one validly issued, fully paid and nonassessable share of Common Stock, without par value, of

the Surviving Corporation.

(d)

Rights of Certificate Holders. Upon conversion thereof in accordance with this Section 8, all shares of Company Common

Stock, Company Series A Preferred Stock, Company Series C Preferred Stock and Company Series D Preferred Stock shall no longer be outstanding

and shall cease to exist, and each holder of a certificate representing any such shares of Company Common Stock, Company Series A Preferred

Stock, Company Series C Preferred Stock, or Company Series D Preferred Stock shall cease to have any rights with respect to such shares

of Company Common Stock, Company Series A Preferred Stock, Company Series C Preferred Stock or Company Series D Preferred Stock, respectively,

except, in all cases, as set forth in Section 9 herein. In addition, each outstanding book-entry that, immediately prior to the

Effective Time, evidenced shares of Company Common Stock, Company Series A Preferred Stock, Company Series C Preferred Stock or Company

Series D Preferred Stock shall, from and after the Effective Time, be deemed and treated for all corporate purposes to evidence the ownership

of the same number of shares of Holdco common Stock, Holdco Series A Preferred Stock, Holdco Series C Preferred Stock or Holdco Series

D Preferred Stock, respectively.

9.

CERTIFICATES. At and after the Effective Time until thereafter surrendered for transfer or exchange in the ordinary course, each

outstanding certificate which immediately prior thereto represented shares of Company Common Stock, Company Series A Preferred Stock,

Company Series C Preferred Stock or Company Series D Preferred Stock shall be deemed for all purposes to evidence ownership of and to

represent the shares of Holdco Common Stock, Holdco Series A Preferred Stock, Holdco Series C Preferred Stock or Holdco Series D Preferred

Stock, as applicable, into which the shares of Company Common Stock, Company Series A Preferred Stock, Company Series C Preferred Stock

or Company Series D Preferred Stock represented by such certificate have been converted as herein provided and shall be so registered

on the books and records of Holdco and its transfer agent. At and after the Effective Time, the shares of capital stock of Holdco shall

be uncertificated; provided, that, any shares of capital stock of Holdco that are represented by outstanding certificates of the

Company pursuant to the immediately preceding sentence shall continue to be represented by certificates as provided therein and shall

not be uncertificated unless and until a valid certificate representing such shares pursuant to the immediately preceding sentence is

delivered to Holdco at its registered office in the State of Florida, its principal place of business, or an officer or agent of Holdco

having custody of books and records of Holdco, at which time such certificate shall be canceled and in lieu of the delivery of a certificate

representing the applicable shares of capital stock of Holdco, Holdco shall (i) issue to such holder the applicable uncertificated shares

of capital stock of Holdco by registering such shares in Holdco’s books and records as book-entry shares, upon which such shares

shall thereafter be uncertificated and (ii) take all action necessary to provide such holder with evidence of the uncertificated book-entry

shares, including any action necessary under applicable law in accordance therewith, including in accordance with Sections 607.0626 and

607.0627 of the FBCA. If any certificate that prior to the Effective Time represented shares of Company Common Stock, Company Series

A Preferred Stock, Company Series C Preferred Stock or Company Series D Preferred Stock shall have been lost, stolen or destroyed, then,

upon the making of an affidavit of such fact by the person or entity claiming such certificate to be lost, stolen or destroyed and the

providing of an indemnity by such person or entity to Holdco, in form and substance reasonably satisfactory to Holdco, against any claim

that may be made against it with respect to such certificate, Holdco shall issue to such person or entity, in exchange for such lost,

stolen or destroyed certificate, uncertificated shares representing the applicable shares of Holdco Common Stock, Holdco Series A Preferred

Stock, Holdco Company Series C Preferred Stock or Holdco Series D Preferred Stock in accordance with the procedures set forth in the

preceding sentence.

10.

ASSUMPTION OF EQUITY PLANS AND AWARDS.

At

the Effective Time, pursuant to this Merger Agreement and the Compensation Plan Agreement entered into between Holdco and the Company

on or about the date hereof (the “Compensation Plan Agreement”), the Company will transfer to Holdco, and Holdco will

assume, sponsorship of all of the Company’s Equity Plans (as defined below), along with all of the Company’s rights and obligations

under the Equity Plans.

At

the Effective Time, pursuant to this Merger Agreement and the Compensation Plan Agreement, the Company will transfer to Holdco, and Holdco

will assume, its rights and obligations under each stock option to purchase a share of Company capital stock (each, a “Stock

Option”) issued under the Equity Plans that is outstanding and unexercised, unvested and not yet paid or payable immediately

prior to the Effective Time, which Stock Options shall be converted into a stock option to purchase or a right to acquire or vest in,

respectively, a share of Holdco capital stock of the same class and with the same rights and privileges relative to Holdco that such

share underlying such Stock Option had relative to the Company immediately prior to the Effective Time on otherwise the same terms and

conditions as were applicable immediately prior to the Effective Time, including at an exercise price per share equal to the exercise

price per share for the applicable share of Company capital stock. For purposes of this Agreement, “Equity Plans”

shall mean, collectively, the Can B Corp. 2021 Incentive Stock Option Plan, and any and all subplans, appendices or addendums thereto,

and any and all agreements evidencing Awards.

11.

HOLDCO SHARES. Prior to the Effective Time, the Company and Holdco shall take any and all actions as are necessary to ensure that

each share of capital stock of Holdco that is owned by the Company immediately prior to the Effective Time shall be cancelled and cease

to be outstanding at the Effective Time, and no payment shall be made therefor, and the Company, by execution of this Agreement, agrees

to forfeit such shares and relinquish any rights to such shares.

12.

NO APPRAISAL RIGHTS. In accordance with the FBCA, no appraisal rights shall be available to any holder of shares of Company Common

Stock, Company Series A Preferred Stock, Company Series C Preferred Stock or Company Series D Preferred Stock in connection with the

Merger.

13.

TERMINATION. This Agreement may be terminated, and the Merger and the other transactions provided for herein may be abandoned, whether

before or after the adoption of this Agreement by the sole stockholder of Merger Sub, at any time prior to the Effective Time, by action

of the board of directors of the Company. In the event of termination of this Agreement, this Agreement shall forthwith become void and

have no effect, and neither the Company, Holdco, Merger Sub nor their respective stockholders, directors or officers shall have any liability

with respect to such termination or abandonment.

14.

AMENDMENTS. At any time prior to the Effective Time, this Agreement may be supplemented, amended or modified, whether before or after

the adoption of this Agreement by the sole stockholder of Merger Sub, by the mutual consent of the parties to this Agreement by action

by their respective boards of directors; provided, however, that, no amendment shall be effected subsequent to the adoption

of this Agreement by the sole stockholder of Merger Sub that by law requires further approval or authorization by the sole stockholder

of Merger Sub or the stockholders of the Company without such further approval or authorization. No amendment of any provision of this

Agreement shall be valid unless the same shall be in writing and signed by all of the parties hereto.

15.

GOVERNING LAW. This Agreement shall be governed by, and construed in accordance with, the laws of the State of Florida, regardless

of the laws that might otherwise govern under applicable principles of conflicts of laws.

16.

COUNTERPARTS. This Agreement may be executed in one or more counterparts, each of which when executed shall be deemed to be an original

but all of which shall constitute one and the same agreement.

17.

ENTIRE AGREEMENT. This Agreement, including the documents and instruments referred to herein, constitutes the entire agreement and

supersedes all other prior agreements and undertakings, both written and oral, among the parties, or any of them, with respect to the

subject matter hereof.

18.

SEVERABILITY. The provisions of this Agreement are severable, and in the event any provision hereof is determined to be invalid or

unenforceable, such invalidity or unenforceability shall not in any way affect the validity or enforceability of the remaining provisions

hereof.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the Company, Holdco and Merger Sub have caused this Agreement to be executed as of the date first written above

by their respective officers thereunto duly authorized.

| |

CAN

B CORP. |

| |

|

|

| |

By: |

/s/

Marco Alfonsi |

| |

Name: |

Marco

Alfonsi |

| |

Title: |

President |

| |

|

| |

NASCENT

PHARMA HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/

Marco Alfonsi |

| |

Name: |

Marco

Alfonsi |

| |

Title: |

President |

| |

|

| |

NASCENT

MERGER SUB, INC. |

| |

|

|

| |

By: |

/s/

Marco Alfonsi |

| |

Name: |

Marco

Alfonsi |

| |

Title: |

President

|

EXHIBIT

3.1

Articles

of Merger

The

following Articles of Merger are submitted in accordance with Section 607.1105 of the Florida Business Corporation Act (the “FBCA”).

First:

The

name and jurisdiction of the surviving corporation:

NAME

Can

B Corp. |

|

JURISDICTION

Florida |

|

DOCUMENT

NO.

P05000139155 |

Second:

The

name and jurisdiction of each merging corporation:

NAME

Nascent

Merger Sub, Inc. |

|

JURISDICTION

Florida |

|

DOCUMENT

NO.

P24000058413 |

Third:

The

merger shall become effective on October 25, 2024.

Fourth:

The

merger was approved by each domestic merging corporation in accordance with s.607.1101(1)(b), F.S.

Fifth:

The

surviving corporation exists before the merger and is a domestic filing entity.

Sixth:

The

Plan of Merger was adopted by the surviving corporation’s Board of Directors.

Seventh:

The

Plan of Merger did not require approval by the shareholders.

Eighth:

The

secretary of the surviving corporation certifies herein that the Plan of Merger has been adopted pursuant to s.607.11045, F.S., and the

conditions specified in subsection (3) of same have been satisfied.

Ninth:

The

undersigned corporation has caused this statement to be signed by a duly authorized officer or director who affirms, under penalties

of perjury, that the facts stated above are true and correct.

[signatures

on next page]

| Dated:

October 23, 2024 |

CAN

B CORP. |

| |

|

|

| |

By: |

/s/

Marco Alfonsi |

| |

|

Marco

Alfonsi, President |

| |

|

|

| |

By: |

/s/

Stanley Teeple |

| |

|

Stanley

Teeple, Secretary |

| |

|

|

| Dated:

October 23, 2024 |

NASCENT MERGER SUB, INC. |

| |

|

|

| |

By: |

/s/

Marco Alfonsi |

| |

|

Marco

Alfonsi, President |

| |

|

|

| |

By: |

/s/

Stanley Teeple |

| |

|

Stanley

Teeple, Secretary |

EXHIBIT

10.1

COMPENSATION

PLAN AGREEMENT

THIS

COMPENSATION PLAN AGREEMENT (this “Agreement”) dated as of October 25, 2024 is between Can B Corp., a Florida

corporation (“Can B”) (which will be the surviving entity following the merger at the Effective Time (as defined herein),

in which Nascent Merger Inc., a Florida corporation (“MergerSub”) will be merged with and into Can B) and Nascent

Pharma Holdings, Inc., a Florida corporation (“Nascent”). All capitalized terms used in this Agreement and not defined

herein have the respective meanings ascribed to them in the Agreement and Plan of Merger, dated as of October 23_ 2024 (the “Merger

Agreement”), by and among Can B, Nascent and MergerSub.

RECITALS

WHEREAS,

pursuant to the Merger Agreement, at the Effective Time, MergerSub will be merged with and into Can B, with Can B continuing as the surviving

entity in such merger and each outstanding share of capital stock of Can B (“Can B Stock”) will be converted into

one share of capital stock of Nascent (“Nascent Stock”) of the same class and with the same rights and privileges

relative to Nascent that such share had relative to Can B prior to the merger (the “Reorganization”);

WHEREAS,

in connection with the Reorganization, (A) Can B will transfer (including sponsorship of) to Nascent, and Nascent will assume (including

sponsorship of), Can B’s 2020 Incentive Stock Option Plan and any subplans, appendices or addendums thereto (the “Can

B Equity Compensation Plans”) and all obligations of Can B pursuant to each stock option to purchase a share of Can B Stock

(a “Can B Option”) that is outstanding immediately prior to the Effective Time and issued under the Can B Equity Compensation

Plans and underlying grant agreements (each such grant agreement, a “Can B Option Agreement” and such grant agreements

together with the Can B Equity Compensation Plans, the “Can B Equity Compensation Plans and Agreements”), all upon

the terms and subject to the conditions set forth in the Merger Agreement and this Agreement, and (B) each such Can B Option will be

converted into an option to purchase a share of Nascent Stock at an exercise price per share equal to the exercise price per share of

Can B Stock subject to such Can B Option immediately prior to the Effective Time;

WHEREAS,

the Board of Directors of Can B has determined that it is in the best interests of Can B for Can B to enter into this Agreement;

WHEREAS,

the Board of Directors of Nascent has determined that it is in the best interests of Nascent and its shareholders for Nascent to enter

into this Agreement;

WHEREAS,

the Board of Directors of Can B and the Board of Directors of Nascent have determined that the Reorganization does not constitute a “Change

in Control” under the Can B Equity Compensation Plans and Agreements or the Can B Options.

NOW,

THEREFORE, for good and valuable consideration, the receipt, adequacy and sufficiency of which are hereby acknowledged, Can B and

Nascent hereby agree as follows:

I.

EQUITY

PLANS AND AWARDS

1.

Subject to and as of the Effective Time, Nascent will assume and will perform, from and after the Effective Time, all of the obligations

of Can B pursuant to the Can B Equity Compensation Plans and Agreements.

2.

Subject to and as of the Effective Time, Nascent will assume each Can B Option that is outstanding and unexercised prior to the Effective

Time each such Can B Option shall be converted into an option to purchase, on otherwise the same terms and conditions as were applicable

under the applicable Can B Equity Compensation Plan and/or Can B Option Agreement (as modified herein), a share of Nascent Stock with

the same rights and privileges applicable to the share of Can B Stock subject to such Can B Option immediately prior to the Effective

Time, at an exercise price per share equal to the exercise price per share of Can B Stock subject to such Can B Option immediately prior

to the Effective Time. All Can B Options shall be adjusted and converted in accordance with the requirements of Section 424 of the United

States Internal Revenue Code of 1986, as amended, and regulations thereunder.

3.

At the Effective Time, the Can B Options, the Can B Equity Compensation Plans and can B Option Agreements and shall each be automatically

deemed to be amended, to the extent necessary or appropriate, to provide that references to Can B in such awards, documents and provisions

shall be read to refer to Nascent and references to Can B Stock in such awards, documents and provisions shall be read to refer to Nascent

Stock. Nascent and Can B agree to (i) prepare and execute all amendments to the Can B Equity Compensation Plans and Agreements, Can B

Option Agreements and other documents necessary to effectuate Nascent’s assumption of the Can B Equity Compensation Plans and Agreements

and outstanding Can B Options, (ii) provide notice of the assumption to holders of such Can B Options, and (iii) submit any required

filings with the Securities and Exchange Commission in connection with same.

4.

On or prior to the Effective Time, Nascent shall reserve sufficient shares of Nascent Stock to provide for the issuance of Nascent Stock

to satisfy Nascent’s obligations under this Agreement with respect to the Can B Options.

5.

Can B and Nascent agree that the Reorganization does not constitute a “Change in Control” under the Can B Equity Compensation

Plans and Agreements or the Can B Option Agreements.

II.

MISCELLANEOUS

1.

Each of Can B and Nascent will, from time to time and at all times hereafter, upon every reasonable request to do so by any other party

hereto, make, do, execute and deliver, or cause to be made, done, executed and delivered, all such further acts, deeds, assurances and

things as may be reasonably required or necessary in order to further implement and carry out the intent and purpose of this Agreement.

IN

WITNESS WHEREOF, the undersigned have executed this Compensation Plan Agreement as of the date first written above.

| |

CAN

B INC. |

| |

a

Florida corporation |

| |

|

|

| |

By: |

/s/

Marco Alfonsi |

| |

|

Name:

Marco Alfonsi |

| |

|

Title:

Chief Executive Officer |

| |

|

|

| |

NASCENT

PHARMA HOLDINGS, INC.

a

Florida corporation |

| |

|

|

| |

By: |

/s/

Marco Alfonsi |

| |

|

Name:

Marco Alfonsi |

| |

|

Title:

Chief Executive Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

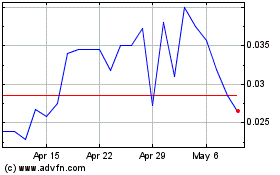

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Oct 2024 to Nov 2024

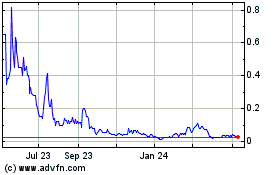

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Nov 2023 to Nov 2024