0001509957

true

false

S-1/A

2,834,755

2,834,755

2,834,755

0001509957

2022-01-01

2022-03-31

0001509957

dei:BusinessContactMember

2022-01-01

2022-03-31

0001509957

2021-12-31

0001509957

2020-12-31

0001509957

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001509957

us-gaap:SeriesAPreferredStockMember

2020-12-31

0001509957

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001509957

us-gaap:SeriesBPreferredStockMember

2020-12-31

0001509957

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001509957

us-gaap:SeriesCPreferredStockMember

2020-12-31

0001509957

us-gaap:SeriesDPreferredStockMember

2021-12-31

0001509957

us-gaap:SeriesDPreferredStockMember

2020-12-31

0001509957

2022-03-31

0001509957

us-gaap:SeriesAPreferredStockMember

2022-03-31

0001509957

us-gaap:SeriesBPreferredStockMember

2022-03-31

0001509957

us-gaap:SeriesCPreferredStockMember

2022-03-31

0001509957

us-gaap:SeriesDPreferredStockMember

2022-03-31

0001509957

2021-01-01

2021-12-31

0001509957

2020-01-01

2020-12-31

0001509957

CANB:ProductSalesMember

2021-01-01

2021-12-31

0001509957

CANB:ProductSalesMember

2020-01-01

2020-12-31

0001509957

CANB:ServiceRevenueMember

2021-01-01

2021-12-31

0001509957

CANB:ServiceRevenueMember

2020-01-01

2020-12-31

0001509957

2021-01-01

2021-03-31

0001509957

CANB:ProductSalesMember

2022-01-01

2022-03-31

0001509957

CANB:ProductSalesMember

2021-01-01

2021-03-31

0001509957

CANB:ServiceRevenueMember

2022-01-01

2022-03-31

0001509957

CANB:ServiceRevenueMember

2021-01-01

2021-03-31

0001509957

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2019-12-31

0001509957

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2019-12-31

0001509957

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2019-12-31

0001509957

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2019-12-31

0001509957

us-gaap:CommonStockMember

2019-12-31

0001509957

us-gaap:TreasuryStockMember

2019-12-31

0001509957

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001509957

us-gaap:RetainedEarningsMember

2019-12-31

0001509957

2019-12-31

0001509957

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2020-12-31

0001509957

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2020-12-31

0001509957

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2020-12-31

0001509957

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2020-12-31

0001509957

us-gaap:CommonStockMember

2020-12-31

0001509957

us-gaap:TreasuryStockMember

2020-12-31

0001509957

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001509957

us-gaap:RetainedEarningsMember

2020-12-31

0001509957

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001509957

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001509957

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001509957

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001509957

us-gaap:CommonStockMember

2021-12-31

0001509957

CANB:CommonStockIssuableMember

2021-12-31

0001509957

us-gaap:TreasuryStockMember

2021-12-31

0001509957

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001509957

us-gaap:RetainedEarningsMember

2021-12-31

0001509957

CANB:CommonStockIssuableMember

2020-12-31

0001509957

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2020-01-01

2020-12-31

0001509957

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2020-01-01

2020-12-31

0001509957

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2020-01-01

2020-12-31

0001509957

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2020-01-01

2020-12-31

0001509957

us-gaap:CommonStockMember

2020-01-01

2020-12-31

0001509957

us-gaap:TreasuryStockMember

2020-01-01

2020-12-31

0001509957

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-31

0001509957

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001509957

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001509957

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001509957

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001509957

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001509957

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001509957

us-gaap:TreasuryStockMember

2021-01-01

2021-12-31

0001509957

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001509957

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001509957

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2022-01-01

2022-03-31

0001509957

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2022-01-01

2022-03-31

0001509957

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2022-01-01

2022-03-31

0001509957

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2022-01-01

2022-03-31

0001509957

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001509957

CANB:CommonStockIssuableMember

2022-01-01

2022-03-31

0001509957

us-gaap:TreasuryStockMember

2022-01-01

2022-03-31

0001509957

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001509957

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001509957

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-01-01

2021-03-31

0001509957

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2021-01-01

2021-03-31

0001509957

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2021-01-01

2021-03-31

0001509957

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2021-01-01

2021-03-31

0001509957

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001509957

CANB:CommonStockIssuableMember

2021-01-01

2021-03-31

0001509957

us-gaap:TreasuryStockMember

2021-01-01

2021-03-31

0001509957

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-03-31

0001509957

us-gaap:RetainedEarningsMember

2021-01-01

2021-03-31

0001509957

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2022-03-31

0001509957

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2022-03-31

0001509957

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2022-03-31

0001509957

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2022-03-31

0001509957

us-gaap:CommonStockMember

2022-03-31

0001509957

CANB:CommonStockIssuableMember

2022-03-31

0001509957

us-gaap:TreasuryStockMember

2022-03-31

0001509957

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001509957

us-gaap:RetainedEarningsMember

2022-03-31

0001509957

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-03-31

0001509957

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2021-03-31

0001509957

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2021-03-31

0001509957

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2021-03-31

0001509957

us-gaap:CommonStockMember

2021-03-31

0001509957

CANB:CommonStockIssuableMember

2021-03-31

0001509957

us-gaap:TreasuryStockMember

2021-03-31

0001509957

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001509957

us-gaap:RetainedEarningsMember

2021-03-31

0001509957

2021-03-31

0001509957

CANB:NoCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2021-01-01

2021-12-31

0001509957

srt:MaximumMember

CANB:AssetAcquisitionAgreementMember

CANB:BotanicalBiotechLLCMember

2021-03-10

2021-03-17

0001509957

srt:PresidentMember

CANB:LebsockAgreementMember

2021-03-10

2021-03-11

0001509957

srt:MaximumMember

srt:PresidentMember

CANB:LebsockAgreementMember

2021-03-11

0001509957

srt:PresidentMember

CANB:CompanysIncentiveStockOptionPlanMember

2021-03-10

2021-03-11

0001509957

CANB:SchlosserAgreementMember

2021-03-15

2021-03-16

0001509957

CANB:EquipmentAcquisitionAgreementMember

2021-08-11

2021-08-12

0001509957

CANB:EquipmentAcquisitionAgreementMember

2021-08-12

0001509957

us-gaap:CommonStockMember

CANB:EquipmentAcquisitionAgreementMember

2021-08-12

0001509957

us-gaap:CommonStockMember

CANB:EquipmentAcquisitionAgreementMember

2021-08-11

2021-08-12

0001509957

CANB:AssetPurchaseAgreementMember

2021-08-11

2021-08-13

0001509957

CANB:AssetPurchaseAgreementMember

2021-08-13

0001509957

us-gaap:CommonStockMember

CANB:AssetPurchaseAgreementMember

2021-08-13

0001509957

CANB:AssetPurchaseAgreementMember

CANB:ImbibeHealthSolutionsAssetAcquisitionMember

2021-02-21

2021-02-22

0001509957

CANB:AcquisitionAgreementMember

CANB:ImbibeHealthSolutionsAssetAcquisitionMember

2021-02-21

2021-02-22

0001509957

CANB:TechnologyIPAndPatentsMember

2021-01-01

2021-12-31

0001509957

CANB:TechnologyIPAndPatentsMember

2020-01-01

2020-12-31

0001509957

CANB:NotesPayableMember

2020-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2020-12-01

2020-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

us-gaap:CommonStockMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2020-01-01

2020-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

us-gaap:WarrantMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2020-01-01

2020-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2020-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-01-01

2021-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2020-01-01

2020-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2020-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2020-12-01

2020-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

us-gaap:CommonStockMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2020-01-01

2020-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2021-01-01

2021-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2020-01-01

2020-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2021-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-01

2021-05-31

0001509957

us-gaap:ConvertibleNotesPayableMember

us-gaap:CommonStockMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-01

2021-05-31

0001509957

us-gaap:ConvertibleNotesPayableMember

us-gaap:WarrantMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-01

2021-05-31

0001509957

CANB:ConvertibleNotesPayableOneMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-01-01

2021-12-31

0001509957

CANB:ConvertibleNotesPayableOneMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2020-01-01

2020-12-31

0001509957

us-gaap:ConvertibleNotesPayableMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2021-05-31

0001509957

us-gaap:ConvertibleNotesPayableMember

us-gaap:CommonStockMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2021-05-01

2021-05-31

0001509957

us-gaap:ConvertibleNotesPayableMember

us-gaap:WarrantMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2021-05-01

2021-05-31

0001509957

CANB:ConvertibleNotesPayableTwoMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2021-01-01

2021-12-31

0001509957

CANB:ConvertibleNotesPayableTwoMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2020-01-01

2020-12-31

0001509957

CANB:ConvertibleNotesPayableTwoMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2021-12-31

0001509957

us-gaap:SubsequentEventMember

us-gaap:ConvertibleNotesPayableMember

2022-04-28

2022-04-30

0001509957

us-gaap:SubsequentEventMember

us-gaap:ConvertibleNotesPayableMember

CANB:HoldersMember

2022-04-12

2022-04-13

0001509957

CANB:PaycheckProtectionProgramMember

2020-01-01

2020-12-31

0001509957

CANB:PaycheckProtectionProgramMember

2021-05-01

2021-05-31

0001509957

CANB:PaycheckProtectionProgramMember

2021-05-31

0001509957

CANB:EquipmentAcquisitionAgreementMember

2021-12-31

0001509957

CANB:LenderMember

2021-11-18

0001509957

2021-11-01

2021-11-18

0001509957

srt:DirectorMember

2020-12-31

0001509957

CANB:ASOPNoteIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2020-12-31

0001509957

CANB:ASOPNoteIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2020-12-01

2020-12-31

0001509957

CANB:ASOPNoteIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2020-01-01

2020-12-31

0001509957

CANB:ASOPNoteIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

us-gaap:WarrantMember

2020-12-31

0001509957

CANB:ASOPNoteIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2022-03-31

0001509957

CANB:ASOFNoteIMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2020-12-31

0001509957

CANB:ASOFNoteIMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2020-12-01

2020-12-31

0001509957

CANB:ASOFNoteIMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2020-01-01

2020-12-31

0001509957

CANB:ASOFNoteIMember

us-gaap:CommonStockMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2020-12-31

0001509957

CANB:ASOFNoteIMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2022-03-31

0001509957

CANB:ASOPNoteIIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-31

0001509957

CANB:ASOPNoteIIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-01

2021-05-31

0001509957

CANB:ASOPNoteIIMember

us-gaap:WarrantMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-31

0001509957

CANB:ASOPNoteIIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2022-01-01

2022-03-31

0001509957

CANB:ASOFNoteIIMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2021-05-31

0001509957

CANB:ASOFNoteIIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-01

2021-05-31

0001509957

CANB:ASOFNoteIIMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2021-05-01

2021-05-31

0001509957

CANB:ASOFNoteIIMember

us-gaap:WarrantMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2021-05-31

0001509957

CANB:ASOFNoteIIMember

CANB:ArenaSpecialOpportunitiesPartnersOneLPMember

2021-05-31

0001509957

CANB:ASOFNoteIIMember

CANB:ArenaSpecialOpportunitiesFundLPMember

2022-03-31

0001509957

us-gaap:SubsequentEventMember

CANB:ASOFNoteIIMember

2022-04-29

2022-04-30

0001509957

us-gaap:SubsequentEventMember

CANB:ASOFNoteIIMember

CANB:HoldersMember

2022-04-12

2022-04-14

0001509957

CANB:BLNoteMember

CANB:BlueLakePartnersLLCMember

2022-03-31

0001509957

CANB:BLNoteMember

CANB:BlueLakePartnersLLCMember

2022-03-01

2022-03-31

0001509957

CANB:BLNoteMember

us-gaap:WarrantMember

CANB:BlueLakePartnersLLCMember

2022-03-31

0001509957

CANB:BLNoteMember

CANB:BlueLakePartnersLLCMember

2022-01-01

2022-03-31

0001509957

CANB:BLNoteMember

CANB:BlueLakePartnersLLCMember

2021-01-01

2021-03-31

0001509957

CANB:MHNoteMember

CANB:MastHillFundLPMember

2022-03-31

0001509957

CANB:MHNoteMember

CANB:MastHillFundLPMember

2022-03-01

2022-03-31

0001509957

CANB:MHNoteMember

us-gaap:WarrantMember

CANB:MastHillFundLPMember

2022-03-31

0001509957

CANB:MHNoteMember

CANB:MastHillFundLPMember

2022-01-01

2022-03-31

0001509957

CANB:MHNoteMember

CANB:MastHillFundLPMember

2021-01-01

2021-03-31

0001509957

CANB:TysadcoNoteMember

CANB:TysadcoPartnersLLCMember

2022-02-28

0001509957

CANB:TysadcoNoteMember

CANB:TysadcoPartnersLLCMember

2022-02-01

2022-02-28

0001509957

CANB:TysadcoNoteMember

CANB:TysadcoPartnersLLCMember

2022-03-31

0001509957

CANB:TysadcoNoteMember

CANB:TysadcoPartnersLLCMember

us-gaap:SubsequentEventMember

2022-04-30

0001509957

CANB:EquipmentAcquisitionAgreementMember

2022-03-31

0001509957

CANB:UnsecuredPromissoryNoteAgreementMember

CANB:LenderMember

2021-11-18

0001509957

CANB:UnsecuredPromissoryNoteAgreementMember

2021-11-17

2021-11-18

0001509957

CANB:UnsecuredPromissoryNoteAgreementMember

CANB:LenderMember

2022-03-31

0001509957

CANB:FutureReceivableSaleAndPurchaseAgreementMember

2022-02-02

0001509957

CANB:FutureReceivableSaleAndPurchaseAgreementMember

2022-01-30

2022-02-02

0001509957

CANB:FutureReceivableSaleAndPurchaseAgreementMember

2022-02-01

2022-02-02

0001509957

CANB:FutureReceivableSaleAndPurchaseAgreementMember

2022-03-31

0001509957

CANB:LenderMember

CANB:UnsecuredPromissoryNoteAgreementMember

2022-02-11

0001509957

CANB:LenderMember

CANB:UnsecuredPromissoryNoteAgreementMember

2022-02-08

2022-02-11

0001509957

CANB:LenderMember

CANB:UnsecuredPromissoryNoteAgreementMember

2022-03-31

0001509957

CANB:ReceivablePurchaseAndSaleAgreementMember

2022-03-03

0001509957

CANB:FutureReceivableSaleAndPurchaseAgreementMember

2022-03-01

2022-03-03

0001509957

CANB:FutureReceivableSaleAndPurchaseAgreementMember

2022-03-03

0001509957

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-12-31

0001509957

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-12-31

0001509957

us-gaap:SeriesDPreferredStockMember

2021-01-01

2021-12-31

0001509957

us-gaap:SeriesDPreferredStockMember

2021-03-27

0001509957

us-gaap:SeriesDPreferredStockMember

2021-02-07

2021-02-08

0001509957

CANB:PasqualeFerroMember

us-gaap:SeriesDPreferredStockMember

2021-03-26

2021-03-27

0001509957

CANB:MarcoAlfonsiMember

us-gaap:SeriesDPreferredStockMember

2021-03-26

2021-03-27

0001509957

CANB:StanleyLTeepleMember

us-gaap:SeriesDPreferredStockMember

2021-03-26

2021-03-27

0001509957

CANB:PhilipScalaMember

us-gaap:SeriesDPreferredStockMember

2021-03-26

2021-03-27

0001509957

us-gaap:SeriesDPreferredStockMember

2021-03-26

2021-03-27

0001509957

CANB:OfferingMember

2021-01-01

2021-12-31

0001509957

CANB:CommonStockOneMember

2021-01-01

2021-12-31

0001509957

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-03-31

0001509957

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-03-31

0001509957

us-gaap:SeriesDPreferredStockMember

2022-01-01

2022-03-31

0001509957

CANB:OfferingMember

2022-01-01

2022-03-31

0001509957

CANB:CommonStockOneMember

2022-01-01

2022-03-31

0001509957

srt:DirectorMember

2021-01-01

2021-12-31

0001509957

srt:DirectorMember

2020-01-01

2020-12-31

0001509957

srt:DirectorMember

2021-12-31

0001509957

srt:DirectorMember

2022-01-01

2022-03-31

0001509957

srt:DirectorMember

2021-01-01

2021-03-31

0001509957

CANB:PasqualeFerroMember

CANB:ExecutiveEmploymentAgreementMember

2020-12-26

2020-12-28

0001509957

us-gaap:SeriesCPreferredStockMember

CANB:ExecutiveEmploymentAgreementMember

2020-12-28

0001509957

CANB:PhilipScalaMember

CANB:ExecutiveEmploymentAgreementMember

2020-12-26

2020-12-28

0001509957

us-gaap:SeriesCPreferredStockMember

2020-12-28

0001509957

CANB:InitialThreeMonthsMember

us-gaap:RestrictedStockMember

CANB:InvestorRelationsAndAdvisoryAgreementMember

2020-07-14

2020-07-15

0001509957

CANB:FourToSixMonthsMember

us-gaap:RestrictedStockMember

CANB:InvestorRelationsAndAdvisoryAgreementMember

2020-07-14

2020-07-15

0001509957

CANB:SevenMonthsAndAfterMember

us-gaap:RestrictedStockMember

CANB:InvestorRelationsAndAdvisoryAgreementMember

2020-07-14

2020-07-15

0001509957

us-gaap:SubsequentEventMember

CANB:IsolateMasterPurchaseAgreementMember

2022-01-26

2022-01-27

0001509957

us-gaap:SubsequentEventMember

CANB:FutureReceivableSaleAndPurchaseAgreementMember

2022-02-02

0001509957

us-gaap:SubsequentEventMember

CANB:FutureReceivableSaleAndPurchaseAgreementMember

2022-01-30

2022-02-02

0001509957

us-gaap:SubsequentEventMember

CANB:IndustrialHempSaleMember

2022-02-08

2022-02-09

0001509957

us-gaap:SubsequentEventMember

CANB:IndustrialHempSaleMember

2022-02-09

0001509957

us-gaap:SubsequentEventMember

CANB:LenderMember

2022-04-15

0001509957

us-gaap:SubsequentEventMember

CANB:LenderMember

2022-04-12

2022-04-15

0001509957

us-gaap:SubsequentEventMember

CANB:HempPurchaseAgreementMember

2022-02-14

2022-02-15

0001509957

us-gaap:SubsequentEventMember

CANB:SecuritiesPurchaseAgreementMember

2022-03-23

2022-03-24

0001509957

us-gaap:SubsequentEventMember

us-gaap:ConvertibleNotesPayableMember

2022-04-12

2022-04-13

0001509957

us-gaap:ConvertibleNotesPayableMember

2021-01-01

2021-12-31

0001509957

us-gaap:SubsequentEventMember

CANB:SecuritiesPurchaseAgreementMember

2022-04-23

2022-04-24

0001509957

us-gaap:SubsequentEventMember

2022-05-01

2022-05-31

0001509957

us-gaap:FairValueInputsLevel1Member

2022-03-31

0001509957

us-gaap:FairValueInputsLevel2Member

2022-03-31

0001509957

us-gaap:FairValueInputsLevel3Member

2022-03-31

0001509957

us-gaap:FairValueInputsLevel1Member

2021-12-31

0001509957

us-gaap:FairValueInputsLevel2Member

2021-12-31

0001509957

us-gaap:FairValueInputsLevel3Member

2021-12-31

0001509957

2022-03-21

0001509957

2022-03-22

2022-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

CANB:Integer

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before investing in our securities, you should carefully consider the risks and uncertainties

described below, together with all of the other information in this prospectus, including our consolidated financial statements and related

notes. If any of the following risks materialize, our business, financial condition, operating results and prospects could be materially

and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Risks

Related to this Offering and our Common Stock

We

are subject to the reporting requirements of federal securities laws, which is expensive.

We

are a public reporting company in the United States and, accordingly, subject to the information and reporting requirements of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) and other federal securities laws, and the compliance obligations of

the Sarbanes-Oxley Act. The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the

SEC and furnishing audited reports to stockholders causes our expenses to be higher than they would be if we remained a privately-held

company.

Our

stock price may be volatile, which may result in losses to our stockholders.

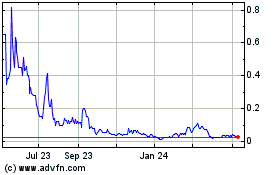

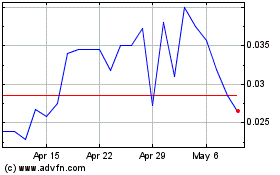

The stock markets have experienced

significant price and trading volume fluctuations, and the trading of our common stock has generally been very volatile

and experienced sharp share-price and trading-volume changes. The trading price of our securities is likely to remain volatile and could

fluctuate widely in response to many factors, including but not limited to the following, some of which are beyond our control:

| |

● |

variations

in our operating results; |

| |

|

|

| |

● |

changes

in expectations of our future financial performance, including financial estimates by securities analysts and investors; |

| |

|

|

| |

● |

changes

in operating and stock price performance of other companies in our industry; |

| |

|

|

| |

● |

additions

or departures of key personnel; and |

| |

|

|

| |

● |

future

sales of our common stock. |

Domestic

and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic

and political conditions unrelated to our performance, may adversely affect the price of our common stock.

In

the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the

market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial

costs and liabilities and could divert management’s attention and resources.

Our

common stock is thinly-traded, and in the future, may continue to be thinly-traded, and you may be unable to sell at or near ask prices

or at all if you need to sell your shares to raise money or otherwise desire to liquidate such shares.

We

cannot predict the extent to which an active public market for our common stock will develop or be sustained due to a number of factors,

including the fact that we are a small company that is relatively unknown to stock analysts, stock brokers, institutional investors,

and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons,

they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of

our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when

trading activity in our shares is minimal, as compared to a seasoned issuer which has a large and steady volume of trading activity that

will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or

more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The

market price for our common stock may be particularly volatile given that we are a relatively small company and have experienced losses

from operations that could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your

purchase price if at all, which may result in substantial losses to you.

We

do not anticipate paying any cash dividends.

We

presently do not anticipate that we will pay any dividends on any of our common stock in the foreseeable future. The payment of dividends,

if any, would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment

of any dividends will be within the discretion of our Board of Directors (the “Board”). We presently intend to retain all

earnings to implement our business plan; accordingly, we do not anticipate the declaration of any dividends in the foreseeable future.

Our

common stock may be subject to penny stock rules, which may make it more difficult for our stockholders to sell their common stock.

Broker-dealer

practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the SEC.

Penny stocks generally are equity securities with a price of less than $5.00 per share. The penny stock rules require a broker-dealer,

prior to a purchase or sale of a penny stock not otherwise exempt from the rules, to deliver to the customer a standardized risk disclosure

document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the

customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the

transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition,

the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination

that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction.

These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that

becomes subject to the penny stock rules.

We

may need additional capital, and the sale of additional shares or other equity securities could result in additional dilution to our

stockholders.

We

may require additional capital for the development and commercialization of our products and may require additional cash resources due

to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If our

resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit

facility. The sale of additional equity securities could result in additional dilution to our stockholders. The incurrence of additional

indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict

our operations. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all.

Our

principal stockholders and management own a significant percentage of our stock and will be able to exert significant control over matters

subject to stockholder approval.

Certain

of our executive officers, directors and large stockholders own a significant percentage of our outstanding capital stock. Our executive

officers, directors, holders of 5% or more of our capital stock and their respective affiliates beneficially own shares representing

more than a majority of the eligible votes of the Company. Accordingly, our directors and executive officers have significant influence

over our affairs due to their substantial ownership coupled with their positions on our management team and have substantial voting power

to approve matters requiring the approval of our stockholders. For example, these stockholders may be able to control elections of directors,

amendments of our organizational documents, or approval of any merger, sale of assets, or other major corporate transaction. This concentration

of ownership may prevent or discourage unsolicited acquisition proposals or offers for our common stock that some of our stockholders

may believe is in their best interest.

If

we are unable to implement and maintain effective internal control over financial reporting, investors may lose confidence in the accuracy

and completeness of our reported financial information and the market price of our common stock may be negatively affected.

As

a public company, we are required to maintain internal control over financial reporting and to report any material weaknesses in such

internal control. Section 404 of the Sarbanes-Oxley Act requires that we evaluate and determine the effectiveness of our internal control

over financial reporting and provide a management report on the internal control over financial reporting. If we have a material weakness

in our internal control over financial reporting, we may not detect errors on a timely basis and our consolidated financial statements

may be materially misstated. We may not be able to complete our evaluation, testing and any required remediation in a timely fashion.

During the evaluation and testing process, if we identify one or more material weaknesses in our internal control over financial reporting,

our management will be unable to conclude that our internal control over financial reporting is effective. Moreover, when we are no longer

a smaller reporting company, our independent registered public accounting firm will be required to issue an attestation report on the

effectiveness of our internal control over financial reporting. Even if our management concludes that our internal control over financial

reporting is effective, our independent registered public accounting firm may conclude that there are material weaknesses with respect

to our internal controls or the level at which our internal controls are documented, designed, implemented or reviewed.

If we are unable

to conclude that our internal control over financial reporting is effective, or when we are no longer a smaller reporting company, if

our auditors were to express an adverse opinion on the effectiveness of our internal control over financial reporting because we had

one or more material weaknesses, investors could lose confidence in the accuracy and completeness of our financial disclosures, which

could cause the price of our common stock to decline. Internal control deficiencies could also result in a restatement of our financial

results in the future. We have concluded that are internal controls have not been sufficient; however, we have begun to take steps

to remediate such insufficiencies. We have communicated to our accounting review firm and audit that we have accomplished the following:

(i) we have transitioned each operating subsidiary to a separate bookkeeping system (QuickBooks) and input data at each operating location

on a daily basis vs. previously batching data and inputting at corporate office. Corporate then verifies data prior to accepting, (ii)

we have a QuickBooks trained person with who inputs data on a real-time basis but not allowed at subsidiary level to access or make certain

changes, (iii) we have installed for the hemp division companies (Botanical Biotech (Miami), TN Botanicals (TN), Co botanicals (CO) daily

tracking procedures whereby every ounce and pound of raw materials (biomass or crude) is tracked by lot number from input to processing

through to finished product, (iv) our accounts receivable tracking system, which is essentially our Duramed Division receivables, is

now tracking by medical device unit number, by doctor, by location, by insurance billing company, and we have a far more refined software

track and billing system than we did prior quarters, (v) we have consolidate banking to a master account with our primary bank (Investors

Bank) by subsidiary and only have one independent subsidiary bank in TN for TN Botanicals which is managed for balances through Investors

Bank, (vi) we have instituted a new procedure for any payables which requires double signatures to release any funds for any reason,

(vii) we have changed merchant accounts to a single user to better tie out to bank balances and accounts receivable, and (viii) Pure

Health Products, LLC, our production facility in Lacey WA in mid-November just received NSF Certification (National Sanitation Foundation),

the highest certification possible which now allows us to bid and product products for major national retailers but also has the highest

certification and maintenance program in the food supplement industry. NSF uses a sophisticated MARKOV software system to track ever

incoming product and package, manage the formulation process and makes appropriate adjustments to every material and unit down to the

gram.

If

securities or industry analysts do not publish research or reports about our business, or if they change their recommendations regarding

our stock adversely, our stock price and trading volume could decline.

The

trading market for our common stock could be influenced by the research and reports that industry or securities analysts publish about

us or our business. We do not currently have and may never obtain research coverage by industry or financial analysts. If no or few analysts

commence coverage of us, the trading price of our stock would likely decrease. Even if we do obtain analyst coverage, if one or more

of the analysts who cover us downgrade our stock, our stock price would likely decline. If one or more of these analysts cease coverage

of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause

our stock price or trading volume to decline.

Because

our management will have broad discretion and flexibility in how the net proceeds from this offering are used, we may use the net proceeds

in ways in which you disagree.

We

currently intend to use the net proceeds from this offering for operations, new product development, acquisitions, rent,

repayment of debt and general corporate purposes, including working capital. The intended use of proceeds from this offering is

more particularly described in the Section titled “Use of Proceeds,” however, such description is not binding and the

actual use of proceeds may differ from the description contained therein. Accordingly, our management will have significant

discretion and flexibility in applying the net proceeds of this offering. You will be relying on the judgment of our management with

regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess

whether the net proceeds are being used appropriately. It is possible that the net proceeds will be invested in a way that does not

yield a favorable, or any, return for us. The failure of our management to use such funds effectively could have a material adverse

effect on our business, financial condition, operating results and cash flow.

The

offering price of our shares from the Company has been arbitrarily determined.

Our

management has determined the shares offered by the Company. The price of the shares we are offering was arbitrarily determined based

upon the illiquidity and volatility of our common stock, our current financial condition and the prospects for our future cash flows

and earnings, and market and economic conditions at the time of the offering. The offering price for the common stock sold in this offering

may be more or less than the fair market value for our common stock.

We

may not register or qualify our securities with any state agency pursuant to blue sky regulations.

The

holders of our shares of common stock and persons who desire to purchase them in the future should be aware that there may be significant

state law restrictions upon the ability of investors to resell our shares. We currently do not intend to and may not be able to qualify

securities for resale in states which require shares to be qualified before they can be resold by our shareholders.

We

are an “emerging growth company,” and we cannot be certain if the reduced reporting requirements applicable to emerging growth

companies will make our common stock less attractive to investors.

We

are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. The Section 107

of the JOBS Act provides that we may elect to utilize the extended transition period for complying with new or revised accounting standards

and such election is irrevocable if made. As such, we have made the election to use the extended transition period for complying with

new or revised accounting standards under Section 102(b)(1) of the JOBS Act. Please refer to a discussion under “Risk Factors”

of the effect on our financial statements of such election.

As

an emerging growth company we are exempt from Section 404(b) of the Sarbanes Oxley Act. Section 404(a) requires Issuers to publish information

in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This

statement shall also assess the effectiveness of such internal controls and procedures. Section 404(b) requires that the registered accounting

firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures

for financial reporting. As an emerging growth company, we are also exempt from Section 14A (a) and (b) of the Exchange, which require

the shareholder approval of executive compensation and golden parachutes.

We

have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of

the JOBS Act, that allows us to delay the adoption of new or revised accounting standards that have different effective dates for public

and private companies until those standards apply to private companies. As a result of this election, our financial statements may not

be comparable to companies that comply with public company effective dates.

We

could face significant penalties for our failure to comply with the terms of our outstanding convertible notes.

Our

various convertible notes contain positive and negative covenants and customary events of default including requiring us in many cases

to timely file SEC reports. In the event we fail to timely file our SEC reports in the future, or any other events of defaults occur

under the notes, we could face significant penalties and/or liquidated damages and/or the conversion price of such notes could be adjusted

downward significantly, all of which could have a material adverse effect on our results of operations and financial condition, or cause

any investment in the Company to decline in value or become worthless.

The

issuance and sale of common stock upon conversion of our convertible notes may depress the market price of our common stock.

If

sequential conversions of the convertible notes and sales of such converted shares take place, the price of our common stock may decline,

and as a result, the holders of the convertible notes will be entitled to receive an increasing number of shares in connection with conversions,

which shares could then be sold in the market, triggering further price declines and conversions for even larger numbers of shares, to

the detriment of our investors. The shares of common stock which the convertible notes are convertible into may be sold without restriction

pursuant to Rule 144. As a result, the sale of these shares may adversely affect the market price, if any, of our common stock.

We

have established preferred stock which can be designated by the Company’s Board of Directors without shareholder approval.

The

Company has 5,000,000 shares of preferred stock authorized. The shares of preferred stock of the Company may be issued from time to time

in one or more series, each of which shall have a distinctive designation or title as shall be determined by the board of directors of

the Company prior to the issuance of any shares thereof. The preferred stock shall have such voting powers, full or limited, or no voting

powers, and such preferences and relative, participating, optional or other special rights and such qualifications, limitations or restrictions

thereof as adopted by the board of directors. Because the board of directors is able to designate the powers and preferences of the preferred

stock without the vote of a majority of the Company’s shareholders, shareholders of the Company will have no control over what

designations and preferences the Company’s preferred stock will have. The issuance of shares of preferred stock or the rights associated

therewith, could cause substantial dilution to our existing shareholders. Additionally, the dilutive effect of any preferred stock which

we may issue may be exacerbated given the fact that such preferred stock may have voting rights and/or other rights or preferences which

could provide the preferred shareholders with substantial voting control over us and/or give those holders the power to prevent or cause

a change in control, even if that change in control might benefit our shareholders. As a result, the issuance of shares of preferred

stock may cause the value of our securities to decrease.

You

will experience immediate and substantial dilution when you purchase shares in this offering.

You will incur immediate

and substantial dilution as a result of this offering. After giving effect to the assumed sale by us of 2,029,703 shares of our common

stock in this offering at an assumed public offering price of $5.05 per Unit, the last reported sale price of our common stock on May

20, 2022, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, investors

in this offering will suffer an immediate dilution of approximately $2.23 per share (assumes warrants are not exercised).

If

we issue additional common stock, or securities convertible into or exchangeable or exercisable for common stock, our stockholders, including

investors who purchase shares of common stock in this offering, may experience additional dilution, and any such issuances may result

in downward pressure on the price of our common stock. We may not be able to sell shares or other securities in any other offering at

a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares

or other securities in the future could have rights superior to existing stockholders. See “Dilution” on page 18 of this

prospectus for a more detailed discussion of the dilution you will incur in connection with this offering.

The

Warrants are speculative in nature.

The Warrants offered

in this offering do not confer any rights of common stock ownership on their holders, such as voting rights or the right to receive dividends,

but rather merely represent the right to acquire shares of our common stock at a fixed price for a limited period of time. Specifically,

commencing on the date of issuance, holders of the Series X Warrants may exercise their right to acquire the common stock and pay an

assumed exercise price of $5.05 per share, prior to five (5) years from the date of issuance, after which date any unexercised Series

X Warrants will expire and have no further value. In addition, there is no established trading market for the Warrants and there can

be no assurance a trading market will develop, even upon the listing of the Series X Warrants. We do not intend to apply for a listing

for the Series Y Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market,

the liquidity of the Series Y Warrants will be limited.

The

price of our common stock or Warrants may fluctuate substantially.

You

should consider an investment in our common stock and Warrants to be risky, and you should invest in our Units only if you can withstand

a significant loss and wide fluctuations in the market value of your investment. In addition, if the market for stocks in our industry

or industries related to our industry, or the stock market in general, experiences a loss of investor confidence, the trading price of

our common stock could decline for reasons unrelated to our business, financial condition and results of operations. If any of the foregoing

occurs, it could cause our stock price to fall and may expose us to lawsuits that, even if unsuccessful, could be costly to defend and

a distraction to management.

Risks

Related to our Business

Since

we have a limited operating history in our industry, it is difficult for potential investors to evaluate our business.

Our

short operating history in our industry may hinder our ability to successfully meet our objectives and makes it difficult for potential

investors to evaluate our business or prospective operations. As an early stage company, we are subject to all the risks inherent in

the financing, expenditures, operations, complications and delays inherent in a new business. Accordingly, our business and success faces

risks from uncertainties faced by developing companies in a competitive environment. There can be no assurance that our efforts will

be successful or that we will ultimately be able to attain profitability.

We

may not be able to raise capital when needed, if at all, which would force us to delay, reduce or eliminate our product development programs

or commercialization efforts and could cause our business to fail.

We

expect to need substantial additional funding to pursue additional product development and launch and commercialize our products. There

are no assurances that future funding will be available on favorable terms or at all. If additional funding is not obtained, we may need

to reduce, defer or cancel additional product development or overhead expenditures to the extent necessary. The failure to fund our operating

and capital requirements could have a material adverse effect on our business, financial condition and results of operations.

If

we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and

development programs or any future commercialization efforts. Any of these events could significantly harm our business, financial condition

and prospects.

Our

independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

Our

historical financial statements have been prepared under the assumption that we will continue as a going concern. Our independent registered

public accounting firm has expressed substantial doubt in our ability to continue as a going concern. Our ability to continue as a going

concern is dependent upon our ability to obtain additional equity financing or other capital, attain further operating efficiencies,

reduce expenditures, and, ultimately, generate more revenue. The doubt regarding our potential ability to continue as a going concern

may adversely affect our ability to obtain new financing on reasonable terms or at all. Additionally, if we are unable to continue as

a going concern, our stockholders may lose some or all of their investment in the Company.

We

depend heavily on key personnel, and turnover of key senior management could harm our business.

Our

future business and results of operations depend in significant part upon the continued contributions of our senior management personnel.

If we lose their services or if they fail to perform in their current positions, or if we are not able to attract and retain skilled

personnel as needed, our business could suffer. Significant turnover in our senior management could significantly deplete our institutional

knowledge held by our existing senior management team. We depend on the skills and abilities of these key personnel in managing the product

acquisition, marketing and sales aspects of our business, any part of which could be harmed by turnover in the future. We do not have

any key person insurance.

We

expect to face intense competition, often from companies with greater resources and experience than we have.

The

health and wellness and hemp derivative industries are highly competitive and subject to rapid change. The industry continues to expand

and evolve as an increasing number of competitors and potential competitors enter the market. Many of these competitors and potential

competitors have substantially greater financial, technological, managerial and research and development resources and experience than

we have. Some of these competitors and potential competitors have more experience than we have in the development of hemp products, including

validation procedures and regulatory matters. Moreover, some of these competitors may have patents or pending patent applications

that our products infringe and for which we would need a license to become free to operate. In addition, our products compete with

product offerings from large and well-established companies that have greater marketing and sales experience and capabilities than we

or our collaboration partners have. If we are unable to compete successfully, we may be unable to grow and sustain our revenue.

We

have substantial capital requirements that, if not met, may hinder our operations.

We

anticipate that we will make substantial capital expenditures for research and product development work and acquisitions. If we cannot

raise sufficient capital, we may have limited ability to expend the capital necessary to undertake or complete research and product development

work and acquisitions. There can be no assurance that debt or equity financing will be available or sufficient to meet these requirements

or for other corporate purposes, or if debt or equity financing is available, that it will be on terms acceptable to us. Moreover, future

activities may require us to alter our capitalization significantly. Our inability to access sufficient capital for our operations could

have a material adverse effect on our financial condition, results of operations or prospects.

Current

global financial conditions have been characterized by increased volatility which could negatively impact our business, prospects, liquidity

and financial condition.

Current

global financial conditions and recent market events have been characterized by increased volatility and the resulting tightening of

the credit and capital markets has reduced the amount of available liquidity and overall economic activity. We cannot guaranty that debt

or equity financing, the ability to borrow funds or cash generated by operations will be available or sufficient to meet or satisfy our

initiatives, objectives or requirements. Our inability to access sufficient amounts of capital on terms acceptable to us for our operations

will negatively impact our business, prospects, liquidity and financial condition.

We

will need to grow the size of our organization, and we may experience difficulties in managing any growth we may achieve.

As

our development and commercialization plans and strategies develop, we expect to need additional research, development, managerial, operational,

sales, marketing, financial, accounting, legal, and other resources. Future growth would impose significant added responsibilities on

members of management. Our management may not be able to accommodate those added responsibilities, and our failure to do so could prevent

us from effectively managing future growth, if any, and successfully growing our company.

We

may expend our limited resources to pursue a particular product and may fail to capitalize on products that may be more profitable or

for which there is a greater likelihood of success.

Because

we have limited financial and managerial resources, we have focused our efforts on particular products. As a result, we may forego or

delay pursuit of opportunities with other products that later prove to have greater commercial potential. Our resource allocation decisions

may cause us to fail to capitalize on viable commercial products or profitable market opportunities. Any failure to improperly assess

potential products could result in missed opportunities and/or our focus on products with low market potential, which would harm our

business and financial condition.

We

engage in transactions with related parties and such transactions present possible conflicts of interest that could have an adverse effect

on us.

We

have entered, and may continue to enter, into transactions with related parties for financing, corporate, business development and operational

services, as detailed herein. Such transactions may not have been entered into on an arm’s-length basis, and we may have achieved

more or less favorable terms because such transactions were entered into with our related parties. We rely, and will continue to rely,

on our related parties to maintain these services. If the pricing for these services changes, or if our related parties cease to provide

these services, including by terminating agreements with us, we may be unable to obtain replacements for these services on the same terms

without disruption to our business. This could have a material effect on our business, results of operations and financial condition.

Such

conflicts could cause an individual in our management to seek to advance his or her economic interests or the economic interests of certain

related parties above ours. Further, the appearance of conflicts of interest created by related party transactions could impair the confidence

of our investors, which could have a material adverse effect on our liquidity, results of operations and financial condition.

Any

inability to protect our intellectual property rights could reduce the value of our technologies and brands, which could adversely affect

our financial condition, results of operations and business.

Our

business is dependent upon our trademarks, trade secrets and other intellectual property rights. There is a risk of certain valuable

trade secrets being exposed to potential misappropriation. The efforts we have taken to protect our proprietary rights may not

be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to

compete. There is a risk that we may have insufficient resources to counter adequately such misappropriation or infringement through

negotiation or the use of legal remedies. It may not be practicable or cost effective for us to fully protect our intellectual property

rights in some countries or jurisdictions. If we are unable to successfully identify and stop unauthorized use of our intellectual property,

we could lose potential revenue and experience increased operational and enforcement costs, which could adversely affect our financial

condition, results of operations and business.

Our

potential for rapid growth and our entry into new markets make it difficult for us to evaluate our current and future business prospects,

and we may be unable to effectively manage any growth associated with these new markets, which may increase the risk of your investment

and could harm our business, financial condition, results of operations and cash flow.

Our

entry into the rapidly growing CBD, CBN, CBG and delta-8 markets may place a significant strain on our resources and increase demands

on our executive management, personnel and systems, and our operational, administrative and financial resources may be inadequate. We

may also not be able to effectively manage any expanded operations, or achieve planned growth on a timely or profitable basis, particularly

if the number of customers using our technology significantly increases or their demands and needs change as our business expands. If

we are unable to manage expanded operations effectively, we may experience operating inefficiencies, the quality of our products and

services could deteriorate, and our business and results of operations could be materially adversely affected.

If

we are unable to develop and maintain our brand and reputation for our product offerings, our business and prospects could be materially

harmed.

Our

business and prospects depend, in part, on developing and then maintaining and strengthening our brands and reputation in the markets

we serve. If problems with our products or technologies cause customers to experience operational disruption or failure or delays, our

brand and reputation could be diminished. If we fail to develop, promote and maintain our brand and reputation successfully, our business

and prospects could be materially harmed.

If

we or any of our suppliers or third-parties on which we rely for the development, manufacturing, marketing, or sale of our products fails

to comply with regulatory requirements applicable to the development, manufacturing, marketing, and sale of our product candidates, regulatory

agencies may take action against us or them, which could significantly harm our business.

Our

product candidates, along with the development process, the manufacturing processes, labeling, advertising, and promotional activities

for these products, are subject to continual requirements and review by the FDA and state and foreign regulatory bodies. Regulatory authorities

subject a marketed product, its manufacturer, and the manufacturing facilities to continual review and periodic inspections. We, our

suppliers, third-parties on which we rely, and our and their respective contractors, suppliers and vendors, will be subject to ongoing

regulatory requirements, including complying with regulations and laws regarding advertising, promotion and sales of products (including

applicable anti-kickback, fraud and abuse and other health care laws and regulations), required submissions of safety and other post-market

information and reports, registration requirements, Clinical Good Manufacturing Practices (cGMP) regulations (including requirements

relating to quality control and quality assurance, as well as the corresponding maintenance of records and documentation), and the requirements

regarding the distribution of samples to physicians and recordkeeping requirements. Regulatory agencies may change existing requirements

or adopt new requirements or policies. We, our suppliers, third-parties on which we rely, and our and their respective contractors, suppliers,

and vendors, may be slow to adapt or may not be able to adapt to these changes or new requirements.

Failure

to comply with regulatory requirements may result in any of the following:

| |

● |

restrictions on our product candidates or manufacturing processes; |

| |

|

|

| |

● |

warning letters; |

| |

|

|

| |

● |

withdrawal of the products from the market; |

| |

|

|

| |

● |

voluntary or mandatory recall; |

| |

|

|

| |

● |

fines; |

| |

|

|

| |

● |

suspension or withdrawal of regulatory approvals; |

| |

|

|

| |

● |

refusal to approve pending applications or supplements to approved

applications that we submit; |

| |

|

|

| |

● |

product seizure; |

| |

|

|

| |

● |

injunctions; or |

| |

|

|

| |

● |

imposition of civil or criminal penalties. |

We

could be subject to costly product liability claims related to our products.

Since

most of our products are intended for human use, we face the risk that the use of our products may result in adverse side effects to

people. We face even greater risks upon further commercialization of our products. An individual may bring a product liability claim

against us alleging that one of our products causes, or is claimed to have caused, an injury or is found to be unsuitable for consumer

use. Any product liability claim brought against us, with or without merit, could result in:

| |

● |

the

inability to commercialize our products; |

| |

|

|

| |

● |

decreased

demand for our products; |

| |

|

|

| |

● |

regulatory

investigations that could require costly recalls or product modifications; |

| |

|

|

| |

● |

loss

of revenue; |

| |

|

|

| |

● |

substantial

costs of litigation; |

| |

|

|

| |

● |

liabilities

that substantially exceed our product liability insurance, which we would then be required to pay ourselves; |

| |

|

|

| |

● |

an

increase in our product liability insurance rates or the inability to maintain insurance coverage in the future on acceptable terms,

if at all; |

| |

|

|

| |

● |

the

diversion of management’s attention from our business; and |

| |

|

|

| |

● |

damage

to our reputation and the reputation of our products. |

Product

liability claims may subject us to the foregoing and other risks, which could have a material adverse effect on our business, results

of operations, financial condition, and prospects.

The

Company could be subject to enforcement

action by the FDA and certain state regulatory agencies for its products containing CBD or THC compounds.

In 2018, the federal Farm

Bill removed hemp as a Schedule I drug under the Controlled Substances Act and hemp may now be grown as a commodity crop, with restrictions;

however, the 2018 Farm Bill did not specifically legalize CBD. Until Congress promulgates rules and regulations relating to hemp derived

cannabinoids, the “legal” status of such, or the processes the Company may have to implement (and at what expense), are still

unknowns. A similar paradigm exists under various state laws with which the Company will have to comply. Further, the FDA currently considers

the addition of CBD to food products, cosmetics or supplements to be illegal and also prohibits the advertisement of CBD products

with health claims. In addition, the FTC under the Federal Trade Commission Act (“FTC Act”) requires that product advertising

is truthful, substantiated and non-misleading. We believe that our advertising meets these guidelines; however, the FTC may bring a challenge

at any time to evaluate our compliance with the FTC Act.

Further, the FDA

has recently increased its review of and enforcement against CBD companies for violations of the Federal Food, Drug, and Cosmetic

Act (“FCDA”), particularly with respect to the sale of food products containing CBD, claiming that CBD can treat medical

conditions in humans or animals, promoting CBD products as dietary supplements, and adding CBD to human and animal foods. Should

the Company become subject to enforcement action by the FDA, it could be forced to spend significant sums defending against such enforcement,

pay significant fines and ultimately could be forced to stop offering some or all of its CBD products, which would materially, negatively

affect the Company’s business and shareholders’ investments. The FDA can also subject individuals to criminal penalties,

including fines and imprisonment, for violating certain provisions of the FDCA related to CBD products. In addition, notwithstanding

the intense pressure on FDA to fast-track the CBD approval process, it is likely that the approval process for use of CBD or other cannabinoids

in foods, cosmetics or supplements will take years and possible that it could never occur at all.

Due

to the controversy over the cannabis plant within the United States, we face challenges getting our products into stores and into the

hands of the end user.

The

Company intends to release products that contain CBD derived from hemp that are legal within the U.S. However, it is possible we may

face scrutiny and run into issues getting our products into stores due to hesitation by stores to carry any product at all affiliated

with the cannabis plant, as well as federal, state and local regulations that may restrict our ability to sell cannabinoid products.

The

Company’s production of Delta-8 THC and Delta-10 THC could subject it to enforcement action by certain federal and

state regulatory agencies.

Delta-8 THC and delta-10 THC are cannabis

compounds that can cause effects similar to delta-9 THC, the main compound in cannabis that causes psychoactive effects. Delta-8 THC

and delta-10 THC can be extracted from either hemp or marijuana, but all of the Company’s delta-8 products are made with hemp

containing no more than 0.3% THC. Because of the 2018 Farm Bill, hemp can be legally grown and used for extractions all over the United

States. Notwithstanding the foregoing, the legality of hemp-derived delta-8 THC and delta-10 THC is in a gray area and

varies from state-to-state, with some states allowing, some not addressing specifically, and others banning due to similarity to delta-9

THC. Although the federal legality of delta-8 THC and delta-10 THC is still unclear, the FDA has recently issued Warning Letters to

five companies for selling products labeled as containing delta-8 tetrahydrocannabinol, noting that delta-8 THC has psychoactive and

intoxicating effects and may be dangerous to consumers. The Warning Letters were primarily targeted at companies marketing the compound

as unapproved treatments for various medical conditions or for other therapeutic uses, without adequate directions for use, or the addition

of delta-8 THC in foods. Should the Company become subject to enforcement action by federal or state agencies, it could be forced

to spend significant sums defending against such enforcement and ultimately could be forced to stop offering some or all of its delta-8

THC and/or delta-10 THC products and/or be subject to other civil or criminal sanctions, which would materially, negatively

affect the Company’s business and shareholders’ investments.

The

novel coronavirus disease of 2019 (“COVID-19”) has had, and continues to have, broad impacts on multiple sectors of the global

economy, making it difficult to predict the extent of its impact on our business.

On

January 30, 2020, the World Health Organization (“WHO”) announced a global health emergency because of a new strain of coronavirus

originating in Wuhan, China (the “COVID-19 outbreak”) and the risks to the international community as the virus spreads globally

beyond its point of origin. In March 2020, the WHO classified the COVID-19 outbreak as a pandemic, based on the rapid increase in exposure

globally.

The

full impact of the COVID-19 outbreak continues to evolve as of the date of this Offering Circular. As such, it is uncertain as to the

full magnitude that the pandemic will have on our financial condition, liquidity, and future results of operations. Management is actively

monitoring the impact of the global situation on our financial condition, liquidity, operations, suppliers, industry, and workforce.

Given the daily evolution of the COVID-19 outbreak and the global responses to curb its spread, we are not able to estimate the effects

of the COVID-19 outbreak on our results of operations, financial condition, or liquidity for the foreseeable future. We have experienced

negative impacts from COVID in the form of reduced sales, delayed operations, inability to effectuate certain business plans, supply

chain issues and the like.

Our

acquisitions may expose us to unknown liabilities.

Because

we have acquired, and expect generally to acquire, all (or a majority of) the outstanding securities of certain of our acquisition targets,

our investment in those companies are or will be subject to all of their liabilities other than their respective debts which we paid

or will pay at the time of the acquisitions. If there are unknown liabilities or other obligations, our business could be materially

affected. We may also experience issues relating to internal controls over financial reporting that could affect our ability to comply

with the Sarbanes-Oxley Act, or that could affect our ability to comply with other applicable laws.

If

we fail to comply with government laws and regulations it could have a materially adverse effect on our business.

Our

industry is subject to extensive federal, state and local laws and regulations that are extremely complex and for which, in many instances,