Current Report Filing (8-k)

June 15 2022 - 2:34PM

Edgar (US Regulatory)

0001509957

false

0001509957

2022-06-09

2022-06-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

June

9, 2022

Date

of Report (Date of earliest event reported)

Can

B̅ Corp.

(Exact

name of registrant as specified in its charter)

| Florida |

|

000-55753 |

|

20-3624118 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

960

South Broadway, Suite 120

Hicksville,

NY |

|

11801 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code 516-595-9544

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

CANB |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Securities

Purchase Documents

On

June 9, 2022, Can B Corp., a Florida corporation (the “Company”) entered into a definitive agreement (the “Agreement”)

with an investor (“Investor”) for the sale of a promissory note (“Note”) and warrants (“Warrants”)

to Investor for total consideration of $56,250.

The

Note is in the principal amount of $62,500 with an original issue discount of 10%. The Note is convertible into common stock of the Company

at a price per share of $4.00, subject to adjustment pursuant to the terms of the Note. The Note bears interest at the rate of 12% per

year, which increases to 16% per year in the event of default. The Company has agreed to pay $500 to Investor for each conversion under

the Note to cover its expenses related thereto. The Company has agreed to reserve at least two times the number of shares convertible

under the Note at all times and has entered into an irrevocable letter agreement with its transfer agent to issue Investor shares resulting

from its conversion of the Note and exercise of Warrants. In the event that the Company issues common stock or securities convertible

into common stock at a price per share less than the conversion price under the Note, the Note’s conversion price will be decreased

to match such dilutive issuance; provided that, in the event a dilutive issuance occurs in the first 180 days after Note issuance, such

adjustment will not be applied until the date 180 days after the Note is issued. The Note contains similar most favored nations terms

where the adjustments will take place, if any, no sooner than 180 days after the Note is issued. The Company may prepay the Note subject

to a 10% prepayment penalty and shall repay all of the Note in the event its current S-1 offering, as amended, is declared effective

by the Securities and Exchange Commission (“SEC”) and shall repay at least 50% of the Note in the event of an alternative

financing occurring after the company has raised at least $1,250,000 in bridge financing. The Company has agreed to offer Investor the

first right to participate in future financings. The Note otherwise contains default and other restrictive terms typical of debt finance

deals of this nature. The Note may be accelerated upon an event of default.

In

conjunction with the issuance of the Note to Investor, the Company also issued Investor Warrants to purchase 9,766 shares of common stock

at a price per share of $6.40. However, if within 180 days after the Warrant issuance the Company’s current S-1 offering, as amended,

is declared effective by the SEC, the exercise price will be adjusted to 120% of the offering price per unit or share offered. The Company

has agreed to register the common stock issuable upon exercise of the Warrant with the SEC pursuant to a registration rights agreement.

If the shares are not so registered within 180 days from Warrant issuance, the Warrant shall have a cashless exercise feature. No fractional

shares will be issued upon exercise of any portion of the Warrant. There are penalties to the Company in the event it does not timely

issue shares upon exercise of the Warrant. The Warrant has anti-dilution terms similar to the Warrant, except that if the Company’s

current S-1 offering, as amended, is declared effective by the SEC and the Note is paid in full, the exercise price shall never be adjusted

due to a dilutive issuance.

In

addition to the foregoing, the Company has agreed to pay $5,000 in Investor’s legal fees and to grant Investor piggyback registration

rights requiring the Company to register all common shares held by Investor resulting from conversion of the Note or exercise of the

Warrants in the event it files a registration statement with the SEC, excluding certain types of registration statements where such piggyback

rights would not apply. Otherwise, the Note, Warrants, registration rights agreement and Agreement contain covenants, representations

and warranties typical of transactions of this type. All such agreements are governed by Delaware law.

The

foregoing descriptions of definitive agreements are qualified in their entirety by the terms of the full text of the agreements, respectively,

attached hereto as exhibits.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

See

item 1.01 regarding the Investor Note and the obligations of the Company relating thereto.

Item

3.02 Unregistered Sales of Equity Securities.

See

Item 1.01 for discussion of the Note and Warrants issued to Investor. The foregoing securities were issued in reliance upon the exemption

from securities registration afforded by Section 4(a)(2) of the Securities Act of 1933 (the “Securities Act”), as amended,

and Regulation D as promulgated under the Securities Act.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits. The following exhibits are filed herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

June 15, 2022 |

Can B̅ Corp. |

| |

|

|

| |

By: |

/s/

Marco Alfonsi |

| |

|

Marco

Alfonsi, CEO |

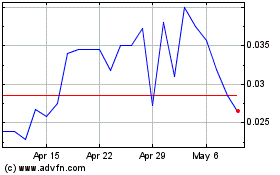

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Mar 2024 to Apr 2024

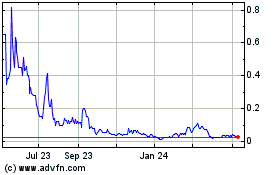

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Apr 2023 to Apr 2024