UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14C

INFORMATION

STATEMENT PURSUANT TO SECTION 14(c)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Check

the appropriate box:

[ ]

Preliminary Information Statement

[ ]

Confidential, for Use of the Commission only (as permitted by Rule 14c-5(d)(2))

[X]

Definitive Information Statement

CANBIOLA,

INC.

(Name

of Registrant As Specified In Its Charter)

Payment

of Filing Fee (Check the Appropriate Box):

[X]

No fee required

[ ]

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

[ ]

Check box if any party of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and

the date of its filing.

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

(4)

|

Date

Filed:

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock

|

|

CANB

|

|

N/A

|

CANBIOLA,

INC.

960

SOUTH BROADWAY, SUITE 120, HICKSVILLE, NY 11801

_______________________________________________________________

IMPORTANT

NOTICE REGARDING INTERNET AVAILABILITY OF

INFORMATION STATEMENT FOR CANBIOLA, INC.

To

the Shareholders of Canbiola, Inc.:

NOTICE

IS HEREBY GIVEN to you as a stockholder of Canbiola, Inc., a Florida corporation (now known as Can B̅ Corp.) (the “Company,”

“we,” “us” or “our”), that you are receiving this notice regarding the internet availability

of an information statement (the “Information Statement”) relating to the matters described below. This notice presents

only an overview of the more complete Information Statement that is available to you on the internet or, upon request, by mail.

We encourage you to access and review all the important information contained in the Information Statement. As described below,

the Information Statement is for informational purposes only and, as a stockholder of the Company, you need not take any action.

By

sending you this notice, we are notifying you that we are making the Information Statement available to you via the internet in

lieu of mailing you a paper copy. You may print and view the full Information Statement on our website at http://www.canbiola.com/investors/.

To view and print the Information Statement, click on the link of the appropriate information statement in order to open the document.

You may request a paper copy or PDF via email of the Information Statement, free of charge, by contacting us in writing at Can

B̅ Corp. c/o Marco Alfonsi, 960 South Broadway, Suite 120, Hicksville, NY 11801 or by calling 516-595-9544. If you do not

request a paper copy or PDF via email by February 23, 2020, you will not otherwise receive a paper or email copy. The Company’s

most recent annual report and quarterly reports are available upon request, without charge, by contacting the Company at the address

above. If you want to receive a paper copy of the Information Statement, you must request one. There is no charge to you for requesting

a copy.

We

are furnishing this notice and Information Statement to the holders of our common and preferred stock in connection with the approval

by written consent of the Company’s Board of Directors and holders of a majority of the issued and outstanding voting stock

of the Company to change the name of the Company to “Can B̅ Corp.” (the “Name Change”). The purpose

of the Information Statement is to notify our stockholders that on January 15, 2020 pursuant to written consent permitted by Section

7607.0704 of the Florida Business Corporations Act (“FBCA”) the holders of a majority of the issued and outstanding

voting stock of the Company executed a written consent approving the Name Change. The amendment to the Company’s Articles

of Incorporation reflecting the Name Change was filed with the state of Florida on January 16, 2020. This notice is first being

sent to our stockholders on or about February 7, 2020.

The

written consent that we received constitutes the only stockholder approval required for to approve the foregoing actions under

the FBCA and, as a result, no further action by any other stockholder is required to approve the foregoing and we have not and

will not be soliciting your approval of the same. This notice and the Information Statement shall constitute notice to you of

the action by written consent in accordance with the FBCA and Rule 14c-2 promulgated under the Exchange Act.

WE

ARE NOT ASKING FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

On

behalf of the Board of Directors,

|

/s/

Marco Alfonsi

|

|

|

Name:

|

Marco

Alfonsi

|

|

|

Title:

|

Chief

Executive Officer and Director

|

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

INFORMATION

STATEMENT PURSUANT TO SECTION 14(c)

OF

THE SECURITIES EXCHANGE ACT OF 1934

AND

RULE 14C PROMULGATED THERETO

CANBIOLA,

INC.

960

South Broadway, Suite 120, Hicksville, NY 11801

________________________________________

INFORMATION

STATEMENT

February

6, 2020

_______________________________________

THIS

INFORMATION STATEMENT IS FOR INFORMATION PURPOSES ONLY AND NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED

IN CONNECTION WITH THIS INFORMATION STATEMENT.

A

NOTICE OF THE INTERNET AVAILABILITY OF THIS INFORMATION STATEMENT IS BEING MAILED ON OR ABOUT FEBRUARY 6, 2020 TO STOCKHOLDERS

OF RECORD ON JANUARY 22, 2020.

This

information statement (“Information Statement”) is being made available to the shareholders of record of Canbiola,

Inc., a Florida corporation (now known as Can B̅ Corp.) (“Company,” “CANB,” “we,” “us,”

or “our”) as of the close of business on January 22, 2020 (“Record Date”). This Information Statement

is being sent to you for information purposes only. No action is requested or required on your part.

WE

ARE NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A PROXY.

GENERAL

OVERVIEW OF ACTIONS

The

Board of Directors has recommended, and, on January 15, 2020 (“Voting Date”), the holders of a majority of the voting

stock of CANB as of the Voting Date have adopted resolutions, to effect the actions listed in this Information Statement. This

Information Statement is being filed with the Securities and Exchange Commission and is provided to CANB’s shareholders

pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (“Exchange Act”).

Through

the written consent of its Board of Directors and stockholders holding a majority of the Company’s voting stock as of the

Voting Date, the Company has approved an amendment to its Articles of Incorporation to change the name of the Company to “Can

B̅ Corp.” (the “Name Change”). The Company’s trading symbol, “CANB”, will remain the

same.

Holders

of 218,939,475 of the 834,181,825 common shares issued and outstanding as of the Voting Date, and 20 out of the 20 Series A Preferred

Shares (representing 400,000,000 votes out of 400,000,000) outstanding as of the Voting Date, approved the Name Change. Thus,

from the 1,234,181,825 votes eligible to be cast in this matter, 618,939,475 of the votes, or approximately 50.15%, approved the

Name Change by written consent.

The

amendment to the Company’s Articles of Incorporation reflecting the Name Change was filed with the state of Florida on January

16, 2020. Notwithstanding the foregoing, under SEC regulations, the Name Change is not supposed to become effective sooner than

40 days after we mail the Notice of Stockholder Action Taken by Written Consent to our stockholders. This notice is first being

mailed to our stockholders on or about February 6, 2020.

In

order to obtain the approval of our stockholders for the Name Change, we could have convened a special meeting of the stockholders

for the specific purpose of voting on such matter. However, Section 607.0704 of the Florida Business Corporations Act (the “FBCA”)

provides that any action required or permitted to be taken at a shareholders’ meeting may be taken without a meeting. In

order to eliminate the costs and management time involved in holding a meeting and obtaining proxies and in order to effect the

Name Change as early as possible in order to accomplish the purposes hereafter described, we elected to utilize the written consent

of a majority of the holders our voting stock. Under the FBCA and our bylaws, the affirmative vote of the holders of at least

a majority of the outstanding stock entitled to vote thereon is required to approve the Name Change.

This

Information Statement is intended to provide such notice as required by the FBCA to provide after the taking of the corporate

action without a meeting to the holders of record of our stock who have not consented in writing to such action.

Purpose

The

Board of Directors proposed the Name Change in order to avoid consumer confusion between the Company’s lead brand and the

corporate identity as reflected in the filings with the Florida Secretary of State.

Effect

on Authorized and Outstanding Shares

The

rights and preferences of shares of our Common Stock subsequent to the Name Change will remain the same. The Name Change will

affect all our stockholders uniformly. We do not anticipate that the number of our stockholders, or any aspect of our current

business plan, will materially change as a result of these changes.

Federal

Income Tax Consequences

The

following description of federal income tax consequences of the actions is based on the Internal Revenue Code of 1986, as amended,

the applicable Treasury Regulations promulgated thereunder, judicial authority, and current administrative rulings and practices

as in effect on the date of this information statement. We have not sought and will not seek an opinion of counsel or a ruling

from the Internal Revenue Service regarding the federal income tax consequences of the Name Change.

We

believe the Name Change will not have federal income tax effects. Our Company should not recognize gain or loss as a result of

the Name Change.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following tables set forth the ownership, as of the Voting Date, of our common stock by each person known by us to be the beneficial

owner of more than 5% of our outstanding voting stock, our directors, and our executive officers and directors as a group. To

the best of our knowledge, the persons named have sole voting and investment power with respect to such shares, except as otherwise

noted. There are not any pending or anticipated arrangements that may cause a change in control.

The

information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the

rules of the Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under these

rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares the power to vote

or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed to

own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within

60 days through the conversion or exercise of any convertible security, warrant, option or other right. More than one person may

be deemed to be a beneficial owner of the same securities.

|

Name

|

|

Title

|

|

Number

of

Common

Shares [9]

|

|

|

%

of

Common

Shares

|

|

|

Number

of

Series A

Preferred

Shares [10]

|

|

|

%

of

Series A

Preferred

Shares

|

|

|

%

of

Eligible

Votes

|

|

|

Number

of

Warrants

currently

exercisable

or

exercisable

in the next

60 days

|

|

|

Marco Alfonsi [1]

|

|

CEO, Director

|

|

|

59,398,915

|

|

|

|

7.12

|

%

|

|

|

5

|

|

|

|

25.00

|

%

|

|

|

12.92

|

%

|

|

|

0

|

|

|

Stanley Teeple [2]

|

|

CFO, Secretary, Director

|

|

|

4,157,811

|

|

|

|

0.50

|

%

|

|

|

4

|

|

|

|

20.00

|

%

|

|

|

6.82

|

%

|

|

|

0

|

|

|

Andrew Holtmeyer [3]

|

|

VP of Business Development

|

|

|

1,107,769

|

|

|

|

0.13

|

%

|

|

|

5

|

|

|

|

25.00

|

%

|

|

|

8.19

|

%

|

|

|

0

|

|

|

Philip Scala [4]

|

|

Interim COO

|

|

|

1,344,828

|

|

|

|

0.16

|

%

|

|

|

0

|

|

|

|

0

|

|

|

|

0.07

|

%

|

|

|

0

|

|

|

Frederick Alger Boyer Jr. [5]

|

|

Independent Director

|

|

|

3,000,000

|

|

|

|

0.36

|

%

|

|

|

0

|

|

|

|

0

|

|

|

|

0.24

|

%

|

|

|

0

|

|

|

Senator Ron Silver [6]

|

|

Independent Director

|

|

|

5,000,000

|

|

|

|

0.60

|

%

|

|

|

0

|

|

|

|

0

|

|

|

|

0.41

|

%

|

|

|

0

|

|

|

James F. Murphy [7]

|

|

Independent Director

|

|

|

3,000,000

|

|

|

|

0.36

|

%

|

|

|

0

|

|

|

|

0

|

|

|

|

0.24

|

%

|

|

|

0

|

|

|

All officers and directors as a group [7 persons]

|

|

|

|

|

77,009,323

|

|

|

|

9.23

|

%

|

|

|

14

|

|

|

|

70.00

|

%

|

|

|

28.93

|

%

|

|

|

0

|

|

|

Pasquale Ferro [8]

|

|

Shareholder

|

|

|

22,379,721

|

|

|

|

2.68

|

%

|

|

|

5

|

|

|

|

25.00

|

%

|

|

|

9.91

|

%

|

|

|

0

|

|

(1)

As of the Voting Date, Marco Alfonsi owned 59,398,915 shares of common stock and 5 shares of Series A Preferred stock, which are

convertible into 50,000,000 common shares and equal 100,000,000 votes. In addition to the listed shares, four members of Mr. Alfonsi’s

family hold an aggregate of 10,000,000 shares of common stock, which shares have not been included in the above calculations.

(2)

As of the Voting Date, Stanley Teeple owned options to purchase 3,000,000 common shares of the Company, 1,157,811 shares of common

stock, and 4 share of Series A Preferred stock, which are convertible into 40,000,000 common shares and equal 80,000,000 votes.

(3)

As of the Voting Date, Andrew Holtmeyer owned approximately 1,107,769 common shares and 5 shares of Series A Preferred stock,

which are convertible into 50,000,000 common shares and equal 100,000,000 votes.

(4)

Philip Scala holds options to purchase 500,000 common shares of the Company and 844,828 common shares.

(5)

Frederick Alger Boyer Jr. holds options to purchase 3,000,000 common shares of the Company.

(6)

Ron Silver holds options to purchase 3,000,000 common shares of the Company and 2,000,000 shares of common stock.

(7)

James F. Murphy holds options to purchase 3,000,000 common shares of the Company.

(8)

As of the Voting Date, Pasquale Ferro held 20,735,218 common shares jointly with his wife and 1,644,503 common shares individually.

Mr. Ferro holds 5 shares of Series A Preferred stock individually, which are convertible into 50,000,000 common shares and equal

100,000,000 votes. Mr. Ferro is the President of Pure Health Products, LLC, a wholly owned subsidiary of the Company.

(9)

There were 834,181,825 shares of common stock and 20 shares of Series A Preferred stock outstanding as of the Voting Date, for

a total of 1,234,181,825 votes eligible to be cast on the Voting Date.

(10)

The Company’s preferred stock is classified as Series A Preferred shares and Series B Preferred Shares. Series B Preferred

shares have no voting rights. Each Series A Preferred share is entitled to 20,000,000 votes and can be converted into 10,000,000

shares of common stock.

The

following tables set forth the ownership of our common stock by each person known by us to be the beneficial owner of more than

5% of our outstanding voting stock, our directors, and our executive officers and directors as a group, assuming

all preferred shares were converted to common shares as of the Voting Date (which they were not).

|

Name

|

|

Title

|

|

Number of

Common

Shares [1]

|

|

|

% of

Common

Shares

|

|

|

Number of

Warrants

currently

exercisable or

exercisable in

the next 60 days

|

|

|

Marco Alfonsi

|

|

CEO, Director

|

|

|

109,398,915

|

|

|

|

10.58

|

%

|

|

|

0

|

|

|

Stanley Teeple

|

|

CFO, Secretary, Director

|

|

|

44,157,811

|

|

|

|

4.27

|

%

|

|

|

0

|

|

|

Andrew Holtmeyer

|

|

Vice President

|

|

|

51,107,769

|

|

|

|

4.94

|

%

|

|

|

0

|

|

|

Philip Scala

|

|

Interim COO

|

|

|

1,344,828

|

|

|

|

0.13

|

%

|

|

|

0

|

|

|

Frederick Alger Boyer Jr.

|

|

Independent Director

|

|

|

3,000,000

|

|

|

|

0.29

|

%

|

|

|

0

|

|

|

Senator Ron Silver

|

|

Independent Director

|

|

|

5,000,000

|

|

|

|

0.48

|

%

|

|

|

0

|

|

|

James F. Murphy

|

|

Independent Director

|

|

|

3,000,000

|

|

|

|

0.29

|

%

|

|

|

0

|

|

|

All officers and directors as a group [4 persons]

|

|

|

|

|

217,009,323

|

|

|

|

20.98

|

%

|

|

|

0

|

|

|

Pasquale Ferro

|

|

Shareholder

|

|

|

72,379,721

|

|

|

|

7.0

|

%

|

|

|

0

|

|

|

|

(1)

|

Had all 20 issued and outstanding Series A Preferred

Shares been converted to common shares there would have been approximately 1,034,181,825

shares of common stock outstanding as of the Voting Date.

|

The

above tables are based upon information derived from our stock records. Except as otherwise indicated below and under applicable

community property laws, we believe that the beneficial owners of our common stock listed below have sole voting and investment

power with respect to the shares shown. Unless stated otherwise, the business address for these shareholders is 960 South Broadway,

Suite 120, Hicksville, NY 11801.

DISSENTERS’

RIGHTS

Under

FBCA and our Articles of Incorporation and bylaws, no stockholder has any right to dissent to the Name Change, nor is any stockholder

entitled to appraisal of or payment for their shares of stock.

INTEREST

OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

None

of our officers or directors, and no person associated with any of them, have any interest in the Name Change that is different

from every other stockholder.

WHERE

YOU CAN FIND MORE INFORMATION

Information

is available by request or can be accessed on the internet. Reports, proxy statements and other information filed with the SEC

by the Company can be accessed electronically by means of the Securities and Exchange Commission’s home page on the Internet

at http://www.sec.gov or at other Internet sites such as http://www.freeedgar.com or http://www.otcmarkets.com.

You

may read and copy any materials that we file with the Securities and Exchange Commission at the commission’s Public Reference

Room at 100 F Street, N.E., Washington D.C. 20549. A copy of any public filing is also available to any shareholder at no charge

upon written request to the Company by providing an e-mail or facsimile number.

PROPOSALS

BY SECURITY HOLDERS

No

security holder has asked the Company to include any proposal in this Information Statement.

MULTIPLE

STOCKHOLDERS SHARING ONE ADDRESS

Only

one information statement to security holders will be delivered to multiple security holders sharing an address unless the Company

has received contrary instructions from one or more of the security holders. Upon written or oral request, a separate copy of

an information statement can be provided to security holders at a shared address. For an oral request, please contact the Company

at 516-595-9544. For a written request, mail request to 960 South Broadway, Suite 120, Hicksville, NY 11801.

EXPENSE

OF THIS INFORMATION STATEMENT

The

expenses of this Information Statement will be borne by us, including expenses in connection with the preparation and sending

of this Information Statement and all related materials. It is contemplated that brokerage houses, custodians, nominees, and fiduciaries

will be requested to forward this Information Statement to the beneficial owners of our Common Stock held of record by such person

and that we will reimburse them for their reasonable expenses incurred in connection therewith.

FORWARD-LOOKING

STATEMENTS

This

Information Statement contains forward-looking statements regarding our intentions to effectuate the Name Change. Forward-looking

statements are not guarantees, and they involve risks, uncertainties and assumptions. Although we make such statements based on

assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those

expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements. We expressly

disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a

result of new information, future events or otherwise.

By

the Order of the Board of Directors.

Dated:

February 6, 2020

|

|

CANBIOLA,

INC.

|

|

|

|

|

|

|

By:

|

/s/

Marco Alfonsi

|

|

|

Name:

|

Marco

Alfonsi

|

|

|

Title:

|

Chief

Executive Officer

|

|

|

|

|

|

|

DIRECTORS:

|

|

|

|

|

|

|

By:

|

/s/

Marco Alfonsi

|

|

|

Name:

|

Marco

Alfonsi

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

By:

|

/s/

Stanley Teeple

|

|

|

Name:

|

Stanley

Teeple

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

By:

|

/s/

Frederick Alger Boyer Jr.

|

|

|

Name:

|

Frederick

Alger Boyer Jr.

|

|

|

Title:

|

Independent

Director

|

|

|

|

|

|

|

By:

|

/s/

Senator Ron Silver

|

|

|

Name:

|

Senator

Ron Silver

|

|

|

Title:

|

Independent

Director

|

|

|

|

|

|

|

By:

|

/s/

James F. Murphy

|

|

|

Name:

|

James

F. Murphy

|

|

|

Title:

|

Independent

Director

|

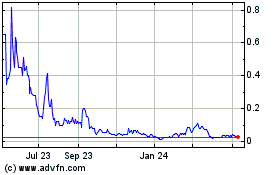

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Mar 2024 to Apr 2024

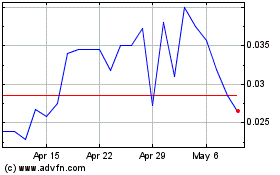

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Apr 2023 to Apr 2024