Current Report Filing (8-k)

July 18 2019 - 4:34PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

July

10, 2019

Date

of Report (Date of earliest event reported)

Canbiola,

Inc.

(Exact

name of registrant as specified in its charter)

|

Florida

|

|

333-208293

|

|

20-3624118

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.

|

960

South Broadway, Suite 120

Hicksville, NY

|

|

11801

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code

516-595-9544

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (

see

General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Effective

July 10, 2019, Canbiola, Inc. (the “Company” or “CANB”) entered into an Employee Services Agreement (the

“Agreement”) with Johnny J. Mack PhD (“Mack”), pursuant to which Mack agreed to serve as the Company’s

interim Chief Operating Officer (“Interim COO”). In consideration for Mack’s services, Mack will (i) receive

a base salary of $7,500 per month, subject to increase after each yearly anniversary of the Agreement (the “Base Salary”),

(ii) be eligible to receive annual cash or stock bonuses, as determined by the Company’s compensation committee, (iii) be

entitled to vacation time and paid days for illness in accordance with the Company’s Employee Handbook policies, and (iv)

receive a one-time issuance of 3,500,000 common shares of the Company. The Company also agreed to hold harmless and indemnify

Mack as authorized or permitted by law and the Company’s governing documents, as the same may be amended from time to time,

except for acts constituting negligence or willful misconduct by Mack.

The

Agreement has an initial term of 90 days and shall renew for additional 90-day terms upon mutual consent of the parties (each,

a “Term”), unless otherwise terminated with 30 days prior written notice. If the Agreement is terminated by the Company

without “Cause,” or by Employee for “Good Reason,” then: (i) the Company shall continue to pay Mack the

Base Salary through the longer of the end of the Term over the course of the then remaining Term in accordance with the Company’s

payroll and payment practices plus an amount equal to the premiums charged by the Company to maintain COBRA benefits continuation

coverage for Mack and his eligible dependents to the extent such coverage is then in place. A termination of the Agreement by

reason of a merger or acquisition is considered the same as a termination by the Company without Cause or by Employee for Good

Reason.

Upon

termination of Mack’s employment prior to the expiration of the Term by reason of Mack’s death, the Company shall

pay Mack’s designated beneficiary or beneficiaries, within 30 days of his death, in a lump sum in cash equal to (i) three

months of Mack’s Base Salary and pro-rated incentive bonus, if any, from the date of Mack’s death, and (ii) any accrued

obligations or benefits owed the Mack for that same period of time. If, as a result of Mack’s incapacity due to physical

or mental illness (“Disability”), Mack is absent from the full-time performance of his duties with the Company for

a period of three consecutive months and, within 30 days after written notice is provided to Mack by the Company, Mack’s

employment under the Agreement may be terminated by the Company for Disability and Mack or his designee will be paid in the same

manner as in termination by his death.

The

Agreement otherwise contains standard terms and conditions. The foregoing discussion is for summary purposes only and is qualified

in its entirety by the actual terms of the Agreement, which is included herewith as an Exhibit.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

See

Item 1.01 for discussion regarding Mack’s appointment as Interim COO pursuant to the Agreement. Additionally, on July 10,

2019, the Company’s Board of Directors (the “Board”) appointed Mack as a director of the Company to fill a vacancy

on the Board. Mack also serves on the Company’s Corporate Advisory Board.

Johnny

J. Mack PhD, age 66, has a distinguished career as senior executive in healthcare, mortgage banking, community development, and

nonprofit organizations. He is a founding member of the board of directors of Realizing the Dream, Inc., with Ambassador Andrew

Young and Martin Luther King, III, and now serves as the president of its rebrand, Realizing the Dream International. Mack has

also served as the executive director of the Martin Luther King, Jr. Center for Nonviolent Social Change and president of the

Drum Major Institute, a New York based NGO co-founded by Dr. Martin Luther King, Jr. He also founded Communities Without Boundaries

International, a peace and development organization, and through it has worked in more than 25 countries globally. Mack is also

principal and managing partner of the Jonymak Group, LLC, a global research and consulting firm that works across sectors –

private, public, and community – focusing on strategic, advisory, development, and public affairs services to business,

government, and nonprofit organizations.

Mack

received the Bachelor of Science degree in Business Administration with a second major in Theology from Oakwood University, Huntsville,

AL. He is a certified public accountant (CPA) and has more than 30 years of experience directing program, administration, and

financial management systems and operations. He is the recipient of the Honorary Doctorate of Humanity conferred by Beulah Heights

University. He is a Senior Fellow at the Martin Luther King Jr. Research and Education Institute, Stanford University, and the

Henry Hart Rice Fellow at the School for Conflict Analysis & Resolution, George Mason University, where he earned both Master

of Science and Doctor of Philosophy degrees.

There

is no family relationship between Mack and any of the Company’s other officers or directors.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits. The following exhibits are filed herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Canbiola, Inc.

|

|

|

|

|

|

Date:

July 18, 2019

|

By:

|

/s/

Marco Alfonsi

|

|

|

|

Marco

Alfonsi, CEO

|

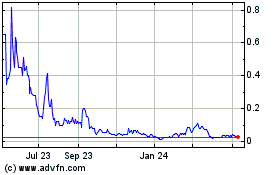

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Mar 2024 to Apr 2024

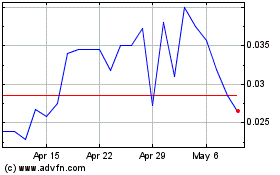

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Apr 2023 to Apr 2024